Best Home Insurance for Second Homes in 2025 (Compare the Top 10 Companies)

Geico, USAA, and Progressive offer the best home insurance for second homes, with low rates starting at $126 per month. These providers ensure that your second home has the right seasonal and unoccupied home insurance for protection on all of your property. Read on and find the insurer that suits you best.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Home Insurance for Second Homes

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Home Insurance for Second Homes

A.M. Best Rating

Complaint Level

Pros & Cons

Geico, USAA, and Progressive stand out for the best home insurance for second homes with rates as low as $126 per month, focusing on their ability to provide tailored protection for seasonal and unoccupied properties.

Your second home is your chalet or your beach house, and because it comes with specific usage such as personal or rental, it needs a specific insurance.

Considering that second homes are frequently left unoccupied and contain fewer personal belongings, it’s best to consider additional insurance solutions. For more details, see best home insurance for short-term rentals.

Our Top 10 Company Picks: Best Home Insurance for Second Homes

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 9% | A++ | Coverage Options | Geico | |

| #2 | 12% | A++ | Military Savings | USAA | |

| #3 | 8% | A+ | Competitive Rates | Progressive | |

| #4 | 7% | A | Customer Service | American Family | |

| #5 | 9% | A+ | Vanishing Deductible | Nationwide |

| #6 | 10% | A+ | Add-on Coverages | Allstate | |

| #7 | 11% | B | Personalized Service | State Farm | |

| #8 | 12% | A | Multi-Policy Discounts | Liberty Mutual |

| #9 | 9% | A | Safety Discounts | Farmers | |

| #10 | 7% | A++ | Bundling Policies | Travelers |

Finding affordable vacation home insurance costs doesn’t need to be difficult. Use the search box above to find competitive homeowners insurance rates from companies near you.

- Geico, USAA, and Progressive offer the best second home insurance

- They provide tailored coverage for seasonal and unoccupied properties

- Compare quotes to find affordable second home insurance

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordably Priced Second Home Coverage: Geico offers some of the lowest rates for insuring vacation properties, with premiums averaging just $206 per month for second homes. Gain insights in our detailed Geico insurance review.

- Convenient Bundling Options: Homeowners can easily combine their primary and secondary residence policies with Geico for potential multi-policy discounts on vacation home insurance.

- User-Friendly Mobile App: The Geico app simplifies policy management for second homeowners, enabling easy premium payments and claims filing for vacation properties.

Cons

- Limited In-Person Support: Geico’s primarily online business model means fewer local agents to assist with complex second home insurance needs.

- Potential Coverage Gaps: Some specialized protections for second homes may not be included in Geico’s standard policies, requiring careful review.

#2 – USAA: Best for Military Savings

Pros

- Military-Focused Second Home Coverage: USAA offers specialized insurance tailored to service members’ unique needs for vacation properties near bases or as investments. Have a look at our full USAA insurance review for more information.

- Comprehensive Natural Disaster Protection: Their policies include robust coverage for weather-related risks often affecting coastal or mountain second homes.

- Replacement Cost Coverage Standard: USAA typically includes full replacement cost for second homes, ensuring adequate protection without depreciation.

Cons

- Restricted Eligibility: Only current and former military members and their families can access USAA’s second home insurance offerings.

- Less Experience With Civilian Vacation Homes: USAA’s focus on military needs may result in fewer specialized options for typical civilian second home scenarios.

#3 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates for Vacation Properties: Progressive offers affordable second home insurance at an average of $211 monthly, making it budget-friendly for many homeowners.

- Name Your Price Tool: This feature helps second homeowners find a policy that fits their budget while still providing essential coverage for their vacation property.

- HomeQuote Explorer: This tool allows easy comparison of multiple insurers’ rates for vacation or second homes, ensuring competitive pricing. Check out our comprehensive Progressive insurance review.

Cons

- Potential for Coverage Exclusions: Some risks specific to certain second home locations may not be included in Progressive’s standard policies.

- Less Specialized in High-Value Properties: Luxury second homes might not receive the same level of tailored coverage as with insurers focused on premium properties.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – American Family: Best for Customer Service

Pros

- Specialized Vacation Home Riders: American Family offers add-ons specifically designed to address unique risks associated with second homes, like extended vacancy periods.

- Seasonal Dwelling Expertise: American Family has experience insuring properties used intermittently, addressing concerns specific to second homes. See further details in our in-depth American Family insurance review.

- Strong Midwestern Presence: Second homeowners in the Midwest benefit from American Family’s deep understanding of regional risks affecting vacation properties.

Cons

- Potential for Stricter Underwriting: American Family may have more rigorous requirements for insuring second homes in high-risk areas.

- Less Competitive for Coastal Properties: Their policies may not be as tailored for beachfront second homes compared to some regional insurers.

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Strong Replacement Cost Coverage: Their policies typically include generous replacement cost provisions, ensuring adequate protection for second homes. Look into the specifics in our Nationwide insurance review.

- Brand New Belongings: This feature provides extra protection for personal items in second homes, replacing them with new items if damaged or stolen.

- Water Backup Protection: Nationwide offers robust coverage for water-related damages, crucial for second homes left unattended for extended periods.

Cons

- Potential for Strict Occupancy Requirements: Their policies may have more stringent rules about how often second homes must be occupied.

- Limited High-Value Home Expertise: Luxury second homes might not receive as specialized coverage as with insurers focused on premium properties.

#6 – Allstate: Best for Add-on Coverages

Pros

- HostAdvantage Add-On: This feature provides extra protection for homeowners who rent out their second homes or vacation properties on a short-term basis. Read through our detailed Allstate insurance review.

- Digital Locker App: This tool helps second homeowners maintain an up-to-date inventory of belongings in their vacation property for more accurate coverage.

- Claim RateGuard: This option can help prevent premium increases on second home insurance after filing a claim, providing financial predictability.

Cons

- Limited Online Policy Management: Some second homeowners may find Allstate’s digital tools less comprehensive than tech-focused competitors.

- Variable Claims Experience: Reviews suggest inconsistent satisfaction with the claims process, which could be problematic for distant second homes.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – State Farm: Best for Personalized Service

Pros

- Personal Articles Policy: This separate policy can provide extra protection for high-value items kept in second homes, such as artwork or jewelry. Examine the insights in our State Farm insurance review.

- Inflation Guard: State Farm automatically adjusts coverage limits for second homes to keep pace with increasing property values and construction costs.

- HomeIndex Inventory Tool: This feature helps vacation homeowners maintain an accurate record of belongings in their second home for more precise coverage.

Cons

- Limited High-Risk Area Coverage: State Farm may be less willing to insure second homes in areas prone to certain natural disasters.

- Less Specialized in Luxury Properties: High-value second homes might not receive the same level of tailored coverage as with insurers focused on premium properties.

#8 – Liberty Mutual: Best for Multi-Policy Discounts

Pros

- Inflation Protection: Their policies automatically adjust coverage limits to keep pace with rising property values, crucial for maintaining adequate protection on second homes.

- Home Protector Plus: This feature provides extra coverage for unforeseen expenses when repairing or rebuilding a damaged second home property. Browse our full Liberty Mutual insurance review for additional information.

- Blanket Jewelry Coverage: This option simplifies protection for valuable items kept in second homes without requiring individual appraisals.

Cons

- Variable Customer Service Quality: Reviews suggest inconsistent experiences when dealing with claims or policy adjustments for second homes.

- Limited Regional Expertise: As a national insurer, Liberty Mutual may lack deep knowledge of local risks affecting specific second home markets.

#9 – Farmers: Best for Safety Discounts

Pros

- Eco-Rebuild Option: This feature provides extra coverage to rebuild second homes with green materials after a covered loss. Access more information in our comprehensive Farmers insurance review.

- Seasonal Home Expertise: Their policies are designed to accommodate the unique risks of properties used intermittently, like second homes.

- Cosmetic Damage Coverage: Farmers may cover repairs for cosmetic damage to second homes, which can be crucial for maintaining property values.

Cons

- Limited Availability: Farmers’ coverage for second home properties may not be available in all states or regions.

- Fewer Online Management Tools: Their digital resources for managing second home policies may be less comprehensive than some tech-focused competitors.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – Travelers: Best for Bundling Policies

Pros

- Green Home Coverage: This option provides extra protection for eco-friendly features in vacation homes, encouraging sustainable second home ownership. Delve into the details in our Travelers insurance review.

- Identity Fraud Protection: Travelers includes coverage for identity theft, which can be particularly valuable for second homes that may be more vulnerable when unoccupied.

- Valuable Items Plus: This feature provides expanded coverage for high-value items often kept in second homes, like artwork or collectibles.

Cons

- Highest Average Premiums: At $235 monthly, Travelers’ rates for second home insurance are the most expensive among the major insurers listed.

- Limited High-Value Home Expertise: Luxury second homes might not receive as specialized coverage as with insurers focused on premium properties.

The Basics of Home Insurance for Second Homes

In some ways, insurance for a second home is similar to that on your primary home; you still need coverage for the house and other structures on the property, liability coverage, and some personal property covered.

Those basic building blocks of a home insurance policy are the same, but the way the coverage is handled may be different. So, how much home insurance should you buy? See table below:

Second Home Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

Allstate $144 $225

American Family $135 $218

Farmers $158 $234

Geico $126 $206

Liberty Mutual $147 $233

Nationwide $134 $224

Progressive $133 $211

State Farm $143 $226

Travelers $160 $235

USAA $136 $210

For the best second home insurance, consult 2nd home insurance brokers who understand unique risks. Get a tailored 2nd home insurance policy and 2nd home insurance quote covering structure, liability, and vacancy concerns.

If you have a loan on your second home, you will be required to provide a policy that meets the guidelines provided by the lender. Usually, that requires that the policy provide enough coverage for the structure to replace it if it were to burn to the ground.

If you own the home outright, you likely will not have any requirements, but will still want to protect your investment.

When deciding what is the best home and car insurance for your second home, it’s crucial to explore bundled options from reputable providers for cost-effective coverage without sacrificing protection.

Second homes are considered riskier for insurance companies than a primary home, and that is largely due to the fact that they are frequently vacant. A burst pipe in a primary home will be noticed immediately, but in a home that is empty for weeks or months at a time, serious damage can take place before it’s caught.

The same applies to homes that are remote – it may take much longer for help to arrive in the event of a fire, which means more damage. As a result, insurance companies rate these homes differently.

Specifics of Home Insurance for Second Homes

Flood insurance may be needed – even required – if you live in a flood zone. This is a separate policy that is purchased independently of your main home insurance policy, rather than an endorsement. If you live near a body of water or on a coast like Florida, you will want this coverage even if it is not required. Not all companies offer flood insurance coverage, so it’s important to shop around.

Beyond the basics of insuring any home, second homes may have a few specific requirements.

Heidi Mertlich LICENSED INSURANCE AGENT

For information on a specific flood insurance providers, see Florida Peninsula insurance review. Some insurance companies will not insure your second home unless you have a primary residence insured with them; be sure to check on this before you get a quote.

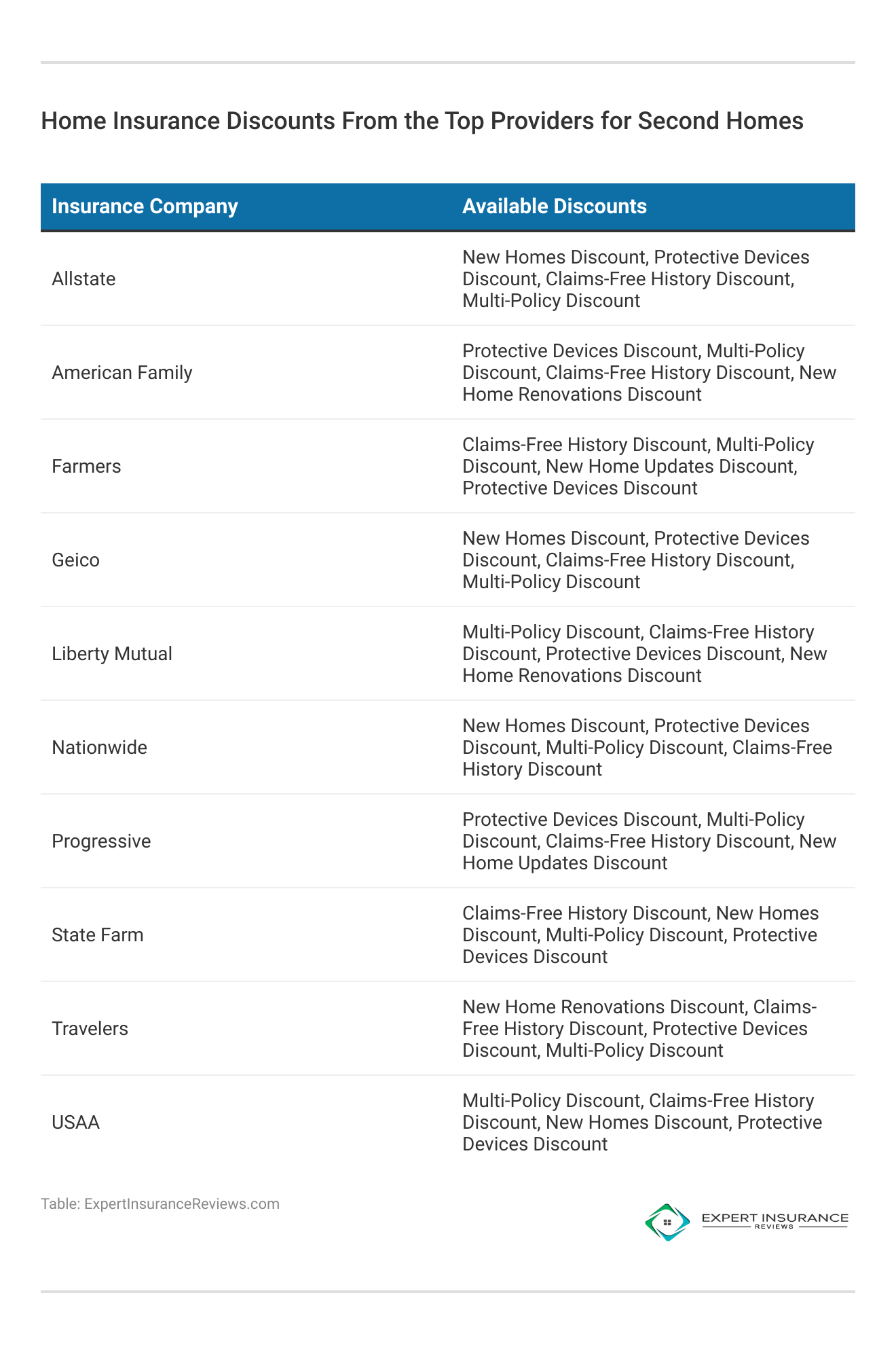

You may be eligible for a multi-policy discount as well if you insure with the same company.

When it comes to coverage, many insurance companies protect second homes differently. Because of the increased risk presented by these properties, policies are often on a named perils basis. That means that you are only covered for the perils (fire, weather, water damage, etc.) that are specifically listed on your policy.

It is an important difference to note, and while you would not usually take such a policy on a primary home, it may be your only choice on your second home.

When it comes to liability, you may have the option of extending coverage from your primary homeowner’s policy. Check with your current insurer on that but bear in mind that most package insurance policies include liability standard. For more details, see types of home insurance policies.

Some companies will also try to insure a second home on an actual cash value basis rather than replacement cost. This is something to avoid as much as possible because it does not usually provide adequate coverage; the insurance company can pay you the depreciated value of your home rather than what it actually costs to replace it.

Replacement cost on a second home might be harder to find, but it’s worth the search.

Read More: Best California Home Insurance

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Key Factors for Choosing Second Home Insurance

The first thing we looked for was the best overall coverage. All of our top picks offer replacement cost coverage on your best second home, and not only actual cash value. We looked for companies that offer great value on the policy, including lots of optional endorsements and available discounts.

Choosing a company that has a good reputation for paying their claims is also a major factor, so all of the insurers we chose, meet our standards. For the best second home insurance policy, prioritize replacement cost coverage. Seek insurers with strong second home insurance quote options and flexible coverage.

Look for insurance for secondary home with reputable claims processing and optional endorsements. For more information, read our article titled “Buying Home Insurance.”

While we generally recommend insuring your second home with the same company as your primary, we did look for companies where that is not a requirement, since it’s not always possible. We also selected companies whose products are widely available.

Shopping for Second Home Insurance

The first place to start when shopping for insurance for your second home is the company that insures your primary residence. A lot of companies that will not insure a second home individually will be willing to work with you if you’ve already got other lines of business in force; the more policies you have with that company, the more likely they are to help you.

In some cases, you might be able to get dwelling coverage for the second home and extend the liability from your primary residence. For top home insurance for second homes, explore offerings from top home insurance companies. Ensure top homeowners insurance with tailored vacation & second home insurance plans.

As you are shopping around, make sure to ask questions about the coverage and discounts available. While you’re unlikely to find a policy that is an all perils versus named perils, it is definitely possible to get replacement cost coverage in most cases.

Unless you have a second home that will not qualify for replacement cost anywhere (very old, rustic, or in need of renovations), you should not let an insurance company talk you into an actual cash value policy. At claim time you will be glad you stood your ground.

Read More: Best Home Insurance for Older Homes

Case Studies: Best Home Insurance for Second Homes

Knowing different situations when choosing home insurance for the second house can be useful. These case studies illustrate how people with different requirements and kinds of properties decided on the second home insurance companies.

- Case Study #1 – Foremost Insurance: John owns a beachfront cottage he uses as a second home and wants reliable insurance. After comparing quotes, he chooses Foremost Insurance for their replacement cost policy, extended replacement cost option, and solid financial footing, making them ideal for his second home.

- Case Study #2 – American Modern Insurance: Sarah owns a mountain chalet used as a vacation home and seeks comprehensive coverage with replacement cost protection. After researching, she chooses American Modern Insurance. Their specialty coverage, including replacement cost and options for lower value or higher risk vacation homes, meets her needs.

- Case Study #3 – State Farm Insurance: David seeks one insurer for his primary and second home, valuing stringent requirements and reliability. He chooses State Farm Insurance for their strong claim reputation and ability to cover both homes. (For more information, read our “State Farm Insurance Review & Complaints: Mobile Home“)

The above examples show how various insurance companies come in handy to provide for the needs of second homeowners. Meaning that by choosing to be certain, you can be able to get the insurance that suits your situation depending on coverage type, financial stability or policy options.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Find the Best Second Home Insurance

For second homes, find the best home insurance coverage for first time buyers to safeguard your little paradise. Make sure you’re getting the coverage you need and not just the least expensive option so that you can enjoy your second home without worrying about it when you aren’t there.

Save on your insurance cost by comparing rates today. Enter your ZIP code below to get an insurance quote from multiple homeowners insurance companies in your area. Whether you are looking for a homeowners policy for your permanent residence, a rental property, or vacation home insurance, shopping around can help you save money.

Frequently Asked Questions

What are some recommended insurance companies for second homes?

Foremost, American Modern, and State Farm are recommended for second home insurance and vacation home insurance. These companies offer competitive second home insurance rates and tailored policies to protect your property.

Do I have to get a second home insurance policy with my primary insurance company?

Generally, yes. However, it’s best to shop around and compare second home insurance quotes for the best rates. Using a second home insurance comparison tool can help you find the most affordable options.

Are second homes considered riskier for insurance companies?

Yes, second homes are often vacant and more susceptible to damage, making them riskier for insurers. Homeowners insurance for second home policies are typically rated differently due to these risks.

The best place to start when you want affordable home insurance is to enter your ZIP code into our free comparison tool below.

Do I need flood insurance for my second home?

If you live in a flood zone or near a body of water, you may need flood insurance. This is often a separate policy from your home insurance for second homes, so it’s important to check with your insurer.

Read More: Types of Home Insurance Coverage: An Expert Guide

Can I insure my second home without having a primary residence insured with the same company?

Some insurance companies require that your primary residence be insured with them before they will offer insurance on a second home. However, others may provide policies independently, allowing you to secure second home house insurance without bundling.

Can you get homeowners insurance on a second home?

Yes, you can get homeowners insurance second home. Insurance providers offer tailored policies for homeowners insurance for second home, covering various risks specific to secondary properties.

Is second home insurance more expensive?

Yes, due to the higher risk associated with properties that are often unoccupied. It’s essential to compare second home insurance rates to find a policy that fits your budget.

Read More: Does home insurance cover mold?

Can you have two primary residences for insurance?

Generally, insurance companies define a primary residence as the place where you live most of the time. While it’s possible to own multiple properties, insuring a second home as a primary residence is not typically allowed.

What is weekend home insurance?

Weekend home insurance, also known as vacation home insurance or 2nd home insurance, provides coverage for properties primarily used for weekend getaways or seasonal stays.

Make sure your home is protected by entering your ZIP code into our home insurance comparison tool below today.

What happens to your insurance when you buy a second home?

When you buy a second home, your existing policy may not cover it adequately. It’s crucial to explore options for second home insurance cover or insurance for a second home to ensure comprehensive protection.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.