Best Arkansas Car Insurance (2025)

At $138 per month, Arkansas auto insurance rates are usually cheaper than the national average. The cheapest Arkansas car insurance companies are State Farm, Geico, and Farm Bureau, but you might find better rates elsewhere. To find the best Arkansas car insurance, make sure to compare quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Arkansas Statistics Summary | Details |

|---|---|

| Road Miles | Total in State:102,609 Vehicle Miles Driven: 3,489 Billon |

| Vehicles | Registered: 2,680,410 Stolen: 5,7222 |

| State Population | 3,013,825 |

| Most Popular Vehicle | Sierra 1500 |

| Uninsured Motorists | 16.6% State Rank: 9 |

| Total Driving Fatalities | 2008-2017 Speeding: 5450 Drunk Driving: 1507 |

| Annual Average Premiums | Collision: $304.87 Comprehensive: $183.36 Liability: $381.14 |

| Cheapest Providers | USAA & State Farm Mutual Auto |

- Arkansas auto insurance typically costs $138 per month, which is cheaper than the national average

- The cheapest Arkansas car insurance companies are usually State Farm, Geico, and Farm Bureau, but you might find better rates with another provider

- To find the cheapest Arkansas car insurance, make sure to take advantage of discounts and compare quotes from multiple companies

With a smaller population, more rural traffic, and a small number of uninsured drivers, Arkansas car insurance rates are some of the cheapest in the nation. Although most drivers in the Natural State see lower quotes than the national average, you might see higher Arkansas car insurance quotes depending on your circumstances.

However, there are plenty of ways to find affordable Arkansas car insurance, no matter what your situation is. Whether you’re a teen driver with a brand new license or you need the best companies for high-risk car insurance, there are multiple ways to buy Arkansas car insurance online for a reasonable price.

Below, you can learn everything you need to know about car insurance in Arkansas, including where to find the best Arkansas car insurance policy that fits your needs. Then, compare Arkansas car insurance rates with multiple companies to find the right price.

Arkansas Car Insurance Coverage and Rates

We know car insurance can be confusing. There are so many companies, coverage types, and add-on options. What is required? What is optional? How do you even know where to start?

We’ve collected a variety of data and information on insurance providers in Arkansas, as well as the rules of the road so you can make an informed decision and stay safe when driving across the state.

But what about the price? What’s a reasonable cost for car insurance? How can you tell? How are premium rates developed? We can help with that too! Let’s start with the average cost of car insurance. How does Arkansas compare to the rest of the country?

| Arkansas Average | National Average | Percent Difference |

|---|---|---|

| $1,239 | $1,311 | 5.81% |

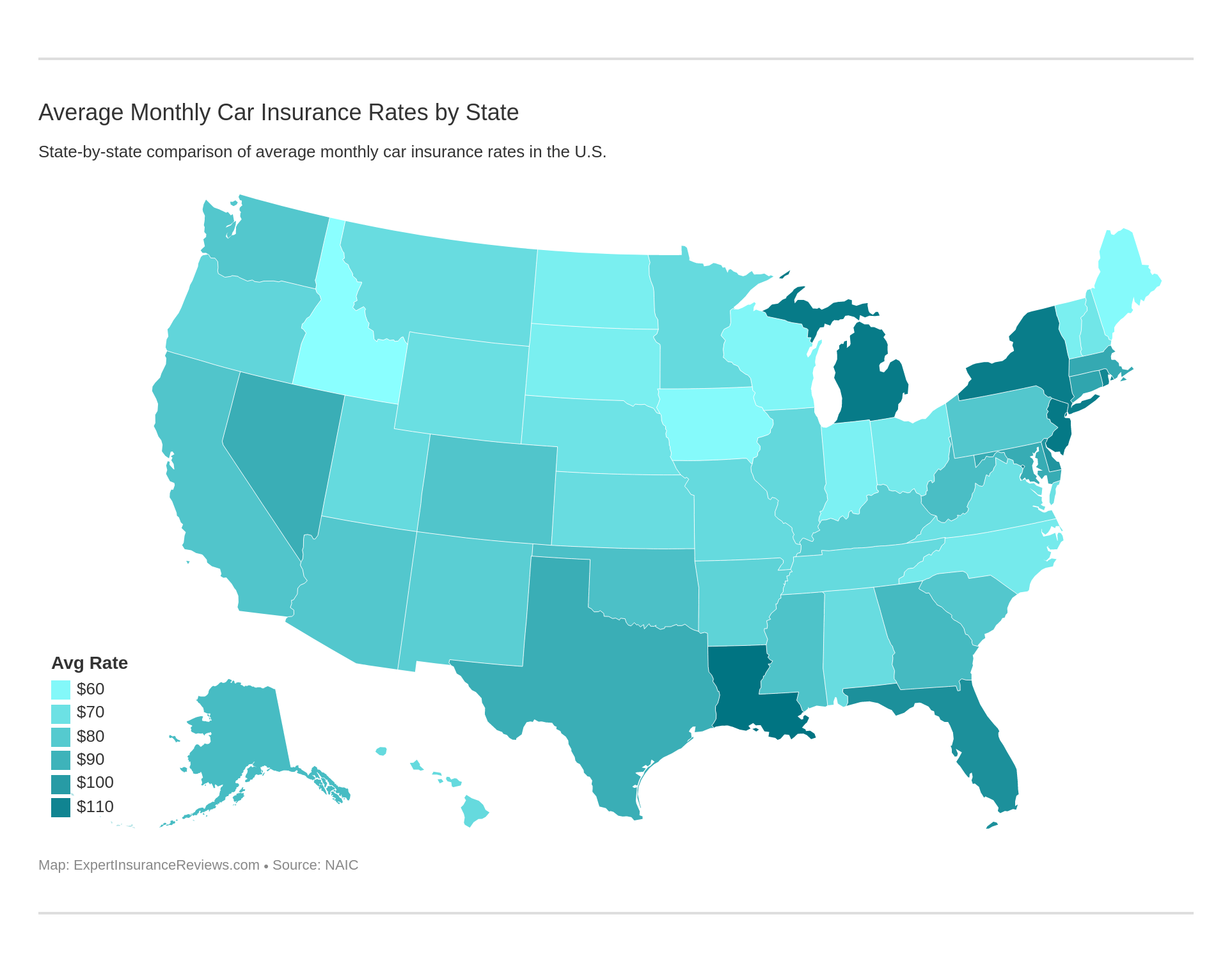

The national average for car insurance is $1,311, while the average in Arkansas is $1,239. This means drivers in Arkansas pay about six percent less for car insurance each year than the average in the United States.

Arkansas Minimum Coverage

Every state in the country requires some level of minimum liability coverage or proof of financial responsibility in order for residents to legally drive on the road. This protects all drivers’ financial interests.

Should you end up in a car accident, Arkansas is a fault state, which means if you are found to be at fault in a car accident, you will be financially responsible for the resulting damages to both people and property.

Knowing what you (and other drivers on the road in the state) are required to maintain helps to be better prepared in the event of an accident.

In Arkansas, drivers are required to maintain the minimum coverage listed in the table below.

| Required Insurance | Minimum Limits |

|---|---|

| Bodily Injury | $25,000 per person $50,000 per accident |

| Property Damage Liability | $25,000 |

As a part of an insurance company’s minimum coverage requirements, they must also offer insureds the option to purchase uninsured motorist coverage, but insureds are not required to accept this. However, if this coverage is declined, it must be noted in writing.

This minimum coverage protects in an accident because it provides financial coverage for damages the other driver experiences.

It does not offer any financial help for your damages or medical costs. In order for you to have that coverage, you will need to speak with your insurance agent about additional coverage. But what questions do you need to ask? What kind of options do you have?

One option you have in Arkansas is no-fault coverage. The purpose of this coverage is to ensure no matter who is at fault in an accident, you have some coverage for damages and medical costs. This includes if something happens while you are in another driver’s vehicle.

To learn more about other additional coverage options, keep reading.

Forms of Financial Responsibility

Financial responsibility is another piece of the minimum liability requirement levied by the state. Proof of insurance is one way to provide this.

The state requires every vehicle that is registered to be covered by some form of financial responsibility. You must keep a copy of the proof of financial responsibility in each vehicle at all times.

If you are stopped by a law enforcement officer and asked to provide said proof of insurance, you can do so both with a traditional insurance card and an electronic copy on your mobile device.

Premiums as a Percentage of Income

Since you know that if you want to legally drive in the state of Arkansas, you must have some form of insurance coverage, even if it is only the minimum liability coverage, you know you’ll be spending money on insurance. But how much money? Will this insurance coverage requirement have a significant impact on your income?

This table provides data on the percentage of disposable income Arkansas drivers can expect to spend on insurance. It also compares how much disposable income state residents spend versus national averages of the same.

| Average | 2012 | 2013 | 2014 |

|---|---|---|---|

| Arkansas Average | 2.56% | 2.67% | 2.65% |

| National Average | 2.34% | 2.43% | 2.40% |

| Percent Difference | 9% | 10% | 10% |

As you can see, residents in Arkansas spend about 2.6 percent of their disposable income on car insurance coverage, while the national average is about 2.4 percent of disposable income spent on insurance coverage. Unfortunately for Arkansas residents, this is about a ten percent increase over the national average.

Perhaps more relevant than the national average, however, is how much disposable income Arkansas’s nearby neighbors spend on car insurance coverage. The below table looks disposable income spent on car insurance for Missouri, Kansas, Oklahoma, Louisiana, and Mississippi.

| State | 2012 | 2013 | 2014 |

|---|---|---|---|

| Kansas | 1.94% | 1.98% | 2.04% |

| Missouri | 2.22% | 2.30% | 2.30% |

| Oklahoma | 2.42% | 2.41% | 2.41% |

| Arkansas | 2.56% | 2.67% | 2.65% |

| Louisiana | 2.97% | 3.61% | 3.61% |

| Mississippi | 2.97% | 3.03% | 3.05% |

If you were to live in Louisiana or Mississippi, instead of Arkansas, you would spend between three and 3.6 percent of your disposable income on car insurance, which is between 15 and 30 percent higher than what Arkansas residents spent.

However, Arkansas residents spend more of their disposable income on insurance than the rest of their neighbors.

CalculatorPro

Average Monthly Car Insurance Rates in AR (Liability, Collision, Comprehensive)

As we mentioned earlier, minimum liability coverage does not cover your personal and property damages. But there are some core coverage options that do. What are these options, what can you expect to pay for them, and what exactly do they cover?

The primary forms of insurance coverage that are available to you and average costs you will pay for these in Arkansas are listed in the below table.

| Coverage Type | 2011-2015 Average Cost in Arkansas |

|---|---|

| Liability | $381.14 |

| Collision | $304.87 |

| Comprehensive | $183.36 |

| Combined/Full | $869.37 |

You already know what liability coverage does. However, what about the remaining three?

Collision – Collision coverage provides financial protection if your vehicle is damaged in a car accident. This includes coverage for repair and even replacement of your vehicle, if necessary.

Comprehensive – Comprehensive coverage provides financial protection if your vehicle is damaged in circumstances other than a collision (ex. fire, hail, vandalism, etc.). This includes coverage for repair and even replacement of your vehicle, if necessary.

Combined/Full – Full coverage includes liability, collision, and comprehensive coverage

Please note that this data, from the National Association of Insurance Commissioners (NAIC), is based on the minimum insurance coverage requirements in Arkansas. You can use the information on the different kinds of core coverage and associated pricing listed in the table as a way to gauge which coverage mix may be right for you and how much it may cost you.

Additional Liability

Core coverage provides coverage for the major issues you may come across, but no insurance policy covers everything. However, there are some additional liability coverage options you can choose to add to your policy that enhance the financial protection it provides.

One example is uninsured/underinsured motorist coverage. Arkansas is ranked ninth in the nation for uninsured drivers, with almost 17 percent of drivers in the state driving without insurance. What happens if you are in an accident with one of these drivers?

This is enough of a concern in the state that Arkansas requires insurance providers to offer uninsured/underinsured motorist coverage to residents as a part of minimum liability coverage.

Unlike minimum liability coverage, however, this is not required, and drivers can choose to opt-in or out of this (if they choose to opt-out, they must do so in writing).

Find out the best uninsured motorist coverage car insurance companies.

In addition to uninsured/underinsured motorist coverage, you also have the option to choose the following liability coverage:

- Medical Payments (MedPay) – provides additional coverage for medical costs that are not already included in your core coverage (this coverage applies to you and anyone included in your policy)

- Personal Injury Protection (PIP) – provides additional coverage for medical costs that are not already included in your core coverage (this coverage applies to anyone involved in an accident, regardless of who is at fault). In Arkansas, this includes three kinds of no-fault coverage (medical payments, disability income, and accidental death benefits). These can be purchased individually, as well as in a bundle. The bundle is referred to as PIP. Read about the best personal injury protection car insurance companies.

Knowing your options for additional liability coverage is important in enabling you to decide on the coverage mix that best fits your needs. However, if you decide to opt-in to any of these coverage options, you want to be confident your insurance provider can payout on a claim, should you ever need to file.

In order to be able to determine whether or not your insurance provider can pay out on claims, the NAIC provides data for something called loss ratio. This is a percentage derived from the number of claims on which an insurance provider pays out versus their premiums.

When you look at loss ratio data, you want to know a company is paying out a reasonable number of claims. Loss ratios that range between 60 and 80 percent are ideal. Anything above this, and it means too many claims are being paid, which results in too much money lost, while anything below this range means not enough claims are being paid.

To help you better understand the loss ratio for each of the different additional liability coverage options, the NAIC provides data for all three, which is listed in this table.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Uninsured/Underinsured Motorist | 70.23% | 68.12% | 83.37% |

| Personal Injury Protection | 28.65% | 0.00% | 94.17% |

| MedPay | 89.94% | 83.09% | 80.99% |

Personal Injury Protection’s loss ratio in Arkansas varies wildly from year-to-year. In 2013 and 2014 it was too low, while in 2015 it was too high. However, the loss ratio for the uninsured/underinsured motorist coverage in the state is within healthy ranges. MedPay loss ratio rates are a little above a healthy range but are still reasonable.

Add-ons, Endorsements, and Riders

Besides core and additional liability coverage, you have some other add-ons, endorsements, and riders you can speak to your insurance agency about if you feel you need additional protection. These options include:

- Guaranteed Auto Protection (GAP) – covers the gap between what your car is worth and what you still owe on your loan

- Personal Umbrella Policy (PUP) – provides protection in the event you are ever faced with a lawsuit as a result of your part in a car accident

- Rental Reimbursement – provides coverage if you have to rent a car if yours is damaged in a car accident and is unavailable to drive while it is being repaired

- Emergency Roadside Assistance – provides coverage for various roadside needs, like a flat tire, towing, etc.

- Mechanical Breakdown Insurance – provides repair coverage, often beyond what is covered by your vehicle’s warranty

- Non-Owner Car Insurance – provides insurance coverage when you don’t own a car

- Modified Car Insurance Coverage – provides coverage for vehicles with special modifications (ex. wheels/tires, specialty paint jobs, spoilers, etc.)

- Classic Car Insurance – provides coverage for vehicles that are considered collector’s items

- Pay-As-You-Drive or Usage-Based Insurance – insurance coverage that is specifically focused on individual driving habits

Average Car Insurance Rates by Age & Gender in AR

While it is a growing topic of discussion and states like California and Hawaii have made it illegal, Arkansas still allows insurance companies to consider gender when adjusting premium rates.

Does gender really have an effect on insurance rates? Do men in Arkansas actually pay more in premiums than women do? Is age a factor? We’ve pulled together data from Quadrant to find out.

| Company | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| USAA | $4,210.03 | $4,407.45 | $1,721.30 | $1,855.30 | $1,336.55 | $1,349.38 | $1,240.31 | $1,248.11 |

| State Farm Mutual Auto | $5,051.46 | $6,355.63 | $1,979.45 | $2,268.23 | $1,757.39 | $1,757.39 | $1,571.32 | $1,571.32 |

| Nationwide Mutual | $6,363.21 | $8,114.04 | $3,008.14 | $3,244.81 | $2,629.04 | $2,679.98 | $2,359.97 | $2,495.08 |

| GEICO General | $6,588.67 | $6,607.80 | $2,492.72 | $2,527.69 | $2,536.43 | $2,508.78 | $2,340.15 | $2,274.76 |

| Safeco Ins Co of IL | $8,280.70 | $9,115.49 | $2,511.18 | $2,626.04 | $2,324.12 | $2,488.44 | $2,220.47 | $2,477.39 |

| Farmers Ins Co | $9,693.38 | $10,046.95 | $2,654.22 | $2,797.50 | $2,316.82 | $2,306.44 | $2,070.77 | $2,176.91 |

| Allstate P&C | $10,596.85 | $12,699.62 | $3,211.86 | $3,487.30 | $2,908.00 | $2,928.74 | $2,593.49 | $2,774.39 |

| Progressive NorthWestern | $11,868.05 | $13,373.52 | $3,372.76 | $3,645.70 | $2,820.71 | $2,675.07 | $2,318.03 | $2,422.91 |

| Travelers Home & Marine Ins Co | $12,955.34 | $20,822.43 | $2,377.54 | $2,746.50 | $2,222.90 | $2,265.25 | $2,194.96 | $2,201.72 |

Based on the data in the above table, both gender and age are factors in how insurance companies adjust rates in Arkansas. But not all companies place the same significance on these variables.

For example, with Nationwide, if you are a 17-year-old-driver, males pay 28 percent more for insurance than females do. By contrast, for drivers of the same age, males pay less than one percent more for insurance coverage than females do under GEICO.

On average across all nine companies listed, 17-year-old male drivers pay 18 percent more for insurance than female drivers do. But as you age, the gap in premium rates shrinks. At 25, the difference in rates between male and female drivers is an average of 8 percent, and at 35, the difference is less than one percent. Find out the average cost of car insurance by age.

This data was put together based on actual, purchased coverage by drivers in Arkansas. To ensure it is representative, it includes rates for drivers across the spectrum, including high-risk drivers, those who only purchase liability coverage, and drivers with additional coverage in their policies.

Cheapest Rates by Zip Code

Age and gender aren’t the only factors that affect your car insurance rates. Providers also take into account where you live.

Why does your zip code matter? Companies look crime, accident, vandalism, and more data in zip codes to determine the likelihood of something happening that may result in a claim being filed.

Across the state, there is a 35 percent difference between the zip code with the lowest average rates and the zip code with the highest average rates in the state.

Cheapest Rates by City

Uniontown, Arkansas, has the lowest average insurance rates in the state, while Ashdown, Arkansas has the highest average rates. Little Rock ranks on the higher end for average insurance rates, which is not surprising, since it is the largest city in the state.

The average premium rates for the ten largest cities in the state (according to World Atlas) are listed in the below table.

| Rank | City/Town | Annual Average |

|---|---|---|

| 1 | Little Rock | $4,351.36 |

| 2 | Fort Smith | $3,843.50 |

| 3 | Fayetteville | $3,864.19 |

| 4 | Springdale | $3,816.55 |

| 5 | Jonesboro | $4,461.36 |

| 6 | North Little Rock | $4,157.69 |

| 7 | Conway | $4,011.47 |

| 8 | Rogers | $3,947.45 |

| 9 | Pine Bluff | $4,260.52 |

| 10 | Bentonville | $3,775.02 |

Surprisingly, the 10th-largest city is the most expensive, while Little Rock, the largest city in the state, has the second least expensive average premium rate.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Best Arkansas Car Insurance Companies

Rates, and how companies derive them, are not the only factors to consider when looking at which car insurance coverage mix and provider is best for you.

Knowing a company’s financial stability, as well as how they rank in terms of customer service, are both important pieces of information to know when making decisions.

Finding this information can be complicated. But not to worry, we’ve pulled together that information for you as well. Keep reading to learn more about customer service reports from JD Power and financial ratings from AM Best.

The Largest Companies Financial Rating

How do you know a company is capable of paying out on claims, should you ever need to file one? A significant piece of the equation is knowing the financial stability of insurance companies. If a company is not financially stable, they will certainly not be able to pay out on claims, so this is a key indicator when shopping for the right company for you.

One way to find out the financial stability of companies is to look at credit ratings given to them by credit agencies who review financial data in order to generate these ratings. AM Best is one such global credit firm, which focuses specifically on the insurance industry.

| Insurance Company | Rating | Outlook |

|---|---|---|

| State Farm Group | A++ | Stable |

| Southern Farm Bureau Casualty Group | A+ | Stable |

| Shelter Insurance Group | A | Stable |

| Allstate Insurance Group | A+ | Stable |

| Progressive Group | A+ | Stable |

| GEICO | A++ | Stable |

| USAA Group | A++ | Stable |

| Liberty Mutual Group | A | Stable |

| Farmers Insurance Group | NR | - |

| Nationwide Corp Group | A+ | Stable |

AM Best’s rating structure is such that any company that receives an A- or better is considered financially solid and has a “stable outlook.”

As you can see, based on their ratings, the ten largest insurance providers in Arkansas are financially stable (except for Farmers Insurance, which is not rated). This means drivers who are insured by one of these companies can rest easy knowing should they ever need to file a claim, their providers have the ability to pay out on that claim.

Companies with Best Ratings

What about customer service? You want to know a company you pay to provide you insurance coverage has customer service that is user-friendly and accessible when you need it.

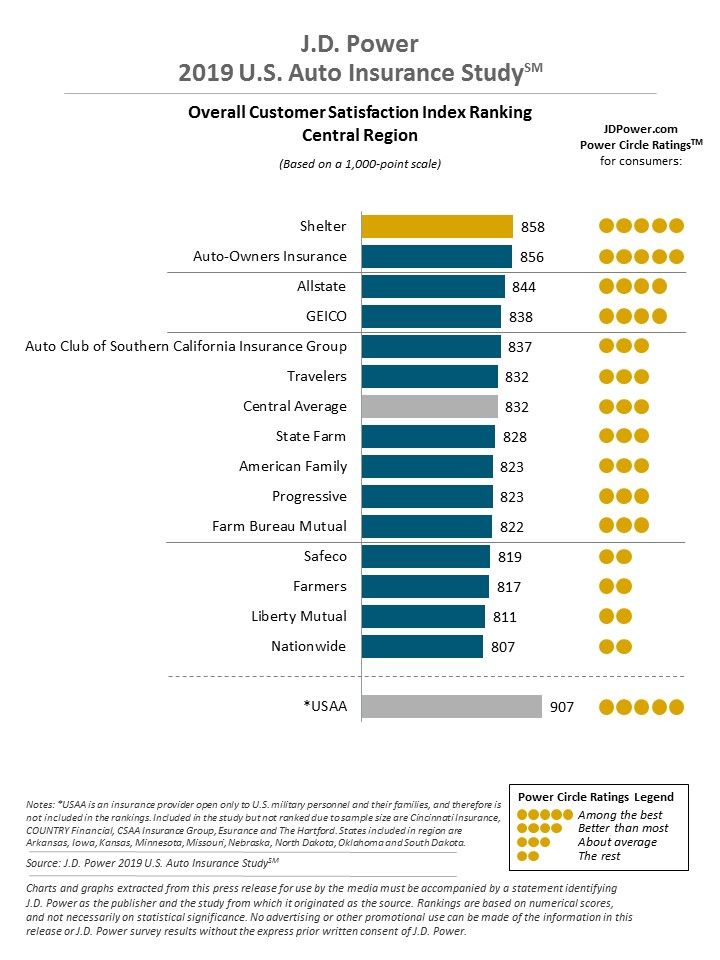

JD Power conducted a study in 2019 that looked into customer service satisfaction in the car insurance industry. They generated Customer Satisfaction Index Ratings for various states and regions in the country.

According to their study, customer satisfaction in the insurance industry is higher than ever. The Customer Satisfaction Index Rating for the central region of the United States (within which Arkansas falls) is below.

According to the index rating above, in the central region of the United States, USAA has the highest, “among the best,” customer satisfaction rating (907 of 1,000). Read our USAA insurance review to learn more.

The next highest rating for insurance that is readily available in Arkansas (based on the list of top 10 companies we provided in the AM Best ratings discussion), is Shelter, which also has an “among the best” rating for customer satisfaction of 858 points out of the 1,000-point scale.

Companies with Most Complaints in Arkansas

Every company deals with complaints. But is the number of complaints they receive worth considering when choosing an insurance provider? Insurance companies each receive complaint ratio data, which allows you to see how many complaints a company receives.

Let’s take a look at the complaint ratio data for the ten largest insurance providers in Arkansas.

| Insurance Company | Direct Premiums Written | Complaint Ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | $500,195 | 0.5 | 66.99% | 25.69% |

| Southern Farm Bureau Casualty Group | $248,792 | 0.49 | 69.46% | 12.78% |

| Shelter Insurance Group | $167,424 | 0.7 | 67.43% | 8.60% |

| Allstate Insurance Group | $141,053 | 0.72 | 47.21% | 7.24% |

| Progressive Group | $139,855 | 0.76 | 58.71% | 7.18% |

| GEICO | $109,940 | 0.68 | 70.69% | 5.65% |

| USAA Group | $92,071 | 0.87 | 73.14% | 4.73% |

| Liberty Mutual Group | $80,245 | 0.99 | 61.30% | 4.12% |

| Farmers Insurance Group | $79,776 | 0.74 | 52.42% | 4.10% |

| Nationwide Corp Group | $57,506 | 0.53 | 51.80% | 2.95% |

To obtain a complaint ratio, the NAIC compares the number of complaints a company receives to the number of premiums written.

An average number of complaints is represented by the number one. When a company’s complaint ratio is less than one, that means they receive fewer complaints than average. If the company’s complaint ratio is greater than one, they receive more complaints than average.

The NAIC complaint ratio data for Arkansas shows that insurance providers in the state typically receive less than the average number of complaints, which is good for you, as a consumer.

The company with the highest complaint ratio is Liberty Mutual Group. They just squeak under the average, with a ratio of 0.99. This is not surprising when you look at their JD Power customer satisfaction index number, where they rank as slightly below average.

By contrast, the company with the lowest complaint ratio is Southern Farm Bureau Casualty Group, which is the second-largest provider in the state.

Their ratio is only 0.49. State Farm’s complaint ratio is only 0.5 (one one-hundredth of a percent higher than Southern Farm Bureau’s complaint ratio), but their customer satisfaction index number ranks them as just average.

The Arkansas Insurance Department handles complaints against insurance companies. If you ever find your self needing to file a complaint against your insurance provider, you can do so by filing complaints online through their electronic complaint form.

You can also mail the form to the Arkansas Insurance Department, Consumer Services Division 1200 West Third Street, Little Rock, Arkansas, 72201-1904, or you can fax it to 501-371-2749.

To make sure you correctly file your complaint, be sure to include:

- Your full name, address, and phone number

- The name of the insurance company

- The name of the insured

- The policy and claim number

- The agent or adjuster’s name

- The date of occurrence

- A brief description of your reasons for filing the complaint

If you have questions or need to request a complaint form (rather than pulling it from their website), you can call the Arkansas Insurance Department at 800-852-5494 or 501-371-2640.

Cheapest Companies in Arkansas

The average rate for full car insurance coverage across the state of Arkansas is $4,111.70. This table looks at the average car insurance coverage rates for some of the largest providers in the state, compared to the state average.

| Company | Annual Average | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| USAA | $2,171 | -$1,940.65 | -89.39% |

| State Farm Mutual Auto | $2,789 | -$1,322.68 | -47.42% |

| GEICO General | $3,485 | -$627.07 | -18.00% |

| Nationwide Mutual | $3,862 | -$249.92 | -6.47% |

| Safeco Ins Co of IL | $4,005 | -$106.22 | -2.65% |

| Farmers Ins Co | $4,258 | $146.18 | 3.43% |

| Allstate P&C | $5,150 | $1,038.33 | 20.16% |

| Progressive NorthWestern | $5,312 | $1,200.39 | 22.60% |

| Travelers Home & Marine Ins Co | $5,973 | $1,861.63 | 31.17% |

Four of the six companies in this table offer insurance premiums that are higher (three significantly higher) than the state average.

The remaining six are all below the state average. For example, USAA is nearly 90 percent less than the state average, with an average rate of $2,171 per year, while State Farm Mutual Auto’s average rate is about 47 percent less than the state average.

Despite how widely these rates vary, most car insurance providers consider many of the same factors when adjusting rates for individual insureds. Knowing these factors, and how heavily different companies weigh these factors, can help you in making an informed decision on your insurance provider.

We’ve already looked at age and gender, but insurance companies look at more than just those. Commute, driving record, and even credit score are some other variables companies look at when figuring out how much to charge you for insurance coverage.

We take a look at these factors and their effects on rates for different companies in the next few sections. Keep reading to learn more.

Commute Rates by Companies

Many Americans across the nation spend time commuting to and from work every day, and Arkansas residents are no exception.

The average commute for Arkansas drivers is 20.8 minutes. The longest average commute times in the state are in Perry and Newton Counties, with 34.8 and 37.7 minutes respectively. The shortest commute time is in Arkansas County, with an average of 15.5 minutes.

The average commute distance in Little Rock (the largest city in the state) is 8.2 miles.

If you are a routine commuter, unfortunately, the more you drive, the more your insurance company may charge you. Why? Because the more you drive the higher your chances of being involved in some kind of vehicle incident.

| Company | 10 Mile Commute (6,000 Annual Mileage) | 25 Mile Commute (12,000 Annual Mileage) | Percent Increase |

|---|---|---|---|

| Allstate | $5,150.03 | $5,150.03 | 0.00% |

| Farmers | $4,257.87 | $4,257.87 | 0.00% |

| GEICO | $3,461.03 | $3,508.22 | 1.36% |

| Liberty Mutual | $4,005.48 | $4,005.48 | 0.00% |

| Nationwide | $3,861.78 | $3,861.78 | 0.00% |

| Progressive | $5,312.09 | $5,312.09 | 0.00% |

| State Farm | $2,721.97 | $2,856.08 | 4.93% |

| Travelers | $5,973.33 | $5,973.33 | 0.00% |

| USAA | $2,109.20 | $2,232.91 | 5.87% |

Fortunately for Arkansas drivers, six of the top insurance providers in the state don’t increase their rates for longer commutes. Those that do have minor increases in their premiums, with the highest increase being USAA, with a six percent increase.

Coverage Level Rates by Companies

You know you can pick different kinds and amounts of coverage, but how do you determine the right amount of coverage for your needs? Only you can decide whether you need high, medium, or low coverage. But one place to start when making that decision is price.

Each increasing level of coverage means higher cost, so you’ll have to make a value decision based on your priorities and the risks you are or aren’t willing to take when it comes to the level of coverage you purchase versus what you believe may happen on the road.

Check out this table to see the average rates in Arkansas for low, medium, and high coverage.

| Insurance Company | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| USAA | $2,080.93 | $2,163.34 | $2,268.89 |

| State Farm | $2,653.10 | $2,786.42 | $2,927.56 |

| GEICO | $3,341.79 | $3,483.60 | $3,628.49 |

| Liberty Mutual | $3,868.57 | $3,977.85 | $4,170.01 |

| Nationwide | $3,886.60 | $3,783.13 | $3,915.62 |

| Farmers | $4,050.03 | $4,214.22 | $4,509.37 |

| Progressive | $4,883.32 | $5,221.81 | $5,831.14 |

| Allstate | $5,006.12 | $5,146.99 | $5,296.98 |

| Travelers | $5,685.15 | $5,989.75 | $6,245.09 |

Not all companies increase their rates at the same percentage for different levels of coverage. Take Progressive, for example. Their average rates increase by about seven percent for medium coverage (versus low), and they increase an additional 19 percent for high coverage.

However, by contrast, Nationwide actually decreases their premium rates by about three percent for medium coverage and then increases their rates by a little under one percent for high coverage.

Read more about Nationwide in our Nationwide insurance review.

Credit History Rates by Companies

Credit score. Everyone needs one, and they require constant vigilance to maintain. But your credit score isn’t just used for getting a credit card or securing a loan. Car insurance companies look at your credit score when determining how to adjust your rates.

This is because some car insurance companies consider a good credit score to be a sign of responsibility. If you have a good track record of living within your means and paying your bills on time, they extrapolate that you will also be responsible on the road.

According to Experian, Arkansas residents have an average credit score is 657. This puts residents in the “fair” credit score range (in order to be considered “good” credit, the score needs to be at least 670).

But does this really have an appreciable effect on your car insurance rate? Take a look at this table to see how different companies adjust your rates, based on good, fair, and poor credit scores.

| Insurance Company | Annual Rates with Good Credit | Annual Rates with Fair Credit | Annual Rates with Poor Credit |

|---|---|---|---|

| USAA | $1,673.63 | $1,963.67 | $2,875.86 |

| State Farm | $1,893.84 | $2,432.50 | $4,040.73 |

| Liberty Mutual | $2,736.58 | $3,493.43 | $5,786.43 |

| GEICO | $2,847.29 | $3,431.81 | $4,174.77 |

| Nationwide | $3,346.08 | $3,673.03 | $4,566.24 |

| Farmers | $3,868.33 | $4,060.17 | $4,845.12 |

| Allstate | $4,020.37 | $4,957.59 | $6,472.14 |

| Progressive | $4,774.48 | $5,135.36 | $6,026.44 |

| Travelers | $5,345.75 | $5,719.88 | $6,854.36 |

As you can see by looking at the table, while the percentage increase varies from company-to-company, every provider listed does increase their rates, the lower your credit score.

If you have fair or poor credit, a good option for you might be Farmers, because they have the lowest percent increases for fair and poor credit (five percent and 25 percent respectively).

To consider the above data from another perspective:

- Good Credit (670+) = average annual premiums: $3,389.59

- Fair Credit (580-669) = 5 – 28 percent increase: $3,847.16

- Poor Credit (300-579) = 25 – 113 percent increase: $5,071.34

Driving Record Rates by Companies

What does your driving record look like? Are you the type to constantly be carrying a balance of points (obtained through moving traffic violations) on your driver’s license? Or do you pride yourself on your perfect driving record?

It should come as no surprise that the more traffic violations you have on your record, the more you can expect to pay in insurance. More traffic violations (including speeding, car accidents, and DUIs) means you are a higher risk driver, with a higher likelihood (from an insurance provider’s perspective) to cost them money.

The below table takes a look at the average rates across several car insurance providers for a clean driving record, a record with one speeding violation, a record with one DUI, and a record with a one-car accident. You can use this data to gauge how your driving record might affect your insurance rates.

| Insurance Company | Clean Record | With 1 Speeding Violation | With 1 DUI | With 1 Accident |

|---|---|---|---|---|

| USAA | $1,667.81 | $1,850.74 | $3,050.64 | $2,115.02 |

| GEICO | $2,361.95 | $2,541.89 | $5,408.92 | $3,625.74 |

| State Farm | $2,561.18 | $2,789.02 | $2,789.02 | $3,016.88 |

| Liberty Mutual | $2,728.95 | $3,668.24 | $5,189.50 | $4,435.22 |

| Nationwide | $3,003.05 | $3,306.76 | $5,255.42 | $3,881.91 |

| Farmers | $3,599.68 | $4,315.87 | $4,504.91 | $4,611.04 |

| Allstate | $4,247.65 | $5,074.04 | $5,933.45 | $5,344.99 |

| Progressive | $4,579.61 | $5,496.11 | $4,812.78 | $6,359.88 |

| Travelers | $5,005.97 | $6,145.34 | $7,570.08 | $5,171.93 |

For speeding violations, a good option may be GEICO, because their rates have the smallest increase for the first speeding violation.

However, to better understand this data and how the various traffic violations might affect your rates, we also put together data on the percent increase for traffic violations, using the data in the above table.

Take a look to see which companies have the most expensive consequences for different road violations.

| Insurance Company | Percent Increase - 1 Speeding Violation | Percent Increase - 1 DUI | Percent Increase - 1 Accident |

|---|---|---|---|

| GEICO | 7.62% | 129.00% | 53.51% |

| State Farm | 8.90% | 8.90% | 17.79% |

| Nationwide | 10.11% | 75.00% | 29.27% |

| USAA | 10.97% | 82.91% | 26.81% |

| Allstate | 19.46% | 39.69% | 25.83% |

| Farmers | 19.90% | 25.15% | 28.10% |

| Progressive | 20.01% | 5.09% | 38.87% |

| Travelers | 22.76% | 51.22% | 3.32% |

| Liberty Mutual | 34.42% | 90.16% | 62.52% |

For speeding, as we already know, GEICO has the lowest rate increase for the first offense. If you’ve recently been in a car accident, Travelers is probably your best bet, as they have the lowest increase in rates, at about three percent.

DUIs are interesting. Most companies have the highest premium rate increase for DUIs. However, State Farm has the same percent increase in rates for both speeding and DUI, and surprisingly, Progressive has a more significant rate increase for speeding than for DUI (20 percent for speeding, versus five percent for DUI).

Largest Car Insurance Companies in Arkansas

Company size, too, is something to consider when making informed car insurance provider decisions. The size of a company in a given region, expressed as market share, combined with loss ratio and complaint data (you’ll remember we’ve already mentioned these factors) is another way to determine which company may best suit your needs.

Essentially, this combined data will help you to make sure the provider you choose is able to pay out on insurance claims, should you ever find yourself needing to file one.

This table looks at the market share and premiums written for the ten largest car insurance providers in Arkansas.

| Rank | Insurance Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm Group | $500,195.00 | 25.69% |

| 2 | Southern Farm Bureau Casualty Group | $248,792.00 | 12.78% |

| 3 | Shelter Insurance Group | $167,424.00 | 8.60% |

| 4 | Allstate Insurance Group | $141,053.00 | 7.24% |

| 5 | Progressive Group | $139,855.00 | 7.18% |

| 6 | GEICO | $109,940.00 | 5.65% |

| 7 | USAA Group | $92,071.00 | 4.73% |

| 8 | Liberty Mutual Group | $80,245.00 | 4.12% |

| 9 | Farmers Insurance Group | $79,776.00 | 4.10% |

| 10 | Nationwide Corp Group | $57,506.00 | 2.95% |

Number of Insurers by State

As we’re sure you are aware, the largest insurance providers in the state are mostly (if not all) national companies that operate throughout the United States but are subject to the individual state’s insurance laws in each case.

Companies like this, that are incorporated somewhere besides the state in which they operate, are referred to as foreign insurers. Not just the large insurance providers are a part of this category, however. It is interesting to note there are 887 foreign insurance providers in the state of Arkansas.

Companies that are incorporated in the state are termed domestic insurers. There are 12 such companies in Arkansas. This puts the total number of insurance providers in Arkansas at 899.

This means you have a lot of options to choose from when making that all-important insurance provider decision.

Arkansas Laws

Are you ready to get out on the road? Before you do, you should make sure you are aware of and following the state driving and insurance laws. Without both of these components, your chances of not being prepared in the event of an accident, or even a traffic stop, are greatly increased.

You want to know you’re both safe and legal on the road, to ensure you avoid fees, suspension of your driver’s license and driving privileges, and even possible jail time, depending on the severity of the offense.

It’s also important to know the laws your insurance providers in the state are subject to, so you can be your own advocate.

But how do you find out all this information? We know you don’t have time to spend hours searching through documents and websites to find out exactly what you need to know. There’s no need to panic because we’ve done the time and work for you.

Keep reading to learn more about which laws may apply to you, license and vehicle registration processes, and more.

Car Insurance Laws

What car insurance laws do you need to be following? What laws are in place to ensure your insurance provider is offering you the coverage you need?

As we’ve already mentioned, Arkansas requires all drivers to have minimum liability insurance coverage on any vehicle they take out on the road. But there are other Arkansas car insurance laws in place regarding fraud, what your insurance company should be doing for you if certain kinds of damage happen to your car, and more.

The following sections provide you with this, and other, important information on car insurance laws.

How State Laws for Insurance are Determined

If you took government or political science classes in high school, you are probably already aware of the basics when it comes to getting laws passed. But let’s do a quick review.

Whenever an individual, group, agency, etc. wishes to create a law, they must put together a bill. This bill outlines the proposed law and why it is important.

In order for any movement to occur, the bill must be put before the legislature (in this case, it would be the Arkansas state legislature). The legislature then reads, reviews, and discusses the bill, to decide whether or not the law is actually beneficial and necessary.

If a majority agrees it is both, they sign the bill into law.

Check out the next few sections to see which laws Arkansas has in place for you and insurance providers to follow.

Windshield Coverage

Most drivers dread being stuck behind large trucks on the highway. No one likes wondering whether or not the rocks, pebbles, and dirt being kicked up or flying off the back of an 18-wheeler will hit their windshield and cause a chip or crack.

When it does happen, which it inevitably will at some point, what is the next step?

Unlike some states, Arkansas does not have a law on the books that requires insurance companies to offer windshield repair/replacement coverage. However, insurance providers can offer this coverage, if they choose to do so, as a part of a comprehensive policy.

If you do have windshield repair/replacement coverage in your policy, there are a few requirements to which both you and your provider are subject.

Your insurance company can choose to cover the cost of repair or replacement using aftermarket, rather than original manufacturer (OEM), parts, as long as those aftermarket parts are equitable to OEM in fit, quality, performance, and warranty.

However, your insurance company cannot dictate where your repair or replacement is done. That is up to you.

High-Risk Insurance

Are you considered a high-risk driver? In most cases, this means you have a higher-than-average number of moving violations or car accidents, or you’ve been convicted of DUI at some point.

If you’ve experienced some or all of the above, not only are you likely a high-risk driver, you may have found yourself struggling to obtain insurance. Many insurance providers do not voluntarily offer insurance coverage to high-risk drivers, because of the potential cost to them.

Don’t be too alarmed, however, Arkansas has a program in place to assist high-risk drivers in obtaining car insurance coverage. This program is called the Arkansas Automobile Insurance Plan (AR AIP).

You remember earlier when we discussed domestic versus foreign insurers, and we noted that every foreign (and domestic) insurance provider who wishes to operate in the state is subject to the insurance laws in the state? AR AIP participation is one such law.

Every insurance provider in the state MUST participate in the program, in order to legally provide insurance to residents in Arkansas.

Companies are mandated to provide insurance coverage through AR AIP to the same percentage of AR AIP-qualified drivers are their percentage of market share.

For example, Shelter Insurance Group has a market share of 8.6 percent in Arkansas. In order to operate in the state, they must insure 8.6 percent of the drivers who apply for insurance through AR AIP.

How do you apply for AR AIP? You can speak to any licensed insurance agent in Arkansas about applying to AR AIP, and they can submit your application for you. However, you can only do so after you have failed to successfully obtain car insurance coverage for the preceding 60 days (this must be noted on your application). In addition, you must have:

- A valid Arkansas driver’s license (which means if your license is suspended for any reason, you will need to get it reinstated before you can apply to AR AIP)

- A vehicle registered in Arkansas

You must also ensure your application is accurate and truthful, you cannot have any unpaid premiums at another insurance provider in the state, and you must provide any and all supplemental information the insurance provider requests as a part of your application.

At a minimum, you will have minimum liability coverage under AR AIP. However, you can expect both that your premium rates will be higher than the average (non-high-risk) driver, and that your minimum liability coverage requirements will be greater.

The below table compares the state minimum liability coverage to the minimum liability coverage you will pay for through AR AIP.

| Required Insurance | AR State Minimum Limits | AR AIP Minimum Limits |

|---|---|---|

| Bodily Injury | $25,000 per person $50,000 per accident | $100,000 per person $300,000 per accident |

| Property Damage Liability | $25,000 | $100,000 |

Your minimum coverage requirements are between 300 and 500 percent higher than the state minimum coverage requirements for an average, non-high-risk driver. You also have the option to include more full coverage options, if you believe you need them.

If you have any questions regarding the AR AIP, you can visit their website or you call the Arkansas Department of Insurance at 1-800-852-5494.

If you do not currently qualify for AR AIP because your license has been suspended, you will need to obtain SR-22 insurance in order to reinstate your license and driving privileges. You will not be able to obtain SR-22 insurance immediately after your license has been suspended.

You will need to wait a full year after your suspension before you can apply for a new license. Additionally, any court-related issues that resulted from your driving suspension must be resolved, and a judge must provide you with written permission to reinstate your driving privileges.

Once you’ve finished the above steps, you can apply for SR22 insurance. through an insurance company that provides it.

Find out the best car insurance companies for high-risk drivers.

Low-Cost Insurance

Though Arkansas has a program in place to support high-risk drivers and enable them to obtain insurance coverage, the state does not currently offer something similar for low-income families to obtain and maintain insurance coverage.

To-date, California, Hawaii, and New Jersey are the only states in the country that provide some form of government-funded assistance to low-income families who need help maintaining their insurance coverage.

Automobile Insurance Fraud in Arkansas

Insurance fraud is expensive and damaging to companies and insureds across the country. The Insurance Information Institute (III) reports that nearly 10 percent of the losses insurance companies absorb are due to insurance fraud. Ten percent!

Unfortunately, the end result of this, for you as the insured, is higher premiums.

Because insurance fraud is such a big issue, most states are taking it very seriously, and Arkansas is no exception. It is one of the 46 states that have created an investigative bureau dedicated to insurance fraud. It is also classified as a crime in the state.

The Arkansas Insurance Department Criminal Investigation Division (CID) is responsible for investigating all forms of insurance fraud in the state, including car insurance fraud. According to the CID, most people who commit insurance fraud do so for one or more of the following reasons:

- They believe it is a victimless crime

- They are attempting to compensate for premiums they have previously paid

- They think exaggerating or faking insurance claims is common practice

- They don’t think they will get caught

- They think it is an easy and fast way to make some money

If you are ever in a position in which you believe you need to report potential fraud, you can do so through the NAIC’s online fraud reporting system. Your complaint will be directed to the CID for investigation.

If you have any questions regarding insurance fraud, reporting insurance fraud, etc., you can call the CID at 866-660-0888. You can also reach them by email at [email protected] or fax at 501-371-2799.

Statute of Limitations

If you need to file a claim or lawsuit for damages resulting from a car accident, the statute of limitations in Arkansas is three years for both personal injury and property damage.

State Specific Laws

Many of the laws we’ve discussed (and will discuss in the following sections) are fairly standard across the country, with some minor variations. For example, the minimum liability coverage requirement law. However, there are some laws in nearly every state that are specific to that state only.

These laws can span the spectrum from the logical to the obscure and bizarre. For example, in Arkansas, it is illegal to honk your horn after 9:00 p.m. at any business that serves sandwiches and/or cold drinks.

Vehicle Licensing Laws

In order to legally drive your vehicle on the streets in Arkansas, it must be registered with the state. Choosing to not register your vehicle (or allowing the registration to lapse or expire) can result in fees, suspension of your license, and suspension of your driving privileges.

If you purchase a new vehicle or you recently moved to Arkansas, you will need to register your vehicle(s) with the state within the first 30 days.

In order to register a new vehicle in the state, you will need:

- The title, bill of sale, or manufacturer statement of origin

- Your insurance card

- The federal odometer statement

You may also need:

- Your personal property tax number (PPAN)

- A lien contract/security agreement

- Your current year county tax assessment

- A proof of paid tax receipt

You can register your vehicle in-person at a DMV location, but the Arkansas Department of Finance and Administration (DFA) recommends avoiding the hassle and the lines and doing so through their online process.

If you need to renew your vehicle registration, you can do so in a few different ways.

- Online through the Arkansas Vehicle Registration Renewal

- Over the phone by calling 1-800-41-2580

- In-person at a State Revenue Office

- Through the mail at Office of Motor Vehicle, P.O. Box 3153, Little Rock, AR 72203-3153

If you have questions regarding car title or registration, you can call the DFA at 501-682-4692.

Real ID

After 9/11, the Department of Homeland Security (DHS) came up with a way to reduce the chances of what happened then from ever happening again by implementing a federal identification program that requires all states to ensure there is a form of identification that proves everyone who holds that form of identification is who they say they are.

This program is commonly referred to as the rather controversial REAL ID Act. Since 2005, when it was first rolled out, the program has been slowly picked up and implemented in states across the U.S.

To-date, only three states in the country still have an extension to ensure they have enough time to get a complaint identification program in place.

According to DHS, Arkansas is one of the many states that are already compliant with the REAL ID Act.

Why does this matter for you? In October of 2020, you will no longer be able to fly commercially anywhere in the United States with your driver’s license, unless it is REAL ID-compliant.

Additionally, should you ever have the need to access a nuclear power plan or U.S. military installation, you will be required to have a REAL ID-complaint form of identification.

Like many states, Arkansas indicates that a license is REAL ID-compliant with a gold circle that has a white star in the middle.

In order to obtain your REAL ID-compliant driver’s license, you will need:

- Proof of identity

- Proof of Social Security Number

- Two proofs of Arkansas state residence

- Legal proof of name change (if applicable)

You will need to bring the above-listed documents (which will need to be originals) to a State Revenue Office that has been designated as an AR REAL ID DL/ID Office.

For questions or additional information on the REAL ID-complaint enhanced ID in Arkansas, you can visit the Arkansas Department of Finance and Administration website.

Penalties for Driving Without Insurance

You already know Arkansas requires minimum liability insurance to drive on the roads in the state. If you are stopped and asked to provide proof of insurance, you can do so using a traditional insurance card, a binder with a copy of your policy, or with an electronic insurance card (usually on a mobile device).

But what happens if you are caught driving without it? This table provides information on the consequences of driving without insurance in the state.

| First Offense | Second Offense |

|---|---|

| Fine: $50 to $250; suspended registration/no plates until proof of coverage plus $20 reinstatement fee; court may order impoundment | Fine: $250 to $500 fine — minimum fine mandatory; suspended registration/no plates until proof of coverage plus $20 reinstatement fee. Court may order impoundment |

Teen Driver Laws

If you are 14 and live in Arkansas, you’re in luck. The state allows teens to apply for an instruction permits at the age of 14 (though you won’t be able to apply for a provisional license until you turn 16, even if you’ve met all the other requirements to do so), as long as you pass a written test.

In order to obtain a learner’s license, you will need to pass a road test, which must be scheduled through the Arkansas State Police department.

There is no state requirement for driver’s education, but you will need to learn the rules of the road in order to pass both the written and road tests necessary to obtain your permit.

You will be required to hold your driver’s permit (this includes both the instruction permit and learner’s license) for a minimum of six months (though if you originally obtained this at 14, you will likely hold it for around two years, until you turn 16 and can apply for a provisional license).

During these six months, you will be able to practice driving as long as a licensed driver who is at least 21 years old is with you at all times. Unlike many states, Arkansas does not have a required number of hours you must drive with supervision before you can apply for your provisional license.

At 16 you can apply for your provisional license, which you must hold until you turn 18. While you have your provisional license, you are not allowed to drive unsupervised between the hours of 11:00 p.m. and 4:00 a.m. and you may not have more than one passenger in your vehicle who is under the age of 21.

When you turn 18, as long as you have a clean driving record, you can apply for your full, unrestricted driver’s license.

Older Driver License Renewal Procedures

Most license renewal requirements in the state of Arkansas are the same, no matter your age. Everyone must provide proof of adequate vision at every other license renewal and no one can renew their license online or through the mail; everyone must renew in-person.

However, at age 70 or older, Arkansas drivers have the option to choose license renewal every four years or every eight years, rather than only having the eight-year renewal option for the general population.

New Residents

If you’ve recently moved to Arkansas, you will need to obtain a state driver’s license.

Arkansas requires all new residents to relinquish their out-of-state driver’s licenses and obtain an Arkansas driver’s licenses within 30 days of establishing residency.

In order to obtain your Arkansas driver’s license, you will need to visit a State Revenue Office and bring your out-of-state license, proof of legal “presence” in the United States, and proof of residency. If you would like to obtain a REAL ID-compliant license in the state, you will need to make sure to bring:

- Proof of identity

- Proof of Social Security Number

- Two proofs of Arkansas state residence

- Legal proof of name change (if applicable)

In addition to the documentation, you will need to pass a vision test and pay any applicable fees (typically $40.00 plus some additional fees) for obtaining a driver’s license in the state.

License renewal procedures

Arkansas only requires drivers’ license renewals every eight years. Renewals cost between $5.00 and $10.00. However, REAL ID licenses will need to be renewed every four years.

Renewals must be completed in-person at a DFA State Revenue Office location. You will need to bring proof of residence and your previous driver’s license with you when you visit.

You can also expect to have a vision check every other renewal, to ensure your vision is still adequate to drive.

Negligent Operator Treatment System (NOTS)

Many states have programs in which they attach points to your driver’s license each time you are found guilty of a moving violation.

If you accrue too many points on your license in a given time period, you will face suspension of your license and driving privileges, as well as possible fines (in some cases even jail time). In California, this is referred to as the Negligent Operator Treatment System or NOTS.

A moving violation occurs when you are found guilty of violating a traffic law at any point when your vehicle is moving (ex. speeding, running a red light, or driving while under the influence).

Non-moving violations can still occur when your vehicle is in motion. However, they are not reported to the department of licensing or insurance companies. Non-moving violations can include distracted driving and driving without a seat belt.

Arkansas is one of the many states that has a NOTS-like program in place to deter drivers from reckless behavior. Under Arkansas’ Administrative Point System, different moving violations will result in an accumulation of between three and eight points.

If you are found to be speeding, for example, and your speed exceeds the speed limit but is less than 15 MPH over the posted speed limit, you will accrue three points. Reckless driving, on the other hand, will get you eight points in one shot.

At ten points on your record, the Arkansas Department of Finance and Administration will send you a warning letter letting you know additional points may mean a suspended license.

If you accrue 14 points, a hearing will be scheduled and your license and driving privileges may be suspended at that time. Your license will automatically be suspended if you are not present at the hearing.

Rules of the Road

When you drive across the state of Arkansas, you need to know the rules of the road. Knowing these rules will help keep your driving record clean, which will help you keep your premium rates down.

We know the last time you paid attention to the details of the rules of the road was probably in driver’s education. Finding all that information again can be time-consuming and frustrating. Not to worry, we’ve collected some major rules of which you need to be aware right here.

Keep reading to find out what Arkansas requires of you when you’re on the road, as well as what the state requires of insurance companies, ridesharing companies, and owners of autonomous vehicles to keep you safe and secure on the road.

Fault vs. No-Fault

As you already know, Arkansas is a fault state, which means whoever is at fault in an accident involving one or more vehicles is financially responsible for the resulting damages. Realistically, this means the person at-fault’s insurance is responsible for paying the damages, both property and injury, that result from the car accident.

However, as we’ve already discussed, you have the option to purchase no-fault coverage in Arkansas, to help you cover the cost of medical payments, disability income, and accidental death benefits, whether or not you were at fault for the accident.

Seat belt and car seat laws

Do you wear your seat belt when driving in Arkansas? If not, you should. Not only does it keep you safer when on the road, but the state considers not wearing the appropriate seat belt (or not having your child in the appropriate child safety restraints) to be a primary offense.

What is a primary offense? Any traffic violations considered primary offenses are such that law enforcement can pull you over and cite you specifically for that violation.

If you are pulled over because an adult (anyone 15 years and older, for this purpose) is not properly seat belted in the state, you will pay a minimum fine of $25 plus additional fees for your first offense.

All children aged five years or less and/or who weigh less than 60 pounds must be in a child safety seat. They cannot legally use an adult seat belt until they are at least 6 years old and weigh a minimum of 60 pounds.

Your first offense, should you be pulled over and cited for a child in your vehicle not being properly secured in a child safety seat, is a minimum fine of $100 plus applicable fees.

Arkansas has laws in place to restrict passengers from riding on any portion of a vehicle that is not intended for them (i.e. the hood, fender, etc.). The exception is cargo areas of work vehicles. If you are doing so in a work capacity while “on-duty,” is legal to ride in the bed of a pickup truck.

Keep Right and Move Over Laws

In Arkansas, if you come across any parked emergency vehicles, utility vehicles, or any other vehicle that has flashing lights, you must change lanes to away from where the vehicle(s) is parked if you can do so.

If you find yourself driving slower than the traffic around you, Arkansas law requires you to move to the right, if it is possible to do so, to avoid slowing down traffic. Under this law, you are not permitted to slow or obstruct traffic by staying in the left lane; you must move to the right.

Speed Limits

Driving above the posted speed limit will get you a minimum of three points added to your driving record under the Arkansas Administrative Point System. In order to avoid this, always pay attention to the posted speed limits.

There are maximum speed limits set by the state for different kinds of roads listed below.

- Rural interstates: 75 MPH (trucks are not allowed to drive about 70 MPH)

- Urban interstates: 65 MPH

- Other limited-access roads: 75 MPH (trucks are not allowed to drive about 70 MPH)

- Other roads: 65 MPH

The rural and urban interstate speed limits reflect a recent and somewhat controversial change in the state.

You should be aware that just because those speeds are the maximum allowed by the state does not mean those speeds will always be the posted speed limit on a given portion of the road.

Speed limits are adjusted within the boundaries set by the state based on weather, road, and traffic conditions, which means often the posted speed limit may be lower than the MPH maximum set by the state.

You must also drive at a speed that is safe for the weather and road conditions, regardless of the posted speed limit.

Ridesharing

Ridesharing apps like Uber and Lyft are a convenient and affordable way to get a ride. However, in recent years they haven’t had the best track records for keeping passengers safe.

What is Arkansas doing to keep you safe both when you’re getting a ride and when you’re sharing the road with Transportation Network Company (TNC) drivers?

TNCs have spread throughout the United States swiftly over the past several years. In Arkansas, the first TNC to operate was Uber (it was first legal for Uber to offer rides in the northwest part of the state in November of 2014). Lyft was approved a few years later.

In order to legally operate as a TNC in the state of Arkansas, companies are required to obtain a permit to do so from the Arkansas Public Service Commission (PSC). The state also requires TNCs to pay a $15,000 annual fee to maintain their permit to operate.

TNCs are required to obtain and retain minimum liability insurance coverage of $1 million any time one of their drivers is providing a ride through their application.

In addition, all TNC drivers must:

- Be at least 19 years old

- Register with the PSC under the appropriate TNC

- Maintain liability insurance

- Only offer rides in a vehicle that has passed mandatory safety checks

- Only offer rides to passengers who have secured a ride through the appropriate application, website, etc.

Currently, the only insurance provider in the state that provides insurance to TNCs while they are providing a ride to a customer through their respective applications is Farmers.

Automation on the Road

Driverless cars continue to make headlines and are controversial across the country. Some states are supportive of autonomous vehicles driving and being tested on their roads, while others prohibit them altogether.

Arkansas allows autonomous vehicle companies to conduct testing on the road in the state. They do require any vehicle on the road (including those considered to be autonomous) to maintain liability insurance coverage, however.

The state also supports the deployment of autonomous vehicles, in very limited circumstances. This can only be done as part of an approved pilot program, and no more than three vehicles in a given pilot program can be deployed on the road in Arkansas.

Safety Laws

Driving safely on the road is about more than just following the speed limit and wearing your seat belt. To keep you and other drivers safe on the road, Arkansas put multiple laws in place.

One safety-related law Arkansas has on the books mandates the minimum amount of outside lighting that must filter into your vehicle. The goal of this law is to ensure you as the driver have the visibility you need to safely drive on the road.

For sedans,

- Windshield: non-reflective tint can be placed on the top five inches of the windshield

- Front side windows: a minimum of 26 percent of outside lighting must filter into the vehicle; no metallic or mirrored tint is permitted

- Back side windows: a minimum of 26 percent of outside lighting must filter into the vehicle; no metallic or mirrored tint is permitted

- Rear window: a minimum of 11 percent of outside lighting must filter into the vehicle; no metallic or mirrored tint is permitted

For SUVs and vans,

- Windshield: non-reflective tint can be placed on the top five inches of the windshield

- Front side windows: a minimum of 26 percent of outside lighting must filter into the vehicle; no metallic or mirrored tint is permitted

- Back side windows: a minimum of 11 percent of outside lighting must filter into the vehicle; no metallic or mirrored tint is permitted

- Rear window: a minimum of 11 percent of outside lighting must filter into the vehicle; no metallic or mirrored tint is permitted

Arkansas allows all available tint colors to be used. Additionally, the driver’s side window of any tinted vehicle must include a sticker that indicates the tinting is legal.

In the following sections, we go over the state laws related specifically to driving under the influence and distracted driving. Keeping reading to learn what you need to know about these laws.

DUI Laws

Had a few drinks? Don’t get behind the wheel in Arkansas (or anywhere). If you make the decision to take your and other people’s lives into your hands and drive while under the influence of alcohol, you can expect to face serious consequences. Ultimately you may cause death or injury to another driver, passenger, or pedestrian.

Even if tragedy doesn’t strike, if you are caught, fines, jail time, and suspension of your license are just some of the consequences. If you are convicted, the DUI will be on your record for at least five years.

In Arkansas, the blood alcohol level (BAC) is 0.08. The state does not have a high BAC (HBAC) level, unlike many states.

According to Responsibility.org, 140 alcohol-related fatalities occurred in 2017 alone. Put another way, this is 4.7 alcohol-related deaths for every 100,000 population, compared to the national average of 3.4 per 100,000 population.

Don’t drink and drive. If you do, the repercussions are serious and include those in this table.

| Penalty | 1st DUI | 2nd DUI | 3rd DUI | 4th DUI |

|---|---|---|---|---|

| Fine | $150-$1000 | $400-$3000 | $900-$5000 | $900-$5000 |

| Jail Time | 24 hours - 1 year, or community service | 7 days-1 year | 90 days to 1 year | 1-6 years |

| Licensed Revoked | 6 months | 2nd offense in 5 years - 2 year revocation | 3rd offense in 5 years - 30 month revocation | 4 years |

| Mandatory Ignition Lock | interlock device equal to license suspension time | interlock device equal to license suspension time. | interlock device equal to license suspension time | interlock device equal to license suspension time |

| Additional Requirements | For license reinstatement, must complete approved treatment or education program and a Victim Impact Panel +$150 reinstatement fee | For license reinstatement, must complete approved treatment or education program and a Victim Impact Panel +$150 reinstatement fee; | For license reinstatement, must complete approved treatment or education program and a Victim Impact Panel +$150 reinstatement fee | For license reinstatement, must complete approved treatment or education program and a Victim Impact Panel +$150 reinstatement fee; |

While it pales in comparison to tragedy and the possible outcomes in the above table, if you are convicted of DUI, your insurance rates will increase (likely quite significantly, as you saw earlier).

If you’re going to live it up, party, or just have a few drinks, make sure you’re prepared. If you can’t get a designated driver, use one of the ridesharing options available to you in Arkansas.

Marijuana-Impaired Driving Laws

Marijuana is legal for medical use in Arkansas, and has been so since May of 2019, but has not been decriminalized for any other use.

However, according to Responsibility.org, the state does not currently have any driving under the influence laws specific to Marijuana usage. Despite this, if you are found to be impaired when driving due to marijuana, you will face consequences.

Distracted Driving Laws

Arkansas has less strict, though somewhat complicated, distracted driving laws than many states. Currently, hand-held usage is banned if you are between the ages of 18 and 20, and all cell-phone usage is banned for any driver who currently holds a learner’s permit or intermediate license.

Texting while driving is illegal for every driver on the road.

If you are over 21 and hold a standard driver’s license, the following laws apply to you:

- Hand-held usage is banned if you are driving past a school building or school zone during school hours and children are there

- Hand-held usage is banned if you are driving past a highway work zone and workers are there

- All cellphone usage is banned if you are driving a school bus unless you are parked or it is an emergency

Any violation of these cellphone usage laws is considered a primary offense.

Driving Safely in Arkansas

Sadly, even if you follow every rule of the road at all times, you cannot control other drivers on the road, weather, and road conditions. These can all result in car accidents and tragedies.

To learn more about road fatalities, where they most often occur, and the most common kinds, we’ve pulled together GeoTab and NHTSA crash data. We’ve also looked at FBI data to give you information on the most common kinds of vehicles stolen in the state and where those thefts are most likely to happen.

Keep reading to learn more.

Vehicle Theft in Arkansas

Having your vehicle stolen is every vehicle owner’s fear at some point. While there is little you can do to prevent this from happening to you, it can be helpful to know what vehicle theft looks like in Arkansas, what vehicles are most commonly stolen, and more.

The number one vehicle stolen in the state is a full-size Chevrolet pickup. Check out this table to see if your vehicle makes the top ten.

| Rank | Make/Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 1 | Chevrolet Pickup (Full Size) | 2004 | 402 |

| 2 | Ford Pickup (Full Size) | 2008 | 252 |

| 3 | GMC Pickup (Full Size) | 1997 | 174 |

| 4 | Dodge Pickup (Full Size) | 1999 | 127 |

| 5 | Honda Accord | 1997 | 122 |

| 6 | Nissan Altima | 2015 | 89 |

| 7 | Toyota Camry | 2013 | 82 |

| 8 | Chevrolet Impala | 2012 | 76 |

| 9 | Chevrolet Malibu | 2006 | 72 |

| 10 | Chevrolet Tahoe | 2003 | 68 |

Whether or not your vehicle made this list, you can talk to your insurance provider to find out if there are options available to you for additional coverage, should your vehicle ever be stolen.

When you look at the data in the above table, remember that the vehicle year listed reflects the year model most commonly stolen in Arkansas in 2016.

Where is vehicle theft the biggest problem in the state? We pulled together data from the FBI on vehicle theft in cities and towns across the state. Search this table to see what vehicle theft looks like in your area.

| City/Town | Population | Vehicle Theft |

|---|---|---|

| Alexander | 2,810 | 3 |

| Alma | 5,699 | 14 |

| Altus | 720 | 0 |

| Amity | $698.00 | 1 |

| Arkadelphia | 10,810 | 10 |

| Ashdown | 4,433 | 9 |

| Atkins | $3,065.00 | 2 |

| Austin | 4,091 | 1 |

| Bald Knob | $2,908.00 | 3 |

| Barling | $4,820.00 | 6 |

| Batesville | $10,806.00 | 15 |

| Bay | 1,819 | 2 |

| Bearden | $874.00 | 0 |

| Beebe | 8,258 | 17 |

| Bella Vista | 28,721 | 8 |

| Benton | 36,702 | 123 |

| Bentonville | 49,301 | 38 |

| Berryville | 5,390 | 3 |

| Bethel Heights | 2,564 | 9 |

| Black Rock | 615 | 0 |

| Blytheville | 14,184 | 15 |

| Bono | 2,304 | 4 |

| Booneville | 3,886 | 8 |

| Bradford | 759 | 1 |

| Brinkley | 2,740 | 10 |

| Brookland | 3,353 | 3 |

| Bryant | 20,593 | 63 |

| Bull Shoals | 1,944 | 4 |

| Cabot | 26,118 | 34 |

| Caddo Valley | 599 | 4 |

| Camden | 11,069 | 21 |

| Cammack Village | 742 | 3 |

| Caraway | 1,275 | 1 |

| Carlisle | 2,164 | 1 |

| Cave Springs | 4,031 | 2 |

| Centerton | 13,521 | 8 |

| Charleston | 2,457 | 1 |

| Cherokee Village | 4,639 | 2 |

| Clarksville | 9,581 | 12 |

| Clinton | 2,505 | 0 |

| Concord | 236 | 0 |

| Conway | 66,299 | 148 |

| Corning | 3,078 | 2 |

| Cotter | 944 | 3 |

| Crossett | 5,069 | 4 |

| Damascus | 378 | 0 |

| Dardanelle | 4,578 | 13 |

| Decatur | 1,803 | 1 |

| Dell | 201 | 0 |

| De Queen | 6,555 | 10 |

| Dermott | 2,711 | 2 |

| Des Arc | 1,617 | 2 |

| De Valls Bluff | 577 | 0 |

| De Witt | 3,120 | 2 |

| Diaz | 1,219 | 5 |

| Dover | 1,404 | 0 |

| Dumas | 4,226 | 3 |

| Dyer | 864 | 0 |

| El Dorado | 18,257 | 44 |

| Elkins | 3,018 | 1 |

| England | 2,741 | 6 |

| Etowah | 318 | 0 |

| Eudora | 2,048 | 8 |

| Eureka Springs | 2,074 | 6 |

| Fairfield Bay | 2,232 | 1 |

| Farmington | 6,949 | 4 |

| Fayetteville | 85,592 | 344 |

| Flippin | 1,338 | 1 |

| Fordyce | 3,904 | 7 |

| Fort Smith | 88,437 | 334 |

| Gassville | 2,140 | 2 |

| Gentry | 3,777 | 1 |

| Gosnell | 3,175 | 0 |

| Gravette | 3,295 | 4 |

| Greenbrier | 5,488 | 5 |

| Green Forest | 2,784 | 2 |

| Greenland | 1,405 | 4 |

| Greenwood | 9,409 | 4 |