10 Best Car Insurance Companies for Dodges in 2025 (Your Guide to the Top Providers)

AAA, Chubb, and Geico are the top providers of the best car insurance companies for Dodges, with rates starting as low as $60 per month. We are committed to helping you compare quotes from these trusted insurers and to help you find the ideal coverage and maximize discounts for your Dodges.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Founder & Former Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. In addition to founding Expert Insurance Reviews, Eric is the CEO of C Street Media, a full-service marketing firm and the...

Founder & Former Insurance Agent

UPDATED: Feb 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Feb 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

82 reviews

82 reviewsCompany Facts

Full Coverage for Dodges

A.M. Best Rating

Complaint Level

Pros & Cons

82 reviews

82 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Dodges

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsAAA tops the list of the best car insurance companies for Dodges, providing competitive rates starting at just $60 per month for comprehensive coverage.

When shopping for car insurance coverage, it is important to select a company that understands the needs of Dodge drivers and provides comprehensive protection for their vehicles.

Our Top 10 Picks: Best Car Insurance Companies for Dodges

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A | Roadside Assistance | AAA |

| #2 | 12% | A++ | High-End Coverage | Chubb | |

| #3 | 25% | A++ | Affordable Rates | Geico | |

| #4 | 10% | A+ | Customer Satisfaction | Erie |

| #5 | 10% | A++ | Financial Stability | Auto-Owners | |

| #6 | 20% | A | Comprehensive Options | Farmers | |

| #7 | 12% | A+ | Innovative Tools | Progressive | |

| #8 | 25% | A | Customizable Policies | Liberty Mutual |

| #9 | 25% | A+ | AARP Benefits | The Hartford |

| #10 | 20% | A | Good Discounts | American Family |

In this guide, we will discuss how to choose the best car insurance company for Dodges by outlining factors such as cost, customer service, and coverage options. Enter your ZIP code now.

- Check for discounts like those for good drivers or low mileage

- Compare rates from different insurers to find the best deal

- Consult an insurance agent or broker for affordable policy options

- Best Car Insurance Companies

- Best Dodge Stratus Car Insurance Quotes (2025)

- Best Dodge Stealth Car Insurance Quotes (2025)

- Best Dodge SRT Viper Car Insurance Quotes (2025)

- Best Dodge Sprinter Cargo Car Insurance Quotes (2025)

- Best Dodge Sprinter Car Insurance Quotes (2025)

- Best Dodge Spirit Car Insurance Quotes (2025)

- Best Dodge Shadow Car Insurance Quotes (2025)

- Best Dodge Ram Wagon Car Insurance Quotes (2025)

- Best Dodge Ram Van Car Insurance Quotes (2025)

- Best Dodge Ram Pickup 3500 Car Insurance Quotes (2025)

- Best Dodge Ram Pickup 2500 Car Insurance Quotes (2025)

- Best Dodge Ram Pickup 1500 Car Insurance Quotes (2025)

- Best Dodge Ram HD Car Insurance Quotes (2025)

- Best Dodge Ram Cargo Car Insurance Quotes (2025)

- Best Dodge Ram 50 Pickup Car Insurance Quotes (2025)

- Best Dodge Ram 350 Car Insurance Quotes (2025)

- Best Dodge Ram 250 Car Insurance Quotes (2025)

- Best Dodge Ram 150 Car Insurance Quotes (2025)

- Best Dodge Omni Car Insurance Quotes (2025)

- Best Dodge Neon Car Insurance Quotes (2025)

- Best Dodge Monaco Car Insurance Quotes (2025)

- Best Dodge Magnum Car Insurance Quotes (2025)

- Best Dodge Intrepid Car Insurance Quotes (2025)

- Best Dodge Dynasty Car Insurance Quotes (2025)

- Best Dodge Daytona Car Insurance Quotes (2025)

- Best Dodge Dart Car Insurance Quotes (2025)

- Best Dodge Colt Car Insurance Quotes (2025)

- Best Dodge Caravan Car Insurance Quotes (2025)

- Best Dodge Journey Car Insurance Quotes (2025)

- Best Dodge Nitro Car Insurance Quotes (2025)

- Best Dodge Caliber Car Insurance Quotes (2025)

- Best Dodge Challenger Car Insurance Quotes (2025)

- Best Dodge Ram Car Insurance Quotes (2025)

- Best Dodge Ram 2500 Car Insurance Quotes (2025)

- Best Dodge Grand Caravan Car Insurance Quotes (2025)

- Best Dodge Ram 3500 Car Insurance Quotes (2025)

- Best Dodge Avenger Car Insurance Quotes (2025)

- Best Car Insurance Company for Dodge

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – AAA: Top Over-all Pick

Pros

- Comprehensive Coverage Options: AAA offers extensive coverage options tailored to various needs, including roadside assistance and travel benefits. Dodge owners can benefit from AAA’s robust roadside assistance, which is useful for long trips and roadside emergencies.

- High Customer Satisfaction: Known for excellent customer service, AAA frequently receives high ratings from policyholders. Dodge drivers can enjoy reliable support and quick claim resolutions thanks to AAA’s strong customer service.

- Strong Financial Stability: AAA is financially robust, providing peace of mind that claims will be handled effectively. Dodge owners can rely on AAA’s financial stability to ensure their claims are processed smoothly. Read more with our AAA insurance review & complaints for further insights.

Cons

- Higher Premiums for Some: Premiums can be higher compared to other providers, especially for certain high-performance models. This could be a downside for Dodge owners with high-performance models like the Charger or Viper.

- Limited Availability: AAA is not available in all states, which may limit access for some potential customers. Dodge drivers in states where AAA is not offered may need to find alternative insurance providers.

#2 – Chubb: Best for High-End Coverage

Pros

- High-End Coverage: Chubb is known for offering high-end coverage options, including extensive liability and comprehensive protection. Dodge owners with luxury or high-performance models like the Challenger SRT can benefit from Chubb’s premium coverage.

- Exceptional Customer Service: Chubb’s customer service is highly rated, providing personalized support and quick resolution of issues. Dodge drivers can expect high-quality service and support for their vehicles.

- Coverage for Unique Vehicles: Provides specialized coverage for luxury and high-performance vehicles. Chubb’s coverage is ideal for Dodge owners with unique or high-value models. Read more with our Chubb Insurance Company Review & Complaints for further insights.

Cons

- Expensive Premiums: Higher cost compared to other providers, which may not be ideal for those seeking budget-friendly options. This could be a concern for Dodge drivers looking to save on insurance premiums.

- Limited Discounts: Fewer discount opportunities compared to competitors, which could impact overall affordability. Dodge owners may find fewer ways to reduce their premiums compared to other providers.

#3 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico is known for offering competitive and often lower rates, making it a great option for budget-conscious drivers. Dodge owners and drivers can enjoy cost-effective coverage for their vehicles.

- User-Friendly Online Tools: Offers a robust online platform for managing policies and filing claims. Dodge enthusiasts can easily manage their policies and claims through Geico’s convenient online tools.

- Wide Range of Discounts: Provides numerous discounts, including for safe driving, military service, and bundling policies. Dodge owners can take advantage of multiple discount opportunities to reduce their insurance costs.

Cons

- Basic Coverage Options: May offer fewer premium coverage options compared to some competitors. Dodge owners seeking specialized or high-end coverage might find Geico’s options limited.

- Customer Service Variability: While generally good, customer service quality can vary based on location and agent. Inconsistent service experiences may affect Dodge drivers’ overall satisfaction. For further insights, check out our Geico insurance review.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Erie: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Known for exceptional customer service and high satisfaction rates among policyholders. Dodge owners can benefit from Erie’s positive customer service, ensuring smooth claim processing.

- Comprehensive Coverage: Offers a range of coverage options, including unique add-ons like accident forgiveness. Dodge drivers can enjoy extensive coverage and add-ons for their vehicles.

- Affordable Rates: Competitive pricing, often providing good value for the coverage offered. Dodge enthusiasts can find affordable insurance that does not compromise on coverage quality.

Cons

- Availability Restrictions: Not available in all states, which may limit options for some customers. Dodge drivers in areas where Erie is not offered might need to look for other insurance providers.

- Limited Online Tools: Fewer online management tools compared to other major insurers. The limited digital presence may be a drawback for tech-savvy Dodge owners. Read more through our Erie Insurance Review & Complaints.

#5 – Auto-Owners: Best for Financial Stability

Pros

- Strong Financial Stability: Known for financial strength, ensuring reliable claim payments. Dodge drivers can rely on Auto-Owners’ financial stability for dependable coverage.

- Comprehensive Coverage: Offers a variety of coverage options, including specialized add-ons. Dodge owners can select from a range of coverage options tailored to their vehicle’s needs.

- Personalized Service: Local agents offer personalized service and tailored insurance solutions. Dodge owners can receive customized coverage and support from Auto-Owners’ local agents.

Cons

- Limited Discounts: Fewer discount options compared to some other providers. This may impact overall affordability for Dodge drivers looking to save on premiums. Read more with our Auto-Owners Insurance.

. - Online Presence: Less robust online tools and digital management compared to some competitors. Dodge enthusiasts who prefer digital management may find Auto-Owners’ online tools lacking.

#6 – Farmers: Best for Comprehensive Options

Pros

- Comprehensive Coverage Options: Extensive coverage options, including unique add-ons like new car replacement. Dodge owners can benefit from Farmers’ broad range of coverage options for their vehicles.

- Good Customer Support: Positive reviews for customer service and claims handling. Farmers’ strong customer support ensures Dodge drivers receive prompt assistance and efficient claims processing.

- Variety of Discounts: Offers various discounts, including those for bundling policies and safe driving. Dodge enthusiasts can take advantage of multiple discounts to reduce their insurance costs. Check out our Farmers insurance review for your guidance.

Cons

- Higher Premiums for Some: Premiums may be higher compared to other providers, especially for high-risk drivers. Dodge owners with high-performance models might face higher premiums.

- Complex Policies: The wide range of options can sometimes make policies complex and hard to navigate. Dodge drivers may find the complexity of Farmers’ policies overwhelming.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Progressive: Best for Innovative Tools

Pros

- Innovative Tools: Offers innovative tools such as the Snapshot program for monitoring driving habits and potentially lowering rates. Dodge owners can use Progressive’s Snapshot to track their driving and potentially lower their premiums.

- Competitive Pricing: Known for competitive pricing and numerous discount opportunities. Dodge drivers benefit from Progressive’s affordability and diverse discount options. Read more through our Progressive Insurance Review & Complaints.

- Flexible Coverage Options: Provides a wide range of coverage options and customization. Dodge enthusiasts can tailor their policies to fit their vehicle’s unique needs and modifications.

Cons

- Customer Service Variability: Customer service experience can vary depending on the representative and location. Inconsistent service quality may impact overall satisfaction for Dodge drivers.

- Discount Complexity: The process for qualifying for certain discounts can be complex and sometimes confusing. Dodge owners may find the discount qualification process challenging.

#8 – Liberty Manual: Best for Customizable Policies

Pros

- Customizable Policies: Offers a range of customizable coverage options to fit individual needs. Dodge owners can tailor their policies to cover specific features and modifications of their vehicles.

- Good Discount Opportunities: Provides various discounts, including those for bundling and safe driving. Dodge drivers can benefit from multiple discounts to reduce their insurance costs. Check out our Liberty Mutual insurance review.

- Excellent Coverage Options: Includes features such as new car replacement and accident forgiveness. Dodge owners can enjoy comprehensive coverage with valuable add-ons like accident forgiveness.

Cons

- Higher Rates for Some: Rates can be higher for certain drivers compared to other providers. Dodge drivers, especially those with high-performance models, might face higher premiums.

- Customer Service Variability: Service quality can vary depending on location and specific circumstances. Inconsistent service experiences may affect Dodge drivers’ overall satisfaction.

#9 – The Hartford: Best for AARP Benefits

Pros

- AARP Benefits: Offers special benefits and discounts for AARP members, making it a good choice for seniors. Dodge owners who are AARP members can enjoy significant discounts and benefits.

- Comprehensive Coverage: Provides extensive coverage options including accident forgiveness and new car replacement. Dodge drivers can benefit from The Hartford’s robust coverage, including valuable features for their vehicles.

- Good Customer Service: Positive customer service reviews and responsive support. Dodge enthusiasts can expect reliable assistance and prompt claim handling from The Hartford. Check out our The Hartford Insurance Review & Complaints.

Cons

- Limited Availability: Not available in all states, which may restrict options for some customers. Dodge drivers in areas where The Hartford is not offered might need to explore other insurance providers.

- Discount Complexity: Some discount options and eligibility criteria can be complex and hard to navigate. Dodge owners may find it challenging to understand and qualify for all available discounts.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – American Family: Best for Good Discounts

Pros

- Exceptional Customer Service: USAA is renowned for its excellent customer service and high satisfaction ratings. Dodge owners and drivers can rely on USAA for superior support and efficient claims handling.

- Competitive Rates: Known for offering competitive rates, especially for military personnel and their families. Dodge drivers can benefit from USAA’s affordability and special rates for eligible members. Read more with our American Family insurance review.

- Comprehensive Coverage Options: Provides a wide range of coverage options, including unique add-ons tailored for various needs. Dodge enthusiasts can access extensive coverage and customization options for their vehicles.

Cons

- Eligibility Restrictions: Available only to military personnel, veterans, and their families, which limits accessibility for others. Dodge drivers not eligible for USAA will need to consider alternative providers.

- Limited Physical Locations: Fewer physical locations compared to other insurers, which might be a drawback for those preferring in-person service. Dodge owners who prefer face-to-face interactions may find USAA’s limited physical presence challenging.

Understanding Car Insurance

Car insurance is a contract that protects drivers from financial loss in the event of an accident. It covers costs associated with bodily injury, property damage, and other related expenses.

In most places, it’s also legally required to have car insurance before operating a motor vehicle on public roads.

Having car insurance is important because it helps cover the costs associated with accidents or theft and prevents these events from leading to financial ruin.

Dodges Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $80 $150

American Family $78 $140

Auto-Owners $75 $135

Chubb $110 $200

Erie $70 $130

Farmers $85 $145

Geico $60 $120

Liberty Mutual $90 $160

Progressive $65 $125

The Hartford $95 $155

Car insurance provides peace of mind by offering protection against unexpected and potentially costly situations. It also allows drivers to focus on the road, not worrying about what would happen if an accident occurred or their car was stolen.

As an added layer of protection, many insurance companies offer additional features such as roadside assistance, rental reimbursement coverage, and gap insurance coverage to ensure that you are fully covered in the event of an accident or other related incident.

Law Requiring Drivers to Carry Car Insurance

The law requires drivers to carry car insurance for a few different reasons. The most important reason is to ensure that both the driver and any third parties involved in an accident are financially protected from associated costs.

Without insurance, those involved in an accident could face severe financial hardship due to medical bills or property damage expenses.

Car insurance also makes it easier for those involved in an accident to receive compensation through their insurer in a timely manner. This helps make sure that they can move on with life as quickly as possible and not worry about long-term debt or legal proceedings.

In addition, car insurance helps reduce the burden on taxpayers by creating a system of shared responsibility amongst motorists. By providing mandatory coverage, citizens help pay for each other’s expenses in the event of an accident.

This helps keep taxes low and encourages safer driving habits, as motorists understand that they may be financially responsible for any accidents or damages caused by their negligence.

Read more: Does my car insurance cover damage caused by my own negligence?

Finally, car insurance is also a way for drivers to demonstrate financial responsibility before taking the wheel. By requiring proof of coverage, governments can ensure that those behind the wheel have the means to pay for any potential damages or injuries caused by their actions.

In summary, car insurance is required by law because it helps protect both drivers and third parties from financial hardship due to accidents. It also reduces the risk for taxpayers, encourages safe driving behavior, and demonstrates financial responsibility prior to operating a motor vehicle. Enter your ZIP code now.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Types of Car Insurance Coverage for a Dodge

Liability insurance is one of the most essential types of car insurance coverage for Dodge drivers. This type of coverage provides protection from financial loss if you are found liable for an accident or injury to another person caused by your driving.

This can include paying medical bills and property damage expenses, as well as legal costs if a lawsuit is filed against you. In most states, liability insurance is legally required in order to operate a motor vehicle on public roads.

Collision coverage helps pay for repairs to your own vehicle after an accident. This can include accidents involving other vehicles or stationary objects like trees, telephone poles, or brick walls.

Collision coverage also covers any damages resulting from flipping over or rolling your car during an accident. It is important to note that collision coverage typically only applies if the accident was your fault. Find the best collision coverage car insurance companies.

Comprehensive car insurance coverage helps pay for repairs to your vehicle when it is damaged by something other than an accident.

This can include fire, wind, hail, theft, vandalism, and flooding. Comprehensive coverage usually comes with a deductible amount which must be paid out of pocket before any payments are made. Find the best comprehensive coverage car insurance companies.

Personal injury protection (PIP) is an additional type of coverage that helps cover medical expenses for yourself and your passengers after an accident.

It also covers lost wages, funeral costs, and other related expenses in some cases. PIP coverage is required in certain states while optional in others. Find the best personal injury protection car insurance companies.

Liability, collision, comprehensive, uninsured/underinsured motorist coverage, PIP, and medical payments are all important types of coverage that can help protect drivers from financial loss if they get into an accident. Find out how much car insurance you need.

Finding the Best Rates for Car Insurance for a Dodge

When it comes to finding the best rates for car insurance for a Dodge, there are several factors that can impact your premiums.

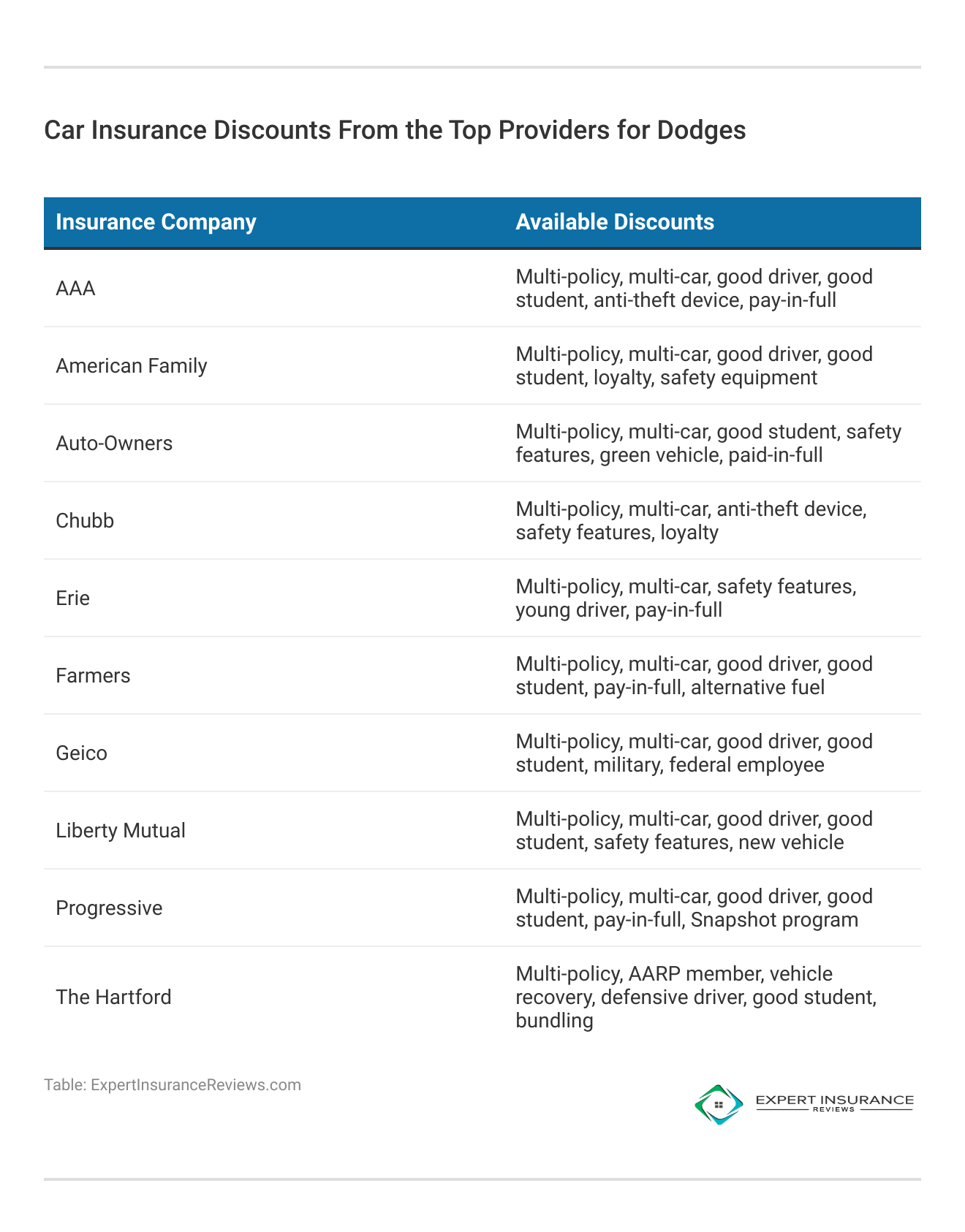

Shopping around and comparing car insurance from different providers is one of the most effective ways to find a good rate on car insurance. Taking advantage of any car insurance discounts you may qualify for is also essential in finding an affordable policy.

Vehicle age plays an important role in determining rates, as older cars typically cost more to insure due to their increased risk of being involved in an accident or experiencing damage due to regular wear and tear.

The safety features installed in a vehicle can also reduce a driver’s premium, as well as discounts available for safer drivers or those who have taken defensive driving courses.

Dodge owners may also qualify for additional discounts based on their car’s make and model. Certain models may be eligible for reduced rates due to their reputation of being reliable and well-constructed vehicles. (For more information, read our “What is the difference between a car’s make” and “model”?”)

Ty Stewart

Licensed Insurance Agent

Understand the coverages included in each policy and use any discounts you qualify for to lower your premium.

In order to get the best possible rate on your Dodge’s car insurance, it is important to do your research and compare quotes from multiple providers. Enter your ZIP code now.

Frequently Asked Questions

Will a Dodge be expensive to insure?

Dodge vehicles can be expensive to insure, depending on the age of the vehicle and its safety features. However, car insurance companies may offer discounts such as multi-car policies or good driver discounts, which could help reduce premiums.

How much will insurance cost for a Dodge Ram?

Car insurance for a Dodge Ram is slightly more expensive than a standard car insurance policy due to the increased size and weight of the vehicle. Enter your ZIP code now.

Will car insurance for a Dodge Charger be expensive?

Dodge Chargers can have high insurance premiums due to their power and performance capabilities. However, car insurance rates may be reduced if the vehicle is equipped with safety features or used for limited-mileage commuting. Read more through our expert insurance reviews.

What are the best car insurance companies for Dodges?

The best car insurance companies for Dodges will vary depending on your specific needs and circumstances. However, some of the top companies for insuring Dodges include:

- State Farm

- Geico

- Allstate

What factors should I consider when choosing an insurance company for my Dodge?

When choosing an insurance company for your Dodge, you should consider factors such as:

- coverage options

- pricing

- customer service

- financial stability

It’s also important to compare quotes from multiple companies to ensure you’re getting the best possible deal. Enter your ZIP code now.

Do I need to get special insurance for my high-performance Dodge?

If you have a high-performance Dodge, such as a Charger or Challenger, you may need to get special insurance coverage to ensure you’re adequately protected. Some insurance companies offer specialized coverage for high-performance vehicles, so be sure to shop around to find the best option for your needs. Read more through our best car insurance companies that accept discover.

Does the age of my Dodge affect my insurance rates?

Yes, the age of your Dodge can affect your insurance rates. Generally, older cars are less expensive to insure than newer ones, as they are typically worth less and are cheaper to repair or replace in the event of an accident.

How can I save money on my Dodge insurance?

To save money on your Dodge insurance, you can consider raising your deductible, taking advantage of discounts for safe driving or multiple policies, and opting for a less expensive coverage level. It’s also a good idea to shop around and compare quotes from multiple insurance companies to find the best deal. Enter your ZIP code now.

What specific coverage options should Dodge owners look for in a car insurance policy?

Dodge owners should look for comprehensive and collision coverage to protect against accidents and non-collision incidents such as theft or weather damage. Additionally, liability insurance, personal injury protection (PIP), and uninsured/underinsured motorist coverage are essential for complete protection. Read more through our best car insurance companies that accept checks.

How does the cost of car insurance for Dodge vehicles compare across different providers?

The cost of car insurance for Dodge vehicles can vary significantly among providers due to factors like coverage options, driver history, and vehicle model. Shopping around and comparing quotes from multiple companies is crucial to finding the best rate.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Eric Stauffer

Founder & Former Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. In addition to founding Expert Insurance Reviews, Eric is the CEO of C Street Media, a full-service marketing firm and the...

Founder & Former Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.