10 Best Car Insurance Companies for Fords in 2025 (Your Guide to the Top Providers)

To find the best car insurance company for Fords, drivers need to compare multiple quotes. At $155 per month, the average Ford insurance policy costs about the same as the national average. Although Ford auto insurance rates are generally low, drivers can save by finding discounts.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Insurance Agent

UPDATED: Feb 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Feb 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Ford

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Company Facts

Full Coverage for Ford

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Geico, and Progressive are the best car insurance companies for Fords, with rates starting at $40 per month. These top providers offer competitive pricing and comprehensive coverage, making them the best choices for Ford owners seeking affordable and reliable insurance options.

These top providers offer competitive rates and comprehensive protection for Ford owners, known for reliability and excellent customer service.

Our Top 10 Company Picks: Best Car Insurance Companies for Ford

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Competitive Pricing State Farm

#2 25% A++ Extensive Discounts Geico

#3 20% A+ Customizable Coverage Progressive

#4 10% A+ Comprehensive Options Allstate

#5 10% A++ Superior Service USAA

#6 18% A Tailored Discounts Farmers

#7 12% A Unique Coverage Liberty Mutual

#8 20% A+ Customer Satisfaction Nationwide

#9 13% A++ Competitive Pricing Travelers

#10 29% A Extensive Discounts American Family

Ford auto insurance quotes tend to be low due to low repair and replacement costs, high safety ratings, and a solid reputation for reliability. Learn more in our article called “Does car insurance cover non-accident repairs?“

- Best Car Insurance Companies

- Best Ford Windstar Cargo Car Insurance Quotes (2025)

- Best Ford Windstar Car Insurance Quotes (2025)

- Best Ford Transit Wagon Car Insurance Quotes (2025)

- Best Ford Transit Van Car Insurance Quotes (2025)

- Best Ford Transit Connect Car Insurance Quotes (2025)

- Best Ford Thunderbird Car Insurance Quotes (2025)

- Best Ford Tempo Car Insurance Quotes (2025)

- Best Ford Taurus X Car Insurance Quotes (2025)

- Best Ford Super Duty Car Insurance Quotes (2025)

- Best Ford Shelby GT500 Car Insurance Quotes (2025)

- Best Ford Shelby GT350 Car Insurance Quotes (2025)

- Best Ford Probe Car Insurance Quotes (2025)

- Best Ford Mustang SVT Cobra Car Insurance Quotes (2025)

- Best Ford Mustang Mach-E Car Insurance Quotes (2025)

- Best Ford GT Car Insurance Quotes (2025)

- Best Ford LTD Crown Victoria Car Insurance Quotes (2025)

- Best Ford Freestyle Car Insurance Quotes (2025)

- Best Ford Freestar Car Insurance Quotes (2025)

- Best Ford Focus Electric Car Insurance Quotes (2025)

- Best Ford Five Hundred Car Insurance Quotes (2025)

- Best Ford Festiva Car Insurance Quotes (2025)

- Best Ford F-450 Super Duty Car Insurance Quotes (2025)

- Best Ford F-350 Car Insurance Quotes (2025)

- Best Ford F-250 Car Insurance Quotes (2025)

- Best Ford F-150 SVT Lightning Car Insurance Quotes (2025)

- Best Ford F-150 Heritage Car Insurance Quotes (2025)

- Best Ford Explorer Sport Trac Car Insurance Quotes (2025)

- Best Ford Explorer Sport Car Insurance Quotes (2025)

- Best Ford Explorer Hybrid Car Insurance Quotes (2025)

- Best Ford Expedition EL Car Insurance Quotes (2025)

- Best Ford Excursion Car Insurance Quotes (2025)

- Best Ford Escort Car Insurance Quotes (2025)

- Best Ford Econoline Wagon Car Insurance Quotes (2025)

- Best Ford Econoline Cargo Car Insurance Quotes (2025)

- Best Ford E Series Wagon Car Insurance Quotes (2025)

- Best Ford E Series Van Car Insurance Quotes (2025)

- Best Ford E-350 Car Insurance Quotes (2025)

- Best Ford E-250 Car Insurance Quotes (2025)

- Best Ford E-150 Car Insurance Quotes (2025)

- Best Ford Crown Victoria Car Insurance Quotes (2025)

- Best Ford Contour SVT Car Insurance Quotes (2025)

- Best Ford Contour Car Insurance Quotes (2025)

- Best Ford Bronco Sport Car Insurance Quotes (2025)

- Best Ford Bronco II Car Insurance Quotes (2025)

- Best Ford Bronco Car Insurance Quotes (2025)

- Best Ford Aspire Car Insurance Quotes (2025)

- Best Ford Aerostar Car Insurance Quotes (2025)

- Best Ford Focus Car Insurance Quotes (2025)

- Best Ford F-350 Super Duty Car Insurance Quotes (2025)

- Best Ford Escape Hybrid Car Insurance Quotes (2025)

- Best Ford Mustang Car Insurance Quotes (2025)

- Best Ford Fusion Hybrid Car Insurance Quotes (2025)

- Best Ford Fusion Car Insurance Quotes (2025)

- Best Ford C-Max Hybrid Car Insurance Quotes (2025)

- Best Ford Ranger Car Insurance Quotes (2025)

- Best Ford Focus ST Car Insurance Quotes (2025)

- Best Ford F-250 Super Duty Car Insurance Quotes (2025)

- Best Ford Escape Car Insurance Quotes (2025)

- Best Ford F-150 Car Insurance Quotes (2025)

- Best Ford Flex Car Insurance Quotes (2025)

- Best Ford Taurus Car Insurance Quotes (2025)

- Best Ford Fiesta Car Insurance Quotes (2025)

- Best Ford Explorer Car Insurance Quotes (2025)

- Best Ford EcoSport Car Insurance Quotes (2025)

- Best Ford Edge Car Insurance Quotes (2025)

- Best Ford Focus RS Car Insurance Quotes (2025)

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple policies, making it a top choice for Car Insurance Companies for Ford.

- Low-Mileage Discount: State Farm provides substantial savings for low-mileage usage, beneficial for Ford owners.

- Diverse Coverage Options: State Farm delivers various coverage options tailored to the specific needs of Ford vehicles. Discover more about offerings in our article called “State Farm Insurance Review & Complaints: Car Insurance.”

Cons

- Limited Multi-Policy Discount: Compared to other Car Insurance Companies for Ford, State Farm’s multi-policy discount is relatively lower.

- Premium Costs: Despite discounts, State Farm’s premiums may still be higher for some coverage levels compared to other providers.

#2 – Geico: Best for Extensive Discounts

Pros

- High Multi-Policy Discount: Geico offers a 25% discount for bundling policies, a major advantage among Car Insurance Companies for Ford.

- Top A.M. Best Rating: Geico’s A++ rating reflects its strong financial stability, making it a reliable choice for Ford insurance. Discover more about offerings in our “Geico Insurance Review & Complaints.”

- Affordable Rates: Geico provides competitive monthly rates for both minimum and full coverage, appealing to Ford owners.

Cons

- Limited Customization: Compared to other Car Insurance Companies for Ford, Geico may offer fewer customizable coverage options.

- Customer Service: While Geico provides extensive discounts, customer service experiences may vary for Ford owners.

#3 – Progressive: Best for Customizable Coverage

Pros

- High Multi-Policy Discount: Progressive offers a 20% discount for bundling policies, benefiting those looking for Car Insurance Companies for Ford.

- Customizable Coverage: Progressive provides a range of customizable coverage options tailored to Ford vehicles.

- A.M. Best Rating: With an A+ rating, Progressive is a reliable choice among Car Insurance Companies for Ford. Access comprehensive insights into our article called “Progressive Insurance Review & Complaints.”

Cons

- Average Discounts: Progressive’s discounts might not be as extensive as those offered by other Car Insurance Companies for Ford.

- Premium Variation: Premium rates with Progressive may vary depending on the coverage level and individual Ford vehicle.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Allstate: Best for Comprehensive Options

Pros

- Broad Coverage: Allstate offers a wide range of coverage options, making it a strong choice among Car Insurance Companies for Ford.

- A+ A.M. Best Rating: Allstate’s A+ rating indicates financial strength and reliability for insuring Ford vehicles. Check out insurance savings in our complete guide titled “Allstate Auto Insurance Review & Complaints: Auto Insurance.”

- Extensive Network: Allstate’s extensive network of agents and repair shops enhances convenience for Ford owners.

Cons

- Lower Multi-Policy Discount: Allstate’s 10% discount for bundling policies is less competitive compared to other Car Insurance Companies for Ford.

- Higher Premiums: Allstate’s premiums may be relatively high compared to other options for Ford insurance.

#5 – USAA: Best for Superior Service Provider

Pros

- Exceptional Service: USAA is known for outstanding customer service, making it a top choice for Car Insurance Companies for Ford.

- A++ A.M. Best Rating: The A++ rating reflects USAA’s strong financial stability and reliability for Ford insurance. Delve into our evaluation of “USAA Insurance Review & Complaints.”

- Competitive Rates: USAA offers competitive monthly rates for both minimum and full coverage for Ford vehicles.

Cons

- Eligibility Restrictions: USAA’s services are only available to military families, limiting access for some Ford owners.

- Limited Availability: Compared to other Car Insurance Companies for Ford, USAA’s coverage is not available nationwide.

#6 – Farmers: Best for Tailored Discounts

Pros

- Customized Discounts: Farmers offers tailored discounts based on individual driving habits, beneficial for Ford owners. Unlock details in our “Farmers Insurance Review & Complaints: Home, Business & Auto Insurance.”

- 18% Multi-Policy Discount: Farmers provides a significant discount for bundling policies, a plus for Car Insurance Companies for Ford.

- A.M. Best Rating: With an A rating, Farmers maintains reliable coverage options for Ford vehicles.

Cons

- Higher Rates for Full Coverage: Farmers’ full coverage premiums might be higher compared to other Car Insurance Companies for Ford.

- Complex Policies: Some customers find Farmers’ policy options complex, which may be challenging for Ford owners.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Unique Coverage

Pros

- Specialized Coverage: Liberty Mutual offers unique coverage options tailored for Ford vehicles.

- 12% Multi-Policy Discount: Liberty Mutual’s discount for bundling policies is advantageous for Ford insurance.

- A Rating: With an A rating from A.M. Best, Liberty Mutual is a reliable choice for Ford owners. Unlock details in our article called “Liberty Mutual Insurance Review & Complaints.”

Cons

- Higher Minimum Coverage Costs: Liberty Mutual’s minimum coverage rates are higher compared to some other Car Insurance Companies for Ford.

- Customer Service Variability: Service quality may vary, impacting the overall experience for Ford owners.

#8 – Nationwide: Best for Customer Satisfaction

Pros

- 20% Multi-Policy Discount: Nationwide offers a competitive discount for bundling policies, benefiting Ford owners.

- A+ A.M. Best Rating: Nationwide’s A+ rating ensures strong financial stability and reliability for Ford insurance. Access comprehensive insights into our article called “Nationwide Insurance Review & Complaints: Auto, Home, Health & Pet Insurance.”

- High Customer Satisfaction: Nationwide is known for excellent customer service and satisfaction among Car Insurance Companies for Ford.

Cons

- Premium Variability: Premium rates can vary widely, potentially affecting affordability for some Ford owners.

- Limited Customization: Compared to other Car Insurance Companies for Ford, Nationwide may offer fewer customization options.

#9 – Travelers: Best for Competitive Pricing

Pros

- Competitive Pricing: Travelers offers some of the most competitive rates for Ford insurance among Car Insurance Companies for Ford.

- 13% Multi-Policy Discount: Travelers provides a notable discount for bundling policies, advantageous for Ford owners.

- A++ A.M. Best Rating: With an A++ rating, Travelers is a financially strong choice for insuring Ford vehicles. Discover insights in our article called “Travelers Insurance Review & Complaints: Home, Auto & Boat Insurance.”

Cons

- Limited Discounts for Full Coverage: Discounts on full coverage options may not be as extensive as those from other Car Insurance Companies for Ford.

- Customer Service: Travelers’ customer service may vary, affecting the overall experience for Ford owners.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – American Family: Best for Extensive Discounts

Pros

- 29% Multi-Policy Discount: American Family offers a substantial discount for bundling policies, a key benefit for Ford insurance. Delve into our evaluation of “American Family Insurance Review & Complaints: Auto, Home & Life Insurance.”

- A Rating: With an A rating from A.M. Best, American Family provides reliable coverage options for Ford vehicles.

- Broad Discount Options: American Family offers extensive discounts and incentives tailored to Ford owners.

Cons

- Higher Rates for Full Coverage: American Family’s full coverage premiums may be higher compared to other Car Insurance Companies for Ford.

- Limited Customization: Coverage options might be less flexible compared to other providers.

Monthly Ford Insurance Rates: Coverage Levels and Providers

When comparing Ford car insurance rates, coverage levels play a crucial role in determining costs. Here’s a look at the monthly premiums for both minimum and full coverage from various top providers.

Ford Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $60 $140

American Family $50 $120

Farmers $55 $135

Geico $45 $110

Liberty Mutual $60 $145

Nationwide $50 $125

Progressive $55 $130

State Farm $50 $120

Travelers $55 $130

USAA $40 $100

State Farm and Geico offer competitive rates for Ford insurance, with minimum coverage starting at $50 and $45, respectively. For full coverage, State Farm and Geico both provide affordable options at $120 and $110 per month.

This table illustrates how various insurers compare in terms of pricing, giving you a clear view of what to expect for both minimum and comprehensive coverage. Read up on the “Types of Car Insurance Coverage: An Expert Guide” for more information.

Ford Car Insurance Coverage Options

Your car is more than just a method of transportation. It’s an asset and a valuable one at that. In fact, outside of your home, it’s most likely the next most expensive item you own, meaning that insuring it properly is imperative. Insurance companies offer a slew of options, and you may need some, if not all, of them.

Let’s cover a few types of car insurance coverage in detail:

Liability Coverage

Required in most states, liability coverage is the foundation of all car insurance policies. Whether you cause an accident, a pile-up, run over a neighbor’s mailbox, or cause injuries to another party, your vehicle’s liability coverage protects you in some of the most common — and the worst — situations. Learn more about car insurance requirements.

Comprehensive Coverage

To protect your asset, comprehensive car insurance may very well be a necessity. In today’s economy, windshields commonly run north of $1,000 to replace, and many states waive car insurance deductibles for windshield repair/replacement.

Comprehensive coverage also kicks in when you need to file claims regarding theft, falling objects, floods, or a variety of other external causes which don’t involve your vehicle colliding with another object.

Read more: Does my car insurance cover damage caused by a lightning strike?

Collision Coverage

Suppose you’ve still got payments to make, whether loan or lease. Comprehensive and collision will be required by your lienholder/lessee in order to protect their investment. If it’s paid off, neither is required, but both are worth looking into.

Liability (listed above) pays for damages or injury to the other party’s person/vehicle in the event that you cause an accident, but liability does not pay to fix your vehicle in such an instance. Collision coverage is offered to repair or replace your vehicle in the event of an at-fault accident. Find the best collision coverage car insurance companies here.

Underinsured Motorist Coverage

This largely unknown coverage could be a lifesaver under the right circumstances. In many states, the required liability coverage one needs to drive covers far less in property damage than would be necessary to replace your vehicle.

State Farm leads the pack with its 17% multi-policy discount, making it an excellent choice for those looking to bundle their car insurance with other policies.

Jeff Root Licensed Insurance Agent

For instance, let’s consider the Ford GT Fastback. Nowadays, they start north of $38,000. If someone totals your vehicle in a state which requires that they carry only $25,000 in property damage liability, you could be left responsible for paying $15,000 or more, all from an accident you didn’t even cause.

Underinsured coverage makes up the difference between the offending driver’s liability limit and the cost of the resulting medical/property damage. Find the best uninsured motorist coverage car insurance companies here.

Roadside Assistance

This is a relatively cheap option at most insurance companies, but it may help you evade the costliest claims. Abandoning a vehicle raises the chances of vandalism and theft, so a few extra bucks a year may protect your purchase and give you peace of mind. Check out insurance savings in our complete guide titled “Does my car insurance cover towing and roadside assistance?”

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Compare Ford Car Insurance Rates and Options

Ford car insurance rates, in general, expect to pay a little less than the national average, whether we’re talking monthly or yearly insurance costs. This, however, can vary by model. One notable exception is the Ford Mustang, a horsepower-packed sports car that insurance companies must rate accordingly. But if you’re in an Explorer, a Bronco, or an F150, you can expect favorable premiums.

Even still, it’s worth keeping in mind that the vehicle you drive is only a single data point factoring into your cost. Your age, driving history, credit score, insurance history, location, and other personal information form part of the picture too. Here’s what you should expect on average on the insurance front:

Ford Car Insurance Monthly Rates by Model & Coverage Type

| Vehicle Model | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Ford Taurus | $33 | $58 | $42 | $149 |

| Ford Mustang | $35 | $72 | $42 | $167 |

| Ford Fusion Hybrid | $32 | $66 | $47 | $164 |

| Ford Fusion Energi | $34 | $63 | $37 | $149 |

| Ford Fusion | $34 | $63 | $37 | $149 |

| Ford Focus ST | $27 | $52 | $42 | $137 |

| Ford Focus RS | $32 | $64 | $42 | $153 |

| Ford Focus | $24 | $52 | $42 | $133 |

| Ford Flex | $32 | $55 | $42 | $145 |

| Ford Fiesta | $22 | $41 | $42 | $121 |

| Ford F-350 | $34 | $58 | $52 | $165 |

| Ford F-250 Super Duty | $32 | $61 | $47 | $158 |

| Ford F-150 | $32 | $47 | $37 | $132 |

| Ford Explorer | $31 | $47 | $37 | $131 |

| Ford Expedition | $34 | $53 | $32 | $132 |

| Ford Escape | $28 | $44 | $32 | $117 |

| Ford Edge | $27 | $50 | $37 | $130 |

| Ford C-Max Hybrid | $27 | $55 | $42 | $140 |

| Ford C-Max Energi | $28 | $58 | $42 | $144 |

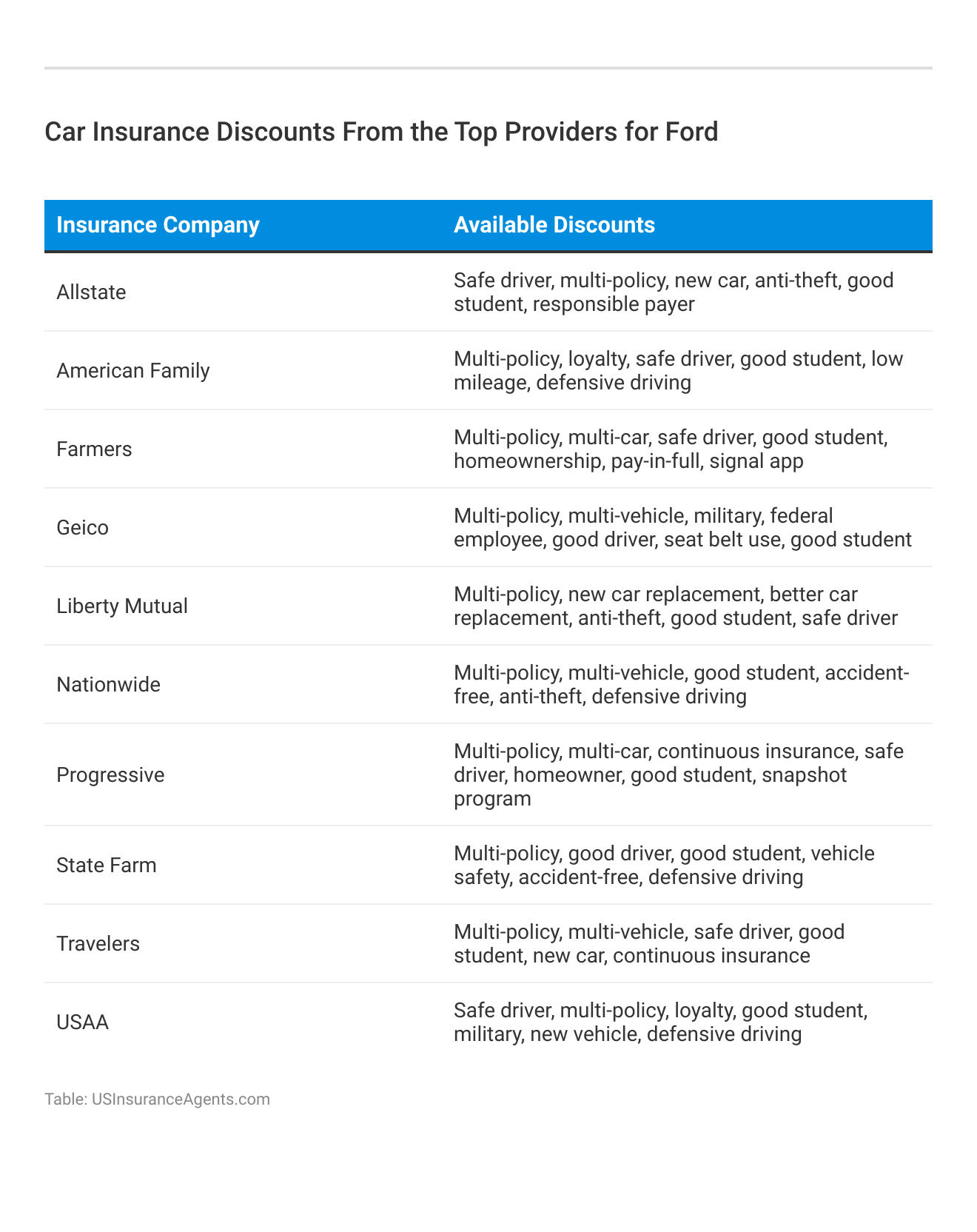

Coverage options and discounts vary from provider to provider. Get all the quotes you can find and look them over thoroughly before you decide. While you’re at it, keep these car insurance discounts in mind to lower the insurance cost:

- Vehicle Safety: Safety is all the rage these days, and as such, many Ford models come standard with some of the highest-tech safety features available. Insurance companies tend to offer discounts accordingly.

- Anti-Theft: If your Ford is prepared to ward off would-be carjackers with anti-theft features, ask your insurance carrier to be sure that you’re seeing those savings.

- Multi-Car: Does your Ford have any companions in the garage? Quote your other vehicle(s) too. Bundling vehicles with the same company often garners one of the biggest discounts available.

- Multi-Line: Whether it’s homeowners, renters, or life insurance, bundling policies of different types will save on each.

- Drivers Training: Maybe it’s been since you’ve taken a driver’s training course. Most insurers offer discounts for taking updated classes, even online.

Thoroughly reviewing these options will help you make an informed decision and potentially lower your insurance expenses.

How to Find the Best Car Insurance Company for Ford

Who should you choose to insure your Ford? In truth, the best may vary from place to place or person to person. While price is naturally a determining factor, it should never be the sole measure. Check around to see who has the best ratings and why then allow those to factor in.

When you need help, who do you trust to address your needs quickly? To help you secure a rental vehicle or help find the right body shop? Every provider does business differently, so which insurance company will offer the best Ford car insurance could have more to do with your personality than the fine print of any insurance renewal.

If you prefer interacting face-to-face, opt for an agent. Captive agents can quote you with a single company, while independent agents (brokers) can quote you from a variety of companies at once; plus, they serve as your face-to-face contact in the event of an emergency, claim, or crisis.

Other companies prefer to operate without local agents at all. This may save on expenses, but if you’re an in-person customer, it may not be worth the headache. If, however, you prefer to do your business online or via an app, the reverse could be true. More information is available about this provider in our article called “Anonymous Car Insurance Quotes.”

Get Quotes From the Best Car Insurance Company for Ford Today

In today’s auto market, claims are costlier than usual and perhaps more expensive than ever. Prices are on the rise, and quality vehicles are becoming scarce. In today’s economy, insurance is about more than the bottom line.

It’s worth finding the insurer who provides you with the peace of mind you’re paying for. If you’re concerned that your current insurer doesn’t have you covered, do yourself a favor and nab a quote or ten. See more details on our article called “Compare Car Insurance.”

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frequently Asked Questions

Is Ford car insurance expensive?

Ford auto insurance tends to run below the aggregate average. However, this varies by model. If you’re driving a Mustang, you’ll find your rate is likely higher than average but incredibly fair for a sports car. If you’re in an Escape, be prepared for insurance that barely scratches your bank account.

For additional details, explore our comprehensive resource titled “Best Car Insurance Quotes by Vehicle.”

What insurance company does Ford use?

Ford Insure is a usage-based policy offered Nationwide. However, bear in mind that all companies can insure Ford vehicles, and most companies also offer usage-based discounts. Gather quotes all around.

Is Ford F-150 car insurance high?

Not at all! Insuring a Ford tends to cost less than the average vehicle. Within that subset, the F150 is among the lesser expensive Fords to insure. Still, compare Ford car insurance quotes to find the best rate available.

What factors should I consider when looking for the best car insurance company for Fords?

When looking for the best car insurance company for Fords, you should consider factors such as the coverage options offered, the cost of the insurance, the company’s reputation, and their customer service.

Which car insurance companies offer Ford car insurance?

Most car insurance companies offer Ford auto insurance, but some may specialize in certain types of vehicles. It’s best to research and compare different companies to find the one that offers the coverage options you need.

To find out more, explore our guide titled “Cheap Car Insurance.”

Is it important to choose a car insurance company that specializes in Fords?

It’s not necessary to choose a car insurance company that specializes in Ford, but it can be helpful as they may have a better understanding of the unique needs and requirements of Ford vehicles.

What is the most trusted car insurance company?

State Farm is widely recognized for customer satisfaction, making it one of the most trusted car insurance companies for Ford. Other top choices include Travelers for overall excellence, American Family for budget options, Geico for accident forgiveness, Shelter for few customer complaints, Auto-Owners for financial strength, Amica for discounts, and USAA for superior service.

Which insurance cover is best for a car?

Comprehensive insurance provides the broadest coverage, protecting Ford models against theft, hijacking, accidents, fire, explosion, and natural disasters such as hail and floods. This type of insurance is ideal for Ford vehicles due to its extensive protection.

Who is Ford insurance?

Ford Insure policies are arranged, administered, and provided by EUI, a subsidiary of Admiral Group plc. This service offers tailored insurance solutions specifically for Ford vehicles.

To learn more, explore our comprehensive resource on “Auto Insurance Companies.”

Who is known for the cheapest car insurance?

USAA, Nationwide, Travelers, Erie, Geico, and Progressive are recognized for offering the cheapest car insurance rates for Ford. These companies provide affordable options for Ford owners.

Which type of insurance is best for a car?

A Comprehensive Car Insurance Policy is the best option for Ford, as it provides full protection, covering a wide range of potential risks.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Who are the top 5 insurance companies?

The top five car insurance companies by market share and average costs include State Farm, Geico, Progressive, Allstate, and USAA. Each offers unique benefits and competitive rates for Ford owners.

What’s the cheapest car insurance for full coverage?

American Family offers full coverage for Ford models at $106 per month, Amica at $190 per month, Auto-Owners at $118 per month, Geico at $108 per month, NJM at $124 per month, Shelter at $130 per month, State Farm at $167 per month, and Travelers at $117 per month.

Learn more by reading our guide titled “Full Coverage Car Insurance: An Expert Guide.”

Which car insurance cover is best?

Fully comprehensive car insurance is often the best option for Ford, offering the highest level of cover. Depending on factors such as age and claims history, it can also be the cheapest option.

Which insurance is best for car accidents?

Comprehensive car insurance is the best for Ford in car accidents, covering third-party liability, own damage, personal accident, uninsured motorist protection, and more.

Is the zero-depreciation add-on cover a better option to comprehensive car insurance?

Yes, a zero-depreciation add-on cover enhances a comprehensive car insurance policy for Ford by covering repair and depreciation costs, resulting in higher claim amounts.

Which type of auto insurance coverage is most important?

Liability coverage is the most important for legal protection. Comprehensive and collision, medical coverage, uninsured/underinsured motorist, and rental reimbursement are also critical for complete coverage for Ford vehicles.

Access comprehensive insights into our guide titled “Collision vs. Comprehensive Coverage.”

Which car insurance company has the best settlement ratio?

As of January 2024, SBI Car Insurance has a claims settlement ratio of 100 percent, followed by HDFC ERGO Car Insurance and Royal Sundaram Car Insurance with settlement ratios of 99 and 98.6 percent, respectively.

Which car insurance pays out the most claims?

Amica is highly recommended for claims handling for Ford, earning the highest rating in the J.D. Power 2023 U.S. Auto Claims Satisfaction Study.

What is engine protection cover in car insurance?

An engine protector cover is an add-on that covers financial risks associated with engine issues in Ford vehicles, including leakage, water ingression, hydrostatic lock, and physical damage to the gearbox, pistons, and connecting rods.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

What is the cheapest car insurance type?

Typically, fully comprehensive insurance is the least expensive for Ford models, although individual circumstances can influence prices.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.