10 Best Car Insurance Companies for Hondas in 2025 (Save With These Providers)

The top three best car insurance companies for Hondas are Geico, Erie and State Farm, with full coverage starting as low as $95 per month. While Honda insurance costs are generally affordable, the specific model you drive can influence your rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Honda

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Honda

A.M. Best Rating

Complaint Level

Pros & Cons

Our top picks of Geico, Erie, and State Farm are the best car insurance companies for Hondas. Hondas are well known for their reliability, fuel efficiency, and low cost, making them one of the best-selling car brands in the United States.

The best car insurance company for Hondas is one that fits your needs and budget. For example, if you have a car loan or lease, you might want to avoid a company that doesn’t offer gap insurance.

Our Top 10 Picks: Best Car Insurance Companies for Honda

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Competitive Pricing Geico

#2 10% A+ Competitive Rates Erie

#3 20% B Strong Network State Farm

#4 10% A++ Financial Stability Auto-Owners

#5 25% A+ Customer Satisfaction Amica

#6 10% A++ Military Focus USAA

#7 8% A++ Comprehensive Coverage Travelers

#8 20% A+ Extensive Options Nationwide

#9 12% A+ Usage-Based Insurance Progressive

#10 25% A+ Excellent Service The Hartford

- Best Car Insurance Companies

- Best Honda S2000 Car Insurance Quotes (2025)

- Best Honda Prelude Car Insurance Quotes (2025)

- Best Honda Fit EV Car Insurance Quotes (2025)

- Best Honda CR-V Hybrid Car Insurance Quotes (2025)

- Best Honda Clarity Car Insurance Quotes (2025)

- Best Honda Civic Hybrid Car Insurance Quotes (2025)

- Best Honda Civic del Sol Car Insurance Quotes (2025)

- Best Honda Civic CRX Car Insurance Quotes (2025)

- Best Honda Accord Plug-In Hybrid Car Insurance Quotes (2025)

- Best Honda Accord Plug-In Hybrid Car Insurance Quotes (2025)

- Best Honda Accord Crosstour Car Insurance Quotes (2025)

- Best Honda Accord Hybrid Car Insurance Quotes (2025)

- Best Honda CR-V Car Insurance Quotes (2025)

- Best Honda Fit Car Insurance Quotes (2025)

- Best Honda Accord Car Insurance Quotes (2025)

- Best Honda Ridgeline Car Insurance Quotes (2025)

- Best Honda Passport Car Insurance Quotes (2025)

- Best Honda Pilot Car Insurance Quotes (2025)

- Best Honda HR-V Car Insurance Quotes (2025)

- Best Honda Odyssey Car Insurance Quotes (2025)

- Best Honda Insight Car Insurance Quotes (2025)

- Best Honda Element Car Insurance Quotes (2025)

- Best Honda CR-Z Car Insurance Quotes (2025)

- Best Honda Civic Car Insurance Quotes (2025)

While Hondas already carry low car insurance rates, there are more ways for drivers to maximize their savings. If you want to find companies that provide you with the best car insurance for your Honda, just enter your ZIP code above in our comparison tool to help you find the best rates for your needs.

- On average, you’ll pay around $135 monthly to insure a Honda

- Most states only require Honda drivers to carry at least liability coverage

- The cheapest full coverage provider, is Geico at just $95 per month

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

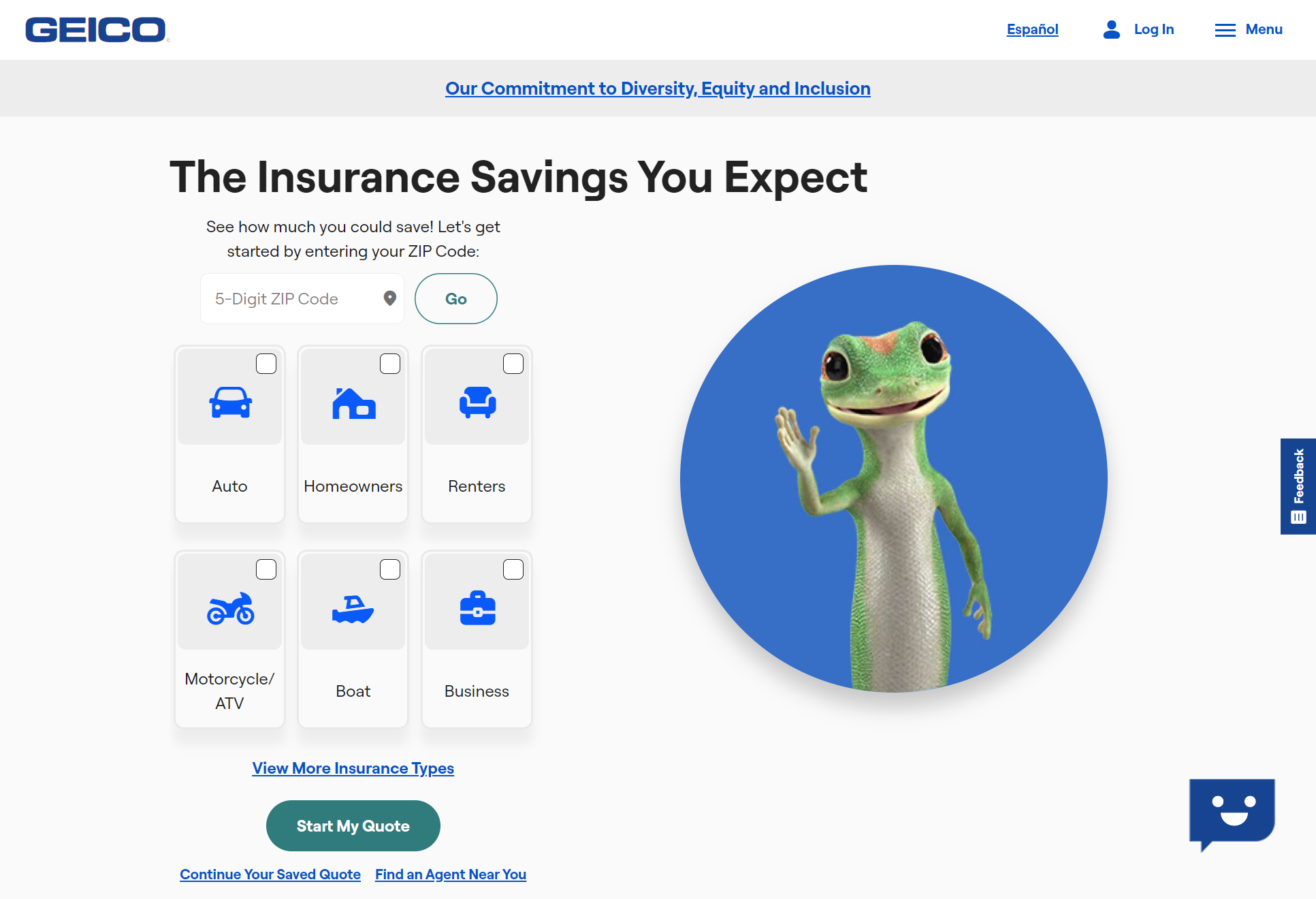

#1 – Geico: Best for Competitive Pricing

Pros

- Competitive Rates: Geico is known for offering some of the most competitive rates in the industry, often providing significant savings for drivers with good driving records. For more information, check out our “Geico Insurance Review & Complaints.”

- Discounts: Geico offers a wide range of discounts, including multi-policy, multi-car, good student, safe driver, military, federal employee, defensive driving, and vehicle safety discounts. These can help lower premiums even further.

- Extensive Coverage Options: Geico provides a comprehensive array of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, rental reimbursement, and roadside assistance.

- Accident Forgiveness: Geico offers accident forgiveness, which prevents your rates from increasing after your first at-fault accident if you qualify.

Cons

- No Custom Coverage: Geico may have a variety of coverage options, however, they do not have customizable coverage to fully personalize the policy.

- Discount Limitations: Although Geico offers many discounts, their availability and the amount you can save may vary by state and individual circumstances.

- Rates for High-Risk Drivers: Geico’s rates may not be as competitive for high-risk drivers (those with poor driving records or multiple claims).

#2 – Erie: Best for Competitive Rates

Pros

- Competitive Rates: Erie Insurance is known for offering competitive rates, often lower than many major insurers, particularly for drivers with good driving records They also offer discounts for paying the annual premium in full and for vehicles with advanced safety features.. Read more with our “Erie Insurance Review & Complaints.”

- Comprehensive Coverage Options: Erie offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, rental car coverage, and roadside assistance.

- Rate Lock Feature: Erie’s Rate Lock feature ensures that your premium remains the same year after year, even if you file a claim or receive a traffic violation. Rates only change if you make changes to your policy.

- First Accident Forgiveness: Erie offers first accident forgiveness, which prevents your rates from increasing after your first at-fault accident.

Cons

- Availability: Erie Insurance is not available in all states. Their coverage is primarily offered in the Midwest, Mid-Atlantic, and Southeast regions of the United States, which can limit access depending on your location.

- Digital Tools and Resources: While Erie offers online account management, their digital tools and mobile app may not be as advanced or user-friendly as those of larger national insurers. Erie also does not offer online quotes in many areas, inconvenient for some customers.

- Rates: Although Erie is known for competitive rates, they may not always be the lowest available. It’s important to compare quotes from multiple insurers to ensure you get the best deal.

#3 – State Farm: Best for Strong Networks

Pros

- Competitive Rates: State Farm is known for offering competitive rates, especially for drivers with good driving records. Their extensive range of discounts can also help lower premiums.

- Extensive Coverage Options: State Farm provides a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, medical payments, rental reimbursement, and roadside assistance. They also offer specialized options like rideshare driver coverage.

- Drive Safe & Save Program: State Farm offers a usage-based insurance program called Drive Safe & Save, which can reward safe driving habits with potential discounts based on driving behavior monitored through a mobile app. If you want to learn more about the Drive Safe & Save Program, read our “State Farm Insurance Review & Complaints: Car Insurance” for more information.

Cons

- Rates: While State Farm offers competitive rates, they may not always be the lowest available. It’s important to compare quotes from multiple insurers to ensure you get the best deal.

- Discount Limitations: The availability and amount of discounts can vary by state and individual circumstances, potentially limiting their impact on your overall premium.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Auto-Owners: Best for Financial Stability

Pros

- Comprehensive Coverage Options: Auto-Owners offer a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, gap insurance, and roadside assistance. They also provide add-ons like diminished value coverage and extended transportation expense coverage.

- Discounts: Auto-Owners provides a variety of discounts, including multi-policy, multi-car, safe driver, good student, paid-in-full, and safety feature discounts. Check our “Best Car Insurance Discounts” guide for the best discount tips.

- Excellent Customer Service: Auto-Owners is known for its strong customer service and receives high ratings for customer satisfaction and claims handling. To see how satisfied customers are, our comprehensive review on Auto-Owners will give you a first hand experience on their customer service.

Cons

- Availability: Auto-Owners Insurance is not available in all states, which could limit access depending on your location.

- Rates: Although generally competitive, Auto-Owners’ rates may not always be the lowest. It’s important to compare quotes from multiple insurers to ensure you get the best deal.

#5 – Amica: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Amica is known for its exceptional customer service and consistently receives high ratings for customer satisfaction and claims handling with many customers reporting positive experiences and quick resolutions.

- Comprehensive Coverage Options: Amica offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, gap insurance, roadside assistance, and rental reimbursement. If you’re curious about liability insurance coverage, check our “Best Bodily Injury Liability Coverage Car Insurance Company.”

- Dividend Policies: Amica offers dividend policies, which return a portion of your premium at the end of the policy term, effectively reducing your overall cost of insurance.

- Discounts: Amica provides various discounts, such as multi-policy, multi-car, loyalty, good student, and defensive driving.

Cons

- Rates: While Amica offers competitive rates, they may not always be the lowest available. It’s important to compare quotes from multiple insurers to ensure you get the best deal for your Honda car insurance.

- Limited Availability: Amica’s insurance products are not available in all states, which could limit access depending on your location. Amica also has fewer local agents compared to larger insurers, which might be a drawback if you prefer in-person service

- Dividend Policies: While dividend policies can save you money, they may come with higher upfront costs compared to standard policies

#6 – USAA: Best for Military Focus

Pros

- Competitive Rates: USAA is known for offering some of the most competitive rates in the industry, particularly for military members and their families. Read our guide on “USAA Insurance Review & Complaints.”

- Comprehensive Coverage Options: USAA offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, gap insurance, roadside assistance, and rental reimbursement.

- New Car Replacement Assistance: If your new Honda is totaled, USAA may help cover the cost of a new car of the same make and model. If you want to know more about this type of coverage, read “Understanding New Car Replacement Insurance Coverage” to learn more.

Cons

- Eligibility: USAA membership is limited to active, retired, and separated veterans of the U.S. military and their eligible family members. Typically, USAA offers excellent rates for Honda car insurance to their members and their families, their rates may not always be the lowest for non-military members, even if eligible through family connections.

- Discount Availability: Discounts and coverage options may vary by state, so not all customers will have access to the same benefits.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Travelers: Best for Comprehensive Coverage

Pros

- Competitive Pricing: Travelers often provide competitive rates and offer a variety of discounts, such as multi-policy, safe driver, and multi-car discounts, which can lead to substantial savings. They also have a pay-in-full discount if you pay your annual premium upfront.

- Extensive Coverage Options: Travelers offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, gap insurance, and roadside assistance, allowing you to tailor your policy to your specific needs. Be sure to read our “Travelers Insurance Review & Complaints.”

- Accident Forgiveness: Travelers offers accident forgiveness, which prevents your rates from increasing after your first at-fault accident.

- New Car Replacement: If your new Honda is totaled within the first five years, Travelers may cover the cost of a new car of the same make and model.

Cons

- Rates: While Travelers offers competitive rates, they may not always be the lowest available. It’s important to compare quotes from multiple insurers to ensure you get the best deal.

- IntelliDrive Program: The IntelliDrive program involves monitoring your driving habits, which some drivers might find intrusive. Additionally, if the program determines risky driving behavior, it could lead to higher premiums.

- Discount Availability: Some discounts and coverage options may vary by state, so not all customers will have access to the same benefits.

#8 – Nationwide: Best for Extensive Options

Pros

- Vanishing Deductible: Nationwide offers a vanishing deductible program where your deductible decreases by $100 for each year of safe driving, up to a maximum reduction limit.

- SmartRide Program: Nationwide’s usage-based insurance program, SmartRide, offers discounts based on your driving habits, rewarding safe driving with potential savings. To find out more about the SmartRide Program, check out “Nationwide Insurance Review & Complaints” for a more in-depth analysis

- Broad Coverage Options: Nationwide provides a wide range of coverage options, including comprehensive, collision, uninsured/underinsured motorist, gap insurance, and roadside assistance, allowing you to customize your policy.

- Multi-Policy Discounts: You can save money by bundling your auto insurance with other types of insurance, such as home or renters insurance.

Cons

- Rates: While competitive, Nationwide’s rates may not always be the lowest, and some customers have reported higher premiums compared to other insurers.

- SmartRide Program Limitations: Although the SmartRide program offers discounts, it also involves monitoring your driving habits, which some drivers may find intrusive.

- Discount Availability: Discounts and coverage options may vary by state, so not all customers will have access to the same benefits.

#9 – Progressive: Best for Usage-Based Insurance

Pros

- Competitive Rates: Progressive is known for offering competitive rates, especially for safe drivers. Their Snapshot program can also lead to further discounts based on your driving habits. Be sure to read our “Progressive Insurance Review & Complaints: Auto Insurance” to find out if Progressive is right for you.

- Name Your Price Tool: This unique feature allows you to enter your budget, and Progressive will show you coverage options that fit within that amount, making it easier to find a plan that suits your financial needs.

- Multi-Policy Discounts: Progressive offers discounts for bundling auto insurance with other types of insurance, such as home or renters insurance.

- Extensive Coverage Options: Progressive provides a wide range of coverage options, including gap insurance, custom parts and equipment value, rideshare coverage, and more, allowing you to tailor your policy to your specific needs.

Cons

- Customer Service: While many customers have positive experiences, there are mixed reviews regarding Progressive’s customer service, with some reporting delays or dissatisfaction with the claims process. Some customers have experienced challenges with the claims process, including slow response times and difficulties in getting claims approved.

- Rate Increases: Some customers have reported significant rate increases upon policy renewal, even without filing claims or changing coverage.

- Snapshot Program: The Snapshot program can result in higher premiums if it determines you are a risky driver. This can be a drawback for those who do not consistently practice safe driving habits.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – The Hartford: Best for Excellent Service

Pros

- Discounts: The Hartford offers various discounts, such as for safe driving, bundling auto and home policies, paying the annual premium in full, and more. To make sure you have the knowledge on The Hartford, take a look at “The Hartford Review & Complaints.”

- Lifetime Car Repair Assurance: If you use one of their authorized repair shops, The Hartford guarantees the work for as long as you own or lease your vehicle.

- New Car Replacement Coverage: If your new Honda (15 months old or newer) is totaled, The Hartford will replace it with a new car of the same make and model.

Cons

- Rates: While The Hartford offers competitive rates, they may not always be the lowest available. It’s important to compare quotes from multiple insurers. If you’re looking for reliable rates, check our page on the “Best Car Insurance Companies.”

- Policy Restrictions: Certain coverage options or discounts might have specific requirements or restrictions, which could limit their applicability.

Deciding Whether Minimum Coverage vs Full Coverage Is Right for You

There are benefits to having minimum coverage or full coverage. Minimum coverage refers to the least amount of insurance required by law in your state. This includes liability insurance, which covers bodily injury and property damage you cause to others in an accident. With its low cost, it comes with limitations, as this does not cover damage to your vehicle or injuries you may sustain.

Honda Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Amica | $50 | $110 |

| Auto-Owners | $48 | $105 |

| Erie | $45 | $100 |

| Geico | $40 | $95 |

| Nationwide | $52 | $108 |

| Progressive | $47 | $102 |

| State Farm | $55 | $120 |

| The Hartford | $51 | $112 |

| Travelers | $53 | $115 |

| USAA | $42 | $98 |

Full coverage usually refers to a combination of liability, collision, and comprehensive insurance and costs far more than minimum coverage due to the broader protection and greater financial security in various scenarios.

Your decision on minimum coverage or full coverage depends on your finances, the value of your vehicle, and your risk tolerance. Check our guide on “Car Insurance Requirements” to learn more about what you need for your car insurance before deciding between minimum and full coverage.

Factors That Affect The Cost of Your Honda’s Car Insurance

When insurance providers determine the cost of insuring a Honda, they take into account numerous factors, including the vehicle’s make and model, the driver’s age and location, as well as the coverage options and deductibles.

Common Factors That Impact Car Insurance Rates

| Factors Insurers Consider | Impact on Rates |

|---|---|

| Driving Record and Claim History | 35% |

| Age, Martial Status, and Gender | 25% |

| Car Make/Model | 18% |

| Insurance Carrier & Policy Options | 9% |

| Location | 8% |

| Credit | 3% |

| Occupation | 2% |

Understanding the factors that affect your insurance premiums can help you manage and potentially lower them. If you want to learn more, read our “Top 12 Factors That Affect Car Insurance Rates: An Expert Guide” to learn more.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Honda Insurance Coverages

All U.S. states, except New Hampshire and Virginia, require Honda drivers to carry liability car insurance coverage. New Hampshire residents must pay for damages out of pocket after an at-fault accident, and Virginia requires uninsured residents to pay an annual $500 uninsured motor vehicle fee. However, you can generally find a liability policy for less than $500 yearly.

Liability insurance pays for any property damage or bodily injury you cause in an at-fault accident up to your policy’s limits. For example, if you only have $20,000 in property damage liability and cause $25,000 in damage, you must pay the remaining $5,000 out of pocket.

The two types of liability coverages include:

- Property Damage Liability: Property damage liability covers any vehicle or property damage you cause in an at-fault accident. Usually, insurers pair this coverage alongside bodily injury liability.

- Bodily Injury Liability: Bodily injury liability pays for the medical bills and lost wages of other drivers in an accident you cause. Read more about the best bodily injury liability car insurance companies here.

In addition to the required coverages above, some states may require other car insurance coverages, including:

- Collision Coverage: Collision coverage pays to repair or replace your vehicle if it gets damaged in an accident. Read more about the best collision coverage car insurance companies.

- Comprehensive Coverage: Comprehensive car insurance protects you in non-collision incidents. For example, if your car gets damaged by weather, vandalism, or theft, you’ll get a check to repair or replace it. Read more about the best comprehensive coverage car insurance companies.

- Medical Payments/Personal Injury Protection: These coverages help pay for medical bills and lost wages for the driver and passengers after an accident. Keep reading to learn more about the best medical payments car insurance companies.

- Uninsured/Underinsured Motorist Protection: If a driver with inadequate or no insurance hits your car, this coverage pays for any property damage or bodily injury. Find out more about the best uninsured coverage car insurance companies.

Some states require drivers to carry medical payments, personal injury protection, and uninsured/underinsured motorist protection. In addition, you might need collision and comprehensive coverage if you have a car loan since most lenders require full coverage. Find out how to get car insurance.

Honda Car Insurance Rates

On average, it costs about $135 monthly for full coverage car insurance for a Honda. However, your actual Honda insurance costs will vary depending on several factors, like the Honda model you purchase.

If your Honda is older, or you can afford to pay damages out of pocket, you could consider carrying just the minimum insurance your state requires to save on your monthly rates. For example, liability-only insurance for a Honda costs around $37 monthly, a savings of around $100.

The cost to insure a Honda also depends on the model you choose. For example, if you pick a Honda with expensive repair parts or a high MSRP, you might be stuck with high car insurance rates. Just enter your ZIP code below with our free comparison tool to get quotes for your Honda.

Exploring Discounts for Honda Owners

Exploring various discounts and saving opportunities available for your Honda’s car insurance is important. Insurance providers often include car insurance discounts depending on your Honda’s features.

Having anti-theft devices in your vehicle, such as an alarm and a vehicle recovery system could drastically reduce your rates. Some providers also offer discounts if you park your Honda in a secure location. It is worth checking the availability of what discounts are eligible for you.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Tips on Finding the Best Car Insurance Company for Hondas

While comparing average rates is a good start in finding affordable Honda car insurance, consider the tips listed below when shopping around to find the best car insurance company for Hondas

The first step is to compare car insurance. Always compare quotes from various companies before deciding on one. Insurers consider multiple factors when setting rates and weigh certain factors differently than others. So, you’ll likely overpay for car insurance if you pick the first company you find.

Consider the coverage you need. Each coverage you add to your policy raises your rates, so ensure you only pay for the coverage you need. For example, you could drop collision and comprehensive coverages if your policy’s cost exceeds 10% of your car’s value. Find out how much car insurance you need.

When it comes to covering your Honda, always consider your environment, how often you drive and what you use it for, be it for leisure or commercial use.

Kristen Gryglik Licensed Insurance Agent

Finally, locate discounts. Most companies offer car insurance discounts to Honda drivers looking for more affordable rates. For example, college students who maintain good grades may qualify for a good student discount. Ask any company you’re considering if you qualify for car insurance discounts.

As you can see, finding the best Honda car insurance company isn’t difficult if you consider your needs and budget and compare policies accordingly.

The Best Car Insurance Company for Hondas: The Bottom Line

If you recently bought a Honda or want to get one, finding the best car insurance company for your needs is vital. It all depends on the make and model of your Honda. An example would be the Honda Civic, the best car insurance for it may not be the same as that of a Honda Fit EV. Be sure to read our guide on “Best Honda Civic Car Insurance Quotes.”

By looking into an insurer’s financial stability, customer service record, claims process timeline, discounts, and payment methods, customers can ensure they are getting the protection they need. Selecting a car insurance provider that meets all the criteria will help Honda drivers get the most out of their policy.

Comparing quotes, locating discounts, and considering coverage needs are the most effective ways to find the best car insurance company for Hondas, and to do just that, enter your ZIP code below, to get quotes from the top providers.

Frequently Asked Questions

What is the average cost to insure a Honda?

It costs about $135 monthly for full coverage car insurance on a Honda. However, your actual Honda insurance costs will vary depending on several factors, like the Honda model you purchase.

What is the best car insurance company for Hondas?

The best car insurance company for Hondas is one that fits your needs and budget. Always compare coverage options, eligible discounts, and quotes to find the right company.

What insurance coverage should I get for my Honda?

All U.S. states, except New Hampshire and Virginia, require Honda drivers to carry liability car insurance coverage. However, you might need collision and comprehensive coverage if you have a car loan since most lenders require full coverage. Read our guide on “Comprehensive Car Insurance: An Expert Guide” to learn more.

What is the cheapest car insurance company for my Honda?

On average, our top three car insurance companies for full coverage, are Geico, Erie, and State Farm starting at just $95, $100, and $120 per month, respectively.

Should I sign up for full coverage or should I just get Liability coverage?

If you’re on a tight budget, liability coverage may seem like the best choice for the short term, especially if you have a good driving record and an area of low accident rates. However, comprehensive long term will cover you for far more if you end up in an accident and could overall, save you money from excess fees that your liability coverage does not cover.

How much does it cost to insure a Honda Civic?

On average, it costs around $154 monthly for full coverage car insurance on a Honda Civic. Read our guide on “Best Car Insurance Quotes by Vehicle” to understand more on how your make and model can affect your insurance costs.

How much does it cost to insure a Honda Accord?

On average, it costs around $131 monthly for full coverage on a Honda Accord.

In what state are Hondas cheapest to insure?

The cost to insure your Honda varies significantly by its model, your driving profile, and specific state regulations. We found that Vermont, Maine, New Hampshire, Ohio, and Virginia are considered the cheapest states to insure. Read our “Best Car Insurance by State” to help you decide on what companies to get quotes from in your location.

How can I find the best car insurance company for my Honda?

When shopping around to find the best car insurance company for Hondas, compare quotes, locate discounts, and consider coverage needs. As you can see, finding the best Honda car insurance company isn’t difficult if you consider your needs and budget and compare policies accordingly. To find quotes suited for you, enter your ZIP code below to find insurance providers in your area.

How do I know which car insurance company is the best in my state?

There are several factors to consider when choosing a car insurance company in your state, including their coverage options, customer service reputation, and price. You can start by researching the top car insurance providers in your state and reading customer reviews to get an idea of their overall reputation and satisfaction levels.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.