10 Best Car Insurance Companies for Kias in 2025 (See the Top Providers Here)

The best car insurance companies for Kias are State Farm, Geico, and Progressive. Geico has the lowest car insurance rates for Kias, starting at $102/month for full coverage. These Kia car insurance providers offer affordable coverage and great car insurance discounts to help Kia owners save.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Mar 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Kias

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Kias

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsWhen it comes to finding the best car insurance companies for Kias, State Farm, Geico, and Progressive lead the way. Geico offers the lowest rates at $98 per month, State Farm provides top-tier service at $104 per month, and Progressive gives flexible coverage at $110 per month. Each one balances affordability and protection, helping Kia drivers get the right insurance coverage at the right price.

The best car insurance provider companies for Kias make it easy to find the right balance of price, coverage, and perks. Whether you want the lowest rate or the best overall value, State Farm, Geico, and Progressive have options that fit your budget. Compare plans and start saving today!

Our Top 10 Company Picks: Best Car Insurance Companies for Kias

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Local Agent | State Farm | |

| #2 | 25% | A++ | Affordable Policy | Geico | |

| #3 | 10% | A+ | Competitive Rates | Progressive | |

| #4 | 25% | A+ | Accident Forgiveness | Allstate | |

| #5 | 20% | A | Customizable Policies | Farmers | |

| #6 | 20% | A+ | Vanishing Deductible | Nationwide |

| #7 | 25% | A | Mobile-Friendly Management | Liberty Mutual |

| #8 | 13% | A++ | Bundling Discount | Travelers | |

| #9 | 30% | A+ | Dividend Payments | Amica | |

| #10 | 15% | A | Online Tools | Safeco |

It provides a quick look at each company’s strengths, helping you find the right balance of cost and protection. Whether you’re after the lowest rates or the most comprehensive coverage, this table makes it easy to compare your options.

- Best Car Insurance Companies

- Best Kia Spectra5 Car Insurance Quotes (2025)

- Best Kia Spectra Car Insurance Quotes (2025)

- Best Kia Soul EV Car Insurance Quotes (2025)

- Best Kia Sorento Hybrid Car Insurance Quotes (2025)

- Best Kia Sephia Car Insurance Quotes (2025)

- Best Kia Seltos Car Insurance Quotes (2025)

- Best Kia Rondo Car Insurance Quotes (2025)

- Best Kia Rio5 Car Insurance Quotes (2025)

- Best Kia Optima Plug-In Hybrid Car Insurance Quotes (2025)

- Best Kia Optima Plug-In Hybrid Car Insurance Quotes (2025)

- Best Kia Niro Plug-In Hybrid Car Insurance Quotes (2025)

- Best Kia Niro Plug-In Hybrid Car Insurance Quotes (2025)

- Best Kia K5 Car Insurance Quotes (2025)

- Best Kia Carnival Car Insurance Quotes (2025)

- Best Kia Borrego Car Insurance Quotes (2025)

- Best Kia AMAnti Car Insurance Quotes (2025)

- Best Kia Forte Car Insurance Quotes (2025)

- Best Kia Optima Car Insurance Quotes (2025)

- Best Kia Sedona Car Insurance Quotes (2025)

- Best Kia Sportage Car Insurance Quotes (2025)

- Best Kia Sorento Car Insurance Quotes (2025)

- Best Kia Soul Car Insurance Quotes (2025)

- Best Kia Niro Car Insurance Quotes (2025)

- Best Kia Telluride Car Insurance Quotes (2025)

- Best Kia Stinger Car Insurance Quotes (2025)

Let’s discuss some options you might like to consider, and then we’ll see how much you should expect to pay for the best Kias car insurance policies. Enter your ZIP code to begin comparing quotes.

- KIA car insurance costs about $147 monthly, based on the insurer

- Comparing quotes can help you find the best KIA insurance near you

- You can save with car insurance discounts or a higher deductible

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Personalized Service: State Farm offers personalized service, letting Kia owners customize coverage with local agents.

- Competitive Bundling Discounts: You can save with State Farm’s 10% bundling discount when combining multiple policies.

- Wide Network of Agents: State Farm is highly accessible with an extensive network of agents nationwide, and Kias owners can easily find in-person assistance.

Cons

- Higher Rates for High-Risk Drivers: State Farm may have higher premiums for Kias drivers with a history of accidents or violations. Learn more in our State Farm insurance review.

- Limited Online Tools: State Farm’s online tools and mobile app may lack advanced features, which could be a drawback for tech-savvy drivers.

#2 – Geico: Best for Coverage Options

Pros

- Affordable Coverage: Geico offers budget-friendly insurance that fits owners’ needs without breaking the bank.

- Easy-to-Use App: Geico’s simple, user-friendly app makes managing your policy and filing claims easy.

- Plenty of Discounts: According to our Geico insurance review, Kia car owners can save with discounts.

Cons

- There is not much in-person support. Geico focuses on online services, so owners who prefer face-to-face help might find their local agent options limited.

- Higher Rates for Risky Drivers: Geico’s coverage rates might be higher if you have accidents or violations on your record.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#3 – Progressive: Affordable and Flexible Coverage

Pros

- Big Savings with Bundling: Progressive offers excellent discounts when you bundle your policy with other coverage, helping you save more.

- Snapshot Rewards Safe Driving: Progressive Snapshot program tailors rates based on your driving habits, which can lead to lower premiums.

- 24/7 Online Convenience: You can efficiently manage your policy with round-the-clock access to claims and policy details online.

Cons

- Potential Rate Increases: According to Progressive insurance reviews, some drivers notice their premiums increase after the first term, even with a good driving record.

- Fewer Local Agents: Progressive focuses more on online services, which might not be ideal if you prefer in-person support.

#4 – Allstate: Best for Deductible Rewards

Pros

- Extra Coverage Options: Allstate offers add-ons like rental car coverage and roadside help, perfect for Kia owners who want more peace of mind.

- Financially Reliable: With a solid A+ rating, Allstate is a trustworthy choice that delivers on claims when needed.

- Bundling Perks: You can save money by bundling your Kias insurance with home or renters coverage and get a nice discount.

Cons

- Higher Premiums for Some Drivers: Allstate may charge higher premiums for drivers with less-than-perfect records, which could be a downside for some Kia owners.

- Mixed Customer Service Reviews: As stated in our Allstate, some customers have reported inconsistent service, which might be frustrating during the claim process.

#5 – Farmers: Best for Safety Discounts

Pros

- Great Safety Discounts: Farmers offers nice savings for Kia owners with advanced safety features, helping you keep costs down.

- Coverage That Fits: Whether you need basic or full coverage, Farmers has options that work for your Kias.

- A-Rated Financial Strength: Farmers A rating from A.M. Best highlights its reliability, ensuring efficient and fair claims handling, as demonstrated in our Farmers insurance review.

Cons

- Fewer Local Agents: Farmers don’t have as many nearby agents, which can be a hassle if you like handling things in person.

- Higher Costs for Newer Models: Farmers may charge higher premiums for insuring newer Kias models, potentially affecting budget-conscious customers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#6 – Nationwide: Comprehensive and Flexible Options

Pros

- Vanishing Deductible Program: Nationwide’s vanishing deductible program allows Kias owners to lower their deductibles over time for safe driving.

- A+ Financial Rating: Nationwide’s A+ rating from A.M. Best indicates solid financial stability, ensuring reliable claim handling. Read more in our Nationwide insurance review.

- Excellent Customer Support: Nationwide might charge higher premiums for drivers with a poor driving history, which could be a downside for those with higher risk profiles.

Cons

- Higher Rates for Riskier Drivers: If your driving history is poor, you might face higher premiums. It’s worth considering if you’ve had some incidents in the past.

- Limited Coverage in Some Areas: Nationwide’s coverage isn’t available everywhere, so it could be challenging for some Kias owners, depending on where they live.

#7 – Liberty Mutual: Custom Policies & Great Discounts

Pros

- Great Multi-Policy Discounts: Bundle your auto and home insurance with Liberty Mutual and save 8%. It’s an easy way to cut costs while maintaining coverage.

- Flexible Coverage Options: Liberty Mutual lets you customize your policy, making it a perfect fit for Kias drivers. Get the coverage you need to stay protected.

- Accident Forgiveness: With Liberty Mutual, your rates won’t go up after your first accident—thanks to their accident forgiveness program. Stress-free and hassle-free!

Cons

- Higher Premiums for Add-Ons: Liberty Mutual may charge higher premiums for additional coverage options, which can increase overall costs for some drivers.

- Mixed Customer Satisfaction: Liberty Mutual has received mixed reviews, particularly about claims handling. Our Liberty Mutual insurance review provides further information.

#8 – Travelers: Strong Reputation

Pros

- Great Bundling Discounts: Travelers get a 9% discount when they bundle, so Kia owners can save on auto and home insurance.

- Flexible Coverage Options: Travelers lets you customize your insurance, making it easy for Kias owners to get the coverage they need

- Generous Accident Forgiveness: Their accident forgiveness program prevents rate hikes after a first accident. Our Travelers Insurance Review covers this in more detail.

Cons

- Limited Local Agents: Travelers have fewer local agents, which might be inconvenient for those preferring face-to-face service.

- Potentially Higher Rates for Certain Models: Travelers may charge more to insure some Kias models, affecting cost-effectiveness.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#9 – Amica: Exceptional Customer Satisfaction

Pros

- Great Bundling Discounts: Amica offers solid savings when you bundle auto, home, and life insurance so Kias owners can save on both.

- Customizable Coverage: Amica lets you personalize your coverage, so you only pay for what fits your needs

- Top-Notch Customer Service: Amica’s responsive support makes the claims process easy and stress-free for Kias owners.

Cons

- Fewer Local Agents: Amica has fewer agents in some areas, which could be a hassle if you like in-person help.

- Higher Premiums for Some Cars: If you drive a specific Kia model, you might face higher premiums, which can add up over time.

#10 – Safeco: Affordable Coverage with Solid Support

Pros

- Great Bundling Discounts: Safeco helps you save when you bundle your auto and home insurance. Learn more in this Safeco auto insurance review.

- Customizable Coverage: You can tweak your Kias full coverage car insurance to fit your needs, giving you more control.

- Friendly Customer Support: Safeco’s customer service is quick, helpful, and easy to reach when you need assistance.

Cons

- Fewer Local Agents: If you like in-person support, you may not find it in certain areas.

- Higher Premiums for Some Models: Some Kias cars may cost more to insure, so you could pay higher premiums.

Exploring Kia Insurance Rates & Coverage Options

Looking for the best insurance for your Kia? We’ve got you covered! Check out top providers’ monthly rates and coverage options to find what works best. Consider Travelers and Progressive car insurance for comprehensive coverage.

Kias Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $50 | $125 | |

| $45 | $112 | |

| $46 | $120 | |

| $40 | $102 | |

| $55 | $140 |

| $48 | $123 |

| $44 | $108 | |

| $49 | $118 | |

| $42 | $105 | |

| $47 | $117 |

Now that you’ve got the breakdown, it’s easier than ever to pick a plan that suits your needs and budget. Drive with peace of mind, knowing you’re covered the right way.

Picking the right coverage is easy when you have the facts. Choose a plan that works for you, and enjoy worry-free driving with your Kia!

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best KIA Car Insurance Discounts Available

Are you looking to lower your KIA insurance costs? Many top providers offer exclusive discounts that can help you save big. Whether it’s safe driver perks or bundling options. The good news is that many top providers offer discounts to help you cut costs. The key is finding the right one for you.

Take advantage of these KIA expert car insurance discounts today and enjoy better coverage at a lower price. Compare offers to see how much you can save!

Car Insurance Discounts From the Top Providers for Kias

| Insurance Company | Available Discounts |

|---|---|

| Allstate Rewards, New Car Discount, Safe Driver Discount, Multi-Policy Discount, Anti-Theft Discount. | |

| Legacy Discount, Multi-Policy Discount, Safe Driver Discount, Loyalty Discount, Paid-in-Full Discount. | |

| Signal Discount, New Car Replacement Discount, Safe Driver Discount, Multi-Vehicle Discount, Bundling Discount. | |

| Safe Driver Discount, Multi-Vehicle Discount, Anti-Theft Discount, Good Student Discount, Military Discount. | |

| RightTrack Discount, Hybrid/Electric Car Discount, Multi-Policy Discount, Good Student Discount, Anti-Theft Discount. |

| SmartRide Discount, Anti-Theft Discount, Multi-Vehicle Discount, Accident-Free Discount, Bundling Discount. |

| Snapshot Discount, Multi-Policy Discount, Pay-in-Full Discount, Safe Driver Discount, Online Quote Discount. | |

| RightTrack Discount, Accident-Free Discount, Teen Safety Discount, Multi-Vehicle Discount, Bundling Discount. | |

| Drive Safe & Save, Multi-Vehicle Discount, Good Student Discount, Vehicle Safety Discount, Bundling Discount. | |

| IntelliDrive Discount, New Car Discount, Multi-Vehicle Discount, Good Student Discount, Anti-Theft Discount. |

Don’t miss out on these KIA insurance discounts! Snag a great deal today and get the coverage you need without overspending.

State Farm is one of the biggest insurance companies in the U.S. They offer all kinds of coverage, like home, life, and car insurance. People know them for their friendly service and plenty of discount options. You’ve probably heard their slogan, “Like a good neighbor, State Farm is there.” They focus on being helpful and easy to work with.

Choosing the Best Insurance Company for a KIA

Picking the right insurance for your Kia Rio car insurance can help you get the best coverage at a price that fits your budget.

Of course, you want to know the coverage amount, but it’s also essential to research each company’s customer ratings and financial strength.

State Farm stands out with its reliable coverage, affordable rates, and 89% customer satisfaction, making it a top choice for Kia drivers looking for value.

Schimri Yoyo Licensed Agent & Financial Advisor

Many insurers will cover a Kia, including Geico, Progressive, and State Farm. Before signing up, check the company’s financial strength—it’s a good way to ensure they’ll have your back if you ever need to file a claim.

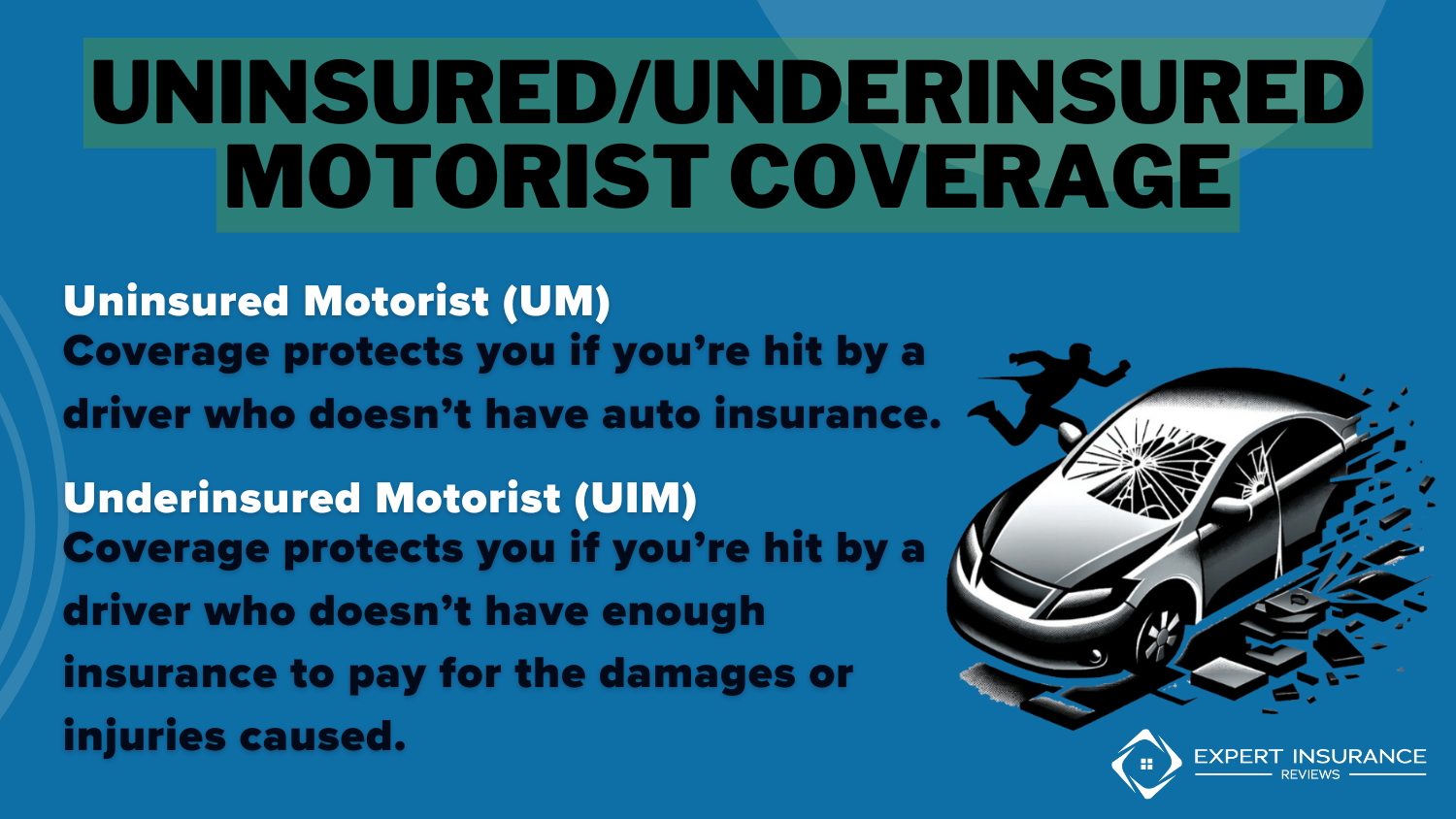

Motorist coverage can be helpful if you’re ever hit by someone without enough insurance. Without it, you might pay out of pocket for damages or injuries. It’s a thoughtful add-on if you want extra peace of mind on the road.

Exploring KIA Car Insurance Affordability

Want to keep your KIA car insurance provider? The key is to shop around and compare car insurance providers. Your driving history and the model of your KIA can impact your premium, so knowing what matters can help you find a better deal.

Also, watch for discounts or bundle deals that could save you some cash. A bit of research goes a long way in finding coverage that fits your budget and still keeps you protected.

If you’re concerned that your current insurer doesn’t have you covered, do yourself a favor and look for the best Kias car insurance quotes. Enter your ZIP code to begin comparing insurance quotes from various providers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frequently Asked Questions

Are Kias expensive to insure?

Kia insurance rates vary depending on the model, location, driving history, and coverage level. Compared to luxury brands, Kias are generally affordable to insure, but specific models, like the Kia Stinger, may have higher costs.

Which insurance companies cover Kia vehicles?

Most major insurance companies, including State Farm, Progressive, Allstate, Geico, and Farmers, offer coverage for Kia auto insurance.

Does Geico cover Kia cars?

Yes, Geico provides insurance coverage for Kia vehicles, including liability, collision, comprehensive car, and other standard auto insurance options.

How much does insurance cost for a Kia?

Kia insurance rates depend on the model. For example, insuring a Kia Rio5 car insurance is generally cheaper than a Kia Stinger insurance due to differences in repair costs and performance.

How can I find affordable insurance for a Kia?

To get the best rates, shop around for quotes, choose a higher deductible, and take advantage of discounts like safe driver perks or bundling options.

What type of insurance do I need for a Kia?

You need liability insurance at minimum, but Kia full coverage (including collision and comprehensive) is recommended, especially for newer Kia models or if you have a loan on the car.

Which companies insure Kia vehicles?

Most significant and regional insurance providers offer coverage for Kia models. Popular choices include Geico, Progressive, and State Farm.

Which insurance company offers the best auto rates?

The best rates vary based on factors like location and driving history. However, USAA, Geico, and State Farm are known for competitive pricing.

Free quote comparison toolto compare your rates against the top insurers.

What is the average cost of Kia Sedona car insurance?

The Kia Sedona, a minivan, generally has moderate insurance costs due to its strong safety features and lower theft risk than sports cars.

Which car insurance company ranks highest in customer satisfaction?

Industry rankings consistently place USAA at the top for customer satisfaction, followed by State Farm and Amica. However, service quality and availability may vary by state.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.