10 Best Car Insurance Companies for Mazdas in 2025 (Your Guide to the Top Providers)

The best car insurance companies for Mazdas are State Farm, USAA and Progressive, offering rates as low as $58/month. These providers are ideal for Mazda owners due to their competitive pricing, comprehensive coverage options, and strong customer satisfaction, making them the best choices for Mazda car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Founder & Former Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. In addition to founding Expert Insurance Reviews, Eric is the CEO of C Street Media, a full-service marketing firm and the...

Founder & Former Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Mazda

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Mazda

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best car insurance companies for Mazdas include State Farm, USAA, and Progressive, offering the starting rates at around $58 per month.

These companies provide affordable insurance solutions tailored for Mazda owners, taking into account factors like driving history and vehicle model. This article explores how rates vary by Mazda model, with State Farm consistently providing affordable coverage. Comparing quotes from multiple providers is crucial to finding the best deal for your Mazda.

Our Top 10 Picks: Best Car Insurance Companies for Mazdas

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | B | Comprehensive Coverage | State Farm | |

| #2 | 10% | A++ | Military Drivers | USAA | |

| #3 | 12% | A+ | Customizable Plans | Progressive | |

| #4 | 20% | A | Car Discounts | Liberty Mutual |

| #5 | 17% | A+ | Vanishing Deductible | Nationwide |

| #6 | 25% | A+ | Safe Driver | Allstate | |

| #7 | 11% | A | Personal Service | Farmers | |

| #8 | 19% | A | Mazda Discounts | American Family | |

| #9 | 8% | A+ | Senior Benefits | The Hartford |

| #10 | 13% | A++ | Hybrid Incentives | Travelers |

Explore our top 10 picks for full coverage car insurance providers for Mazdas. From State Farm’s comprehensive coverage to USAA’s benefits for military drivers and Progressive’s customizable plans, each provider offers unique advantages.

- Best Car Insurance Companies

- Best Mazda Truck Car Insurance Quotes (2025)

- Best Mazda Tribute Hybrid Car Insurance Quotes (2025)

- Best Mazda RX-7 Car Insurance Quotes (2025)

- Best Mazda Protege5 Car Insurance Quotes (2025)

- Best Mazda Protege Car Insurance Quotes (2025)

- Best Mazda Navajo Car Insurance Quotes (2025)

- Best Mazda MX-6 Car Insurance Quotes (2025)

- Best Mazda MX-5 Miata RF Car Insurance Quotes (2025)

- Best Mazda MX-5 Miata Car Insurance Quotes (2025)

- Best Mazda MX-3 Car Insurance Quotes (2025)

- Best Mazda MPV Car Insurance Quotes (2025)

- Best Mazda Millenia Car Insurance Quotes (2025)

- Best Mazda Mazdaspeed Protege Car Insurance Quotes (2025)

- Best Mazda Mazdaspeed MX-5 Miata Car Insurance Quotes (2025)

- Best Mazda Mazdaspeed6 Car Insurance Quotes (2025)

- Best Mazda Mazdaspeed3 Car Insurance Quotes (2025)

- Best Mazda6 Wagon Car Insurance Quotes (2025)

- Best Mazda CX-30 Car Insurance Quotes (2025)

- Best Mazda B-Series Car Insurance Quotes (2025)

- Best Mazda 929 Car Insurance Quotes (2025)

- Best Mazda 626 Car Insurance Quotes (2025)

- Best Mazda 323 Car Insurance Quotes (2025)

- Best Mazda RX-8 Car Insurance Quotes (2025)

- Best Mazda 6 Car Insurance Quotes (2025)

- Best mazda MX-5 Miata Car Insurance Quotes (2025)

- Best Mazda 3 Car Insurance Quotes (2025)

- Best Mazda 5 Car Insurance Quotes (2025)

- Best Mazda Tribute Car Insurance Quotes (2025)

- Best Mazda CX-5 Car Insurance Quotes (2025)

- Best Mazda CX-3 Car Insurance Quotes (2025)

- Best Mazda CX-9 Car Insurance Quotes (2025)

Take the first step toward cheaper car insurance rates. Enter your ZIP code above to see how much you could save.

- State Farm offers the best car insurance rates for Mazdas

- USAA and Progressive offer competitive options tailored for Mazda owners

- Comparing quotes helps find the best car insurance coverage for Mazdas

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – State Farm: Overall Top Pick

Pros:

- Affordable Rates: State Farm stands out for offering highly competitive rates for the best car insurance companies for Mazdas.

- Comprehensive Coverage Options: They provide extensive coverage plans that can be tailored to the specific needs of Mazda drivers. Explore our State Farm insurance review for comprehensive insights.

- Strong Customer Satisfaction: State Farm has high customer satisfaction ratings, reflecting their reliable service and support for Mazda owners.

Cons:

- Limited Discounts: Compared to other best car insurance companies for Mazdas, State Farm might provide fewer model-specific discounts.

- Regional Variability: Rates and service quality can vary significantly depending on the region, which may affect Mazda owners differently.

#2 – USAA: Best for Military Drivers

Pros:

- Exceptional Military Benefits: USAA offers specialized benefits and discounts for military families, making them a standout among the best car insurance companies for Mazdas.

- High Satisfaction Rates: Renowned as one of the best car insurance companies for Mazdas, USAA excels in customer service and support, especially appreciated by military families.

- Competitive Rates: USAA often provides lower rates for Mazda owners, enhancing affordability for those who qualify. Uncover more details in our USAA insurance review.

Cons:

- Eligibility Restrictions: Only available to military members and their families, limiting accessibility for the general Mazda owner population.

- Limited Coverage Options: USAA’s coverage options might be less flexible compared to other best car insurance companies for Mazdas.

#3 – Progressive: Best for Customizable Plans

Pros:

- Flexible Coverage Options: Progressive allows Mazda owners to tailor their coverage extensively, which is a key advantage among the best car insurance companies for Mazdas. Check out our Progressive insurance review for a thorough analysis.

- Discount Programs: Provides a range of discount options, including those for safe driving and bundling, which can be advantageous for Mazda drivers when choosing the best car insurance companies for Mazdas.

- User-Friendly Tools: Progressive is one of the best car insurance companies for Mazdas, offering top-rated online tools and an app that make it easy for Mazda owners to manage their insurance.

Cons:

- Variable Pricing: While customization is a strength, rates can vary widely, potentially leading to higher costs for some Mazda owners.

- Customer Service Issues: Progressive may have inconsistent customer service experiences, which could be a drawback compared to other best car insurance companies for Mazdas.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Car Discounts

Pros:

- Variety of Discounts: Liberty Mutual provides various discounts for Mazda owners, such as those for safe driving practices and advanced vehicle safety features, making it one of the best car insurance companies for Mazdas.

- Comprehensive Coverage: Provides extensive coverage options, which can be beneficial for Mazda owners seeking protection. Read our Liberty Mutual insurance review to learn more.

- Strong Financial Ratings: Liberty Mutual, one of the best car insurance companies for Mazdas, boasts strong financial ratings, guaranteeing dependable coverage for Mazda drivers.

Cons:

- Higher Premiums: Discounts may not always offset the potentially higher premiums compared to other best car insurance companies for Mazdas.

- Complex Discount Structure: The process to qualify for and apply discounts can be complicated, making it harder for Mazda owners to maximize savings.

#5 – Nationwide: Best for Vanishing Deductible

Pros:

- Vanishing Deductible Program: Provides a distinctive vanishing deductible program that can help lower expenses for Mazda owners, making it one of the best car insurance companies for Mazdas. Discover specific details in our Nationwide insurance review.

- Broad Coverage Options: Nationwide offers extensive coverage that fits the needs of different Mazda models, making it one of the best car insurance companies for Mazdas.

- Customer Loyalty Rewards: Rewards for long-term customers can be advantageous for Mazda drivers who stay with Nationwide.

Cons:

- Premium Costs: The initial premiums might be higher compared to other best car insurance companies for Mazdas.

- Limited Regional Presence: Availability and service quality can vary based on location, affecting Mazda owners differently.

#6 – Allstate: Best for Safe Driver

Pros:

- Safe Driver Discounts: Allstate provides substantial discounts for safe drivers, making it one of the best car insurance companies for Mazdas, especially for those with clean driving records.

- Comprehensive Coverage Options: Provides a wide range of coverage options tailored for the best car insurance for Mazdas.

- Strong Mobile App: Allstate’s app offers features that help Mazda owners manage their policies easily. Dive into our Allstate auto insurance review for an in-depth overview.

Cons:

- Higher Rates for Some Models: Coverage might be more expensive for certain Mazda models compared to other best car insurance companies for Mazdas.

- Mixed Customer Service Reviews: Customer service experiences can be inconsistent, which may impact Mazda owners’ satisfaction.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Farmers: Best for Personal Service

Pros:

- Personalized Service: Farmers offers personalized service and guidance, which can be advantageous for Mazda owners looking for the best car insurance companies for Mazdas to meet their specific coverage needs.

- Flexible Coverage Options: Offers various coverage options and add-ons suited for Mazda drivers. Find more information in our Farmers insurance review.

- Local Agent Access: Farmers’ network of local agents provides tailored assistance from some of the best car insurance companies for Mazdas.

Cons:

- Potentially Higher Premiums: Personalized service might come with higher premiums compared to other best car insurance companies for Mazdas.

- Inconsistent Policy Details: Coverage specifics can vary significantly by agent, which may affect Mazda owners’ experience.

#8 – American Family: Best for Mazda Discounts

Pros:

- Exclusive Mazda Discounts: American Family offers specific discounts for Mazda vehicles, making them a strong contender among the best car insurance companies for Mazdas.

- Comprehensive Coverage: Offers extensive coverage choices that are well-suited for different Mazda models from the best car insurance companies for Mazdas.

- Good Customer Service: Generally positive reviews for customer service make these the best car insurance companies for Mazdas, providing added value for Mazda drivers.

Cons:

- Availability Issues: Not available in all states, limiting access for some Mazda owners. Explore our American Family insurance review for additional insights.

- Potentially Higher Costs: Discounts might not fully offset higher base rates compared to other companies.

#9 – The Hartford: Best for Senior Benefits

Pros:

- Senior Discounts: Provides targeted discounts for senior drivers, making it advantageous for older Mazda owners through the best car insurance companies for Mazdas. See our The Hartford insurance review for further details.

- Comprehensive Coverage: Offers a range of extensive coverage options ideal for various Mazda models, provided by the best car insurance companies for Mazdas.

- Strong Customer Service: Generally positive customer service feedback, which supports Mazda owners.

Cons:

- Age-Related Rate Increases: Rates may increase significantly as drivers age, potentially making it less affordable for senior Mazda owners.

- Limited Policy Options: Coverage options might be less flexible compared to other best car insurance companies for Mazdas.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – Travelers: Best for Hybrid Incentives

Pros:

- Hybrid Vehicle Incentives: Provides discounts and incentives for hybrid Mazda models, establishing them as some of the best car insurance companies for Mazdas, especially for hybrid owners.

- Comprehensive Coverage: Provides a range of coverage options suitable for various Mazda models. Explore the benefits in our Travelers insurance review.

- Strong Financial Stability: Travelers, one of the best car insurance companies for Mazdas, has a strong financial rating, guaranteeing dependable coverage for Mazda owners.

Cons:

- Inconsistent Discount Application: Hybrid incentives may not be uniformly applied, affecting Mazda owners differently.

- Higher Premiums for Non-Hybrids: Coverage costs for non-hybrid Mazda models might be higher compared to other best car insurance companies for Mazdas.

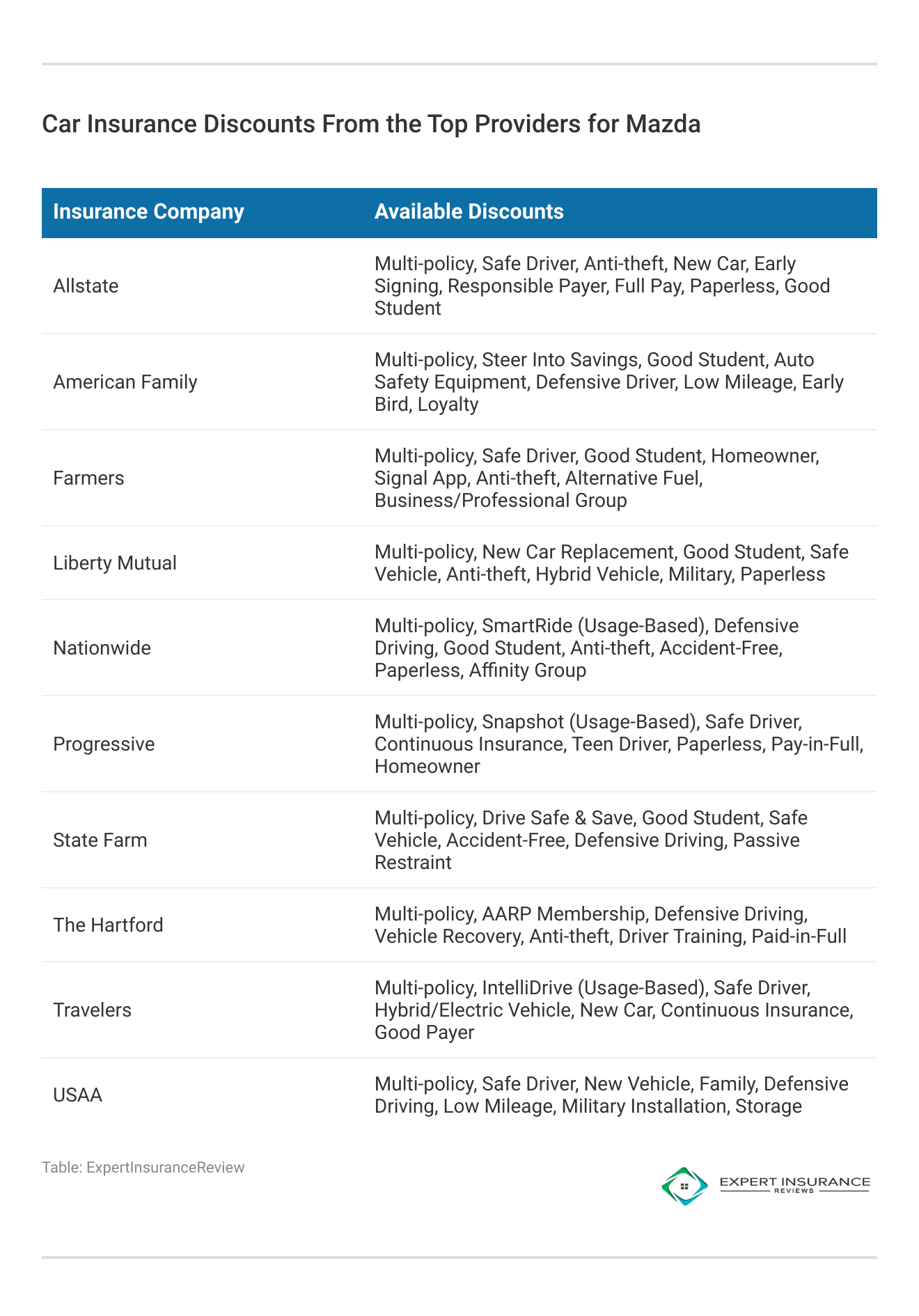

Comparative Analysis of Mazda Car Insurance Rates and Discounts

Finding the right car insurance for your Mazda can significantly impact your overall driving experience and expenses. In this overview, we’ll examine how to get car insurance by comparing monthly rates from different providers for both minimum and full coverage options.

State Farm consistently delivers the best car insurance rates for Mazdas, making it the top choice for affordable and comprehensive coverage.

Jeff Root Licensed Insurance Agent

Additionally, we’ll highlight the discounts available from top car insurance companies, helping Mazda owners maximize savings while ensuring comprehensive protection. Understanding these factors will empower you to make informed decisions regarding your Mazda insurance policy.

Mazda Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $72 | $155 |

| American Family | $67 | $142 |

| Farmers | $74 | $157 |

| Liberty Mutual | $75 | $160 |

| Nationwide | $68 | $148 |

| Progressive | $70 | $150 |

| State Farm | $65 | $145 |

| The Hartford | $71 | $153 |

| Travelers | $69 | $149 |

| USAA | $58 | $135 |

Choosing the best car insurance for your Mazda involves careful consideration of both rates and available discounts. Taking advantage of various discounts offered by insurance providers, you can find a policy that not only fits your budget but also provides the necessary coverage for your vehicle.

Whether you prioritize minimum or full coverage, the right choice can enhance your driving experience and peace of mind. Remember to review your options regularly to ensure you’re getting the best deal possible.

Choosing the Right Car Insurance Coverage for Mazdas

Mazda owners have a variety of car insurance coverage options to choose from, ensuring they can find a policy that meets their specific needs and budget. Understanding these coverage types can help you make informed decisions to protect your vehicle and finances effectively. Here’s a brief overview of the most common coverage options available for Mazdas:

- Liability Coverage: This basic coverage is required by law and helps pay for damages and injuries you cause to others in an accident. It’s essential for protecting your financial assets.

- Collision Coverage: This particularly useful for newer models or high-value Mazdas. Collision car insurance coverage covers repairs to your Mazda if it’s damaged in a collision with another vehicle or object.

- Comprehensive Coverage: Protects against non-collision events like theft, vandalism, or natural disasters. It’s beneficial for ensuring your Mazda is covered in a wide range of scenarios.

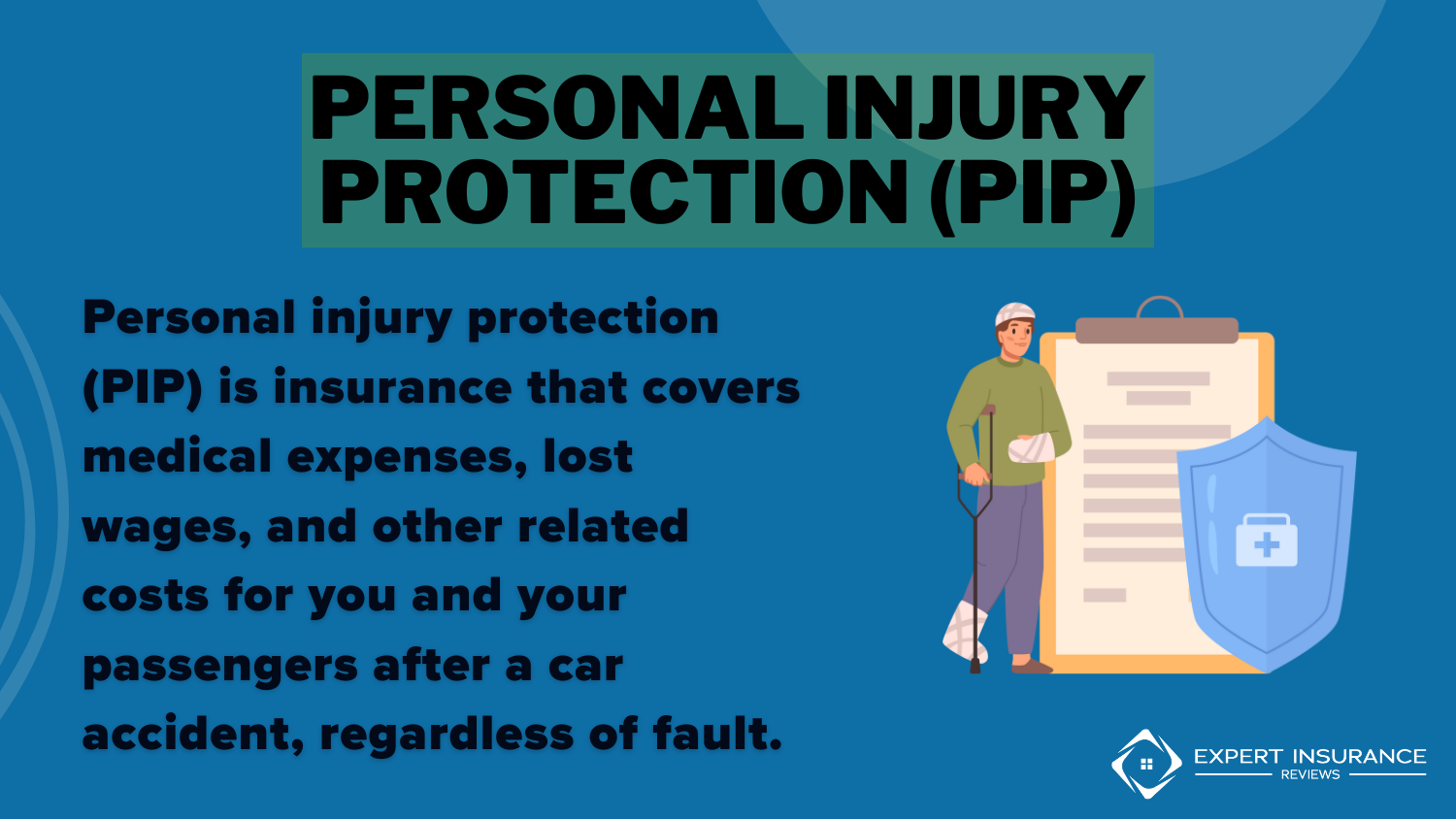

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers regardless of who is at fault in an accident. Personal injury protection also can include lost wages and other related costs.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you’re in an accident with a driver who has insufficient or no insurance. This coverage helps cover medical expenses and repairs.

Selecting the right car insurance coverage for your Mazda is crucial to ensuring comprehensive protection for both your vehicle and personal finances. Whether you’re aiming for full protection with comprehensive coverage or focusing on essential liability, evaluating each option will help you make an informed decision.

The right coverage protects your Mazda and gives you peace of mind for unexpected road incidents. Comparing quotes from different providers helps you find the best fit for your budget and coverage. To gain in-depth knowledge, consult our resource titled, “Does my car insurance cover damage caused by a construction zone accident?”

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Key Factors Affecting Car Insurance Rates of Mazdas

Insuring your Mazda is crucial for protecting your investment and ensuring peace of mind on the road. However, understanding what factors affect the cost of car insurance can make navigating the insurance landscape more manageable.

Understanding these factors is crucial for Mazda owners looking to secure the best coverage at the most competitive price. Several factors play a significant role in determining car insurance rates for Mazdas, from the specific model you own to your personal driving history and location.

- Vehicle Model: Your Mazda model significantly impacts insurance costs, with models like the Mazda3 often having higher premiums than the more affordable Mazda CX-30 due to varying repair costs and safety ratings.

- Driving History: A clean driving record lowers your insurance rates, while accidents or violations can increase your premiums.

- Location: Your location affects rates; urban areas with more traffic and crime may have higher premiums, while rural locations often have lower costs.

- Age and Gender: Young drivers often face higher insurance rates due to increased risk, while older, experienced drivers typically enjoy lower premiums.

- Credit Score: Insurance companies often use credit scores to determine rates, with higher scores leading to lower premiums and lower scores increasing costs.

By being aware of these influences, you can better navigate the insurance landscape and find a policy that not only meets your needs but also fits your budget. Taking the time to compare quotes from different providers and understanding the nuances of how these factors affect your rates will empower you to make smarter decisions and ultimately secure the best insurance for your Mazda.

How to Secure the Best Car Insurance of Mazdas

Finding the right policy can make a significant difference in both coverage and cost. Understanding how to compare auto insurance rates effectively can help you secure the best deal for your vehicle. This guide highlights key factors and tips for comparing Mazda insurance rates to help you get the best value.

- Get Multiple Quotes: Use online comparison tools to gather quotes from various providers. This allows you to compare rates and coverage options side-by-side.

- Assess Coverage Options: Look beyond just the price. Compare the coverage options each provider offers, including liability limits, collision, comprehensive, and any additional benefits.

- Consider Customer Service: Check customer reviews and ratings for insights into the insurance provider’s service quality and claims handling.

- Evaluate Discounts: Inquire about available discounts and assess how they impact your overall premium. Sometimes, bundling multiple policies or utilizing specific discounts can lead to significant savings.

- Review Regularly: Your insurance needs and rates may change over time. Regularly reviewing and comparing your auto insurance can help you stay informed about potential savings.

Understanding the factors that influence your premiums, you can secure a policy that offers both value and protection. Take the time to find and compare car insurance quotes, review coverage options, and consider available discounts to make an informed decision.

View this post on Instagram

Your Mazda deserves the best coverage, and with the right approach, you can ensure it’s protected without breaking the bank. Start comparing today and drive with confidence knowing you’ve found the best insurance for your needs.

Guide to the Best Car Insurance of Mazdas

The best car insurance companies for Mazdas include State Farm, USAA, and Progressive, known for their competitive rates and comprehensive coverage options. The article explores different types of car insurance coverage, such as full and minimum coverage, and advises Mazda owners to utilize available discounts to obtain both affordable and effective insurance.

This also outlines key insights on how rates can vary based on the specific Mazda model, driving history, and location, and stresses the importance of comparing quotes to find the best deal. Key factors influencing insurance rates include the Mazda model, driving history, and location. For optimal savings and coverage, compare quotes from multiple insurers and explore discounts.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frequently Asked Questions

How much is insurance on a 2024 Mazda CX-5?

On average, insurance for a 2024 Mazda CX-5 costs around $202 per month, but rates can vary based on factors like driving history and location. For additional details, explore our resource titled, “Best Mazda CX-5 Car Insurance Quotes.”

What is the cheapest car insurance for Mazda?

The cheapest car insurance for Mazdas is typically offered by State Farm, which provides competitive rates starting around $135 per month.

Are Mazdas expensive to maintain?

Generally, Mazdas are not considered expensive to maintain. They offer reliable performance with reasonable maintenance costs compared to many other brands.

What is the cheapest Mazda to insure?

The Mazda CX-3 is often the cheapest Mazda to insure, with lower average premiums compared to other Mazda models.

Are Mazdas difficult to repair?

Mazdas are not generally difficult to repair. They have a reputation for reliability and straightforward repairs, with many common parts readily available. For more insights, consult our guide titled, “Can I choose where to get my vehicle repaired after an accident?”

Which company gives the best insurance for Mazda?

State Farm, USAA, and Progressive are among the top companies offering the best insurance for Mazdas due to their competitive rates and comprehensive coverage options.

Ready to find affordable car insurance? Get started today by entering your ZIP code below into our free comparison tool.

What are the disadvantages of a Mazda?

Some disadvantages of Mazdas include limited rear-seat space in certain models, higher costs for advanced features, and varying availability of dealership service centers.

Is Mazda premium or luxury?

Mazda is not classified as a luxury brand; it is considered a mainstream brand offering premium features and high-quality builds at a more affordable price.

Are Mazda cars worth buying?

Mazda cars are considered worth buying due to their reliability, strong performance, and high safety ratings, often receiving positive reviews for their value and driving experience. To expand your knowledge, refer to our handbook titled, “SafeAuto Insurance Review & Complaints.”

Are Mazdas cheap to run?

Mazdas are relatively cheap to run, thanks to their efficient fuel economy, reasonable maintenance costs, and overall reliability.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Eric Stauffer

Founder & Former Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. In addition to founding Expert Insurance Reviews, Eric is the CEO of C Street Media, a full-service marketing firm and the...

Founder & Former Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.