10 Best Car Insurance Companies for Mercurys in 2025 (Check Out These Providers)

The top picks for the best car insurance companies for Mercurys are Geico, State Farm, and Progressive, offering competitive rates starting at $55/month. These companies excel in offering excellent coverage options, local agents, online tools and personalized policies tailored to Mercury vehicles.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Insurance Agent

UPDATED: Feb 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Feb 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Mercury

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Mercury

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best car insurance companies for Mercurys are Geico, State Farm, and Progressive, with Geico standing out for its competitive rates starting at $55/month.

These providers offer personalized coverage, local agents, and easy-to-use online tools, helping Mercury drivers find affordable, comprehensive protection by comparing quotes. For detailed information, refer to our comprehensive report titled “Full Coverage Car Insurance: An Expert Guide.”

Our Top 10 Picks: Best Car Insurance Companies for Mercury

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Competitive Rates Geico

#2 17% B Local Agents State Farm

#3 20% A+ Online Tools Progressive

#4 25% A+ Personalized Coverage Allstate

#5 10% A++ Military Benefits USAA

#6 20% A+ Customer Service Nationwide

#7 20% A Local Presence Farmers

#8 10% A Customizable Policies Liberty Mutual

#9 13% A++ Financial Stability Travelers

#10 29% A Personalized Options American Family

Explore these options to get the best coverage at the lowest cost. Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Exceptional Cost-Effectiveness: Geico stands out for its exceptional cost-effectiveness and some of the lowest base rates for Mercury insurance. To delve deeper, refer to our in-depth report titled “Cheap Car Insurance: An Expert Guide.”

- Comprehensive Online Management: Offers a robust online system for managing policies and claims, making it ideal for tech-savvy Mercury owners.

- Broad Coverage Options: Offers a wide variety of coverage options that can be customized to meet the needs of Mercury vehicles, ensuring flexible protection.

Cons

- Limited Personalized Support: While Geico excels in competitive rates, it may not offer the personalized support and in-depth assistance that some Mercury owners might prefer.

- Potential Additional Costs: The cost of adding extra coverages or endorsements may increase, potentially reducing the overall savings for Mercury drivers compared to other insurers.

#2 – State Farm: Best for Local Agents

Pros

- Personalized Local Interaction: State Farm offers Mercury drivers personalized service through its extensive network of local agents. Unlock details in our article called “State Farm Insurance Review & Complaints: Car Insurance.”

- Tailored Coverage Solutions: Local agents offer tailored coverage for Mercury vehicles, delivering a customized insurance experience.

- Community-Based Support: Offers community-based support and advice, ensuring that Mercury drivers receive relevant and localized information.

Cons

- Higher Premiums in Some Areas: Rates can be higher in certain regions, which may make it less cost-effective for Mercury owners compared to other options.

- Less Advanced Digital Tools: State Farm’s online tools may be less sophisticated, limiting convenience for tech-oriented Mercury drivers.

#3 – Progressive: Best for Online Tools

Pros

- Cutting-Edge Digital Features: Progressive is renowned for its cutting-edge digital features, making it one of the best car insurance companies for Mercurys in terms of online functionality and ease of use.

- Efficient Comparison Tools: Provides advanced comparison tools for Mercury owners to easily evaluate and adjust coverage options.

- Flexible Policy Adjustments: Offers flexible policy adjustments online, allowing easy customization for Mercury vehicles. To gain further insights, consult our comprehensive guide titled “Progressive Insurance Review & Complaints: Auto Insurance.”

Cons

- Less Personal Touch: The focus on online tools may lack the personal touch, which could be a drawback for Mercury drivers who prefer direct interactions.

- Overwhelming Options: The extensive options and features might overwhelm Mercury drivers, making it hard to choose the best coverage.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – All State: Best for Personalized Coverage

Pros

- Highly Tailored Coverage Plans: Allstate excels in tailored coverage plans, making it ideal for Mercurys needing specific protection and customization.

- Dedicated Customer Service: Known for dedicated customer service, Allstate ensures that Mercury owners receive focused attention and support for their unique insurance needs.

- Comprehensive Bundle Options: Provides extensive bundling options that can lead to additional savings and more comprehensive coverage for Mercury drivers. Discover more about offerings in our article called “Allstate Home Insurance Review & Complaints: Home Insurance.”

Cons

- Potentially Expensive Premiums: Personalized coverage options might lead to higher premiums, which could concern Mercury owners seeking affordable insurance.

- Complex Policy Details: Complex policy details and coverage options may complicate the insurance experience for some Mercury drivers.

#5 – USAA: Best for Military Benefits

Pros

- Exclusive Military Discounts: USAA is a top choice for Mercury insurance, offering exclusive discounts and benefits for military members. To gain profound insights, consult our extensive guide titled “USAA Insurance Review & Complaints: Life, Home, & Auto Insurance.”

- Top-Tier Customer Satisfaction: Known for high customer satisfaction and reliability, USAA provides excellent service and support for Mercury drivers who are eligible.

- Comprehensive Coverage: Offers comprehensive coverage tailored to military members and their families, ensuring robust protection for Mercurys.

Cons

- Eligibility Restrictions: Insurance is limited to military members and their families, so it is not an option for non-military Mercury owners.

- Regional Availability: USAA may not be available in all regions, potentially limiting access for Mercury drivers in certain areas.

#6 – Nationwide: Best for Customer Service

Pros

- Exceptional Service Quality: Nationwide is praised for exceptional customer service, highly valued by Mercury owners seeking reliable support.

- Robust Coverage Options: Offers a range of robust coverage options that can be tailored to fit the specific needs of Mercury drivers. For detailed information, refer to our comprehensive report titled “Nationwide Insurance Review & Complaints: Auto, Home, Health & Pet Insurance.”

- Accident Forgiveness Programs: Offers accident forgiveness programs to prevent rate increases after minor accidents, benefiting Mercury drivers seeking stability.

Cons

- Higher Premiums in Some Regions: Premiums may be higher in some regions, making it less affordable than other top insurers for Mercury drivers.

- Discounts Might Be Limited: Nationwide may offer fewer discount opportunities compared to competitors, potentially affecting overall savings for Mercury owners.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Farmers: Best for Local Presence

Pros

- Strong Community Ties: Farmers boasts a strong local presence, offering Mercury owners the advantage of community-based service and support through local agents. To learn more, explore our comprehensive resource on insurance titled “Farmers Insurance Review & Complaints: Home, Business & Auto Insurance.”

- Customizable Policy Options: Provides customizable policy options that can be tailored to the specific needs of Mercury drivers, ensuring appropriate coverage.

- Variety of Discounts: Offers a range of discounts that can help Mercury owners reduce their insurance costs, making it a competitive choice.

Cons

- Higher Premium Costs: Premiums may be higher compared to some other insurers, which could affect affordability for Mercury owners.

- Inconsistent Service Quality: The quality of service may vary depending on the local agent, potentially impacting the overall experience for Mercury drivers.

#8 – Liberty Mutual: Best for Customizable Policies

Pros

- Highly Flexible Policies: Liberty Mutual offers highly flexible policies tailored to Mercury owners’ needs, making it one of the best car insurance companies for Mercurys. For detailed information, refer to our comprehensive report titled “Liberty Mutual Insurance Review & Complaints.”

- Innovative Coverage Options: Provides innovative coverage options and add-ons that can enhance protection for Mercury vehicles.

- Competitive Rates with Customization: Offers competitive rates with a high level of policy customization, allowing Mercury drivers to get exactly the coverage they need.

Cons

- Higher Deductibles: Customizable policies may have higher deductibles, which could be a drawback for Mercury drivers seeking to minimize out-of-pocket costs

- Complex Policy Management: The broad customization options might complicate policy management for Mercury owners.

#9 – Travelers: Best for Financial Stability

Pros

- Reliable Financial Backing: Travelers is known for its strong financial stability, providing reliable and secure coverage for Mercury drivers among the best car insurance companies for Mercurys.

- Extensive Coverage Options: Offers an extensive range of coverage options that can be tailored to meet the needs of Mercury vehicles. For a comprehensive overview, explore our detailed resource titled “Travelers Insurance Review & Complaints.”

- Discounts for Safe Driving: Provides discounts for safe driving and other criteria, helping Mercury owners save on their insurance premiums.

Cons

- Potentially Higher Premiums: Rates may be higher compared to some competitors, which could impact affordability for certain Mercury drivers.

- Limited Local Representation: Travelers may have fewer local agents compared to other insurers, potentially affecting the level of personalized service for Mercury owners.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – American Family: Best for Personalized Options

Pros

- Highly Tailored Insurance Solutions: American Family is praised for tailored insurance solutions that fit Mercury drivers’ needs, making it a top contender.

- Flexible Policy Features: Provides flexible policy features that can be customized to provide the best protection for Mercury vehicles.

- Excellent Customer Support: Known for providing excellent customer support, which enhances the overall insurance experience for Mercury owners. For a thorough understanding, refer to our detailed analysis titled “American Family Insurance Review & Complaints.”

Cons

- Potentially Higher Costs: Personalized options may lead to higher costs, which could concern budget-conscious Mercury drivers.

- Fewer Discounts: May offer fewer discount opportunities compared to other top insurers, potentially limiting savings for Mercury owners.

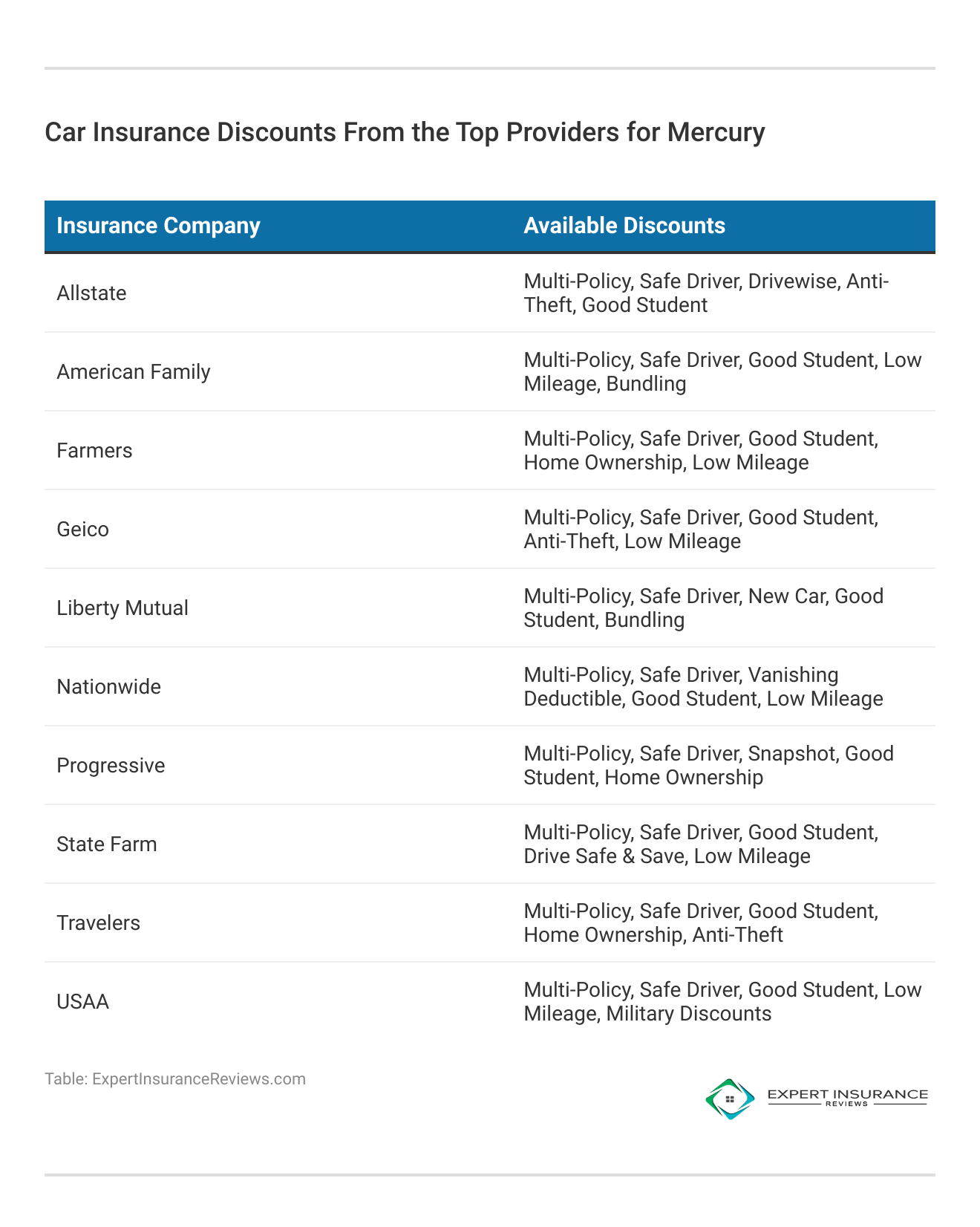

Comparing Mercury Car Insurance Rates: Coverage Levels, Providers, and Discounts

Finding the right car insurance for your Mercury involves comparing rates, which range from $55 to $160 per month.

Geico stands out as the best choice for Mercury insurance with its unbeatable rates and comprehensive coverage options.

Jeff Root Licensed Insurance Agent

Discounts for multi-policy, safe driver, and good student can help lower costs. With average insurance at $86 per month, shopping around ensures you get the best coverage and price.

Mercury Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $75 $150

American Family $70 $145

Farmers $80 $155

Geico $60 $125

Liberty Mutual $85 $160

Nationwide $72 $140

Progressive $65 $130

State Farm $68 $135

Travelers $77 $145

USAA $55 $115

Monthly rates for Mercury car insurance vary by provider: minimum coverage ranges from $55 (USAA) to $85 (Liberty Mutual), while full coverage costs between $115 (USAA) and $160 (Liberty Mutual). Compare options to find the best rate for your needs.

You’ll need proper car insurance coverage if you own a Mercury. Several insurers in your area are likely willing to cover your Mercury, but you’ll need to do some research to find the best car insurance company for Mercurys in your area.

Fortunately, your Mercury probably isn’t very expensive to cover. Mercury car insurance costs around $1,032 annually or $86 each month. Still, you must shop online and compare car insurance quotes to find coverage for your specific model and year.

If you search for minimum coverage, your Mercury car insurance rates will be lower than if you want a full coverage policy. Still, full coverage could help you stay protected if you’re in an accident or if someone or something damages your vehicle.

You can shop online to find Mercury car insurance quotes and compare prices to get a cheap car insurance policy in your area. Otherwise, you may pay too much for coverage. As you compare quotes, ask about discount opportunities for your Mercury coverage.

Determining the Type of Car Insurance You Need for Your Mercury

You can choose between full coverage or a minimum coverage policy for your Mercury. Minimum coverage or liability-only policy is often much cheaper than full coverage but does not offer as much protection if your vehicle sustains damage.

Each state has its own rules concerning minimum coverage for car insurance. However, you’ll need at least the following liability insurance coverages:

- Property Damage Liability: Property damage liability covers you if you cause an accident and damage someone’s car or other personal property.

- Bodily Injury Liability: Bodily injury liability covers you if you cause an accident and injure or kill one or more people. Find the best bodily liability car insurance companies.

The amount of liability coverage you’ll need depends on where you live. In some states, you may also need one or more of the following types of car insurance coverage:

- Personal Injury Protection (PIP): Personal injury protection (PIP) auto insurance helps pay medical bills and may replace lost wages after a covered accident. Find the best personal injury protection car insurance companies.

- Medical Payments (MedPay): MedPay insurance helps with hospital bills and doctor visits after a covered accident. Find the best medical payments (MedPay) coverage car insurance companies.

- Uninsured/Underinsured Motorist Coverage: Uninsured or underinsured motorist coverage helps if someone causes an accident but doesn’t carry proper insurance coverage. Find the best uninsured/underinsured motorist coverage car insurance companies.

If your state does not require PIP, MedPay, or uninsured/underinsured motorist coverage, consider purchasing them voluntarily. They provide additional protection and safety in the event of an accident.

PIP and MedPay cover medical expenses regardless of fault, ensuring necessary treatment without financial strain. Investing in these coverages provides peace of mind and financial security in unforeseen circumstances.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Evaluating the Need for Full Coverage Insurance for Your Mercury

You may want to buy full coverage car insurance, but it depends on your situation. For example, full coverage helps if you cause a car accident or if someone or something damages your vehicle while it’s parked. To purchase full coverage, you’ll need the following:

- Collision Insurance: Collision auto insurance helps if you cause an accident and damage your car. Collision insurance will pay for repairs up to your vehicle’s actual cash value (ACV) once you pay your deductible. Find the best collision coverage car insurance companies.

- Comprehensive Insurance: Comprehensive car insurance helps if inclement weather, wild animals, theft, or vandalism cause damage to your Mercury. Find the best comprehensive coverage car insurance companies.

If your Mercury is older and has a low actual cash value (ACV), full coverage insurance may not be necessary. Consider focusing on essential coverage to save on premiums.

Still, for most Mercury drivers, a full coverage policy may offer the right amount of coverage and protection when you’re on the road. It ensures comprehensive financial security in various driving situations.

Understanding the Cost of Mercury Car Insurance

Mercury car insurance costs around $1,032 annually or $86 each month. Still, how much you pay will depend on several variables.

Some of the most significant factors that affect car insurance rates include:

- Age & Gender

- Driving Record

- Location

- Coverage & Vehicle Type

- Credit Score & Marital Status

As you compare car insurance for a Mercury, you’ll determine which companies offer the coverage you’re looking for at a price that works with your budget. It’s important to compare quotes for car insurance, so you don’t pay too much per month.

Depending on your Mercury’s model and year, your insurance rates might be higher than the national average. However, comparing quotes can help you find affordable coverage in your area.

View this post on Instagram

Additionally, consider working with an insurance broker for personalized recommendations and expert guidance. This approach will help you secure comprehensive and cost-effective coverage for your Mercury.

Finding Additional Ways to Save on Mercury Car Insurance

You may save money on your car insurance coverage if you increase your car insurance deductible. Still, you should ensure you have enough money to pay your deductible if you ever need to file a claim.

Keeping a clean driving record and improving your credit score can also help you save on car insurance coverage. Unfortunately, both things take time, so you may want to compare car insurance quotes annually or bi-annually to ensure your quotes improve as your driving history and credit improve.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Finding Affordable Best Car Insurance Company for Mercury

If you own a Mercury, you need the right car insurance. You can purchase a minimum coverage or liability-only policy that meets your state’s minimum coverage requirements at the lowest rates. Still, you may want the additional protection that comes with a full coverage policy. Adding collision and comprehensive insurance for your Mercury can save a lot of money if you ever need to file a claim.

Mercury auto insurance typically costs about $86 per month. To find out how much you’ll pay for coverage in your area, it’s a good idea to compare quotes from various companies. Without this comparison, you might end up paying more than necessary. For a comprehensive overview, explore our detailed resource titled “Understanding Full Coverage Car Insurance.”

Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

Frequently Asked Questions

What is the most trusted car insurance company for Mercury vehicles?

Geico, State Farm, and Progressive are among the most trusted car insurance companies for Mercury vehicles, offering competitive rates and reliable coverage.

To delve deeper, refer to our in-depth report titled “Cheap Car Insurance: An Expert Guide.”

Which company is best for handling car insurance claims for Mercury owners?

State Farm is highly rated for its customer service and efficient claims handling process, making it a top choice for Mercury car insurance claims.

Who are the top five car insurance companies for Mercury cars?

The top five car insurance companies for Mercury cars are Geico, State Farm, Progressive, Allstate, and USAA.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

How can I find Mercury auto insurance near me?

You can find Mercury auto insurance near you by using online comparison tools and entering your ZIP code to view quotes from local insurance providers.

Which car insurance coverage is best for a Mercury vehicle?

Full coverage, which includes liability, collision, and comprehensive insurance, is generally the best option for Mercury vehicles to ensure maximum protection.

To find out more, explore our guide titled “Collision vs. Comprehensive Coverage.”

Where can I find affordable Mercury car insurance near me?

Affordable Mercury car insurance can be found by comparing quotes from top providers like Geico, State Farm, and Progressive. Use an online quote tool to find the best rates in your area.

Can I get discounts on Mercury car insurance?

Yes, Mercury car owners can qualify for various discounts, such as safe driver, multi-policy, and good student discounts, to lower their insurance premiums.

Is full coverage necessary for an older Mercury vehicle?

Full coverage may not be necessary for an older Mercury vehicle with a low actual cash value. However, it can provide added protection if the vehicle is in good condition and used frequently.

What should I consider when choosing Mercury Mariner car insurance?

When choosing Mercury Mariner car insurance, consider factors like coverage options, customer reviews, claims handling, and discounts to ensure you get the best protection and value.

To gain profound insights, consult our extensive guide titled “Full Coverage Car Insurance.”

How can I save money on Mercury car insurance?

To save money on Mercury car insurance, compare quotes from multiple providers, increase your deductible, maintain a clean driving record, and explore available discounts.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.