10 Best Car Insurance Companies for Teslas in 2025 (Your Guide to the Top Providers)

State Farm, Progressive, and USAA are top choices for Tesla insurance. USAA's minimum coverage starts at $102/month but State Farm offers great value with affordable full coverage, and Progressive provides competitive rates and many options. Save on Tesla insurance with these top picks.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Tesla

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Tesla

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsThe top pick for the best car insurance companies for Teslas is State Farm, with Progressive and USAA also offering strong options.

State Farm stands out for its value, while Progressive and USAA provide comprehensive coverage and competitive pricing. This car insurance coverage guide reveals how to get the most value from Tesla insurance by comparing top providers for optimal protection and savings.

Our Top 10 Picks: Best Car Insurance Companies for Tesla

| Company | Rank | Safety Feature Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | B | Personalized Policies | State Farm | |

| #2 | 14% | A+ | Coverage Options | Progressive | |

| #3 | 10% | A++ | Military Savings | USAA | |

| #4 | 13% | A++ | Affordable Rates | Geico | |

| #5 | 8% | A+ | Add-on Coverages | Allstate | |

| #6 | 9% | A | Safe-Driving Discounts | Liberty Mutual |

| #7 | 12% | A+ | Usage-Based Coverage | Nationwide |

| #8 | 10% | A | Various Discounts | Farmers | |

| #9 | 7% | A | Roadside Assistance | AAA |

| #10 | 10% | A++ | Specialized Coverage | Travelers |

By considering these top insurance providers, you can make an informed choice that best suits your Tesla insurance needs.

See if you’re getting the best deal on car insurance by entering your ZIP code above.

- Best value and coverage are provided by State Farm among Tesla insurers.

- Coverage includes protection for Tesla’s advanced tech and electric systems

- Specialized plans cater to the unique needs of Tesla vehicles

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Extensive Coverage: State Farm provides extensive car insurance options for Tesla, ensuring comprehensive protection.

- Discount Opportunities: Discover our State Farm insurance review to see the various discounts offered for Tesla drivers, including those for safe driving and bundling policies.

- Reliable Customer Service: Known for reliable customer support for Tesla owners.

Cons

- Limited Tesla-Specific Add-Ons: Car insurance companies for Tesla like State Farm may have fewer specialized add-on options.

- Average Discounts: Tesla drivers might find fewer exclusive discounts compared to other car insurance companies for Tesla.

#2 – Progressive: Best for Coverage Options

Pros

- Broad Coverage Options: View our Progressive insurance review to explore the diverse range of coverage options available specifically for Tesla vehicles.

- Customizable Policies: Tesla drivers can customize their coverage with unique add-ons.

- Flexible Rates: Competitive rates for Tesla insurance with adjustable policy features.

Cons

- Complex Customization: Customizing Tesla coverage with Progressive may be complicated.

- Service Speed: Some customers report slower response times from Progressive for Tesla insurance claims.

#3 – USAA: Best for Military Families

Pros

- Specialized Coverage for Military: USAA provides tailored Tesla insurance plans specifically for military families.

- Military Discounts: In our USAA insurance review, find out how military-affiliated drivers can benefit from significant savings on Tesla insurance

- High Customer Satisfaction: USAA is renowned for excellent service to Tesla owners.

Cons

- Eligibility Restriction: Only available to military families, limiting access for non-military Tesla owners.

- Limited Coverage Options: Tesla-specific coverage might be less extensive compared to other car insurance companies for Tesla.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Geico: Best for Affordable Rates

Pros

- Cost-Effective Tesla Insurance: Explore our Geico insurance review to see how the company offers some of the most affordable rates for Tesla insurance.

- Tesla Discounts: Includes multiple discounts for Tesla drivers, such as for safe driving and bundling.

- Easy Management: User-friendly online tools for managing Tesla insurance policies.

Cons

- Limited Coverage Options: Coverage for Tesla vehicles may be less comprehensive compared to other car insurance companies for Tesla.

- Customer Service: Some users report less personalized service for Tesla drivers.

#5 – Allstate: Best for Add-On Coverages

Pros

- Wide Range of Add-Ons: Allstate offers a variety of add-on coverages specifically for Tesla vehicles.

- Comprehensive Protection: Extensive protection plans available for Tesla drivers.

- Customizable Plans: With our Allstate insurance review, learn about the competitive pricing and extensive options available for tailoring coverage for Tesla.

Cons

- Higher Premiums: Add-on coverages can increase overall premiums for Tesla insurance.

- Claims Process: Claims processing for Tesla-related incidents may be slower.

#6 – Liberty Mutual: Best for Safe-Driving Discounts

Pros

- Generous Safe-Driving Discounts: Liberty Mutual provides substantial discounts for safe driving habits, benefiting Tesla drivers.

- Specialized Tesla Packages: In our Liberty Mutual insurance review, you can discover innovative coverage options designed specifically for Tesla vehicles.

- Customer Focus: Strong emphasis on driver safety with support tailored for Tesla owners makes Liberty Mutual car insurance recommended for Tesla.

Cons

- Discount Limits: Safe-driving discounts might not be as high as those from some other car insurance companies base on Liberty Mutual car insurance quote for tesla.

- Regional Limitations: Tesla coverage options might be restricted in certain areas, but a Liberty Mutual insurance quote for Tesla can provide more details.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Usage-Based Coverage

Pros

- Usage-Based Tesla Coverage: Nationwide offers usage-based insurance that benefits low-mileage Tesla drivers.

- Behavior-Based Discounts: Discounts based on driving behavior are tailored for Tesla owners.

- Flexible Policies: Delve into our Nationwide insurance review to find adaptable insurance policies that suit Tesla drivers’ needs.

Cons

- Variable Rates: Rates can fluctuate widely based on usage and driving behavior.

- Availability Issues: Coverage options for Tesla may not be available in all regions

#8 – Farmers: Best for Various Discounts

Pros

- Multiple Discounts: Farmers provides a wide range of discounts for Tesla drivers.

- Customizable Plans: See our Farmers insurance review to learn about the flexible insurance plans tailored specifically for Tesla vehicles.

- Strong Customer Support: Reliable customer service for Tesla insurance needs.

Cons

- Higher Premiums: Discounts may not fully offset higher base premiums for Tesla insurance.

- Complex Options: The variety of discounts and coverage options might be overwhelming for some Tesla owners.

#9 – AAA: Best for Roadside Assistance

Pros

- Exceptional Roadside Assistance: Within our AAA insurance review, find out about the comprehensive roadside assistance offered specifically for Tesla owners

- Member Benefits: Additional perks and discounts for Tesla drivers who are AAA members.

- Reliable Support: Known for prompt and reliable roadside service for Tesla vehicles.

Cons

- Limited Insurance Coverage: Tesla insurance coverage options may be less comprehensive compared to other car insurance companies for Tesla.

- Membership Requirement: Roadside assistance benefits are exclusive to AAA members.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – Travelers: Best for Specialized Coverage

Pros

- Unique Coverage Options: Our Travelers insurance review reveals the specialized insurance coverage available specifically for Tesla vehicles.

- Customizable Policies: Tesla owners can tailor their insurance plans with unique options.

- Innovative Coverage: Includes specialized protection for advanced Tesla technology.

Cons

- Higher Premiums: Specialized coverage options may lead to higher premiums for Tesla insurance.

- Limited Discounts: Fewer discount opportunities compared to some other car insurance companies for Tesla.

Evaluating Insurance Coverage for Your Tesla

Your Tesla is a valuable investment, and protecting it with the right insurance coverage is crucial. To ensure you’re receiving optimal protection, compare rates and coverage options from various insurance providers.

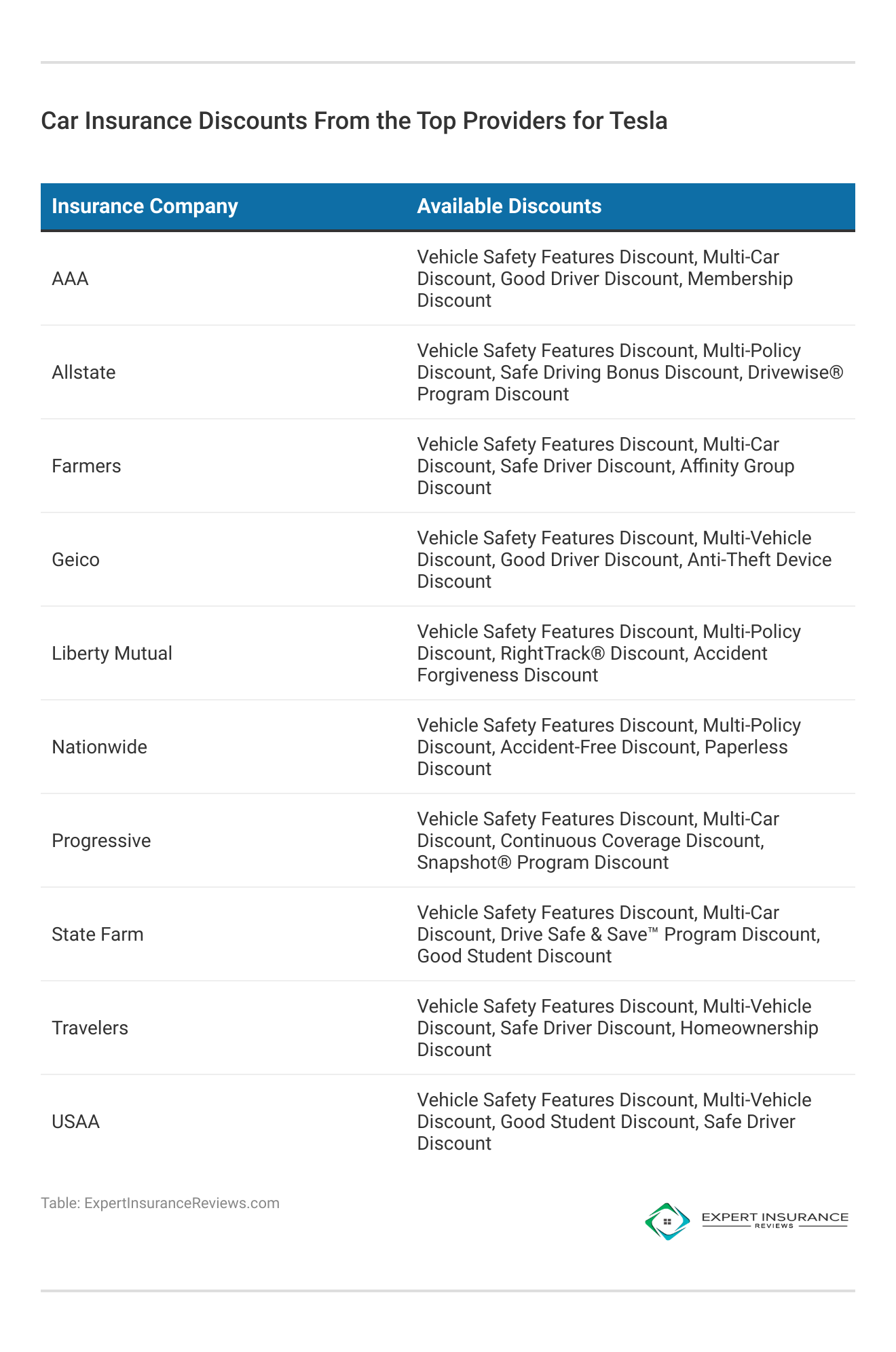

To find the best insurance for your Tesla, compare car insurance quotes and coverage levels from different providers. Here’s a snapshot of monthly insurance rates for Teslas across various companies:

Tesla Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $189 | $465 |

| Allstate | $260 | $638 |

| Farmers | $317 | $773 |

| Geico | $125 | $377 |

| Liberty Mutual | $325 | $785 |

| Nationwide | $195 | $476 |

| Progressive | $327 | $814 |

| State Farm | $146 | $420 |

| Travelers | $362 | $910 |

| USAA | $102 | $310 |

By evaluating these options, you can secure the best insurance coverage for your Tesla and drive with confidence.

When selecting insurance for your Tesla, consider these key types of coverage: Liability coverage protects against damages and bodily injury you may cause to others. Comprehensive coverage handles non-collision-related damages such as theft or natural disasters.

Tim Bain Licensed Insurance Agent

Collision coverage pays for damage to your Tesla from collisions, regardless of fault. Uninsured motorist coverage helps cover costs if you’re in an accident with a driver who lacks sufficient insurance. Roadside assistance provides support for issues like flat tires or breakdowns.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Essential Tesla Insurance Tips from Top Providers

Insuring a Tesla is like insuring any other car, with a few unique aspects. You’ll need to meet state minimum liability requirements, and if you have a loan, consider comprehensive and collision coverage. Even without a loan, these coverages offer added peace of mind. For additional details, explore our comprehensive resource titled “Collision vs. Comprehensive Coverage: An Expert Guide.”

However, Teslas come with their own set of challenges. Their advanced technology and high-end components can make repairs more costly compared to more conventional cars, which can influence insurance rates.

Insurance companies assess risk based on extensive data about claim frequencies and payouts, and with Tesla still being relatively new, there’s less historical data available. This can sometimes result in higher premiums as insurers account for the potential costs of repairs.

That said, don’t be discouraged. As Tesla’s safety record and claims data grow, insurance rates are likely to become more favorable. To get the best deal, make sure to compare quotes from the best car insurance companies for Tesla. They can offer tailored coverage options and discounts that reflect the unique attributes of your high-tech ride.

Discover the Best Tesla Insurance Rates by Model

Navigating insurance rates for your Tesla can be a game-changer in managing costs. In this guide, we’ll break down the best insurance providers for various Tesla models. For the Model 3, State Farm offers the most competitive rates, while Tesla Model 3 insurance cost with Geico provides a cost-effective option.

For the Model S, Progressive provides exceptional coverage options. The Model X benefits from the specialized plans and savings offered by USAA. For the Model Y, State Farm’s comprehensive protection is a top choice, and Liberty Mutual car insurance for Tesla compares favorably to other providers.

Liberty Mutual insurance recommended for Tesla offers generous safe-driving discounts, making it a strong option to consider. Additionally, Tesla Model Y insurance cost Geico provides another competitive option. For the Roadster, Progressive delivers the best coverage tailored to high-performance vehicles.

Allstate is a great choice for add-on coverages across the range, Nationwide excels with usage-based coverage, Farmers provides various discounts, AAA is known for exceptional roadside assistance, and Travelers offers specialized coverage options.

Best Tesla Car Insurance Rates by Model

Whether you’re driving a sleek sedan, a versatile SUV, or a high-performance sports car, securing the right insurance is crucial. Dive in with us to uncover which Tesla model offers the most budget-friendly insurance rates and how you can get the best value for your money. For a comprehensive overview, explore our detailed resource titled “Best Car Insurance Quotes by Vehicle.”

Case Studies: Top Car Insurance Providers for Teslas

When choosing car insurance for your Tesla, it’s essential to consider how different providers can meet your specific needs. The following case studies illustrate how State Farm, Progressive, and USAA address various requirements and scenarios for Tesla owners.

- Case Study #1 – Cost-Effective Comprehensive Coverage: Rachel from Denver chose State Farm for her Tesla Model 3 due to its competitive rates and comprehensive coverage. State Farm’s bundling discounts and safe-driving rewards helped her manage costs while ensuring thorough protection for her vehicle.

- Case Study #2 – Customizable Family Coverage: The Johnsons in San Diego selected Progressive for their Tesla Model Y because of its flexible insurance options. Progressive’s customizable policies allowed them to tailor coverage to their family’s needs and the Tesla’s advanced features.

- Case Study #3 – Tailored Benefits for Military Families: Lieutenant Colonel James, a retired military officer in Virginia, chose USAA for his Tesla Model S. USAA’s specialized coverage and car insurance discounts for active military and veterans provided comprehensive protection and savings, catering specifically to his needs as a military veteran.

These case studies demonstrate how different car insurance providers can meet varied needs for Tesla owners. Each scenario highlights how personalized coverage options, discounts, and specialized plans can effectively address individual circumstances and preferences.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

The Bottom Line on Tesla Insurance

Navigating Tesla insurance in today’s market can be challenging due to the high costs associated with advanced technology and specialized repairs. Although there are budget-friendly options, it’s essential to prioritize an insurer that delivers both solid coverage and value.

If you’re questioning whether your current policy meets your needs, it’s a good idea to explore new quotes and evaluate your choices. Look for insurers that offer a blend of affordability, extensive discounts, and reliable protection tailored to high-tech vehicles. To gain profound insights, consult our extensive guide titled “Full Coverage Car Insurance.”

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Frequently Asked Questions

Does car insurance companies for Tesla cover liability?

Yes, liability coverage is a standard offering from most car insurance companies for Tesla, ensuring you’re protected against damages and injuries you may cause to others. To delve deeper, refer to our in-depth report titled “What is no-fault in Car Insurance?“

Does Tesla have their own car insurance?

Tesla does offer its own insurance in some areas, but exploring options from different car insurance companies for Tesla like State Farm, Progressive, and USAA can help you find the best rates and coverage.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers

How much do car insurance companies for Tesla Model 3 cost?

Insurance for a Tesla Model 3 typically starts at around $146 per month when using car insurance companies for Tesla such as State Farm, Progressive, and USAA.

What car insurance group is a Tesla Model 3?

The Tesla Model 3 is classified in higher insurance groups due to its advanced technology, which car insurance companies for Tesla like State Farm and Progressive take into account when setting rates.

Do car insurance companies cover batteries for Tesla?

Most comprehensive car insurance policies for Tesla cover the vehicle’s batteries, but it’s always best to confirm this with your specific provider.

Are Tesla expensive to insure through car insurance companies?

Insuring a Tesla can be more costly due to its high-tech features and repair costs. However, car insurance companies for Tesla such as USAA offer competitive rates and discounts to help manage these expenses.

Do car insurance companies for Tesla cover tire protection?

Many car insurance companies for Tesla include tire protection as part of their comprehensive coverage, but it’s important to check with your provider for specific details.

What is collision deductible buyback from car insurance for Tesla?

Collision deductible buyback is an option offered by some car insurance companies for Tesla, allowing you to reduce your deductible after an accident by paying a slightly higher premium. To gain further insights, consult our comprehensive guide titled “Car Insurance Deductibles: An Expert Guide“

Can I insure my electric vehicle with car insurance companies for Tesla?

Yes, many car insurance companies for Tesla offer tailored policies specifically designed to meet the unique needs of these vehicles.

Is car insurance higher for Teslas?

Yes, car insurance companies for Tesla like State Farm, Progressive, and USAA offer tailored policies designed to meet the unique needs of Tesla owners.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.