10 Best Car Insurance Companies for Volkswagens in 2025 (Check Out These Providers)

Geico, State Farm, and Progressive offer the best car insurance companies for Volkswagens, with rates as low as $45 per month. These companies provide exceptional coverage and competitive pricing, making them ideal choices for Volkswagen owners seeking reliable and affordable insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage for Volkswagens

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

Company Facts

Full Coverage for Volkswagens

A.M. Best Rating

Complaint Level

Pros & Cons

- Best Car Insurance Companies

- Best Volkswagen Vanagon Car Insurance Quotes (2025)

- Best Volkswagen Touareg Hybrid Car Insurance Quotes (2025)

- Best Volkswagen Touareg 2 Car Insurance Quotes (2025)

- Best Volkswagen Tiguan Limited Car Insurance Quotes (2025)

- Best Volkswagen Taos Car Insurance Quotes (2025)

- Best Volkswagen Routan Car Insurance Quotes (2025)

- Best Volkswagen R32 Car Insurance Quotes (2025)

- Best Volkswagen Rabbit Car Insurance Quotes (2025)

- Best Volkswagen Phaeton Car Insurance Quotes (2025)

- Best Volkswagen Passat Wagon Car Insurance Quotes (2025)

- Best Volkswagen New Beetle Car Insurance Quotes (2025)

- Best Volkswagen Jetta SportWagen Car Insurance Quotes (2025)

- Best Volkswagen Jetta Hybrid Car Insurance Quotes (2025)

- Best Volkswagen Jetta GLI Car Insurance Quotes (2025)

- Best Volkswagen Jetta Car Insurance Quotes (2025)

- Best Volkswagen Golf SportWagen Car Insurance Quotes (2025)

- Best Volkswagen ID.4 Car Insurance Quotes (2025)

- Best Volkswagen Golf GTI Car Insurance Quotes (2025)

- Best Volkswagen Golf Alltrack Car Insurance Quotes (2025)

- Best Volkswagen Fox Car Insurance Quotes (2025)

- Best Volkswagen EuroVan Car Insurance Quotes (2025)

- Best Volkswagen e-Golf Car Insurance Quotes (2025)

- Best Volkswagen CrossBlue Car Insurance Quotes (2025)

- Best Volkswagen Corrado Car Insurance Quotes (2025)

- Best Volkswagen Cabrio Car Insurance Quotes (2025)

- Best Volkswagen Cabriolet Car Insurance Quotes (2025)

- Best Volkswagen Beetle Convertible Car Insurance Quotes (2025)

- Best Volkswagen Atlas Cross Sport Car Insurance Quotes (2025)

- Best Volkswagen Arteon Car Insurance Quotes (2025)

- Best Volkswagen Atlas Car Insurance Quotes (2025)

- Best Volkswagen Beetle Car Insurance Quotes (2025)

- Best Volkswagen Passat Car Insurance Quotes (2025)

- Best Volkswagen Tiguan Car Insurance Quotes (2025)

- Best Volkswagen Touareg Car Insurance Quotes (2025)

- Best Volkswagen Eos Car Insurance Quotes (2025)

Each company balances affordability with quality service, ensuring Volkswagen drivers receive optimal insurance value.

Get the right car insurance at the best price, enter your ZIP code above to shop for coverage from the top insurers.

- Geico offers best car insurance companies for Volkswagens

- These insurers are known for exceptional customer service and reliability

- Coverage options start as low as $45 per month for Volkswagen owners

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Based on Geico insurance review & complaints, Geico offers competitive rates starting as low as $50 per month for Volkswagens with minimum coverage.

- High A.M. Best Rating: Geico boasts an A++ rating from A.M. Best, indicating superior financial stability for their Volkswagen coverage.

- Excellent Customer Service: Geico is renowned for its reliable and efficient customer service, providing peace of mind for Volkswagen owners.

Cons

- Limited Coverage Options: While rates are low, Geico may offer fewer coverage add-ons compared to some competitors for Volkswagens.

- Discount Limitations: Some drivers might find that the range of available discounts for Volkswagen vehicles is less extensive.

#2 – State Farm: Best for Comprehensive Coverage

Pros:

- Comprehensive Coverage: State Farm excels in providing comprehensive coverage options for Volkswagens, including collision and comprehensive insurance.

- Competitive Monthly Rates: State Farm offers competitive monthly rates starting at around $55 for Volkswagens with minimum coverage.

- Bundling Discounts: Significant discounts are available for bundling auto insurance with other policies, benefiting Volkswagen owners. Discover more about in our guide “State Farm Insurance Review & Complaints.”

Cons:

- Limited Multi-Policy Discount: The multi-policy discount is less substantial compared to some competitors for Volkswagens.

- Potentially Higher Premiums: Despite discounts, premiums can still be relatively high for certain coverage levels of Volkswagens.

#3 – Progressive: Best for Snapshot Program

Pros:

- Snapshot Program: Progressive’s Snapshot program offers potential discounts based on driving habits, which can be advantageous for Volkswagen owners.

- Competitive Rates: Progressive insurance review provides competitive rates, starting around $60 per month for Volkswagens with minimum coverage.

- Flexible Coverage Options: A wide range of coverage options are available, allowing for customization based on individual needs of Volkswagen.

Cons:

- Variable Premiums: Rates can vary significantly based on the results of the Snapshot program, which may not be ideal for all Volkswagen drivers.

- Complex Discount Structure: The variety of discounts in Volkswagen and programs can be confusing to navigate.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Allstate: Best for Extensive Add-ons

Pros:

- Extensive Add-ons: Allstate is known for offering a wide range of coverage add-ons, such as accident forgiveness and roadside assistance, for Volkswagens.

- Strong Customer Service: Allstate provides strong customer service and support, ensuring Volkswagen owners receive help when needed.

- Competitive Rates: Rates start around $65 per month for Volkswagens with minimum coverage. To understand better, look at our detailed guide called “Allstate Auto Insurance Review & Complaints.”

Cons:

- Higher Premiums: The cost for extensive add-ons for Volkswagen vehicles can result in higher premiums compared to some competitors.

- Complex Policy Options: The range of add-ons and options can be overwhelming for some Volkswagen owners.

#5 – USAA: Best for Exceptional Service

Pros:

- Exceptional Service: USAA is highly rated for customer service, offering excellent support to Volkswagen owners.

- Discounts for Military Members: USAA provides special discounts for military members and their families on Volkswagen vehicles.

- Competitive Rates: Rates start around $45 per month for Volkswagens with minimum coverage.

Cons:

- Eligibility Restrictions: USAA insurance review for Volkswagen vehicles is available only to military members, veterans, and their families, which limits its accessibility.

- Limited Availability: The lack of availability to the general public can be a downside for non-military Volkswagen owners.

#6 – Farmers: Best for Customized Coverage

Pros:

- Highly Customizable Policies: Farmers insurance group review allows extensive customization of coverage options for Volkswagens.

- Variety of Discounts: Offers a range of discounts, including those for good drivers and multi-policy holders with Volkswagen.

- Solid A.M. Best Rating: With an A rating from A.M. Best, Farmers demonstrates strong financial stability for their Volkswagen coverage.

Cons:

- Higher Costs: Customization options can lead to higher premiums for Volkswagen owners.

- Complex Policy Options: The wide range of options and discounts for Volkswagen vehicles may be complex to navigate.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Coverage Variety

Pros:

- Coverage Variety: Liberty Mutual offers a wide range of coverage options and add-ons for Volkswagens.

- Discount Opportunities: Provides various discounts, including those for safe drivers and multiple policies on Volkswagen vehicles.

- Strong A.M. Best Rating: Liberty mutual insurance review has a solid A rating from A.M. Best, indicating financial stability for their Volkswagen coverage options.

Cons:

- Higher Premiums: Rates can be higher for Volkswagen vehicles compared to some competitors due to the extensive coverage options.

- Customer Service Variability: Customer service experiences can vary with Volkswagen, potentially impacting satisfaction.

#8 – Nationwide: Best for Vanishing Deductible

Pros:

- Vanishing Deductible Program: Nationwide’s Vanishing Deductible program reduces your deductible over time, benefiting Volkswagen owners.

- Competitive Rates: Rates start around $55 per month for Volkswagens with minimum coverage.

- Various Coverage Options: Nationwide insurance reviews offers a range of coverage options tailored to different needs for Volkswagen vehicles.

Cons:

- Availability of Program: The Vanishing Deductible program for Volkswagen vehicles is not available in all states.

- Premiums for Additional Coverage: Premiums can increase with additional coverage options for Volkswagen vehicles.

#9 – Travelers: Best for Safe Driver

Pros:

- Safe Driver Discounts: Travelers insurance offers discounts for safe driving records, which can be beneficial for Volkswagen owners.

- Competitive Pricing: Rates start around $60 per month for Volkswagens with minimum coverage.

- Solid Coverage Options: Provides a range of coverage options for Volkswagen vehicles, including liability and comprehensive.

Cons:

- Higher Initial Premiums: Some drivers might find initial premiums higher for Volkswagen vehicles compared to competitors.

- Limited Customization: The options for customizing Volkswagen coverage may be less extensive.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – Amica: Best for High Satisfaction

Pros:

- High Satisfaction Ratings: Amica is known for high customer satisfaction, providing excellent service to Volkswagen owners.

- Competitive Rates: Offers competitive rates starting around $50 per month for Volkswagens with minimum coverage.

- Various Discounts: Provides a range of discounts, including for safe driving and multi-policy holders on Volkswagen vehicles. For additional information, see our comprehensive guide called “Best Car Insurance Discount.”

Cons:

- Higher Premiums for Some Add-ons: Premiums can be higher for additional coverage options for Volkswagen vehicles.

- Limited Availability: Provides a range of discounts, including for safe driving and multi-policy holders with Volkswagen.

How to Compare Rates and Coverage Options for Volkswagens

Finding the right car insurance for your Volkswagen can be daunting. However, taking the time to shop around and compare car insurance rates can save you money in the long run.

When shopping for car insurance, it’s important to compare coverage options as well as rates. This way, you can get an idea of which policy provides the most comprehensive protection at the best price.

Volkswagens Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $65 $145

Amica $50 $125

Farmers $70 $150

Geico $50 $120

Liberty Mutual $65 $155

Nationwide $55 $130

Progressive $60 $140

State Farm $55 $135

Travelers $60 $145

USAA $45 $115

When choosing car insurance for your Volkswagen, consider customer service, financial stability, and claims handling. Look for discounts for a good driving record or homeownership to lower your premium. Research insurers to ensure they’re reputable and offer reliable service. Comparing rates and coverage options will help you make the best choice for peace of mind and financial protection.

How Popular are Volkswagens

Volkswagens are one of the most popular car brands in the world. Over the past few decades, they have been a staple on forecourts and roads across the globe.

This is due to their reputation for reliability, affordability, comfort, and style. Volkswagen also has a rich history, with over 70 years of manufacturing experience under its belt.

Volkswagen is a top-selling global brand, known for its affordable and reliable cars. Insurance options vary by location and vehicle type, so it’s important to compare car insurance. Look for discounts to save money. Overall, Volkswagen offers dependable vehicles for various budgets.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Explaining Car Insurance for Volkswagens

When explaining car insurance for Volkswagens, it’s essential to highlight the importance of choosing the best providers. Companies like Geico, State Farm, and Progressive offer coverage that caters specifically to the needs of Volkswagen owners, providing both basic liability and comprehensive options.

Why Volkswagen Drivers Must Carry Car Insurance

Volkswagen drivers must carry insurance to meet legal requirements and protect themselves financially, making it crucial to choose the best insurance company.

Leading providers like Geico, State Farm, and Progressive offer tailored coverage that ensures Volkswagen owners are adequately protected. These companies provide options that not only comply with state regulations but also offer financial security through comprehensive and liability coverage (Read more: Types of Car Insurance Coverage).

By selecting the best car insurance company, Volkswagen drivers can enjoy peace of mind knowing they are covered against potential losses, whether from accidents, theft, or damage. With competitive rates and reliable service, these top insurers ensure that Volkswagen owners can drive confidently, knowing they have the necessary protection.

Understanding the Different Types of Coverage for Volkswagens

When it comes to choosing Volkswagen car insurance, there are a variety of coverage options available. Liability coverage is probably the most important type of VW car insurance that you can get, as it covers any damage or injuries you may cause to another person in an accident.

It also helps protect you from property damage claims and third-party lawsuits that may result from an incident involving your vehicle.

For insuring your Volkswagen, comprehensive covers non-accident damage like theft, while collision covers accident repairs. These options offer extra protection but cost more. Choose based on your car’s age, condition, and value. Research providers to find the best coverage for your needs. Find out how much car insurance you need.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Finding the Best Car Insurance for Volkswagen Drivers

Choosing the right car insurance for your Volkswagen can be a difficult process.

However, by taking some time to compare rates and coverage options, as well as researching different companies and discounts available, you can find an insurer that provides the most comprehensive protection at the best price.

By following these steps, you should have no problem finding the best car insurance companies for Volkswagens.

Case Studies: Car Insurance for Volkswagens

Finding the right car insurance for your Volkswagen can be challenging. These case studies illustrate different approaches individuals took to secure suitable coverage, highlighting the importance of comparing quotes, understanding options, and leveraging discounts.

- Case Study #1 – Volkswagen Jetta: Sarah, a 30-year-old marketing professional, sought insurance for her 2020 Volkswagen Jetta. She compared quotes from Geico, State Farm, and Progressive, focusing on coverage and customer service. This decision saved her money and ensured robust protection for her vehicle.

- Case Study #2 – Volkswagen Tiguan: John, a 45-year-old small business owner, needed insurance for his 2022 Volkswagen Tiguan. He prioritized comprehensive coverage to address high repair costs. After evaluating Allstate, Liberty Mutual, and USAA, he chose USAA for its high customer satisfaction and extensive coverage.

- Case Study #3 – Volkswagen Beetle: Lisa, a 28-year-old teacher, wanted the best rate for her 2019 Volkswagen Beetle. She compared Progressive, Farmers, and Nationwide, leveraging Progressive’s Snapshot Program for safe driving discounts. By combining this with other discounts for her driving record and bundled policies, she significantly reduced her premium.

These cases show that comparing providers, understanding coverage, and utilizing discounts can help you find the best insurance for your Volkswagen. For more understanding, examine our extensive guide named “Understanding Full Coverage Car Insurance.”

Frequently Asked Questions

Are Volkswagens expensive to insure?

The cost of insuring a Volkswagen generally depends on factors such as the specific model, your driving history, age, location, and the coverage type. Volkswagens can be reasonably affordable to insure, but it’s essential to compare quotes from different providers to find the best rate for your specific circumstances (Read More: How do I Track the Progress of my Progressive Car Insurance Claim?).

Is insurance high for a Volkswagen Jetta?

Insurance rates for a Volkswagen Jetta vary based on several factors including the driver’s history, the car’s age, and where you live. Typically, the Jetta is not among the most expensive cars to insure, but shopping around for quotes is the best way to ensure you get a competitive rate. Enter your ZIP code into our free quote tool below to find the best policy for you.

How much is car insurance for a Volkswagen Tiguan?

The insurance cost for a Volkswagen Tiguan is influenced by similar factors as other vehicles, such as the driver’s profile and the vehicle’s specifics. Generally, the Tiguan’s insurance rates are comparable to other mid-size SUVs, but comparing quotes will give you the most accurate pricing.

What are some of the best car insurance companies for Volkswagens?

Top car insurance companies for Volkswagens include Geico, State Farm, Progressive, Allstate, and USAA. These companies are noted for offering competitive rates and comprehensive coverage options.

How can I determine which car insurance company is best for my Volkswagen?

To find the best insurance for your Volkswagen, compare quotes, assess customer service, review claims handling, and check financial stability. To explore more, review our in-depth guide named “How do I Track the Progress of my State Farm Car Insurance Claim?“

Do I need special insurance for my Volkswagen?

No, you do not need special insurance just for your Volkswagen. However, ensure your policy provides adequate coverage based on your car’s value and your personal liability needs.

What types of coverage should I consider for my Volkswagen?

Consider coverage types such as liability, comprehensive, collision, and personal injury protection. Liability coverage is essential, while comprehensive and collision coverage offer additional protection for various types of damage.

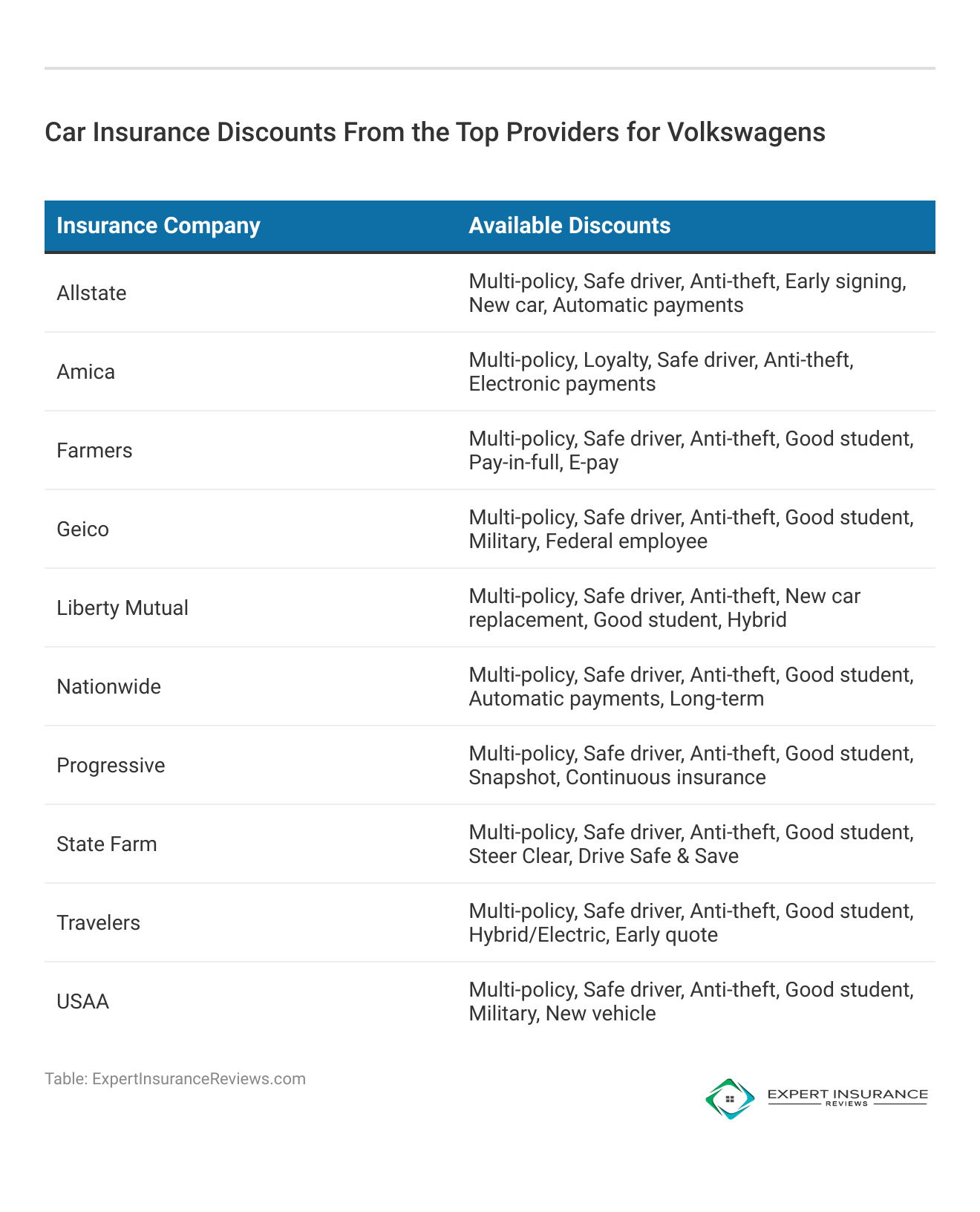

Can I get discounts on my car insurance for my Volkswagen?

Yes, you may qualify for discounts such as safe driver discounts, multi-policy discounts, and discounts for having a good credit score. Many insurers offer specific discounts that can help reduce your premium.

What factors affect the cost of car insurance for my Volkswagen?

Factors affecting insurance costs include the make and model of your car, your driving history, age, location, the level of coverage, and your credit score. Each insurer weighs these factors differently, so comparing quotes is crucial (Read more: Does National General Offer Safe Driving Discounts?).

How can I save money on car insurance for my Volkswagen?

To save money on car insurance, compare quotes from different providers, take advantage of available discounts, choose a higher deductible, and maintain a clean driving record. Improving your credit score can also help lower your premium. Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.