Best Insurance for Rebuilt Titles in 2025 (Check Out the Top 10 Companies)

The best insurance for rebuilt titles includes USAA, Geico, and Allstate, with rates starting at $33/month. These companies stand out due to their comprehensive coverage options and competitive rebuilt title insurance costs, ensuring that drivers can find suitable and affordable protection for their vehicles.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Jan 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Rebuilt Titles

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Rebuilt Titles

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe best insurance for rebuilt titles comes from USAA, Geico and Allstate, offering comprehensive coverage starting at just $33 per month.

USAA stands out as the top pick overall, providing excellent rates for rebuilt title insurance making it an ideal choice for budget-conscious consumers. Geico offers full coverage after inspections, balancing affordability and reliability. Allstate complements this with a solid reputation and diverse plans, providing quality protection for rebuilt title vehicles.

Our Top 10 Company Picks: Best Insurance for Rebuilt Titles

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A++ | Military Members | USAA | |

| #2 | 9% | A++ | Affordable Rates | Geico | |

| #3 | 7% | A+ | Safe-Driving Discounts | Allstate | |

| #4 | 6% | B | Teen Discounts | State Farm | |

| #5 | 8% | A+ | Competitive Rates | Progressive | |

| #6 | 9% | A+ | Accident Forgiveness | Nationwide |

| #7 | 11% | A | Loyalty Rewards | American Family | |

| #8 | 9% | A | Family Plans | Farmers | |

| #9 | 8% | A++ | Safe Drivers | Travelers | |

| #10 | 6% | A | 24/7 Support | Liberty Mutual |

These top three providers offer a blend of affordability and comprehensive coverage, making them the best choices for insuring rebuilt title vehicles. For a comprehensive overview, explore our detailed resource titled, “Best Car Insurance Company That Accepts Salvage Titles.”

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- USAA offers top coverage and rates for rebuilt titles

- Geico and Allstate provide attractive options, with full inspections coverage

- Rebuilt title insurance can be more affordable than standard auto insurance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – USAA: Overall Top Pick

Pros:

- Tailored Coverage: USAA provides some of the best insurance for rebuilt titles specifically designed for military members, ensuring comprehensive protection. Dive into our USAA insurance review for insights.

- Competitive Rates: As one of the best insurances for rebuilt titles options, USAA offers highly competitive rates for rebuilt vehicles.

- Excellent Customer Service: Known for outstanding service, USAA offers superior support, which is crucial when dealing with insurance for rebuilt titles.

Cons:

- Eligibility Restrictions: USAA is only available to military members and their families, limiting access to its excellent rebuilt title insurance.

- Limited Coverage Options: The best insurance for rebuilt titles at USAA may not include all the specialized coverage options found with other insurers.

#2 – Geico: Best for Affordable Rates

Pros:

- Budget-Friendly: Geico is renowned for offering some of the best insurance for rebuilt titles at very affordable rates, making it a cost-effective choice.

- Flexible Coverage Options: Geico provides customizable policies, ensuring you get the best insurance for rebuilt titles tailored to your needs. Check our Geico insurance review for comprehensive details.

- Streamlined Claims Process: Geico’s efficient claims process is a significant advantage when managing insurance for rebuilt titles.

Cons:

- Inspection Requirements: Geico’s best insurance for rebuilt titles requires a thorough inspection, which might be inconvenient for some.

- State Variability: Coverage options for rebuilt titles can vary significantly by state, potentially affecting the value of Geico’s insurance.

#3 – Allstate: Best for Safe-Driving Discounts

Pros:

- Discounts for Safe Driving: Allstate offers excellent discounts for safe driving, which enhances the value of its best insurance for rebuilt titles.

- Comprehensive Coverage: Provides extensive coverage options for rebuilt titles, ensuring broad protection.

- Customizable Policies: Allstate’s flexible policies allow you to tailor the best insurance for rebuilt titles to your specific needs. Discover more in our Allstate auto insurance review.

Cons:

- Higher Premiums: The best insurance for rebuilt titles from Allstate may come with higher premiums compared to some competitors.

- Complex Policy Details: Understanding the terms and conditions of Allstate’s insurance for rebuilt titles may require additional effort.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – State Farm: Best for Teen Discounts

Pros:

- Teen Discounts: State Farm provides excellent discounts for teenage drivers, making it a great option for the best insurance for rebuilt titles for younger drivers.

- Wide Network of Agents: With a vast network, State Farm offers personalized service for the best insurance for rebuilt titles. Gain more insights from our State Farm insurance review.

- Flexible Coverage Options: Offers a range of coverage options to tailor the best insurance for rebuilt titles to individual needs.

Cons:

- Potentially Higher Rates for Teens: While discounts are available, rates for teen drivers may still be higher compared to other insurance options.

- Variable Coverage by State: Coverage details for rebuilt titles can differ from state to state, affecting consistency.

#5 – Progressive: Best for Competitive Rates

Pros:

- Competitive Pricing: Progressive offers some of the best insurance for rebuilt titles at highly competitive rates, making it a cost-effective choice.

- Extensive Coverage Options: Provides a wide range of coverage options, ensuring you find the best insurance for rebuilt titles to fit your needs.

- User-Friendly Online Tools: Progressive’s online tools make it easy to manage your rebuilt title insurance and find the best options.

Cons:

- Inspection Requirements: Like many insurers, Progressive requires a thorough inspection for the best insurance for rebuilt titles.

- Coverage Limits: Some policy limits may not meet the needs of all drivers with rebuilt title vehicles. Read our Progressive insurance review for full details.

#6 – Nationwide: Best for Accident Forgiveness

Pros:

- Accident Forgiveness: Nationwide’s accident forgiveness program adds value to the best insurance for rebuilt titles, especially for drivers with a history of accidents.

- Comprehensive Coverage: Offers a broad range of coverage options for rebuilt titles, ensuring thorough protection.

- Customer Service: Known for strong customer service, which is crucial when managing the best insurance for rebuilt titles.

Cons:

- Higher Premiums for Accident Forgiveness: The benefit of accident forgiveness might come with higher premiums for rebuilt titles. Find additional details in our Nationwide insurance review.

- Limited Availability: Accident forgiveness benefits may not be available in all regions, affecting the value of Nationwide’s insurance.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – American Family: Best for Loyalty Rewards

Pros:

- Loyalty Rewards: American Family offers rewards for long-term customers, adding extra value to the best insurance for rebuilt titles.

- Flexible Coverage Plans: Provides a variety of coverage options tailored to the needs of rebuilt title vehicles. Explore our American Family insurance review for a complete list.

- Strong Customer Support: Known for excellent customer service, which enhances the experience with the best insurance for rebuilt titles.

Cons:

- Limited Discounts for Rebuilt Titles: Loyalty rewards may not specifically apply to rebuilt title vehicles, impacting potential savings.

- Potentially Higher Rates: Some policyholders may find that the best insurance for rebuilt titles at American Family comes with higher rates.

#8 – Farmers: Best for Family Plans

Pros:

- Comprehensive Family Plans: Farmers offers robust family plans that include the best insurance for rebuilt titles, providing extensive coverage.

- Tailored Coverage: Allows customization of policies to ensure the best insurance for rebuilt titles meets family needs which is covered in our Farmers insurance review.

- Additional Benefits: Offers various additional benefits and discounts that can enhance the overall value of the best insurance for rebuilt titles.

Cons:

- Complexity of Plans: The breadth of options can make it challenging to find the ideal policy for rebuilt titles.

- Potentially Higher Costs: Family plans might come with higher costs, which could be a drawback for those seeking affordable rebuilt title insurance.

#9 – Travelers: Best for Safe Drivers

Pros:

- Safe Driver Discounts: Travelers offers substantial discounts for safe driving, making it one of the best insurances for rebuilt titles for cautious drivers.

- Comprehensive Coverage: Provides a wide range of coverage options to protect rebuilt title vehicles. Read our Travelers insurance review to learn what else is offered.

- Strong Claims Handling: Known for efficient claims handling, which is crucial for managing rebuilt title insurance.

Cons:

- Discounts May Vary: Safe driver discounts and their impact on the best insurance for rebuilt titles can vary depending on individual circumstances.

- Potential Coverage Gaps: Some drivers might find gaps in coverage that could affect the value of Travelers’ insurance for rebuilt titles.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for 24/7 Support

Pros:

- 24/7 Customer Support: Liberty Mutual offers round-the-clock support, providing reliable assistance for the best insurance for rebuilt titles.

- Flexible Coverage Options: Offers a range of coverage options to suit various needs for rebuilt title vehicles.

- Comprehensive Benefits: Provides additional benefits that enhance the overall value of the best insurance for rebuilt titles which you can learn more about in our Liberty Mutual insurance review.

Cons:

- Higher Premiums: The extensive support services may result in higher premiums for rebuilt title insurance.

- Complex Policy Terms: Navigating Liberty Mutual’s policy terms may be challenging for some, potentially complicating the process for rebuilt title insurance.

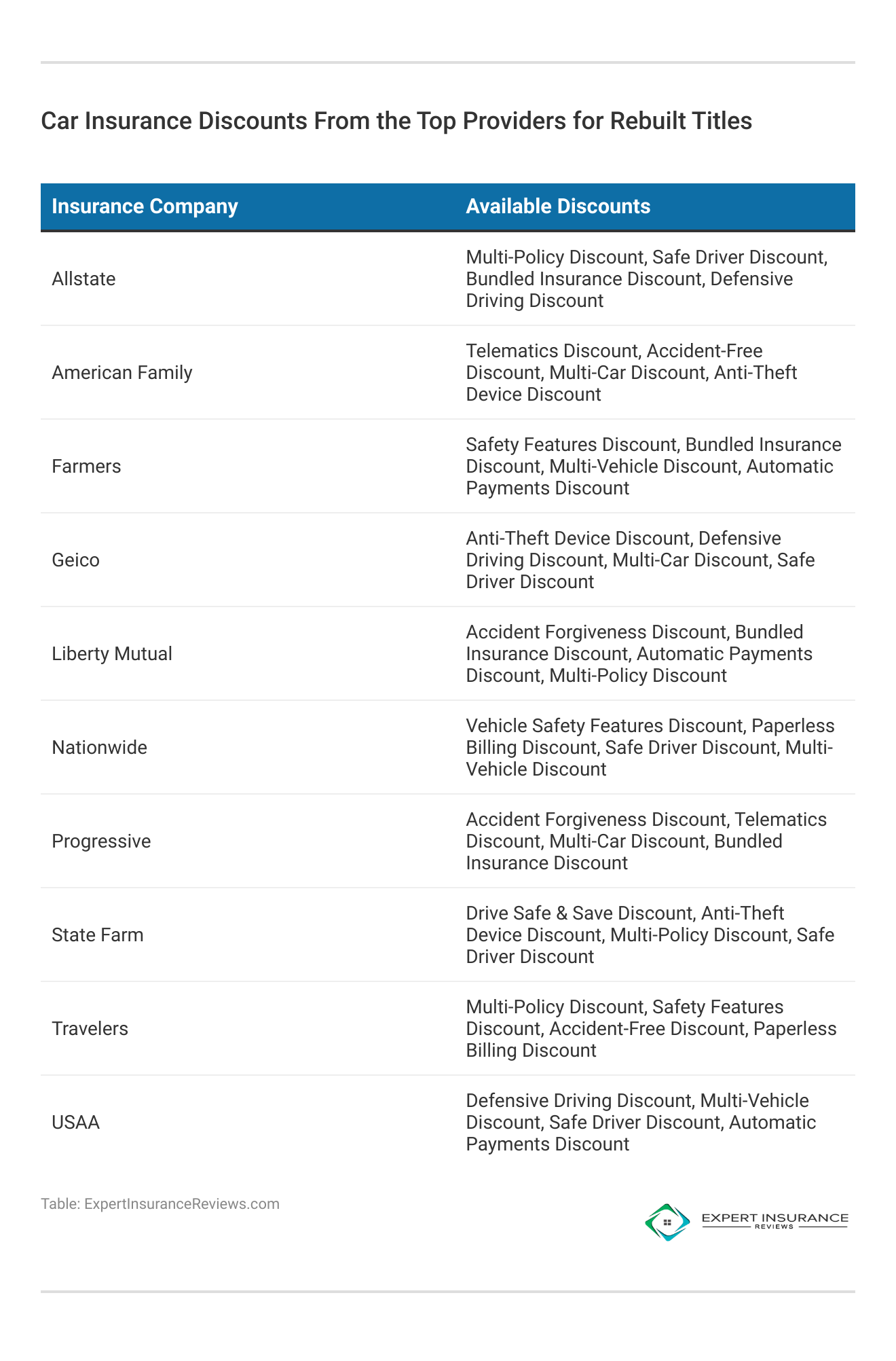

Rebuilt Titles Car Insurance Rates & Discounts by Top Providers

Finding the right insurance for a vehicle with a rebuilt title can be challenging, but understanding the available options and rates can make a significant difference. This guide provides a detailed comparison of monthly rates for both minimum and full coverage across top insurance providers, ensuring you have a clear understanding of what each company offers.

Rebuilt Title Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $67 | $125 |

| American Family | $56 | $117 |

| Farmers | $62 | $120 |

| Geico | $38 | $80 |

| Liberty Mutual | $73 | $134 |

| Nationwide | $60 | $115 |

| Progressive | $49 | $105 |

| State Farm | $43 | $86 |

| Travelers | $42 | $99 |

| USAA | $33 | $78 |

Moreover, it highlights the best car insurance discounts available from these insurers, which can further reduce your premium costs. Securing affordable and comprehensive coverage for a rebuilt title car requires careful evaluation of both the coverage options and potential savings through discounts.

By thoroughly comparing these factors, you can choose a policy that not only fits your budget but also provides the necessary protection for your vehicle. Use this guide as a resource to navigate the complexities of insuring a rebuilt title vehicle, ensuring that you make an informed decision that balances cost with comprehensive coverage.

List of Insurance Providers That Accept Rebuilt Title Cars

Securing insurance for a vehicle with a rebuilt title can be a challenge, as not all providers offer coverage for these types of vehicles. However, there are several reputable best car insurance companies that do accept rebuilt title cars. Let’s look at the list of companies that insure rebuilt title cars.

| List of Providers That Insure Rebuilt Title Cars |

|---|

| 21st Century |

| Allstate |

| American Family |

| Esurance |

| Everest |

| Farmers |

| Geico |

| Infinity |

| Kemper |

| National General |

| Nationwide |

| Omni |

| Progressive |

| Root Insurance |

| Safeco |

| State Farm |

| The General |

| The Hartford |

| Titan |

| USAA |

Most car insurance companies offer coverage for vehicles with rebuilt titles, regardless of their size or reputation. Coverage options may vary depending on the insurer and the specific condition of the rebuilt vehicle. Some companies may offer full coverage policies, while others might limit coverage to liability-only.

The key step is obtaining a successful inspection. This process not only validates the vehicle’s condition but also influences the type and cost of insurance coverage you can obtain.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Exploring Car Insurance Costs for Rebuilt Title Vehicles

The cost of car insurance for rebuilt title cars can vary widely depending on several factors, including the level of coverage you choose, the insurance provider, the state you live in, and the specific condition of the vehicle. Rebuilt title cars, repaired after being declared total losses, must pass a thorough inspection to meet safety standards before insurance can be issued.

USAA stands out as the top choice for rebuilt title insurance, offering unbeatable rates and comprehensive coverage tailored for budget-conscious drivers.

Ty Stewart Licensed Insurance Agent

This inspection is crucial as it directly influences the type and extent of coverage insurers are willing to offer. Most insurers offer basic liability coverage, but securing full coverage with collision and comprehensive insurance for rebuilt title cars can be more difficult. Insurers often avoid full coverage for rebuilt title vehicles due to risks, leading to higher premiums or stricter terms.

Rebuilt Title Car Insurance Monthly Rates by Provider & Coverage Type

| Insurance Company | Liability | Comprehensive | Collision | Full Coverage |

|---|---|---|---|---|

| Allstate | $162 | $126 | $192 | $318 |

| American Family | $114 | $98 | $126 | $224 |

| Farmers | $147 | $118 | $170 | $288 |

| Geico | $91 | $73 | $106 | $179 |

| Liberty Mutual | $77 | N/A | N/A | $200 |

| Nationwide | $117 | $93 | $136 | $229 |

| Progressive | $144 | $108 | $175 | $283 |

| State Farm | $120 | $97 | $138 | $235 |

| Travelers | $39 | N/A | N/A | $103 |

| USAA | $82 | $68 | $93 | $161 |

By understanding liability car insurance costs and full coverage insurance for rebuilt title vehicles, you can better understand your options and find a policy that fits your budget and coverage needs. Use this information to make an informed choice and ensure that you select the best insurance plan for your rebuilt title car.

Insurance Providers That Do Not Cover Rebuilt Title Vehicles

It’s worth noting that not all insurance companies will offer coverage for rebuilt title vehicles. Insurance policies can differ from state to state, and some insurers have restrictions regardless of the vehicle’s inspection status. Here is the list of companies that typically don’t cover rebuilt titles:

- Direct General Insurance: Often excludes rebuilt title vehicles from coverage due to company policies and state regulations.

- Liberty Mutual Insurance: Generally, does not offer insurance for rebuilt titles, focusing instead on vehicles with clean titles.

- Travelers Insurance: Typically avoids providing coverage for rebuilt title cars, potentially due to risk management preferences.

These companies generally do not provide coverage for vehicles with rebuilt titles. This can be due to varying state regulations or company policies on salvage and rebuilt titles. For example, the Georgia Department of Revenue requires all rebuilt titles to pass a DMV inspection before they can be registered.

Even if an insurer accepts rebuilt titles, the vehicle must still meet specific state requirements to be eligible for coverage. It’s crucial to check with your local insurance providers and understand your state’s regulations to ensure you find an insurer that will cover your rebuilt title vehicle.

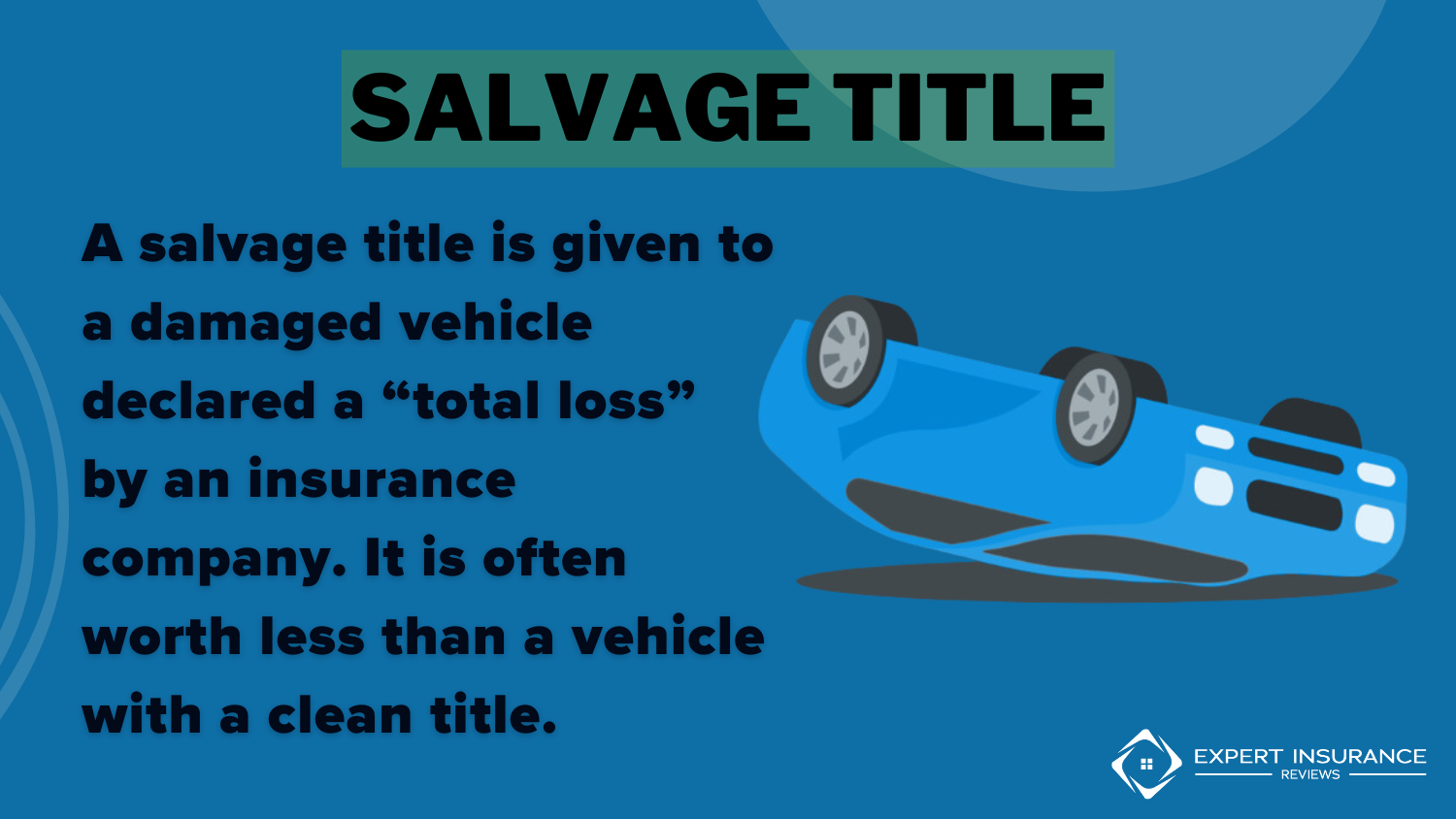

Understanding the Difference Between a Rebuilt Title and a Salvage Title

When it comes to vehicle titles, two terms often arise: Salvage Title and Rebuilt Title. While they may seem similar, they represent different stages in a vehicle’s lifecycle, particularly concerning insurance and resale value.

- Salvage Title: Issued to a vehicle deemed a total loss by an insurance company due to significant damage; indicates the vehicle is not roadworthy and cannot be legally driven until repairs are made.

- Rebuilt Title: Assigned to a vehicle that has been repaired and restored after receiving a salvage title; requires passing a thorough inspection to verify it meets safety and operational standards, allowing it to be legally driven and insured.

These titles reflect different stages in a vehicle’s history and impact how the vehicle is treated in terms of legality, insurability, and market value. Here’s a brief look at the key differences:

- Condition: A salvage title indicates a vehicle is not drivable, while a rebuilt title signifies it has been repaired and is roadworthy.

- Insurance: Vehicles with salvage titles generally cannot be insured until repaired and retitled as rebuilt. Rebuilt title vehicles can often be insured, though coverage options may be limited compared to standard vehicles.

- Resale Value: Vehicles with salvage titles typically have a significantly lower resale value compared to rebuilt title vehicles, which can retain more value if properly repaired.

Each title type has specific implications for a vehicle’s roadworthiness, insurance options, and resale value. Understanding these differences helps you navigate insurance options, as some providers may offer limited coverage or higher rates for salvage and rebuilt title vehicles.

Additionally, resale value can be affected, with rebuilt titles generally holding more value than salvage titles due to their restored condition. By grasping these differences, you can make informed choices when it comes to buying, insuring, and selling vehicles, especially when selecting the best car insurance company that accepts salvage titles.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How to Buy Car Insurance for Rebuilt Title Vehicles

Purchasing car insurance for a rebuilt title vehicle involves a few essential steps to ensure you find the right types of car insurance coverage. After you’ve completed the necessary repairs and received approval from an inspection, follow these guidelines to secure the best auto insurance for your vehicle.

- Research Providers: Find insurers that cover rebuilt title vehicles.

- Get Quotes: Compare rates and coverage from multiple companies.

- Understand Coverage: Check what each policy offers, including any limitations.

- Look for Discounts: Explore available discounts to reduce your premium.

- Finalize Your Policy: Choose the best option and review the policy terms before committing.

Car insurance for rebuilt title vehicles might involve some extra effort, but by following these steps, you can find the appropriate coverage for your needs. Do thorough research, compare different quotes, and utilize discounts to ensure you get the best insurance plan for your rebuilt vehicle.

Advantages and Disadvantages of Insuring Rebuilt Title Cars

Providing coverage for a vehicle with a rebuilt title comes with its own set of benefits and drawbacks. A rebuilt title indicates that a vehicle has been repaired after being deemed a total loss. These factors can significantly impact your decision-making process when considering insurance for such vehicles.

Pros:

- Lower Premiums: Insurance for rebuilt title cars often costs less than for standard vehicles. This is because rebuilt vehicles have already undergone repairs and have been inspected, which can mitigate some of the risk for insurers.

- Availability of Coverage: Many insurance companies offer coverage for rebuilt title vehicles once they pass a thorough inspection. This means that you can still secure insurance even if the vehicle had previous damage.

- Cost Savings on Repairs: Insuring a rebuilt title car might offer specific discounts for repairs and maintenance, as insurers may recognize the improvements made to restore the vehicle to a safe condition.

Cons:

- Limited Coverage Options: Insurers may offer limited coverage options for rebuilt title cars compared to standard vehicles. Some companies may only provide liability coverage, while full coverage might be restricted or more expensive.

- Higher Deductibles: Policies for rebuilt title cars often come with higher deductibles. This means that in the event of a claim, you may need to pay more out of pocket before your insurance coverage kicks in.

- Lower Resale Value: Vehicles with rebuilt titles generally have lower resale values. This can affect the overall value of your investment, as potential buyers might be wary of the vehicle’s history.

Rebuilt title car insurance can provide several financial advantages, especially regarding lower premiums compared to standard vehicle insurance. Insurers often offer competitive rates for rebuilt title vehicles because they recognize the potential for cost savings when insuring cars that have been restored. Additionally, policyholders may find various coverage options tailored to their needs.

View this post on Instagram

However, there are also potential drawbacks to consider. Many insurance providers may offer limited coverage options for rebuilt title cars, which could affect the level of protection available. Additionally, higher deductibles may lead to increased out-of-pocket costs if you make a claim. For a comprehensive overview, explore our detailed resource titled, “How to File a Car Insurance Claim.”

Case Studies: Best Car Insurance Company That Accepts Rebuilt Titles

Case Study 1: Mark’s Search for Full Coverage

Mark recently purchased a rebuilt title car and was in search of an insurance company that would provide him with full coverage. After researching different insurance companies, he found that Geico was willing to offer full coverage for his rebuilt title vehicle after a thorough inspection.

Mark was relieved to find an option that suited his needs and provided the level of coverage he was looking for. To gain further insights, consult our guide titled, “Can I track the progress of my car insurance claim with Geico?”

Case Study 2: Sarah’s Liability-Only Coverage

Sarah was also in the market for insurance for her rebuilt title car. However, she discovered that some insurance companies only offer liability-only coverage for rebuilt title vehicles. After exploring her options, Sarah decided to go with a smaller insurance company that provided liability coverage for her car.

Although it wasn’t the full coverage she initially wanted, she felt it was a suitable option considering her budget and the nature of her vehicle. To gain in-depth knowledge, consult our resource titled, “Understanding Full Coverage Car Insurance.”

Case Study 3: John’s Limited Options

John had a difficult time finding an insurance company that would accept his rebuilt title car. He reached out to several major insurance companies, but they all declined coverage for rebuilt title vehicles.

John’s search led him to a smaller insurance company that was willing to provide coverage for his car after the necessary inspection. Although he had limited options, John was grateful to find an insurer that would accept his rebuilt title vehicle. To gain profound insights, consult our guide titled, “Compare Car Insurance.”

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Top Car Insurance Providers for Rebuilt Title Vehicles

The article highlights the top insurance providers for rebuilt title vehicles, emphasizing USAA, Geico, and Allstate as the best options due to their affordable rates and comprehensive coverage. It provides insights into the challenges and considerations of insuring rebuilt title cars, such as inspection requirements and varying coverage options.

The article also differentiates between salvage and rebuilt titles, and offers practical tips for finding the right insurance, including comparing quotes and understanding state regulations. For those seeking insurance, the article suggests using online tools to obtain free quotes and explore coverage options. For detailed information, refer to our report titled, “Car Insurance Requirements.”

Find the best comprehensive car insurance quotes by entering your ZIP code below into our free comparison tool today.

Frequently Asked Questions

Is rebuilt better than salvaged?

Yes, rebuilt titles are preferable as they indicate the vehicle is repaired and roadworthy. For additional details, explore our resource titled, “What should I do if my vehicle is deemed a total loss?”

Do car insurance companies accept rebuilt title cars?

Yes, many do, but coverage options vary by insurer and state.

What are the best car insurance companies that accept rebuilt title cars?

USAA, Geico, and Allstate are top choices for rebuilt title cars.

Can you drive around with a salvage title?

No, you must first repair and pass an inspection to receive a rebuilt title. Discover more details in our guide titled, “Best Car Insurance Company for Bad Driving Records.”

Which car insurance companies don’t accept rebuilt title cars?

Direct General, Liberty Mutual, and Travelers often do not cover rebuilt titles.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

How much is car insurance for rebuilt title vehicles?

Rates start around $78 per month but vary by insurer and coverage.

What’s the difference between a rebuilt title and a salvage title?

Salvage titles indicate total loss and severe damage; rebuilt titles are for repaired and inspected vehicles.

What are rebuilt title cars?

Vehicles previously declared salvage due to damage but repaired and roadworthy, receiving a rebuilt title after inspection. To delve deeper about the repair process, refer to our in-depth report titled, “Can I choose where to get my vehicle repaired after an accident?”

How do I buy car insurance for rebuilt title vehicles?

Ensure the vehicle has passed inspection, then compare quotes from various insurers.

What is the meaning of salvage in insurance?

Salvage refers to recovering value from a totaled vehicle, often leading to a salvage title.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.