Best Home Insurance for Older Homes in 2025 (Your Guide to the Top 10 Companies)

For the best home insurance for older homes, Progressive stands out as the top pick overall, with rates starting at $102 per month. While Nationwide and Farmers also excel in protecting aging properties. These companies provide the best home insurance for older homes with reliable coverage and competitive rates.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jan 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Jan 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Home Insurance for Older Homes

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Home Insurance for Older Homes

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe best home insurance for older homes is provided by Progressive, Nationwide, and Farmers Insurance, each offering exceptional coverage starting at $102 per month.

Progressive stands out for its tailored policies that cater to historic and aging properties, ensuring comprehensive protection. Nationwide and Farmers also offer competitive rates with valuable coverage options. These companies address the unique needs of older homes, providing reliable and cost-effective insurance solutions.

Our Top 10 Company Picks: Best Home Insurance for Older Homes

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 11% | A+ | Competitive Rates | Progressive | |

| #2 | 10% | A+ | Multi-Policy Savings | Nationwide |

| #3 | 12% | A | Safety Discounts | Farmers | |

| #4 | 7% | A++ | Online Convenience | Geico | |

| #5 | 9% | A | 24/7 Support | Liberty Mutual |

| #6 | 10% | A | Claims Service | American Family | |

| #7 | 8% | A++ | Safe Drivers | Travelers | |

| #8 | 9% | B | Student Savings | State Farm | |

| #9 | 8% | A+ | UBI Savings | Allstate | |

| #10 | 7% | A++ | Military Benefits | USAA |

Explore our top picks for home insurance tailored to older homes, offering specialized coverage and valuable discounts. To gain in-depth knowledge, consult our guide titled, “Home Insurance Coverage.”

Make sure your home is protected by entering your ZIP code into our home insurance comparison tool above today.

- Progressive offers the best rates for home insurance on older homes

- Older homes often require specialized coverage due to their unique features

- Discounts and specialized coverage help offset higher costs for older homes

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – Progressive: Overall Top Pick

Pros:

- Affordable Coverage: Progressive offers some of the most competitive rates for the best home insurance for older homes, making it a cost-effective option. Explore our Progressive insurance review for comprehensive insights.

- Tailored Policies: Their policies are specifically designed to address the unique needs of older homes, providing comprehensive coverage.

- Customizable Options: Progressive allows for customization of policies to better fit the specific risks associated with older properties.

Cons:

- Higher Deductibles: To achieve lower premiums, Progressive’s best home insurance for older homes may come with higher deductibles.

- Limited Discounts: Compared to other insurers, Progressive’s options for additional discounts on the best home insurance for older homes might be less extensive.

#2 – Nationwide: Best for Multi-Policy Savings

Pros:

- Bundling Benefits: Nationwide offers substantial savings when you bundle the best home insurance for older homes with other policies, such as auto or life insurance. Uncover key details in our Nationwide insurance review.

- Flexible Coverage: They provide flexible policy options tailored to the needs of older homes, ensuring comprehensive protection.

- Discounts for Safe Features: Discounts for safety upgrades and modernizations are available, helping reduce the cost of the best home insurance for older homes.

Cons:

- Price Variability: The cost of Nationwide’s best home insurance for older homes can vary significantly based on location and home specifics.

- Customer Service Concerns: There have been occasional complaints about customer service, which can affect the overall experience of managing the best home insurance for older homes.

#3 – Farmers: Best for Safety Discounts

Pros:

- Safety Feature Discounts: Farmers provides significant discounts on the best home insurance for older homes if you have safety features like alarms or updated wiring.

- Comprehensive Coverage: They offer extensive coverage options that address the unique risks associated with older homes. for an in-depth analysis, check out our Farmers insurance review.

- Claim Support: Farmers has a strong reputation for supporting claims related to older home issues, ensuring you get help when needed.

Cons:

- Higher Premiums: The premiums for the best home insurance for older homes with Farmers can be higher compared to some competitors.

- Limited Online Tools: Farmers may have fewer online resources for managing your policy compared to other insurers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Geico: Best for Online Convenience

Pros:

- User-Friendly Online Tools: Geico’s online platform makes it easy to get quotes and manage the best home insurance for older homes. Read our Geico insurance review to learn more.

- Quick Quote Process: Geico’s streamlined process helps you quickly compare and secure the best home insurance for older homes.

- 24/7 Customer Service: Access to customer service around the clock ensures you can handle any issues with your older home’s coverage promptly.

Cons:

- Limited Specialized Coverage: Geico’s best home insurance for older homes might not offer as many specialized options for historic properties.

- Fewer Local Agents: Geico relies heavily on online interactions, which might not be ideal if you prefer face-to-face consultations for the best home insurance for older homes.

#5 – Liberty Mutual: Best for 24/7 Support

Pros:

- Around-the-Clock Support: Liberty Mutual offers 24/7 customer support for the best home insurance for older homes, ensuring help is always available.

- Customizable Policies: They provide customizable policies to fit the specific needs of older homes, offering peace of mind. Discover specific details in our Liberty Mutual insurance review.

- Discounts for Upgrades: Liberty Mutual offers discounts for home upgrades and improvements, helping to lower the cost of the best home insurance for older homes.

Cons:

- Higher Costs: The premium rates for Liberty Mutual’s best home insurance for older homes can be higher compared to other providers.

- Complex Policies: Their policies might be more complex, potentially requiring more time to understand the full extent of coverage for older homes.

#6 – American Family: Best for Claims Service

Pros:

- Efficient Claims Processing: American Family is known for its efficient claims service, crucial for handling issues with the best home insurance for older homes.

- Comprehensive Coverage Options: They offer extensive coverage that addresses the unique challenges of older homes. Dive into our American Family insurance review for an in-depth look.

- Customer Satisfaction: High customer satisfaction ratings for claims handling make American Family a reliable choice for the best home insurance for older homes.

Cons:

- Premium Variability: The cost of the best home insurance for older homes can vary widely depending on specific home characteristics and location.

- Limited Discounts: Fewer options for additional discounts on the best home insurance for older homes compared to some competitors.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Travelers: Best for Safe Drivers

Pros:

- Discounts for Safe Features: Travelers provides discounts on the best home insurance for older homes if you have safety features installed.

- Comprehensive Coverage: Their policies offer robust protection for the specific needs of older homes.

- Strong Financial Stability: Travelers’ strong financial ratings ensure reliability in handling claims for older homes.

Cons:

- Higher Premiums for Older Homes: Travelers’ premiums for the best home insurance for older homes may be on the higher side. Find more information in our Travelers insurance review.

- Limited Online Management: The online management tools might not be as advanced as those offered by competitors.

#8 – State Farm: Best for Student Savings

Pros:

- Discounts for Students: State Farm offers discounts for homes with student residents, which can be beneficial for some older homes. Discover the complete picture in our State Farm insurance review.

- Comprehensive Coverage: They provide extensive coverage options suitable for the unique needs of older homes.

- Strong Local Presence: With a vast network of local agents, State Farm offers personalized support for the best home insurance for older homes.

Cons:

- Variable Coverage Options: The coverage options for older homes might not be as extensive as those offered by some other insurers.

- Potentially Higher Premiums: The cost of the best home insurance for older homes with State Farm may be higher compared to other providers.

#9 – Allstate: Best for UBI Savings

Pros:

- Usage-Based Insurance Discounts: Allstate offers usage-based insurance (UBI) discounts that can lower the cost of the best home insurance for older homes.

- Tailored Coverage Options: They provide customizable options to address the specific needs of older homes. Gain valuable knowledge from our Allstate home insurance review.

- Innovative Tools: Allstate’s innovative tools can help you better manage and understand your policy for older homes.

Cons:

- Limited Historical Home Expertise: Their focus on UBI might not offer as much specialized expertise for the best home insurance for older homes.

- Higher Base Premiums: The base premiums for the best home insurance for older homes can be higher compared to other insurers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – USAA: Best for Military Benefits

Pros:

- Exclusive Military Discounts: USAA provides specialized discounts and benefits for military families, making it a top choice for the best home insurance for older homes.

- Customized Protection Coverage: They offer coverage options specifically designed to meet the needs of older homes. Explore the benefits in our USAA insurance review.

- Excellent Customer Service: Known for outstanding customer service, USAA ensures a smooth experience for those securing the best home insurance for older homes.

Cons:

- Eligibility Limitations: USAA’s services are only available to military families, limiting access for others seeking the best home insurance for older homes.

- Higher Costs for Some: The cost of the best home insurance for older homes might be higher for those not taking full advantage of military discounts.

Insurance Rates & Discounts for Older Homes

When insuring an older home, monthly rates can vary significantly based on coverage levels and providers. This detailed comparison highlights the monthly premiums for both minimum and full coverage across several best insurance companies, offering a clear view of how each provider stacks up in terms of cost.

Older Home Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $124 | $205 |

| American Family | $111 | $194 |

| Farmers | $134 | $215 |

| Geico | $102 | $184 |

| Liberty Mutual | $125 | $207 |

| Nationwide | $116 | $199 |

| Progressive | $112 | $184 |

| State Farm | $124 | $203 |

| Travelers | $133 | $214 |

| USAA | $114 | $185 |

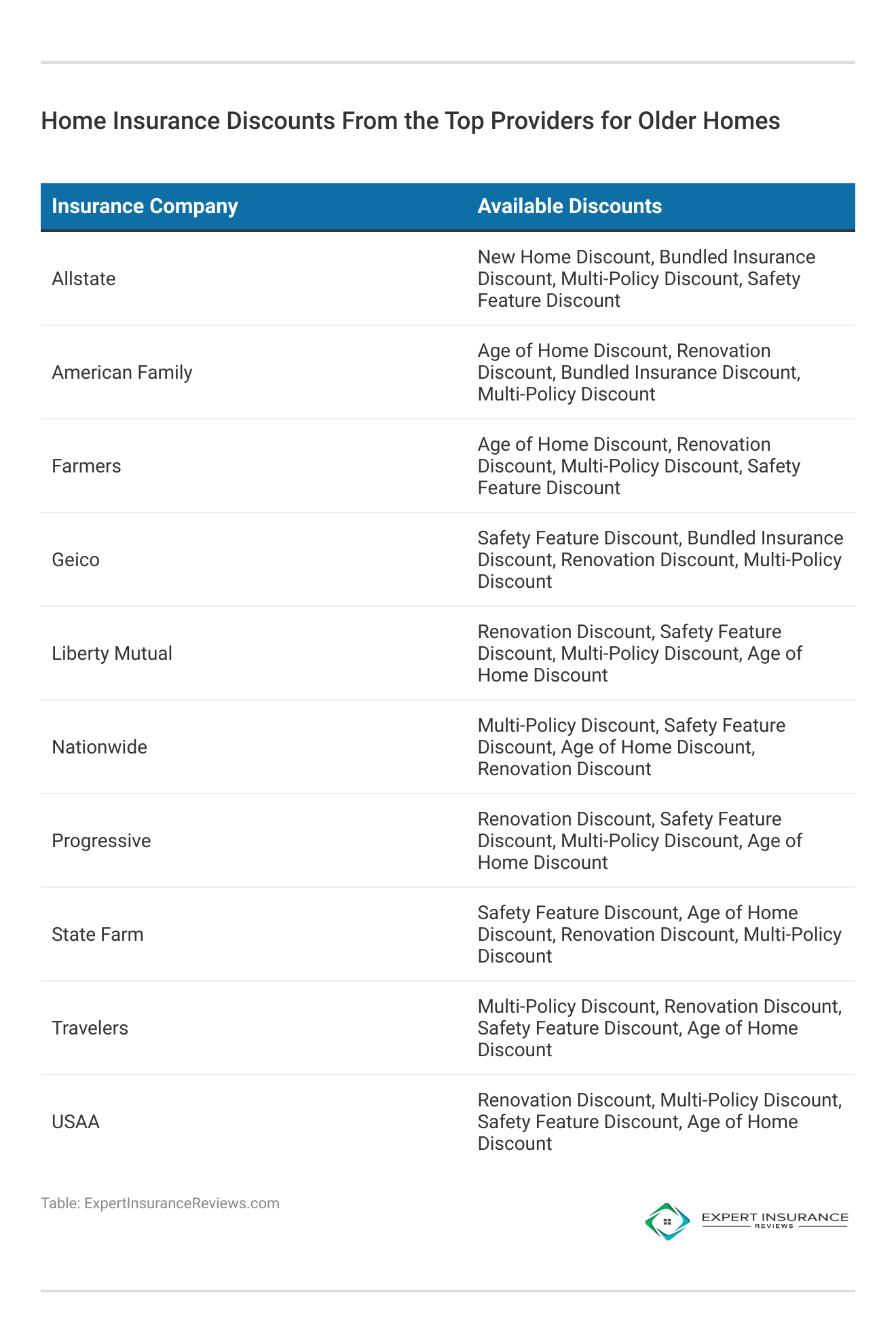

Additionally, it explores the various discounts available for older home insurance, such as those for renovations, safety features, and multi-policy bundles. This comprehensive overview will help homeowners make an informed choice by balancing cost with coverage quality and potential savings.

By reviewing the monthly insurance rates and discounts for older homes offered by top insurance providers, homeowners can better understand their options. With this knowledge, homeowners can make an informed decision to choose a policy that delivers both financial benefits and essential protection for their valued older home.

Key Basics to Know About Home Insurance for Older Homes

Home insurance is essential for protecting your investment, especially if you own an older home. Understanding the unique aspects of insuring an older property can help homeowners make informed decisions and secure the best coverage. Here are some key basics to consider:

- Higher Risk Factors: Older homes may have outdated systems, increasing risk and potentially leading to higher premiums or stricter policy conditions. For additional details, explore our comprehensive resource titled, “Does home insurance cover mold?“

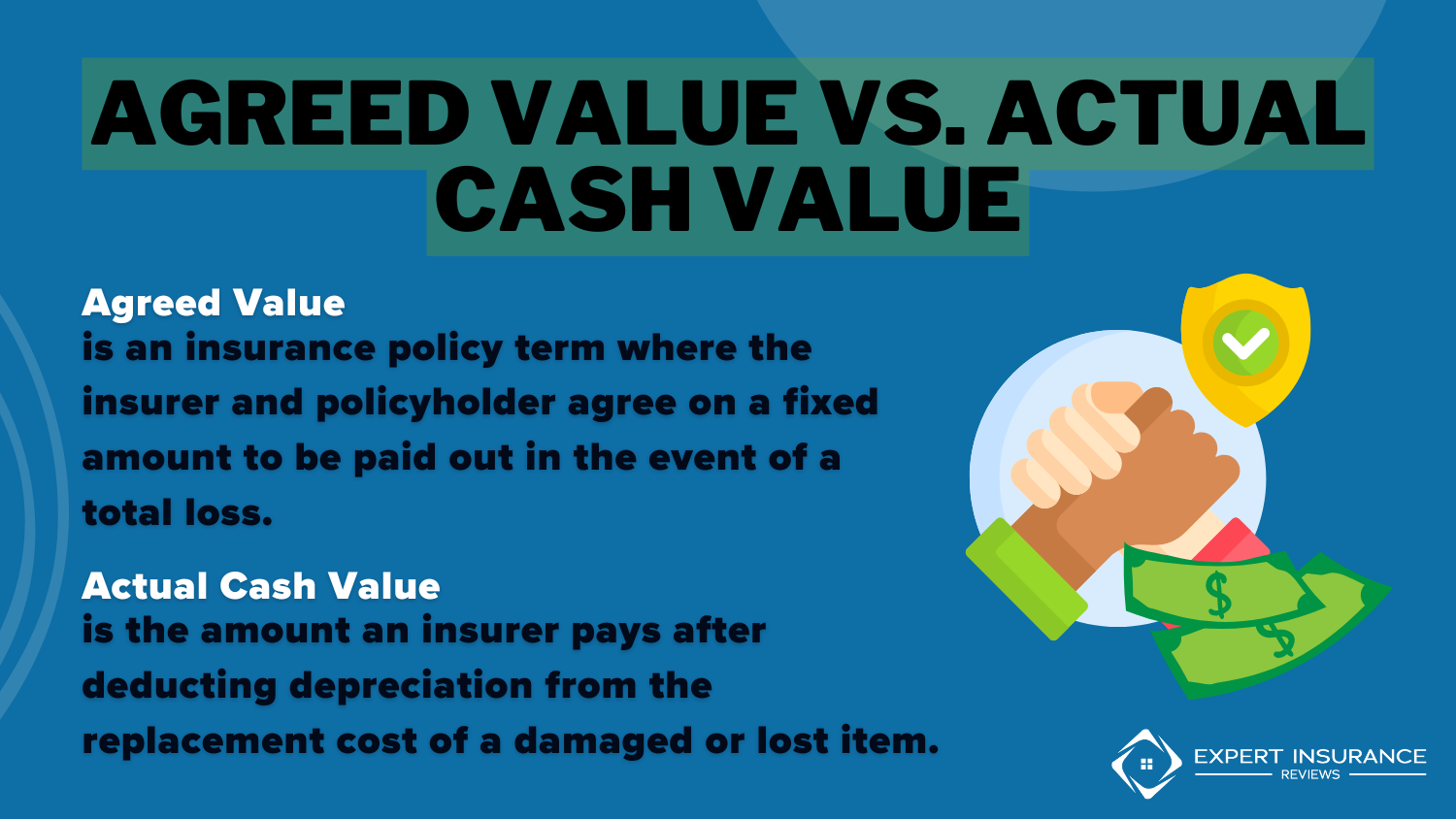

- Coverage Types: Choose for replacement cost coverage to ensure rebuilding costs are covered without depreciation, rather than actual cash value.

- Specialized Policies: Look for policies tailored to historic or older homes for enhanced coverage suited to unique features and materials.

- Discounts and Savings: Inquire about discounts for updated safety features or recent renovations to help reduce premiums.

- Inspection Requirements: An inspection may be necessary to evaluate home condition, as regular maintenance can positively influence insurance rates and options.

Insuring an older home involves understanding its unique characteristics and risks. By being informed about the types of home insurance coverage, replacement costs, available discounts, and potential exclusions, homeowners can find a policy that adequately protects their cherished property while maximizing savings.

To secure the best coverage and optimize savings, consulting with insurance professionals is essential. Their expertise will help you navigate the complexities of older home insurance and make well-informed decisions tailored to your specific needs.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Factors to Consider When Choosing Insurance Policies for Older Homes

Owning an older home brings unique charm and historical value, but it also presents distinct insurance needs. When choosing a policy, homeowners need to evaluate several factors to guarantee sufficient protection and financial peace of mind, including what does home insurance cover.

Here’s a guide to help owners of older homes choose the right insurance policy.

- Replacement Cost Coverage: Covers the cost to rebuild or repair the home using materials of similar quality, even if they cost more than the home’s current market value.

- Actual Cash Value Coverage: Provides coverage based on the home’s current market value, minus depreciation. This can be less comprehensive, especially for older homes with unique features.

- Modified Replacement Cost Coverage: Offers a middle ground by covering the cost to repair or replace the home with updated materials, rather than exact replacements.

- Historic Home Insurance: Designed for homes with historical value, offering protection that considers the unique features and materials used in historic properties.

- Specialty Policies: Tailored for homes that may not qualify for standard insurance, these policies offer various coverage levels and can include options for extended or additional protection.

Choosing the right insurance policy for an older home requires careful consideration of the home’s unique characteristics and potential risks. Replacement Cost Coverage is often the best option for comprehensive protection.

However, Actual Cash Value, Modified Replacement Cost, Historic Home Insurance, and Specialty Policies each offer their own unique advantages. Homeowners should assess their needs, consult with insurance professionals, and select a policy that best aligns with their home’s value and preservation needs.

How We Choose the Best Insurance for Older Homes

When choosing the best insurance for older homes, we employ a detailed approach tailored to various scenarios. Not every option will fit every home perfectly, but our recommendations ensure there is a suitable choice for every situation.

Progressive stands out as the top choice for insuring older homes, offering tailored coverage and competitive rates.

Ty Stewart Licensed Insurance Agent

We focus on companies with robust reputations, especially those experienced with higher value and historic homes. This is crucial since claims for such properties can be substantial, making the insurer’s ability to handle claims and their reputation for reliability vital.

For older homes of lesser value, our selected insurance carriers also meet rigorous standards for reputation and reliability. Below is a table displaying the A.M. Best and Better Business Bureau (BBB) ratings for the top ten home insurance companies, reflecting their financial strength and customer service quality.

Customer & Financial Ratings From the Top Home Insurance Providers for Older Homes

| Insurance Company | A.M. Best | BBB |

|---|---|---|

| Allstate | A+ | A+ |

| American Family | A | A |

| Chubb | A++ | A+ |

| Erie | A+ | A+ |

| Farmers | A | A+ |

| Liberty Mutual | A | A |

| Nationwide | A+ | A+ |

| State Farm | B | A+ |

| Travelers | A++ | A+ |

| USAA | A++ | A+ |

Selecting the best home insurance coverage for older homes involves a detailed evaluation of insurance companies based on their reputation, financial strength, and ability to handle claims. By considering these factors, homeowners can find a reliable and valuable policy, enabling informed decisions to confidently protect their cherished older homes.

The Significance of Comparing Older Home Insurance Options

Exploring different options for older home insurance is crucial for homeowners who want the best coverage and rates suited to their distinctive properties. Older homes often have distinct features and potential risks that can influence insurance premiums and policy options. Comparing quotes from multiple insurers helps homeowners find the best rates and coverage for their older home’s needs.

Additionally, different insurers may provide various discounts and incentives for older homes, such as renovation or multi-policy discounts, which can lead to significant savings. Overall, taking the time to shop around can lead to more tailored options and greater peace of mind. To delve deeper, refer to our in-depth report titled, “Compare Home Insurance.”

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Tips for Saving Money on Home Insurance for an Older Home

Home insurance for older homes can be more expensive due to factors like outdated materials and higher repair costs. However, there are several strategies homeowners can use to reduce their premiums and find better value for their insurance coverage:

- Enhance Home Safety Features: Installing modern safety features like smoke detectors and security systems can reduce your insurance premium, as providers often offer discounts for these risk-reducing upgrades.

- Bundle Your Insurance Policies: Bundling home insurance with other policies like auto or life can lead to substantial savings, thanks to multi-policy discounts.

- Increase Your Deductible: A higher deductible can reduce your monthly premium, but make sure it’s an amount you can afford to pay if you need to file a claim.

- Shop Around for Quotes: Compare quotes from various providers to find the best rates and discounts for your older home, and check for any special programs available.

- Maintain and Update Your Home: Regular maintenance and updates, like repairing the roof and updating electrical systems, can lower insurance costs by reducing risks and making the home less of a liability.

Implementing these strategies can significantly reduce the cost of insuring your older home while ensuring you maintain sufficient coverage. By following these steps, you can reduce your premiums and tailor your policy to meet your specific needs, ensuring that your older home remains well-protected when buying home insurance.

Case Studies: Home Insurance for Older Homes – Real-world Scenarios

Case Study 1: The Restoration Project

Mr. Johnson owns a historic home that is over 100 years old. He wanted to ensure that his beloved home was adequately protected, so he searched for the best insurance provider for older homes. Mr. Johnson selected Chubb for insuring his historic property, benefiting from their restoration and renovation coverage for peace of mind.

For additional overview, explore our detailed resource titled, “Best Home Insurance for Short Term Rentals.”

Case Study 2: Preserving Heritage

The Smith family inherited a charming Victorian house from their ancestors. They wanted to preserve its unique architectural features while ensuring it was adequately insured. They turned to State Farm, which provided specialized coverage for older homes. State Farm’s policy covered water backup and offered mold protection, addressing risks in older properties.

To gain further insights, consult our comprehensive guide titled, “Does home insurance cover roof leaks?”

Case Study 3: Renovation and Remodeling

Ms. Rodriguez purchased an older home with the intention of renovating and remodeling it to suit her taste. However, she faced challenges when it came to finding suitable insurance coverage during the renovation process. Farmers Insurance protected Ms. Rodriguez’s investment during home renovations with a specialty policy, providing essential coverage.

For more insights, consult our resource titled, “Best Home Insurance for Second Homes.”

Comprehensive Guide to Home Insurance for Older Homes

Homeowners with older properties need specialized insurance to address the unique risks and higher costs of aging homes. Progressive, Nationwide, and Farmers excel for older homes with tailored policies, competitive rates, and comprehensive coverage. When choosing insurance, it’s crucial to understand how replacement cost differs from actual cash value, as this affects claims processing.

Moreover, specialized policies tailored for historic or renovated homes offer enhanced protection. Homeowners should seek discounts for safety upgrades or multi-policy bundles to reduce premiums. They should also compare quotes and seek expert advice to balance cost and coverage for their older home. To expand your knowledge, refer to our guide titled, “How Much Home Insurance To Buy.”

Protecting your home doesn’t have to be expensive. Enter your ZIP code below into our free tool to find affordable homeowners insurance today.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frequently Asked Questions

Is homeowners insurance for old homes more expensive?

Yes, usually annual premiums are high, but it depends on the home. Typically, older homes are more expensive to insure than newer homes.

To gain profound insights, consult our extensive guide titled, “Renting vs. Buying: Is it Better to Rent or to Own a Home?”

What does a homeowner typically insure for the house?

Typically, homeowners insurance covers damages to your home, the property on which your home is located, as well as some of your valuable items within (but not attached to) your home.

Can I get homeowner’s insurance without an inspection?

No. Companies providing the best homeowners insurance for older homes (and homes in general) will require an inspection before agreeing on coverage rates.

Who should be listed on homeowner’s insurance?

To purchase homeowners insurance, companies require the name of the policyholder to be listed. Additionally, the policyholder should be currently living in the home being insured.

Is home insurance cheaper on a new home?

Yes. Most home insurance companies offer some of the best property insurance rates for purchasing home insurance on a new home.

To gain in-depth knowledge, consult our comprehensive resource titled, “Best Home Insurance for New Home Builds.”

What is the cheapest home insurance company?

Finding the best and the cheapest house insurance company may be difficult, as the best coverage for your specific home will be more expensive. Similarly, the cheapest home insurance company may provide the minimum coverage, leaving you paying more in the event of an accident.

Secure cheap insurance for your home by entering your ZIP code into our free quote comparison tool below.

What is the best reliable home insurance?

Progressive, Amica, and Allstate are known for their reliability, strong financial stability, and excellent customer service.

What is the most reasonable homeowners insurance?

Geico and Liberty Mutual provide competitive rates while offering solid coverage options, making them reasonable choices.

Which insurance company has the highest customer satisfaction?

Amica, USAA, and Erie Insurance consistently receive high ratings for customer satisfaction and service.

For detailed information, refer to our comprehensive report titled, “Erie Insurance Review & Complaints.”

What insurance is the most commonly purchased homeowners insurance?

Major providers like State Farm, Allstate, and Progressive are the most commonly purchased due to their extensive coverage and recognition.

Which homeowners policy provides the most coverage?

Policies with replacement cost coverage from companies like Chubb and Farmers offer extensive protection for homes and valuable items.

Find the best coverage for your home by using our free comparison tool below to see homeowners insurance rates from multiple companies.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.