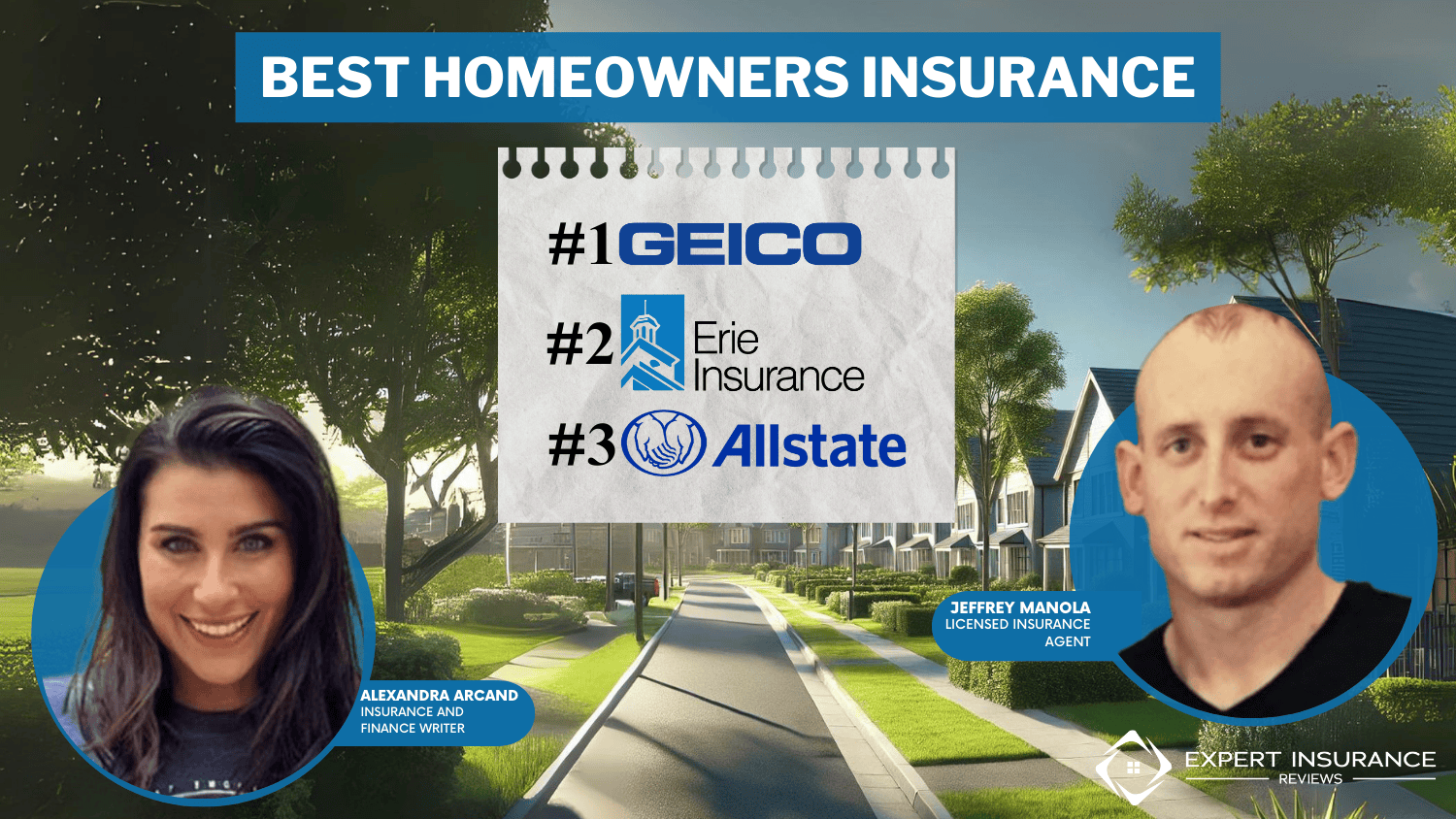

Best Homeowners Insurance in 2025 (Check Out the Top 10 Companies)

The best homeowners insurance companies are Geico, Erie, and Allstate. Geico home insurance is competitive, and rates start at $80/month. Erie is famous for really good customer service, ranking at the top for homeowners insurance claim satisfaction, and Allstate provides comprehensive coverage with excellent discounts.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Insurance Agent

UPDATED: Dec 31, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 31, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Home Insurance Cost

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 11,638 reviews

11,638 reviewsCompany Facts

Home Insurance Cost

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsThe best homeowners insurance companies are Geico, Erie, and Allstate, and rates start at just $80 monthly.

This table shows the best homeowners insurance providers. It includes important details like ratings and unique features, as well as a wide variety of options for homeowners. This article clarifies what home insurance covers.

Our Top 10 Company Picks: Best Homeowners Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 25% A++ Competitive Rates Geico

#2 25% A+ Customer Service Erie

#3 25% A+ Comprehensive Coverage Allstate

#4 20% A Extensive Options Farmers

#5 25% A Multiple Discounts Liberty Mutual

#6 17% B Strong Network State Farm

#7 20% A+ Customizable Policies Nationwide

#8 25% A Family-Oriented Service American Family

#9 30% A+ Claims Satisfaction Amica

#10 5% A+ Senior Focused The Hartford

Erie stands out in customer service, providing policyholders with great support. However, it’s only sold in 11 states. Geico and Allstate offer comprehensive coverage in more states.

You can get homeowners insurance at the best price in your neighborhood by entering your ZIP code above.

- Geico is the top pick for affordable home insurance rates and reliable service

- Erie is known for the best homeowners insurance customer service

- The value of your home will increase your monthly insurance rates

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Our Geico review covers the competitive rates for the best home insurance options.

- Bundling Deals: Clients get the best home insurance rates when bundling policies with auto insurance from Geico.

- Excellent Financial Strength: Geico can successfully process homeowners insurance claims because of its high financial strength.

Cons

- Fewer Coverage Options: Geico might not have the specialized or high-value coverage you see with other homeowners insurance companies.

- Online-Only Claims Process: Processing claims solely online may not provide the support that some customers need.

#2 – Erie: Best for Customer Service

Pros

- Extensive Coverage Available: Erie’s homeowners’ insurance includes replacement cost coverage policies, which provide the comprehensive protection your home deserves.

- Excellent Customer Service: We highlight its excellent customer service in our Erie review, keeping with the company’s goal to deliver the best homeowners insurance experience.

- Attractive Discounts: Erie has a safe home and bundling discounts for big homeowners insurance savings.

Cons

- Limited Availability: Erie offers coverage in a select group of states, which may restrict choices when finding the best homeowners policy.

- Increased Premiums: Its rates may be marginally more elevated than other affordable homeowners insurance providers, impacting cost accessibility.

#3 – Allstate: Best for Comprehensive Coverage

Pros

- Out-of-The Box Programs: Allstate offers a claim satisfaction guarantee that provides peace of mind with the best homeowners insurance to ensure a positive experience.

- Discount Opportunities: There are great ways to save on Allstate homeowners insurance.

- Best in Comprehensive Coverage: As discussed in our Allstate review, the company offers the best comprehensive coverage for homeowners insurance.

Cons

- Inconsistent Claims Experience: Homeowners experience inconsistent claims service from Allstate.

- Higher Premium Costs: Allstate has higher rates for homeowners insurance than other competitors.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Farmers: Best for Extensive Options

Pros

- Wide Range of Options: Farmers offer many homeowners insurance policy types, highlighted in our Farmers review.

- Robust Agent Network: This means personalized help for homeowners is never far away.

- Wide Selection of Coverage Add-Ons: Farmers offers many add-ons, such as earthquake coverage, allowing homeowners a tailored option.

Cons

- Higher Premiums: This could be a turnoff for those looking to keep their homeowners’ insurance costs down.

- Complex Policy Options: Having many options might overwhelm customers when finding the best homeowners insurance.

#5 – Liberty Mutual: Best for Multiple Discounts

Pros

- Home Safeguard Program: Their proactive measures save you damage costs, providing a superior experience with the best homeowners insurance.

- Extensive Discounts: Liberty Mutual offers multiple discounts to help you find the best homeowners insurance policy. Get a list in our Liberty Mutual review.

- Wide Selection of Coverage: The best homeowners insurance covers specialized items such as heirlooms and expensive jewelry.

Cons

- Varying Levels of Customer Service: The level of quality service with Liberty Mutual varies, as some homeowners say.

- Online Experience Issues: The online claims process can be tricky to navigate, which affects how easily you can manage your homeowners’ insurance.

#6 – State Farm: Best for Strong Network

Pros

- Robust Agency Network: State Farm has an extensive local agent network for personalized home insurance support.

- Robust Coverage: State Farm provides a wide range of coverage options for homeowners seeking the best homeowners insurance.

- Discounts Galore: Homeowners can qualify for multiple discounts for cheaper State Farm home insurance rates. Read our State Farm review for more info.

Cons

- Upper-Rate for Some: This may be at the higher end of the scale from specific options and make for an altogether unfeasible option in the search for the best homeowner’s insurance.

- Claims Handling Delays: A few customers have complained about delays in claim settlements, much of which is usually frustrating for homeowners.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Customizable Policies

Pros

- Customizable Coverage: Nationwide spotlights its customizable plans. Read our Nationwide review for tailored homeowners insurance policies.

- Multi-Policy Discounts: Significant savings are available by bundling Nationwide homeowners insurance with other policies.

- Strong Financial Ratings: Nationwide can reliably pay homeowners insurance claims for their customers.

Cons

- Limited Availability: Nationwide’s homeowners insurance options are unavailable in some areas.

- Mixed Customer Feedback: Homeowners experience inconsistencies with Natioinwide’s customer service.

#8 – American Family: Best for Family-Oriented Service

Pros

- Robust Discounts: It offers discounts for safe homes and loyalty, making homeowners insurance affordable.

- Family-Oriented Service: Read our American Family review to learn about its family-centered features, which make it an excellent choice for homeowners.

- Comprehensive Coverage Options: AmFam home insurance options include protections for renters and home-based businesses, among other things.

Cons

- Limited Availability: American Family’s homeowners’ insurance may not be available in some states.

- Higher Premiums for Certain Coverage: Higher costs are associated with comprehensive coverage for homeowners insurance.

#9 – Amica: Best for Claims Satisfaction

Pros

- Competitive Pricing: Amica provides complete protection at competitive prices for customers looking for home insurance at a fair price.

- Unique Dividends: Amica dividend programs give money back to customers after the fact, increasing the value of top-placed home insurance.

- Excellent Claims Handling: Excellent claims handling for homeowners is highlighted in our Amica review.

Cons

- Few Physical Agents: It’s mostly internet-based, which is not the best place for customers who prefer face-to-face interaction when buying homeowners insurance.

- Overwhelming Choice: The customization of so many options may leave some homeowners confused about the best homeowners insurance.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – The Hartford: Best for Seniors

Pros

- Senior-Focused Coverage: Retired homeowners get the best homeowners insurance for seniors from The Hartford. Learn more in our The Hartford review.

- A+ Financial Stability Rating: Strong financial ratings prove its reliability when paying home insurance claims.

- Discount Opportunities: The company offers discounts for home safety features. A claims-free history also helps homeowners get cheap Hartford insurance rates.

Cons

- Limited Availability for Younger Homeowners: The focus is primarily on seniors. Younger homeowners may pay higher rates for home insurance.

- Higher Premiums for Specialized Coverage: Some unique options cost more, increasing The Hartford homeowners insurance rates.

How to Choose the Best Homeowners Insurance Plan

To choose the best homeowners insurance, assess your home’s value and required home insurance coverage. Use the table below to compare quotes from different providers to find the best rates.

Home Insurance Rates by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $90 | |

| $86 | |

| $87 | |

| $80 |

| $88 | |

| $85 | |

| $95 |

| $89 |

| $92 | |

| $93 |

Every company has its offerings, so comparing homeowners insurance quotes is crucial. Review each company’s coverage options and consider additional features such as natural disaster coverage. Policies offer different coverage types. These often include dwelling, personal property, liability, and extra living costs.

Homeowners need to evaluate their needs and choose the right mix of coverage. Customer serving ratings and claims reviews will also ensure you find the most reliable insurer at the best price.

Homeowners Insurance Discounts and Savings

Home insurance companies often give different discounts so people can save money on premiums. Typical discounts include combining policies and using home security systems. Keeping a clean claim record is also beneficial.

Homeowners Insurance Discounts From the Top Providers

| Insurance Company | Available Discounts |

|---|---|

| Multi-policy, Protective devices, Early signing, Responsible payment | |

| Multi-policy, Home protection, Smart home, Loyalty | |

| Multi-policy, Claim-free, Autopay, Loyalty | |

| Multi-policy, Fire alarms, Sprinkler system, New home |

| Multi-policy, Home safety, Claim-free, New home | |

| Multi-policy, Home security system, Smoke-free, New home | |

| Multi-policy, Claims-free, New/renovated home, Protective devices |

| Multi-policy, Protective devices, Claims-free, Roof rating |

| Multi-policy, Home security system, Impact-resistant roof | |

| Multi-policy, Protective devices, Retiree, New home |

Bundling home insurance with car or life insurance offers many benefits. Not only do customers save money by bundling insurance policies, but it comes with other benefits:

- Streamlined Approach꞉ Combining policies means using one company. This simplifies payments and claims, helping you stay organized.

- Wide Protection꞉ Bundling lets you create personalized coverage for your home. It protects all your belongings under one plan.

- Cost Savings: Bundling homeowners insurance with other policies can lead to significant discounts on premiums, reducing overall insurance costs.

Bundling brings ease and convenience to homeowners insurance, and Amica has the best homeowners insurance bundling discount of 30%.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Navigating Homeowners Insurance Claims With the Best Companies

According to annual J.D. Power customer surveys, Amica, Erie, and Farmers have the highest satisfaction with home insurance claims. Understanding the home insurance claims process and claim reviews is important to finding the best homeowners insurance.

To start a homeowners insurance claim, report the incident to your insurance provider either online or over the phone. Your insurer will send an adjustor to assess the damage and determine an appropriate payout. After your claim is approved, you will get compensation based on the types of home insurance coverage in your policy.

Homeowners Insurance Deductible Unpacked

Deductibles play a crucial role in homeowners insurance by determining the amount you must pay out of pocket before your coverage kicks in. Settling for a higher deductible can reduce your premium costs.

Homeowners should carefully consider their financial circumstances when selecting a deductible. High deductibles mean lower rates, but you will have to pay more to repair your home if you ever file a claim.

Learn More: Does home insurance cover mold?

Top Picks for Best Homeowners Insurance

The best homeowners insurance companies are Geico, Erie, and Allstate. As the top pick, Geico shines with its competitive prices and trustworthy coverage choices. Geico also offers many discounts that reduce costs while providing robust protection.

Geico offers the best homeowners insurance for its competitive rates and comprehensive coverage tailored to meet diverse needs.

Jeff Root Licensed Insurance Agent

Its easy-to-use platform helps people when buying home insurance. Geico is a top option for those who want affordable and full coverage. Enter your zip code below and start shopping for the best home insurance near you.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frequently Asked Questions

What company has the best homeowners insurance?

Geico is our top pick for the best homeowners insurance for its affordable rates and comprehensive coverage options.

Which homeowners insurance company has the highest customer satisfaction?

Erie ranks high in customer satisfaction and is frequently praised for providing the best homeowners insurance through its excellent customer service.

Who is the most expensive homeowners insurance?

Chubb is known for being one of the most expensive homeowners insurance providers, offering extensive coverage for high-value homes. Enter your ZIP code below to find the best home insurance provider.

Which insurance company has the most complaints?

State Farm has received a notable number of complaints regarding its best homeowners insurance policies, particularly about delays in claim settlements.

Who is the most trustworthy home insurance company?

USAA is considered one of the most trustworthy homeowners insurance companies, especially for military families seeking the best homeowners insurance.

Which homeowners insurance provider is the best for seniors?

The Hartford offers the best home insurance for seniors, as it mainly caters to the needs of retired people.

Which homeowners insurance company is best for claim settlement?

Amica is widely recognized for its efficient claim settlement process, making it one of the best homeowners insurance companies for peace of mind. Our free comparison tool helps you find the right homeowners insurance for your home.

Where is homeowners insurance the most expensive?

Homeowners insurance is the most expensive in coastal areas like Florida, where the risk of hurricanes significantly raises the cost of the best homeowners insurance.

What insurance is the most commonly purchased by homeowners?

HO-3 policies are the most commonly purchased homeowners insurance, providing broad coverage for both the dwelling and personal belongings. Compare the best home insurance for new builds to learn more.

What is the most basic homeowner policy called?

The most basic homeowner policy is the HO-1, which offers limited coverage and is the least comprehensive option among the best homeowners insurance plans.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.