10 Best Car Insurance Companies for GMCs in 2024 (Your Guide to the Top Providers)

State Farm, Geico, and Progressive provide the best car insurance companies for GMCs, starting at only $45 per month. We're dedicated to helping you compare quotes from these reputable insurers, enabling you to find the perfect coverage and take advantage of discounts for your GMC.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for GMC

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,128 reviews

13,128 reviewsCompany Facts

Full Coverage for GMC

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviews

State Farm leads the pack for the best car insurance companies for GMCs, offering competitive rates beginning at only $45 per month for comprehensive coverage.

GMC car insurance quotes can be vastly different in price, but drivers with clean driving records should be able to find car insurance for GMC vehicles at a reasonable rate. Whether you are looking for GMC auto insurance for a GMC Acadia or GMC Envoy, this guide will help you find cheap car insurance for your GMC.

Our Top 10 Picks: Best Car Insurance Companies For GMC

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Comprehensive Options State Farm

#2 25% A++ Competitive Rates Geico

#3 20% A+ Flexible Options Progressive

#4 10% A+ Financial Stability Allstate

#5 10% A++ Military Benefits USAA

#6 12% A Customizable Coverage Liberty Mutual

#7 18% A Personalized Service Farmers

#8 20% A+ Broad Coverage Nationwide

#9 13% A++ Financial Stability Travelers

#10 29% A Customer Satisfaction American Family

- Best Car Insurance Companies

- Best GMC Yukon Hybrid Car Insurance Quotes (2024)

- Best GMC Yukon Denali Car Insurance Quotes (2024)

- Best GMC Vandura Car Insurance Quotes (2024)

- Best GMC Typhoon Car Insurance Quotes (2024)

- Best GMC Syclone Car Insurance Quotes (2024)

- Best GMC Suburban Car Insurance Quotes (2024)

- Best GMC Sonoma Car Insurance Quotes (2024)

- Best GMC Sierra HD Car Insurance Quotes (2024)

- Best GMC Sierra 2500 Classic Car Insurance Quotes (2024)

- Best GMC Sierra 1500 Classic Car Insurance Quotes (2024)

- Best GMC Sierra C3 Car Insurance Quotes (2024)

- Best GMC Sierra 3500 Classic Car Insurance Quotes (2024)

- Best GMC Sierra 3500HD Car Insurance Quotes (2024)

- Best GMC Sierra 2500HD Classic Car Insurance Quotes (2024)

- Best GMC Sierra 2500HD Car Insurance Quotes (2024)

- Best GMC Sierra 1500HD Classic Car Insurance Quotes (2024)

- Best GMC Sierra 1500HD Car Insurance Quotes (2024)

- Best GMC Sierra 1500 Hybrid Car Insurance Quotes (2024)

- Best GMC Sierra 1500 Car Insurance Quotes (2024)

- Best GMC Savana Cargo Car Insurance Quotes (2024)

- Best GMC Savana Car Insurance Quotes (2024)

- Best GMC Safari Cargo Car Insurance Quotes (2024)

- Best GMC Safari Car Insurance Quotes (2024)

- Best GMC S 15 Jimmy Car Insurance Quotes (2024)

- Best GMC S 15 Car Insurance Quotes (2024)

- Best GMC Rally Wagon Car Insurance Quotes (2024)

- Best GMC R/V 3500 Series Car Insurance Quotes (2024)

- Best GMC Jimmy Car Insurance Quotes (2024)

- Best GMC Envoy XUV Car Insurance Quotes (2024)

- Best GMC Envoy XL Car Insurance Quotes (2024)

- Best GMC Envoy Car Insurance Quotes (2024)

- Best GMC Acadia Limited Car Insurance Quotes (2024)

- Best GMC Sierra 2500HD Car Insurance Quotes (2024)

- Best GMC Sierra 3500HD Car Insurance Quotes (2024)

- Best GMC Sierra Car Insurance Quotes (2024)

- Best GMC Acadia Car Insurance Quotes (2024)

- Best GMC Yukon XL Car Insurance Quotes (2024)

- Best GMC Yukon Car Insurance Quotes (2024)

Continue reading to learn about how to find the best car insurance company for GMCs, from what coverages to look for to ways to save no matter what car insurance company you pick. Enter your ZIP code now to begin.

- State Farm offers competitive rates starting at $45 per month

- Leading insurance providers offer options for GMCs

- GMC vehicles can access a variety of discount opportunities

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: Offers some of the lowest rates for GMC vehicles, starting around $55 per month for comprehensive coverage. The 17% multi-policy discount further reduces costs, making it an attractive option for bundling multiple policies.

- Strong Customer Service: Known for its excellent customer service and easy claim process. With an A.M. Best rating of B, State Farm maintains a solid reputation for reliability in handling claims and customer support, ensuring GMC owners are well taken care of.

- Broad Coverage Options: Provides a wide range of coverage options, including customizable policies for various GMC models. This flexibility allows GMC enthusiasts to tailor their coverage to fit specific needs and preferences. Read more with our State Farm auto insurance review for further insights.

Cons

- Limited Digital Tools: Online tools and mobile app functionality may not be as advanced compared to some competitors. This can make managing your policy and accessing support less convenient for tech-savvy GMC drivers.

- Average Discounts for New Drivers: Discounts for new drivers might not be as significant compared to some other providers. The lack of specialized discounts for new drivers could result in higher premiums for those just starting out with their GMC vehicles.

#2 – Geico: Best for Competitive Rates

Pros

- Affordable Rates: Known for its competitive rates, especially for younger drivers and those with good driving records. Geico’s A++ A.M. Best rating highlights its financial strength and stability, ensuring reliability in providing coverage for GMC owners.

- User-Friendly App: Highly-rated mobile app that makes managing your policy and filing claims easier. The app’s ease of use adds a level of convenience that enhances the overall customer experience for GMC drivers. For further insights, check out our Geico auto insurance review.

- Many Discounts: Offers numerous discounts including for safety features, military service, and good students. With a 25% multi-policy discount, Geico provides additional savings opportunities when bundling different types of insurance.

Cons

- Customer Service Concerns: Some customers report issues with customer service responsiveness. Although Geico is strong in other areas, customer service has received mixed reviews, impacting overall satisfaction for GMC enthusiasts.

- Higher Rates for High-Risk Drivers: May not be the best option for drivers with poor driving records or high-risk profiles. High-risk GMC drivers may find that Geico’s rates are less competitive compared to other insurers.

#3 – Progressive: Best for Flexible Options

Pros

- Flexible Coverage Options: Provides a variety of coverage options and add-ons for GMC vehicles, including usage-based insurance. Progressive’s flexibility allows GMC owners to choose coverage that best fits their driving habits and vehicle needs.

- Snapshot Program: Offers a telematics program that can help lower rates based on driving habits. The Snapshot program can lead to potential savings for safe GMC drivers by monitoring driving behavior and adjusting rates accordingly. Read more through our Progressive insurance review.

- Comprehensive Online Tools: Excellent online tools for managing your policy and comparing rates. The user-friendly digital experience is supported by Progressive’s A+ A.M. Best rating, ensuring both reliability and accessibility for GMC enthusiasts.

Cons

- Variable Rates: Rates can be inconsistent, and may vary significantly based on your location and driving history. This variability can make it challenging for GMC owners to predict exact costs without a personalized quote.

- Complex Pricing Structure: The pricing structure can be complex, making it harder to understand how your rates are determined. The complexity may lead to confusion regarding how discounts and surcharges are applied for GMC drivers..

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Allstate: Best for Financial Stability

Pros

- Financial Stability: Known for strong financial stability and ability to pay out claims. Allstate’s A+ A.M. Best rating underscores its financial robustness and reliability in claims settlement for GMC owners.

- Comprehensive Coverage: Offers extensive coverage options and features, including accident forgiveness and new car replacement. This breadth of coverage options is designed to cater to a wide range of GMC drivers’ needs.

- Local Agents: Large network of local agents who can provide personalized service. The presence of numerous local agents allows for tailored advice and support specific to GMC vehicle insurance needs. Read more with our Allstate auto insurance review.

Cons

- Higher Premiums: May have higher premiums compared to some other insurers, especially for drivers with less-than-perfect records. This can be a disadvantage for GMC owners seeking lower-cost options.

- Mixed Customer Reviews: Some customers report mixed experiences with customer service and claims handling. While Allstate is strong in many areas, inconsistencies in service quality may impact overall satisfaction for GMC enthusiasts.

#5 – USAA: Best for Military Benefits

Pros

- Excellent Service: Highly rated for customer service and claims handling, particularly for military families. USAA’s A++ A.M. Best rating and specialized focus on military members enhance its reputation for excellent service to GMC owners.

- Exclusive Discounts: Offers exclusive discounts for military members and their families. The 10% multi-policy discount and other military-specific savings can make insurance more affordable for eligible GMC drivers.

- Comprehensive Coverage: Provides comprehensive coverage options tailored to the needs of military personnel. This includes unique benefits and features designed to meet the specific requirements of military GMC enthusiasts. Learn more through our USAA insurance review.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families, limiting access for others. This exclusivity means that non-military GMC owners cannot benefit from USAA’s offerings.

- Limited Local Agents: Fewer local agents compared to some other insurers, which can impact personalized service. The reliance on a smaller network of agents may affect the availability of in-person support for GMC enthusiasts.

#6 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Coverage: Offers a wide range of customizable coverage options, including add-ons like new car replacement. Liberty Mutual’s A rating from A.M. Best reflects its solid financial standing and ability to provide tailored coverage solutions for GMC drivers.

- Excellent Discounts: Provides various discounts, such as for hybrid vehicles, bundling policies, and good students. The 12% multi-policy discount is a notable feature for GMC owners who bundle multiple insurance products.

- Strong Financial Ratings: Known for financial stability and reliability. Liberty Mutual’s A rating from A.M. Best indicates a strong capacity to handle claims and maintain financial health for GMC enthusiasts. Check out our Liberty Mutual auto insurance review.

Cons

- Higher Rates for Some: May have higher rates compared to some competitors, particularly for newer or high-risk drivers. This can be a disadvantage for GMC owners seeking more affordable insurance options.

- Customer Service Variability: Customer service quality can vary depending on the local office and agent. Inconsistencies in service levels may affect the overall customer experience for GMC drivers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Known for providing personalized service and customized insurance solutions. Farmers’ A rating from A.M. Best supports its reputation for strong customer service and reliable coverage for GMC owners.

- Wide Range of Coverage: Offers a broad selection of coverage options, including specialized coverage for different GMC models. Farmers’ flexibility in coverage ensures that specific needs and preferences of GMC enthusiasts are met.

- Discount Programs: Various discount opportunities, including bundling and safe driving discounts. The 18% multi-policy discount is particularly attractive for GMC drivers looking to save by combining insurance products. Check out our Farmers auto insurance review for your guidance.

Cons

- Higher Premiums: Rates may be higher compared to some competitors, particularly for newer or high-risk drivers. This can lead to higher overall costs for GMC owners with less-than-perfect driving records.

- Mixed Online Experience: The online tools and app may not be as user-friendly or advanced as some other insurers. This can affect the convenience of managing your policy and accessing support online for GMC enthusiasts.

#8 – Nationwide: Best for Broad Coverage

Pros

- Comprehensive Coverage Options: Provides extensive coverage options, including unique features like vanishing deductibles. Nationwide’s A+ A.M. Best rating underscores its reliability and ability to offer diverse coverage solutions for GMC owners.

- Customer Satisfaction: High ratings for customer satisfaction and claims handling. Nationwide’s strong financial stability and customer service contribute to positive experiences for GMC drivers.

- Flexible Coverage: Offers flexible coverage options tailored to different GMC models and driver needs. This adaptability ensures that specific insurance needs of GMC enthusiasts are effectively addressed. Read more through our Nationwide insurance review.

Cons

- Higher Rates for Certain Models: Insurance rates might be higher for certain GMC models, such as the Sierra 2500HD. This can lead to increased costs for owners of these specific GMC vehicles.

- Complex Policy Terms: Policy terms and options can be complex, requiring careful review. The complexity may require additional time and effort to fully understand and select the right coverage for GMC drivers.

#9 – Travelers: Best for Financial Stability

Pros

- Strong Financial Stability: Known for strong financial stability and reliability in paying out claims. Travelers’ A++ A.M. Best rating reflects its ability to handle claims effectively and maintain financial health, providing reassurance for GMC owners.

- Broad Coverage: Offers a comprehensive range of coverage options, including customizable policies. This broad selection allows GMC enthusiasts to tailor their insurance to their specific needs and vehicle requirements. Read more with our Travelers auto insurance review.

- Discount Opportunities: Provides numerous discounts, including for bundling and safe driving. The 13% multi-policy discount is advantageous for GMC owners who bundle different types of insurance, potentially reducing overall costs.

Cons

- Higher Premiums for High-Risk Drivers: Rates can be higher for drivers with poor driving histories or high-risk profiles. GMC drivers with less favorable records may find Travelers less cost-effective.

- Customer Service Variability: Experiences with customer service can vary depending on location and specific agent. Inconsistencies in service quality may impact overall satisfaction for GMC owners seeking personalized support.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – American Family: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Known for high customer satisfaction and positive reviews from policyholders. American Family’s A rating from A.M. Best supports its reputation for excellent service and reliability, which is beneficial for GMC drivers.

- Comprehensive Coverage: Offers a wide array of coverage options, including accident forgiveness and vanishing deductibles. This range of options provides valuable benefits and protection tailored to GMC vehicle owners. Read more with our American Family auto insurance review.

- Discount Programs: Includes discounts for bundling policies, safe driving, and other criteria. The 29% multi-policy discount is particularly attractive for GMC enthusiasts who combine multiple insurance products, potentially leading to significant savings.

Cons

- Higher Premiums for Some Drivers: May have higher premiums compared to competitors, particularly for high-risk drivers. This can be a disadvantage for GMC owners with challenging driving records.

- Limited Digital Features: Digital tools and online resources might not be as advanced as those offered by some other insurers. This can affect the convenience and efficiency of managing your policy online, which may be less appealing to tech-savvy GMC drivers.

Types of Car Insurance Coverages for GMCs

To save on car insurance, focus on carrying only the essential types of car insurance coverages required by your state and, if applicable, your GMC’s lender. Most states mandate liability insurance, which covers costs if you cause an accident that injures others or damages property.

Additionally, some states require Medical Payments (MedPay) insurance, which helps with medical bills after an accident, and Personal Injury Protection (PIP), which covers medical expenses, lost wages, and more. Uninsured/Underinsured Motorist coverage is also required in some states to cover costs if you’re hit by a driver with insufficient or no insurance.

GMC Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $65 $150

American Family $50 $135

Farmers $55 $135

Geico $45 $125

Liberty Mutual $60 $145

Nationwide $50 $140

Progressive $55 $140

State Farm $50 $130

Travelers $55 $145

USAA $40 $120

States vary in their coverage limits, so higher liability coverage might be necessary depending on your location. For vehicles with a lease or loan, collision and comprehensive insurance are often required and are beneficial for covering repair costs. However, for older GMC models that have significantly depreciated in value, these coverages may be unnecessary if their cost approaches the vehicle’s value.

Optional coverages like gap insurance, modified car insurance, rental car insurance, roadside assistance, and umbrella insurance can provide additional benefits but are not required and will raise your rates. Consider these options based on your needs and budget to enhance your coverage effectively.

Average GMC Insurance Rates

Insurance costs are important to consider when shopping for a model of car. The average cost of car insurance varies based on several factors. Some of the factors that will affect your car insurance rates are which model you choose and which coverages you choose, as you can see from the car insurance rates below.

A GMC Sierra 2500HD will be more expensive to insure, as is the GMC Yukon. Models that will be cheaper to insure are the GMC Acadia and the GMC Canyon. Basically, GMC models with higher retail costs will have higher insurance rates.

This is because replacement parts cost more if serious damage to expensive cars occurs. As well, if the more expensive GMC is totaled, insurance will have to pay you more than if a cheaper car was totaled.

In addition to what model you own, two other factors that will play a bearing on what insurance rates you pay are age and driving record, shown by the rates below.

If you are a younger driver or a driver with a poor driving record, make sure you do research into which companies are best for your driving demographic. For example, a company that is advertised as cheap may be cheap for the majority of drivers but not for drivers with a DUI or drivers under the age of 20. Enter your ZIP code now to begin comparing.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Picking the Right GMC Car Insurance Company

Price is a big factor to consider when shopping among car insurance companies, and it is usually one of the top deciding factors when drivers are looking for a new car insurance company. However, there are other things to consider when looking for the best company for your GMC. You should also consider the following factors when picking a company.

Some sites to check for car insurance company ratings include A.M. Best, J.D. Power, and the BBB. You want to ensure the company has solid ratings and a smooth claim-handling process before signing up.

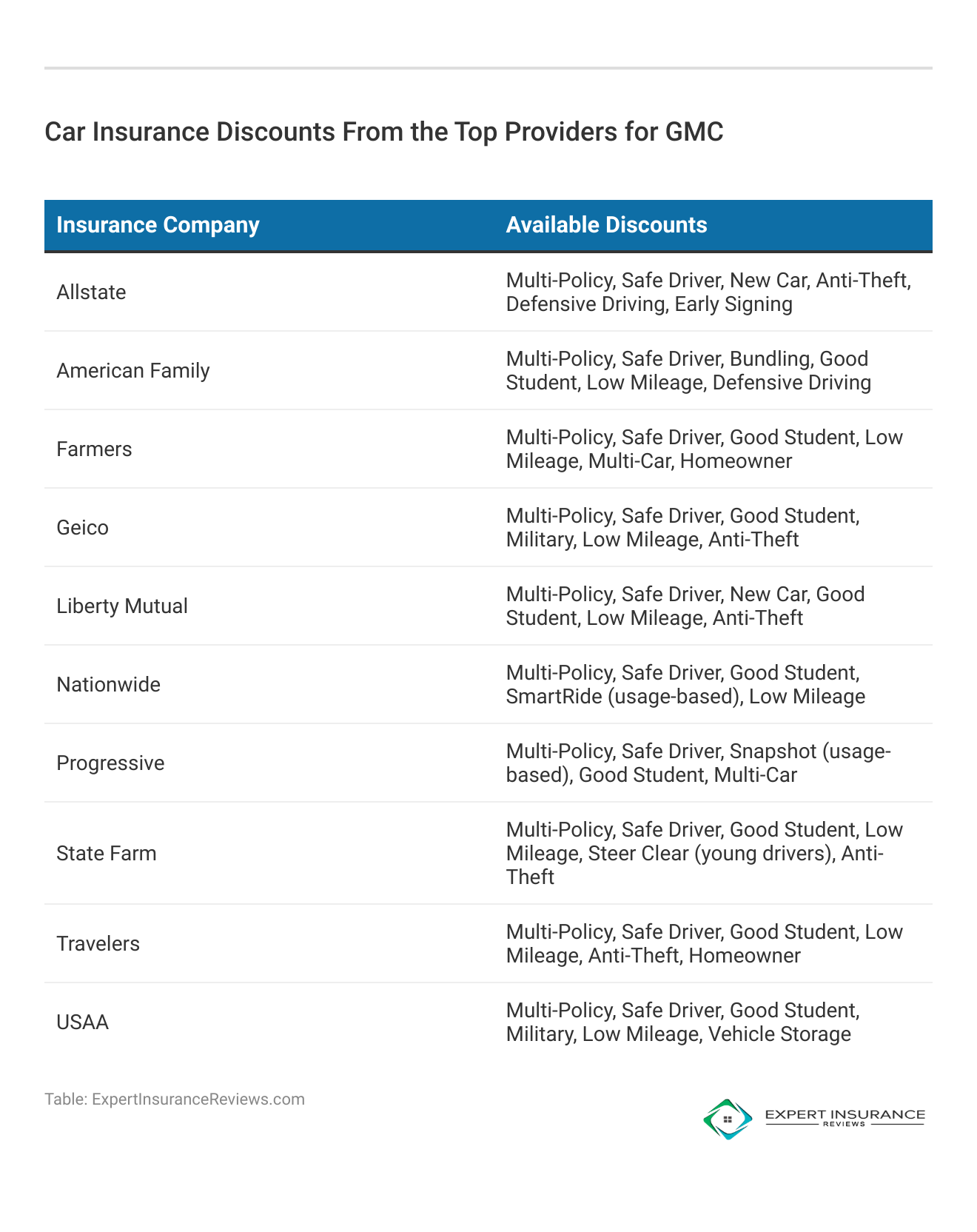

Ways to Save on GMC Car Insurance

If you want to save on your GMC car insurance rates, the first thing you can do is see if your car insurance company has any more car insurance discounts you can apply for. If your car insurance company sells more than one type of insurance, you could purchase a second type of insurance to earn a bundling discount.

You can also check for defensive driver discounts, good student discounts, and other discounts that aren’t automatically applied to policies. If you qualify, you can sign up for these discounts by submitting proof of eligibility, such as a transcript showing that you are earning B grades or higher at school.

Tim Bain

Licensed Insurance Agent

If you have already gotten all the car insurance discounts available to you, then you can look into raising your car insurance deductibles to lower your car insurance rates. You should only do this if you have a low deductible, as you still want to easily afford to pay the car insurance deductible after an accident.

Finally, if you have already worked to lower your car insurance rates at your current insurance company, then the next thing you should do is see what rates other companies are charging. Getting plenty of car insurance quotes will help drivers see which company has the best coverage and rate for their needs. Learn how to get car insurance. Enter your ZIP code now to begin.

The Final Word on GMC Car Insurance

The majority of drivers will be able to find affordable car insurance rates for their GMC. Most GMC models have average rates, although more expensive models will cost more on average to insure. Drivers with poor driving records will also have higher rates, but as long as they take the time to compare car insurance rates, they should be able to save at least a little on their policy.

To find the best car insurance company for GMCs in your area, use our free car insurance quote comparison tool. It helps you find the best rate and coverage for your GMC model. Enter your ZIP code now to begin.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frequently Asked Questions

What is GMC?

GMC is a brand of trucks, vans, and SUVs manufactured by General Motors.

Is GMC insurance expensive?

Most GMC insurance rates are average compared to other car insurance brands, but GMC will be higher for more expensive GMC models.

Drivers that are high-risk, such as young drivers and drivers with poor driving records, will also have higher rates. Enter your ZIP code now to begin.

Does GMC have insurance?

Yes, GMC offers OnStar insurance services, but it’s crucial to check expert insurance reviews before committing.

Understanding whether OnStar insurance is a good choice and comparing quotes will help you make an informed decision.

Just because a company provides insurance tailored to a specific car brand doesn’t necessarily mean it is the best option available.

Are GMC Sierra 1500 insurance rates expensive?

GMC Sierra 1500 insurance rates will be similar in price to the other GMC models we covered in this guide.

If you find that your rates are expensive for your GMC Sierra 1500, take the time to shop around and get a few other quotes to see if you are getting the best car insurance rate.

Which insurance provider offers the highest multi-policy discount for GMC vehicles?

American Family offers the highest multi-policy discount at 29%. This substantial discount helps reduce overall insurance costs when bundling multiple policies. Enter your ZIP code now to begin.

What unique coverage options does Progressive offer for GMC vehicles?

Progressive is known for its flexible coverage options, including a variety of add-ons tailored to GMC vehicles. This flexibility allows drivers to customize their coverage to better suit their individual needs.

Additionally, Progressive is one of the best car insurance companies that accept Discover, making it easier for drivers who prefer to use this payment method to manage their premiums.

How does Geico’s mobile app enhance the customer experience?

Geico’s mobile app is highly rated for its user-friendly interface and efficient claims processing. It also offers features like roadside assistance and policy management on-the-go, enhancing overall customer convenience.

What are the key benefits of USAA’s coverage for military families?

USAA provides specialized benefits for military families, including deployment and relocation support. Their coverage often includes competitive rates and tailored services that accommodate the unique needs of service members. Enter your ZIP code now to begin.

Which insurer provides the most comprehensive coverage options for GMC models?

State Farm offers the most comprehensive coverage options for GMC models, including extensive add-ons and optional coverages. Their plans are designed to provide thorough protection across a range of scenarios.

Additionally, State Farm is one of the best car insurance companies that accept checks for premium payments, which adds flexibility and convenience for policyholders who prefer traditional payment methods.

How does the 20% multi-policy discount from Nationwide compare to other providers?

Nationwide’s 20% multi-policy discount is competitive and aligns with the discounts offered by other top providers. This discount helps policyholders save significantly when bundling multiple insurance policies.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.