Best Connecticut Car Insurance (2025)

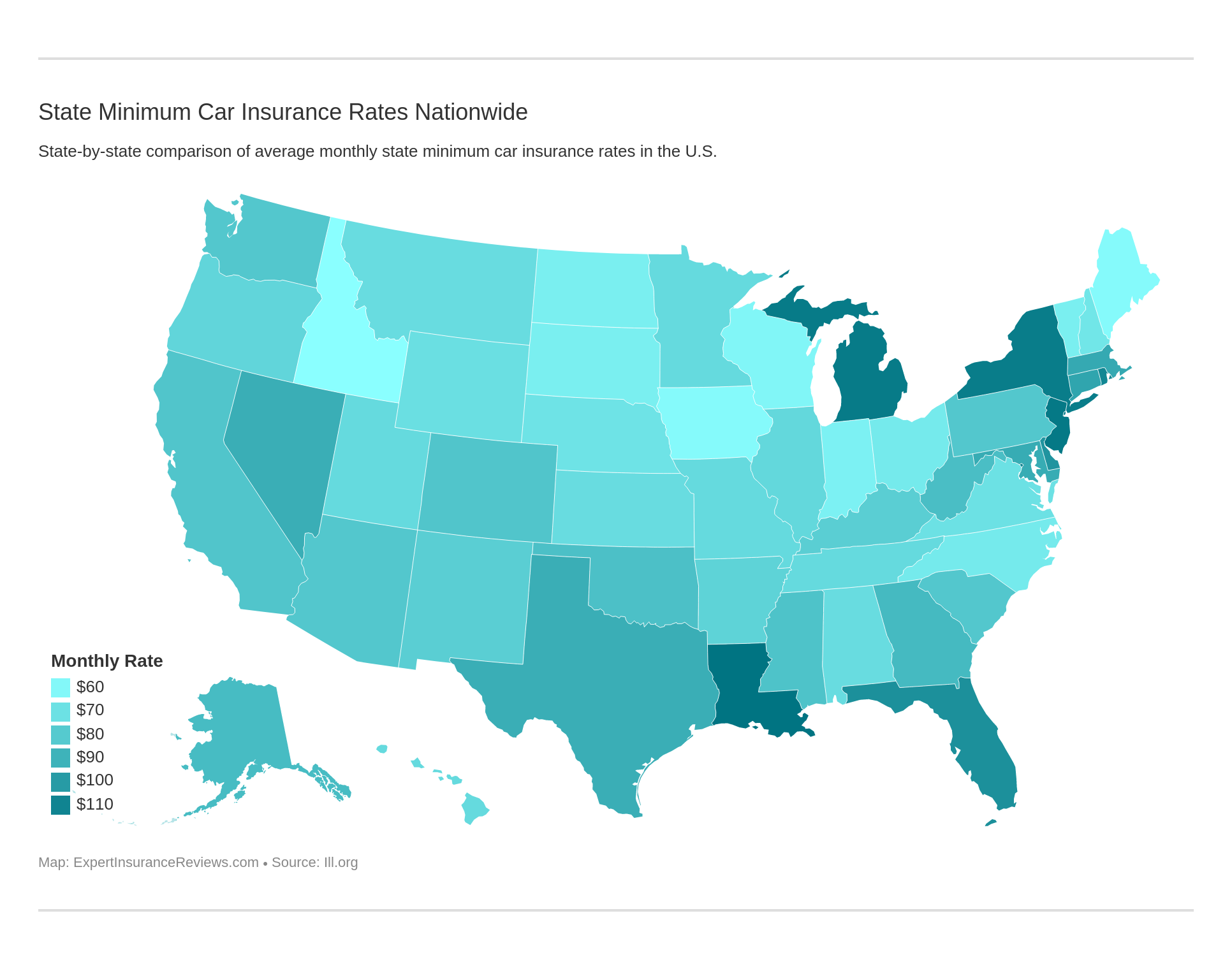

Connecticut car insurance rates average $136 per month while Connecticut minimum car insurance requirements are 25/50/25 for bodily injury and property damage coverage. The insurance companies providing the best Connecticut car insurance coverage are State Farm, Geico, and USAA.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

CT Stats Summary

| Connecticut Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 21,512 Vehicle Miles Driven: 315.9 billion |

| Vehicles | Registered: 2,755,233 Stolen: 6,338 |

| State Population | 3,574,147 |

| Most Popular Vehicle | Nissan Rogue |

| Uninsured Motorists | 9.4% State Rank: 36 |

| Total Driving Fatalities | 2008-2017 Speeding: 856 Drunk Driving: 1,064 |

| Annual Average Premiums | Collision: $348.70 Comprehensive: $126.02 Liability: $633.95 |

| Cheapest Providers | State Farm & GEICO |

Connecticut is one of the most densely populated states in the country. With so many people in the state and drivers on the road, you’ll want to make sure you’re prepared whether you’re a resident, college student, or visitor.

The best way to do this is by making sure you choose the best Connecticut car insurance coverage for your needs and lifestyle. You’ll also want to keep in mind the rules of the road, so you can drive safely in the state.

In order for you to make an informed decision on your car insurance, you need to know your options, the types of coverage available, which companies may be the best fit for you, and more. There’s a lot to know. But don’t worry; take a deep breath, because we’ve put together everything you need to know right here.

Keep reading to find the information you need to know when making that all-important car insurance coverage decision. Ready to get started? Why not use your zip code to get cheap car insurance quotes.

Connecticut Car Insurance Coverage and Rates

Making the right decision for your car insurance coverage can be difficult. What kind of coverage do you need? What does the state require you to have? Where do you go to find out what your options are? Knowing this information is key when having a conversation with an insurance agent, so you can be your own advocate and know what questions to ask.

Knowing how frustrating, time-consuming, and sometimes overwhelming this can be, we’ve gathered information on insurance providers in your area, minimum state car insurance requirements, average rates, and more so you’ll be ready when its time to decide.

A good place to get started is price. Knowing the average rates, and how they’re derived, as well as how those rates compare to rate across the country, can help you determine what’s reasonable for your needs and income.

Check out this table to see what an average rate for all types of car insurance can be in Connecticut, compared to an average rate of the same for the country as a whole.

| Connecticut Average | National Average | Percent Difference |

|---|---|---|

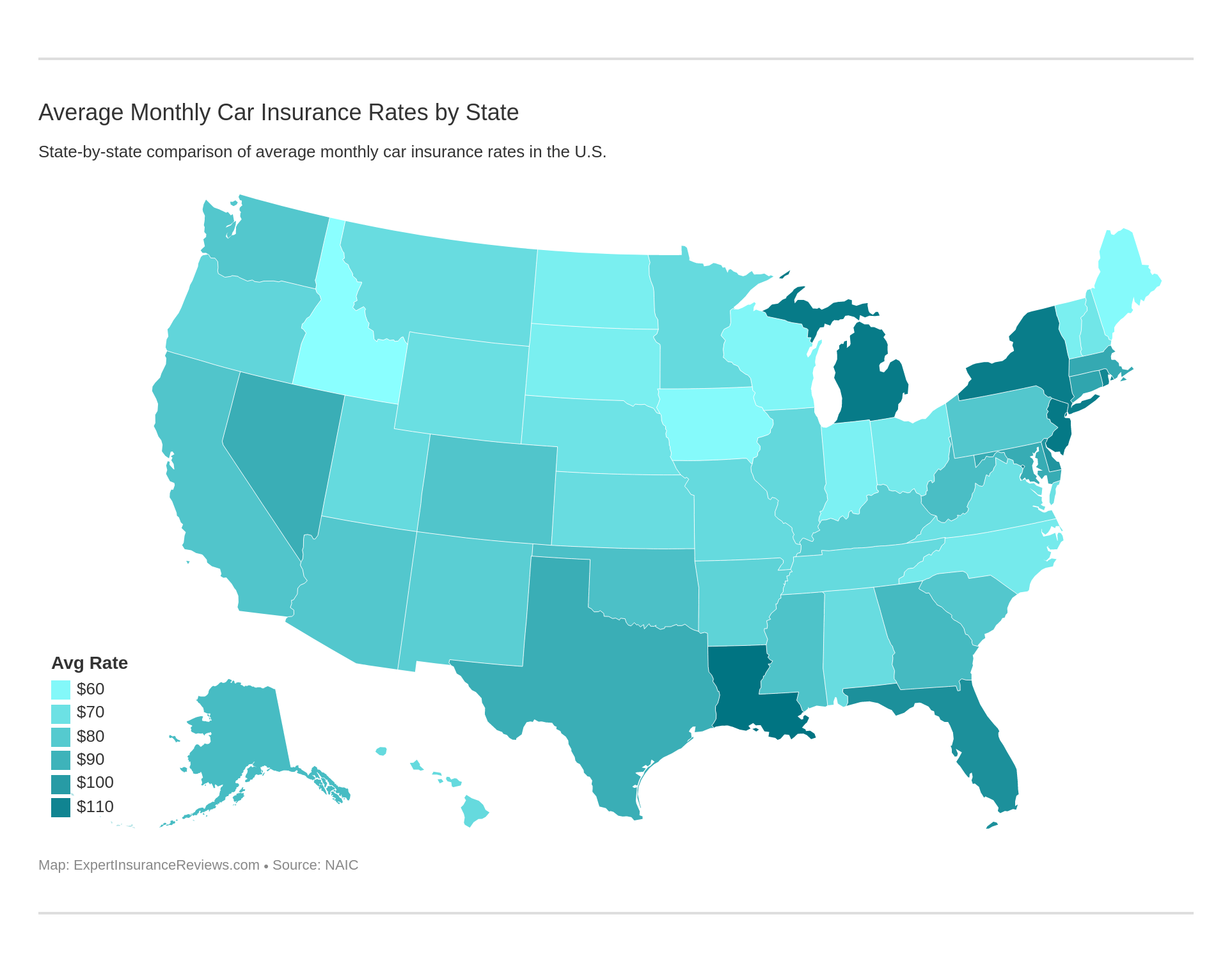

| $1,638 | $1,474 | 11.13% |

Based on the data in this table, you can see that a national average for all car insurance types is $1,474, compared to the Connecticut state average of $1,638. In other words, Connecticut drivers can expect to pay about 11 percent more for car insurance than the country-wide average.

Connecticut Minimum Coverage

To keep every driver financially protected when they are out on the road, Connecticut (like other states in the country) requires all drivers (of both cars and motorcycles) to maintain minimum liability insurance coverage. Without at least this minimum coverage, you cannot legally drive on the road in the state.

In the event of a car accident, whoever is at fault will be financially responsible for any damages that result from the accident. This is termed a “fault” system. Connecticut, like many states, practices this approach for handling financial responsibility when an accident occurs.

With this in mind, knowing what drivers are required to maintain can help you be prepared and informed, when deciding if you need coverage beyond the minimum requirements. Connecticut drivers must maintain the minimum coverage requirements in this table.

| Required Insurance | Minimum Limits |

|---|---|

| Bodily Injury | $25,000 per person $50,000 per accident |

| Property Damage Liability | $25,000 |

| Uninsured/Underinsured Motorist Coverage | $25,000 per person $50,000 per accident |

Many states do not require drivers to purchase uninsured/underinsured motorist coverage. Often, this is considered additional, voluntary, liability coverage. However, in Connecticut, this is required for all drivers.

It is important to note that the insurance coverage listed in the above table is just the minimum requirement. If you are in an accident and the cost of damages exceeds the amounts required for minimum coverage, you will be personally financially responsible to pay the difference.

To obtain additional financial protection, you can purchase core coverage, additional liability, and other add-ons, riders, etc.

But how do you know what’s right for you? Keep reading to learn more about these options.

Forms of Financial Responsibility

In Connecticut, the only acceptable form of financial responsibility is proof of car insurance coverage. If you do not have a valid proof of insurance with you when at a traffic stop, you may face fines, suspension of your driver’s license and driving privileges, and possibly even jail time.

Connecticut, like 47 other states in the country, does accept electronic proof of insurance if you are at a traffic stop.

However, the only options available to you for proof of insurance are a declaration page or a valid permanent insurance card (the electronic proof must be considered a valid permanent insurance card). The state does not accept temporary insurance cards, bills, or binders as legal proofs of insurance.

Premiums as a Percentage of Income

Since insurance coverage is required in Connecticut, you’ll need to ensure you’re ready to pay for at least the minimum coverage level in the state. But what does this mean for your wallet? How much of your income can you expect to allocate to insurance coverage?

Take a look at this table to find out how much of your disposable income you may be spending on car insurance coverage. You can also see how Connecticut drivers compare to the national average, for disposable income spent on car insurance coverage.

https://docs.google.com/spreadsheets/d/1DA7O8uoueN3xKFu40Kn6_GZSVadpPdGgoVFUHXzF_K4/edit#gid=1272428312

| Averages | 2012 | 2013 | 2014 |

|---|---|---|---|

| Connecticut Average | 1.94% | 2.06% | 2.02% |

| National Average | 2.34% | 2.43% | 2.40% |

| Percent Difference | 21% | 18% | 19% |

Based on this data, Connecticut drivers spend about 2.01 percent of their disposable income on car insurance coverage. In comparison, the national average for disposable income spent on car insurance is 2.39 percent, which is about 19 percent more than Connecticut residents.

In the below table, we compare Connecticut to its nearest neighbors for disposable income spent on car insurance coverage. We specifically take a look at the amount of disposable income residents in Rhode Island, Massachusetts, New York, and New Jersey spend on car insurance coverage.

https://docs.google.com/spreadsheets/d/1DA7O8uoueN3xKFu40Kn6_GZSVadpPdGgoVFUHXzF_K4/edit#gid=1272428312

| State | 2012 | 2013 | 2014 |

|---|---|---|---|

| Connecticut | 1.94% | 2.06% | 2.02% |

| Massachusetts | 2.12% | 2.23% | 2.20% |

| New Jersey | 2.75% | 2.86% | 2.76% |

| New York | 2.80% | 2.85% | 2.77% |

| Rohde Island | 2.83% | 2.94% | 2.95% |

As you can see, as compared to their neighbors, Connecticut residents are in luck, as they spend less of their disposable income on car insurance than residents of all four of the states nearest to them.

CalculatorPro

Average Monthly Car Insurance Rates in CT (Liability, Collision, Comprehensive)

Minimum liability coverage is just that. The minimum amount of coverage you can purchase. It may not cover all your needs. In fact, in the event of an accident, it may not even cover the cost of damages you are responsible for paying. If that happens, you will be responsible for paying the difference out of your own pocket.

How can you increase the protection you have in your policy? Your insurance provider also offers something called “core coverage,” which you can purchase for your policy to increase your coverage. Within core coverage, you have the following options: collision, comprehensive, and full/combined. You have the choice to purchase all or some of these.

Check out this video to find out more about core coverage and the protections each can offer.

To find out how much you might pay for each of the core coverage types, as well as minimum liability coverage, check out the below table.

Imported from Manual Input

| Coverage Type | 2011-2015 Average Cost in Connecticut | 2011-2015 National Average | Percent Difference |

|---|---|---|---|

| Liability | $633.95 | $516.39 | 22.77% |

| Collision | $348.70 | $299.73 | 16.34% |

| Comprehensive | $126.02 | $138.87 | -9.25% |

| Combined/Full | $1,108.67 | $954.99 | 16.09% |

These are average numbers, so they are just a baseline, but they can help you start to form an idea of what a reasonable rate for you might be. The National Association of Insurance Commissioners (NAIC) rates in the above table may not be representative of what your rates ultimately will be, because they are based on the minimum coverage requirements in Connecticut.

Take a look at how average rates compare between Connecticut and its surrounding states.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Additional Liability Coverage Options

If core coverage doesn’t seem like enough, you have some additional liability options you can purchase as well.

You already know about uninsured/underinsured motorist coverage, which is required in Connecticut, as a part of the minimum liability coverage for drivers in the state.

As the name implies, this additional liability coverage provides financial protection for you, should you ever end up in an accident with an uninsured driver. With 9.4 percent of drivers in the state currently uninsured, this may be something you face.

There are two other forms of additional liability coverage available to you for consideration:

- Medical Payments (MedPay) – provides additional coverage for medical costs that are not covered by your core insurance coverage (for both you and anyone listed on your policy)

- Personal Injury Protection (PIP) – provides additional coverage for medical costs that are not already covered by your core insurance coverage (for you and anyone involved in an accident, no matter who is at fault)

Making sure you are aware of all your options, including these additional liability coverage choices, is important as you consider the best car insurance coverage mix for your lifestyle.

But you want to know purchasing these options is worth it, right? If your insurance company can’t or won’t pay out on claims for these coverage types, should you ever need to file one, it may not be worth the extra cost to you to add these to your policy.

The NAIC provides what is called “loss ratio” data, so you can find out if insurance companies you’re considering can (and are willing) to pay out on claims. The loss ratio is a percent generated by comparing how many claims an insurance company pays to the premiums they are paid.

To understand what this data means, you need to know what a good loss ratio looks like. Ultimately the percentage indicates whether or not companies are paying out on a fair number of claims. An optimal range for loss ratio is between 60 and 80 percent.

If insurance companies have loss ratio numbers that are above this range, they are paying out on too many claims. While this may sound good for you, it’s not, because if an insurance company pays out on too many claims, they are actually losing money.

If insurance companies have loss ratio numbers that are below the 60-80 percent range, this means they are not paying out on enough claims.

The NAIC provides loss ratio data for the insurance market in Connecticut across a three-year range for uninsured/underinsured motorist coverage, PIP, and MedPay. We’ve collected this information and put it in the below table.

Ihttps://www.naic.org/prod_serv/AUT-PB-15.pdf

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Uninsured/Underinsured Motorist | 66.28% | 61.91% | 57.36% |

| Personal Injury Protection | 95.40% | 78.54% | 77.20% |

| MedPay | 84.13% | 78.08% | 79.20% |

As you can see, both uninsured/underinsured motorists and MedPay loss ratio numbers are in healthy ranges for all three years, though MedPay is on the high side for 2013. The PIP loss ratio number for 2013 is too high, at 95 percent. However, for 2014 and 2015, the loss ratios are within the optimal range.

Add-ons, Endorsements, and Riders

If you have core coverage, and even additional liability coverage, and still feel you need more protection, there are some extra options you can consider. You can speak to your insurance agent about the following add-ons, endorsements, and riders that can also be added to your policy:

- Guaranteed Auto Protection (GAP) – covers the gap between what your car is worth and what you still owe on your loan

- Personal Umbrella Policy (PUP) – provides protection in the event you are ever faced with a lawsuit as a result of your part in a car accident

- Rental Reimbursement – provides coverage if you have to rent a car if yours is damaged in a car accident and is unavailable to drive while it is being repaired

Read more: Does my car insurance cover rental cars when I am traveling out of town?

- Emergency Roadside Assistance – provides coverage for various roadside needs, like a flat tire, towing, etc.

- Mechanical Breakdown Insurance – provides repair coverage, often beyond what is covered by your vehicle’s warranty

- Non-Owner Car Insurance – provides insurance coverage when you don’t own a car

- Modified Car Insurance Coverage – provides coverage for vehicles with special modifications (ex. wheels/tires, specialty paint jobs, spoilers, etc.)

- Classic Car Insurance – provides coverage for vehicles that are considered collector’s items

- Pay-As-You-Drive or Usage-Based Insurance – insurance coverage that is specifically focused on individual driving habits

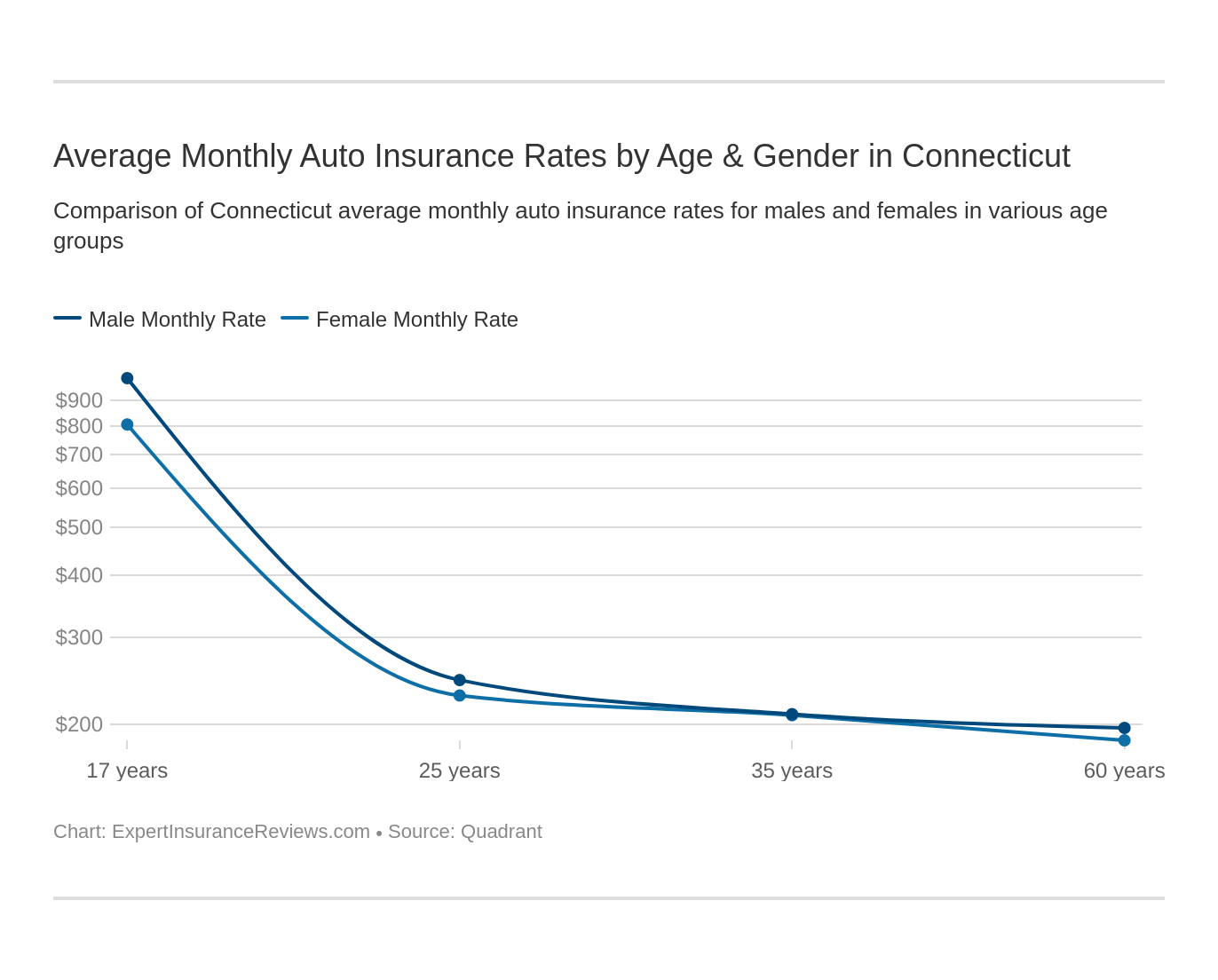

Average Car Insurance Rates by Age & Gender in CT

Though it is becoming somewhat controversial, so much so that some states have outlawed it, many states still allow insurance companies to include gender as a factor when adjusting car insurance premium rates. Connecticut is currently still in the group of states that allow gender as a factor.

However, does gender really have as big of an impact on insurance rates as is sometimes suggested? Does age have any effect on the gap in rates often associated with gender?

Quadrant provides data to answer these questions in Connecticut, which we’ve listed in the below table.

| Company | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| GEICO General | $5,263.28 | $6,225.80 | $2,191.49 | $2,126.23 | $2,272.26 | $2,278.35 | $2,107.40 | $2,124.47 |

| State Farm Mutual Auto | $5,517.07 | $6,936.22 | $2,041.38 | $2,342.71 | $1,815.86 | $1,815.86 | $1,670.41 | $1,670.41 |

| USAA CIC | $6,175.72 | $6,480.54 | $2,622.21 | $2,716.62 | $1,958.26 | $1,937.36 | $1,826.50 | $1,802.82 |

| Nationwide Discover Agency | $6,485.04 | $8,226.75 | $2,717.04 | $2,921.42 | $2,343.37 | $2,370.04 | $2,105.93 | $2,209.18 |

| Progressive Casualty | $11,031.05 | $12,232.33 | $3,016.42 | $3,379.83 | $2,642.90 | $2,461.27 | $2,252.80 | $2,346.17 |

| Allstate F&C | $11,215.24 | $13,243.90 | $3,843.87 | $4,038.70 | $3,673.14 | $3,634.67 | $3,382.07 | $3,621.23 |

| Travelers Home & Marine Ins Co | $13,987.79 | $22,605.07 | $1,970.21 | $2,216.01 | $1,810.97 | $1,837.61 | $1,806.15 | $1,800.54 |

| Safeco Ins Co of IL | $17,597.17 | $19,837.39 | $3,558.72 | $3,883.84 | $3,516.76 | $3,825.92 | $2,706.04 | $3,337.15 |

When you look at the data in the above table, you can see that both gender and age are factors when insurance companies adjust rates for drivers in Connecticut. However, different companies adjust their rates more or less dramatically based on these factors.

Take Travelers Home & Marine Insurance Company, for example, whose rates for 17-year-old males are about 62 percent more than their rates for 17-year-old female drivers. But USAA’s rates for males of the same age is only about five percent more than their rates for female drivers.

For all the companies in the above table, 17-year-old males pay an average of 22 percent more than 17-year-old females pay for car insurance coverage. However, age is definitely a factor in this gender rate gap.

When you’re 25, males pay an average of about eight percent more than female drivers. By the time you turn 35, the average difference between males and females is less than half a percent, with some companies like Progressive and Allstate even charging female drivers a bit more than male drivers for car insurance coverage.

Data in the above table is based on what drivers in Connecticut have actually purchased. To make it representative of the full span of drivers, it includes rates for high-risk drivers, drivers who only have liability coverage, and drivers who purchase additional coverage.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

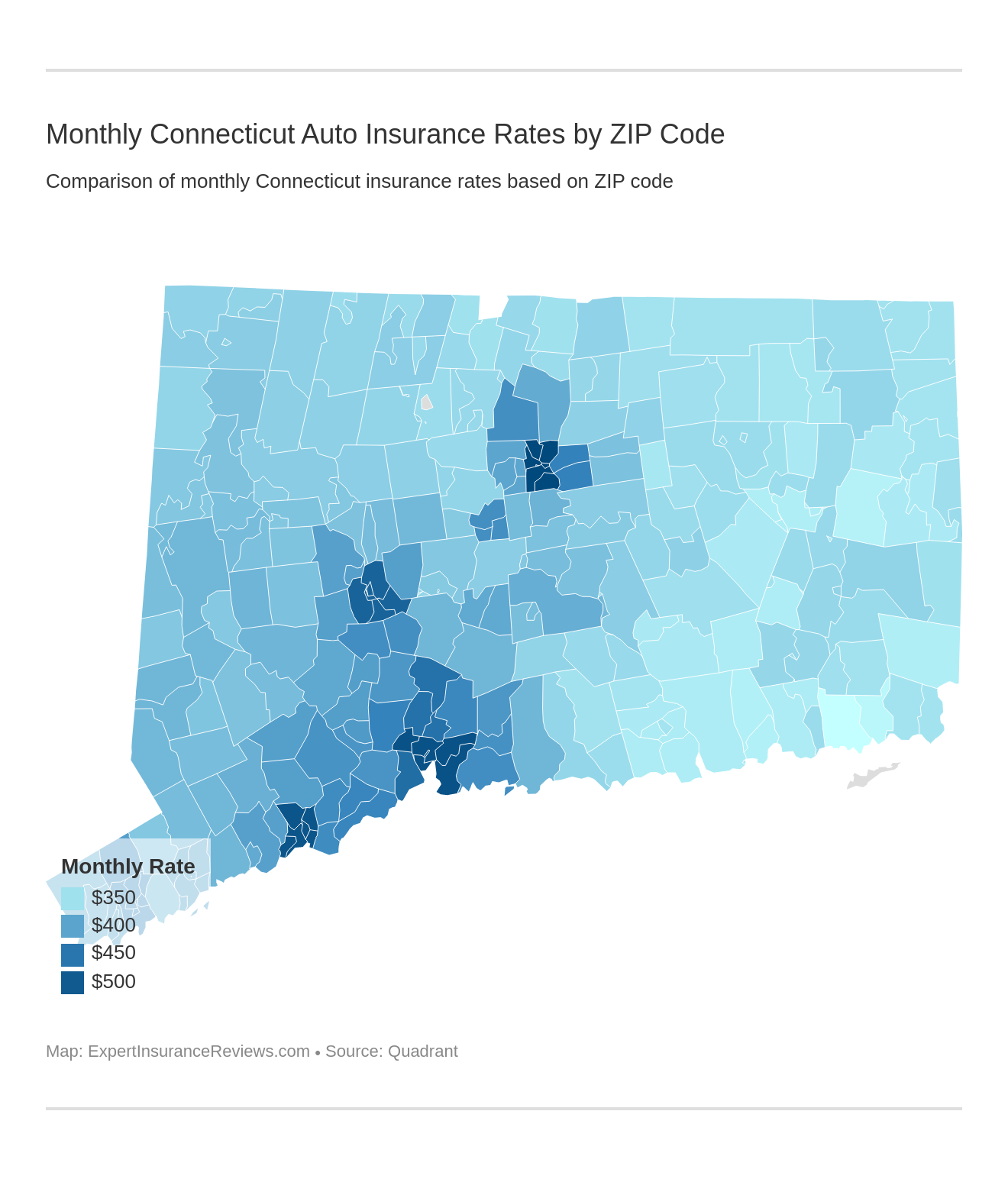

Cheapest Rates by ZIP Code

In addition to age and gender, car insurance companies count your ZIP code among the factors they consider when adjusting your rates. Where you live can have a significant effect on your insurance premiums.

Why? One of the ways companies adjust rates is by research crime statistics in order to better gauge the risk they are taking by insuring you. How do they do this? Often they research these statistics based on ZIP code.

As you can see, ZIP code is significant, as even in the same city, your rates can vary quite widely. If you live in Hartford, Connecticut, the average rate in the 06016 ZIP code is $4,292.35, while if you live in the same city in the 06120 ZIP code, the average rate is $6,373.96. This is nearly a 50 percent increase from 06016 to 06120.

Cheapest Rates by City

Now that we’ve looked at zip codes, let’s take a look at rates by city.

As you might expect, the larger cities in Connecticut (Hartford, New Haven, Bridgeport, etc.) have higher rates than the smaller towns like Mystic and Canterbury. Across all the cities and towns listed in the above table, there is about a 63 percent difference from least to highest average rates.

Connecticut’s 10 largest cities and their average premiums are located in the below table.

| Rank | City/Town | Average Annual Rates |

|---|---|---|

| 1 | Bridgeport | $6,067.20 |

| 2 | New Haven | $6,173.99 |

| 3 | Hartford | $5,131.08 |

| 4 | Stamford | $4,855.38 |

| 5 | Waterbury | $4,094.49 |

| 6 | Norwalk | $4,710.55 |

| 7 | Danbury | $4,622.17 |

| 8 | New Britain | $5,004.14 |

| 9 | Bristol | $4,594.54 |

| 10 | Meridan | $4,749.98 |

The average premiums in this table were calculated using the averages for ZIP codes in each city (from the data in the previous sections). It is interesting to note that while the largest cities remain the most expensive, the fourth-most expensive city for insurance premiums is New Britain, which is the eighth-largest city on the list.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Best Connecticut Car Insurance Companies

You should consider more than just rates when deciding which car insurance company and coverage mix is the best for your needs. There are less quantitative and more qualitative considerations you should look at when making this all-important-decision.

For example, knowing the financial stability and customer service ratings of a company are both key pieces of information in deciding on which company is best for you.

We know finding and deciphering this data can be frustrating. How do you find it? Where do you start looking? How do you make sure the data you’re looking at allows you to make an apples-to-apples comparison between companies? Don’t worry, because we’ve got your back.

To help you make the best decision, we’ve collected information on the largest providers in the state from JD Power and AM Best.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

The Largest Companies Financial Rating

As we discussed when we looked at loss ratio for the additional liability coverage available to you in Connecticut, it’s important for you to know that a company from which you purchase insurance is financially able to pay out on claims, should you ever need to file one.

But aside from loss ratio, how do you know if a company will pay out on claims? Loss ratio only tells you whether or not a company pays claims, and if so how much, but not whether or not a company is actually financially stable enough to do so.

AM Best, which is a global credit firm that looks at the financial stability of companies in the insurance market, rates companies based on their financial stability.

You can use this information to indicate whether or not a company you are considering purchasing insurance coverage from is a good choice from the perspective of their current financial rating and future outlook.

This table includes AM Best’s financial ratings and outlooks for the largest insurance companies in Connecticut.

| Insurance Company | Rating | Outlook |

|---|---|---|

| GEICO | A++ | Stable |

| Allstate Insurance Group | A+ | Stable |

| Liberty Mutual Group | A | Stable |

| Progressive Group | A+ | Stable |

| Travelers Group | A++ | Stable |

| State Farm Group | A++ | Stable |

| USAA Group | A++ | Stable |

| Nationwide Corp Group | A+ | Stable |

| Amica Mutual Group | A+ | Stable |

| Metropolitan Group | A | Stable |

In looking at data from AM Best, it is important to know that they indicate that any company with an A- rating or better is financially secure and has a stable outlook. Based on this information, and the data in the above table, you can see that the top ten largest insurers in Connecticut are all good options from the financial stability perspective.

Companies with Best Ratings

Customer service is a bit more difficult to quantify but is also important. You want to know that a service, in this case car insurance coverage, you are purchasing has the customer relations structure necessary to meet your needs.

If you need to call someone, will they answer? Will they be knowledgeable and helpful? These are just a couple of questions you, as the consumer, should know the answer to before deciding on an insurance provider.

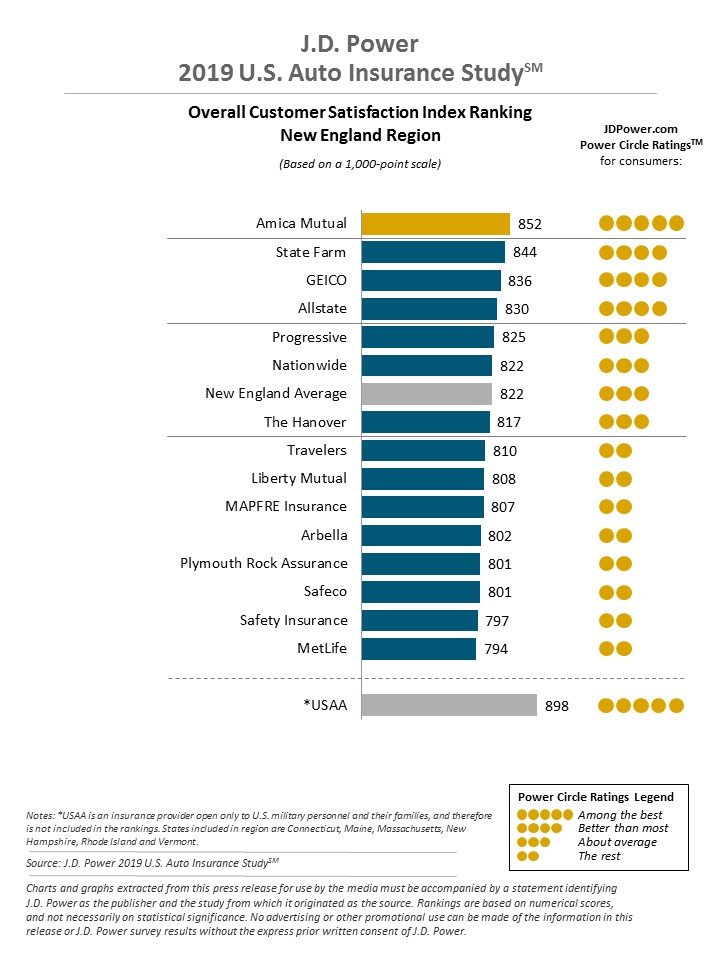

One way to find customer service rating information is to look at data from JD Power. They recently conducted a study on the customer service satisfaction of consumers in the car insurance industry. To make their data usable, they created a Customer Service Index Rating system, which they used to rate companies across the United States.

Each region (and some states) in the U.S. has a customer service satisfaction index rating for the largest providers in that region or state. Check out the Customer Satisfaction Index Rating below to find out the ratings for the New England region.

USAA and Amica Mutual Group have the highest customer satisfaction ratings. Both companies fall within the “among the best” rating, with 898 and 852 points, respectively, out a 1,000 point scale.

In fact, seven out of the 10 largest insurance companies in Connecticut are rated “about average” or above. This is good news for you as you shop for insurance in the state.

Companies with Most Complaints in Connecticut

Now that you know what customer service ratings look like for the major insurance providers in the New England area, let’s look at complaints. Obviously, every company deals with complaints. While this information should not be ignored, it is important to know if it is worth including in your decision-making process.

The only way to determine this is to know what complaints look like for the various companies in your area.

The NAIC assigns insurance providers a number called a complaint ratio to help you understand how many complaints an insurance company receives (thereby helping you to determine whether or not this is a variable you should consider when shopping for insurance).

This table provides the complaint ratio data for the largest insurance providers in Connecticut.

| Insurance Company | Direct Premiums Written | Complaint Ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| GEICO | $528,907 | 0.68 | 75.82% | 18.02% |

| Allstate Insurance Group | $304,028 | 0.5 | 54.93% | 10.36% |

| Liberty Mutual Group | $297,602 | 5.95 | 64.66% | 10.14% |

| Progressive Group | $268,001 | 0.75 | 63.25% | 9.13% |

| Travelers Group | $195,421 | 0.09 | 72.77% | 6.66% |

| State Farm Group | $192,401 | 0.44 | 61.48% | 6.55% |

| USAA Group | $137,617 | 0.74 | 70.23% | 4.69% |

| Nationwide Corp Group | $123,130 | 0.28 | 63.22% | 4.19% |

| Amica Mutual Group | $111,152 | 0.46 | 60.16% | 3.79% |

| Metropolitan Group | $105,129 | 1.3 | 59.38% | 3.58% |

A complaint ratio is derived by comparing the number of complaints a particular company receives against the number of premiums that the company writes. If a company is deemed to receive an average number of complaints, their complaint ratio would be one.

When a company’s complaint ratio is higher than one, this indicates they receive more than the average number of complaints, while if the ratio is less than one, the reverse is true.

According to the NAIC data provided in the above table, insurance providers in Connecticut mostly receive less than the average number of complaints, though there are a couple of exceptions.

The company with the highest complaint ratio is Liberty Mutual Group, with a 5.95. While this number seems unusually high, keep in mind that their JD Power customer satisfaction index number put them below average, with a “the rest” rating and 808 out of 1,000 points.

The company with the lowest complaint ratio is Travelers Group, with a 0.09. This is especially interesting because Travelers, like Liberty Mutual, is in the “the rest” rating category, and only has two points more than Travelers, with 810 out of 1,000 points.

If you ever need to file a complaint, the State of Connecticut Insurance Department Consumer Affairs Division will review and process it. To file a complaint, you have a few different options:

- You can send an email to [email protected]

- You can file a complaint using the online complaint form

- You can download the form and send it through the mail to P.O. Box 819, Hartford, Ct. 06142-0819

If you have questions, you can submit them through the online portal or you can call the consumer helpline at 800-203-3447 or 860-297-3900.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

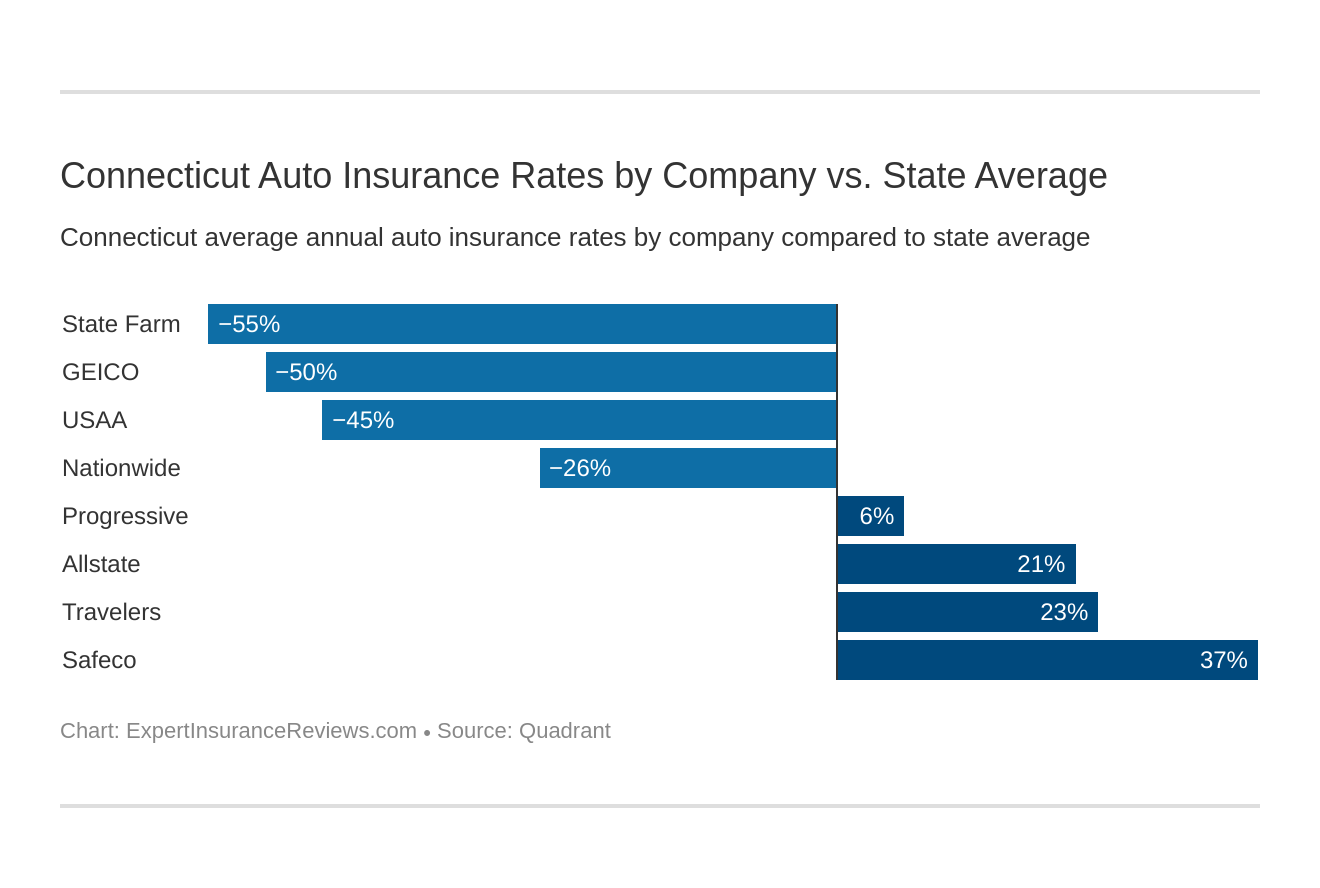

Cheapest Insurance Companies in Connecticut

In Connecticut, the average rate for full coverage car insurance in the state is $4,618.92. In the data below, we compare the average rates for car insurance coverage by company to the state average.

| Company | Annual Average | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| State Farm Mutual Auto | $2,976.24 | -$1,642.68 | -55.19% |

| GEICO General | $3,073.66 | -$1,545.26 | -50.27% |

| USAA CIC | $3,190.00 | -$1,428.92 | -44.79% |

| Nationwide Discover Agency | $3,672.34 | -$946.58 | -25.78% |

| Progressive Casualty | $4,920.35 | $301.43 | 6.13% |

| Allstate F&C | $5,831.60 | $1,212.68 | 20.79% |

| Travelers Home & Marine Ins Co | $6,004.29 | $1,385.37 | 23.07% |

| Safeco Ins Co of IL | $7,282.87 | $2,663.95 | 36.58% |

The rates across companies vary widely. For example, State Farm, which has the lowest rate in the table, is 55 percent lower than the state average, while Safeco Insurance Company has the highest rate in the table, and is almost 37 percent more expensive than the state average.

Half of the companies in this list are above the state average, while the remaining half are below the state average.

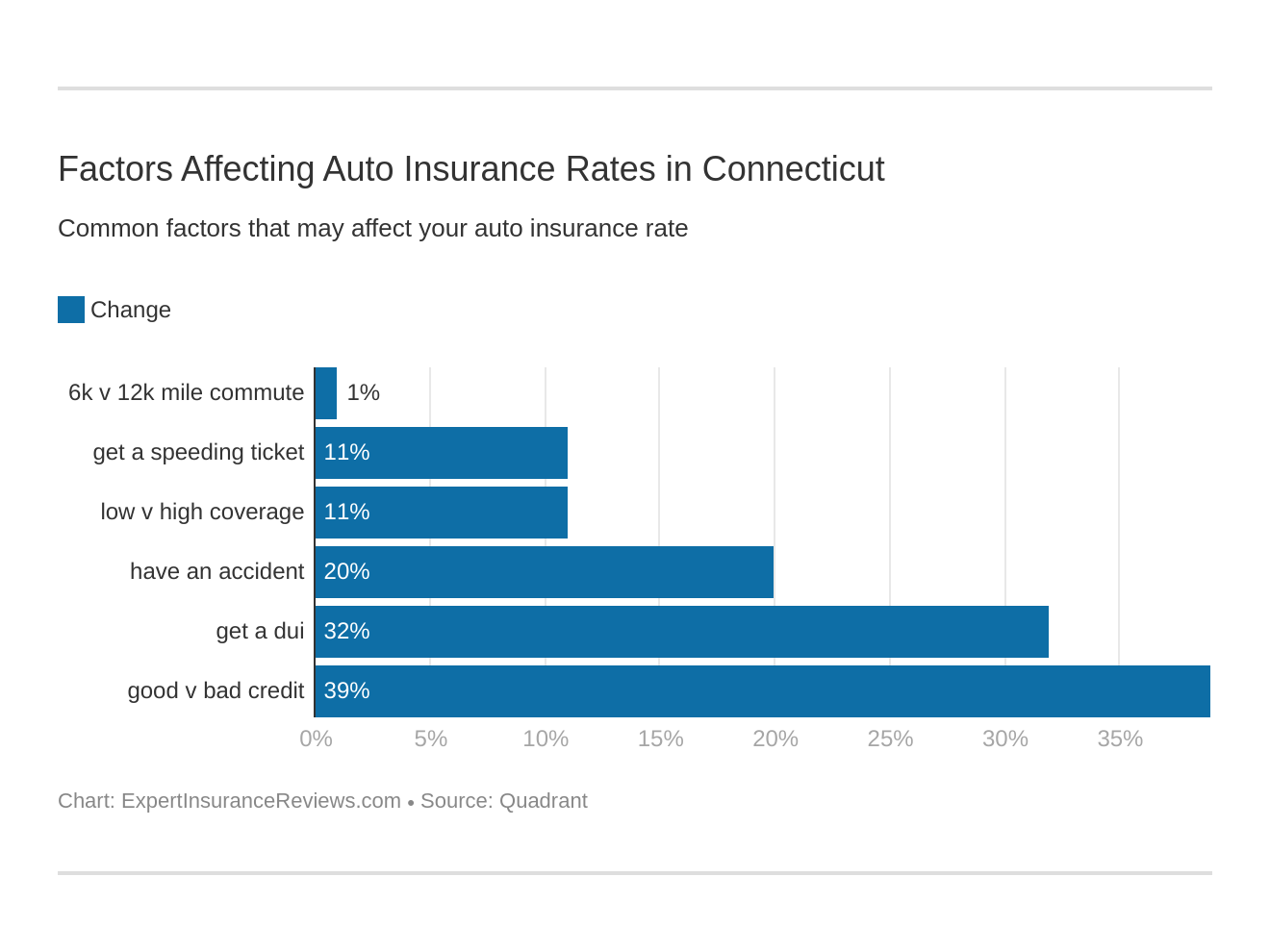

While the range of rates is surprisingly dramatic, with an increase of 144 percent from the lowest rate to the highest in the above table, most insurance companies use the same variables to adjust their rates.

When you’re shopping for insurance companies, you can look at the different factors they consider, and how various companies weigh those factors, to help you decide which insurance company is right for you.

For example, you already know that both age and gender can have a significant effect on insurance rates for most companies. But these are not the only factors insurance companies look at; others include commute distance, driving record, and credit score.

Depending on where you fall on the spectrum for each of these factors, different insurance companies will have better rates than others for your specific history and needs.

Keep reading to learn more about the factors that can affect your car insurance rates.

Commute Rates by Companies

Do you spend hours in the car each week commuting to and from work? Do you find yourself racking up mileage in your vehicle just to reach your regular destinations? Unfortunately for many Americans, yet another factor insurance companies consider when adjusting rates in commute distance.

The more miles you drive each year, the higher your insurance rates may be. This is because statistically, the more time you spend on the road, the higher your likelihood of getting in a car accident.

Does this hold true in Connecticut? Check out the below table to find out.

| Insurance Company | 10 Mile Commute (6,000 Annual Mileage Average) | 25 Mile Commute (12,000 annual mileage) | Percent Increase |

|---|---|---|---|

| Allstate | $5,831.60 | $5,831.60 | 0.00% |

| GEICO | $3,026.65 | $3,120.67 | 3.11% |

| Liberty Mutual | $7,282.87 | $7,282.87 | 0.00% |

| Nationwide | $3,672.34 | $3,672.34 | 0.00% |

| Progressive | $4,920.35 | $4,920.35 | 0.00% |

| State Farm | $2,902.75 | $3,049.73 | 5.06% |

| Travelers | $6,004.29 | $6,004.29 | 0.00% |

| USAA | $3,151.80 | $3,228.20 | 2.42% |

Fortunately for commuters in Connecticut, commute distance is not a significant factor for the largest insurance companies in the state.

In fact, five out of the companies listed in the above table do not increase their rates at all for longer commute distances. Of the three companies that do increase their rates in the above table, the largest increase is only five percent.

Coverage Level Rates by Companies

In a basic sense, there are three main categories for levels of coverage: low, medium, and high. But what is the right level for you? Do you need low? Or do you need high coverage? You are the only person who can determine this, based on your risks, needs, and what you can afford.

Let’s take a look at price. As you might expect, as you increase your level of coverage, the price you pay also increases. In this table, we consider the costs associated with the different levels of coverage for some of the major insurers in Connecticut.

| Insurance Company | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| State Farm | $2,789.79 | $2,981.27 | $3,157.66 |

| GEICO | $2,839.48 | $3,033.89 | $3,347.61 |

| USAA | $2,980.78 | $3,193.11 | $3,396.11 |

| Nationwide | $3,727.81 | $3,699.88 | $3,589.35 |

| Progressive | $4,567.50 | $4,875.19 | $5,318.35 |

| Allstate | $5,499.08 | $5,823.32 | $6,172.41 |

| Travelers | $5,551.63 | $5,961.96 | $6,499.29 |

| Liberty Mutual | $6,996.02 | $7,227.27 | $7,625.34 |

While most companies increase their rates for increasing levels of coverage, not all companies increase at their premiums at the same rates.

For example, USAA increases their rates by about 7 percent from low to medium coverage, and an additional 6 percent for high coverage (for a total 0f an almost 14 percent increase between low and high coverage). Read our USAA insurance review to learn more about the company.

By contrast, Nationwide actually decreases their rates slightly. From low to medium coverage, their rates decrease by about three-quarters of a percent, while from medium to high coverage, their rates decrease by an additional three percent. Their full rate change from low to high coverage is a decrease of 3.7 percent.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Credit History Rates by Companies

What’s your credit score like? Do you pride yourself on a high score? Have you struggled to develop a good score? Unfortunately (or fortunately, depending on your score), this can have an effect on your insurance rates. The significance of this effect varies between companies but is indisputably a factor.

Experian reports that residents in Connecticut have an average credit score of 690. If you’re among the average, you’re in good shape with regard to how your credit score may affect your insurance rates, because 690 is typically considered a “good” score.

Just how much of a factor is credit score when companies adjust insurance rates? Check out this table to see what your credit score can do to your insurance rates.

| Insurance Company | Annual Rates with Good Credit | Annual Rates with Fair Credit | Annual Rates with Poor Credit |

|---|---|---|---|

| GEICO | $2,053.29 | $2,696.58 | $4,471.11 |

| State Farm | $2,134.56 | $2,652.13 | $4,142.03 |

| USAA | $2,505.79 | $2,847.51 | $4,216.70 |

| Nationwide | $2,889.69 | $3,264.41 | $4,862.94 |

| Allstate | $4,455.94 | $5,615.43 | $7,423.44 |

| Progressive | $4,602.01 | $4,804.53 | $5,354.50 |

| Liberty Mutual | $5,064.02 | $6,442.61 | $10,341.99 |

| Travelers | $5,517.46 | $5,680.08 | $6,815.35 |

When looking at the above table, it becomes clear that credit can have a fairly significant effect on your credit score (particularly from companies like Geico Insurance and Liberty Mutual Insurance, for example).

If your credit score falls within the fair or poor credit score ranges, you may want to consider Travelers or Progressive, as their rate increases for fair and poor credit scores are the lowest at three percent and 23 percent respectively for Travelers and 4 percent and 16 percent respectively for Progressive. Learn more about these two companies in our Travelers vs Progressive car insurance comparison.

To consider the above data from another perspective:

- Good Credit (670+) = average annual premiums: $5,290.74

- Fair Credit (580-669) = 3 – 31 percent increase: $5,635.66

- Poor Credit (300-579) = 16 – 117 percent increase: $5,667.60

Driving Record Rates by Companies

Do you have some speeding tickets on your record? Have you recently been in an accident? Or are you on the other end of the spectrum and have a perfect driving record?

All else being equal, if you’ve got some traffic violations on your record, you can expect your insurance rates to be higher than someone with a perfect driving record. Drivers with traffic violations on their records are typically considered higher risk by insurance companies, so to offset this risk, they charge you higher rates.

Take a look at this table to see what some of the major insurance providers in Connecticut do when you have a clean driving record, versus one speeding violation, one car accident, and one DUI.

| Insurance Company | Clean Record | With 1 Speeding Violation | With 1 DUI | With 1 Car Accident |

|---|---|---|---|---|

| GEICO | $1,942.20 | $2,384.75 | $5,420.88 | $2,546.81 |

| USAA | $2,470.92 | $2,470.92 | $4,713.93 | $3,104.24 |

| State Farm | $2,770.61 | $3,044.79 | $3,044.79 | $3,044.79 |

| Nationwide | $2,991.13 | $3,331.67 | $4,466.56 | $3,900.02 |

| Progressive | $4,197.03 | $4,975.08 | $4,415.90 | $6,093.37 |

| Travelers | $4,833.25 | $6,327.84 | $7,620.42 | $5,235.67 |

| Allstate | $4,964.26 | $4,964.26 | $7,267.10 | $6,130.79 |

| Liberty Mutual | $6,377.55 | $6,859.28 | $7,908.84 | $7,985.83 |

If you’ve had a few speeding tickets recently, you may want to consider Allstate or USAA, because they do not increase their rates for your first speeding violation.

In order to better determine which companies have more dramatic increases for poor driving records than others, we’ve calculated the percent increase for each of the data points in the above table. Check out this table to see what these increases look like.

| Insurance Company | Percent Increase - 1 Speeding Violation | Percent Increase - With 1 DUI | Percent Increase - wtih 1 Accident |

|---|---|---|---|

| Allstate | 0.00% | 46.39% | 23.50% |

| USAA | 0.00% | 90.78% | 25.63% |

| Liberty Mutual | 7.55% | 24.01% | 25.22% |

| State Farm | 9.90% | 9.90% | 9.90% |

| Nationwide | 11.38% | 49.33% | 30.39% |

| Progressive | 18.54% | 5.21% | 45.18% |

| GEICO | 22.79% | 179.11% | 31.13% |

| Travelers | 30.92% | 57.67% | 8.33% |

As we already noted, your best bet if you’ve recently gotten caught driving a bit too fast maybe USAA or Allstate because they do not increase their rates for the first offense. However, if you’ve been in a car accident, Travelers may be a good option, because their rate increase for the first car accident is only about eight percent.

One point to take note of is how different companies handle DUIs. For the majority, a DUI results in the largest rate increase by a significant margin.

However, there are exceptions. State Farm increases rates by the same percentage for both speeding and DUI, while Progressive actually increases rates more dramatically for the first speeding violation than for the first DUI (19 percent and five percent, respectively).

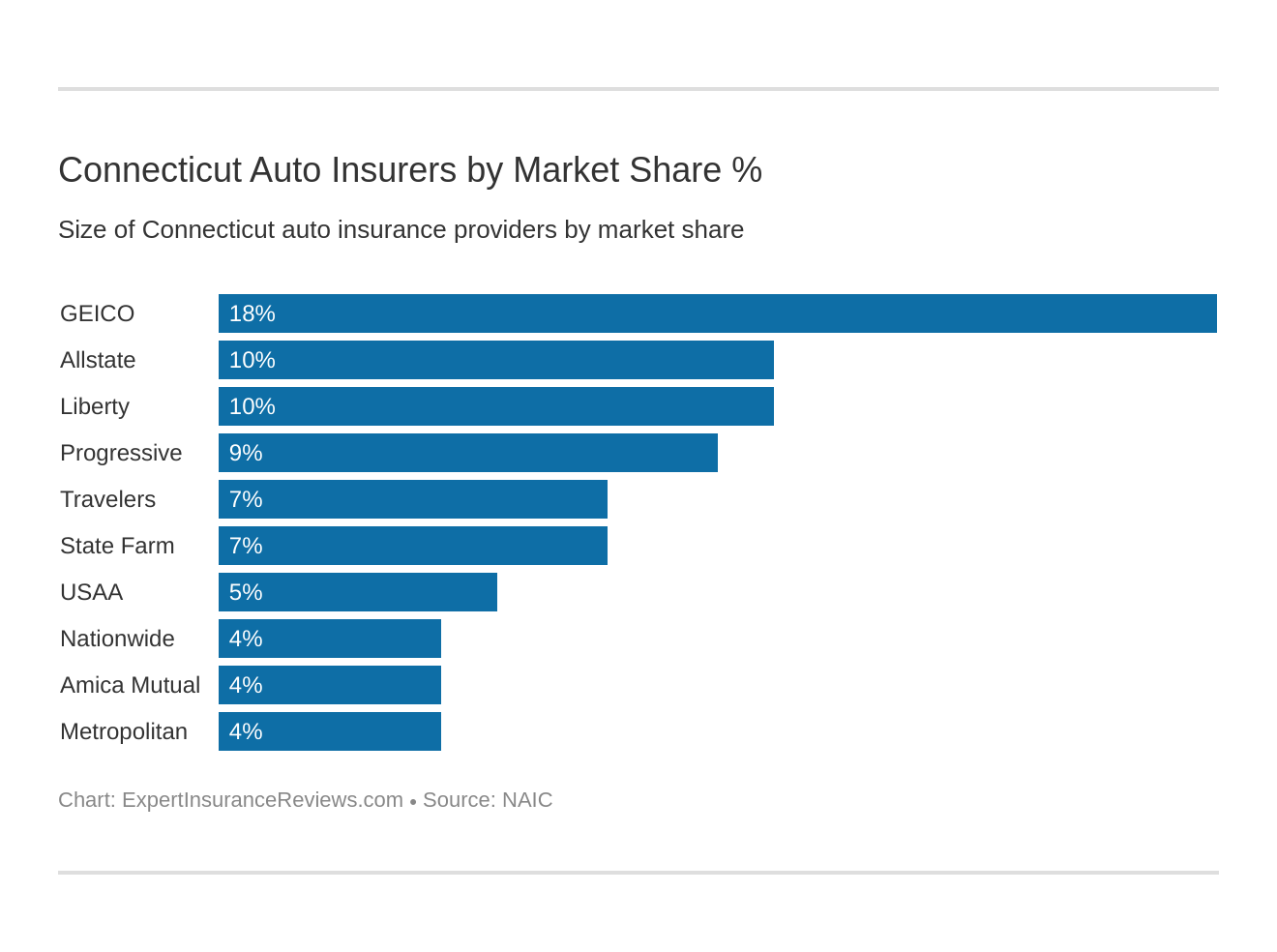

Largest Car Insurance Companies in Connecticut

Another factor you may want to consider when shopping for car insurance companies is company size.

When you take a look a the combination of the company size (i.e. market share), loss ratio, and complaint data (the latter two, we’ve already discussed), you have an additional set of data points to review for making a decision on which insurance provider is best for you.

This data provides another indication of whether or not various providers will have the ability to pay out on insurance claims. In the below table, we provide the market share and premiums written for the largest insurance providers in Connecticut.

| Rank | Insurance Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | GEICO | $528,907 | 18.02% |

| 2 | Allstate Insurance Group | $304,028 | 10.36% |

| 3 | Liberty Mutual Group | $297,602 | 10.14% |

| 4 | Progressive Group | $268,001 | 9.13% |

| 5 | Travelers Group | $195,421 | 6.66% |

| 6 | State Farm Group | $192,401 | 6.55% |

| 7 | USAA Group | $137,617 | 4.69% |

| 8 | Nationwide Corp Group | $123,130 | 4.19% |

| 9 | Amica Mutual Group | $111,152 | 3.79% |

| 10 | Metropolitan Group | $105,129 | 3.58% |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Number of Insurers by Connecticut

You have a lot of options for insurance coverage in Connecticut. When you’re shopping for insurance, you can choose from 796 different insurance providers. While there are a number of options, there are only two kinds of insurance companies in Connecticut:

- Foreign – foreign insurers are those that are incorporated outside of Connecticut. Of the 796 insurance providers in the state, 729 are foreign insurers.

- Domestic – domestic insurers are those that are incorporated within the state of Connecticut. Of the 796 insurance providers in the state, 67 are domestic insurers.

It is important to note that regardless of where a company is incorporated, in order to legally operate in the state, they must all follow the state insurance laws.

Connecticut Laws

We’re getting closer to you having all the information you need to make an informed decision on your car insurance provider and coverage mix. However, there are still some things we need to review, to make sure you have all the relevant information at your fingertips and you’re prepared for whatever might happen while you’re on the road.

It’s important to know the laws that can affect you when you’re on the road. This includes both the state insurance laws that all insurance companies are subject to and the laws you must follow in order to legally drive on the road.

Being familiar with the laws your insurance provider is subject to enables you to be your own advocate. Knowing the laws you are subject to ensures that not only are you prepared when you’re on the road, but you are also able to avoid potential fees, fines, and the possibility of your driver’s license and driving privileges being suspended.

Like much of the information we’ve looked at so far, we know this can be difficult and time-consuming to find. We’ve done the research for you and compiled the relevant information you need to know in the following sections.

Read on to discover more about laws of which to take note, proper vehicle and licensing processes and procedures, and more.

Connecticut Car Insurance Laws

You already know there are certain car insurance laws specific to drivers like the minimum liability insurance requirement. In addition, there are laws related to fraud, processes for obtaining insurance if you are high risk, and more that you should know.

Your insurance company also has laws it must follow that outline what coverage they must provide in the event of certain kinds of damage, who they must insure, and more.

Keep reading to ensure you are informed when it comes to relevant insurance laws that apply to you and your insurance company.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How State Laws for Insurance are Determined

In today’s political climate, people are either very aware of legislative processes and how laws are enacted, or they are intentionally completely unaware. To make sure you are informed on how insurance laws are enacted, let’s look at an overview of the processes necessary to do so.

In the event that someone or a group of people decides a law needs to be enacted, their first step is to write a bill. The bill must include specifics on their proposal, why they believe it is needed, etc. Once the bill is prepared, the next step is to put it before the state (in this case Connecticut) legislature.

It is then reviewed by the legislature. They discuss and debate the law to determine its validity, necessity, and benefits. Then they vote. If a majority agree it is both necessary and beneficial, the bill will be signed into law.

More insurance law information can be found in the next few sections.

Windshield Coverage

Ever had your windshield chipped or cracked? This is a frustrating, and often expensive, result of operating a vehicle on the road that nearly every driver has experienced at some point. Since you can almost expect this to happen at some point, what is your car insurance provider required to do about this in Connecticut?

We’re glad you asked.

Insurance providers in Connecticut are required to offer optional “full glass coverage” to insureds as a part of a comprehensive policy. This coverage includes repair or replacement for any glass damage to your windshield with no deductible.

If you’ve opted to include this coverage in your policy, and find yourself needing to use it, there are some additional details of which you should be aware. As the insured, you have the right to choose where the repair or replacement of your windshield is completed.

However, if the cost of your repair shop of choice is higher than what is covered by your insurance plan, you will be required to pay the difference.

In addition, your insurance company can choose to pay for aftermarket, or used, parts in your repair. However, if they choose to do this, they must notify you in writing.

High-Risk Insurance

When you’ve had a few too many speeding tickets, an accident or two, or a DUI, you may be considered a high-risk driver. If you are classified as such, you may find it difficult to obtain car insurance coverage (even the minimum required amount). This is because often, car insurance companies do not voluntarily choose to insure high-risk drivers.

If this is you, don’t worry. Connecticut, like many states, has set up a program to help high-risk drivers obtain the coverage they need to legally operate their vehicles on the road. This program is referred to as the Connecticut Automobile Insurance Assigned Risk Plan, or CT ARP.

As you already know, any insurance company that provides coverage in Connecticut is required to follow the laws enacted upon them by the state. This includes participation in the CT ARP. The CT ARP is not an insurance provider.

Instead, they match high-risk drivers with insurance companies and mandate those companies provide at least the minimum liability coverage requirement.

What does this look like? To make it fair for companies across the state, CT ARP looks at an insurance company’s market share and requires them to insure a commensurate percentage of high-risk drivers in the state. For example, Nationwide has four percent of the market share in Connecticut.

Under the state insurance laws, they are required to insure four percent of the high-risk drivers that qualify through CT ARP.

Ready to apply for CT ARP? First off, you can speak to any licensed insurance agent in Connecticut about applying to CT ARP, and they can submit your application for you.

However, you can only do so once you have been unable to obtain car insurance coverage for the preceding 60 days (this must be noted on your application). In addition, you must have:

- A valid Connecticut driver’s license

- A vehicle registered in Connecticut

To make sure you are not disqualified at any time during the process, you must also ensure you have not missed a payment for insurance premiums in the preceding two years.

You must also have brought in your vehicle to be inspected by an insurance representative when asked (failure to do this may mean your application is denied and you are barred from reapplying for up to one year).

Under CT ARP you can obtain similar coverage to what you would if you were insured through the voluntary market. At a minimum, you will receive the required liability coverage.

You should be aware that you will likely pay much higher rates than the average Connecticut driver. Coverage levels for minimum liability are also significantly higher than for the average driver.

The below table compares the minimum liability requirements for the average driver to the requirements for a high-risk driver.

| Required Insurance | CT State Minimum Limit | CT ARP Minimum Limit |

|---|---|---|

| Bodily Injury | $25,000 per person $50,000 per accident | $250,000 per person $500,000 per accident |

| Property Damage Liabiliy | $25,000 per accident | $100,000 per accident |

| Uninsured/Underinsured Motorist | $25,000 per person $50,000 per accident | equal to (and up to twice as much as) the bodily injury requirement |

We did a quick percent increase calculation, and the results show that if you are a high-risk driver, your minimum liability requirements are between 300 and 900 percent higher than if you are an average driver in Connecticut. If you deem it necessary, you also have the option to add more coverage (i.e. core coverage, additional liability, etc.).

For questions about the CT ARP, you can visit their website. In addition, if you would prefer to speak to someone, you can always call the State of Connecticut Insurance Department at 860-297-3800 or 1-800-203-3447.

Unlike most states, Connecticut does not have an SR-22 form requirement for drivers who are working to reinstate their drivers’ licenses.

Find out the best car insurance companies for high-risk drivers.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Low-Cost Insurance

While Connecticut provides the CT ARP to support high-risk drivers in obtaining insurance, the state does not currently offer a similar plan for low-income drivers to acquire and retain the mandatory car insurance coverage.

In the United States, the only places that currently have a government-funded assistance program to ensure low-income families can retain their car insurance (and thereby legally drive on the road) are California, Hawaii, and New Jersey.

Automobile Insurance Fraud in Connecticut

Insurance fraud may seem like no big deal. What’s the problem with fudging the answers on your insurance information a bit to lower your rates? This may sound harmless, but in reality it’s not. It is not a victimless crime, nor is it something that does not affect you.

According to the Insurance Information Institute (III), almost 10 percent of the losses an insurance company must absorb are the result of insurance fraud. Ten percent is not pocket change by any means. In the long run, because the insurance companies must absorb those losses, you end up paying higher premiums.

To combat insurance fraud in Connecticut, the State of Connecticut Insurance Department Fraud and Investigations Unit was formed. This organization investigates insurance fraud committed by insurers.

Connecticut treats insurance fraud committed by insureds as a Class D felony. If you are convicted of insurance fraud, you could face fines of up to $5,000 and five years in prison.

If you believe you are the victim of insurance fraud and wish to report or ask questions to find out if you should report, you can email the State of Connecticut Insurance Department Fraud and Investigations Unit at [email protected].

Statute of Limitations

Should you ever find your self in a position in which you need to file a claim or lawsuit for damages that result from a car accident, the statute of limitations, if you live in Connecticut, is two years for personal injury and three years for property damage.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Connecticut Specific Laws

Most states, Connecticut included, have numerous laws on the books that are relatively consistent throughout the country. As an example, nearly every state in the country has a minimum liability coverage requirement law, though the exact amounts and requirements may vary from state-to-state.

However, Connecticut has some laws specific to the state, as do many other states across the country. Some seem like common sense. For example, it is illegal to shoot a gun (of any kind) from a public highway. This includes hunting.

Others are perhaps overly safety-conscious. In New Haven, Connecticut, it is illegal for fire trucks to drive faster than 25 MPH, even when they are headed to an emergency. This has the potential to dramatically affect the emergency service response times if you are in an accident.

Vehicle Licensing Laws

If you want to legally drive on the road in Connecticut, you must ensure your vehicle is registered with the state. In the event that you do not register your vehicle in Connecticut, or your current registration expires, you may end up facing fees and suspension of your license and driving privileges.

If you’ve recently moved to the state, you will need to register your vehicle within 60 days as well as obtain a new driver’s license. In order to do this, you will need to visit a Connecticut Department of Motor Vehicles (DMV) location in-person. You will need to bring the following documents with you:

- Application for Registration and Certificate of Title

- Most recent out-of-state title

- Proof of identification

- Proof of vehicle inspection by authorized DMV employee

You will also be required to provide proof of insurance (at least the minimum liability coverage requirement) and get an emissions test for your vehicle in order to legally register it.

If you are registering a new vehicle, the State of Connecticut Department of Motor Vehicles website will walk you through the process, based on the type and the proposed usage of your vehicle. You will need to visit a DMV location. In general, you will need to do/bring the following (though specifics vary from vehicle to vehicle):

- Check your status with the state (taxes, tickets, etc.)

- Proof of identification

- Application for registration and title

- Proof of ownership

- Proof of insurance

- Bill of sale

If you need to renew your vehicle registration, you can do so through the State of Connecticut DMV online portal.

If you have questions about registering your vehicle or any other DMV-related questions, you can reach out in a few different ways:

- Visit a DMV location

- Call at 860-263-5700 (if you live in Hartford) or 800-842-8222 (if you live anywhere else in Connecticut)

- Send an email

- Send through standard mail at Department of Motor Vehicles, 60 State Street, Wethersfield, CT 06161

Real ID

Connecticut is one of the majority of the states across the country that is now compliant with the REAL ID Act of 2005, according to the Department of Homeland Security (DHS). This Act was put in place after 9/11 to reduce the chances of such a tragedy ever occurring again.

It has been a somewhat controversial decision across the country, but at this time, 47 states are compliant, two have an extension for reaching compliance, and one is under review. Connecticut has been offering REAL ID-compliant forms of identification since 2011, so many residents already have the updated driver’s license.

Why does this matter for you? In October of 2020, you will no longer be able to fly commercially using a standard driver’s license as a form of identification.

You will be required to have a REAL ID-compliant driver’s license in order to board the plane. You will also be required to have a REAL ID-compliant form of identification to access military installations and nuclear power plants (if you have a need to do so).

In Connecticut, a REAL ID-complaint driver’s license is indicated by a gold circle with a white star in the center, typically located on the upper right-hand corner.

In order to obtain a REAL ID in Connecticut, you must visit a DMV (or other partner office that is qualified) location in-person. When you visit, you must bring the following:

- Passport or birth certificate

- Social Security Card

- Two proofs of Connecticut residence

- Proof of name change (if applicable)

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Penalties for Driving Without Insurance

You already know Connecticut requires at least minimum liability insurance coverage in order for you to legally drive in the state. If you’re stopped, a law enforcement officer will only accept a valid insurance card (either paper or digital) as proof of insurance.

But what happens if you’re caught driving without insurance? Check out this table to see what consequences you may face if you take the risk of driving without insurance.

| Penalty | First Offense | Second Offense |

|---|---|---|

| Fine | $100-$1000 | $100-$1000 |

| License & Registration Suspension | one month (reinstatement reqires $175 fee and proof of insurance) | six months (reinstatement reqires $175 fee and proof of insurance) |

Teen Driver Laws

If you’re a teenager in Connecticut, you’re probably excited to learn to drive, but you’ll have to wait until you turn 16 to apply for your learner’s permit. If you’re under 18, you will also need to sign up for and complete driver education (home training is also permitted, but only if parents/guardians take a two-hour class on teen driving laws).

You are required to log 40 hours of supervised driving while you hold your permit, and you must hold your permit for a minimum of four months. After meeting the requirements for the learner’s permit, you will be allowed to apply for an intermediate license.

While you hold your intermediate license (which you will be required to hold either for one year or until you turn 18, whichever comes first), you will not be able to drive unsupervised between 11 p.m. and 5 a.m.

For the first six months, you will not be allowed to drive with any passengers, except for parents/guardians or a driving instructor. For the second six months, the only passengers you will be able to have in the car are parents/guardians, a driving instructor, or immediate family.

Older Driver License Renewal Procedures

Connecticut requires older drivers (anyone 65 and older) to renew their driver’s licenses every two years, rather than the every eight that is required for the general population (drivers younger than 65).

However, all drivers, both members of the general population and the older population, are required to renew their licenses in person, rather than online or in person.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

New Residents

When you move to Connecticut, you will need to obtain a driver’s license in the state within 60 days of establishing residency. Unfortunately, you cannot obtain a driver’s license online. You are required to visit a Connecticut DMV in-person. When you visit, you will need to bring the following:

- Proof of identification

- Proof of legal presence

- Proof of state residency

- Social Security Number

As long as your out-of-state driver’s license is valid, you will not need to take a driving test, but you will need to pass a vision exam.

License Renewal Procedures

If you are Connecticut resident and you need to renew your license (driving with an expired license is prohibited), you can do so anytime in the six months before it expires. You can renew your license at any DMV or partner location in the state.

When you go in to renew your license, you must bring your current driver’s license with you, along with your renewal application (which you may receive in the mail).

You will not be required to take a driving test or vision exam. However, if your license is expired (and has been so for at least two years), you will need to take a driving test, as well as any other state requirements for obtaining a license for the first time.

Read More: What is the process for renewing my car insurance policy?

Negligent Operator Treatment System (NOTS)

Numerous states throughout the country maintain points-based programs to discourage reckless driving. These programs are structured such that when you are ticketed or convicted of a moving violation, a set number of points will be attached to your driver’s license.

If and when you accrue a certain number of points on your license within a given time period (usually a year), your license and driving privileges will be suspended. You may also have to pay fines (in addition to payment requirements for reinstating your license). California has named this program the Negligent Operator Treatment System (NOTS).

To better understand how the program works, we must define a moving versus non-moving violation. In general, legally, a moving violation is specifically related to violating traffic laws when your vehicle is in motion. This includes speeding, running a red light, driving under the influence, etc.

A non-moving violation does not mean instances occur only when your car is stationary. Essentially, a non-moving violation is an offense that is not reported to your licensing department, department of motor vehicles, or insurance companies.

Examples of non-moving violations include distracted driving and driving without a seat belt.

The state of Connecticut does maintain a points system for drivers who are found guilty of moving violations. In Connecticut, points remain on a driver’s record for two years before dropping off. If at any point during those two years, the number of points on an individual’s record reaches 10 points, their license will be suspended.

This table provides the number of points you can expect to receive for various moving violations in the state.

| Moving Violation | Points |

|---|---|

| Speeding | 1 |

| Failure to Obey a Stop Sign | 2 |

| Passing in a No-Pass Zone | 3 |

| Failure to drive a reasonable distance apaort with intent to harrass | 4 |

| Negligent Homicide with a Motor Vehicle | 5 |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Rules of the Road

To make sure you stay safe on the road in Connecticut, there are a number of rules of the road of which you need to be aware of. In addition to helping you drive safely, knowing and following these rules will help you maintain a clean driving record, thereby keeping your insurance rates lower.

While some rules of the road, like following the posted speed signs, are fairly self-explanatory, some are more subtle and more difficult to find. We know it can be frustrating sometimes to remember all the rules of the road. We’ve pulled together some of the key laws you need to follow and explained them in the next few sections.

Read on to discover what you need to know about the rules of the road. We’ve also collected useful information on what the state requires insurance companies, ridesharing services, and autonomous vehicle companies to follow, to keep residents like you safe every day.

Fault vs. No-Fault

We briefly mentioned earlier that Connecticut follows a “fault” system for car insurance. As we described, this means that whoever is at fault for an accident is financially responsible for any resulting damages.

However, until 1994, Connecticut followed a “no-fault” system for car insurance. In a no-fault system, any damages (for both property and injury) that result from a car accident are paid for by the individuals’ insurance companies, regardless of who is at fault.

Additionally, it typically limits how drivers can approach suing the at-fault driver for compensation.

Under the no-fault system Connecticut operated in until 1994, the state required all drivers to purchase something called a “basic reparations coverage benefit” of $5,000 in addition to the minimum liability coverage requirement.

It helped compensate drivers for lost wages and medical expenses resulting from an accident. However, this also meant drivers could not sue the at-fault driver for similar compensation.

Seat Belt and Car Seat Laws

If you are a driver anywhere in the United States, you are already aware that you and your passengers are required to wear seat belts any time you are operating your vehicle. However, details of seat belt laws, particularly with regard to child restraints, vary from state-to-state.

In Connecticut, if you or one of your passengers is not properly seat-belted, this is considered a primary offense, and you can face fines of $50 or more. If you are convicted of improper seat restraints for a child, you will be required to attend a child restraint education program.

Anyone 2 years old or younger and weighing less than 30 pounds must be secured in a rear-facing child restraint in the back seat of a vehicle. At two years (until four years) old and/or weighing between 30-40 pounds, children must be secured in a forward or rear-facing child restraint in the back seat.

Between 5-7 years of age, and/or weighing between 40-60 pounds, children must be secured in a forward or rear-facing child restraint or a booster seat with a lap and shoulder belt. Once a child is 8 years old, they can use a standard adult seat belt and are also permitted to sit in the front seat of a vehicle.

The state also maintains explicit laws regarding riding in the bed of a truck. If you are 16 and older, you are permitted to do so in limited circumstances.

If you are 15 or younger, you can only do so if some form of seat belt is used. The circumstances in which it is acceptable to ride in the back of a pickup truck include parades, farming operations, and hayrides during the months of August through December.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Keep Right and Move Over Laws

When you drive in Connecticut, you are expected to modify your speed and location on the road depending on what is happening on the road. In the event that there is a stationary emergency or non-emergency vehicle on the road, you must move out of the lane closest to those vehicles, if it is safe and possible to do so.

If an emergency vehicle is driving on the road at a speed slower than the posted limit, you are expected to also reduce your speed to below the posted limit. In addition, you are required to move out of the lane closest to the emergency vehicle(s) if it is safe and possible to do so.

If at any point while on the road you find yourself driving slower than the traffic around you, you are expected to keep (or move to) the right, if it is safe and possible to do so, in order to not slow down the flow of traffic.

Speed Limits

As we’ve already noted, driving above the speed limit can result in a ticket and points against your driver’s license as well as increased insurance premium rates. It is also unsafe and can heighten your chances of getting into an accident. You should always pay attention to and follow the posted speed limits.

In Connecticut, the maximum speed limit you can drive anywhere in the state is 65 MPH (that does not mean you can drive that speed anywhere, it simply means there are no posted speed limits higher than 65 MPH anywhere in the state). The following are the categories of roads and associated maximum speeds across the state:

- Rural interstates: 65 MPH

- Urban interstates: 55 MPH

- Other limited access roads: 65 MPH

- Other roads: 55 MPH

All posted speed limits throughout the state are established and approved by the Office of State Traffic Administration (OSTA). It is important to note that the speed limits listed above are the speed limit maximums set for the state. The actual, posted speed limits may be lower, based on road conditions.

To find out the approved speed limits in your area (by town), you can visit the Speed Limits Certificates and Listings page on the Connecticut Department of Transportation website.

Ridesharing

Transportation network companies (TNCs) are now a commonly accepted form of transportation. Companies like Uber and Lyft are ubiquitous in most places across the country. However, every state has different laws and requirements for how ridesharing companies hire, manage, and insure their drivers and legally operate in the state.

The laws are put in place to both keep you safe as a TNC customer and as a driver sharing the road with ridesharing company drivers. Connecticut is no exception to this, and in 2018, enacted a suite of new laws that TNCs must follow in order to legally operate in the state.

In Connecticut, TNCs are required to register with the Connecticut Department of Transportation (DOT) every year and pay annual fees. The first time they register with the state, they are required to pay an initial fee of $50,000 and then every year following, they must pay a $5,000 registration fee.

The state also allows the commissioner of the DOT to suspend, revoke, or refuse renewal to any TNC for a variety of reasons.

TNCs are mandated to conduct thorough federal and state criminal background checks on every driver they employ. They are required to rerun these checks every three years on current employees. Potential drivers (and current drivers) may be prohibited from driving if they have been found guilty of any of the following:

- Three or more moving violations in the past three years

- One or more serious traffic violations in the past three years

- License suspension for refusing a breathalyzer test in the past three years

- Driving under the influence in the past seven years

- Fraud in the past seven years

- Sexual offenses in the past seven years

- A felony with a motor vehicle in the past seven years

- Acts of violence or terror in the past seven years

- Listed on the state or national sex offender registry

- Not holding a valid drivers license or vehicle registration

Additionally, all drivers must be 19 or older. Every vehicle must be safety-certified (and this certification must be renewed every two years).

There are specific insurance requirements TNCs must follow as well. Drivers must maintain separate insurance for when they are working for a TNC versus when they are using their vehicle(s) in a personal capacity.

When drivers are logged into the TNC application and are available to provide a ride, but are not currently doing so, they must maintain minimum liability coverage of $50,000 for one person, $100,000 per accident, and $25,000 for property damage, as well as the uninsured/underinsured motorist coverage all Connecticut drivers must carry.

When drivers are actively providing a ride that was arranged through the appropriate application, they are required to maintain minimum liability coverage of one million dollars per accident. They are also required to maintain the state-mandated uninsured/undersinured motorist coverage.

Currently, the list of companies that offer insurance policies to drivers working under a TNC are GEICO, Liberty Mutual, and State Farm.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Automation on the Road

It is common to hear news stories, both positive and negative, about autonomous vehicles on the road. The growing focus on this technology means more and more states are putting laws in place to govern when and how autonomous vehicles can be operated to ensure residents and drivers are kept safe.

In Connecticut, testing of autonomous vehicles is permitted under their Fully Autonomous Vehicle Testing Pilot Program in certain cities across the state. A licensed operator is required to be in the vehicle at all times. This means, even if a fully autonomous function is being tested, a “driver” is still in the vehicle in the event of an emergency.

Any company that wishes to test their autonomous vehicles in the state must put their application before a review board, who will then decide whether or not that company will be permitted to test their vehicles in Connecticut.

All autonomous vehicles must carry a minimum liability insurance policy of at least $5 million.

Safety Laws

Beyond just following the speed limit and wearing your seat belt, or setting laws for how TNCs and autonomous vehicles operate on the road, Connecticut has a number of other safety-related laws in place to protect you on the road.

To ensure you have the visibility you need to be able to maintain situational awareness, see what you need to on the road, and be able to react accordingly, Connecticut has specific laws regarding window tinting and what is and is not permitted.

For sedans,

- Windshield: non-reflective tint can be placed above the manufacturer’s AS-1 line

- Front windows: a minimum of 36 percent of outside lighting must filter into the vehicle; tint must be less than 22 percent reflective

- Backside windows: a minimum of 36 percent of outside lighting must filter into the vehicle; tint must be less than 27 percent reflective

- Rear window: any darkness can be used

For SUVs and vans,

- Windshield: non-reflective tint can be placed above the manufacturer’s AS-1 line

- Front side windows: a minimum of 36 percent of outside lighting must filter into the vehicle; tint must be less than 22 percent reflective

- Backside windows: any darkness can be used; tint must be less than 27 percent reflective

- Rear window: any darkness can be used

Connecticut allows any tint color available but does require dual side mirrors if any tinting is applied to the rear windows. All tinted windows must include a sticker certifying the tinting is legal and must be placed between the film and glass. Film manufacturers in the state are required to certify their film.

Keep reading to learn more about driving under the influence, distracted driving, and the consequences associated with each.

DUI Laws

Planning on partying it up? Or even just having a couple of drinks? You should never drive after having consumed alcohol; not only is this dangerous, it will result in serious consequences, as well as significantly higher insurance rates (as you saw earlier).

Driving while under the influence is a foolish and sometimes deadly decision that puts you and anyone around you at risk. Even if a tragedy does not occur, if you are caught, you’ll pay in fines, jail time, loss of your driver’s license, and more. Should you be convicted of DUI, the offense will remain on your record for a minimum of ten years.

Connecticut defines the blood alcohol level (BAC) at 0.08. They do not currently have a high BAC (HBAC) limit. Responsibility.org reports that there were 120 alcohol-impaired driving fatalities in the state in 2017. This translates to 3.4 deaths per 100,000 population, which is equal to the national average for alcohol-impaired driving fatalities.

When you drink and drive, you are choosing to break the law, endanger yourself and others, and run the risk of facing consequences like those listed in this table.

| Penalty | 1st DUI | 2nd DUI | 3rd DUI |

|---|---|---|---|

| Fine | $500-$1000 | $1000-$4000 | $2000-$8000 |

| Jail Time | Either 1) up to 6 months w/mandatory 2 day min or 2) up to six months suspended with probation requiring 100 hours community service | up to 2 years with mandatory min of 120 consecuative days and probation with 100 hours community service | up to 3 years. mandatory min of one year and probation with 100 hours community service |