Auto-Owners Roadside Assistance Review for 2025 (Benefits & Costs Analyzed)

Auto-Owners roadside assistance costs as little as $3/mo to add to your policy and includes coverage for lockouts, fuel delivery, battery jump-starts, flat tires, and towing. See what customers say and how Auto-Owners stacks up against other top roadside assistance providers for service and value.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Insurance Agent

UPDATED: Mar 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Auto-Owners has roadside assistance coverage starting at $3/mo, which helps with tire delivery, battery jump-start, or towing.

Learn More: Auto-Owners Insurance Review

Auto-Owners roadside assistance offers reliable protection for unexpected issues on the road.

However, you must carry full coverage insurance to add roadside to your policy.

Auto-Owners Roadside Assistance Coverage Ratings

| Rating Criteria | |

|---|---|

| Overall Score | 4.1 |

| Coverage Value | 4.2 |

| Customer Satisfaction | 4.1 |

| Coverage Flexibility | 3.8 |

| Policy Benefits | 4.2 |

Ready to get cheap Auto-Owners roadside assistance? Enter your ZIP code to compare insurance quotes from Auto-Owners vs. top insurers near you.

- Auto-Owners roadside coverage starts at $3 monthly

- Roadside assistance covers towing, lock-outs, and fuel delivery

- You must carry full coverage to qualify for roadside assistance

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Auto-Owners Insurance Roadside Assistance: Benefits & Cost

Roadside assistance with Auto-Owners is a great choice for drivers seeking reliable help for road emergencies, costing as low as $3 monthly.

Auto-Owners roadside coverage offers help with services such as towing, battery jumpstarts, and flat tire changes, ensuring you’re never stranded during unexpected breakdowns.

See how much Auto-Owners roadside assistance costs vs. other top providers:

Roadside Assistance Cost by Provider

| Insurance Company | Monthly Rates |

|---|---|

| $3 | |

| $3 | |

| $3 | |

| $1 | |

| $4 |

| $3 |

| $2 | |

| $3 | |

| $2 | |

| $2 |

You must have a full coverage policy – including liability, collision, and comprehensive insurance – to get Auto-Owners roadside assistance. However, it costs as little as a few dollars monthly to add the coverage.

For more information, read our article titled, “What types of car insurance coverage does Auto-Owners offer?”

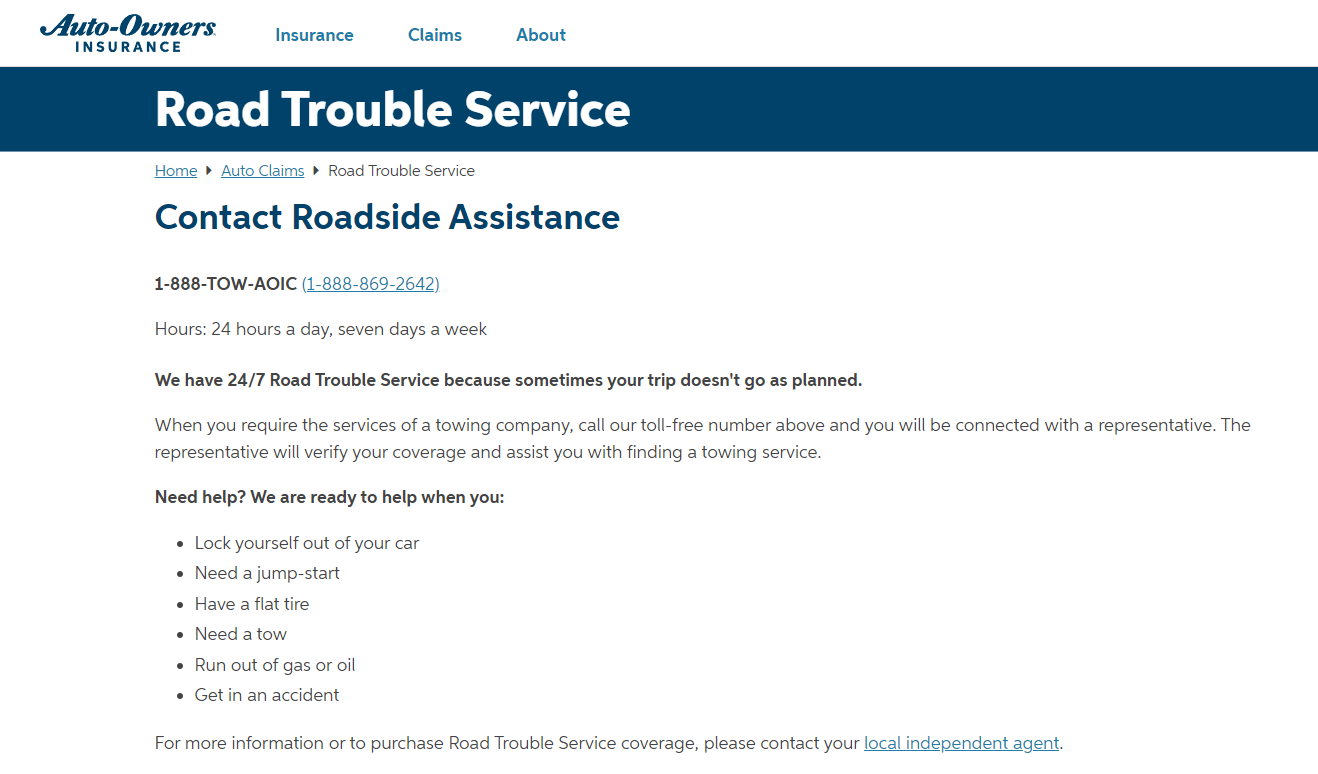

If you need a tow and have the add-on coverage, you can call 1-888-TOW-AOIC (1-888-869-2642) any time to get help. The operator will confirm your coverage under the Road Trouble Service program and then send a tow truck to assist.

Understanding Auto-Owners Roadside Assistance Coverage Limits

Roadside assistance with Auto-Owners has a 15-mile towing limit, which may not suit those who frequently travel rural highways with fewer repair shops.

Auto-Owners roadside coverage is a good fit for those who use their vehicle primarily for local errands or occasional road trips, as long as they stay within a 15-mile radius of their preferred repair shop.

Michelle Robbins Licensed Insurance Agent

However, Auto-Owners’ 15-mile towing limit falls short compared to USAA’s 50-mile limit. If you’re more than 15 miles from your preferred mechanic, you may have to rely on an unfamiliar one unless you pay for extended towing.

Does car insurance cover non-accident repairs? No, you must pay for your vehicle’s major repairs. If you have a warranty for auto repairs made that guarantees the work, the warranty provider is responsible for paying for the repairs made previously if they are defective.

In addition, while car insurance covers mechanical failure for minor repairs a tow truck driver can handle, it doesn’t cover major repairs.

Carrying spare parts in your car for common problems like replacing a failed taillight or belt is a good idea.

See Real Customer Stories: Auto-Owners Roadside Coverage

Below are some actual examples of how Auto-Owners roadside assistance provides fast and effective service to help policyholders get back on the road quickly.

- Case Study #1 – Auto-Owners Flat Tire Help: John, an Auto-Owners policyholder, had a flat tire on a remote highway. He called roadside assistance, and within 30 minutes, a service provider arrived to replace his tire, showcasing the prompt service of Auto-Owners’ roadside assistance.

- Case Study #2 – Understanding Towing Limits: Sarah’s car broke down near her preferred shop. She used Auto-Owners’ roadside assistance, and the tow truck arrived within the 15-mile towing limit, illustrating how this limit works for local trips.

- Case Study #3 – Roadside Mechanical Fix: Mark had a blown fuse, causing his headlights to malfunction. He contacted Auto-Owners’ roadside assistance, and the tow driver replaced the fuse on the spot, allowing him to continue without delay.

These cases illustrates how Auto-Owners’ roadside assistance offers peace of mind to policyholders, saving policyholders from the expenses associated with a vehicle breakdown (Learn More: Does my car insurance cover towing and roadside assistance?).

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Auto-Owners Roadside Assistance: Always There When You Need It

Roadside assistance coverage is something you hardly think about until you need it. It may be very comforting to know that someone is available to help you 24/7 when you need assistance.

Auto-Owners offers roadside assistance coverage, and the cost for this add-on insurance is modest — it more than pays for itself with your first call for assistance when towing is involved.

Read More: Does my car insurance cover towing and roadside assistance?

However, most car insurance companies offer roadside assistance, enter your ZIP code below to begin comparing quotes.

Frequently Asked Questions

What happens if I need a tow that is farther than the 15-mile limit?

If your vehicle needs a tow from outside the allowed 15-mile limit, you must pay the charges for the additional mileage. The average cost of this towing for extra distance is $2 to $4 per mile.

Can I ask the tow truck driver to make repairs?

This insurance covers minor mechanical repairs. Examples of these minor repairs include changing a blown fuse, replacing a taillight (if you have the replacement bulb), and perhaps changing an air filter or a belt if you have the replacement part.

Will roadside assistance coverage insurance pay for major mechanical repairs?

Roadside assistance coverage will only help with the labor for minor repairs but will not cover the cost of the replacement parts, such as a new tire.

Learn More: Does car insurance cover mechanical failure?

Does Auto-Owners Insurance have roadside assistance?

Yes, Auto-Owners Insurance offers roadside assistance coverage as an add-on, ensuring help is just a call away if you need a tow, jump-start, or fuel delivery while stranded.

How much does roadside assistance cost with Auto-Owners?

The cost of roadside assistance with Auto-Owners starts at just $3/mo. However, many factors affect your rates for car insurance and roadside assistance, such as location and driving record.

What services does Auto-Owners roadside assistance offer?

Auto-Owners roadside assistance covers towing, battery jump-starts, flat tires, lockouts, and fuel delivery.

Is Auto-Owners the same as AAA?

No, Auto-Owners Insurance isn’t the same as AAA. While both have roadside coverage, AAA is primarily a motor club offering some insurance products, while Auto-Owners is an insurance provider that sells roadside assistance as an add-on.

Check out our AAA insurance review to find out more about its roadside services. Then, enter your ZIP code to instantly compare AAA vs. Auto-Owners car insurance quotes in your area.

What’s the best company for roadside assistance?

The best company for roadside assistance depends on your specific needs, but Auto-Owners has high ratings for its efficient service, reliability, and coverage options. So, it competes closely with AAA and other top insurers for roadside support.

What is the financial rating of Auto-Owners?

Auto-Owners Insurance has a superior financial strength rating of A++ from A.M. Best, proving it can reliably pay out claims to policyholders.

What states does Auto-Owners Insurance cover?

Auto-Owners Insurance sells insurance coverage in 26 states in the United States, focusing primarily on the Midwest and Southeast. Check their website or contact an agent to confirm availability in your state.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.