Does Liberty Mutual car insurance include roadside assistance? (2025)

Liberty Mutual car insurance does include roadside assistance, and you can buy it for around $20 monthly. Roadside assistance benefits with Liberty Mutual include unlocking doors, fuel delivery, battery jumps, flat changes, and towing to a repair shop.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Liberty Mutual roadside assistance costs around $20 monthly

- The company’s program has different limits of $50 to $200 for services

- Coverage is only active for named vehicles in the policy

Yes, Liberty Mutual car insurance does include roadside assistance, but you must purchase it as an add-on for around $20 monthly. It may be a worthwhile addition to your insurance coverage to help in cases of a flat tire.

Keep reading to learn more about Liberty Mutual roadside assistance, and check out our Liberty Mutual insurance review for customer reviews and policy options.

Want to compare quotes for Liberty Mutual roadside assistance vs. AAA? Enter your ZIP code into our free quote tool above to instantly compare costs from the top providers near you.

Liberty Mutual Roadside Assistance Coverage

Roadside assistance coverage is not available for purchase separately. You must add it to an existing Liberty Mutual car insurance policy, which can be quickly done online (Learn More: Best Car Insurance Company That Sells Online).

Check out the table below to see how much adding roadside coverage to your policy would cost:

Roadside Assistance Coverage Monthly Rates by Provider

| Insurance Company | Rates |

|---|---|

| AAA | $26 |

| Allstate | $24 |

| Farmers | $25 |

| Geico | $22 |

| Liberty Mutual | $20 |

| Nationwide | $21 |

| Progressive | $23 |

| State Farm | $25 |

| Travelers | $23 |

| USAA | $22 |

If you do not already have this coverage, roadside assistance coverage from Liberty Mutual is worth adding to your auto policy. This is one type of extra insurance you should consider when thinking about how much car insurance you need.

Roadside assistance offers 24/7 help for these common car troubles:

- Getting locked out of your vehicle

- Needing a jump-start for a drained battery

- Changing a flat tire

- Running out of fuel

- Having mechanical troubles and needing a tow to the nearest mechanic for repair

The average cost of a tow truck is $75 to show up, plus $2 to $4 per mile. If the nearest mechanic is 100 miles away, the towing bill might be $275 to $475. The towing offered under this program is to the nearest repair facility, no matter how many miles it takes to get there — this is useful when you on a long stretch of highway without nearby services.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

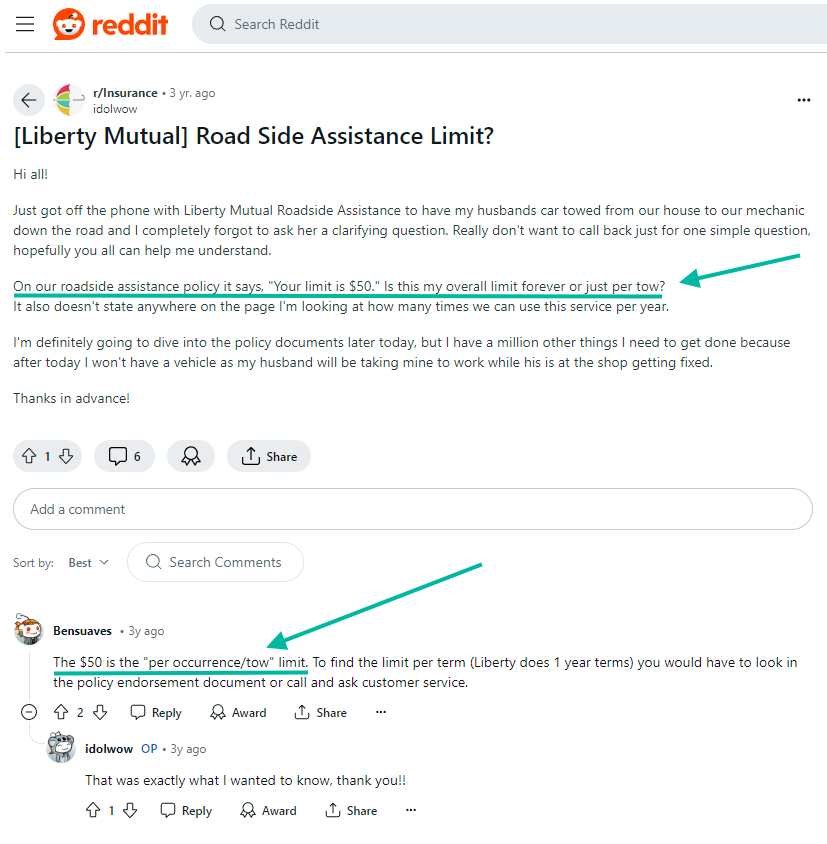

Understanding Roadside Assistance Coverage Limits

Liberty Mutual offers roadside assistance coverage that pays the first part of the services up to the policy limit, and you have to pay the rest.

With Liberty Mutual, you can choose a limit of $50, $100, $150, or $200. You probably should choose the highest amount because the cost of car towing is enough to pass the smaller limits easily.

Eric Stauffer Founder & Licensed Insurance Agent

Whatever limit you choose is per tow, not your overall limit, according to Liberty Mutual roadside assistance Reddit reviews.

However, if you have questions about your limit or want to change it, simply speak with a Liberty Mutual representative.

Does car insurance cover non-accident repairs? No, if your vehicle has a breakdown that requires major repairs, Liberty Mutual roadside assistance only helps with the towing to the nearest mechanic. If repairs were recent, and you still have a warranty that guarantees the work, the warranty provider might pay for the repairs if the parts used previously were defective.

Parents rejoice. It’s back to school time. We also know parents worry when students are away from home, so making sure they have things like 24-hour Roadside Assistance can help. pic.twitter.com/WHVk7n9EX0

— Liberty Mutual (@LibertyMutual) August 23, 2023

Does car insurance cover mechanical failure? For major repairs, the answer is no. For example, suppose you are driving down a highway, and your engine trouble light comes on, indicating a serious problem. You pull over to investigate under the hood. Your car overheats and a big puff of blue-gray smoke comes out of the exhaust while the engine dies.

Roadside assistance coverage will only get your vehicle to the nearest shop for repairs, but you will have to pay for the repair work.

Deciding to Buy Liberty Mutual Roadside Assistance

You may rarely need roadside assistance , but it’s a type of car insurance coverage worth having. Having someone available to help you 24/7 when you need assistance on a road trip is comforting for most people. It will not necessarily cover everything if you need long-distance towing, but it pays for the service bill up to the policy limit.

The cost to add this basic coverage to your Liberty Mutual insurance policy is minimal, but most of the best insurance companies offer roadside assistance.

Read to learn how to lower your car insurance rates? Start shopping for affordable roadside coverage today by entering your ZIP code into our quote comparison tool below.

Frequently Asked Questions

What does Liberty Mutual roadside assistance cover?

Roadside assistance with Liberty Mutual includes coverage for towing, jump-starts, flat tire changes, lockout help, and fuel delivery.

Learn More: What should you do if you have a tire blowout?

What happens if I need services that exceed the policy’s limits?

If your service bill exceeds the maximum amount of your roadside assistance coverage, you will have to pay the excess amount out-of-pocket.

Will the tow truck driver make repairs?

Repairs, except for changing a tire, are not covered. Your car needs to be towed to the nearest mechanic for any repairs.

Will roadside assistance coverage insurance pay for major mechancial repairs?

Does car insurance cover mechanical failure? Roadside assistance coverage won’t cover the cost of the replacement parts, such as a new tire, or pay for major repairs.

Who is cheaper than Liberty Mutual?

There are various other companies that often have lower rates for most drivers, such as Geico and State Farm. However, it’s critical to always compare quotes for roadside coverage to find the cheapest car insurance for you.

Read More:

Is Liberty Mutual roadside assistance free?

No, you must pay for Liberty Mutual roadside assistance coverage, which costs around $20 monthly.

What is the roadside assistance Liberty Mutual phone number?

Speak with Liberty Mutual customer service 24/7 at 1-800-426-9898.

How is Liberty Mutual roadside assistance vs. AAA?

While Liberty Mutual offers the basic roadside coverages you’ll find at most companies, you’ll find more comprehensive and unique benefits with AAA. For instance, with AAA roadside coverage, you get trip interruption coverage, travel discounts, and identity theft monitoring, though you’ll have to buy a membership. See if AAA’s roadside program is the best one for you in our AAA insurance review & complaints.

Use our free quote comparison tool below to see how much you could pay for Liberty Mutual vs. AAA roadside assistance auto insurance.

Does Liberty Mutual have 12-month policies?

Yes, you can get a 12-month policy with Liberty Mutual, which could be cheaper than a 6-month policy.

How long is Liberty Mutual’s grace period?

Liberty Mutual offers its policyholders a grace period of 10 to 14 business days for premium payments.

How much is Liberty Mutual roadside assistance?

The Liberty Mutual roadside assistance price is around $20 monthly.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.