Best Idaho Car Insurance (2025)

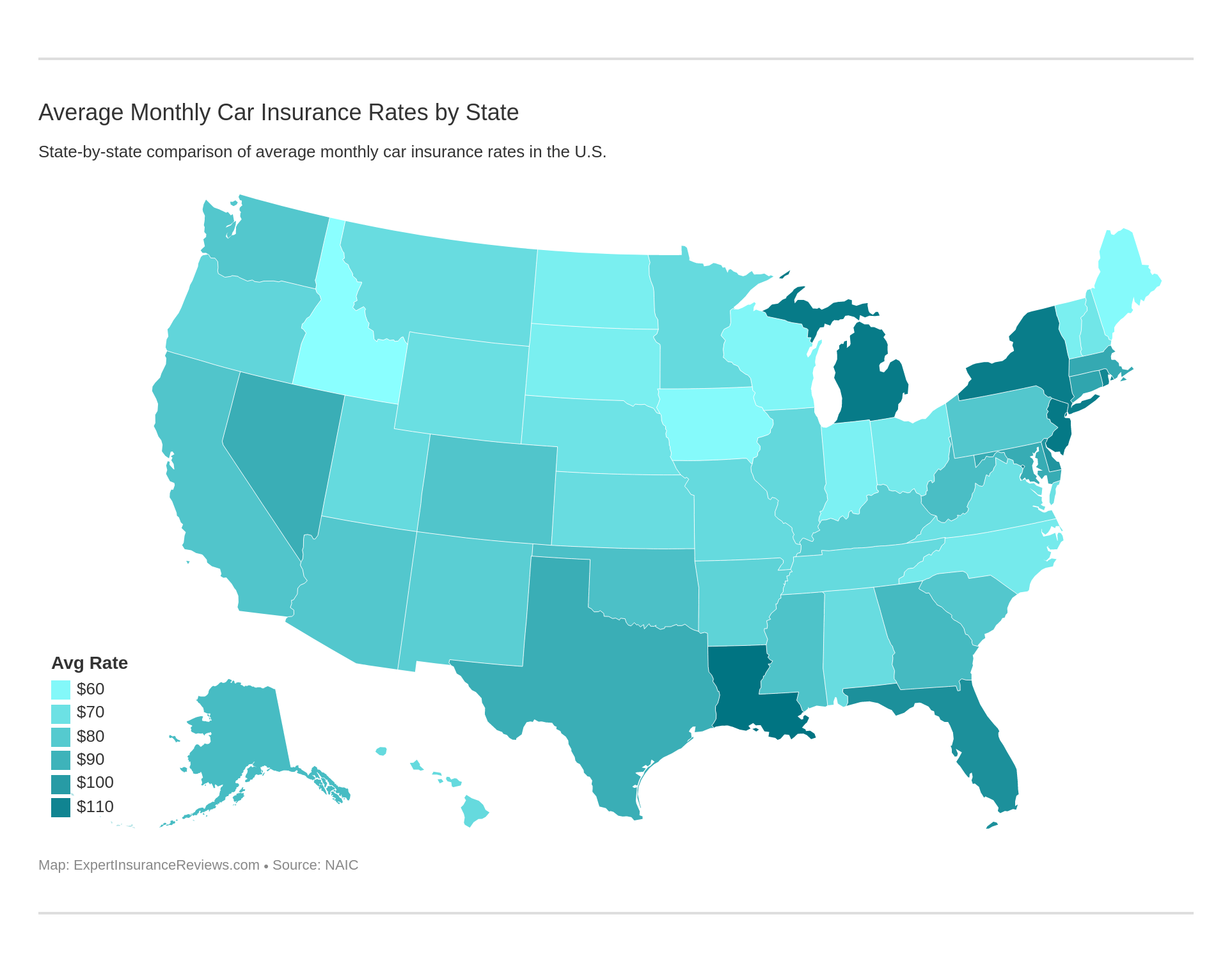

Idaho auto insurance rates average $57 per month while Idaho minimum car insurance requirements are 25/50/15 for bodily injury and property damage coverage. The cheapest Idaho car insurance companies are State Farm and USAA, but factors such as your age, gender, and driving record can affect your Idaho car insurance quotes.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

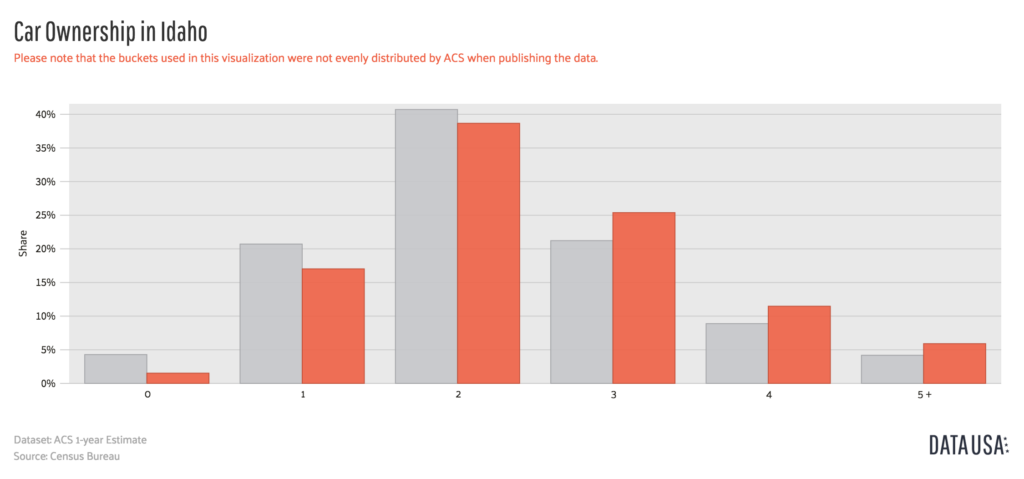

| Idaho Statistics Summary | Details |

|---|---|

| Road Miles | Total Roadway Miles: 51,163 Vehicle Miles Driven (in millions): 16,662 |

| State Population | 1,754,208 |

| Vehicles | Total Registered: 1,788,384 Vehicles Stolen: 1,871 |

| Most Popular Vehicle | Ford F150 |

| Uninsured Motorists | 8.2 % State Rank: 40 |

| Driving Fatalities in 2017 | Speeding: 48 DUI: 60 Total: 244 |

| Annual Insurance Costs (2015) | Liability: $344.29 Collision: $219.05 Comprehensive: $116.55 Full Coverage: $679.89 |

| Cheapest Provider | State Farm |

Idaho is attracting a lot of new residents, including a lot of Californians. Those who do live here and enjoy life in the state have plenty to explore. But whether you’re headed north towards the Panhandle and the Canadian border or heading to work in Boise, you need car insurance.

Car insurance is the law in Idaho, and you know you have to buy it, but shopping for it isn’t the most enjoyable task you can imagine.

Digging through company reviews, calling agents and representatives, trying to figure out what coverage you really need – it’s a headache. You have better things to do, so you want everything you need to know in one place.

That place is right here. We’ve gathered all the details on Idaho auto insurance in one place.

This comprehensive guide will break down all of the car insurance laws in Idaho, what coverage is optional, and look at the best car insurance companies by reputation, price, and a whole lot more.

Read on, and then let us help you compare Idaho car insurance rates so you can start saving today.

Idaho Car Insurance Coverage and Rates

Whether you are buying your first car insurance policy, are new to Idaho, or are simply ready to look for a better deal, car insurance can be confusing.

You know you need at least the legal minimum, but what else do you need? With so many options to choose from and so many companies after your business, it’s hard to even know where to start.

We’ll help you start at the beginning, with a concise explanation of the coverage musts and coverage maybes.

Below you’ll find everything you need to know about Idaho’s required coverage, options that you can choose from, and of course rates from several of the biggest companies in Idaho thanks to our data from Quadrant.

Idaho Minimum Auto Insurance Coverage

How much coverage do you absolutely need to have in Idaho to avoid a ticket? Here’s a look at what you need to carry and in what minimum amounts, according to the Idaho Department of Insurance.

| Insurance Required | Coverage |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $15,000 per accident |

| Uninsured Motorist Coverage (unless rejected in writing) | Amount must equal selected bodily injury liability coverage amount |

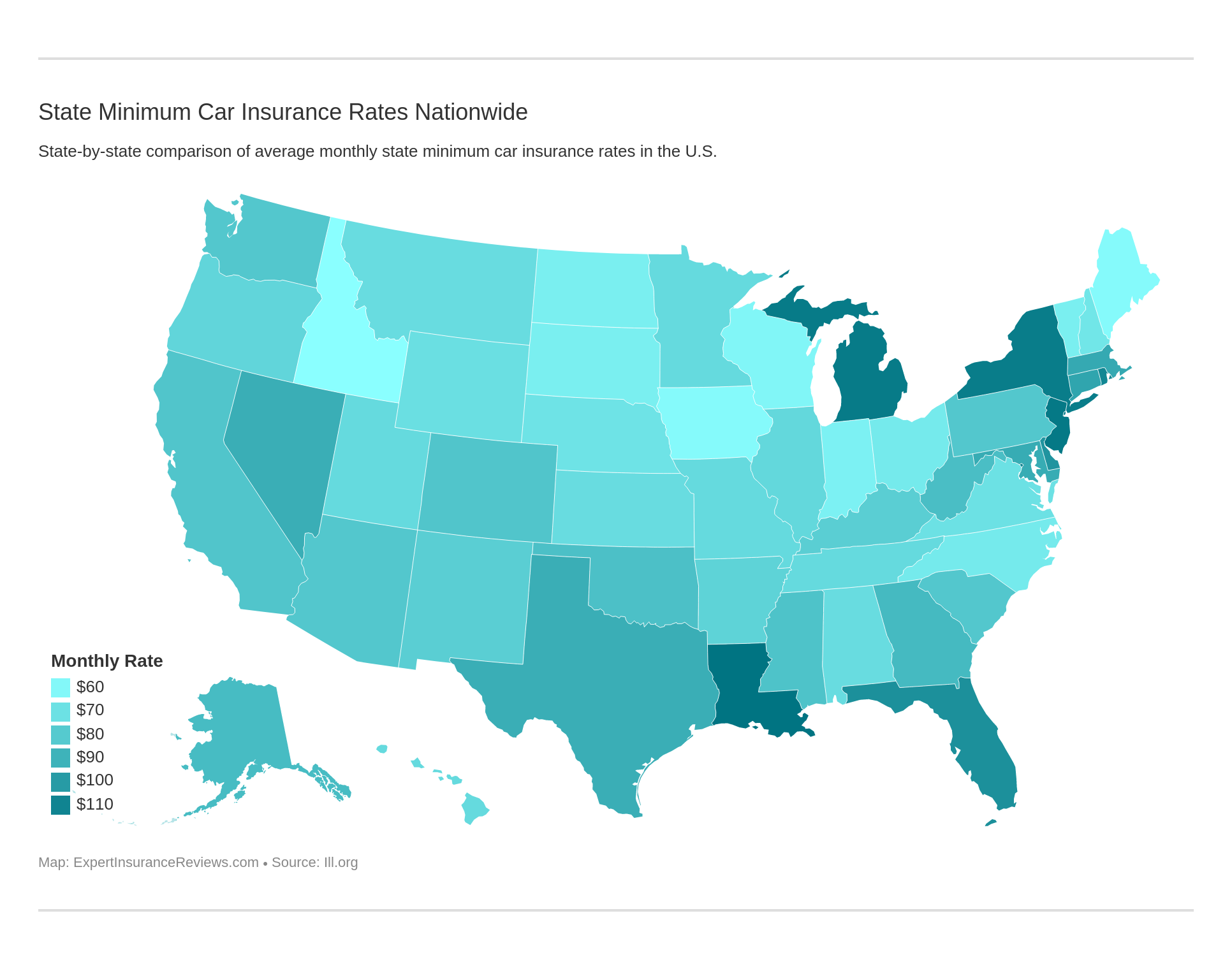

As a fault state, Idaho requires you to have liability insurance that pays for injuries or property damage when you are at fault in an accident. Idaho’s minimum limits aren’t the highest, but not the lowest. Take a look at how the other states stack up courtesy of AAA.

You don’t actually have to carry Uninsured/Underinsured Motorist coverage but if you choose not to carry it, you must reject it in writing.

If you do carry it, you must carry a minimum amount equal to your liability limits.

Idaho is one of the states that allow you to provide proof of insurance in an electronic format, says Allstate. That means you can use your phone to provide proof rather than searching for that little ID card.

Forms of Financial Responsibility

Most drivers satisfy Idaho’s financial responsibility laws with car insurance, but the state does offer a few additional options.

If you own more than 25 cars, you can self-insure, but since most of us don’t have a fleet (or anywhere to park it) this option doesn’t usually apply.

If you are able to provide an indemnity bond in the amount of $50,000, with $15,000 of that provided for property damage, you can bypass purchasing insurance. Idaho’s law allows up to five cars this way, with bonds of up to $120,000.

No matter which option you choose, remember that you must be able to provide proof of financial responsibility on request.

The cost of minimum insurance vary from state to state.

Premiums as a Percentage of Income

Of all the things you want to spend your disposable income (what you have left after taxes) on, car insurance isn’t likely anywhere near the top of the list. Fortunately, Idahoans don’t spend an inordinate amount on it.

| Idaho Insurance and Disposable Income | 2012 (Idaho) | 2012 (National) | 2013 (Idaho) | 2014 (National) | 2014 (Idaho) | 2014 (National) |

|---|---|---|---|---|---|---|

| Disposable Income Amount (Average) | $31,589.00 | $39,473.00 | $32,312.00 | $39,192.00 | $33,600.00 | $40,859.00 |

| Full Coverage Policy Cost (Average) | $639.19 | $924.45 | $650.57 | $950.92 | $673.13 | $981.77 |

| Percent of Income Spent on Car Insurance | 2.02% | 2.34% | 2.01% | 2.43% | 2.00% | 2.40% |

The average percentage of income spent on car insurance in the state is well below the national average.

Idaho also spends less than its neighbors. Oregononions spend an average of 2.45 percent on car insurance, while in Montana that amount is 2.41 percent.

CalculatorPro

Average Monthly Car Insurance Rates in ID (Liability, Collision, Comprehensive)

Core coverage refers to the three basic parts of a full coverage auto insurance policy. Those are liability, collision, and comprehensive coverage. While only the first of those is required by law, drivers with a car loan will be required to carry the other two as well.

These three coverages make up the most commonly chosen car insurance coverages. Here’s a look at what they cost, on average, in Idaho, compared to the national average.

| Coverage Type | Idaho Average (2015) | National Average (2015) |

|---|---|---|

| Liability | $344.29 | $538.73 |

| Collision | $219.05 | $322.61 |

| Comprehensive | $116.55 | $148.04 |

| Combined | $679.89 | $1,009.38 |

Additional Liability

On top of what’s required by state law, there are some other options that can be added to your Idaho insurance policy for extra coverage.

We’ve already mentioned Uninsured/Underinsured (UM/UIM) Motorist coverage, which Idaho drivers can choose to opt-out of carrying. Let’s look at why you should consider carrying it.

8.2 percent of drivers in Idaho don’t carry insurance.

The good news is, that’s really low. Idaho ranks 40th in the nation for uninsured drivers. That doesn’t mean you might not wind up in an accident with one of those drivers, or with an uninsured driver from another state.

And then there’s the issue of underinsured drivers, which is a bit more complex. There’s no set number for what makes a driver underinsured; it happens when the costs of an accident exceed the available coverage.

For an Idaho driver carrying the legal minimum, a serious accident with major injuries can quickly exceed the bodily injury coverage. And consider how easy it is to exceed $15,000 in property damage when the average cost of a new car is about $36,000, with even a compact car averaging a $20,000 price tag.

If your new car is totaled by a person carrying only the minimum, your uninsured motorist protection can help make up the difference.

There is a second type of additional liability coverage available to Idaho drivers. Medical Payments, or MedPay, provides extra coverage for medical bills incurred by you or your passengers regardless of who is at fault in the accident.

Now let’s look at how these coverages perform in Idaho, using loss ratios provided by the National Association of Insurance Commissioners (NAIC).

Loss ratios tell us how much companies are paying out in claims compared to the amount they take in as premiums.

You want to see loss ratios that are neither too high (indicating companies are paying out too much and may be at financial risk) or too low (indicating companies aren’t paying out as much as they should on claims).

Here’s a look at loss ratios for additional liability in Idaho compared to the national average.

| Loss Ratio | Idaho (2015) | National (2015) |

|---|---|---|

| Medical Payments (MedPay) | 79.94 | 75.72 |

| Uninsured/ Underinsured Motorist Coverage | 59.20 | 75.11 |

Loss ratios for MedPay in Idaho are about average, but the ratio for UM/UIM is on the low side.

Add-ons, Endorsements, and Riders

There are a lot more options that can be added to an insurance policy. Not all drivers will need all of them, and not all insurance companies will offer all of them.

These add-ons round out your insurance policy and add additional protection based on your needs.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Car Insurance

Usage-based insurance is a recent trend in the industry and uses tracking systems to record driving habits and calculate a discount for the driver. Most major insurance companies and plenty of small ones offer such a program, which is optional.

Pay-per-mile insurance is the newest form of pay-as-you-drive coverage. It’s available in a limited number of states, and currently, Idaho isn’t one of them.

Average Car Insurance Rates by Age & Gender in ID

Age and gender are both factors that affect car insurance rates in Idaho. As a general rule, younger drivers pay more for car insurance because they have less experience and are therefore a higher risk.

Gender also has an impact on rates because there are some statistical differences in risk. The highest risk group is young, male drivers, and the rates in Idaho bear that out.

| Company | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,345.01 | $2,332.52 | $2,040.06 | $2,114.91 | $8,575.44 | $9,910.14 | $2,620.54 | $2,771.46 |

| American Family Mutual | $2,098.66 | $2,098.66 | $1,865.53 | $1,865.53 | $7,458.86 | $9,709.85 | $2,098.66 | $2,634.55 |

| Farmers Ins Co Of ID | $1,579.86 | $1,568.87 | $1,394.21 | $1,475.19 | $7,662.21 | $7,928.27 | $1,819.86 | $1,917.77 |

| Geico General | $2,003.54 | $1,977.85 | $1,905.97 | $1,851.21 | $4,285.41 | $5,332.81 | $2,715.75 | $2,092.87 |

| Safeco Ins Co of IL | $1,441.66 | $1,555.14 | $1,167.08 | $1,303.18 | $4,638.27 | $5,157.45 | $1,530.65 | $1,618.67 |

| Depositors Insurance | $1,856.77 | $1,901.41 | $1,674.47 | $1,778.32 | $4,550.02 | $5,610.65 | $2,171.95 | $2,339.94 |

| State Farm Mutual Auto | $1,150.90 | $1,150.90 | $1,037.46 | $1,037.46 | $3,436.89 | $4,333.19 | $1,298.56 | $1,498.32 |

| Travelers Home & Marine Ins Co | $1,355.74 | $1,376.87 | $1,363.72 | $1,357.36 | $6,688.71 | $10,577.29 | $1,440.61 | $1,650.04 |

| USAA | $1,099.98 | $1,098.36 | $1,073.73 | $1,059.32 | $3,611.65 | $4,046.57 | $1,458.58 | $1,572.68 |

As you can see, rates drop sharply from age 25 and beyond, and the gender difference levels out as well, in some cases even reversing.

Idaho Rates By Zip Code

Where you live in Idaho makes a difference to your rates as well. Search the table below to find your zip code and compare rates from different carriers.

| Zipcode | Annual Average | Allstate F&C | American Family Mutual | Farmers Ins Co Of ID | Geico General | Safeco Ins Co of IL | Depositors Insurance | State Farm Mutual Auto | Travelers Home & Marine Ins Co | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| 83536 | $3,008.28 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,989.82 | $3,344.06 | $1,998.09 |

| 83546 | $2,999.62 | $4,631.61 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $2,000.81 | $3,281.24 | $1,998.09 |

| 83531 | $2,994.12 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,338.96 | $2,872.16 | $1,921.71 | $3,435.94 | $1,998.09 |

| 83544 | $2,991.37 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $2,017.88 | $3,281.24 | $1,998.09 |

| 83520 | $2,988.00 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,872.16 | $1,921.71 | $3,161.57 | $1,998.09 |

| 83553 | $2,987.99 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $2,003.38 | $3,265.37 | $1,998.09 |

| 83523 | $2,980.70 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,924.06 | $3,161.57 | $1,998.09 |

| 83543 | $2,975.21 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,965.99 | $3,161.57 | $1,998.09 |

| 83860 | $2,974.33 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,776.38 | $1,949.95 | $3,566.74 | $2,028.83 |

| 83530 | $2,973.80 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,825.55 | $3,435.94 | $1,998.09 |

| 83526 | $2,973.54 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,246.18 | $1,998.09 |

| 83449 | $2,968.69 | $4,339.03 | $3,935.85 | $3,231.61 | $2,777.53 | $2,404.62 | $2,712.31 | $2,023.09 | $3,349.33 | $1,944.86 |

| 83434 | $2,968.23 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,916.45 | $3,457.46 | $1,944.86 |

| 83826 | $2,967.64 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,921.71 | $3,455.88 | $2,028.83 |

| 83853 | $2,967.64 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,921.71 | $3,455.88 | $2,028.83 |

| 83404 | $2,967.30 | $4,279.29 | $3,935.85 | $3,319.49 | $2,841.52 | $2,404.62 | $2,803.64 | $1,939.56 | $3,236.84 | $1,944.86 |

| 83524 | $2,965.83 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,863.47 | $3,374.98 | $1,854.19 |

| 83809 | $2,964.55 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,776.38 | $1,974.64 | $3,453.94 | $2,028.83 |

| 83548 | $2,964.45 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,921.71 | $3,161.57 | $1,854.19 |

| 83865 | $2,964.42 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,921.71 | $3,479.87 | $2,028.83 |

| 83805 | $2,964.11 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,889.90 | $3,455.88 | $2,028.83 |

| 83455 | $2,963.74 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $2,102.03 | $3,262.32 | $1,890.34 |

| 83428 | $2,963.46 | $4,339.03 | $3,935.85 | $3,231.61 | $2,777.53 | $2,404.62 | $2,712.31 | $2,016.77 | $3,382.90 | $1,870.51 |

| 83539 | $2,963.26 | $4,631.61 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,892.81 | $3,242.75 | $1,998.09 |

| 83856 | $2,961.57 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,953.39 | $3,422.54 | $2,028.83 |

| 83422 | $2,960.74 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $2,075.08 | $3,262.32 | $1,890.34 |

| 83836 | $2,960.60 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,948.96 | $3,365.22 | $2,028.83 |

| 83822 | $2,959.92 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,953.39 | $3,407.67 | $2,028.83 |

| 83549 | $2,959.83 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,959.63 | $3,236.40 | $1,998.09 |

| 83401 | $2,959.48 | $4,181.57 | $3,935.85 | $3,319.49 | $2,841.52 | $2,404.62 | $2,712.31 | $2,023.03 | $3,272.09 | $1,944.86 |

| 83452 | $2,959.41 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $2,063.11 | $3,262.32 | $1,890.34 |

| 83533 | $2,959.06 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,115.83 | $1,998.09 |

| 83221 | $2,958.18 | $4,201.19 | $3,935.85 | $3,231.61 | $2,841.52 | $2,452.43 | $2,762.33 | $2,105.49 | $3,148.31 | $1,944.86 |

| 83845 | $2,957.53 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,895.95 | $3,390.67 | $2,028.83 |

| 83554 | $2,956.33 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,242.78 | $1,998.09 |

| 83821 | $2,956.28 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,898.85 | $3,376.45 | $2,028.83 |

| 83444 | $2,955.14 | $4,153.76 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,962.74 | $3,404.85 | $1,944.86 |

| 83848 | $2,953.98 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,921.71 | $3,332.93 | $2,028.83 |

| 83811 | $2,953.78 | $4,076.47 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,776.38 | $1,959.78 | $3,300.64 | $2,028.83 |

| 83864 | $2,953.66 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,323.02 | $2,802.25 | $1,929.51 | $3,479.87 | $2,028.83 |

| 83218 | $2,953.40 | $4,224.74 | $3,935.85 | $3,231.61 | $2,841.52 | $2,452.43 | $2,762.33 | $2,016.77 | $3,248.63 | $1,866.71 |

| 83402 | $2,952.67 | $4,213.93 | $3,935.85 | $3,319.49 | $2,841.52 | $2,395.81 | $2,803.64 | $1,937.78 | $3,181.16 | $1,944.86 |

| 83450 | $2,951.80 | $4,185.79 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,937.02 | $3,368.48 | $1,944.86 |

| 83840 | $2,951.68 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,921.71 | $3,365.22 | $2,028.83 |

| 83841 | $2,951.68 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,921.71 | $3,365.22 | $2,028.83 |

| 83541 | $2,950.11 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,935.36 | $3,161.57 | $1,854.19 |

| 83555 | $2,949.99 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,225.41 | $2,804.12 | $1,900.98 | $3,149.76 | $1,998.09 |

| 83850 | $2,949.04 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $2,012.25 | $3,342.64 | $2,028.83 |

| 83813 | $2,948.73 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,776.38 | $1,983.50 | $3,302.74 | $2,028.83 |

| 83406 | $2,948.71 | $4,234.50 | $3,935.85 | $3,319.49 | $2,841.52 | $2,404.62 | $2,712.31 | $2,004.26 | $3,141.01 | $1,944.86 |

| 83852 | $2,947.82 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,919.29 | $3,332.93 | $2,028.83 |

| 83236 | $2,946.32 | $4,192.99 | $3,935.85 | $3,231.61 | $2,777.53 | $2,452.43 | $2,762.33 | $2,008.19 | $3,211.14 | $1,944.86 |

| 83839 | $2,946.09 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,985.71 | $3,342.64 | $2,028.83 |

| 83522 | $2,945.39 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,889.98 | $3,115.83 | $1,998.09 |

| 83427 | $2,945.31 | $4,279.29 | $3,935.85 | $3,231.61 | $2,841.52 | $2,404.62 | $2,712.31 | $2,016.77 | $3,141.01 | $1,944.86 |

| 83847 | $2,945.23 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,895.95 | $3,332.93 | $2,028.83 |

| 83425 | $2,944.13 | $4,305.88 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,900.69 | $3,215.70 | $1,944.86 |

| 83274 | $2,942.05 | $4,192.99 | $3,935.85 | $3,231.61 | $2,841.52 | $2,452.43 | $2,762.33 | $1,937.52 | $3,179.32 | $1,944.86 |

| 83424 | $2,941.37 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $1,900.69 | $3,262.32 | $1,890.34 |

| 83540 | $2,940.84 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,225.41 | $2,804.12 | $1,859.37 | $3,395.55 | $1,854.19 |

| 83861 | $2,940.69 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,965.80 | $3,359.32 | $2,028.83 |

| 83545 | $2,938.99 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,832.79 | $3,164.06 | $1,854.19 |

| 83431 | $2,938.11 | $4,270.46 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,947.35 | $3,150.27 | $1,944.86 |

| 83420 | $2,937.21 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,915.05 | $3,234.18 | $1,890.34 |

| 83866 | $2,937.09 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,933.37 | $3,359.32 | $2,028.83 |

| 83810 | $2,936.68 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,964.36 | $3,279.25 | $2,028.83 |

| 83429 | $2,936.38 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,932.41 | $3,209.35 | $1,890.34 |

| 83451 | $2,936.22 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,838.44 | $3,301.86 | $1,890.34 |

| 83442 | $2,935.59 | $4,270.46 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,956.08 | $3,118.91 | $1,944.86 |

| 83436 | $2,934.77 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,900.69 | $3,226.58 | $1,890.34 |

| 83542 | $2,933.61 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,038.34 | $1,998.09 |

| 83833 | $2,932.09 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,931.25 | $3,271.08 | $2,028.83 |

| 83842 | $2,931.94 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,921.71 | $3,279.25 | $2,028.83 |

| 83824 | $2,931.84 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,921.71 | $3,368.17 | $2,028.83 |

| 83262 | $2,931.35 | $4,050.30 | $3,935.85 | $3,231.61 | $2,777.53 | $2,452.43 | $2,762.33 | $2,098.97 | $3,128.26 | $1,944.86 |

| 83537 | $2,929.55 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,804.12 | $1,896.98 | $3,267.47 | $1,854.19 |

| 83445 | $2,929.41 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,832.34 | $3,246.69 | $1,890.34 |

| 83421 | $2,928.50 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,234.18 | $1,890.34 |

| 83215 | $2,928.21 | $4,201.19 | $3,935.85 | $3,028.45 | $2,841.52 | $2,452.43 | $2,762.33 | $2,016.77 | $3,248.63 | $1,866.71 |

| 83446 | $2,927.88 | $4,305.88 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,211.60 | $1,866.71 |

| 83851 | $2,927.88 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,938.71 | $3,271.08 | $2,028.83 |

| 83440 | $2,926.93 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,830.10 | $3,226.58 | $1,890.34 |

| 83671 | $2,926.88 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,242.78 | $1,998.09 |

| 83870 | $2,926.80 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,885.23 | $3,359.32 | $2,028.83 |

| 83433 | $2,925.74 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,209.35 | $1,890.34 |

| 83872 | $2,925.52 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,849.83 | $3,406.89 | $1,947.30 |

| 83876 | $2,923.27 | $3,941.82 | $3,668.25 | $3,306.96 | $2,892.45 | $2,478.28 | $2,776.38 | $1,945.43 | $3,271.08 | $2,028.83 |

| 83535 | $2,922.35 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,884.61 | $3,345.44 | $1,854.19 |

| 83443 | $2,922.33 | $4,270.46 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,118.91 | $1,944.86 |

| 83832 | $2,921.33 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,860.24 | $3,267.47 | $1,947.30 |

| 83812 | $2,919.68 | $3,988.75 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,921.71 | $3,167.40 | $2,028.83 |

| 83803 | $2,919.27 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,705.06 | $1,966.22 | $3,329.59 | $2,028.83 |

| 83871 | $2,918.98 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,842.99 | $3,354.93 | $1,947.30 |

| 83460 | $2,918.87 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,876.70 | $1,817.18 | $3,226.58 | $1,944.86 |

| 83448 | $2,918.32 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $1,802.78 | $3,226.58 | $1,890.34 |

| 83868 | $2,918.02 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,992.56 | $3,342.64 | $2,028.83 |

| 83806 | $2,917.85 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,832.79 | $3,354.93 | $1,947.30 |

| 83827 | $2,917.63 | $3,988.75 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $1,921.71 | $3,265.37 | $1,998.09 |

| 83830 | $2,917.14 | $4,033.13 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,921.71 | $3,269.84 | $2,028.83 |

| 83438 | $2,917.01 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,338.96 | $2,926.80 | $1,900.69 | $3,226.58 | $1,890.34 |

| 83837 | $2,916.87 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,973.04 | $3,351.76 | $2,028.83 |

| 83204 | $2,916.73 | $3,950.56 | $3,935.85 | $3,220.36 | $2,827.17 | $2,452.43 | $2,783.09 | $2,094.87 | $3,115.76 | $1,870.51 |

| 83547 | $2,916.57 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,150.00 | $1,998.09 |

| 83808 | $2,914.35 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,950.38 | $3,351.76 | $2,028.83 |

| 83801 | $2,911.64 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,776.38 | $1,971.85 | $3,184.02 | $2,028.83 |

| 83823 | $2,911.17 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,865.74 | $3,354.93 | $1,854.19 |

| 83804 | $2,911.12 | $3,923.58 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,954.48 | $3,102.03 | $2,028.83 |

| 83867 | $2,910.15 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,921.71 | $3,342.64 | $2,028.83 |

| 83435 | $2,910.08 | $3,999.42 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,900.69 | $3,215.70 | $1,944.86 |

| 83849 | $2,909.77 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,918.28 | $3,342.64 | $2,028.83 |

| 83844 | $2,909.41 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,832.79 | $3,278.99 | $1,947.30 |

| 83201 | $2,908.65 | $3,950.56 | $3,935.85 | $3,220.36 | $2,827.17 | $2,404.62 | $2,783.09 | $2,072.13 | $3,113.54 | $1,870.51 |

| 83802 | $2,907.88 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,921.71 | $3,322.24 | $2,028.83 |

| 83202 | $2,902.87 | $4,008.90 | $3,935.85 | $3,220.36 | $2,827.17 | $2,404.62 | $2,783.09 | $2,034.83 | $3,040.47 | $1,870.51 |

| 83873 | $2,902.47 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,854.26 | $3,340.98 | $2,028.83 |

| 83210 | $2,902.40 | $4,037.34 | $3,935.85 | $3,028.45 | $2,777.53 | $2,452.43 | $2,762.33 | $1,995.38 | $3,187.48 | $1,944.86 |

| 83846 | $2,901.21 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,861.68 | $3,322.24 | $2,028.83 |

| 83245 | $2,900.20 | $3,992.53 | $3,935.85 | $3,231.61 | $2,827.17 | $2,452.43 | $2,631.16 | $2,033.19 | $3,127.33 | $1,870.51 |

| 83209 | $2,897.71 | $3,950.56 | $3,935.85 | $3,220.36 | $2,827.17 | $2,452.43 | $2,631.16 | $2,075.63 | $3,115.76 | $1,870.51 |

| 83423 | $2,897.09 | $3,999.42 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,941.79 | $3,199.88 | $1,866.71 |

| 83277 | $2,895.19 | $4,037.34 | $3,935.85 | $3,028.45 | $2,777.53 | $2,452.43 | $2,762.33 | $2,016.77 | $3,179.32 | $1,866.71 |

| 83843 | $2,891.59 | $4,600.50 | $3,552.57 | $3,306.96 | $2,596.54 | $2,214.33 | $2,673.74 | $1,853.42 | $3,278.99 | $1,947.30 |

| 83501 | $2,890.80 | $4,691.81 | $3,552.57 | $3,208.69 | $2,596.54 | $2,225.41 | $2,804.12 | $1,846.78 | $3,237.05 | $1,854.19 |

| 83552 | $2,888.02 | $3,954.45 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,892.81 | $3,242.78 | $1,998.09 |

| 83869 | $2,875.40 | $3,923.58 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,705.06 | $1,933.66 | $3,102.03 | $2,028.83 |

| 83687 | $2,871.66 | $3,973.77 | $4,166.07 | $3,203.06 | $2,499.48 | $2,267.71 | $2,801.06 | $1,909.39 | $3,297.43 | $1,726.98 |

| 83626 | $2,871.31 | $4,004.21 | $4,166.07 | $3,041.94 | $2,515.57 | $2,338.96 | $2,805.89 | $1,859.31 | $3,382.91 | $1,726.98 |

| 83686 | $2,871.09 | $3,973.77 | $4,166.07 | $3,203.06 | $2,499.48 | $2,381.57 | $2,717.98 | $1,908.45 | $3,262.45 | $1,726.98 |

| 83858 | $2,869.16 | $3,819.53 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,705.06 | $1,926.26 | $3,157.25 | $2,028.83 |

| 83612 | $2,868.51 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,808.07 | $3,088.31 | $1,866.71 |

| 83525 | $2,867.22 | $3,863.12 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,894.73 | $3,144.95 | $1,998.09 |

| 83250 | $2,865.42 | $3,992.53 | $3,695.28 | $3,231.61 | $2,827.17 | $2,452.43 | $2,631.16 | $1,964.55 | $3,127.33 | $1,866.71 |

| 83651 | $2,864.29 | $3,973.77 | $4,166.07 | $3,185.49 | $2,499.48 | $2,269.58 | $2,801.06 | $1,991.41 | $3,164.82 | $1,726.98 |

| 83672 | $2,864.12 | $4,637.51 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,705.50 | $3,054.16 | $1,866.71 |

| 83464 | $2,863.70 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,961.37 | $3,160.69 | $1,866.71 |

| 83605 | $2,863.42 | $3,937.96 | $4,166.07 | $3,014.28 | $2,499.48 | $2,345.70 | $2,838.90 | $1,965.27 | $3,276.10 | $1,726.98 |

| 83467 | $2,862.84 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,940.19 | $3,174.07 | $1,866.71 |

| 83286 | $2,859.35 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,788.99 | $3,364.85 | $1,866.71 |

| 83610 | $2,859.27 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,814.28 | $2,998.91 | $1,866.71 |

| 83462 | $2,859.10 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,919.91 | $3,160.69 | $1,866.71 |

| 83468 | $2,858.98 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,338.96 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83654 | $2,858.61 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,828.16 | $2,979.06 | $1,866.71 |

| 83233 | $2,858.15 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,338.96 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83213 | $2,857.29 | $4,201.19 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,916.84 | $3,206.17 | $1,866.71 |

| 83465 | $2,856.96 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83466 | $2,856.96 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83607 | $2,856.56 | $4,054.78 | $4,166.07 | $3,041.94 | $2,515.57 | $2,375.37 | $2,805.89 | $1,921.26 | $3,101.23 | $1,726.98 |

| 83676 | $2,855.64 | $4,004.21 | $4,166.07 | $3,041.94 | $2,515.57 | $2,338.96 | $2,805.89 | $1,826.41 | $3,274.70 | $1,726.98 |

| 83263 | $2,854.56 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.87 | $3,364.85 | $1,866.71 |

| 83272 | $2,854.56 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.87 | $3,364.85 | $1,866.71 |

| 83223 | $2,854.55 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83283 | $2,854.55 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83252 | $2,854.44 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,780.84 | $3,138.23 | $1,866.71 |

| 83285 | $2,854.44 | $4,192.99 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,283.25 | $1,870.51 |

| 83234 | $2,853.72 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,776.88 | $3,135.65 | $1,866.71 |

| 83217 | $2,852.05 | $4,073.85 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,769.34 | $3,166.74 | $1,870.51 |

| 83214 | $2,851.19 | $4,034.89 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,803.19 | $3,167.89 | $1,866.71 |

| 83220 | $2,849.58 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83238 | $2,849.58 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83281 | $2,849.34 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,745.81 | $3,127.33 | $1,866.71 |

| 83463 | $2,849.34 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83855 | $2,848.45 | $3,897.43 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,852.90 | $3,413.29 | $1,947.30 |

| 83243 | $2,847.29 | $4,116.21 | $3,695.28 | $3,231.61 | $2,827.17 | $2,452.43 | $2,631.16 | $1,745.81 | $3,059.27 | $1,866.71 |

| 83251 | $2,846.67 | $3,999.42 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,973.22 | $3,255.95 | $1,866.71 |

| 83340 | $2,846.21 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,222.00 | $2,706.72 | $1,932.28 | $3,392.53 | $1,823.77 |

| 83230 | $2,845.61 | $4,190.56 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,206.20 | $1,870.51 |

| 83228 | $2,845.31 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,776.88 | $3,250.62 | $1,866.71 |

| 83237 | $2,844.28 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,767.61 | $3,250.62 | $1,866.71 |

| 83254 | $2,844.20 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,697.43 | $3,364.85 | $1,866.71 |

| 83211 | $2,843.72 | $4,037.34 | $3,695.28 | $3,028.45 | $2,827.17 | $2,452.43 | $2,631.16 | $1,806.31 | $3,248.63 | $1,866.71 |

| 83239 | $2,843.53 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,691.38 | $3,364.85 | $1,866.71 |

| 83276 | $2,843.08 | $4,190.56 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,723.03 | $3,206.20 | $1,870.51 |

| 83255 | $2,842.92 | $4,034.33 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,921.71 | $3,238.75 | $1,866.71 |

| 83631 | $2,841.87 | $3,916.80 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,863.50 | $3,391.58 | $1,866.71 |

| 83232 | $2,841.86 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,250.62 | $1,866.71 |

| 83287 | $2,841.86 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,250.62 | $1,866.71 |

| 83644 | $2,839.20 | $3,892.56 | $4,166.07 | $3,041.94 | $2,543.13 | $2,230.07 | $2,805.89 | $1,928.74 | $3,217.41 | $1,726.98 |

| 83857 | $2,838.56 | $3,897.43 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,831.70 | $3,345.44 | $1,947.30 |

| 83244 | $2,834.89 | $4,034.33 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,900.69 | $3,187.51 | $1,866.71 |

| 83241 | $2,833.28 | $4,073.85 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,739.83 | $3,217.91 | $1,870.51 |

| 83246 | $2,831.92 | $3,992.53 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,751.93 | $3,088.06 | $1,866.71 |

| 83253 | $2,831.54 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83212 | $2,829.43 | $3,992.53 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,745.81 | $3,071.82 | $1,866.71 |

| 83834 | $2,828.33 | $3,897.43 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,832.79 | $3,345.44 | $1,854.19 |

| 83278 | $2,826.86 | $4,012.05 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,971.75 | $3,053.03 | $1,866.71 |

| 83235 | $2,826.72 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83226 | $2,826.16 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,895.71 | $3,160.69 | $1,866.71 |

| 83641 | $2,824.89 | $3,878.18 | $4,166.07 | $3,041.94 | $2,515.57 | $2,252.15 | $2,717.98 | $1,824.03 | $3,161.37 | $1,866.71 |

| 83271 | $2,824.30 | $4,037.34 | $3,695.28 | $3,028.45 | $2,827.17 | $2,452.43 | $2,631.16 | $1,820.94 | $3,059.27 | $1,866.71 |

| 83327 | $2,824.05 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,706.72 | $1,896.19 | $3,277.85 | $1,744.94 |

| 83229 | $2,823.92 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83469 | $2,823.92 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83347 | $2,823.71 | $4,034.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,719.58 | $3,317.43 | $1,744.94 |

| 83353 | $2,823.59 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,222.00 | $2,706.72 | $1,932.28 | $3,188.93 | $1,823.77 |

| 83341 | $2,823.22 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,814.30 | $3,312.51 | $1,744.94 |

| 83342 | $2,821.81 | $4,034.89 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,787.86 | $3,231.96 | $1,744.94 |

| 83655 | $2,820.93 | $4,004.21 | $3,695.28 | $3,041.94 | $2,543.13 | $2,338.96 | $2,746.31 | $1,765.46 | $3,386.32 | $1,866.71 |

| 83311 | $2,820.70 | $4,034.89 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,777.86 | $3,231.96 | $1,744.94 |

| 83312 | $2,820.50 | $4,034.89 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,776.05 | $3,231.96 | $1,744.94 |

| 83666 | $2,820.16 | $3,990.50 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,259.27 | $1,866.71 |

| 83333 | $2,819.20 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,157.63 | $2,706.72 | $1,903.09 | $3,243.00 | $1,823.77 |

| 83635 | $2,816.93 | $3,863.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,338.96 | $2,746.31 | $1,740.19 | $3,282.34 | $1,866.71 |

| 83323 | $2,816.45 | $4,004.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,770.01 | $3,231.96 | $1,744.94 |

| 83316 | $2,816.20 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,703.17 | $3,360.47 | $1,744.94 |

| 83321 | $2,816.17 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,702.88 | $3,360.47 | $1,744.94 |

| 83835 | $2,814.62 | $3,378.15 | $3,668.25 | $3,306.96 | $2,892.45 | $2,224.25 | $2,705.06 | $1,913.57 | $3,214.11 | $2,028.83 |

| 83350 | $2,812.32 | $3,923.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,733.43 | $3,312.05 | $1,744.94 |

| 83325 | $2,811.29 | $3,893.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,810.88 | $3,312.51 | $1,744.94 |

| 83336 | $2,810.54 | $3,923.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,712.02 | $3,317.43 | $1,744.94 |

| 83318 | $2,809.93 | $3,923.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,712.02 | $3,311.97 | $1,744.94 |

| 83328 | $2,809.58 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,761.33 | $3,242.70 | $1,744.94 |

| 83344 | $2,809.18 | $3,893.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,812.35 | $3,276.17 | $1,744.94 |

| 83335 | $2,807.89 | $3,893.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,816.63 | $3,276.17 | $1,744.94 |

| 83324 | $2,807.80 | $4,122.97 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,837.80 | $3,189.15 | $1,744.94 |

| 83320 | $2,807.71 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,078.91 | $2,706.72 | $1,932.41 | $3,188.93 | $1,823.77 |

| 83677 | $2,807.29 | $3,863.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,282.34 | $1,866.71 |

| 83338 | $2,807.01 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,807.70 | $3,189.15 | $1,744.94 |

| 83638 | $2,806.24 | $3,812.10 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,781.75 | $3,282.34 | $1,866.71 |

| 83227 | $2,806.14 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,900.69 | $2,975.52 | $1,866.71 |

| 83334 | $2,805.37 | $3,951.78 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,806.74 | $3,189.15 | $1,744.94 |

| 83346 | $2,805.21 | $3,923.89 | $3,989.27 | $3,028.45 | $2,640.14 | $2,078.91 | $2,722.48 | $1,806.80 | $3,312.05 | $1,744.94 |

| 83352 | $2,804.68 | $4,122.97 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,809.70 | $3,189.15 | $1,744.94 |

| 83313 | $2,804.18 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,078.91 | $2,706.72 | $1,900.71 | $3,188.93 | $1,823.77 |

| 83348 | $2,804.18 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,078.91 | $2,706.72 | $1,900.69 | $3,188.93 | $1,823.77 |

| 83604 | $2,803.70 | $3,957.83 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,716.71 | $3,153.84 | $1,866.71 |

| 83660 | $2,803.64 | $4,004.21 | $3,695.28 | $3,041.94 | $2,515.57 | $2,338.96 | $2,746.31 | $1,784.72 | $3,378.79 | $1,726.98 |

| 83332 | $2,803.35 | $3,895.92 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,745.80 | $3,303.66 | $1,744.94 |

| 83349 | $2,802.61 | $4,065.22 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,848.81 | $3,189.15 | $1,744.94 |

| 83637 | $2,802.41 | $4,035.84 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,040.72 | $1,866.71 |

| 83302 | $2,801.88 | $3,957.83 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,776.05 | $3,182.42 | $1,744.94 |

| 83622 | $2,801.87 | $3,851.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,961.84 | $2,998.91 | $1,866.71 |

| 83650 | $2,801.63 | $3,920.66 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,148.92 | $1,866.71 |

| 83615 | $2,801.62 | $3,812.10 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,282.34 | $1,866.71 |

| 83355 | $2,801.00 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,737.29 | $3,205.41 | $1,744.94 |

| 83629 | $2,800.10 | $3,893.01 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,850.06 | $3,052.86 | $1,866.71 |

| 83314 | $2,793.41 | $3,895.92 | $3,989.27 | $3,028.45 | $2,777.53 | $2,252.15 | $2,501.20 | $1,745.80 | $3,205.41 | $1,744.94 |

| 83337 | $2,791.00 | $3,895.92 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,706.72 | $1,740.19 | $3,277.85 | $1,744.94 |

| 83624 | $2,790.70 | $3,920.66 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,695.73 | $3,094.98 | $1,866.71 |

| 83330 | $2,789.58 | $3,895.92 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,786.32 | $3,303.66 | $1,744.94 |

| 83645 | $2,786.61 | $3,928.48 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,767.19 | $3,003.84 | $1,866.71 |

| 83639 | $2,785.64 | $3,920.66 | $3,695.28 | $3,041.94 | $2,515.57 | $2,252.15 | $2,771.34 | $1,828.33 | $3,178.81 | $1,866.71 |

| 83619 | $2,784.05 | $4,004.21 | $3,695.28 | $3,041.94 | $2,543.13 | $2,338.96 | $2,746.31 | $1,721.94 | $3,097.92 | $1,866.71 |

| 83301 | $2,782.56 | $3,767.16 | $3,989.27 | $3,136.73 | $2,640.14 | $2,243.36 | $2,517.12 | $1,821.89 | $3,182.42 | $1,744.94 |

| 83628 | $2,780.47 | $3,920.66 | $3,695.28 | $3,041.94 | $2,515.57 | $2,252.15 | $2,771.34 | $1,781.81 | $3,178.81 | $1,866.71 |

| 83611 | $2,777.71 | $3,850.00 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,770.53 | $2,998.91 | $1,866.71 |

| 83643 | $2,776.34 | $3,863.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,003.84 | $1,866.71 |

| 83602 | $2,775.91 | $3,776.31 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,061.71 | $1,866.71 |

| 83632 | $2,771.35 | $3,818.17 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,003.84 | $1,866.71 |

| 83322 | $2,770.68 | $3,895.92 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,706.72 | $1,740.19 | $3,094.98 | $1,744.94 |

| 83815 | $2,769.93 | $3,287.39 | $3,668.25 | $3,069.45 | $2,892.45 | $2,188.37 | $2,616.57 | $1,925.45 | $3,252.68 | $2,028.83 |

| 83661 | $2,763.83 | $3,917.84 | $3,695.28 | $3,041.94 | $2,543.13 | $2,252.15 | $2,746.31 | $1,721.94 | $3,089.14 | $1,866.71 |

| 83814 | $2,761.06 | $3,287.39 | $3,668.25 | $3,106.56 | $2,892.45 | $2,137.80 | $2,616.57 | $1,925.45 | $3,186.27 | $2,028.83 |

| 83670 | $2,756.15 | $3,893.01 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,550.15 | $1,836.16 | $3,051.43 | $1,707.67 |

| 83657 | $2,747.13 | $3,960.33 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,550.15 | $1,740.19 | $2,998.91 | $1,707.67 |

| 83616 | $2,743.03 | $3,798.47 | $3,533.88 | $3,203.06 | $2,515.57 | $2,156.72 | $2,622.63 | $2,000.78 | $3,167.23 | $1,688.94 |

| 83854 | $2,732.36 | $3,359.90 | $3,668.25 | $2,736.09 | $2,892.45 | $2,152.23 | $2,681.54 | $1,908.48 | $3,163.44 | $2,028.83 |

| 83633 | $2,728.15 | $3,895.92 | $3,695.28 | $3,028.45 | $2,097.93 | $2,252.15 | $2,771.34 | $1,740.19 | $3,205.41 | $1,866.71 |

| 83623 | $2,725.76 | $3,895.92 | $3,695.28 | $3,028.45 | $2,097.93 | $2,252.15 | $2,771.34 | $1,718.69 | $3,205.41 | $1,866.71 |

| 83669 | $2,725.33 | $3,970.99 | $3,438.58 | $3,203.06 | $2,499.48 | $2,158.46 | $2,550.15 | $1,790.11 | $3,228.23 | $1,688.94 |

| 83713 | $2,719.52 | $3,912.68 | $3,533.88 | $3,107.12 | $2,451.67 | $2,258.52 | $2,626.54 | $1,871.30 | $3,077.54 | $1,636.40 |

| 83627 | $2,717.41 | $4,004.78 | $3,695.28 | $3,028.45 | $2,097.93 | $2,252.15 | $2,771.34 | $1,740.19 | $2,999.83 | $1,866.71 |

| 83634 | $2,711.21 | $3,786.71 | $3,438.58 | $3,203.06 | $2,470.64 | $2,146.48 | $2,580.24 | $1,846.56 | $3,239.70 | $1,688.94 |

| 83617 | $2,706.75 | $3,882.38 | $3,695.28 | $3,041.94 | $2,543.13 | $2,080.69 | $2,550.15 | $1,806.66 | $3,052.86 | $1,707.67 |

| 83648 | $2,692.24 | $3,920.66 | $3,695.28 | $3,041.94 | $2,470.64 | $2,252.15 | $2,771.34 | $1,599.08 | $3,072.20 | $1,406.90 |

| 83636 | $2,691.56 | $3,951.90 | $3,695.28 | $3,041.94 | $2,403.40 | $2,080.69 | $2,550.15 | $1,740.19 | $3,052.86 | $1,707.67 |

| 83714 | $2,691.46 | $3,892.84 | $3,533.88 | $3,041.94 | $2,403.40 | $2,140.68 | $2,622.63 | $1,874.85 | $3,076.52 | $1,636.40 |

| 83704 | $2,671.21 | $3,645.33 | $3,533.88 | $3,107.12 | $2,451.67 | $2,177.55 | $2,590.59 | $1,805.21 | $3,093.17 | $1,636.40 |

| 83708 | $2,652.60 | $3,892.48 | $3,438.58 | $3,012.15 | $2,403.40 | $2,030.14 | $2,473.21 | $1,827.67 | $3,068.76 | $1,726.98 |

| 83647 | $2,647.03 | $3,810.09 | $3,695.28 | $3,041.94 | $2,097.93 | $2,252.15 | $2,771.34 | $1,836.28 | $2,911.33 | $1,406.90 |

| 83705 | $2,646.43 | $3,652.78 | $3,533.88 | $3,012.15 | $2,451.67 | $2,158.80 | $2,586.68 | $1,732.81 | $3,052.70 | $1,636.40 |

| 83712 | $2,644.60 | $3,724.95 | $3,438.58 | $3,039.47 | $2,470.64 | $2,153.26 | $2,473.21 | $1,741.39 | $3,123.46 | $1,636.40 |

| 83702 | $2,643.34 | $3,724.95 | $3,438.58 | $3,039.47 | $2,470.64 | $2,011.10 | $2,473.21 | $1,850.82 | $3,144.94 | $1,636.40 |

| 83642 | $2,642.29 | $3,677.17 | $3,438.58 | $2,785.84 | $2,408.93 | $2,216.06 | $2,580.24 | $1,841.47 | $3,143.40 | $1,688.94 |

| 83709 | $2,641.37 | $3,547.57 | $3,438.58 | $3,270.65 | $2,451.67 | $2,030.14 | $2,581.95 | $1,821.11 | $2,994.27 | $1,636.40 |

| 83646 | $2,636.84 | $3,708.80 | $3,438.58 | $2,763.07 | $2,408.93 | $2,146.48 | $2,622.63 | $1,772.67 | $3,143.40 | $1,726.98 |

| 83703 | $2,630.15 | $3,724.95 | $3,438.58 | $3,012.15 | $2,403.40 | $2,094.92 | $2,630.93 | $1,809.91 | $2,920.16 | $1,636.40 |

| 83725 | $2,625.99 | $3,680.86 | $3,438.58 | $2,945.06 | $2,403.40 | $2,116.06 | $2,511.51 | $1,827.67 | $3,074.37 | $1,636.40 |

| 83706 | $2,615.06 | $3,602.20 | $3,438.58 | $3,012.15 | $2,403.40 | $2,008.23 | $2,511.51 | $1,711.24 | $3,211.80 | $1,636.40 |

| 83716 | $2,612.88 | $3,669.45 | $3,438.58 | $2,975.76 | $2,470.64 | $2,036.00 | $2,473.21 | $1,741.54 | $3,074.37 | $1,636.40 |

The most expensive zip codes in the state are found in the northern end, right about where Idaho’s panhandle begins. Surprisingly, zip codes in the Boise area have the lowest rates.

Idaho Rates By City

As we noted above, the cheapest zip codes are in Boise, so it’s no surprise that the city is among the cheapest, as is Meridian.

Matching our zip code rates too are cities like Kamiah and Peirce, in Northern Idaho.

| City | Annual Average |

|---|---|

| MERIDIAN | $2,639.57 |

| BOISE | $2,645.74 |

| MOUNTAIN HOME | $2,647.03 |

| GARDEN CITY | $2,691.46 |

| LETHA | $2,691.57 |

| MOUNTAIN HOME A F B | $2,692.24 |

| EMMETT | $2,706.75 |

| KUNA | $2,711.21 |

| HAMMETT | $2,717.41 |

| STAR | $2,725.33 |

| GLENNS FERRY | $2,725.77 |

| KING HILL | $2,728.15 |

| POST FALLS | $2,732.36 |

| EAGLE | $2,743.03 |

| OLA | $2,747.13 |

| SWEET | $2,756.15 |

| PAYETTE | $2,763.83 |

| COEUR D ALENE | $2,765.50 |

| CORRAL | $2,770.68 |

| INDIAN VALLEY | $2,771.35 |

| BANKS | $2,775.91 |

| MESA | $2,776.34 |

| CASCADE | $2,777.71 |

| HOMEDALE | $2,780.47 |

| TWIN FALLS | $2,782.56 |

| FRUITLAND | $2,784.04 |

| MARSING | $2,785.64 |

| MIDVALE | $2,786.60 |

| GOODING | $2,789.58 |

| GRAND VIEW | $2,790.70 |

| HILL CITY | $2,791.00 |

| BLISS | $2,793.41 |

| HORSESHOE BEND | $2,800.10 |

| WENDELL | $2,801.00 |

| DONNELLY | $2,801.62 |

| MURPHY | $2,801.63 |

| GARDEN VALLEY | $2,801.87 |

| ROGERSON | $2,801.88 |

| LOWMAN | $2,802.41 |

| RICHFIELD | $2,802.61 |

| HAGERMAN | $2,803.35 |

| PARMA | $2,803.64 |

| BRUNEAU | $2,803.70 |

| BELLEVUE | $2,804.18 |

| PICABO | $2,804.18 |

| SHOSHONE | $2,804.68 |

| OAKLEY | $2,805.21 |

| HANSEN | $2,805.37 |

| CLAYTON | $2,806.14 |

| MCCALL | $2,806.23 |

| JEROME | $2,807.02 |

| YELLOW PINE | $2,807.29 |

| CAREY | $2,807.71 |

| DIETRICH | $2,807.80 |

| HAZELTON | $2,807.89 |

| MURTAUGH | $2,809.18 |

| FILER | $2,809.58 |

| BURLEY | $2,809.93 |

| HEYBURN | $2,810.54 |

| EDEN | $2,811.29 |

| RUPERT | $2,812.32 |

| HAYDEN | $2,814.63 |

| CASTLEFORD | $2,816.17 |

| BUHL | $2,816.20 |

| DECLO | $2,816.44 |

| LAKE FORK | $2,816.93 |

| HAILEY | $2,819.20 |

| PLACERVILLE | $2,820.16 |

| ALMO | $2,820.50 |

| ALBION | $2,820.70 |

| NEW PLYMOUTH | $2,820.93 |

| MALTA | $2,821.81 |

| KIMBERLY | $2,823.22 |

| SUN VALLEY | $2,823.59 |

| PAUL | $2,823.71 |

| COBALT | $2,823.92 |

| SHOUP | $2,823.92 |

| FAIRFIELD | $2,824.05 |

| ROCKLAND | $2,824.31 |

| MELBA | $2,824.89 |

| CHALLIS | $2,826.16 |

| ELLIS | $2,826.72 |

| STANLEY | $2,826.86 |

| HARVARD | $2,828.33 |

| ARBON | $2,829.43 |

| MAY | $2,831.54 |

| LAVA HOT SPRINGS | $2,831.92 |

| GRACE | $2,833.28 |

| HOWE | $2,834.89 |

| PRINCETON | $2,838.55 |

| MIDDLETON | $2,839.20 |

| DAYTON | $2,841.86 |

| FISH HAVEN | $2,841.86 |

| IDAHO CITY | $2,841.87 |

| MOORE | $2,842.92 |

| SODA SPRINGS | $2,843.08 |

| GEORGETOWN | $2,843.53 |

| AMERICAN FALLS | $2,843.72 |

| MONTPELIER | $2,844.20 |

| FRANKLIN | $2,844.28 |

| CLIFTON | $2,845.31 |

| CONDA | $2,845.61 |

| KETCHUM | $2,846.21 |

| MACKAY | $2,846.67 |

| HOLBROOK | $2,847.29 |

| POTLATCH | $2,848.45 |

| GIBBONSVILLE | $2,849.34 |

| SWANLAKE | $2,849.34 |

| BERN | $2,849.58 |

| GENEVA | $2,849.58 |

| ARIMO | $2,851.19 |

| BANCROFT | $2,852.05 |

| DOWNEY | $2,853.72 |

| MALAD CITY | $2,854.44 |

| WAYAN | $2,854.44 |

| BLOOMINGTON | $2,854.55 |

| THATCHER | $2,854.55 |

| PRESTON | $2,854.56 |

| SAINT CHARLES | $2,854.56 |

| WILDER | $2,855.64 |

| LEMHI | $2,856.96 |

| NORTH FORK | $2,856.96 |

| ARCO | $2,857.30 |

| DINGLE | $2,858.15 |

| NEW MEADOWS | $2,858.60 |

| TENDOY | $2,858.99 |

| CARMEN | $2,859.10 |

| CAMBRIDGE | $2,859.27 |

| WESTON | $2,859.35 |

| CALDWELL | $2,859.99 |

| SALMON | $2,862.84 |

| LEADORE | $2,863.70 |

| WEISER | $2,864.12 |

| MCCAMMON | $2,865.42 |

| ELK CITY | $2,867.22 |

| COUNCIL | $2,868.51 |

| NAMPA | $2,869.02 |

| RATHDRUM | $2,869.15 |

| GREENLEAF | $2,871.31 |

| SPIRIT LAKE | $2,875.40 |

| STITES | $2,888.02 |

| LEWISTON | $2,890.80 |

| SPRINGFIELD | $2,895.19 |

| DUBOIS | $2,897.10 |

| INKOM | $2,900.20 |

| MOSCOW | $2,900.50 |

| MULLAN | $2,901.21 |

| ABERDEEN | $2,902.40 |

| WALLACE | $2,902.47 |

| POCATELLO | $2,906.49 |

| AVERY | $2,907.88 |

| OSBURN | $2,909.77 |

| MONTEVIEW | $2,910.08 |

| SILVERTON | $2,910.15 |

| BLANCHARD | $2,911.12 |

| DEARY | $2,911.17 |

| ATHOL | $2,911.64 |

| CALDER | $2,914.35 |

| POLLOCK | $2,916.57 |

| KELLOGG | $2,916.87 |

| PARKER | $2,917.01 |

| FERNWOOD | $2,917.14 |

| ELK RIVER | $2,917.63 |

| BOVILL | $2,917.85 |

| SMELTERVILLE | $2,918.02 |

| SUGAR CITY | $2,918.32 |

| TROY | $2,918.98 |

| BAYVIEW | $2,919.27 |

| CLARKIA | $2,919.68 |

| GENESEE | $2,921.33 |

| RIRIE | $2,922.33 |

| JULIAETTA | $2,922.35 |

| REXBURG | $2,922.90 |

| WORLEY | $2,923.28 |

| VIOLA | $2,925.52 |

| MACKS INN | $2,925.75 |

| TENSED | $2,926.80 |

| WARREN | $2,926.88 |

| PLUMMER | $2,927.88 |

| SPENCER | $2,927.88 |

| ATOMIC CITY | $2,928.21 |

| CHESTER | $2,928.51 |

| SAINT ANTHONY | $2,929.41 |

| KENDRICK | $2,929.55 |

| PINGREE | $2,931.35 |

| DESMET | $2,931.84 |

| MEDIMONT | $2,931.94 |

| HARRISON | $2,932.09 |

| LUCILE | $2,933.61 |

| NEWDALE | $2,934.77 |

| RIGBY | $2,935.59 |

| TETON | $2,936.22 |

| ISLAND PARK | $2,936.38 |

| CATALDO | $2,936.68 |

| SANTA | $2,937.09 |

| ASHTON | $2,937.21 |

| LEWISVILLE | $2,938.11 |

| PECK | $2,938.99 |

| SAINT MARIES | $2,940.69 |

| LAPWAI | $2,940.83 |

| FELT | $2,941.37 |

| SHELLEY | $2,942.05 |

| HAMER | $2,944.13 |

| NAPLES | $2,945.23 |

| IONA | $2,945.31 |

| COTTONWOOD | $2,945.39 |

| KINGSTON | $2,946.09 |

| FIRTH | $2,946.32 |

| PONDERAY | $2,947.82 |

| COCOLALLA | $2,948.73 |

| PINEHURST | $2,949.04 |

| WINCHESTER | $2,949.99 |

| LENORE | $2,950.11 |

| KOOTENAI | $2,951.68 |

| LACLEDE | $2,951.68 |

| TERRETON | $2,951.80 |

| BASALT | $2,953.40 |

| SANDPOINT | $2,953.66 |

| CLARK FORK | $2,953.78 |

| NORDMAN | $2,953.98 |

| ROBERTS | $2,955.14 |

| COOLIN | $2,956.28 |

| WHITE BIRD | $2,956.33 |

| IDAHO FALLS | $2,957.04 |

| MOYIE SPRINGS | $2,957.53 |

| BLACKFOOT | $2,958.18 |

| GREENCREEK | $2,959.06 |

| TETONIA | $2,959.41 |

| RIGGINS | $2,959.83 |

| OLDTOWN | $2,959.92 |

| HOPE | $2,960.60 |

| DRIGGS | $2,960.74 |

| PRIEST RIVER | $2,961.57 |

| KOOSKIA | $2,963.26 |

| IRWIN | $2,963.46 |

| VICTOR | $2,963.74 |

| BONNERS FERRY | $2,964.11 |

| COLBURN | $2,964.42 |

| REUBENS | $2,964.45 |

| CAREYWOOD | $2,964.55 |

| CULDESAC | $2,965.83 |

| EASTPORT | $2,967.64 |

| PORTHILL | $2,967.64 |

| MENAN | $2,968.23 |

| SWAN VALLEY | $2,968.69 |

| FERDINAND | $2,973.54 |

| GRANGEVILLE | $2,973.79 |

| SAGLE | $2,974.33 |

| NEZPERCE | $2,975.21 |

| CRAIGMONT | $2,980.70 |

| WEIPPE | $2,987.99 |

| AHSAHKA | $2,988.00 |

| OROFINO | $2,991.37 |

| FENN | $2,994.12 |

| PIERCE | $2,999.61 |

| KAMIAH | $3,008.28 |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Car Insurance Companies in Idaho

Everyone wants the best car insurance for their money, but what does that really mean? What makes a car insurance company the best?

Most car insurance shoppers are looking for the best price, and that’s definitely a factor. But you’re paying that insurance premium in order to have the company take good care of you when there is a claim, right?

You want to find out which company offers great service and a great price too, but there is so much information out there, and it’s not easy to make sense of what it all means. There has to be an easier way to find the best company.

We have taken the effort out of finding the right car insurance company for your needs by gathering all the data you need right here.

We will go over the financial and customer satisfaction ratings for the biggest insurers in Idaho and compare them on rates gathered by Quadrant across several different scenarios to help you narrow down your choices.

The Largest Companies’ Financial Ratings

Most insurance shoppers don’t spend much time worrying about financial ratings. They’re important, however, to choosing the right insurance company. That’s because they tell you how financially stable your insurance company is.

In other words, it tells you which companies are going to be able to pay their claims, even in the event of a major catastrophe.

The gold standard in financial rating for insurance companies is AM Best. They rate companies on a letter-graded scale based on their stability and future outlook.

| Providers (Listed by Size, Largest to Smallest) | A.M. Best Rating |

|---|---|

| State Farm Group | A++ |

| Geico | A++ |

| Farm Bureau Group | A |

| Liberty Mutual Group | A |

| Progressive Group | A+ |

| Farmers Insurance Group | A |

| Allstate Insurance Group | A+ |

| USAA Group | A++ |

| American Family Insurance Group | A |

| Sentry Insurance Group | A+ |

The ratings for the top companies in Idaho range from A (Excellent) to A+ and A++ (Superior). Those are all solid ratings, meaning you can count on any of these companies to be around for the long haul.

Companies With the Best Ratings

When it comes to insurance company ratings, J.D. Power has a lot of clout. They’re known for annual customer surveys of insurance and other companies, and rate car insurers by region.

PEMCO was the top-rated insurer in 2019 for the Northwest region, but it serves only Oregon and Washington. Of the biggest insurance companies in Idaho, American Family had the best rating, followed closely by State Farm, and Farmers, all of which ranked as above average.

Allstate’s rating was right at the average, and the rest of the companies ranked below average.

Companies With the Most Complaints in State

The Idaho Department of Transportation gathers complaints data for car insurance companies. Very few complaints were registered for the top ten companies. In fact, most of them had no complaints at all.

| Company Name | # of Complaints | Index | Market Share | Premium |

|---|---|---|---|---|

| Liberty Mutual | 1 | 5.01 | 2.00 % | $20,868,399 |

| Safeco | 3 | 3.86 | 7.76 % | $81,136,546 |

| Geico | 1 | 5.92 | 1.69 % | $17,656,811 |

| Farm Bureau | 1 | 0.93 | 10.71 % | $111,964,098 |

The complaint ratio tells us how many complaints the company had compared to its market share in the state. Although Safeco has the highest number of complaints, Geico’s ratio is actually higher because they have a smaller portion of the market share.

Cheapest Insurance Companies in Idaho

All other things being equal, here’s how the biggest companies in Idaho compare when it comes to rates. Because rates vary so much from person to person, the cheapest on this list might not be the cheapest for you. We’ll look at some different scenarios that can affect which company is the best choice in the upcoming sections.

| Company | Annual Average | Compared to State Average ($) | Compared to State Average (%) |

|---|---|---|---|

| Allstate F&C | $4,088.76 | $1,225.95 | 29.98% |

| American Family Mutual | $3,728.79 | $865.97 | 23.22% |

| Farmers Ins Co Of ID | $3,168.28 | $305.47 | 9.64% |

| Geico General | $2,770.68 | -$92.14 | -3.33% |

| Safeco Ins Co of IL | $2,301.51 | -$561.30 | -24.39% |

| Depositors Insurance | $2,735.44 | -$127.37 | -4.66% |

| State Farm Mutual Auto | $1,867.96 | -$994.85 | -53.26% |

| Travelers Home & Marine Ins Co | $3,226.29 | $363.48 | 11.27% |

| USAA | $1,877.61 | -$985.20 | -52.47% |

State Farm is the cheapest option overall. USAA is a close second but is only available to military members and their families.

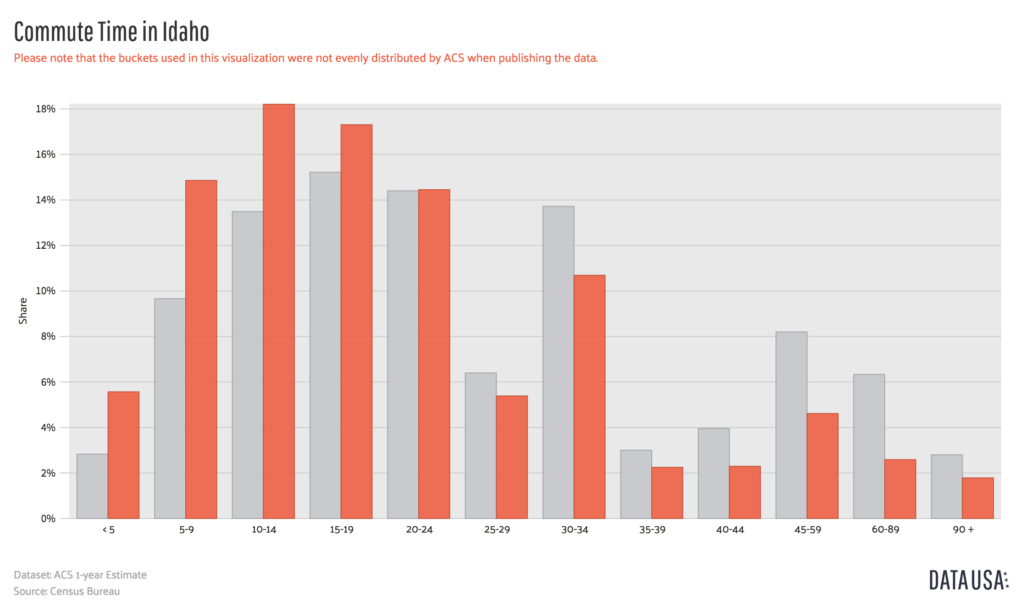

Commute Rates By Company

How your commute and annual mileage affects your rates depends on the company. Some companies don’t charge any more for a longer commute, while others increase rates by one to two hundred dollars a year.

| Group | 10-mile commute, 6,000 mile annual average | 25-mile commute, 12,000 mile annual average |

|---|---|---|

| Allstate | $4,088.76 | $4,088.76 |

| American Family | $3,651.77 | $3,805.81 |

| Travelers | $3,226.29 | $3,226.29 |

| Farmers | $3,168.28 | $3,168.28 |

| Geico | $2,723.05 | $2,818.30 |

| Nationwide | $2,735.44 | $2,735.44 |

| Liberty Mutual | $2,301.51 | $2,301.51 |

| State Farm | $1,823.01 | $1,912.91 |

| USAA | $1,855.16 | $1,900.06 |

Even with a longer commute, State Farm still comes out cheaper than the shorter commute at every other company.

Commute distance does not affect your rate nearly as much as some other factors.

Coverage Level Rates By Company

Your choice of coverage level is one of the biggest factors impacting your car insurance rates, and a lot of people choose lower levels in order to stick to a budget.

As you can see here, though, what you pay for coverage also depends on the company. Rather than choosing a low level of coverage at one company, you could get a high level of coverage elsewhere for the same or even less money.

| Group | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| Allstate | $3,935.49 | $4,080.92 | $4,249.86 |

| American Family | $3,729.46 | $3,914.07 | $3,542.83 |

| Travelers | $3,172.59 | $3,273.82 | $3,232.47 |

| Farmers | $3,012.76 | $3,132.36 | $3,359.73 |

| Geico | $2,627.36 | $2,766.30 | $2,918.37 |

| Nationwide | $2,696.85 | $2,874.15 | $2,635.33 |

| Liberty Mutual | $2,177.07 | $2,297.91 | $2,429.56 |

| State Farm | $1,762.35 | $1,871.85 | $1,969.68 |

| USAA | $1,822.69 | $1,874.40 | $1,935.74 |

Credit Score Rates By Company

Idaho car insurance companies use your credit score as one of the rating factors in setting your premium cost.

According to Experian, Idaho’s average credit score is an above-national-average 681.

| Group | Annual Rates with Poor Credit | Annual Rates with Fair Credit | Annual Rates with Good Credit |

|---|---|---|---|

| Allstate | $5,398.15 | $3,666.01 | $3,202.11 |

| American Family | $4,816.08 | $3,436.47 | $2,933.82 |

| Farmers | $3,573.21 | $3,033.33 | $2,898.31 |

| Geico | $3,368.23 | $2,689.62 | $2,254.17 |

| Liberty Mutual | $3,283.44 | $2,020.02 | $1,601.08 |

| Nationwide | $3,266.83 | $2,632.86 | $2,306.63 |

| State Farm | $2,624.03 | $1,658.82 | $1,321.02 |

| Travelers | $3,694.26 | $3,107.83 | $2,876.79 |

| USAA | $2,744.62 | $1,599.54 | $1,288.67 |

If you have poor credit, you will pay more just about everywhere, but all company’s rates are certainly not equal. Those with poor credit will want to avoid Allstate, but can still get a great rate from State Farm.

If you have good credit, both State Farm and Liberty Mutual are good choices rate-wise.

Driving Record Rates By Company

Few things can cause insurance rates to rise more than a ding on your driving record. Tickets, accidents, and other violations can all have an impact.

A driver with a clean record will get every company’s best rate, but that doesn’t mean there isn’t a way to save even if your record isn’t perfect.

| Group | Clean Record | With 1 speeding violation | With 1 accident | With 1 DUI |

|---|---|---|---|---|

| USAA | $1,347.13 | $1,632.10 | $1,921.59 | $2,609.61 |

| Travelers | $1,990.40 | $3,169.07 | $2,832.53 | $4,913.17 |

| State Farm | $1,703.63 | $1,867.96 | $2,032.29 | $1,867.96 |

| Nationwide | $2,088.90 | $2,347.77 | $2,712.70 | $3,792.39 |

| Liberty Mutual | $1,912.27 | $2,429.40 | $2,394.45 | $2,469.94 |

| Geico | $1,703.22 | $2,870.72 | $2,715.10 | $3,793.66 |

| Farmers | $2,765.42 | $3,123.03 | $3,502.85 | $3,281.82 |

| American Family | $2,939.25 | $3,328.97 | $4,158.40 | $4,488.53 |

| Allstate | $3,374.66 | $4,001.71 | $4,240.80 | $4,737.87 |

A DUI is generally the biggest rate increase, but not at State Farm or Farmers; both charge a bigger increase for an accident. Travelers isn’t where you want to be after a DUI, with a massive hike in rates. (For more information, read our “Does State Farm cover medical bills resulting from the accident?“).

Largest Car Insurance Companies in Idaho

State Farm’s low rates and strong reputation make it no surprise that they are the biggest car insurance company in Idaho.

| Company Name | Direct Premiums Written | Market Share |

|---|---|---|

| State Farm Group | $142,722 | 15.04% |

| Geico | $100,544 | 10.60% |

| Farm Bureau Group | $98,873 | 10.42% |

| Liberty Mutual Group | $96,435 | 10.16% |

| Progressive Group | $86,456 | 9.11% |

| Farmers Insurance Group | $81,594 | 8.60% |

| Allstate Insurance Group | $79,124 | 8.34% |

| USAA Group | $53,222 | 5.61% |

| American Family Insurance Group | $27,659 | 2.91% |

| Sentry Insurance Group | $18,243 | 1.92% |

Total Number of Car Insurance Companies

A total of 832 property and casualty insurance companies are licensed in Idaho. That’s a big number, but it’s worth noting that being licensed in a state doesn’t mean they currently write car insurance there.

Of those companies, 10 are domestic. That means they are incorporated in Idaho.

The rest, 822, are foreign. That means they are incorporated in other states.

State Laws

Idaho’s state laws govern a lot of different aspects of driving. They cover not just how much insurance you need, but the insurance companies themselves and how claims are handled. They also cover driver and vehicle licensing and the rules of the road. That’s a lot of laws.

You need to know how Idaho law applies to you and how to keep in compliance, but with laws changing and all of the complex language in the statutes, it’s hard to keep up. You need a simple and focused guide to the laws that apply to you on Idaho’s roads.

That simple guide is right here; concise and clear coverage of the must-know rules.

We will cover insurance laws, driver and vehicle licensing including new and older drivers and the laws that keep us safer on the road.

Car Insurance Laws

In Idaho, all laws regarding insurance and motor vehicles are determined by the Idaho State Legislature. All of the insurance laws are found in Title 41 of the code, while motor vehicle laws are found in Title 49.

Idaho uses a file and use system, according to the National Association of Insurance Commissioners (NAIC). That means that insurance companies need to file their rates with the insurance commissioner before using them. Prior approval of rates isn’t required. (For more information, read our “Idaho car insurance laws“)

Windshield Coverage

CarWinshields.info data states that Idaho allows the use of aftermarket parts in windshield replacement. If you prefer OEM parts, you have the right to request them, but you may need to pay the difference out of pocket.

There is no law on the books requiring insurance companies to offer windshield-specific coverage, but some do. In most cases, it will be covered under your comprehensive insurance and be subject to that deductible (some companies waive deductibles for repair as opposed to replacement). (For more information, read our “Are Car Insurance premiums tax deductible?“).

High-Risk Insurance

High-risk insurance is also referred to as non-standard insurance and is for drivers that may not qualify for standard coverage.

Most people are classified as high-risk due to driving history; multiple tickets and accidents, major violations, and convictions for driving without insurance are all things that can result in being labeled as high-risk.

Insurance companies rate drivers based on the likelihood of a claim, and the more dings on your record, the higher your rates will go.

Drivers in this situation may need to file an SR-22. This is a filing done by the insurance company guaranteeing the driver has the required coverage. While any company can file an SR-22, many non-standard companies specialize in handling the filings.

Eventually, standard insurance companies will decide not to offer coverage to some drivers at any price. That’s when non-standard companies step in, but there are some situations where even a non-standard company can’t help.

When that happens, you can turn to the Idaho Automobile Insurance Plan. Part of the Western Association of Automobile Insurance Plans, this insurance pool requires all insurance companies to participate in spreading the risk and providing coverage to those drivers that have been unable to obtain insurance.

This is not a cheap insurance plan. High-risk insurance is always more expensive.

The ultimate goal of a high-risk insurance plan is to get a driver covered while they work on improving the issues that prevent them from qualifying for standard insurance.

Low-Cost Insurance

Idaho insurance rates are already pretty low, so the state doesn’t provide any sort of low-income assistance program.

Shopping around is always the best way to get a lower rate on your insurance.

Automobile Insurance Fraud in Idaho

Insurance fraud is a crime in Idaho, punishable by law.

All acts of fraud are charged as felonies in Idaho. That means they are accompanied by heavy penalties.

Penalties for insurance fraud in Idaho includes fines of up to $15,000 and up to 15 years in prison.

Fraud can constitute anything from lying on an insurance application to staging an accident in order to make a claim. There are many different types of fraud, according to the Insurance Information Institute. Even “soft” fraud can carry heavy penalties.

The Idaho Department of Insurance encourages suspected fraud to be reported ad operates a fraud bureau whose job it is to investigate.

The Departement of Insurance Fraud Reporting can be contacted by phone at 1-866-939-7226.

You can also report fraud online.

Statute of Limitations

In Idaho, the statute of limitations for filing personal injury claims is two years.

You have an extra year to file property damage claims; the statute there is three years.

Vehicle Licensing Laws

The Real ID Act, passed by Congress in 2005 and enforced by the Department of Homeland Security, requires everyone to have a form of identification that meets a higher level of security standards when boarding planes and entering federal facilities.

What that means to the average citizen is that as of October 1, 2020, a driver’s license that doesn’t meet the REAL ID requirements will no longer be an acceptable form of ID for boarding a domestic flight. You will need either a REAL ID or another acceptable document, such as a passport or military ID.

In Idaho, the Star Card is the new REAL ID that can be issued on request. In order to upgrade your license to the Star Card, you will need to present additional documentation when you renew your license.

According to the Idaho Department of Transportation, these are the requirements (click through for a full list):

- Proof of identity: birth certificate, passport, etc.

- Social Security Card or other acceptable document showing your SSN

- Proof of Idaho Residency: mortgage deed, rental agreement, utility bill, etc.

Penalties For Driving Without Insurance

It’s illegal to drive without insurance in Idaho, and you must present proof of insurance upon request to law enforcement. Idaho allows proof of insurance to be presented in both paper and electronic formats.

Idaho also has an electronic database for insurance, the Online Insurance Verification System (OIVS). Insurance companies report all new policy and cancellation information to this database, allowing law enforcement to verify coverage is in force.

You can avoid a conviction if you provide proof that you did have insurance in place at any time before or at your court date. If you fail to do so, you will face penalties:

- For a first offense, a license suspension until proof is provided and a $75 reinstatement fee

- For a second or subsequent offense within five years, the fine goes up to $1,000 and you could face jail time of up to six months.

Teen Driver Laws

Idaho uses a Graduated Driver Licensing (GDL) program to help teens become safe drivers. This multi-stage program has requirements and restrictions along the way to help ease new drivers into the responsibilities of being behind the wheel and gain experience on the road.

Below you will see all of the stages and the requirements along the way.

| Type of License | Age of Eligibility | Requirements | Restrictions |

|---|---|---|---|

| Driver Training Permit | 14.5 years | Enroll in Driver Education | May only drive with instructor |

| Supervised Instruction Permit | 14.5 years +instruction period (min. 30 days for public school program) | Pass course including: -30 hours classroom -6 hours behind the wheel -6 hours observation in car | May only drive with a licensed driver over 21 |