American Family Insurance Review & Complaints: Auto, Home & Life Insurance (2025)

American Family Insurance Company offers full coverage car insurance policies as well as basic homeowner's and life insurance. An American Family Insurance quote returns American family insurance rates ranging from $280.70/mo for low coverage to $284.70/mo for a high-coverage plan.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

hide

| American Family Overview | Details |

|---|---|

| Year Founded | 1927 |

| Current Executives | Jack Salzwedel - CEO |

| Number of Employees | 11,307 |

| Total Assets (2017) | $27,502,521 |

| HQ Address | 6000 American Parkway Madison, WI 53783 |

| Phone Number | 1-800-692-6326 |

| Company Website | https://www.amfam.com/ |

| Premiums Written (Auto, 2017) | $4,381,962 |

| Loss Ratio | 70.32% |

| Best For | Families with young drivers, bundling |

Nicknamed AmFam, the company was started by a single insurance agent and eventually grew to be one of the biggest insurance groups in the nation. Today they promise to protect the dreams of other Americans.

In addition to auto insurance, the company writes home, life, business, and specialty coverage as well. American Family Group encompasses a dozen different subsidiaries operating in different markets, making them a pretty big player in both insurance and financial services.

Should you park your car under the American Family roof?

Like most insurance companies they make a lot of promises, and like most large insurance companies it can be difficult to tell just how well they will live up to those promises for you as an individual.

A clear look at where the insurer stands and how well they live up to their slogan will help you make the right call.

We’ve got everything you need to know about AmFam right here. They write policies directly as well as through a list of subsidiary companies:

- American Family Mutual Insurance Company

- American Standard Insurance Company

- American Family Life Insurance Company

- American Family Brokerage, Inc.

- American Family Insurance Company of Ohio

- American Standard Insurance Company of Ohio

- American Family Securities, LLC

- Amfam.com Inc.

- PGC Holdings Corporation (General Insurance Companies “The General”)

- Homesite Insurance

This review will cover the company, from financial stability to community involvement, and look at their auto insurance policies in-depth, including how their rates stack up. Read on to learn more and get started with our free comparison tool by entering your ZIP code above.

Read more: Homesite Insurance Review & Complaints: Life, Auto & Home Insurance

How are the company’s ratings?

Let’s start with a look at how the insurer fares in the ratings. There are a number of companies out there that rate insurance companies, and they don’t all look at the same factors.

Here are the ratings; below we’ll examine what they mean.

American Family Car Insurance Company Ratings

| Ratings Agency | American Family Ratings |

|---|---|

| A.M. Best | A |

| Better Business Bureau | A |

| Moody's | N/A |

| S&P | N/A |

| NAIC Complaint Index | 0.69 |

| JD Power | Claims Satisfaction 3/5 Shopping Study 4/5 |

| Consumer Reports | 89 |

The only one of the three major financial strength rating companies to have a current rating for the insurer is AM Best. They’re the big name in financial stability ratings, and they give AmFam an A, or “excellent” just as they have for the past 15 years.

It’s not the top rating available, but it indicates that the company is stable and has a good outlook for the future.

Neither Moody’s nor Standard & Poor (S&P) have a current rating for AmFam, although a couple of the subsidiary life insurance companies are rated by S&P.

The next ratings on the list are more customer-focused. All of them have to do with how satisfied people who have their insurance are with their service.

The National Association of Insurance Commissioners (NAIC) collects complaints data for insurance companies. For 2018, AmFam’s complaint index of 0.69 is well below the national average of 1.19. That means that for its size, the volume of the complaints is on the low side.

J.D. Power is a well-known name since companies are fond of bragging when they win one of the company’s awards.

AmFam isn’t an award winner, but they rank pretty well in the national surveys, earning an average score in the claims satisfaction survey and above average for the auto insurance shopping study.

J.D. Power also ranks insurance companies on a regional level, and AmFam’s rankings differ quite a bit depending on the region.

The Better Business Bureau ranks companies on a variety of factors, including complaint volume and response to complaints. The business has an A rating, a step down from the best available A+ rating. The drop is due to their failure to respond to three complaints filed against them.

Consumer Reports, too, has its own ranking system based on consumer surveys, rating insurance companies out of a possible 100. AmFam rates an 89 here.

Out of 95 ratings on ConsumerAffairs.com, 72 are 1-star reviews and 7 are 2-star reviews, and ten are 5-star reviews. This is pretty typical for this particular site, which is generally a forum for complaints against insurance companies rather than the type of place a customer might go to report how pleased they are. The number of reviews overall is fairly low, which suggests there are plenty of happy customers who didn’t bother to write a review.

Overall, the company has good ratings. They’re not stellar in most areas, but there’s nothing of concern in the ratings either.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What’s the history of American Family Insurance?

The company was founded in 1927 under the name Famers Mutual by Hermann Wittwer, an insurance salesman who decided to start his own company.

Originally serving farmers in Wisconsin, the company quickly expanded over the following years and decades, moving into other industries and other states.

In 1963, to represent its broader product lineup, the company took on the name American Family Mutual Insurance Company. Two years later they introduced the jingle they still use to this day.

The expansion included acquisition and creation of a number of subsidiary companies, all of which now operate as a part of American Family Group. These include low-cost car insurance company The General and Homesite Insurance.

In 2018, the insurer reached number 311 on the Fortune 500 list. Quite a success story for a small company launched by a Wisconsin insurance salesman.

Read more: American Family KnowYourDrive: Complete Guide & Review

How big is its market share?

In 2015, its market share in the private passenger auto market was 1.85 percent.

That number rose to 1.87 percent in 2016 and 1.89 percent in 2017.

Those aren’t big increases, but the general trend is upward, which is a good sign for the insurer’s future. Their continued expansion into new states should help increase their overall market share.

What’s the company’s typical sales approach?

American Family uses a captive agent system to sell insurance. That means their agents work solely for them and don’t sell policies from a variety of companies like an independent agent.

That’s something of an old-school approach to insurance sales that hearkens back to the days of direct mail and even door-to-door insurance sales. Several of the biggest insurance companies in the nation still use a captive agent system, including State Farm and Allstate.

Like those companies, AmFam has also moved into the modern era. They have online quoting available and you can also handle a policy purchase over the phone. That’s in addition to the old-fashioned method of sitting down in an agent’s office.

No matter how you approach quoting or purchasing your policy, however, they will pass your information on to a local agent. You may receive calls or emails from that agent, even if you decide not to proceed after getting a quote.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are their commercials like?

The company has been using the same jingle, a simple and memorable tune, since 1965, and it still appears in their advertising today.

The current “Insure Carefully. Dream Fearlessly” campaign focuses on the dreams and goals of Americans.

Although they don’t have a single spokesperson like some companies, they do use famous faces. Commercials have featured celebrity brand ambassadors including Derek Jeter, John Legend, Kevin Durant, and Jennifer Hudson.

Some of these have been a part of AmFam’s volunteer-driven One Saturday campaign.

https://youtu.be/aIF6NZLPAp0

They have also focused on historic American heroes, including a series of Black History Month spots that featured historical figures and modern leaders.

All of their efforts include the hashtag #DreamFearlessly.

What community service do they do?

The One Saturday campaign mentioned above is just one of the ways in which the business gives back.

The American Family Dreams Foundation operates in local communities offering scholarships, grants, and matching gifts to the tune of $11.7 million in giving for 2017.

A $10 million grant was announced in 2003 to build the American Family Children’s Hospital at the University of Wisconsin Hospital and Clinics. By the opening of the hospital in 2007, several million more was raised by employees and agents.

AmFam also partners with PGA golf star Steve Stricker (also a brand ambassador) on the Steve Stricker American Family Foundation. The foundation supports charities and initiatives aimed at helping families and children.

In addition to major foundation work, employees and agents volunteer thousands of hours and raise funds for the United Way.

What does the future hold?

American Family’s market share in the auto insurance industry is increasing, and they rank in the top ten nationwide in spite of the fact that they operate in less than half of the states.

As they continue to expand to new states, it’s likely that they’re going to continue to grow that market share. The future looks pretty good for this company.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Are employees satisfied?

According to the workplace data website Payscale, the median employee age is 39, with an average tenure at the company of 3.1 years. 75 percent of employees report high job satisfaction.

Among the surveyed employees, the company has an overall ranking of 3.7 out of five for employee satisfaction.

Over at Glassdoor, the company has an overall 3.4 rating for employee satisfaction. Employees praise the company for great benefits and a good work/life balance, as well as flexible hours and competitive pay.

Has the company won any awards and accolades?

The insurer has won a number of awards over the years, including some recent awards.

In 2018 the Human Rights Campaign named them to their list of Best Places to Work for LGBTQ Equality with a 100 percent corporate equality index rating. They’ve earned this ranking for three years running.

In 2018 American Family was named Innovation Carrier of the Year by Insurance Nexus at the annual Insurance Innovation Awards.

Forbes ranked American Family at number 447 of the top 500 large companies to work for in the United States for 2019. They also made the Zippia list of the 100 Best Companies to Work for in Wisconsin for 2018.

The product lineup from them is comprehensive, especially when it comes to their main focus, personal lines. They do offer business insurance as well, and a variety of other coverage including farm & ranch insurance, travel, and even access to health insurance through partners.

What car insurance products do they offer?

Their first product offering is still their biggest line of business, and they write all of the basic coverage you would expect on a standard auto policy. There are a few options that are a little less common, such as Accidental Death & Dismemberment coverage.

Car insurance discounts are somewhat limited, leaving off some of the more specific discounts many large insurers offer. Available discounts include:

- Auto/Home

- Auto/Life

- Multi-Vehicle

- Good Student

- Accident-Free

- Defensive Driving Course

AmFam has an award-winning program for young drivers called the Teen Safe Driver Program. It uses in-car technology called the DriveCam system to record driving behavior and provide feedback that helps teens improve.

Studies of the program have shown large reductions in dangerous driving behavior, up to 70%. The National Safety Council gave the program its Teen Driving Safety Leadership Award in 2010.

They also have a usage-based insurance program, which most major insurers have introduced in recent years. Their version is called mySafetyValet, and it’s advertised to policyholders as a method of becoming a better driver.

They offer a 5% discount just for signing up for the program, which involves placing a small device in your car to monitor your driving behavior and earn you even more discounts.

Currently, the majority of these systems can only be beneficial to the user, as there is no penalty if the device records poor driving habits, just a reward for good driving. However, some insurance companies are moving towards penalizing unsafe driving habits, so it is something important to be aware of for the future.

Where does American Family provide the cheapest rates?

The bottom line with car insurance rates is that every company determines its rates differently.

What that means is that while we can say one company is expensive overall and another cheap overall, which offers the best rates in any given situation will differ based on that situation.

One company might be a lot cheaper for young drivers, while another might be your best bet if you have an accident on your record.

In order to see where the company stacks up, we’ll look at the numbers not just on average, but for several different scenarios.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are the average car insurance rates per state?

Below is a comparison of American Family’s average annual rates compared to the state average. We’ve only listed the states in which the business operates.

American Family Average Monthly Car Insurance Rates Compared to State Average

| State | American Family Average Monthly Rates | State Average Monthly Rates | Higher/Lower ($) Than State Average Monthly Rates | Higher/Lower (%) Than State Average Monthly Rates |

|---|---|---|---|---|

| Alaska | $346.09 | $285.13 | $60.96 | 1.47% |

| Colorado | $311.09 | $323.03 | -$11.95 | -0.32% |

| Iowa | $251.82 | $248.44 | $3.38 | 0.11% |

| Idaho | $310.73 | $248.26 | $62.48 | 1.68% |

| Illinois | $317.94 | $275.46 | $42.49 | 1.11% |

| Indiana | $306.64 | $284.58 | $22.06 | 0.60% |

| Kansas | $178.87 | $273.30 | -$94.44 | -4.40% |

| Minnesota | $293.44 | $366.94 | -$73.50 | -2.09% |

| Missouri | $273.91 | $277.41 | -$3.50 | -0.11% |

| North Dakota | $317.70 | $347.15 | -$29.45 | -0.77% |

| Nebraska | $184.59 | $273.64 | -$89.05 | -4.02% |

| Nevada | $453.43 | $405.14 | $48.29 | 0.89% |

| Ohio | $126.26 | $225.81 | -$99.55 | -6.57% |

| Oregon | $293.94 | $288.98 | $4.96 | 0.14% |

| South Dakota | $337.29 | $331.86 | $5.43 | 0.13% |

| Texas | $404.06 | $336.94 | $67.12 | 1.38% |

| Utah | $308.23 | $300.99 | $7.24 | 0.20% |

| Washington | $309.42 | $254.94 | $54.48 | 1.47% |

| Wisconsin | $126.11 | $300.51 | -$174.40 | -11.53% |

Alaska and Washington are the two most expensive states to take out an AmFam policy, with rates at 17.61 percent above average in both states.

What are the state-by-state comparisons of top companies?

Here’s a look at how the top ten companies – American Family is one of them – in the U.S. and their rates differ by state. Remember that these are averages, and rates differ based on a lot of factors.

| State | Average Annual Premiums | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | Data Not Available | $2,006.80 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

Next, we will look at the factors that can land your rate above or below these averages.

Read more: Minnesota Life Insurance Review & Complaints: Life Insurance

What are car insurance rates by commute?

This isn’t a company where you have to worry about rising rates with a longer commute. The difference is, on average, less than $100 a year.

American Family Average Monthly Commute Rates

| Commute Type | American Family Average Rate |

|---|---|

| 10-mile, 500 miles monthly | $283.44 |

| 25-mile, 1,000 miles monthly | $290.40 |

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How much are rates by coverage level?

With AmFam, you can carry a lot more coverage without paying a lot more. In fact, the high coverage level is on average cheaper than medium coverage, and you can go from low to high for less than $100 a year.

American Family Average Monthly Car Insurance Rates by Coverage Level

| Coverage Level | American Family Average Annual Rates |

|---|---|

| Low | $280.70 |

| Medium | $295.36 |

| High | $284.70 |

How does credit history affect rates?

American Family doesn’t increase its rates as much as some other companies for poor credit, but there is a definite difference. They rank among the lower-priced insurers on average for those with poor credit.

American Family Average Monthly Rates by Credit History

| Credit History | American Family Average Rates |

|---|---|

| Poor | $372.33 |

| Fair | $264.12 |

| Good | $224.31 |

What are rates by driving record?

Like all insurance companies, this insurer offers its best rates to drivers with a clean record.

Rates for drivers with one speeding ticket, however, really aren’t that much higher. In fact, overall the increases for each of these common scenarios aren’t a huge increase compared to some other major companies.

American Family Average Monthly Car Insurance Rates By Driving Record

| Driving Record | American Family Average Rate |

|---|---|

| Clean Record | $224.46 |

| 1 Speeding Ticket | $252.14 |

| 1 Accident | $310.22 |

| 1 DUI | $360.85 |

American Family Compared to the Competition: Your Top Car Insurance Choice

In this comparison, we’ll assess how American Family Insurance stands against key competitors like Allstate, Farmers, Progressive, and USAA. From rates to coverage, discover why American Family might be your ideal car insurance provider.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What coverage is offered by American Family?

American Family offers full coverage car insurance policies with a variety of options in addition to the basics.

The policy starts with the required liability and, depending on the state, no-fault coverage. they offer all of the following and will help you ensure you’re in compliance with state laws.

- Bodily Injury Liability

- Property Damage Liability

- Personal Injury Protection (PIP)

- Medical Expense (Med Pay)

- Uninsured/Underinsured Motorist Bodily Injury

- Uninsured/Underinsured Motorist Property Damage

Coverages can be increased well above the legal minimums to better protect you from the financial impact of an accident.

With the liability basics in place, the insurer offers a solid list of optional coverages.

- Collision

- Comprehensive

- Loan/Lease Gap

- Rental Reimbursement

- Emergency Roadside Assistance

- Accidental Death & Dismemberment (AD&D)

Do they offer bundling options?

American Family offers discounts to policyholders for carrying more than one policy. First up is the multi-vehicle discount, which applies to anyone insuring more than one vehicle.

There is a discount for insuring your home with AmFam as well, and that includes both a homeowners policy and a renters policy. This bundle includes a discount on the home policy as well.

Finally, they also give an auto discount to those that have a life insurance policy in force with the company.

You may also want to consider bundling with the coverage’s listed below:

Homeowner’s Insurance

American Family’s homeowner’s insurance covers all of the basics – replacement cost for the structure itself, personal property, and liability. The company also offers a list of optional add-ons and upgrades for homeowner’s, including:

- Personal property replacement cost

- Scheduled Personal Property

- Identity Theft

- Personal Injury

- Home Day Care

- Home Office and Studio

- Vacant Home

- Sewer and Sump Pump Backup

Auto and home bundling are available along with other discounts to bring down rates. In addition to covering standard single-family homes, there are also policies for:

- Condo Insurance

- Mobile and Manufactured Home

- Renter’s Insurance to cover personal property for tenants

Life Insurance

Both standard term with various lengths and whole life are available, along with two other options. These are a simple term and a more flexible option to round out the offerings.

The SimplyProtected Term Life Insurance is an easy to obtain policy good for those who need quick, basic coverage. These policies are affordable and a good place to start if you haven’t purchased life insurance coverage before.

MyLife is a flexible policy with two options. The Freedom option has higher coverage during the years when you need it most, and continuing protection into the later years of life. With this plan no insurance premiums are necessary with reduced coverage in retirement. The Legacy option maximizes both coverage and cash accumulation over the years in order to provide for your family in the future.

Do they offer motorcycle insurance?

The insurer offers two levels of motorcycle insurance, the Basic Plan and the Basic Plan Plus. They insure a variety of different types of bikes, from cruisers to sportbikes.

At the Basic level, you get liability, comprehensive, and collision coverage among other basic coverage. The Plus level also adds coverage for a wide variety of accessories from trailers to saddlebags. There are also a variety of discounts available for motorcycle insurance, including one for riders over 50, and multiple cycle discount.

Recreational and Off-Road Vehicles

Policies are available for recreational vehicles including motor homes and travel trailers, as well as for off-road vehicles such as snowmobiles and ATVs.

Damage and liability coverage specific to the needs of each type of vehicle are included in the policy. Recreational vehicle policies include extended personal property and roadside assistance, while trailer coverage is added for off-road vehicles. AmFam has full-time policies for those who live on the road in their RV full-time, providing the extra coverage you need when spending most of your time traveling.

Boats and Watercraft

The insurer covers a wide variety of watercraft, including sailboats, kayaks, and motorboats. Their policies include coverage for boats while on the water as well as on the trailer – and coverage for the trailer itself.

Sails, spars, and rigging are covered for sailboats, while motorized craft are covered for outboard motors and other manufacturer-installed equipment.

Business Insurance

The company writes coverage for a variety of different small and mid-sized businesses including offices, medical and dental, janitorial, garage and auto repair.

Their small business package policies include general liability, employment practices liability, business property, and a variety of other coverage specific to the type of business. Some options are available as individual policies; while others come in packages so you can select the coverage you need most.

Farm and Ranch

AmFam was started to serve farmers and it continues to serve them today with Farm and Ranch insurance policies. Coverage is provided for farm equipment, liability, dwelling, and personal property among other farm-specific needs.

These policies are specifically aimed at family-run farms that include a dwelling and personal property, and not at commercial operations.

They offer basic options for travel insurance including travel medical, trip cancellation, and both auto and boat coverage for trips into Mexico. The Mexican auto insurance is a convenient option since many people wind up purchasing it from a random company just before crossing the border – buying from a trusted company provides more peace of mind.

Health Insurance

American Family offers health insurance products through Time Insurance Company, a subsidiary of Assurant Health. Plans include:

- Major Medical

- Dental

- Medicare Supplemental

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What other products do they offer?

There are several other products available, including flood insurance through the National Flood Insurance Plan and umbrella policies to cover excess liability above and beyond underlying policy limits.

Where do they operate?

Although they are continuing to expand, American Family doesn’t write auto insurance in every state and their operations are rather limited to 19 states.

AmFam auto is not available in the following states.

- Alabama

- Alaska

- Arkansas

- California

- Connecticut

- Delaware

- Florida

- Hawaii

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Mississippi

- Montana

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- Tennessee

- Texas

- Vermont

- Virginia

- West Virginia

- Wyoming

- District of Columbia

What else does American Family offer?

The insurer has some other options to choose from that can help reduce your rates or protect you for specific risks. Their list of options isn’t as long as some other companies, however, and absent are things like accident forgiveness.

KnowYourDrive is AmFam’s usage-based insurance program, and like all such programs, it records and monitors driving habits.

These programs have really become popular in the past several years, so it’s not surprising to see a big company on board the wagon. It uses an app to track driving behaviors such as hard braking and gives drivers a score.

https://youtu.be/2-0wrSwbhdQ

The program provides an initial discount for signing up and will calculate a longer-term discount based on the information gathered. The program isn’t offered in all states, but the site doesn’t say which ones do have the option.

Rideshare Coverage is available in some states (again, they aren’t listed) to provide added protection for those that drive for companies like Uber or Lyft.

With most states enacting laws requiring specific coverage for rideshare drivers, many insurance companies are responding to meet the need. AmFam is one of the major insurers to offer this coverage.

The insurer also has coverage available for classic cars and for vehicles used for business.

The Dreams Restored Program is their preferred repair shop network. The program provides quick repair service with a guarantee on the work for as long as you own the car. It can be used whether the insurance company is paying for the repairs or you are paying out of pocket.

The Teen Safe Driver Program uses an app similar to the KnowYourDrive system and allows parents to keep an eye on their new driver’s habits behind the wheel. The program leads to a discount on the teen’s coverage after one year or 3,000 miles logged.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What discounts does the company offer?

Below are all of the discounts listed on American Family’s website, along with the percentage they’ll save you if provided.

American Family Discounts and Percentages Off

| Discount | Percentage Off (up to) | Details/Requirements |

|---|---|---|

| Loyalty | Depends on length of loyalty | Remain insured with AmFam |

| Auto and Home | 29% off auto 20% off home | Have both auto and home in force with AmFam |

| Auto and Life | Not stated | Have both auto and life in force with AmFam |

| Air Bags | 10-30%, varies by state | Vehicles with factory airbags |

| 55+ Defensive Driver | 5-10% | Drivers over age 55 and take a defensive driving course |

| Early Bird | Not stated | Sign policy documents at least seven days before effective date |

| Switching to American Family | Not stated | Switch from another insurance company |

| Good driver | Not stated | Maintain a clean record |

| Low Mileage | Not stated | Drive less than 7,500 miles a year |

| Know Your Drive | 5% for signing up 40% (up to) discount after evaluation period | Must install and use the KnowYourDrive app |

| Good Student | 25% | Must: - be a full-time student - have a B average or be in top 20% of class |

| Student Away at School | Not stated | Students away at school who have not taken a vehicle |

| Young Volunteer | Not stated | Drivers under 25 who complete 40 hours or more of volunteer work a year |

| Generational | Not stated | Children of AmFam policyholders |

| AutoPay | Not stated | Set up automatic withdrawal of premium payments |

| Full Pay | Not stated | Pay full term premium up front |

| Paperless | Not stated | Sign up for online policy management |

| Multi-Car | Not stated | Have more than one car insured with AmFam |

There are several other discounts that aren’t listed on the website, but that other sources list as available:

- Anti-lock brakes

- Farm vehicle

- Anti-theft

- Continuous coverage

- Daytime running lights

- Passive restraint (seatbelts)

American Family doesn’t provide a lot of information on how much each of these discounts can actually save you. That’s likely because it varies by state, and the site directs visitors to contact an agent for specifics.

Notable among the discounts are several unusual options for young drivers, such as the volunteer discount. The generational discount is also unusual and would be helpful to young drivers who no longer live at home and are getting coverage individually.

A lot of the discounts are aimed at bringing new customers in as well as keeping existing customers.

Absent from American Family’s discount list is any kind of affinity group discount. They don’t have discounts for first responders or for members of the military, either.

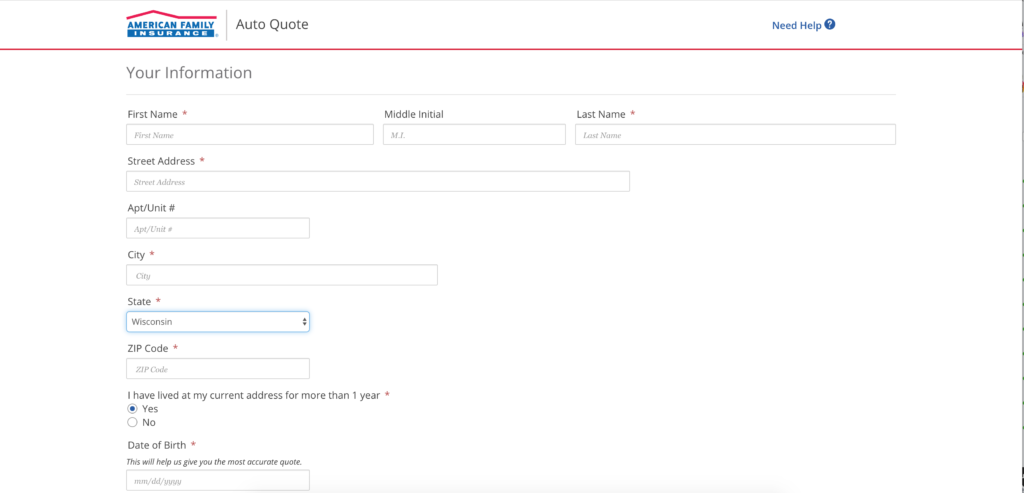

How do you get a quote online?

You can start an online quote for car insurance right on the company’s front page.

To start the quote, you will have to enter your name, address, birthdate, and email address. From there, the system will automatically locate vehicle and driver information for that address.

You can select the vehicles and drivers you want to insure. The system will then take you through coverage options and provide a quote.

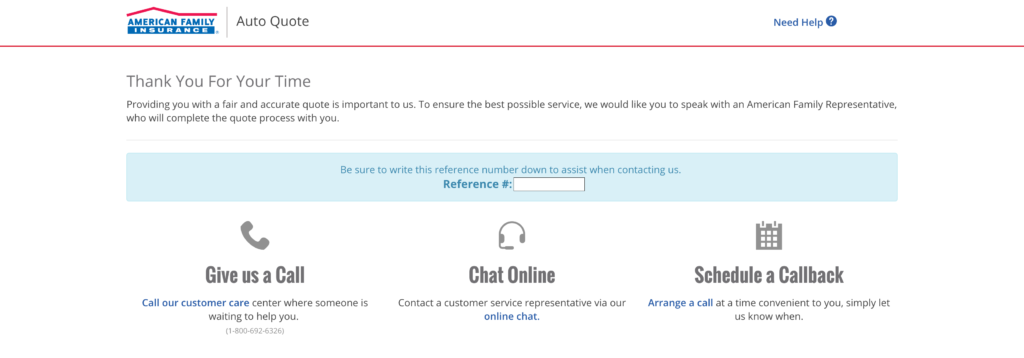

In some cases, the system will be unable to provide a quote online, and will then direct you to contact an agent or customer service representative for assistance.

This happened as we attempted a sample quote, but the system did not explain why we were unable to get quote information online.

Reaching this screen is likely to cause some frustration from those hoping to get quotes without having to speak to an agent.

Here’s a look at what you will need to have on hand to get an online quote from American Family.

| Information | Required/Not Required |

|---|---|

| Driver's License Number | Not required |

| Social Security Number | Optional |

| Phone Number | Not required |

| Email Address | Required |

| Vehicle Identification Number | Not required |

| Home Address | Required |

Social security numbers and drivers licenses will be required to complete the application. Entering your social security number is optional during the quote process; bear in mind that if you choose not to enter your SSN it may impact the accuracy of the quote.

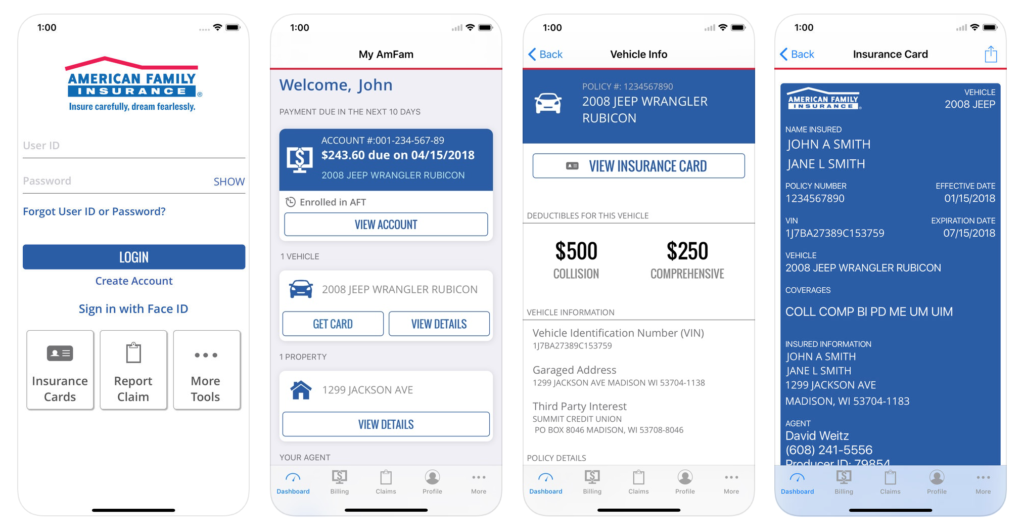

How are American Family’s website and app design?

American Family has an easy to navigate website that has a wealth of information available to help both existing and potential customers.

The drop-down menus are intuitive and offer the most relevant information, including product details, claims information, and contact information.

It’s just as readable on a smartphone screen or a tablet as it is on a desktop or laptop, making it easy to use regardless of your device.

The MyAmFam app is available for both Apple and Android phones and allows you to take care of a number of tasks on the go. These include:

- Pay bills

- Access electronic ID cards

- Request roadside assistance

- View policy details

- File a claim

- Contact customer service

The app has a 4.8-star rating on the iTunes store and a 4.4 rating in the Google Play store. There are some complaints about the app, including trouble with paying bills and constant requests for updates. Overall, however, customers have a positive experience with the app.

The screenshots above will give you an idea of what the app looks like. It’s clean and appears easy to use.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

What are the pros and cons?

We’ve covered a lot of ground and looked at a lot of information about American Family Insurance. Now let’s wrap it up with a simplified look at the pros and cons of choosing AmFam for your car insurance.

American Family Car Insurance Pros and Cons

| Pros | Cons |

|---|---|

| Combines personal service of an agent with modern techonology | Online quote system doesn't always work, results in solicitation |

| Very low rates in some states | Not available in all states |

| Not a lot of add-ons and extras available | Good list of discounts, particularly for younger drivers |

Do you still have questions? We’ve got some more answers, and if we didn’t answer it, you can head on over to American Family’s FAQ section for more details.

Is there a risk to using the KnowYourDrive app?

The insurer won’t increase your premiums based on any information gathered by the app, it can only be used to calculate a discount.

The discount will vary based on the information, and not everyone will get the top-end percentage off, but there’s no risk of increases. The company promises they won’t share your personal information with anyone else.

Do I have to have an agent?

Yes. Policies are all administered by local agents, so one will be assigned to you even if you quote online. They take care of completing things and are your go-to person for questions.

But if you prefer to deal with things minus human interaction, nearly everything can be taken care of online or with the mobile app. You can choose your own agent if you don’t want to have one assigned to you.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Are passenger vehicles the only policies that can be bundled?

No! They will bundle specialty vehicle policies as well, including RVs, classic cars, boats, ATVs, and more under the multi-vehicle discount.

The discount varies, but the insurer does offer increased discounts the more you bundle.

American Family Insurance Claims Process

Ease of Filing a Claim (Online, Over the Phone, Mobile Apps)

American Family Insurance offers multiple convenient options for filing insurance claims. Customers can choose to file their claims online through the company’s website or mobile app, making it a hassle-free process. Additionally, customers can file claims over the phone, providing flexibility in how they report incidents and seek assistance.

Average Claim Processing Time

How long does it take for American Family to process a car insurance claim? While specific claim processing times may vary depending on the nature and complexity of the claim, American Family Insurance is committed to efficiently handling claims. The company strives to process claims promptly to provide customers with timely assistance during challenging situations.

Customer Feedback on Claim Resolutions and Payouts

American Family Insurance has received positive feedback from customers regarding its claim resolutions and payouts. Customer satisfaction surveys and ratings indicate that the company generally delivers on its promises when it comes to settling claims.

The National Association of Insurance Commissioners (NAIC) reports a complaint index for AmFam below the national average, suggesting a relatively low volume of complaints concerning claims.

Read more: What is American Family’s policy on rental car coverage during the claims process?

Digital and Technological Features of American Family Insurance

Mobile App Features and Functionality

American Family Insurance offers a robust mobile app that provides policyholders with various features and functionalities. The app allows users to access their insurance policies, view and manage their coverage, make premium payments, and report and track claims from the convenience of their smartphones or tablets.

It also offers digital ID cards and other useful tools to enhance the overall insurance experience.

Online Account Management Capabilities

Customers can manage their insurance policies and accounts conveniently through American Family Insurance’s user-friendly online platform. This digital service enables policyholders to review policy details, update personal information, make policy changes, and request quotes. It provides a seamless and efficient way for customers to stay informed and in control of their insurance needs.

Digital Tools and Resources

American Family Insurance offers a range of digital tools and resources to assist customers in understanding and managing their insurance coverage. These resources include educational materials, blog articles, and calculators that help individuals make informed decisions about their insurance needs.

The company’s commitment to providing digital resources reflects its dedication to customer education and support in the digital age.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frequently Asked Questions

What is American Family Insurance?

American Family Insurance is a Wisconsin-based mutual insurance company that offers a variety of insurance products, including auto, home, and life insurance.

Is American Family Insurance a reputable company?

Yes, American Family Insurance is a reputable company with a strong financial rating and positive customer reviews.

What types of insurance does American Family Insurance offer?

American Family Insurance offers auto insurance, home insurance, renters insurance, life insurance, and business insurance.

How can I get a quote for American Family Insurance?

You can get a quote for American Family Insurance by visiting their website, calling their customer service line, or contacting a local agent.

Does American Family Insurance offer discounts?

Yes, American Family Insurance offers discounts for bundling multiple policies, having a good driving record, being a good student, and more.

What is the claims process like for American Family Insurance?

The claims process for American Family Insurance is straightforward and can be initiated through their website, mobile app, or by calling their claims hotline.

How is American Family Insurance rated by independent agencies?

American Family Insurance has strong financial ratings from independent agencies, including A.M. Best, Moody’s, and Standard & Poor’s.

Can I manage my American Family Insurance policy online?

Yes, American Family Insurance has an online portal where you can manage your policy, view billing information, and access other resources.

Does American Family Insurance have a mobile app?

Yes, American Family Insurance has a mobile app available for download on both iOS and Android devices. The app allows customers to access their policy information, pay bills, and file claims.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.