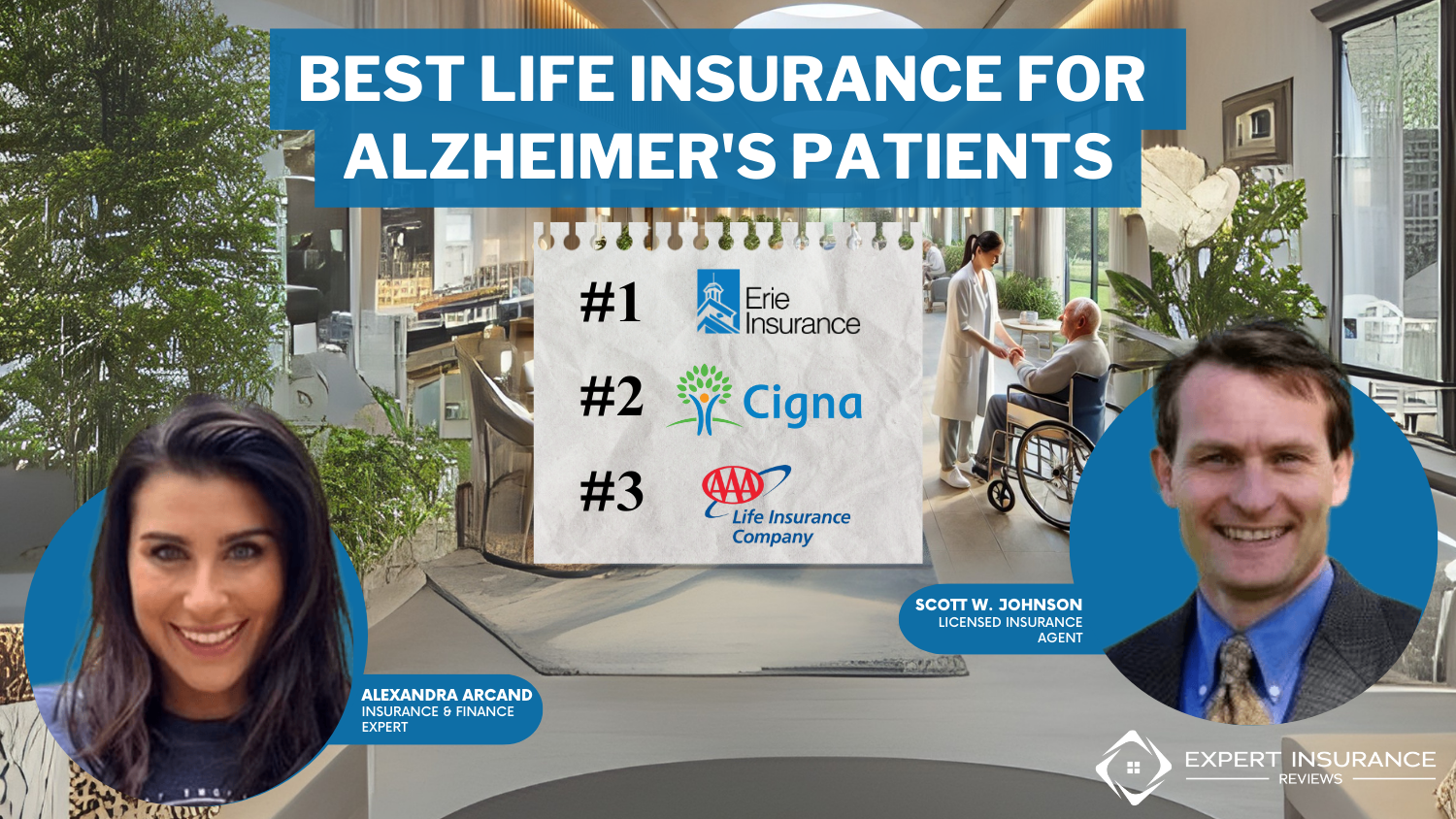

Best Life Insurance for Alzheimer’s Patients in 2025 (Compare the Top 10 Companies)

Erie, Cigna, and AAA are the top providers for the best life insurance for Alzheimer's patients. Alzheimer's life insurance rates start at $44/mo. With Erie's fixed monthly rate, Cigna's terminal illness rider, and AAA's exclusive member benefits, Alzheimer's patients can enjoy the security they deserve.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Mar 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 30, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Whole Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 3,027 reviews

3,027 reviewsCompany Facts

Whole Policy

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsErie, Cigna, and AAA offer the best life insurance for Alzheimer’s patients. With a $44 monthly starting rate, they can get coverage for added security.

Erie stands out for its fixed rate since the policy purchase and quick admission. Cigna excels in offering living benefits, such as early policy use for medical and care expenses for Alzheimer’s patients.

AAA provides member benefits for caregivers, such as discounts on healthcare facilities.

Our Top 10 Company Picks: Best Life Insurance for Alzheimer's Patients

| Insurance Company | Rank | A.M. Best | Medical Aid | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A+ | 10% | Regional Coverage | Erie |

| #2 | A | 15% | Dementia Care | Cigna | |

| #3 | A | 10% | Caregiver Support | AAA |

| #4 | A- | 20% | Nationwide Network | Blue Cross Blue Shield | |

| #5 | B+ | 15% | Long-Term Care | Humana | |

| #6 | A | 10% | Flexible Policies | American Family | |

| #7 | A- | 5% | Affordable Coverage | Colonial Penn | |

| #8 | A- | 10% | Basic Coverage | Kemper | |

| #9 | A++ | 15% | Veteran Support | USAA | |

| #10 | A | 10% | Elderly Care | AIG |

Our life insurance guide will help you secure life insurance for Alzheimer’s patients and answer your questions about eligibility, available insurance products, and more.

- Erie simplifies its application process, requiring no medical exam

- The guaranteed issue life policy ensures every Alzheimer’s patient has a plan

- Some insurers have no exam requirement, which speeds up the application

When you’re ready to buy life insurance for Alzheimer’s patients, enter your ZIP code to compare rates.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – Erie: Top Overall Pick

Pros

- Simplified Application Procedure: The underwriting procedure is not lengthy, and no medical exam is needed for Alzheimer’s patients to be accepted.

- Admission Despite Pre-Existing Condition: According to our Erie insurance review, the company ensures that Alzheimer’s patients get the security they need regardless of health diagnosis.

- Fixed Monthly Rates: Policyholders need not worry, as Erie has a fixed rate over time, proving it is the best life insurance for Alzheimer’s patients.

Cons

- Waiting Periods: There is a 2-3 year waiting period, but if the policyholder passes during this time, the beneficiaries get a portion of the refund or payout.

- Lower Plan Coverage: The guaranteed issue policies restrict coverage amounts that may not be enough for Alzheimer’s patients’ financial needs.

#2 – Cigna: Best for Dementia Care

Pros

- Living Benefits: The Cigna insurance review highlights the accelerated death benefits, which allow the policyholder to access the funds early to cover their health expenses.

- Extensive Insurance for Dementia Care: The terminal illness accelerated benefit rider is designed to focus on and cover applicants with chronic diseases like Alzheimer’s.

- Guaranteed Acceptance: They issue no medical exam for life insurance with Alzheimer’s – making life insurance for dementia accessible.

Cons

- Strict Eligibility: The accelerated death benefits require a terminal diagnosis with a life expectancy of 12 months or less, which may exclude those in the earlier stage.

- Higher Premium Rates: No medical exam policy tends to have pricier monthly premiums than the traditional plan.

#3 – AAA: Best for Caregiver Support

Pros

- End-of-Life Expense Coverage: AAA’s insurance review states that this program helps cover medical bills, funeral costs, and outstanding debts.

- Member Benefits for Caregivers: Policyholders and their families will have access to exclusive membership programs, such as discounts on healthcare-related services.

- No Medical Exam: This ensures that Alzheimer’s patients have life insurance for dementia policies to ease their financial struggles.

Cons

- Entire Benefits Waiting Period: The AAA guaranteed issue plan has a 2-3 year waiting period. When the policyholder passes away, only a partial payout is given.

- Pricier than Traditional Policies: Monthly costs for life insurance for dementia are usually higher for policies that do not require a medical examination.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – BCBS: Best for Nationwide Network

Pros

- Extensive Nationwide Presence: The BCBS insurance review mentions that it operates in 50 states and has broad support for Alzheimer’s patients.

- Integrated Health and Life Insurance Options: It offers plans alongside health coverage that help Alzheimer’s patients manage their financial security and medical care.

- Caregiver Assistance Program: Alzheimer’s patients can get care options and financial planning resources for their families.

Cons

- Complex Policy Structure: Its policies have complex terms and conditions that need extra effort to understand.

- Limited Life Insurance Availability: The best life insurance for Alzheimer’s patients varies from state to state, and some insurers offer fewer options.

#5 – Humana: Best for Long-Term Care

Pros

- Long-Term Care Riders: Our Humana insurance review stated it allows Alzheimer’s patients to receive a portion of their death benefit early to pay for their care and medical expenses.

- Chronic Illness Coverage: Alzheimer’s patients can take advantage of accelerated benefits for their medical and caregiving bills.

- Strong Network of Healthcare Services: It has integrated life and health insurance, providing additional resources for patients and their families.

Cons

- Expensive Premiums: The plan with long-term care options for Alzheimer’s insurance is pricier than the usual monthly rates.

- Tight Eligibility Criteria: Some Alzheimer’s insurance coverage and terms demand medical underwriting that may exclude Alzheimer’s patients in a later stage.

#6 – American Family: Best for Guaranteed Issue

Pros

- No Medical Exam or Health Questions: Alzheimer’s patients qualify for the guaranteed issue policy without a medical exam or health screenings.

- Guaranteed Acceptance: Applicants are approved for the company’s plan regardless of their pre-existing condition, such as Alzheimer’s.

- Affordable and Fixed Premium: There are no premium hikes throughout the plan’s duration. The American Family insurance review has more details on this policy.

Cons

- Restricted Payouts: The payouts for the guaranteed issue policy are limited and may not be enough to cover all the expenses of Alzheimer’s patients.

- Benefit Qualification Delay: Like most insurers, American Family’s waiting time for life insurance for Alzheimer’s patients is 2 to 3 years.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Colonial Penn: Best for Affordable Coverage

Pros

- Locked-In Rates: Colonial Penn insurance review promotes its fixed price once the policy is purchased for Alzheimer’s patients.

- Cash Value Accumulation: Some Alzheimer’s insurance coverage of Colonial Penn policies builds cash value over time that policyholders may borrow.

- Unrestricted Enrollment: With no exam policy, Alzheimer’s patients can easily qualify for the necessary coverage.

Cons

- No Living Benefits: It does not offer accelerated death benefits for Alzheimer’s insurance, which are primarily available from other insurance providers.

- Two-Year Waiting Period: If a policyholder passes away during this period, their beneficiary gets a refund and interest on their Alzheimer’s insurance coverage premiums.

#8 – Kemper: Best for Basic Coverage

Pros

- Easy Application and Approval: Kemper insurance review explains its easy application process, which involves minimal paperwork and helps secure coverage faster.

- Reliable Payout for Final Expenses: Quick response on claims to cover the financial burden of the families, making it the best life insurance for Alzheimer’s patients.

- Fixed Premium for Life: Once they buy the policy, Alzheimer’s patients can enjoy stable premiums and payments over time.

Cons

- Limited Policy Customization: Insurance for dementia care policies allows fewer riders and add-on benefits that are less flexible than those of competitors.

- Expensive-Than-Normal Applicant’s Rates: The no medical exam comes with higher premiums than traditional life insurance.

#9 – USAA: Best for Veteran Support

Pros

- Long-Term Care: USAA insurance review features accelerated death benefits and long-term care riders, enabling Alzheimer’s patients to access care and medical costs early.

- Educational Resources Support: It offers specialized resources such as financial planning, career support, and access to VA benefits information.

- Guaranteed Acceptance Policy: Guaranteed acceptance coverage for veterans with Alzheimer’s who might not be eligible for regular life insurance.

Cons

- Limited Eligibility: USAA insurance for dementia care is limited and exclusive to active military, veterans, and their families.

- Limited Coverage for Advanced Alzheimer’s: Veterans with advanced Alzheimer’s may find it challenging to qualify for specific policies due to their stringent underwriting standards.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – AIG: Best for Elderly Care

Pros

- Available Guaranteed Issue Policies: According to our AIG insurance review, the company offers guaranteed life insurance, ensuring Alzheimer’s patients obtain plans without a medical exam.

- Living Benefits for Chronic Illness: Policyholders receive a portion of their payout early to assist with Alzheimer’s care expenses.

- Guaranteed Issue Policies Available: AIG offers guaranteed acceptance life insurance, ensuring Alzheimer’s patients can get coverage without medical exams.

Cons

- Cash Value Loans: If the policyholder borrows from their cash value, the final payout of insurance for dementia care is reduced if it is unpaid.

- Policy Availability: Only a few policies offering the best life insurance for Alzheimer’s patients are offered in all states, limiting access to the plan.

Best Life Insurance Monthly Rates for Alzheimer’s Patients

It can be difficult, but not impossible, to find the best life insurance for Alzheimer’s patients with reasonable monthly premiums. Certain insurance companies, like guaranteed life insurance, provide specialty plans that don’t require a medical examination.

When choosing life insurance for an Alzheimer’s patient, prioritize guaranteed acceptance policies with stable premiums.

Eric Stauffer Founder & Former Insurance Agent

Knowing your alternatives helps you obtain coverage that suits your requirements without breaking the bank. But here are the monthly rates of the top 10 life insurance companies for Alzheimer’s patients.

Life Insurance Monthly Rates for Alzheimer's Patients by Provider & Coverage Level

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $50 | $90 |

| $53 | $93 | |

| $48 | $88 | |

| $55 | $95 | |

| $52 | $92 | |

| $60 | $100 | |

| $47 | $87 |

| $58 | $98 | |

| $49 | $89 | |

| $44 | $84 |

USAA trumps the lowest premiums for life insurance for Alzheimer’s patients, but remember it is military-focused, so if you do not fall into this category, go for other companies with low rates, like Kemper, Erie, and American Family.

Kemper provides basic life insurance coverage at just $49 monthly rates for Alzheimer’s patients and ensures they get the desired and needed coverage for their health condition. If this amount is still out of your budget, check the discount options below to decrease your monthly premiums even more.

Life Insurance Discounts From the Top Providers for Alzheimer's Patients

| Insurance Company | AutoPay | Bundling | Family History | Healthy Lifestyle | Non-Smoker |

|---|---|---|---|---|---|

| 2% | 4% | 5% | 6% | 8% |

| 5% | 5% | 15% | 5% | 10% | |

| 3% | 5% | 5% | 7% | 9% | |

| 2% | 4% | 10% | 6% | 8% | |

| 3% | 4% | 12% | 6% | 9% | |

| 3% | 5% | 8% | 7% | 8% | |

| 2% | 7% | 5% | 6% | 8% |

| 4% | 5% | 10% | 6% | 9% | |

| 3% | 6% | 8% | 6% | 7% | |

| 3% | 5% | 10% | 7% | 10% |

One good saving option is to bundle your insurance with other insurance, like home, auto, and health, because you can have up to 25% off on your monthly rates.

Getting Life Insurance for Alzheimer’s Patients

Suppose it’s too late for you to secure long-term care or nursing home insurance feasibly. You can still purchase guaranteed issue life insurance policies or burial or final expense insurance, even after an Alzheimer’s diagnosis.

If you or a loved one has been diagnosed with Alzheimer’s disease, securing traditional whole or term life insurance policies will be nearly impossible.

Even the best insurance companies consider Alzheimer’s to be a pre-existing condition. Companies view life insurance coverage for dementia and Alzheimer’s similarly. Both diseases impact a person’s life expectancy. While treatments have advanced, there’s still no actual cure.

Comment

byu/PorQuesoWhat from discussion

inAlzheimers

According to the Centers for Disease Control and Prevention (CDC), Alzheimer’s disease is the 6th leading cause of death in America. Your employer’s group life insurance plan might cover you if you still work. But that coverage ends if you leave your job.

Your best coverage options are guaranteed-issue life insurance or burial and final expense insurance. The table below shows the average annual burial and final expense insurance rates with differing death benefit standard rates.

Final Expense Life Insurance Monthly Rates by Age, Gender, and Death Benefit

| Age | $5,000 (Female) | $5,000 (Male) | $10,000 (Female) | $10,000 (Male) | $15,000 (Female) | $15,000 (Male) | $20,000 (Female) | $20,000 (Male) | $25,000 (Female) | $25,000 (Male) |

|---|---|---|---|---|---|---|---|---|---|---|

| 40-Years-Old | $15 | $17 | $25 | $30 | $35 | $42 | $45 | $55 | $55 | $68 |

| 45-Years-Old | $16 | $18 | $26 | $32 | $38 | $44 | $47 | $58 | $57 | $70 |

| 50-Years-Old | $17 | $19 | $28 | $33 | $39 | $47 | $50 | $61 | $62 | $75 |

| 55-Years-Old | $19 | $23 | $32 | $40 | $46 | $57 | $59 | $74 | $73 | $91 |

| 60-Years-Old | $22 | $27 | $39 | $49 | $55 | $70 | $72 | $92 | $89 | $113 |

| 65-Years-Old | $27 | $33 | $48 | $60 | $69 | $88 | $90 | $115 | $111 | $143 |

| 70-Years-Old | $33 | $42 | $61 | $78 | $89 | $115 | $117 | $151 | $145 | $188 |

| 75-Years-Old | $43 | $55 | $81 | $104 | $119 | $154 | $157 | $203 | $194 | $253 |

| 80-Years-Old | $62 | $77 | $118 | $148 | $174 | $219 | $230 | $290 | $287 | $361 |

| 85-Years-Old | $75 | $92 | $140 | $175 | $209 | $262 | $280 | $350 | $345 | $430 |

Take the data with a grain of salt; life insurance quotes for Alzheimer’s patients may cost more than what is listed above. Whatever your condition, don’t lie about the state of your health on your application. It’s illegal to take out a life insurance policy on someone who doesn’t give consent.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Final Expense or Burial Insurance for Alzheimer’s Patients

Final expense and burial insurance is an excellent option for families dealing with Alzheimer’s disease. It is one of the only life insurance plans for those over 80 who do not have medical exam options. Your beneficiary receives a small cash benefit to help cover funeral costs and other left-behind expenses.

You can purchase a guaranteed issue or a simplified issue policy. Simplified issue burial insurance requires you to answer some medical questions.

Companies that sell final expense insurance include:

- Liberty Bankers Life Final Expense Insurance

- Settlers Life Insurance

- Security National Life Insurance

- Prosperity Life Insurance and Final Expense

- Sagicor Life Final Expense Insurance

- United Home Life Insurance and Final Expense

A waiting period may apply to final expense insurance. If you pass away before the waiting period ends, usually two or three years, your beneficiary doesn’t receive the death benefit. Instead, the provider returns your premium payments to your beneficiary, usually with interest.

Guaranteed Issue Life Insurance for Alzheimer’s Patients

As the name implies, anyone can purchase guaranteed-issue life insurance, including Alzheimer’s patients.

However, expect high premiums for guaranteed issue life insurance rates for Alzheimer’s patients. The death benefit, often limited, is usually $25,000 or less. The insured often needs to be at least 50 years old. A waiting period also applies to this type of policy. Again, usually two or three years.

Read more: What is the life insurance waiting period?

3 Case Studies: Life Insurance for Alzheimer’s Patients

In this section, we will look into the varied experiences of Alzheimer’s patients who could secure life insurance despite their health conditions and successfully get financial aid in times of crisis.

Although navigating life insurance with health conditions is challenging, there are many options you can check and ways to get coverage at an affordable cost. Moreover, you can also find a life insurance advisor to lay out everything for you. So, be inspired by these case studies of John, Mary, and Robert.

Case Study 1: John’s Burial Insurance

John, a 68-year-old man diagnosed with Alzheimer’s disease, was concerned about the financial burden his funeral expenses would place on his family. He decided to buy life insurance for seniors with dementia to ensure that his final expenses would be covered.

Despite his pre-existing condition, John was able to secure a burial insurance policy with a death benefit of $15,000. The policy required a waiting period of two years before the full death benefit would be payable. John’s annual premium for the policy was $800.

Case Study 2: Mary’s Guaranteed Issue Life Insurance

Mary, a 55-year-old woman in the early stages of Alzheimer’s disease, wanted to provide some financial security for her family after her passing. She applied for guaranteed issue life insurance with dementia, which is available to individuals regardless of their health conditions. Mary was approved for a policy with a death benefit of $25,000.

The policy had a waiting period of three years, during which only a portion of the death benefit would be paid out in the event of her death. Mary’s annual premium for the policy was $1,200.

Case Study 3: Robert’s Employer-Provided Coverage

Robert, a 45-year-old man with early-onset Alzheimer’s disease, was fortunate to have employer-provided group life insurance coverage. The policy provided a death benefit of $100,000. As long as Robert remained employed, he was eligible for Alzheimer’s insurance coverage. However, if he were to leave his job, the coverage would end, and he would need to seek alternative life insurance options.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Getting Life Insurance for Alzheimer’s Patients

You might struggle to find affordable life insurance for Alzheimer’s patients, but it’s not impossible. Two valid options include final expense or burial insurance and guaranteed issue life insurance.

If Alzheimer’s and dementia run in your family, don’t wait until you need coverage to purchase long-term care insurance; you can buy them early.

Schimri Yoyo Licensed Agent & Financial Advisor

Apply when you’re still young and healthy to receive the best rates. Find the best life insurance for Alzheimer’s patients near you by entering your ZIP code into our free tool, and get life insurance quotes from reputable providers.

Frequently Asked Questions

Can you get life insurance if you have Alzheimer’s?

Yes, you can. Many life insurance companies are lenient with the application, requiring no medical examination and guaranteeing life insurance for dementia. Check insurers like Erie, AAA, Cigna, and Humana.

Which Alzheimer’s charity is best?

The best Alzheimer’s charity depends on your priorities:

- Alzheimer’s Association: Best overall for research, advocacy, and caregiver support.

- Alzheimer’s Foundation of America (AFA): Best for caregiver support and free memory screenings.

- Cure Alzheimer’s Fund: Best for research, with 100% of donations funding scientific breakthroughs.

- BrightFocus Foundation: Best for research grants targeting Alzheimer’s and vision diseases.

- UsAgainstAlzheimer’s: Best for advocacy and policy change to accelerate a cure.

Is Alzheimer’s covered by insurance?

Yes. You can notify your insurance provider and seek advice on how to increase your life insurance coverage, including an offer for Alzheimer’s.

Does life insurance pay out for dementia?

Will life insurance pay for dementia? Most life insurance policies pay for dementia, though the amount varies depending on the policy purchased; the company underwrites the insurance policy based on your needs. You can check your early quotes here by entering your ZIP code.

What is the most effective Alzheimer’s treatment?

The most effective Alzheimer’s treatments currently include FDA-approved drugs like Leqembi (lecanemab) and Aduhelm (aducanumab), which help slow disease progression.

Other therapies focus on symptom management, including cholinesterase inhibitors (Donepezil, Rivastigmine) and NMDA receptor antagonists (Memantine). Lifestyle changes and cognitive therapy can also help improve quality of life.

What is the life expectancy of someone with early-onset Alzheimer’s?

The life expectancy of someone with early-onset Alzheimer’s (before age 65) is typically 8 to 12 years after diagnosis. However, some may live longer, as it varies depending on overall health and care.

Can I insure against dementia?

Yes. Insuring yourself with life insurance against dementia is early protection, especially if it runs in your family. Getting life insurance later, though available, could indicate less coverage and higher premiums. Learn how to buy life insurance.

Is Alzheimer’s hereditary?

Yes, Alzheimer’s can be hereditary. While most cases are sporadic, specific genes (like APOE4) can increase the risk. Rare early-onset cases are strongly linked to inherited genetic mutations.

Is Alzheimer’s considered a disability?

Yes, Alzheimer’s is considered a disability under the Social Security Administration (SSA) and Americans with Disabilities Act (ADA), qualifying individuals for benefits like Social Security Disability Insurance (SSDI) and accommodations.

Is Alzheimer’s treatment expensive?

Yes, Alzheimer’s treatment is expensive, with costs ranging from $50,000 to $100,000+ per year, including medications, home care, and nursing facilities. Many families rely on Medicare, Medicaid, or long-term care insurance to help cover expenses.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.