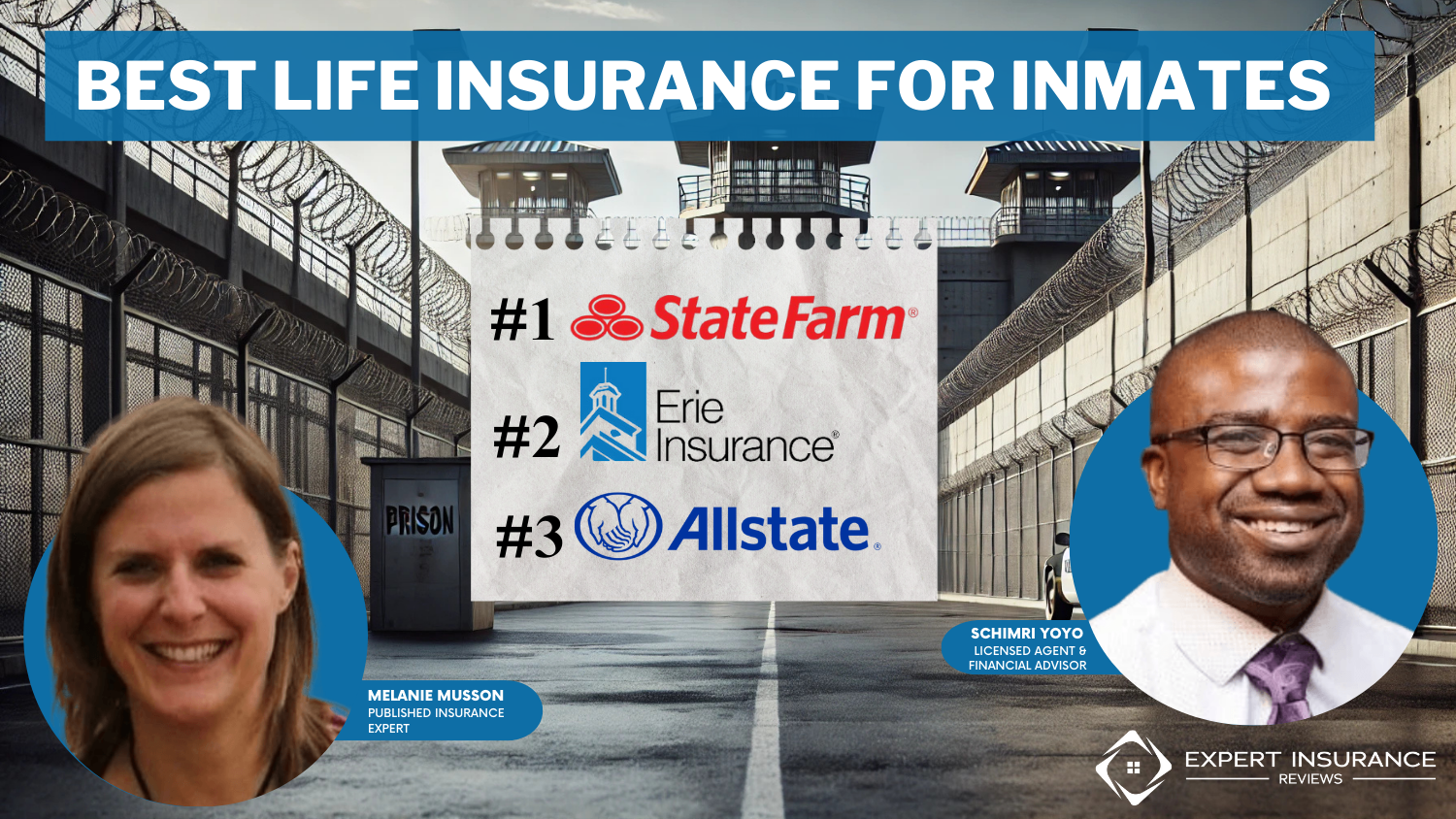

Best Life Insurance for Inmates in 2025 (Check Out the Top 10 Companies)

The best life insurance for inmates starts at $100/mo. With State Farm's simplified plans requiring no exam, Erie's permanent life insurance with a fixed rate over time, and Allstate's term length variations ranging from 10 to 30 years, inmates can have diverse choices depending on their budget and needs.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Whole Policy

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 11,638 reviews

11,638 reviewsCompany Facts

Whole Policy

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsState Farm, Erie, and Allstate offer the best life insurance for inmates, with a starting monthly rate of $100. State Farm is known for its simplified plans, which do not require medical exams.

Erie provides customizable death benefits through lump sum or structured payouts. Lastly, Allstate offers a variety of term lengths, ranging from 10 to 30 years, which applicants can choose based on their budgets.

Our Top 10 Company Picks: Best Life Insurance for Inmates

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 6% | A++ | Customizable Plans | State Farm | |

| #2 | 7% | A+ | Family-Focused Coverage | Erie |

| #3 | 10% | A+ | Flexible Terms | Allstate | |

| #4 | 10% | A+ | Easy Application | Progressive | |

| #5 | 5% | A+ | Long-Term Protection | The Hartford |

| #6 | 5% | A | Family-Oriented Plans | Farmers | |

| #7 | 5% | A | Affordable Rates | Liberty Mutual |

| #8 | 8% | A+ | Comprehensive Coverage | Nationwide |

| #9 | 8% | A++ | Accessible Coverage | Travelers | |

| #10 | 8% | A++ | Premium Coverage | Chubb |

Those are the best life insurance companies for inmates, and you can choose whichever suits your unique needs.

- State Farm offers convertible term coverage to a whole life insurance plan

- A 9% to 25% bundling discount for insurance like life, home, and auto

- Life insurance rate of term and whole policies range from $100 to $140 a month

This life insurance coverage guide is for those seeking the best and most affordable coverage. Enter your ZIP code to start comparing rates as soon as possible.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Simplified Issue Policies: No medical exam is required, making it easier for qualifying inmates to get the best life insurance coverage.

- Policy Continuation During Short Sentences: If the premiums are paid and the inmate has an active policy before incarceration, the beneficiaries will receive the payout.

- Convertible Term Coverage: If the term policy was bought before incarceration, they may be able to convert it to whole life later for lifelong coverage after their release.

Cons

- No Policies Available for Current Inmates: Like most insurers, State Farm does not offer life insurance for incarcerated persons.

- Possible Premium Increases After Release: Inmates who continue or request coverage after release face higher premiums for direct life insurance.

#2 – Erie: Best for Family-Focused Coverage

Pros

- Affordable Whole Life Plan: Erie offers permanent life insurance with fixed premiums, ensuring the family receives a guaranteed payout.

- Customizable Death Benefits: Lump sum or structured payouts for beneficiaries to help them with financial matters after the policyholder’s passing.

- Cash Value Accumulation: Families can borrow in modified whole-life policies as it build cash value over time in life insurance for prisoners.

Cons

- No Policies for Current Inmates: Erie does not offer policies like burial insurance for inmates and incarcerated individuals.

- Medical Exam Requirements: Erie requires a medical exam, which may be difficult for high-risk applicants to qualify for the best life insurance for inmates.

#3 – Allstate: Best for Flexible Terms

Pros

- Variety of Term Lengths: Allstate insurance provides data on policies ranging from 10 to 30 years, which individuals choose according to their financial situations.

- Policy Continuation: If an individual purchases a policy before going to prison, their coverage remains active as long as premiums are paid.

- Optional Add-Ons: Critical illness and accidental death are other options that provide additional benefits for families. Read our guide on how to increase life insurance coverage.

Cons

- No New Policies for Current Inmates: Incarcerated individuals cannot avail of policies like any other insurer that offers the best life insurance for felons.

- Limited Availability for Whole Life Insurance: Focus on term insurance and less permanent life insurance for inmates.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Progressive: Best for Easy Application

Pros

- Fast and Easy Online Application: The online application allows applicants to compare quotes and apply in just a few minutes.

- No Medical Exam Requirement: Through its partnership with eFinancial, it offers simplified issue policies so those with criminal records can easily qualify.

- Third-Party Provider: Progressive partners with multiple insurers to increase the likelihood of providing life insurance for high-risk individuals like inmates.

Cons

- No Direct Underwriting: Progressive does not issue the life insurance plan directly, so approval depends on third-party insurers.

- Premiums Variations: Higher premiums for the best life insurance for inmates, especially for those with criminal records.

#5 – Hartford: Best for Long-Term Protection

Pros

- Permanent Life Insurance Protection: The Hartford insurance review highlights that whole and universal life policies are for a lifetime, so long as premiums are paid.

- Coverage Continuation: The purchased life insurance for convicted felons’ policy prior to incarceration can remain active.

- Guaranteed Death Benefit: Provides financial benefits for families through its payouts in life insurance for inmates’ plans.

Cons

- Limited Availability for High-Risk Applicants: Former inmates may face higher rates or even policy denials in their applications.

- Policy Restriction: The incarcerated applicants could not avail of the policies in the best life insurance for inmates.

#6 – Farmers: Best for Family-Oriented Plans

Pros

- Flexible Death Benefit Option: Families can get a lump sum or structured payouts after the policyholder’s passing.

- Convertible Term Plan: If the policyholder buys a term plan prior to incarceration, they can convert it to a whole-life plan.

- Spouse and Child Riders: Farmers insurance group review states that optional riders allow the policyholder to add their children and spouse.

Cons

- Policy Limitations: Like most insurers, incarcerated applicants cannot get life insurance for felons from Farmers.

- Medical Assessment: Some policies mandate underwriting and health screening, which may disqualify high-risk applicants.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Affordable Rates

Pros

- Competitive Policy Pricing: Liberty Mutual offers the most affordable $125 monthly rate for the best life insurance for inmates.

- Flexible Term Plans: Liberty Mutual insurance provides term lengths ranging from 10 to 30 years, enabling applicants to get coverage suitable for their budget.

- Strong Financial Stability: It ensures the beneficiaries receive the payouts for burial insurance for inmates, proven by its A rating from A.M. Best.

Cons

- Whole Life Option Restriction: It primarily centers on term life insurance, and those who want a whole life plan may need to look elsewhere.

- Fewer Add-Ons: It offers fewer riders and add-ons, making it less competitive for the best life insurance for inmates.

#8 – Nationwide: Best for Comprehensive Coverage

Pros

- Comprehensive Riders Option: According to our Nationwide insurance review, the company provides critical illness, disability, and long-term care riders to maximize coverage.

- Coverage Continuation: If they bought their best life insurance for inmates before incarceration, policyholders can maintain their coverage even during incarceration.

- Ensured Death Benefits: Whole and universal life policies provide an ensured payout for beneficiaries upon the policyholder’s death.

Cons

- No New Policy for Incarcerated Applicants: Nationwide does not offer life insurance to currently incarcerated applicants.

- Expensive Premiums: Former inmates applying after being released may encounter higher rates in the best life insurance for inmates due to their criminal record.

#9 – Travelers: Best for Accessible Coverage

Pros

- Specialized Inmate Life Plan: This plan is designed to accommodate the unique risks for inmates, as most policies exclude inmates from the standard policy.

- Nationwide Accessibility: Travelers insurance reviews claim it has a nationwide reach, meaning the inmate’s plan can be applied across different jurisdictions and states.

- Dynamic Features: Alterable life insurance guidelines based on correctional policies, such as the size of the facility, the health of the inmate population, and other factors.

Cons

- Complex Claims Procedure: The process requires approval and takes longer as additional documentation from the facility is needed.

- Criminal Activity Exclusion: An Inmate’s death due to their criminal activities or resulting in conditions of incarceration (fight, riot, or suicide) could be excluded from coverage’s benefits.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – Chubb: Best for Premium Coverage

Pros

- Comprehensive Coverage: Chubb insurance review offers robust coverage that correctional facilities can depend on for multiple types of claims, such as inmate health needs.

- High-Quality Claims Response: Efficient burial insurance for inmates and other related claims, including medical care and accidental death, is processed quickly, ensuring timely support.

- Worldwide Presence: Chubb can access global insurance solutions if specialized coverage is needed, like for international components.

Cons

- Complex Plan Terms: Complex conditions require more time to navigate and may even require legal experts to understand what is and isn’t covered.

- Lengthy Applications: Because of its level of flexibility, the application process is longer than that of other providers.

Comparing Life Insurance Rates for Inmates

Getting the best life insurance for inmates may be a little challenging, but the table below shows the term and whole policy rates for your reference.

Life Insurance Monthly Rates for Inmates by Provider & Coverage Level

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $100 | $110 | |

| $120 | $130 | |

| $130 | $140 |

| $115 | $125 | |

| $125 | $135 |

| $121 | $132 |

| $110 | $120 | |

| $105 | $115 | |

| $126 | $136 |

| $117 | $127 |

Allstate has the lowest term and whole policy rates, which are $5 less than State Farm’s.

Now, let’s check all the discounts these insurers offer that you may be eligible to lower your premiums.

Life Insurance Discounts From Top Providers for Inmates

| Insurance Company | AutoPay | Bundling | Employer-Sponsored | Healthy Lifestyle | Non-Smoker |

|---|---|---|---|---|---|

| 3% | 10% | 12% | 7% | 10% | |

| 4% | 8% | 10% | 8% | 9% | |

| 2% | 7% | 10% | 6% | 8% |

| 3% | 5% | 9% | 7% | 8% | |

| 4% | 5% | 10% | 6% | 10% |

| 2% | 8% | 9% | 7% | 12% |

| 3% | 10% | 10% | 7% | 9% | |

| 3% | 6% | 10% | 10% | 8% | |

| 3% | 5% | 10% | 7% | 10% |

| 3% | 8% | 9% | 8% | 11% |

Unfortunately, these providers do not offer direct savings options for inmates. However, you can consider other options, like bundling your insurance with other types, such as auto, home, and health.

Life insurance for inmates often costs more than standard rates due to the increased level of risk that comes with incarceration.

Tim Bain Licensed Insurance Agent

Take a look at the table of average guaranteed issue life insurance rates below to see how this may impact your budget for inmate life insurance premiums.

Guaranteed Issue Life Insurance Monthly Rates by Age, Gender, and Policy

| Age | Policy Coverage Amount | Male Premium | Female Premium |

|---|---|---|---|

| 50 | $10,000 | $55 | $45 |

| $15,000 | $71 | $64 | |

| $25,000 | $106 | $95 | |

| 60 | $10,000 | $76 | $61 |

| $15,000 | $103 | $83 | |

| $25,000 | $152 | $128 | |

| 70 | $10,000 | $127 | $102 |

| $15,000 | $169 | $135 | |

| $25,000 | $254 | $191 |

Guaranteed issue coverage is only available to applicants 50 or older, but the best insurance companies will offer these policies to those as young as forty.

Shop around to find the best life insurance company that offers 30-year terms.

Buying Life Insurance for Inmates

Yes, you can get life insurance for someone in prison, but you may have a hard time finding a provider willing to cover such a high-risk individual.

Since life insurance for inmates poses a great risk to the insurance provider, you cannot find policies with traditional companies. You must shop for multiple quotes to find affordable high-risk life insurance companies.

Read more: Can you buy life insurance for someone else?

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Types of Life Insurance for Inmates

State insurance laws can restrict life insurance for inmates, and most insurance companies have their own regulations regarding life insurance with a criminal record.

For that reason, most life insurance companies will only offer guaranteed issue life insurance policies to inmates. Guaranteed life insurance policies cover inmates’ burial and other final expense insurance for inmates that often come with other limitations.

For example, most guaranteed issue policies are only available to people over 50 and provide coverage up to $25,000, which may not be enough for your family.

If you had life insurance coverage in place before being sent to prison, your coverage will still apply as long as your premiums are paid and you don’t die committing a criminal act.

Unfortunately, your choices are quite limited if you don’t already have coverage in place.

Inmates can choose to purchase accidental death & dismemberment insurance but realize that it does not provide death benefits if they die of illness, disease, or as a result of a pre-existing medical condition.

Read more: Accidental Death and Dismemberment Insurance

Buying Life Insurance for Felons

Can you get life insurance on an inmate? Life insurance for inmates is not easy to find, but it’s not impossible to get coverage as a felon.

Your criminal history will impact your life insurance quotes for inmates, but some providers offer guaranteed life insurance for convicted felons.

Factors Affecting Life Insurance Rates for Inmates

| Factor | Description |

|---|---|

| Criminal Record Severity | Violent crimes lead to higher rates or denial. |

| Length of Incarceration | Longer sentences increase risk for insurers. |

| Parole or Probation Status | Some insurers require a waiting period after release. |

| Age at Application | Older applicants pay higher premiums. |

| Health Status | Poor health or substance abuse raises rates. |

| Policy Availability | Inmates have limited options, often high-cost policies. |

| Insurance Provider’s Risk Assessment | Insurers have different policies on covering ex-inmates. |

| Rehabilitation & Work History | Stable employment post-release can help. |

| Time Since Release | Many insurers require 1-5 years post-release. |

| Cause of Incarceration | Fraud is often viewed less risky than violent crimes. |

Regarding the type of life insurance available, felons face a few restrictions when qualifying for life insurance coverage. Inmates can expect to pay higher premiums, but shopping online for high-risk life insurance allows them to compare quotes and find affordable and best life insurance for felons.

Not all insurers will issue life insurance policies to inmates; if they do, policy premiums will be high. If you need to purchase high-risk life insurance policies for inmates, reducing as much risk as possible is important.

Every insurance company assesses risk differently. Research providers specializing in high-risk policies to find coverage that fits your needs.

Zach Fagiano Licensed Insurance Broker

You may qualify for a high-risk policy depending on the nature of the crime and your risk category.

An attorney or someone with the power of attorney can argue on your behalf. If they can prove that your family and other dependents will suffer financially after your death, you may qualify for high-risk life insurance for inmates.

Be aware that this kind of coverage comes with higher premiums but can give you the level of coverage you need to keep your family comfortable after your death.

Read more: Life Insurance for Felons.

Case Studies: Life Insurance for Inmates

Can convicted felons get life insurance? Let us understand and explore life insurance for convicted felons from different cases and perspectives.

Case Study 1: John’s Burial Expenses

John, a long-term inmate, wants to ensure that his family is financially protected in the event of his passing. With the help of an attorney, John explores guaranteed-issue life insurance policies that cover burial expenses. Despite facing higher premiums, John finds an affordable policy that provides peace of mind for his loved ones.

Case Study 2: Accidental Death & Dismemberment Coverage for Mark

Mark, a felon with a history of dangerous activities, is interested in obtaining life insurance coverage that protects his family in case of accidental death or dismemberment. Despite being limited to this specific type of coverage, Mark discovers an insurer specializing in high-risk individuals and secures a policy tailored to his needs.

Case Study 3: Finding Affordable Coverage for Sarah

Sarah, an inmate with a clean record prior to her conviction, seeks life insurance coverage that extends beyond burial expenses. Aware of the limitations imposed on inmates, Sarah diligently compares quotes from multiple high-risk life insurance providers online. She identifies an insurer offering more affordable rates and broader coverage options through careful research.

There you have it. We hope this guide helps you understand guaranteed life insurance and find the best life insurance for inmates. Enter your ZIP code to start comparing life insurance for prisoners.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frequently Asked Questions

How can inmates apply for life insurance?

Inmates can apply for life insurance by working with insurance agents or brokers specializing in serving incarcerated individuals. These professionals can guide inmates through the application process and help them find suitable insurance options.

Are there any limitations or exclusions for inmates when purchasing life insurance?

Yes, inmates may have limitations or exclusions when purchasing life insurance. Insurance providers often consider factors such as the length of incarceration, the reason for incarceration, and the inmate’s health status, which can affect the availability and cost of life insurance coverage.

Can you get life insurance for someone in prison?

Obtaining life insurance for an incarcerated person is possible, but the possibilities are limited. Because of the heightened risk, most standard insurers refuse coverage or demand high fees. Certain policies, such as group life insurance through penal facilities or guaranteed issue life insurance, may be available, but these frequently have limitations and pay out smaller benefits.

Can inmates with pre-existing conditions get life insurance?

Inmates with pre-existing conditions may still be eligible for life insurance, but the availability and cost of coverage can be affected. Insurance providers may require additional medical information or underwriting processes to assess the risk associated with the pre-existing condition.

Who is permanent life insurance best for?

Permanent life insurance is best for individuals who want lifelong coverage, build cash value over time, and provide financial security for their beneficiaries, estate planning, or wealth transfer needs.

What types of life insurance are available for inmates?

Inmates typically have access to two main life insurance policies: term and whole life insurance. Term life insurance covers a specific period, while whole life insurance provides lifelong coverage. Enter your ZIP code to get your term and whole life insurance quotes.

Who should I list as my life insurance beneficiary?

Choose a life insurance beneficiary based on your financial goals, such as a spouse, children, family members, a trust, a charity, or an estate. Consider multiple or contingent beneficiaries and legal and tax implications, and update your choice after significant life events.

Who is the best beneficiary for life insurance?

The best beneficiary for life insurance is someone who depends on you financially, such as a spouse, child, or trusted individual, who will responsibly use the payout to cover expenses, debts, or future needs.

What is the best life insurance for police officers?

The best life insurance for police officers is a policy that offers high-risk occupation coverage, such as term or permanent life insurance, from providers like Northwestern Mutual, Prudential, or USAA. These providers offer tailored benefits, duty-related death coverage, and affordable premiums.

What type of beneficiary is the best?

The best type of beneficiary depends on your goals. Still, a primary beneficiary who is financially responsible, such as a spouse, child, or trust, ensures the payout is used effectively for intended purposes like debt repayment, education, or living expenses.

Who is the primary beneficiary of insurance?

The primary insurance beneficiary is the person or entity designated to receive the policy’s payout upon the insured’s death.

What are the disadvantages of permanent life insurance?

The disadvantages of permanent life insurance include higher premiums, potential complexity, slower cash value growth in the early years, and the risk of policy lapse if premiums are not maintained.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active life and health insurance licenses in seven states and over 20 years of experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.