Best Life Insurance for Overweight Individuals in 2025 (Compare the Top 10 Companies)

AAA, Allstate, and American Family provide the best life insurance for overweight individuals. Life insurance for obese people starts at $32 a month. AAA leads with its lenient policy underwriting. Allstate is known for its flexible plans and customer service. American Family stands out for its renewal advantage.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,027 reviews

3,027 reviewsCompany Facts

Whole Policy

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 11,638 reviews

11,638 reviewsCompany Facts

Whole Policy

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 2,235 reviews

2,235 reviewsCompany Facts

Whole Policy

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsAAA, Allstate, and American Family offer the best life insurance for overweight individuals, with monthly rates starting at $32. AAA stands out for its affordable rates for high BMI insurance applicants, requiring no medical assessment.

Allstate excels at offering flexible policies to fit various customers’ needs. American Family has stable rates upon renewal regardless of high BMI. Check the table below to find more details of the top 10 companies for obese people.

Our Top 10 Company Picks: Best Life Insurance for Overweight Individuals

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 4% | A | Strong Reputation | AAA |

| #2 | 10% | A+ | Extensive Coverage | Allstate | |

| #3 | 5% | A | Loyalty Rewards | American Family | |

| #4 | 5% | A | Flexible Policies | Liberty Mutual |

| #5 | 5% | A | Reliable Claims | Farmers | |

| #6 | 8% | A++ | Affordable Premiums | Geico | |

| #7 | 8% | A+ | Personalized Service | Nationwide |

| #8 | 6% | A++ | Industry Leader | State Farm | |

| #9 | 5% | A+ | Financial Stability | The Hartford |

| #10 | 5% | A++ | Military Benefits | USAA |

This guide on buying life insurance for overweight individuals can help you get the best coverage tailored to your needs.

- AAA has some of the cheapest rates and lenient BMI policy underwriting

- The BMI and other health factors determine life insurance rates

- These insurers have A to A++ ratings from A.M. Best

Life insurance for overweight people is easier to find than many people think. If you want to buy life insurance for overweight people, enter your ZIP code to get life insurance quotes from companies in your area.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#1 – AAA: Top Overall Pick

Pros

- Affordable Rates for High BMI Insurance Applicants: The AAA insurance review highlights the cheaper rates for applicants classified as overweight or obese.

- Lenient Underwriting for Higher Weight: AAA has flexible underwriting guidelines in accepting applicants with higher BMIs than competitors.

- No Medical Exam Requirement: Some life insurance for overweight do not require an exam, making it easier for overweight people to qualify.

Cons

- Higher Rates for No-Exam Policies: While this policy is easier to obtain, it tends to have higher premiums than fully underwritten policies.

- Limited Coverage Amounts: The simplified issue policies have a lower coverage range than the traditional underwritten policies.

#2 – Allstate: Best for Extensive Coverage

Pros

- Flexible Policies: To qualify for the best life insurance for overweight individuals, policyholders can choose between term and modified whole life insurance, whichever fits their needs.

- Accommodating Life Insurance BMI Chart: Allstate is more forgiving of higher BMI levels, giving overweight applicants better options.

- Financially Stable: With an A+ A.M. Best rating, $51 billion in revenue, and $99 billion in total assets in 2022, it is established with a strong capacity for fast claims and service.

Cons

- Expensive Premiums for Certain BMI Ranges: Applicants with very high BMI or obesity class II or III encounter higher premiums.

- Medical Exam Required: A medical exam is required before getting the policy, and rates will be impacted if additional health issues are found.

#3 – American Family: Best for Loyalty Rewards

Pros

- Less Restrictive BMI Policy: Flexible BMI guidelines are available if the applicant qualifies for life insurance for obese adults at standard or preferred rates.

- Renewal Advantage: The American Family insurance review discusses the stability of policyholder renewal despite higher BMIs.

- Loyalty Savings: Overweight individuals who maintain coverage will have lower price hikes over time and experience the best life insurance for overweight individuals.

Cons

- Geographical Limitations: Availability is limited as it may not be offered nationwide for life insurance for overweight applicants.

- Required Medical Exam: A complete medical exam is required, which could impact premiums for overweight people.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#4 – Liberty Mutual: Best for Flexible Policies

Pros

- BMI Lenient Guidelines: More accommodating to higher BMI applicants than other providers, ensuring they get the best life insurance for overweight individuals.

- No Medical Exam Policy: A complete medical exam is not required, making life insurance approval more straightforward and faster.

- Affordable Rates for Moderately Overweight Applicants: Slightly elevated BMIs may be eligible for life insurance for obese adults, standard or near-preferred rates.

Cons

- Expensive Rates for Severe Obesity: Very high obesity in the life insurance BMI chart, like class II or III, has a significant rate increase.

- Medical Exam for Larger Policies: Although Liberty Mutual is listed among the best no-exam life insurance companies, higher coverage requires a full medical exam.

#5 – Farmers: Best for Reliable Claims

Pros

- BMI Leniency: Farmers’ insurance review claims it never denied or overpriced applicants based only on BMI; instead, it assesses their overall health and lifestyle.

- Broad Coverage Choices: Offers term, whole, and universal policies that overweight individuals can choose from depending on their unique needs.

- Personalized Agent Support: Dedicated agents assist during claims and policy customization to make things easier for overweight applicants.

Cons

- Limited Availability: Some coverage options are not available in some states. Check in advance if it is available in your state.

- Medical Exam for Larger Policy: Medical exams are required, which may raise premiums if pre-existing conditions exist in overweight people.

#6 – Geico: Best for Affordable Premiums

Pros

- Competitive Market Pricing: Secures lower rates than traditional providers with just a $63 whole policy monthly rate for life insurance for overweight people.

- Discounted Pricing for Bundling: The Geico insurance review suggests that bundling insurance like home, auto, and life can save you 25%.

- Partnered Underwriting Method: Partners with companies like Banner Life and Prudential to allow applicants to access multiple pricing choices.

Cons

- Fewer Customization Policy: The customization of policies depends on partner insurers, so customers cannot have full flexibility in overweight people’s desired policy.

- Customer Experience Varies: Claims and other coverage management are handled by partner companies, so service quality and claims resolution differ.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Personalized Service

Pros

- Holistic Health Assessment: This more customized assessment focuses on the overall health rather than just the BMI. You can find out more about it in the Nationwide insurance review.

- Flexible Underwriting: Overweight applicants may qualify for standard or preferred rates depending on overweight people’s overall health.

- High Customer Satisfaction: High customer satisfaction rates with a score of 826/1000 on J.D. Power in 2023 and few complaints on claims and policies.

Cons

- Not the Cheapest for Severe Obesity: BMIs of 40+ face higher premiums or are directed to other special policies for obesity insurance coverage.

- Agent-Based Process Issues: This process is less convenient for those who prefer online applications as it requires an agent for policy management and other concerns.

#8 – State Farm: Best for Industry Leader

Pros

- More Lenient BMI: According to State Farm insurance review, the company established a more accommodating method for applicants with higher BMIs.

- Extensive Options: Provides term, whole, and universal life insurance for various needs of overweight individuals.

- Budget-Wise Rates: Even with higher BMIs, they can qualify for standard or preferred rates under some conditions for life insurance for obese adults.

Cons

- Strict Medical Requirements: A full medical exam is required, and other health conditions, such as diabetes and hypertension, can drive high rates.

- Term Life Insurance for Overweight: It must be done with an agent, making the process convenient for those who prefer to do it online.

#9 – The Hartford: Best for Financial Stability

Pros

- Expert Risk Management: It underwrites life insurance for overweight applicants. Check all underwriting options in the Hartford insurance review

- Good Disability Insurance: Specialized coverage for individuals who cannot work due to weight-related health concerns can still qualify for the best life insurance for overweight.

- Focus on Group Insurance: Employers offer group life insurance via Hartford for more convenience and less strict application.

Cons

- Restricted Individual Insurance: The company no longer offers individual life insurance, so those without a group insurance option must look for individual insurance elsewhere.

- Employer-Dependent Options: The best offer comes from employer-sponsored group life plans for life insurance for overweight people

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

#10 – USAA: Best for Military Benefits

Pros

- Flexible Underwriting for Military: USAA tends to consider BMI and weight-related conditions, especially for military members and veterans.

- No Deployment Exclusions: Obesity insurance coverage remains valid even when deployed to combat zones.

- Affordable Rates for Overweight Policyholders: The USAA insurance review highlights that the insurer offers reasonable rates despite elevated BMIs.

Cons

- Strict Membership Requirement: Only offered to life insurance for obese military members, veterans, and their families.

- Medical Exam for Larger Policies: This is flexible for BMI concerns, but other conditions like heart disease and diabetes may raise premiums.

Life Insurance Monthly Rates for Overweight People

This life insurance coverage guide offers everything you need to know. The basics of getting life insurance are knowing how much it would cost. So, here is the table for the top providers’ monthly terms and whole policy rates of the best life insurance.

Life Insurance Monthly Rates for Overweight Individuals by Provider & Coverage Level

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $35 | $60 |

| $40 | $70 | |

| $37 | $65 | |

| $38 | $68 | |

| $36 | $63 | |

| $45 | $75 |

| $39 | $72 |

| $34 | $62 | |

| $41 | $73 |

| $32 | $58 |

AAA, USAA, and State Farm are among the providers that offer the lowest rates, with $32 to $62 per month on the terms and whole policy.

AAA not only offers low rates on its policy but is also the top overall pick for its inclusivity and extensive service. Moreover, you can still reduce the policy rates with the savings options we have prepared for you.

Life Insurance Discounts From the Top Providers for Overweight Individuals

| Insurance Company | Bundling | Family History | Healthy Lifestyle | Loyalty | Non-Smoker |

|---|---|---|---|---|---|

| 4% | 5% | 6% | 3% | 8% |

| 10% | 10% | 7% | 3% | 10% | |

| 5% | 5% | 7% | 4% | 9% | |

| 5% | 10% | 7% | 3% | 8% | |

| 8% | 10% | 7% | 4% | 12% | |

| 5% | 8% | 6% | 3% | 10% |

| 8% | 5% | 7% | 3% | 12% |

| 6% | 15% | 10% | 4% | 8% | |

| 5% | 8% | 7% | 3% | 10% |

| 5% | 10% | 7% | 2% | 10% |

Though it sounds so good, discounts set conditions for qualifying policyholders. If you qualify for more discount options, you’ll also save more on your monthly premiums.

Best Life Insurance Rates and Factors for Obese People

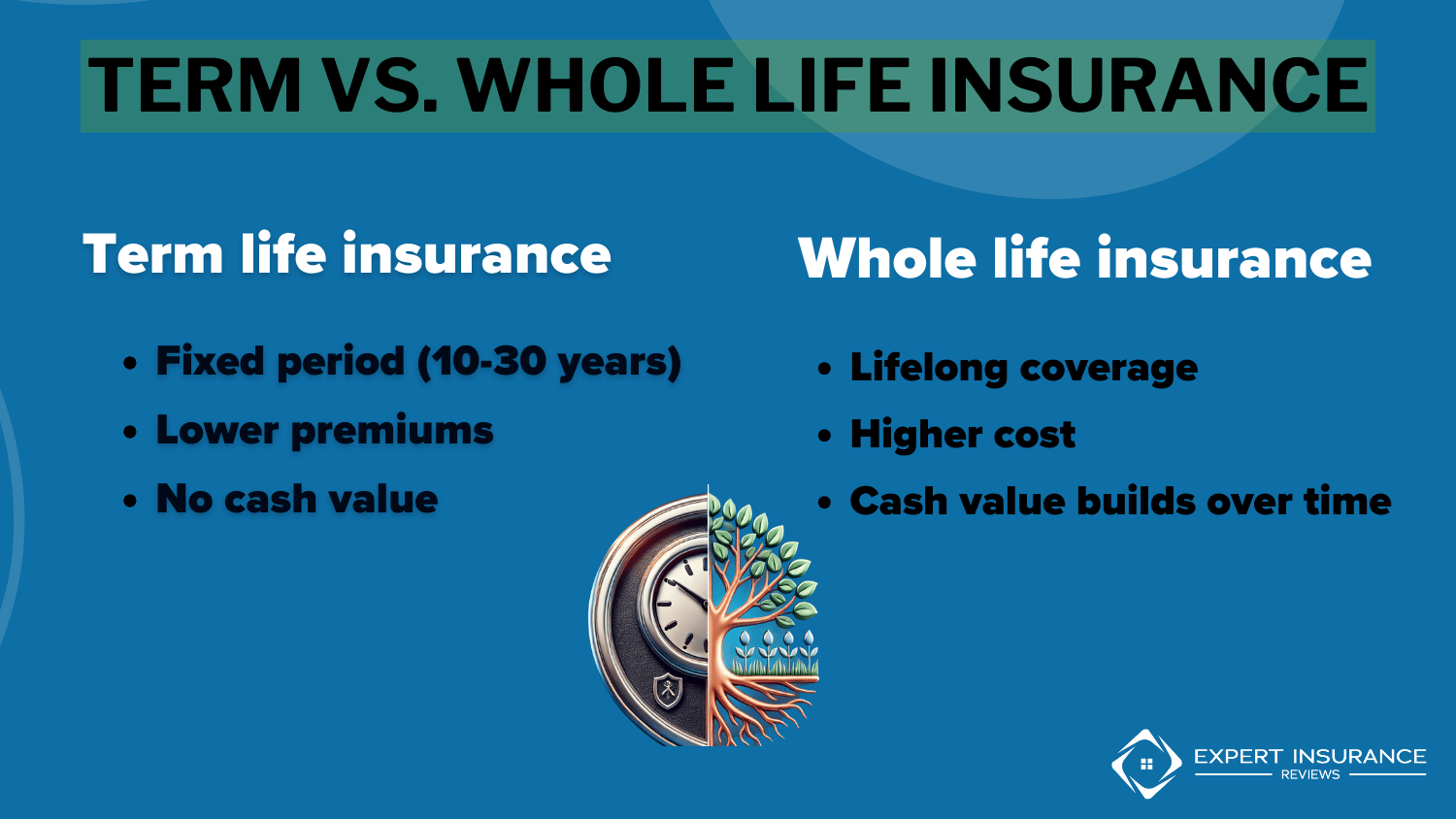

Term vs whole life insurance: which is better? The rates of term life insurance and whole life insurance vary.

The table below shows the monthly rate differences.

Life Insurance Average Monthly Rates for Overweight People by 20 Year/$250,000

| Age | Term Policy | Whole Policy |

|---|---|---|

| 30 | $22 | $176 |

| 40 | $35 | $280 |

| 50 | $80 | $693 |

| 60 | $176 | $1,020 |

Term policy insurance is cheaper, but coverage is also limited to a specific period of time. Whole life insurance is much more expensive but covers you for life as long as premiums are paid.

In addition, several factors, like BMI, must be considered to determine the monthly rate of overweight people. The higher a person’s BMI, the higher their life insurance rates will be. This is because many overweight people have lower life expectancies. The table below lists other factors.

Factors Affecting the Monthly Rates of Obese Individuals

| Factor | Impact on Monthly Rates |

|---|---|

| Age | Older age → Higher premiums |

| BMI (Body Mass Index) | Higher BMI → Higher premiums |

| Dietary Habits | Poor diet → Higher premiums |

| Family Medical History | Higher risk → Higher premiums |

| Gender | Varies by insurer |

| Lifestyle & Activity Level | Sedentary lifestyle → Higher premiums |

| Location | High healthcare costs area → Higher premiums |

| Medical Examination Results | Poor health indicators → Higher premiums |

| Occupation | High-risk jobs → Higher premiums |

| Pre-existing Conditions | More health issues → Higher premiums |

| Tobacco Use | Smoker → Higher premiums |

| Type of Insurance Policy | Comprehensive coverage → Higher premiums |

| Weight Loss Efforts | Documented improvement → Potential discounts |

Each life insurance company determines its rates using rating categories, each determined by the risk factors associated with an applicant. An obese person may qualify for a standard plus rating but is likely to be rated Standard if they have other health conditions.

Moreover, individuals in the Standard Plus or Standard categories pay more for life insurance than those in the Preferred or Preferred Plus categories.

Insurers like AAA and Allstate tend to be more flexible with weight limits, meaning you could qualify for lower premiums even if your BMI is above average.

Laura Berry Former Licensed Insurance Producer

In the end, applicants can save money on their life insurance premiums by improving their chances of qualifying for Standard Plus and maintaining good general health, such as by lowering blood pressure and cholesterol.

Read more: Can you get life insurance with high cholesterol?

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Getting Life Insurance for Overweight People

In most cases, overweight people can still qualify for life insurance. Most life insurance companies will only deny an overweight person if they have other health conditions, such as cardiovascular diseases, diabetes, or some cancers, as well.

If you are denied by one company, you would most likely be accepted by another life insurance company for overweight people. You may also qualify for a guaranteed acceptance policy. However, these generally offer limited coverage with higher rates.

Case Studies: Life Insurance Guide for Overweight Individuals

Best life insurance for overweight individuals generally goes through scrutiny of their overall health. Although some insurers are lenient and do not require a medical exam, the premiums are high. But if you want higher policies, insurance companies mandate a full medical assessment. However, you can do something to lower your credit life insurance plan, such as starting healthy routines and lifestyles.

In this section, we will explore the life-changing experience of overweight individuals who were able to get the life insurance they deserved. Learn more about their specific situations below.

Case Study 1: Sarah’s Successful Life Insurance Application

Sarah is an overweight individual who decided to apply for life insurance. Despite her weight, she has been improving her health, including following a healthy diet and exercise plan and regularly visiting her doctor. Sarah applied for life insurance coverage and provided all the necessary information about her health and lifestyle.

The insurance company reviewed her application and considered her overall health and commitment to improving her well-being. Sarah was approved for life insurance at a standard rating, which means she received coverage at a reasonable premium rate. This case study demonstrates that overweight individuals who actively work on improving their health can still qualify for life insurance.

Case Study 2: Mark’s Limited Coverage With Guaranteed Acceptance Policy

Mark is an obese individual with pre-existing health conditions such as cardiovascular diseases and diabetes. Due to health risks, he applied for life insurance but was denied coverage by several of the best insurance companies. However, Mark was able to secure a guaranteed acceptance policy.

Although the coverage provided by the guaranteed acceptance policy was limited, it offered some financial protection for Mark’s family in the event of his passing. While the premiums for such policies are typically higher, Mark recognized the importance of life insurance coverage despite his health challenges.

Case Study 3: Emily’s Improved Rates Through Weight Loss

Emily was overweight and wanted to secure obesity insurance coverage. She decided to make significant changes in her lifestyle, including adopting a healthy diet and exercise routine. Over time, Emily successfully lost a significant amount of weight and improved her overall health.

When Emily applied for life insurance after her weight loss journey, she provided evidence of her improved health and regular medical check-ups. The insurance company recognized her efforts and offered her coverage at a preferred rate. This allowed Emily to obtain life insurance at a more affordable premium rate, reflecting her improved health status.

Ways to Save on Life Insurance Rates for Overweight People

Many of the best life insurance companies ask questions about your health and medical history. Be as honest as possible, and include details about your diet and health regimen, physician’s orders, whether you follow them, and if you’ve had weight-related complications.

Comment

byu/_panem-et-circenses_ from discussion

inLifeInsurance

If you started a healthy diet and exercise regimen that is helping you lose weight, you may want to include this in your insurance rate reconsideration after improving your health. You may also include a recent doctor’s visit so that the life insurance company knows a medical professional is monitoring you.

Better health can mean lower life insurance premiums, as insurers assess risk based on factors like weight and medical history.

Heidi Mertlich Licensed Insurance Agent

Understanding your life insurance policy terms and riders allows you to explore ways to save money on life insurance. For example, overweight individuals can start a diet and exercise to get lower premiums.

That’s a wrap for the best life insurance for overweight individuals. You can find affordable whole or term life insurance for overweight people by entering your ZIP code into our free quote comparison tool.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frequently Asked Questions

Can overweight individuals obtain life insurance coverage?

Yes, overweight individuals can obtain life insurance coverage. While being overweight may affect the premium rates and eligibility criteria, it does not necessarily disqualify individuals from getting life insurance.

How does being overweight impact life insurance rates?

Being overweight can affect life insurance rates because insurers consider weight a potential risk factor for certain health conditions. The higher the body mass index (BMI), the higher the premium rates.

Are there specific BMI thresholds that affect life insurance rates?

Life insurance for obese adults may have different insurance underwriting guidelines, but generally, BMI thresholds exist. When an individual’s BMI falls within the “overweight” or “obese” categories, it can result in higher premiums compared to individuals with a normal BMI.

Are medical exams required for overweight individuals applying for life insurance?

Medical exams may be required for overweight individuals, depending on the insurance company and the coverage amount sought. Insurers often assess an applicant’s health status through medical underwriting, which may involve a medical exam, blood tests, and other relevant assessments.

Can pre-existing health conditions related to weight impact life insurance coverage?

Yes, pre-existing health conditions related to weight, such as diabetes, high blood pressure, or heart disease, can impact life insurance coverage. Insurers consider these conditions as potential risks and may adjust premiums accordingly or impose exclusions on coverage related to those conditions.

Was there a denial of life insurance due to weight?

Yes, there are cases of denied life insurance due to weight, especially if an individual’s BMI is significantly high and linked to severe health risks like diabetes or heart disease. In such cases, alternatives like guaranteed issue policies, group life insurance, or insurers with more flexible BMI guidelines (such as Allstate or AAA) may offer cheap life insurance policies.

Should I lose weight before getting life insurance?

Losing weight before applying for life insurance helps you get lower premiums and better coverage, especially if you have health risks associated with obesity. However, some insurers consider recent weight loss temporary, so maintaining your weight before applying may be beneficial.

How much is life insurance for overweight females?

Life insurance rates for overweight females vary based on age, BMI, health conditions, and policy type. On average, a 35-year-old overweight woman (BMI 30-35) might pay $25–$40 a month for a 20-year, $500,000 term policy, while someone with severe obesity (BMI 40+) may see rates increase by 50-100% or face policy denial.

How much is the monthly term life insurance rate for overweight people?

The monthly rate for term life insurance for overweight individuals varies based on age, BMI, health, and coverage amount. On average:

- Mildly overweight (BMI 30-35) – $25–$50 a month for a 20-year, $500,000 policy

- Moderately obese (BMI 35-40) – $50–$100 per month, depending on health

- Severely obese (BMI 40+) – 100%+ higher rates or possible denial

Rates are cheaper for younger applicants and vary by insurer. Enter your ZIP code to find term life insurance companies.

What is the best life insurance for overweight people?

The best life insurance for overweight individuals is AAA insurance, Allstate, and American Family.

Was there a life insurance weight limit for the overweight?

Yes, most companies have BMI limits for life insurance for plus-size applicants, typically around 45-50. Applicants who exceed this range may face higher premiums, policy restrictions, or denial.

What are the requirements for health insurance for overweight applicants?

Health insurance for obese adults typically requires basic personal info, medical history, BMI records, and sometimes a medical exam, with group and ACA plans being more lenient. Learn how to correctly buy health insurance.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.