Best Mississippi Car Insurance (2025)

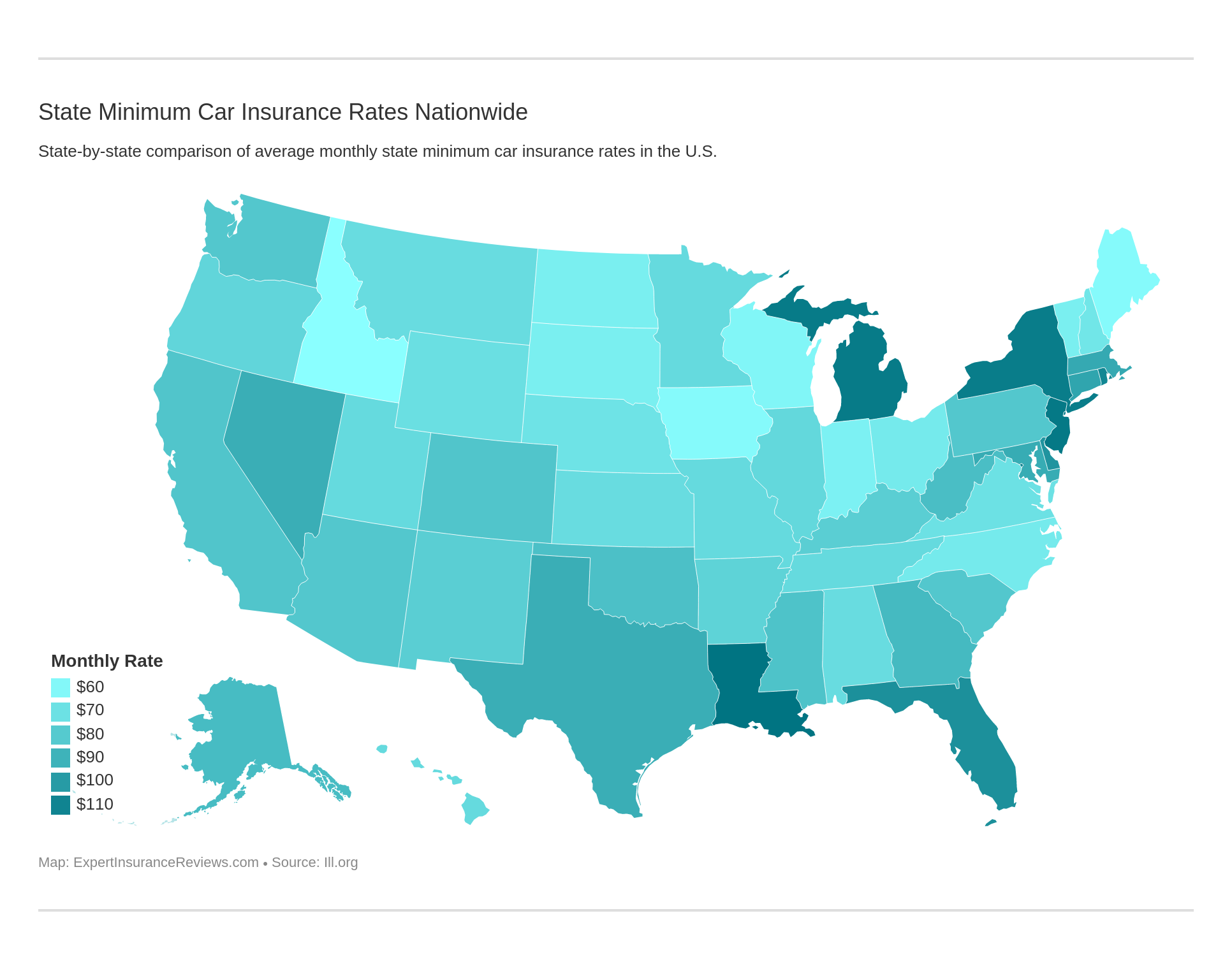

Mississippi minimum auto insurance requirements are 25/50/25 for bodily injury and property damage. Mississippi auto insurance rates average $83 per month while USAA is one of the best car insurance companies in Mississippi. To find the cheapest car insurance in Mississippi, it's best to compare multiple Mississippi car insurance quotes.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Mississippi minimum auto insurance requirements are 25/50/25 for bodily injury and property damage

- Mississippi auto insurance rates average $83 per month

- Mississippi is an at-fault car insurance state

| Mississippi Statistics Summary | Details |

|---|---|

| Miles of Roadway | 76,777 |

| Vehicles | Registered: 2,040,524 Stolen: 4,243 |

| Population | 2.98 Million |

| Most Popular Vehicles | Ford F-150 |

| Uninsured Motorists | Percentage: 23.7% Rank: 2 |

| Driving Related Deaths | Total: 690 Speeding: 59 DUI: 148 |

| Average Annual Premiums | Liability: $460.50 Collision: $323.22 Comprehensive: $210.33 |

| Cheapest Providers | USAA Nationwide |

Deep in the heart of the bible belt sits the great state of Mississippi. The Mississippi River that makes up the majority of the western border of the state is the second-largest river in the U.S. and one of the largest rivers in the world. It spans over 2300 miles and reaches to central Minnesota.

Jackson, with a population of around 580,000 people, is the largest metropolitan area in Mississippi. Gulfport and Southhaven are the next most populous cities.

After thousands of years of Native American cultures, in 1817 Mississippi became a part of the United States. To this day it still holds a rich history of Native American artifacts, mounds, and relics.

The state holds to the south and is a humid atmosphere that lies relatively flat with a lot of swampy areas — a beautiful place for any traveler or resident.

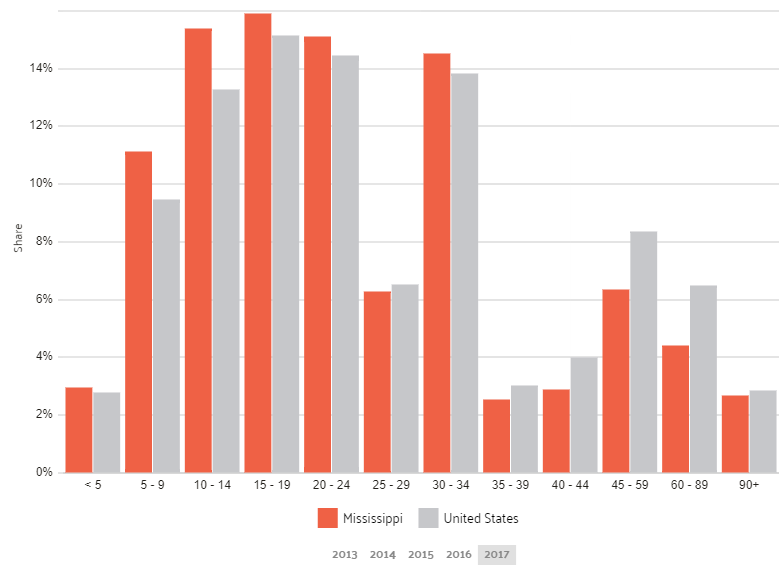

With a median age of 37.5, Mississippi has life in every age bracket. The average annual income in the state is about $44,000. That’s right around the nation’s average but a relatively low number. The future looks bright for Mississippians though. The state is growing, and the south will always be a popular place for tourism and snowbirds.

If you’ve been thinking of moving to the rivers of the south and need some help with auto insurance, look no further; this article will explain everything you need to know about the best Mississippi car insurance. We’ll take you through the rates, coverage, and laws to get you through the quite annoying process of buying auto insurance.

Mississippi Car Insurance Coverage and Rates

In the modern-day, we don’t travel down the Mississippi River in a handmade wooden vessel like Huck Finn, and Tom did.

We travel by car, and there’s a lot to take care of when owning a car. Car insurance is a pain in most cases. A hundred different companies are telling you they have the same car insurance coverage for a cheaper rate. Some are telling the truth, and some aren’t.

Mississippi is an at-fault state. This is the traditional form of car insurance, and the most straightforward way to understand and use. At-fault car insurance means that the person who was at fault for causing a car accident is also responsible for any ensuing harm (read our “Mississippi Car Insurance Laws” for more information).

The at-fault driver’s insurance carrier will absorb these losses, up to policy limits; but after that, it comes straight out of the pocket of the at-fault driver for bodily injury, vehicle damage, etc.

No-fault insurance means that when it comes to an accident, no matter who is at fault, insurance provides personal injury protection with no maximum for any injuries that occur. This system can get complicated quickly, so be happy Mississippi is not a no-fault state.

There is a lot of information that can help you decide which insurance is for you. Within the article, you will find all the information you need to start the buying process. Skip the hours of searching google to see what’s best, read this article, and you will leave with the knowledge needed to decide on insurance in Mississippi.

Minimum Auto Insurance Coverage in Mississippi

As of 2006, the minimum coverage required by law in Mississippi was increased to higher liability limits than previously mandated.

Like almost all other states, Mississippi requires mandatory minimum levels of auto insurance. If you live and drive in the country, you must have coverage of at least these levels:

- Bodily injury liability coverage of $25,000 per person

- Bodily injury liability coverage of $50,000 per accident involving more than one person

- Property damage liability coverage of $25,000

Carrying auto insurance at these levels, or higher is the easiest and most common way to make sure you comply with Mississippi mandatory minimum auto insurance laws.

What all this means for you, is that in the case of an accident you will need coverage. These laws are requirements intended to help you and other drivers stay safe on the road.

Forms of Financial Responsibility

Every driver of a motor vehicle must carry evidence of financial responsibility in his or her motor vehicle at all times. This proof shows that you can pay for what is needed in the case of an accident. In most cases, this is, simply, your proof of insurance. Bills from the DMV for minimum coverage payments are accepted and a few others.

The most important thing to remember is that in Mississippi, you must have proof of financial responsibility. Not having any evidence of insurance will land you a ticket and sometimes even a small amount of jail time.

You also may be legally required to file out an SR22 form in Mississippi from your insurance provider. This will prevent suspension of your driver’s license, or reinstate your license.

An SR22 form, known as proof of financial responsibility is not insurance. It is a certification filed by your auto insurance company that you will maintain the minimum liability insurance for a predetermined amount of time. This law keeps the roads safer.

Premiums as a Percentage of Income

Knowing what you’re spending on car insurance compared to your overall salary is a great tool for figuring out the right rate for you and your family.

Mississippi is not overpriced when it comes to auto insurance. Most prices you pay will be right around average unless you have a bad driving record or poor credit.

| Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|

| $957.59 | $31,365.00 | 3.05% | $925.13 | $30,580.00 | 3.03% | $902.95 | $30,385.00 | 2.97% |

The table above shows the percentages spent on auto insurance of the average annual income of people in Mississippi. From 2012 to 2014, Mississippi had some of the highest premium percentages of income in the entire United States.

This isn’t because auto premiums are overpriced though, it is because the disposable income of Mississippians is quite a bit lower than most states.

If you’re ready to figure out some prices for your information, the insurance calculator below can give you a quote based on your background information.

CalculatorPro

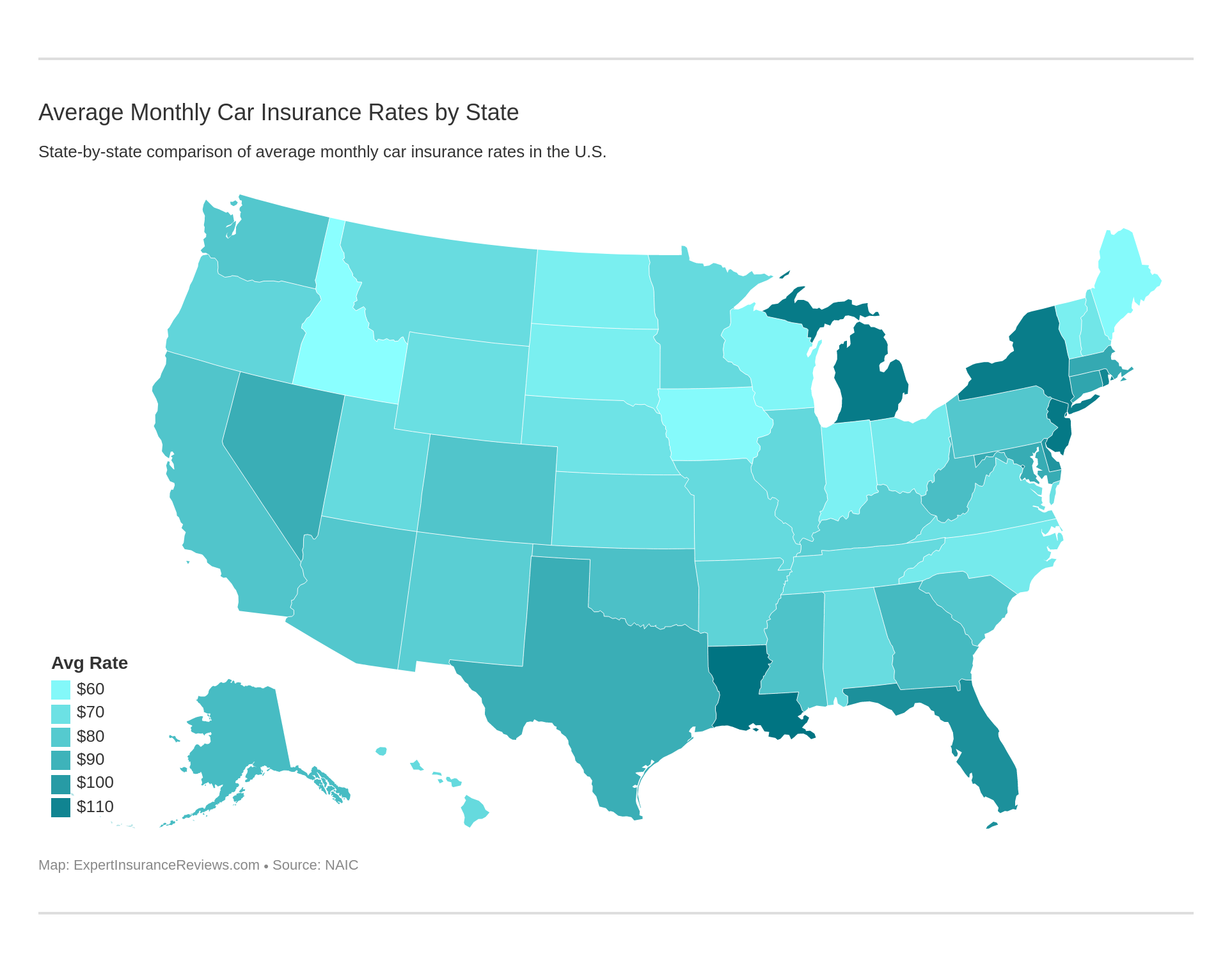

Average Monthly Car Insurance Rates in MS (Liability, Collision, Comprehensive)

Core coverage includes the parts of your policy that is considered full coverage. These three parts are liability car insurance, collision car insurance, and comprehensive car insurance. Combined the three make up full coverage auto insurance which will keep you protected in every situation.

| Coverage Type | Average Cost in Mississippi (2015) | Average Cost Nationwide (2015) |

|---|---|---|

| Liability | $460.50 | $538.73 |

| Collision | $323.22 | $322.61 |

| Comprehensive | $210.33 | $148.04 |

| Total (Full Coverage) | $994.05 | $1,009.38 |

In 2015, Mississippi was below the national average in terms of core coverage cost. This information is gathered based on data from the National Association of Insurance Commissioners (NAIC).

The cost of coverage is about a hundred dollars lower than the average for the rest of the nation. This is great for the Magnolia State.

Additional Liability

Mississippi does not participate in PIP or Personal Injury Protection insurance. This is because it is usually included in most core coverage options.

Loss ratios in Mississippi and the rest of the U.S are good to know for insurance consumers. In Mississippi, the loss ratio for companies due to uninsured motorists is almost 80 percent.

Loss ratios aren’t a well-known factor among buyers, but if you know the facts, they can be very important in helping you understand auto insurance better.

A loss ratio that’s too high means that insurance companies are paying out too much in claims – if the rate climbs over 100 percent they are paying out more than they’re taking in. If the company’s loss ratio is too low, it means they aren’t paying out any claims.

Both of these are important to you knowing the inner workings of the auto insurance company you choose.

Add-ons, Endorsements, and Riders

There are many different types of extra insurance coverage that you can add to your core coverage in Mississippi. These are meant to help you ease your mind on the road.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Car Insurance

Buying any of these add-ons will cover you even further than core coverage. While minimum coverage is all you need and may save you a buck or two, having extra insurance will keep you safer the more you purchase.

Average Car Insurance Rates by Age & Gender in MS

Statistics show that, in general, women are safer drivers than men. In some states, it has been outlawed to alter car insurance rates based on gender. Women also make around $15,000 less a year in Mississippi than men do.

| Company | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Geico | $2,966.41 | $2,806.48 | $2,694.14 | $2,503.52 | $7,389.86 | $6,979.27 | $4,950.27 | $2,400.88 |

| Allstate | $2,759.49 | $2,635.21 | $2,463.36 | $2,519.32 | $11,031.99 | $11,772.88 | $3,133.31 | $3,215.18 |

| SAFECO Ins | $2,629.22 | $2,846.39 | $2,112.59 | $2,370.20 | $9,446.38 | $10,504.45 | $2,794.00 | $2,941.24 |

| Progressive | $2,591.63 | $2,419.61 | $2,124.47 | $2,061.68 | $9,375.44 | $10,495.41 | $2,662.75 | $2,769.80 |

| Nationwide | $2,046.11 | $2,102.48 | $1,835.74 | $1,945.49 | $4,088.44 | $5,202.84 | $2,318.23 | $2,510.05 |

| State Farm | $1,877.59 | $1,877.59 | $1,680.17 | $1,680.17 | $5,427.70 | $6,823.62 | $2,091.75 | $2,382.03 |

| Travelers | $1,683.09 | $1,713.42 | $1,600.71 | $1,602.55 | $7,522.15 | $11,907.14 | $1,765.06 | $2,047.25 |

| USAA | $1,385.56 | $1,371.97 | $1,293.28 | $1,308.31 | $3,448.85 | $4,091.04 | $1,689.16 | $1,861.86 |

In Mississippi, companies are allowed to charge different rates based on gender; however, some do not. If you are a young man, look for the companies that do not inflate rates due to you being a male.

Teens are more likely to be in an accident, receive a citation, and speed than any other age. Because of this, they are always charged a great deal more than any other age group. The more experience you have on the road, the better.

According to the table, almost every top insurance company in Mississippi does not over-inflate prices due to gender. Men and women generally pay around the same amount.

Cheapest Rates By Zip Code

Car insurance companies look at your zip-code to determine rates. They take into account the poverty rates, crime rates, thefts, etc. in each zip-code.

They use these tools because they can decide how big of as risk you may be as a driver if you live in a certain area.

| Zipcode | Annual Average | City |

|---|---|---|

| 39086 | $4,323.64 | HERMANVILLE |

| 39096 | $4,250.87 | LORMAN |

| 39150 | $4,242.23 | PORT GIBSON |

| 39120 | $4,189.65 | NATCHEZ |

| 39144 | $4,185.94 | PATTISON |

| 39635 | $4,170.57 | FERNWOOD |

| 39190 | $4,157.25 | WASHINGTON |

| 39669 | $4,149.93 | WOODVILLE |

| 39633 | $4,144.61 | CROSBY |

| 39174 | $4,138.74 | TOUGALOO |

| 39558 | $4,129.33 | LAKESHORE |

| 39173 | $4,112.92 | TINSLEY |

| 39069 | $4,107.16 | FAYETTE |

| 39210 | $4,105.52 | JACKSON |

| 39175 | $4,053.43 | UTICA |

| 39668 | $4,050.99 | UNION CHURCH |

| 39632 | $4,041.93 | CHATAWA |

| 39555 | $4,024.29 | HURLEY |

| 39474 | $4,013.94 | PRENTISS |

| 38768 | $4,009.06 | ROME |

| 39631 | $4,006.38 | CENTREVILLE |

| 39427 | $4,005.18 | CARSON |

| 39204 | $3,996.62 | JACKSON |

| 39193 | $3,994.81 | WHITFIELD |

| 38630 | $3,994.56 | FARRELL |

| 39083 | $3,990.92 | HAZLEHURST |

| 38623 | $3,989.17 | DARLING |

| 38765 | $3,988.98 | PANTHER BURN |

| 39077 | $3,988.22 | GALLMAN |

| 39483 | $3,987.89 | FOXWORTH |

| 39212 | $3,984.87 | JACKSON |

| 39638 | $3,984.59 | GLOSTER |

| 39426 | $3,984.17 | CARRIERE |

| 39556 | $3,979.89 | KILN |

| 39209 | $3,962.53 | JACKSON |

| 39643 | $3,956.73 | KOKOMO |

| 39663 | $3,955.17 | SILVER CREEK |

| 39213 | $3,953.96 | JACKSON |

| 38767 | $3,953.83 | RENA LARA |

| 39217 | $3,953.54 | JACKSON |

| 39429 | $3,946.60 | COLUMBIA |

| 39421 | $3,944.37 | BASSFIELD |

| 39202 | $3,943.82 | JACKSON |

| 39661 | $3,941.64 | ROXIE |

| 39062 | $3,934.82 | D LO |

| 38960 | $3,934.31 | TIE PLANT |

| 39466 | $3,932.75 | PICAYUNE |

| 39203 | $3,932.74 | JACKSON |

| 38964 | $3,932.66 | VANCE |

| 39645 | $3,932.21 | LIBERTY |

| 39462 | $3,930.59 | NEW AUGUSTA |

| 39272 | $3,928.45 | BYRAM |

| 39647 | $3,921.03 | MC CALL CREEK |

| 38645 | $3,917.55 | LYON |

| 39059 | $3,917.41 | CRYSTAL SPRINGS |

| 39216 | $3,917.37 | JACKSON |

| 38926 | $3,913.97 | ELLIOTT |

| 39478 | $3,912.18 | SANDY HOOK |

| 38614 | $3,910.45 | CLARKSDALE |

| 39170 | $3,909.79 | TERRY |

| 38617 | $3,907.93 | COAHOMA |

| 39470 | $3,906.10 | POPLARVILLE |

| 39479 | $3,906.08 | SEMINARY |

| 38963 | $3,905.77 | TUTWILER |

| 38782 | $3,905.29 | WINTERVILLE |

| 39151 | $3,904.25 | PUCKETT |

| 39165 | $3,901.71 | SIBLEY |

| 39154 | $3,901.26 | RAYMOND |

| 39080 | $3,899.88 | HARPERVILLE |

| 39653 | $3,896.44 | MEADVILLE |

| 39269 | $3,895.61 | JACKSON |

| 39191 | $3,894.35 | WESSON |

| 39664 | $3,894.09 | SMITHDALE |

| 38921 | $3,893.53 | CHARLESTON |

| 38958 | $3,892.34 | SWAN LAKE |

| 38631 | $3,890.85 | FRIARS POINT |

| 39058 | $3,890.11 | CLINTON |

| 38764 | $3,887.91 | PACE |

| 39564 | $3,887.70 | OCEAN SPRINGS |

| 39115 | $3,887.65 | MIDNIGHT |

| 39206 | $3,878.24 | JACKSON |

| 39630 | $3,878.24 | BUDE |

| 39576 | $3,878.23 | WAVELAND |

| 38781 | $3,877.63 | WINSTONVILLE |

| 39482 | $3,875.20 | SUMRALL |

| 39428 | $3,874.34 | COLLINS |

| 39452 | $3,870.67 | LUCEDALE |

| 38643 | $3,868.11 | LAMBERT |

| 39520 | $3,866.44 | BAY SAINT LOUIS |

| 38957 | $3,863.48 | SUMNER |

| 38760 | $3,858.94 | METCALFE |

| 39476 | $3,858.15 | RICHTON |

| 39572 | $3,857.61 | PEARLINGTON |

| 39119 | $3,855.45 | MOUNT OLIVE |

| 39078 | $3,854.09 | GEORGETOWN |

| 39665 | $3,853.84 | SONTAG |

| 38927 | $3,850.63 | ENID |

| 39562 | $3,845.77 | MOSS POINT |

| 39525 | $3,845.45 | DIAMONDHEAD |

| 39423 | $3,842.30 | BEAUMONT |

| 39140 | $3,841.08 | NEWHEBRON |

| 38669 | $3,838.40 | SHERARD |

| 39574 | $3,838.19 | SAUCIER |

| 38646 | $3,837.93 | MARKS |

| 38772 | $3,834.97 | SCOTT |

| 39201 | $3,834.60 | JACKSON |

| 39044 | $3,829.25 | BRAXTON |

| 39061 | $3,826.84 | DELTA CITY |

| 39507 | $3,826.06 | GULFPORT |

| 39040 | $3,824.40 | BENTONIA |

| 39641 | $3,823.17 | JAYESS |

| 39149 | $3,818.60 | PINOLA |

| 39656 | $3,814.87 | OAK VALE |

| 38738 | $3,812.76 | PARCHMAN |

| 38639 | $3,811.84 | JONESTOWN |

| 39565 | $3,811.40 | VANCLEAVE |

| 38644 | $3,811.03 | LULA |

| 38609 | $3,808.67 | BELEN |

| 39455 | $3,807.38 | LUMBERTON |

| 39503 | $3,806.41 | GULFPORT |

| 39475 | $3,806.35 | PURVIS |

| 39530 | $3,805.23 | BILOXI |

| 39457 | $3,804.09 | MC NEILL |

| 38920 | $3,803.75 | CASCILLA |

| 39501 | $3,803.48 | GULFPORT |

| 39117 | $3,803.32 | MORTON |

| 39153 | $3,803.11 | RALEIGH |

| 39322 | $3,799.94 | BUCKATUNNA |

| 39561 | $3,799.92 | MC HENRY |

| 39581 | $3,799.78 | PASCAGOULA |

| 38928 | $3,799.62 | GLENDORA |

| 39657 | $3,798.18 | OSYKA |

| 39194 | $3,796.49 | YAZOO CITY |

| 39567 | $3,796.13 | PASCAGOULA |

| 39162 | $3,792.33 | SATARTIA |

| 39666 | $3,791.10 | SUMMIT |

| 39152 | $3,790.79 | PULASKI |

| 39563 | $3,790.24 | MOSS POINT |

| 39654 | $3,788.18 | MONTICELLO |

| 38622 | $3,786.36 | CROWDER |

| 39367 | $3,785.18 | WAYNESBORO |

| 39362 | $3,783.41 | STATE LINE |

| 39573 | $3,782.76 | PERKINSTON |

| 38739 | $3,780.58 | DUBLIN |

| 39553 | $3,780.36 | GAUTIER |

| 39039 | $3,779.30 | BENTON |

| 38945 | $3,778.84 | MONEY |

| 38959 | $3,778.81 | SWIFTOWN |

| 38654 | $3,777.42 | OLIVE BRANCH |

| 39461 | $3,776.69 | NEELY |

| 39082 | $3,775.83 | HARRISVILLE |

| 38946 | $3,774.88 | MORGAN CITY |

| 39116 | $3,774.16 | MIZE |

| 39571 | $3,773.31 | PASS CHRISTIAN |

| 39179 | $3,773.12 | VAUGHAN |

| 38745 | $3,773.09 | GRACE |

| 39366 | $3,770.60 | VOSSBURG |

| 38666 | $3,770.51 | SARDIS |

| 38619 | $3,766.41 | COMO |

| 38670 | $3,766.40 | SLEDGE |

| 39208 | $3,766.27 | PEARL |

| 38680 | $3,765.54 | WALLS |

| 39737 | $3,764.74 | BELLEFONTAINE |

| 38671 | $3,764.60 | SOUTHAVEN |

| 39211 | $3,763.62 | JACKSON |

| 38723 | $3,763.33 | AVON |

| 39531 | $3,761.10 | BILOXI |

| 38962 | $3,761.01 | TIPPO |

| 39532 | $3,759.95 | BILOXI |

| 38658 | $3,759.59 | POPE |

| 38722 | $3,756.01 | ARCOLA |

| 39451 | $3,753.90 | LEAKESVILLE |

| 38664 | $3,753.89 | ROBINSONVILLE |

| 38626 | $3,753.83 | DUNDEE |

| 39168 | $3,753.10 | TAYLORSVILLE |

| 39540 | $3,752.09 | DIBERVILLE |

| 39560 | $3,752.02 | LONG BEACH |

| 39363 | $3,751.02 | STONEWALL |

| 39073 | $3,750.39 | FLORENCE |

| 39652 | $3,749.56 | MAGNOLIA |

| 38721 | $3,746.71 | ANGUILLA |

| 39088 | $3,744.73 | HOLLY BLUFF |

| 39667 | $3,741.79 | TYLERTOWN |

| 39348 | $3,740.64 | PAULDING |

| 38628 | $3,738.19 | FALCON |

| 38672 | $3,737.03 | SOUTHAVEN |

| 38620 | $3,735.77 | COURTLAND |

| 39360 | $3,735.32 | SHUBUTA |

| 38621 | $3,733.97 | CRENSHAW |

| 38606 | $3,732.00 | BATESVILLE |

| 39771 | $3,729.29 | WALTHALL |

| 39629 | $3,728.90 | BOGUE CHITTO |

| 39355 | $3,728.41 | QUITMAN |

| 39534 | $3,726.87 | BILOXI |

| 39648 | $3,726.10 | MCCOMB |

| 39330 | $3,725.47 | ENTERPRISE |

| 38966 | $3,725.45 | WEBB |

| 39056 | $3,724.16 | CLINTON |

| 39041 | $3,723.62 | BOLTON |

| 38637 | $3,723.28 | HORN LAKE |

| 39071 | $3,722.60 | FLORA |

| 39146 | $3,721.72 | PICKENS |

| 39114 | $3,719.91 | MENDENHALL |

| 38676 | $3,719.33 | TUNICA |

| 38641 | $3,719.02 | LAKE CORMORANT |

| 39095 | $3,716.05 | LEXINGTON |

| 39042 | $3,715.65 | BRANDON |

| 39439 | $3,715.21 | HEIDELBERG |

| 39347 | $3,715.16 | PACHUTA |

| 39079 | $3,713.87 | GOODMAN |

| 38703 | $3,712.66 | GREENVILLE |

| 39066 | $3,710.36 | EDWARDS |

| 38955 | $3,708.50 | SLATE SPRING |

| 39218 | $3,702.94 | RICHLAND |

| 39148 | $3,702.55 | PINEY WOODS |

| 38961 | $3,702.54 | TILLATOBA |

| 39662 | $3,702.34 | RUTH |

| 38901 | $3,701.07 | GRENADA |

| 38948 | $3,699.62 | OAKLAND |

| 39456 | $3,698.94 | MC LAIN |

| 38651 | $3,698.93 | NESBIT |

| 38701 | $3,697.29 | GREENVILLE |

| 39051 | $3,696.62 | CARTHAGE |

| 39232 | $3,694.35 | FLOWOOD |

| 39477 | $3,690.13 | SANDERSVILLE |

| 39436 | $3,690.06 | EASTABUCHIE |

| 38780 | $3,689.71 | WAYSIDE |

| 39063 | $3,689.07 | DURANT |

| 38632 | $3,682.39 | HERNANDO |

| 39577 | $3,682.18 | WIGGINS |

| 39157 | $3,679.51 | RIDGELAND |

| 39464 | $3,679.49 | OVETT |

| 39601 | $3,677.90 | BROOKHAVEN |

| 39111 | $3,675.57 | MAGEE |

| 39166 | $3,675.50 | SILVER CITY |

| 39097 | $3,675.04 | LOUISE |

| 39324 | $3,675.00 | CLARA |

| 39094 | $3,674.46 | LENA |

| 39169 | $3,672.14 | TCHULA |

| 39038 | $3,664.36 | BELZONI |

| 38748 | $3,662.26 | HOLLANDALE |

| 38731 | $3,661.77 | CHATHAM |

| 39047 | $3,660.84 | BRANDON |

| 39046 | $3,659.71 | CANTON |

| 38756 | $3,658.99 | LELAND |

| 39054 | $3,657.05 | CARY |

| 38940 | $3,655.46 | HOLCOMB |

| 39045 | $3,655.41 | CAMDEN |

| 38776 | $3,653.82 | STONEVILLE |

| 38665 | $3,651.72 | SARAH |

| 38744 | $3,651.42 | GLEN ALLAN |

| 38953 | $3,650.55 | SCOBEY |

| 38720 | $3,649.03 | ALLIGATOR |

| 38950 | $3,646.01 | PHILIPP |

| 38965 | $3,643.19 | WATER VALLEY |

| 39192 | $3,639.14 | WEST |

| 38642 | $3,638.78 | LAMAR |

| 39425 | $3,638.61 | BROOKLYN |

| 39180 | $3,638.12 | VICKSBURG |

| 38740 | $3,637.80 | DUNCAN |

| 39098 | $3,637.11 | LUDLOW |

| 39159 | $3,636.31 | ROLLING FORK |

| 38762 | $3,632.23 | MOUND BAYOU |

| 38924 | $3,628.78 | CRUGER |

| 39145 | $3,625.04 | PELAHATCHIE |

| 39167 | $3,624.79 | STAR |

| 39109 | $3,624.08 | MADDEN |

| 38668 | $3,622.60 | SENATOBIA |

| 38618 | $3,621.23 | COLDWATER |

| 39074 | $3,621.23 | FOREST |

| 39171 | $3,621.20 | THOMASTOWN |

| 38754 | $3,620.77 | ISOLA |

| 38943 | $3,619.19 | MC CARLEY |

| 38733 | $3,619.01 | CLEVELAND |

| 38638 | $3,619.00 | INDEPENDENCE |

| 39359 | $3,618.77 | SEBASTOPOL |

| 38774 | $3,614.79 | SHELBY |

| 38647 | $3,614.30 | MICHIGAN CITY |

| 38602 | $3,613.97 | ARKABUTLA |

| 39183 | $3,612.05 | VICKSBURG |

| 39460 | $3,610.79 | MOSS |

| 39736 | $3,605.47 | ARTESIA |

| 39092 | $3,600.62 | LAKE |

| 38677 | $3,600.13 | UNIVERSITY |

| 39177 | $3,598.46 | VALLEY PARK |

| 39465 | $3,595.96 | PETAL |

| 39754 | $3,594.89 | MONTPELIER |

| 39356 | $3,594.35 | ROSE HILL |

| 38929 | $3,592.64 | GORE SPRINGS |

| 39437 | $3,591.52 | ELLISVILLE |

| 39301 | $3,590.48 | MERIDIAN |

| 39459 | $3,588.62 | MOSELLE |

| 39156 | $3,588.08 | REDWOOD |

| 38922 | $3,587.49 | COFFEEVILLE |

| 38875 | $3,587.22 | TREBLOC |

| 39110 | $3,585.80 | MADISON |

| 39753 | $3,585.73 | MAYHEW |

| 38611 | $3,585.69 | BYHALIA |

| 39443 | $3,584.35 | LAUREL |

| 39328 | $3,581.18 | DE KALB |

| 39189 | $3,580.07 | WALNUT GROVE |

| 39108 | $3,579.90 | MC COOL |

| 39113 | $3,577.34 | MAYERSVILLE |

| 39352 | $3,577.24 | PORTERVILLE |

| 39401 | $3,576.03 | HATTIESBURG |

| 39161 | $3,572.20 | SANDHILL |

| 39358 | $3,571.39 | SCOOBA |

| 39402 | $3,570.70 | HATTIESBURG |

| 38880 | $3,569.73 | WHEELER |

| 39406 | $3,569.43 | HATTIESBURG |

| 38923 | $3,568.65 | COILA |

| 38603 | $3,568.33 | ASHLAND |

| 38925 | $3,567.82 | DUCK HILL |

| 38725 | $3,567.45 | BENOIT |

| 39354 | $3,566.10 | PRESTON |

| 38635 | $3,565.45 | HOLLY SPRINGS |

| 38675 | $3,565.33 | TULA |

| 38746 | $3,565.13 | GUNNISON |

| 39440 | $3,563.50 | LAUREL |

| 39342 | $3,563.25 | MARION |

| 38661 | $3,563.18 | RED BANKS |

| 38737 | $3,557.39 | DREW |

| 39090 | $3,555.26 | KOSCIUSKO |

| 38679 | $3,554.17 | VICTORIA |

| 38726 | $3,553.32 | BEULAH |

| 39338 | $3,551.31 | LOUIN |

| 39422 | $3,551.23 | BAY SPRINGS |

| 39481 | $3,550.30 | STRINGER |

| 39364 | $3,550.22 | TOOMSUBA |

| 39480 | $3,547.87 | SOSO |

| 38732 | $3,547.21 | CLEVELAND |

| 38655 | $3,546.16 | OXFORD |

| 38917 | $3,545.32 | CARROLLTON |

| 39339 | $3,545.05 | LOUISVILLE |

| 38759 | $3,536.26 | MERIGOLD |

| 39341 | $3,535.00 | MACON |

| 39067 | $3,533.97 | ETHEL |

| 39772 | $3,533.04 | WEIR |

| 39346 | $3,531.74 | NOXAPATER |

| 38649 | $3,531.38 | MOUNT PLEASANT |

| 39767 | $3,530.20 | STEWART |

| 38601 | $3,529.60 | ABBEVILLE |

| 38673 | $3,529.00 | TAYLOR |

| 38769 | $3,528.71 | ROSEDALE |

| 38730 | $3,526.44 | BOYLE |

| 39160 | $3,524.48 | SALLIS |

| 39361 | $3,523.19 | SHUQUALAK |

| 38685 | $3,521.01 | WATERFORD |

| 38930 | $3,515.83 | GREENWOOD |

| 38659 | $3,515.40 | POTTS CAMP |

| 39107 | $3,515.10 | MC ADAMS |

| 38736 | $3,514.70 | DODDSVILLE |

| 38633 | $3,512.62 | HICKORY FLAT |

| 38778 | $3,512.44 | SUNFLOWER |

| 38771 | $3,511.46 | RULEVILLE |

| 38944 | $3,510.10 | MINTER CITY |

| 39735 | $3,507.47 | ACKERMAN |

| 38773 | $3,507.10 | SHAW |

| 39739 | $3,505.06 | BROOKSVILLE |

| 38820 | $3,502.51 | ALGOMA |

| 39747 | $3,501.38 | KILMICHAEL |

| 39745 | $3,491.90 | FRENCH CAMP |

| 38629 | $3,489.04 | FALKNER |

| 38761 | $3,488.52 | MOORHEAD |

| 39332 | $3,483.53 | HICKORY |

| 39744 | $3,482.78 | EUPORA |

| 38753 | $3,479.37 | INVERNESS |

| 38949 | $3,474.25 | PARIS |

| 39337 | $3,471.13 | LITTLE ROCK |

| 39307 | $3,469.69 | MERIDIAN |

| 38751 | $3,465.74 | INDIANOLA |

| 38967 | $3,462.61 | WINONA |

| 38954 | $3,461.84 | SIDON |

| 38941 | $3,459.81 | ITTA BENA |

| 39323 | $3,452.16 | CHUNKY |

| 39176 | $3,449.52 | VAIDEN |

| 38952 | $3,445.67 | SCHLATER |

| 38683 | $3,443.86 | WALNUT |

| 38913 | $3,442.80 | BANNER |

| 39345 | $3,441.63 | NEWTON |

| 38852 | $3,441.34 | IUKA |

| 38833 | $3,435.53 | BURNSVILLE |

| 39320 | $3,435.11 | BAILEY |

| 39350 | $3,433.57 | PHILADELPHIA |

| 39326 | $3,433.51 | DALEVILLE |

| 38674 | $3,432.60 | TIPLERSVILLE |

| 38663 | $3,430.33 | RIPLEY |

| 39335 | $3,428.04 | LAUDERDALE |

| 39751 | $3,427.87 | MANTEE |

| 39057 | $3,425.08 | CONEHATTA |

| 39752 | $3,422.43 | MATHISTON |

| 39327 | $3,422.39 | DECATUR |

| 38838 | $3,419.25 | DENNIS |

| 38827 | $3,415.14 | BELMONT |

| 39365 | $3,414.63 | UNION |

| 38871 | $3,412.67 | THAXTON |

| 38610 | $3,410.42 | BLUE MOUNTAIN |

| 39305 | $3,408.00 | MERIDIAN |

| 39336 | $3,406.58 | LAWRENCE |

| 38865 | $3,394.09 | RIENZI |

| 38847 | $3,392.76 | GOLDEN |

| 39325 | $3,391.49 | COLLINSVILLE |

| 39746 | $3,383.81 | HAMILTON |

| 38834 | $3,383.63 | CORINTH |

| 38846 | $3,382.11 | GLEN |

| 38650 | $3,381.54 | MYRTLE |

| 38625 | $3,374.28 | DUMAS |

| 38873 | $3,370.72 | TISHOMINGO |

| 38844 | $3,369.73 | GATTMAN |

| 38915 | $3,366.35 | BRUCE |

| 38916 | $3,364.61 | CALHOUN CITY |

| 38862 | $3,357.07 | PLANTERSVILLE |

| 38914 | $3,357.03 | BIG CREEK |

| 38627 | $3,353.55 | ETTA |

| 38869 | $3,350.42 | SHERMAN |

| 38829 | $3,346.49 | BOONEVILLE |

| 38876 | $3,343.84 | TREMONT |

| 38855 | $3,336.26 | MANTACHIE |

| 38877 | $3,334.47 | VAN VLEET |

| 38951 | $3,333.71 | PITTSBORO |

| 38868 | $3,329.58 | SHANNON |

| 38864 | $3,329.46 | RANDOLPH |

| 38843 | $3,318.23 | FULTON |

| 38825 | $3,314.90 | BECKER |

| 38863 | $3,305.09 | PONTOTOC |

| 38828 | $3,293.99 | BLUE SPRINGS |

| 38859 | $3,293.38 | NEW SITE |

| 38879 | $3,289.64 | VERONA |

| 38858 | $3,288.88 | NETTLETON |

| 38848 | $3,288.03 | GREENWOOD SPRINGS |

| 38870 | $3,287.96 | SMITHVILLE |

| 38857 | $3,287.84 | MOOREVILLE |

| 38652 | $3,284.97 | NEW ALBANY |

| 38874 | $3,284.95 | TOCCOPOLA |

| 38850 | $3,284.84 | HOULKA |

| 39740 | $3,283.58 | CALEDONIA |

| 38851 | $3,277.10 | HOUSTON |

| 38860 | $3,274.37 | OKOLONA |

| 39756 | $3,274.33 | PRAIRIE |

| 38856 | $3,274.20 | MARIETTA |

| 38826 | $3,272.51 | BELDEN |

| 39730 | $3,269.64 | ABERDEEN |

| 38841 | $3,265.32 | ECRU |

| 39755 | $3,261.14 | PHEBA |

| 38801 | $3,258.36 | TUPELO |

| 39705 | $3,257.98 | COLUMBUS |

| 38821 | $3,253.21 | AMORY |

| 38866 | $3,251.39 | SALTILLO |

| 39773 | $3,249.13 | WEST POINT |

| 38824 | $3,247.35 | BALDWYN |

| 39710 | $3,246.30 | COLUMBUS |

| 38878 | $3,246.00 | VARDAMAN |

| 39702 | $3,243.42 | COLUMBUS |

| 38804 | $3,239.30 | TUPELO |

| 38849 | $3,237.09 | GUNTOWN |

| 39741 | $3,231.09 | CEDARBLUFF |

| 39750 | $3,228.95 | MABEN |

| 39776 | $3,220.89 | WOODLAND |

| 39766 | $3,208.63 | STEENS |

| 39769 | $3,196.85 | STURGIS |

| 39743 | $3,180.23 | CRAWFORD |

| 39701 | $3,158.94 | COLUMBUS |

| 39759 | $3,077.33 | STARKVILLE |

Identifying average rates by zip code can help you move to a place you want to be, but know where the better areas are so you don’t overpay on insurance. More often than not, the most expensive zip-codes are in downtown areas.

The most expensive zip-code in all of Mississippi is in Hermanville at 39086. The rate is $4324.64 at that zipcode. The cheapest zip-code is in Starkville. The zip code is 39759 and comes in at a rate of $3077.33.

Choosing where to live is important, but some of these rates are affected in different ways, be sure to know where you’re living. Rates by zip code are a great statistic to discover the best places to buy auto insurance. Many different factors go into why each zip code is more or less expensive than the other

Cheapest Rates By City

| City | Annual Average |

|---|---|

| STARKVILLE | $3,077.33 |

| CRAWFORD | $3,180.23 |

| STURGIS | $3,196.85 |

| STEENS | $3,208.63 |

| WOODLAND | $3,220.89 |

| COLUMBUS | $3,226.66 |

| MABEN | $3,228.95 |

| CEDARBLUFF | $3,231.09 |

| GUNTOWN | $3,237.09 |

| VARDAMAN | $3,246.00 |

| BALDWYN | $3,247.35 |

| TUPELO | $3,248.83 |

| WEST POINT | $3,249.13 |

| SALTILLO | $3,251.39 |

| AMORY | $3,253.21 |

| PHEBA | $3,261.14 |

| ECRU | $3,265.32 |

| ABERDEEN | $3,269.64 |

| BELDEN | $3,272.51 |

| MARIETTA | $3,274.20 |

| PRAIRIE | $3,274.33 |

| OKOLONA | $3,274.37 |

| HOUSTON | $3,277.10 |

| CALEDONIA | $3,283.58 |

| HOULKA | $3,284.84 |

| TOCCOPOLA | $3,284.95 |

| NEW ALBANY | $3,284.97 |

| MOOREVILLE | $3,287.84 |

| SMITHVILLE | $3,287.96 |

| GREENWOOD SPRINGS | $3,288.04 |

| NETTLETON | $3,288.88 |

| VERONA | $3,289.64 |

| NEW SITE | $3,293.38 |

| BLUE SPRINGS | $3,293.99 |

| PONTOTOC | $3,305.09 |

| BECKER | $3,314.90 |

| FULTON | $3,318.23 |

| RANDOLPH | $3,329.46 |

| SHANNON | $3,329.58 |

| PITTSBORO | $3,333.71 |

| VAN VLEET | $3,334.47 |

| MANTACHIE | $3,336.26 |

| TREMONT | $3,343.84 |

| BOONEVILLE | $3,346.49 |

| SHERMAN | $3,350.42 |

| ETTA | $3,353.55 |

| BIG CREEK | $3,357.04 |

| PLANTERSVILLE | $3,357.07 |

| CALHOUN CITY | $3,364.61 |

| BRUCE | $3,366.36 |

| GATTMAN | $3,369.73 |

| TISHOMINGO | $3,370.72 |

| DUMAS | $3,374.28 |

| MYRTLE | $3,381.54 |

| GLEN | $3,382.11 |

| CORINTH | $3,383.63 |

| HAMILTON | $3,383.81 |

| COLLINSVILLE | $3,391.50 |

| GOLDEN | $3,392.76 |

| RIENZI | $3,394.09 |

| LAWRENCE | $3,406.58 |

| BLUE MOUNTAIN | $3,410.42 |

| THAXTON | $3,412.67 |

| UNION | $3,414.64 |

| BELMONT | $3,415.14 |

| DENNIS | $3,419.25 |

| DECATUR | $3,422.39 |

| MATHISTON | $3,422.43 |

| CONEHATTA | $3,425.08 |

| MANTEE | $3,427.87 |

| LAUDERDALE | $3,428.04 |

| RIPLEY | $3,430.33 |

| TIPLERSVILLE | $3,432.60 |

| DALEVILLE | $3,433.51 |

| PHILADELPHIA | $3,433.57 |

| BAILEY | $3,435.11 |

| BURNSVILLE | $3,435.53 |

| IUKA | $3,441.34 |

| NEWTON | $3,441.63 |

| BANNER | $3,442.80 |

| WALNUT | $3,443.86 |

| SCHLATER | $3,445.67 |

| VAIDEN | $3,449.52 |

| CHUNKY | $3,452.16 |

| ITTA BENA | $3,459.81 |

| SIDON | $3,461.84 |

| WINONA | $3,462.61 |

| INDIANOLA | $3,465.74 |

| LITTLE ROCK | $3,471.13 |

| PARIS | $3,474.25 |

| INVERNESS | $3,479.37 |

| EUPORA | $3,482.78 |

| HICKORY | $3,483.53 |

| MOORHEAD | $3,488.52 |

| FALKNER | $3,489.03 |

| MERIDIAN | $3,489.39 |

| FRENCH CAMP | $3,491.89 |

| KILMICHAEL | $3,501.38 |

| ALGOMA | $3,502.51 |

| BROOKSVILLE | $3,505.06 |

| SHAW | $3,507.10 |

| ACKERMAN | $3,507.47 |

| MINTER CITY | $3,510.10 |

| RULEVILLE | $3,511.46 |

| SUNFLOWER | $3,512.44 |

| HICKORY FLAT | $3,512.62 |

| DODDSVILLE | $3,514.71 |

| MC ADAMS | $3,515.10 |

| POTTS CAMP | $3,515.40 |

| GREENWOOD | $3,515.83 |

| WATERFORD | $3,521.01 |

| SHUQUALAK | $3,523.19 |

| SALLIS | $3,524.48 |

| BOYLE | $3,526.44 |

| ROSEDALE | $3,528.71 |

| TAYLOR | $3,529.00 |

| ABBEVILLE | $3,529.60 |

| STEWART | $3,530.20 |

| MOUNT PLEASANT | $3,531.38 |

| NOXAPATER | $3,531.74 |

| WEIR | $3,533.04 |

| ETHEL | $3,533.97 |

| MACON | $3,535.00 |

| MERIGOLD | $3,536.26 |

| LOUISVILLE | $3,545.05 |

| CARROLLTON | $3,545.32 |

| OXFORD | $3,546.16 |

| SOSO | $3,547.87 |

| TOOMSUBA | $3,550.22 |

| STRINGER | $3,550.30 |

| BAY SPRINGS | $3,551.23 |

| LOUIN | $3,551.31 |

| BEULAH | $3,553.33 |

| VICTORIA | $3,554.17 |

| KOSCIUSKO | $3,555.26 |

| DREW | $3,557.39 |

| RED BANKS | $3,563.18 |

| MARION | $3,563.25 |

| GUNNISON | $3,565.13 |

| TULA | $3,565.33 |

| HOLLY SPRINGS | $3,565.45 |

| PRESTON | $3,566.10 |

| BENOIT | $3,567.45 |

| DUCK HILL | $3,567.82 |

| ASHLAND | $3,568.33 |

| COILA | $3,568.65 |

| WHEELER | $3,569.73 |

| SCOOBA | $3,571.39 |

| HATTIESBURG | $3,572.06 |

| SANDHILL | $3,572.20 |

| LAUREL | $3,573.93 |

| PORTERVILLE | $3,577.24 |

| MAYERSVILLE | $3,577.34 |

| MC COOL | $3,579.90 |

| WALNUT GROVE | $3,580.07 |

| DE KALB | $3,581.18 |

| CLEVELAND | $3,583.11 |

| BYHALIA | $3,585.69 |

| MAYHEW | $3,585.73 |

| MADISON | $3,585.80 |

| TREBLOC | $3,587.22 |

| COFFEEVILLE | $3,587.49 |

| REDWOOD | $3,588.08 |

| MOSELLE | $3,588.62 |

| ELLISVILLE | $3,591.52 |

| GORE SPRINGS | $3,592.64 |

| ROSE HILL | $3,594.35 |

| MONTPELIER | $3,594.89 |

| PETAL | $3,595.96 |

| VALLEY PARK | $3,598.46 |

| UNIVERSITY | $3,600.13 |

| LAKE | $3,600.62 |

| ARTESIA | $3,605.47 |

| MOSS | $3,610.80 |

| ARKABUTLA | $3,613.97 |

| MICHIGAN CITY | $3,614.30 |

| SHELBY | $3,614.79 |

| SEBASTOPOL | $3,618.77 |

| INDEPENDENCE | $3,619.00 |

| MC CARLEY | $3,619.19 |

| ISOLA | $3,620.77 |

| THOMASTOWN | $3,621.20 |

| COLDWATER | $3,621.23 |

| FOREST | $3,621.23 |

| SENATOBIA | $3,622.60 |

| MADDEN | $3,624.08 |

| STAR | $3,624.79 |

| PELAHATCHIE | $3,625.04 |

| VICKSBURG | $3,625.09 |

| CRUGER | $3,628.78 |

| MOUND BAYOU | $3,632.23 |

| ROLLING FORK | $3,636.31 |

| LUDLOW | $3,637.11 |

| DUNCAN | $3,637.80 |

| BROOKLYN | $3,638.61 |

| LAMAR | $3,638.78 |

| WEST | $3,639.14 |

| WATER VALLEY | $3,643.19 |

| PHILIPP | $3,646.01 |

| ALLIGATOR | $3,649.03 |

| SCOBEY | $3,650.55 |

| GLEN ALLAN | $3,651.42 |

| SARAH | $3,651.72 |

| STONEVILLE | $3,653.82 |

| CAMDEN | $3,655.41 |

| HOLCOMB | $3,655.46 |

| CARY | $3,657.05 |

| LELAND | $3,658.99 |

| CANTON | $3,659.71 |

| CHATHAM | $3,661.77 |

| HOLLANDALE | $3,662.26 |

| BELZONI | $3,664.36 |

| TCHULA | $3,672.14 |

| LENA | $3,674.46 |

| CLARA | $3,675.00 |

| LOUISE | $3,675.04 |

| SILVER CITY | $3,675.50 |

| MAGEE | $3,675.57 |

| BROOKHAVEN | $3,677.90 |

| OVETT | $3,679.49 |

| RIDGELAND | $3,679.51 |

| WIGGINS | $3,682.18 |

| HERNANDO | $3,682.39 |

| BRANDON | $3,688.25 |

| DURANT | $3,689.07 |

| WAYSIDE | $3,689.71 |

| EASTABUCHIE | $3,690.06 |

| SANDERSVILLE | $3,690.13 |

| FLOWOOD | $3,694.35 |

| CARTHAGE | $3,696.62 |

| NESBIT | $3,698.93 |

| MC LAIN | $3,698.94 |

| OAKLAND | $3,699.62 |

| GRENADA | $3,701.07 |

| RUTH | $3,702.34 |

| TILLATOBA | $3,702.54 |

| PINEY WOODS | $3,702.55 |

| RICHLAND | $3,702.94 |

| GREENVILLE | $3,704.98 |

| SLATE SPRING | $3,708.50 |

| EDWARDS | $3,710.36 |

| GOODMAN | $3,713.87 |

| PACHUTA | $3,715.17 |

| HEIDELBERG | $3,715.21 |

| LEXINGTON | $3,716.05 |

| LAKE CORMORANT | $3,719.02 |

| TUNICA | $3,719.33 |

| MENDENHALL | $3,719.91 |

| PICKENS | $3,721.72 |

| FLORA | $3,722.60 |

| HORN LAKE | $3,723.28 |

| BOLTON | $3,723.62 |

| WEBB | $3,725.45 |

| ENTERPRISE | $3,725.47 |

| MCCOMB | $3,726.10 |

| QUITMAN | $3,728.41 |

| BOGUE CHITTO | $3,728.91 |

| WALTHALL | $3,729.29 |

| BATESVILLE | $3,732.00 |

| CRENSHAW | $3,733.97 |

| SHUBUTA | $3,735.32 |

| COURTLAND | $3,735.77 |

| FALCON | $3,738.19 |

| PAULDING | $3,740.64 |

| TYLERTOWN | $3,741.79 |

| HOLLY BLUFF | $3,744.73 |

| ANGUILLA | $3,746.71 |

| MAGNOLIA | $3,749.57 |

| FLORENCE | $3,750.39 |

| SOUTHAVEN | $3,750.82 |

| STONEWALL | $3,751.02 |

| LONG BEACH | $3,752.02 |

| DIBERVILLE | $3,752.08 |

| TAYLORSVILLE | $3,753.10 |

| DUNDEE | $3,753.83 |

| ROBINSONVILLE | $3,753.89 |

| LEAKESVILLE | $3,753.90 |

| ARCOLA | $3,756.01 |

| POPE | $3,759.59 |

| TIPPO | $3,761.01 |

| BILOXI | $3,763.29 |

| AVON | $3,763.33 |

| BELLEFONTAINE | $3,764.74 |

| WALLS | $3,765.54 |

| PEARL | $3,766.27 |

| SLEDGE | $3,766.40 |

| COMO | $3,766.41 |

| SARDIS | $3,770.51 |

| VOSSBURG | $3,770.60 |

| GRACE | $3,773.09 |

| VAUGHAN | $3,773.12 |

| PASS CHRISTIAN | $3,773.31 |

| MIZE | $3,774.16 |

| MORGAN CITY | $3,774.88 |

| HARRISVILLE | $3,775.83 |

| NEELY | $3,776.69 |

| OLIVE BRANCH | $3,777.42 |

| SWIFTOWN | $3,778.81 |

| MONEY | $3,778.84 |

| BENTON | $3,779.30 |

| GAUTIER | $3,780.36 |

| DUBLIN | $3,780.58 |

| PERKINSTON | $3,782.76 |

| STATE LINE | $3,783.41 |

| WAYNESBORO | $3,785.18 |

| CROWDER | $3,786.36 |

| MONTICELLO | $3,788.18 |

| PULASKI | $3,790.79 |

| SUMMIT | $3,791.10 |

| SATARTIA | $3,792.33 |

| YAZOO CITY | $3,796.49 |

| PASCAGOULA | $3,797.96 |

| OSYKA | $3,798.18 |

| GLENDORA | $3,799.62 |

| MC HENRY | $3,799.92 |

| BUCKATUNNA | $3,799.94 |

| RALEIGH | $3,803.11 |

| MORTON | $3,803.32 |

| CASCILLA | $3,803.75 |

| MC NEILL | $3,804.09 |

| PURVIS | $3,806.35 |

| CLINTON | $3,807.14 |

| LUMBERTON | $3,807.38 |

| BELEN | $3,808.67 |

| LULA | $3,811.03 |

| VANCLEAVE | $3,811.40 |

| JONESTOWN | $3,811.84 |

| GULFPORT | $3,811.98 |

| PARCHMAN | $3,812.76 |

| OAK VALE | $3,814.87 |

| MOSS POINT | $3,818.01 |

| PINOLA | $3,818.60 |

| JAYESS | $3,823.17 |

| BENTONIA | $3,824.40 |

| DELTA CITY | $3,826.84 |

| BRAXTON | $3,829.25 |

| SCOTT | $3,834.98 |

| MARKS | $3,837.93 |

| SAUCIER | $3,838.19 |

| SHERARD | $3,838.40 |

| NEWHEBRON | $3,841.08 |

| BEAUMONT | $3,842.30 |

| DIAMONDHEAD | $3,845.45 |

| ENID | $3,850.63 |

| SONTAG | $3,853.84 |

| GEORGETOWN | $3,854.09 |

| MOUNT OLIVE | $3,855.45 |

| PEARLINGTON | $3,857.61 |

| RICHTON | $3,858.15 |

| METCALFE | $3,858.94 |

| SUMNER | $3,863.48 |

| BAY SAINT LOUIS | $3,866.44 |

| LAMBERT | $3,868.11 |

| LUCEDALE | $3,870.67 |

| COLLINS | $3,874.34 |

| SUMRALL | $3,875.20 |

| WINSTONVILLE | $3,877.63 |

| WAVELAND | $3,878.23 |

| BUDE | $3,878.24 |

| MIDNIGHT | $3,887.65 |

| OCEAN SPRINGS | $3,887.70 |

| PACE | $3,887.91 |

| FRIARS POINT | $3,890.85 |

| SWAN LAKE | $3,892.34 |

| CHARLESTON | $3,893.53 |

| SMITHDALE | $3,894.09 |

| WESSON | $3,894.35 |

| MEADVILLE | $3,896.44 |

| HARPERVILLE | $3,899.88 |

| RAYMOND | $3,901.26 |

| SIBLEY | $3,901.71 |

| PUCKETT | $3,904.26 |

| WINTERVILLE | $3,905.29 |

| TUTWILER | $3,905.77 |

| SEMINARY | $3,906.08 |

| POPLARVILLE | $3,906.10 |

| COAHOMA | $3,907.93 |

| TERRY | $3,909.79 |

| CLARKSDALE | $3,910.45 |

| SANDY HOOK | $3,912.19 |

| ELLIOTT | $3,913.97 |

| CRYSTAL SPRINGS | $3,917.41 |

| LYON | $3,917.55 |

| MC CALL CREEK | $3,921.02 |

| BYRAM | $3,928.45 |

| NEW AUGUSTA | $3,930.59 |

| LIBERTY | $3,932.20 |

| JACKSON | $3,932.54 |

| VANCE | $3,932.66 |

| PICAYUNE | $3,932.75 |

| TIE PLANT | $3,934.31 |

| D LO | $3,934.83 |

| ROXIE | $3,941.64 |

| BASSFIELD | $3,944.37 |

| COLUMBIA | $3,946.60 |

| RENA LARA | $3,953.83 |

| SILVER CREEK | $3,955.17 |

| KOKOMO | $3,956.73 |

| KILN | $3,979.89 |

| CARRIERE | $3,984.17 |

| GLOSTER | $3,984.59 |

| FOXWORTH | $3,987.89 |

| GALLMAN | $3,988.22 |

| PANTHER BURN | $3,988.98 |

| DARLING | $3,989.17 |

| HAZLEHURST | $3,990.92 |

| FARRELL | $3,994.55 |

| WHITFIELD | $3,994.81 |

| CARSON | $4,005.18 |

| CENTREVILLE | $4,006.38 |

| ROME | $4,009.06 |

| PRENTISS | $4,013.94 |

| HURLEY | $4,024.29 |

| CHATAWA | $4,041.93 |

| UNION CHURCH | $4,051.00 |

| UTICA | $4,053.44 |

| FAYETTE | $4,107.16 |

| TINSLEY | $4,112.92 |

| LAKESHORE | $4,129.33 |

| TOUGALOO | $4,138.74 |

| CROSBY | $4,144.61 |

| WOODVILLE | $4,149.93 |

| WASHINGTON | $4,157.25 |

| FERNWOOD | $4,170.57 |

| PATTISON | $4,185.94 |

| NATCHEZ | $4,189.65 |

| PORT GIBSON | $4,242.24 |

| LORMAN | $4,250.87 |

| HERMANVILLE | $4,323.64 |

Just like rates by zip-code, rates by the city are a great statistic to look at. The city rates are a broader picture of what to expect in certain areas.

Again, the most expensive city in Mississippi is in Hermanville, and the cheapest city is in Starkville. Be careful. Hermanville may have a high cost of living and low crime rates while Starkville may have the opposite.

Keep in mind; these statistics are all averages. If you have a good driving record, and excellent credit, your rates will be cheaper. If you have bad credit and accident’s DUI’s or tickets, your rates will be much more expensive.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Car Insurance Companies in Mississippi

You always want to save money when it comes to auto insurance, but if you pay a little more and get better coverage it’s worth it. Sometimes the cheapest isn’t the best. More coverage can save you know what if you get involved in a bad accident.

Let us break down the best insurance companies in Mississippi and the entire United States. You can decide for yourself which is best for you. Instead of searching for hours and hours on the internet, you can find all your data in one place. Doing your search for the right company short, sweet, and to the point.

In the next sections, we’ll give you all the data you need to choose the best company for you.

The Largest Companies’ Financial Rating

Financial ratings may seem a bit superfluous to your life, but when it comes to auto insurance, these ratings can help a lot. The companies that come out with financial ratings aren’t paid by the insurance companies, sp they are unbiased. An unbiased opinion on what you may be purchasing is always a positive.

Every company you see on T.V. may have the most money, and hence the ability to buy that expensive air-time. But sometimes those companies aren’t the best for you.

Each year AM Best comes out with a financial rating for top companies in auto insurance. This rating gives a grade to every company to help you understand which companies are the best. This information can be vital in determining the best company for you.

Companies with the best financial ratings have the ability to pay claims, even in the case of a major accident. This can keep you protected.

| Company | A.M. Best Rating |

|---|---|

| Geico | A++ |

| State Farm | A++ |

| USAA | A++ |

| Allstate | A+ |

| Progressive | A+ |

| Farmers | A |

| Liberty Mutual | A |

| Travelers Group | A |

A++ is the highest you can rating a company can get. In this case, most of the top companies have the best ratings as well. Be careful; if they know this rating is high, they may be overcharging you.

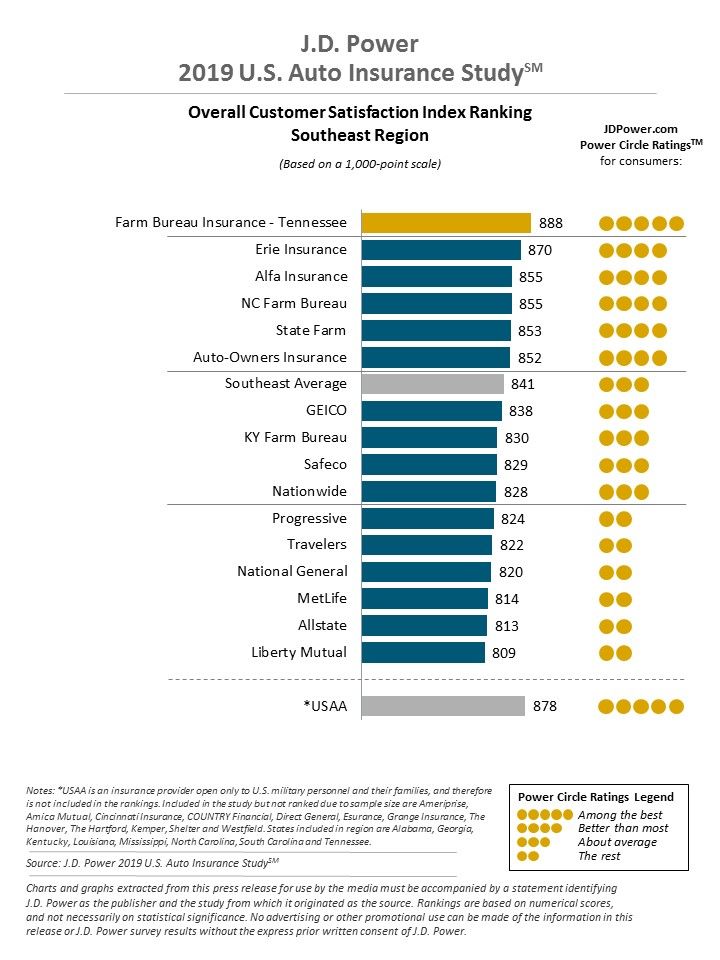

Companies With The Best Ratings

JD Power is the most trusted name in insurance ratings and many other fields. They release awards yearly to the top companies in each state and the entire nation.

USAA ranks above all other insurance companies due to them only supporting military members and their families, so they are in a bracket all alone. But in the southeast region, none of the top 10 companies in the nation such as Geico, State Farm, or Progressive rank in the top 5 according to JD Power.

The best-ranked insurance company in the Southeast region is Farm Bureau Insurance of Tennessee. They come in with a score even higher than USAA at 888 out of 1000. This is higher than most companies in the entire country.

Cheapest Insurance Companies in Mississippi

Rates are an essential part of car insurance. Saving money is always a good thing, so knowing the best prices and what companies in Mississippi have them can be your best friend.

In the following sections, we will break down the rates by different factors, including commute, coverage levels, and credit history.

This will help you decide which company is best for you, and which covers that the company offers that best fits your needs.

Commute Rates By Company

Car insurance companies can sometimes get aggressive with rates when you have a longer commute. The rule of thumb to use is, the more you are on the road, the more accidents, tickets, or other insurance-related situations can happen.

| Company | Commute and Annual Mileage | Annual Average |

|---|---|---|

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $13,847.08 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $13,055.12 |

| MS | 25 miles commute. 12000 annual mileage. | $3,608.63 |

| MS | 10 miles commute. 6000 annual mileage. | $3,570.71 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,926.49 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,926.49 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,899.06 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,824.14 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,122.82 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,011.15 |

Each company can change or not change these rates by commute. In Mississippi, where long commutes are not the norm, rates do not change drastically.

Some companies like Liberty Mutual will bump their rates up by almost a thousand dollars, however. The best thing to do is if you know you have a long commute, find companies that do not inflate their rates based on commute.

Coverage Level Rates By Company

Coverage levels are very different. They are broken down in three groups; low coverage, which is usually the bare minimum, medium coverage, and high coverage.

Each company charges based on what they cover so within each bracket; some companies may include more or less.

More often than not, you can find a company that charges the same amount for a medium coverage that another does for minimum or low coverage. Assure you know what is being covered by your company.

| Company | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $5,160.28 |

| Allstate | Medium | $4,936.29 |

| Liberty Mutual | High | $4,750.94 |

| Allstate | Low | $4,727.46 |

| Progressive | High | $4,710.11 |

| Liberty Mutual | Medium | $4,435.93 |

| Progressive | Medium | $4,368.16 |

| GEICO | High | $4,286.85 |

| Liberty Mutual | Low | $4,179.80 |

| GEICO | Medium | $4,114.68 |

| Travelers | High | $3,897.41 |

| Progressive | Low | $3,859.52 |

| GEICO | Low | $3,857.53 |

| Travelers | Medium | $3,752.92 |

| Travelers | Low | $3,540.18 |

| State Farm | High | $3,161.38 |

| State Farm | Medium | $2,967.50 |

| Nationwide | High | $2,914.81 |

| State Farm | Low | $2,811.35 |

| Nationwide | Medium | $2,747.46 |

| Nationwide | Low | $2,606.25 |

| USAA | High | $2,200.90 |

| USAA | Medium | $2,045.11 |

| USAA | Low | $1,922.75 |

USAA’s high coverage is cheaper in Mississippi than any other insurance companies low coverage. If you have served and have USAA, you’re sitting pretty even with the highest coverage.

The cheapest companies next to USAA are Nationwide and Progressive.

Choose carefully which level is best for you. If you have a long history of excellent driving, then low coverage may be all you need

Credit History Rates By Company

| Group | Credit History | Annual Average |

|---|---|---|

| Liberty Mutual | Poor | $14,094.18 |

| Liberty Mutual | Fair | $9,029.73 |

| Liberty Mutual | Good | $7,062.75 |

| GEICO | Poor | $6,161.23 |

| Allstate | Poor | $5,721.87 |

| Allstate | Fair | $5,065.11 |

| Progressive | Poor | $4,891.94 |

| Travelers | Poor | $4,233.92 |

| Progressive | Fair | $4,170.46 |

| Allstate | Good | $4,037.04 |

| USAA | Poor | $3,914.74 |

| Progressive | Good | $3,875.40 |

| Travelers | Good | $3,502.98 |

| GEICO | Fair | $3,490.89 |

| Travelers | Fair | $3,453.60 |

| State Farm | Poor | $3,451.55 |

| Nationwide | Poor | $3,397.54 |

| Nationwide | Fair | $2,747.94 |

| GEICO | Good | $2,606.95 |

| Nationwide | Good | $2,459.66 |

| State Farm | Fair | $2,102.98 |

| USAA | Fair | $2,069.13 |

| USAA | Good | $1,776.60 |

| State Farm | Good | $1,581.04 |

Out of all factors that car insurance companies use to determine rates, credit history is by far the most important.

The difference between mediocre and good credit can mean upwards of $4000. This table breaks down the most expensive to the cheapest rates for each top company by what drivers credit history.

The most competitive company in Mississippi is State Farm when it comes to credit history, but even they inflate charges by up to two thousand dollars when you have poor credit.

Keeping track of your credit is essential. How many accounts you have and how much debt is on each of those accounts affects your credit score a great deal.

According to Experian, the average credit score in Mississippi is 647. This is the lowest in the entire nation. This is terrible news for the insurance rates of the state. This can affect those rates drastically.

Driving Record Rates By Company

| Company | Driving Record | Annual Average |

|---|---|---|

| Allstate | With 1 DUI | $5,956.24 |

| GEICO | With 1 DUI | $5,869.23 |

| Liberty Mutual | With 1 DUI | $5,170.33 |

| Liberty Mutual | With 1 accident | $5,046.99 |

| Progressive | With 1 accident | $4,952.25 |

| Allstate | With 1 accident | $4,912.99 |

| Allstate | With 1 speeding violation | $4,726.86 |

| Travelers | With 1 DUI | $4,688.01 |

| Liberty Mutual | With 1 speeding violation | $4,442.21 |

| Progressive | With 1 speeding violation | $4,338.27 |

| Progressive | With 1 DUI | $4,267.10 |

| Allstate | Clean record | $4,169.28 |

| GEICO | With 1 speeding violation | $4,078.45 |

| GEICO | With 1 accident | $3,856.26 |

| Progressive | Clean record | $3,692.78 |

| Nationwide | With 1 DUI | $3,574.60 |

| Travelers | With 1 speeding violation | $3,558.80 |

| Travelers | With 1 accident | $3,413.50 |

| State Farm | With 1 accident | $3,312.87 |

| Travelers | Clean record | $3,260.37 |

| Liberty Mutual | Clean record | $3,162.70 |

| State Farm | With 1 DUI | $2,949.82 |

| State Farm | With 1 speeding violation | $2,949.82 |

| Nationwide | With 1 accident | $2,809.29 |

| USAA | With 1 DUI | $2,783.92 |

| State Farm | Clean record | $2,707.79 |

| GEICO | Clean record | $2,541.48 |

| Nationwide | With 1 speeding violation | $2,438.23 |

| Nationwide | Clean record | $2,202.58 |

| USAA | With 1 accident | $2,050.45 |

| USAA | With 1 speeding violation | $1,785.46 |

| USAA | Clean record | $1,605.19 |

DUI’s are a sure-fire way to ruin your affordable auto insurance rates no matter what coverage you have.

Just one speeding ticket can change your annual rates by hundreds of dollars. Accidents are also going to raise your rates drastically. Though your credit history may be less important than your credit history, it can still land you an expensive rate.

If you have a clean record in Mississippi, Nationwide could offer you rates as low as $2000 annually.

Number of Insurers in Mississippi

In each state there a number of different companies that you can be insured by. The list is endless; it seems. Most only know of the familiar names in the auto insurance business, but there are hundreds more.

In Mississippi, there are 15 domestic insurers and 907 foreign insurers. Coming to a grand total of 922 insurers that you have the choice to use. That is more than enough options.

The term “foreign” insurers mean out of state, not out of the country. With that many companies to choose from, it can be a tricky task to choose the right one. That’s where we come in play.

Mississippi State Laws

Laws in every state are confusing and hard to read. Using language that is as dense as it gets is the best asset of our lawmakers. Breaking down the crucial laws in plain language can help you with every part of your life but especially when it comes to shopping for car insurance.

In this section, we’ll review the state laws of Mississippi that are good to remember and also some Mississippi car insurance laws that are the most important.

Car Insurance Laws

Since we’ve covered a lot on auto insurance already, let’s continue with car insurance laws that people forget, that need to be known.

How State Laws for Car Insurance Are Determined

In every state, car insurance laws are determined in a different way. Insurance is regulated on a state level, and states use different tactics to regulate the rates that companies are allowed to charge its buyers.

According to the NAIC, Mississippi uses a prior approval system. This system means that before rates are determined and given to the consumer that they must be approved by the state legislature.

Many believe this system saves people a lot of money on rates as oppose to the file-and-use system.

Windshield Coverage

Windshield coverage can get weird, quickly. Many insurance companies will not cover your windshield any longer if you use a company that isn’t approved by them.

Windshields crack, its simply part of life and something you cannot control. For this reason, most insurance companies have no qualms about covering them. Plus, they aren’t too expensive to replace.

When it becomes tricky, is when you replace your windshield without assuring the company you use is accepted by your insurance company.

High-Risk Insurance

High-risk insurance refers to individuals with a poor driving record, bad credit, or simple inexperience behind the wheel.

Of course, high-risk insurance is much more expensive than the average driver’s insurance. With bad driving, comes bad rates. Many insurance companies you come across will reject you completely. If you have multiple driving incidents, companies will not insure you at all.

Without insurance, you are taking the risk of driving altogether.

Low-Cost Insurance

Mississippi does not have a low-cost insurance system set up. Those systems are usually in states where there is a high poverty rate and a low average annual income.

The only states that have government-funded programs are California, Hawaii, and New Jersey. These programs are built to help low-income families be able to protect themselves while they drive.

Automobile Insurance Fraud in Mississippi

Insurance fraud can be committed in a number of ways, but the main way is filing a claim that did not actually happen and expecting a payout from it.

Some other common fraud acts are misrepresenting facts on an insurance application, submitting claims for injuries or damage that never occurred, services never rendered or equipment never delivered, and staging accidents.

Depending on the severity, and amount of money stolen; insurance fraud in Mississippi is punishable by up to 20 years in prison and a fine up to $100,000.

If you suspect anyone you know or have seen is committing insurance fraud in the state, the Mississippi Insurance Department website will show you how to report it.

Statute of Limitations

A statute of limitation refers to the period of time for the bringing of legal action. This means that people affected have a certain amount of time to pursue legal action after an incident.

For example, if a driver gets in an accident and six years later says they have damage from the accident and tries to sue the other driver; they will not be under the statute of limitations. The claim will be null and void.

In Mississippi, there are two different amounts of time; one for PI or personal Injury and one for PD or Property Damage. The limitations for PI and PD are both three years for the state.

State Specific Laws

Auto insurance can sometimes be a drag to talk about. This section is meant to give your brain a break and have some fun. We all know there are weird laws in every state; here are some of the weirdest to come out of Mississippi.

- It is illegal to house your horse 50 feet from any road.

- It is illegal to live with your significant other if you’re not married.

- In Columbus, the fine for shooting a gun in public is actually less than the fine for waving a gun in public.

Vehicle Licensing Laws

As in most states, vehicle licensing laws are handled in Mississippi by the DMV. There are a lot of different rules and regulation to know about, but these are the most important ones to keep in mind. Knowing these could help you out in your shopping for insurance.

Real ID

According to Homeland Security, The Real ID Act establishes security standards for license issuance and production. This prohibits Federal agencies from accepting driver’s licenses and ID cards from states not meeting the Act’s minimum standards.

Mississippi is a Real ID-compliant state. If you have a Real ID license, it will be noted by a star on your driver’s license.

Penalties for Driving Without Insurance

If you are caught driving without the minimum amount of liability coverage in Mississippi, you will face at least:

- A $1,000 fine.

- A driver’s license suspension of one year.

As long as you have the following on your proof of insurance (electronic or paper), you have nothing to worry about.

- Make

- Model

- Year

- Safety rating

- Value of the car

- Your name and the name of any other drivers under your car’s policy.

- The expiration date of your insurance policy’s term.

Teen Driver Laws

Teens are high-risk drivers. Statistics show that they are the most delicate drivers on the road.

According to IIHS, teens in Mississippi must get their permit at 15 and wait one year to turn 16 and get their license. States passed these rules to combat the safety of teen driving. Instead of letting teens be tossed right into driving, the year grace period gives them a chance to learn.

These tactics help teens transition into driving more seamlessly, but they are still the highest risk drivers on the road. That is why they pay so much more for insurance than any other age group.

Older Driver License Renewal Procedures

Mississippi does not have laws that are different for older people than younger people. The general population of the state must get their license renewed every four or eight years. This is a personal option for the driver.

Older drivers can be just as dangerous on the roads as teens can. Seeing, hearing, and motor functions start to fade as you get older, and these are all extremely dangerous things on the road.

However, elderly people are charged the least out of all age groups on car insurance. As you learned earlier, if you are 60 or older in Mississippi, no matter what company it is, you are going to be paying about $1,000 less than 35 and older.

New Residents

New residents in Mississippi are not required by law to have their license renewed by a certain time. When the license you currently have expires, you can go to your local DMV and purchase the Mississippi drivers license.

Rules of the Road

There are so many rules around the driving world that sometimes we all forget or just need to be freshened up on some of the basic laws of the road. The rules can get a bit complicated, so here are some of the most important ones that go unnoticed on occasion.

Some are straight forward and act as a reminder while others are things drivers forget and need be repeated. For most road laws, the IIHS website is a convenient place to visit.

Fault Vs. No-Fault

As we discussed in an earlier section, fault and no-fault states are vastly different when it comes to auto insurance.

At-fault car insurance means that the person who was at fault for causing a car accident is also responsible for any ensuing harm. The at-fault driver’s insurance carrier will absorb these losses, up to policy limits; but after that, it comes straight out of the pocket of the at-fault driver for bodily injury, vehicle damage, etc.

Seat Belts and Car Seat Laws

Mississippi is a fairly lax state when it comes to seat-belt laws. There are no huge government programs like the “Click-It or Ticket” program in Florida.

It is a finable offense if a driver or passenger are not wearing one. Car seats also must be strapped in properly.

Keep Right And Move Over Laws

The keep right law states that slower traffic must keep right in all instances. This is not only for safety for all drivers but also to keep the flow of traffic moving and limit commutes.

The move-over law states that if you are in the left lane and a car comes up behind you going faster than you are, that you must switch lanes. Just like the keep right law, this keeps traffic moving at a much faster pace.

Speed Limits

Speed limits are the most ignored law on the road. They keep everyone safe but ignoring them and driving at ridiculous speeds can put you and everyone around you at risk.

In Mississippi, the speed limit on all highways is 70 mph, and on other 3-4 lane roads, it is 65 mph.

Ridesharing

Uber and Lyft are coming to the main stage of driving. If you are driving for a ridesharing service, some companies will not insure you when you are doing so. Be careful what company covers what if you plan on being a rideshare driver.

In Minnesota, most major insurance companies will cover you if you are in an Uber. Some insurance policies that drivers have may not cover the passenger in the case of an accident.

Carpooling is not a favorite form of transportation for Mississippians.

Automation On The Road

There are no state-specific laws in Mississippi that govern whether or not you can operate automated cars.

With today’s technology, this is becoming more and more a possibility. In places like Michigan, you must be behind the wheel even if you aren’t driving.

Simply driving a car like the old days, but in a safe way, seems to be the best option.

Safety Laws

Some more laws that you need to remember when it comes to are impaired and distracted driving laws. There are a lot of different safety regulations that are simply meant to help everyone be better on the roads.

The number one job of the Mississippi Department of Transportation is to see through the safety of the roads.

DUI Laws

DUI’s are the number one cause of death on the road in every state in the country.

The legal limit across America is 0.08, but now many states are starting to give out tickets for “buzzed driving” as well. This is considered to be around the 0.04 to 0.05 range. They cannot legally detain you, but it is now becoming a fineable offense.

They do not have laws against high Blood Alcohol levels. Some neighboring states are passing out higher fines and sentences if you are caught with a BAC above 0.15. Mississippi does not partake in these.

A DUI could land you $10,000 in fines, not to mention legal fees; plus a good amount fo jail time. The foolproof way to avoid all this is simple, don’t drink and drive.

Marijuana Impaired Driving Laws

Marijuana is not yet legal in the state of Mississippi, so it is still fineable and illegal; However, there is no state-specific law against driving while on marijuana.

Distracted Driving Laws

Distracted driving can be just as dangerous as driving under the influence.

With all the distractions we have in today’s world, it is becoming an epidemic, texting while driving is starting to catch up statistically to drunk driving.

To combat this, Mississippi has developed laws that make distracted driving a fineable offense as well. Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Driving in Mississippi

How do you stay safe? How do you keep your insurance rates falling and out of trouble? Knowing the statistics is the answer. But it can be hard to make sense of all of them.

In this section, we’ll break down the stats, facts, and how to keep yourself in the know, so you have the facts for your insurance shopping.

From thefts to fatalities in your county, the statistics of Mississippi will help you understand what you’re being charged.

Vehicle Theft in Mississippi

Vehicle theft is a huge issue in America. It is growing in every city in the country. The sure-fire way to combat it is by locking your doors. In some cities, it is much worse than in others, so the data can be shocking.

| Rank in Mississippi | Make/Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 1 | Chevrolet Pickup (Full Size) | 1994 | 286 |

| 2 | Ford Pickup (Full Size) | 2006 | 278 |

| 3 | Nissan Altima | 2015 | 128 |

| 4 | Chevrolet Impala | 2006 | 114 |

| 5 | GMC Pickup (Full Size) | 2000 | 103 |

| 6 | Toyota Camry | 2014 | 94 |

| 7 | Honda Accord | 2007 | 91 |

| 8 | Dodge Pickup (Full Size) | 2005 | 85 |

| 9 | Chevrolet Malibu | 2015 | 73 |

| 10 | Chevrolet Tahoe | 2005 | 68 |

As you can see in the table the most stolen car in Mississippi is the 1994 Chevy Pickup.

Road Fatalities in Mississippi

Of the 2.98 million people residing in Mississippi in 2017, there were 690 road fatalities. This is a good number compared to the rest of the United States.

In the United States as a whole, there were 34,247 fatal motor vehicle crashes in 2017 in which 37,133 deaths occurred.

Fatalities By Road Conditions

Thankfully, road conditions in Mississippi are very good due to the weather. The biggest worry on roads in the state would be darkness and heavy rain.

In 2017 there were 30 fatal accidents due to rain and around 260 due to complete darkness and inability to see.

Fatalities: Five Year Trend for the Top 10 Counties

County to county fatalities can be telling for where the most dangerous areas are. Some counties have strictly rural roads and will have more single-vehicle crashes. While other counties that have large cities in them may have more multiple car pile-ups.

| Mississippi County Fatalities by 2017 Ranking | County | Total Fatalities (2013) | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Hinds County | 28 | 31 | 47 | 46 | 45 |

| 2 | Harrison County | 24 | 23 | 28 | 21 | 34 |

| 3 | Desoto County | 17 | 19 | 24 | 24 | 23 |

| 4 | Jackson County | 18 | 28 | 20 | 27 | 23 |

| 5 | Lee County | 19 | 20 | 14 | 19 | 23 |

| 6 | Rankin County | 21 | 18 | 16 | 19 | 22 |

| 7 | Panola County | 15 | 11 | 10 | 12 | 21 |

| 8 | Pike County | 9 | 11 | 15 | 13 | 20 |

| 9 | Forrest County | 8 | 9 | 15 | 10 | 18 |

| 10 | Marshall County | 14 | 14 | 17 | 16 | 17 |

The county with the most fatalities in Mississippi in 2017, was Hinds County with 45 fatalities.

Rural Vs. Urban Fatality Rates

Rural and urban roads and their safety issue are very different. On rural roads, the dangers involve bad roads, no lighting on roads, wild animals, etc. But the dangers of urban roads involve pedestrians, motorcycles, traffic, etc.

| Rural vs Urban Fatalities | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Rural | 519 | 551 | 559 | 533 | 430 |

| Urban | 94 | 56 | 118 | 154 | 259 |

| Unknown | 0 | 0 | 0 | 0 | 1 |

Most traffic fatalities in the past five years happened in rural areas in Mississippi. This has something to do with here not being any extremely large cities in the state.

Fatalities By Vehicle Type

As in every state, the most fatalities happen in regular passenger vehicles and pick-up trucks.

In Mississippi, 309 of the 690 fatal crashes in 2017 were in passenger vehicles. Coming to about 45 percent of all fatal crashes.

Fatalities By Crash Type

This section refers to what kind of accident the fatality happened in. The most in Mississippi were single-vehicle cars. Which means that they ran off the road, or we’re drunk driving, etc.

As mentioned before, driving in the darkness in the long scenic roads like the Natchez Trace Parkway probably account for many of these deaths.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 613 | 607 | 677 | 687 | 690 |

| Single Vehicle | 396 | 366 | 399 | 409 | 375 |

| Involving a Large Truck | 63 | 81 | 72 | 78 | 102 |

| Involving Speeding | 126 | 96 | 96 | 81 | 59 |

| Involving a Rollover | 168 | 151 | 207 | 200 | 174 |

| Involving a Roadway Departure | 382 | 325 | 424 | 432 | 399 |

| Involving an Intersection | 110 | 112 | 104 | 98 | 108 |

Fatalities Involving Speeding By County

Speeding is a dangerous thing. Next to drinking while driving speeding can endanger everyone around you and make you unable to control the vehicle in a proper way.

Mississippi has become one of the safest states in America when it comes to speeding. In 2008 there were 327 fatal crashed due to speeding. Now, in 2017, there were only 59 deaths due to speeding.

Fatalities Involving an Alcohol-Impaired Driver

The best way to get yourself killed is by driving under the influence. Driving drunk kills more people every year than any other thing on the roads.

Mississippi is also doing a great job limiting deaths due to drinking. In 2017 there were 148 fatal crashes because of drinking.

Teen Drinking and Driving

Drinking while driving should never be done no matter what age. But underage teen driving under the influence is becoming more of an issue in the past years.

Stanford Children’s Health found that the leading cause amongst teens is alcohol-impaired driving.

Transportation

Transportation is important to talk about when it comes to auto insurance. In the next sections, we’ll talk about how many cars are on the road, commute times, and how much traffic there is in the great Magnolia State.

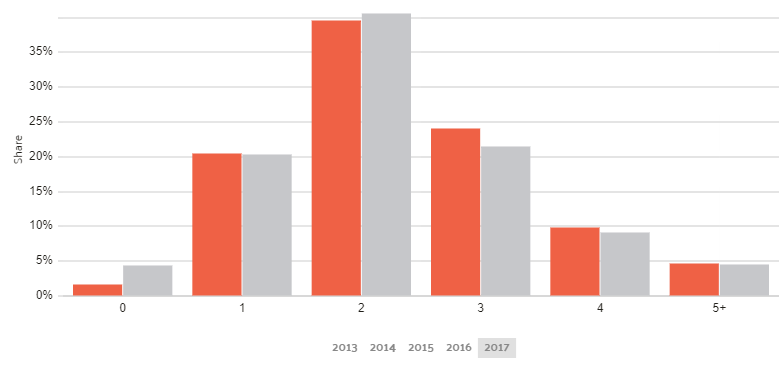

The best way to go anywhere in the United States is by car. As do, most households in America, about 40 percent of Mississippians have two cars per household.

Commute Time

Commute times are important. Traffic congestion can raise your rates. For example, in Los Angeles, California; the rates for car insurance based on traffic congestion are going to be much higher than those in Montana.

Out of the 1.2 million employees in Mississippi, the average commute time is about 24 minutes. This is shorter than the national average by a few minutes. A positive from every standpoint.

To add, 2.7 percent of the employees in the state have “super commutes.” This refers to travel times of over 90 minutes. This number may seem high, but it’s higher than other states because the population of drivers is lower.

Commuter Transportation

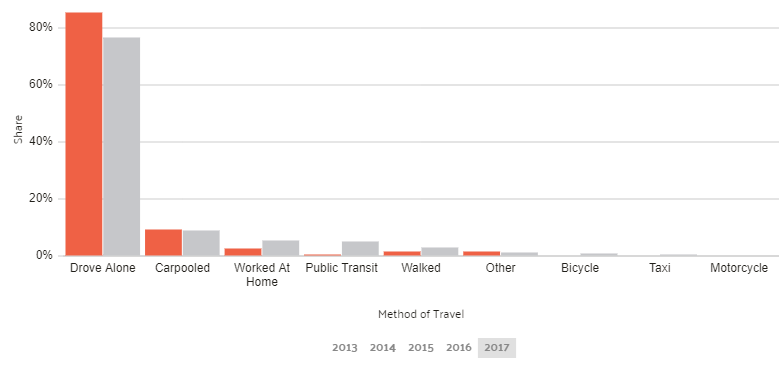

How people get to work is great data to look at to see how your state stacks up the rest of the United States. Knowing these facts, you are better prepared to know the roads and how they work in Mississippi.

According to the graph, almost 85 percent of people in the state drive alone to work. This is quite a bit higher than the national average. To add, even fewer people work from home than the rest of the nation.

A positive is how little people use motorcycles in Mississippi. At less than 1 percent of the road traveling by motorcycle, the road is much safer.

Traffic Congestion in Mississippi