Best Nevada Car Insurance (2025)

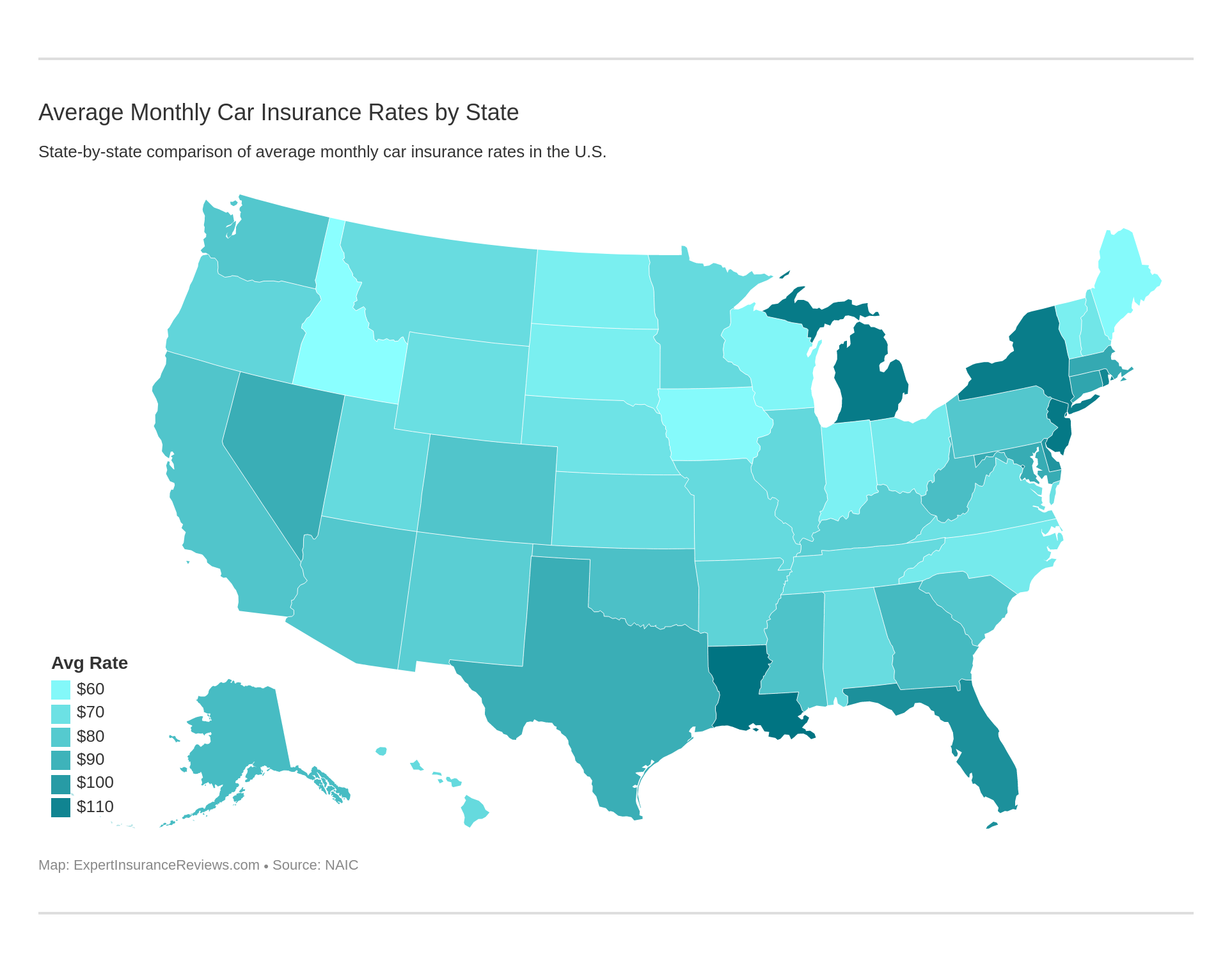

Nevada car insurance laws require 25/50/20 of bodily injury and property damage coverage, and there is absolutely no Nevada car insurance grace period. If you lapse on your coverage for one day, your state registration could be suspended. Nevada car insurance rates average $92 per month.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Nevada minimum auto insurance requirements are 25/50/20 for bodily injury and property damage

- Nevada car insurance rates average $92 per month

- To find cheap Nevada car insurance, compare multiple Nevada car insurance quotes

| Summary | Stats |

|---|---|

| Miles of Roadway | 43,900 |

| Vehicles Registered | 2,241,530 |

| State Population | 3,034,000 |

| Most Popular Vehicle in Nevada | Toyota RAV4 |

| Uninsured % / Underinsured % | 10.6 % |

| Total Driving Related Death | Traffic Fatalities: 330 DUI Fatalities: 87 |

| Average Annual Premiums | Liability: $647 Collision: $294 Comprehensive: $117 Full: $1,058 |

| Cheapest Car Insurance Providers | Depositors, USAA |

Many tourists from around the world come to Nevada to see its vibrant lights of famed casinos and hotels, the stretch of the Red Canyon, or the massive Hoover Dam. But if you call Nevada home you need car insurance.

In this guide, we will cover Nevada car insurance rates, insurance laws, driving safety laws, and transportation data. We’ll provide everything you need to know about car insurance in Nevada.

To compare car insurance rates in Nevada, enter your ZIP code above right now for free Nevada car insurance quotes.

Nevada Car Insurance Coverage and Rates

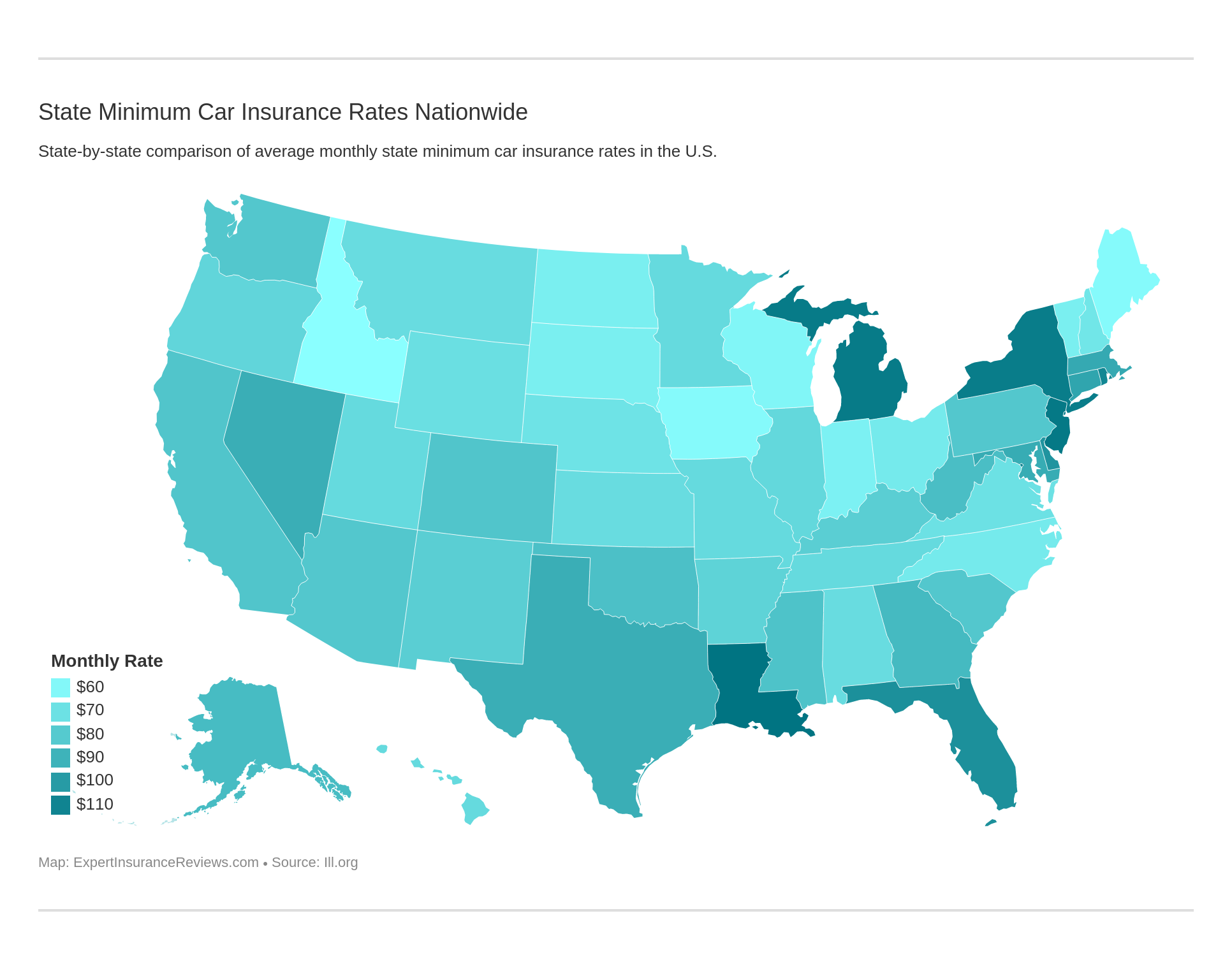

Nevada is one of the most expensive states for car insurance coverage. Motorists will likely pay higher than average annual premiums with more dollar amounts covering minimum liability coverage.

Like anywhere else in the U.S, Nevada has many car insurance requirements. We’ll explore those requirements in all the sections and sub-sections below.

Minimum Car Insurance Coverage in Nevada

Nevada car insurance laws require motorists to have liability insurance coverage.

Liability coverage must contain minimum coverage of $25,000 for bodily injury or death of one person in any one accident, $50,000 for bodily injury (BI) or death of two or more persons on any one accident, and minimum coverage of $20,000 for bodily injury or property damage (PD) of others in any one accident.

There is no Nevada car insurance loophole to allow you to get out of this requirement. If your Nevada car insurance lapses, you could be fined.

Forms of Financial Responsibility

No motorists should drive without physical copies of financial responsibilities. Forms of financial responsibility are items that prove that you’re a licensed driver, you’re insured, and that your vehicle is registered.

When you go to the DMV or if you’re pulled over by law enforcement, you’ll need proof of insurance which could be an insurance card or a copy of a car insurance bill. Remember that there is no Nevada car insurance grace period. You must get coverage right away.

With innovation being a big part of our lives, DMV officials and law enforcement officials may accept electronic forms of financial responsibility.

Premiums as a Percentage of Income

Have you ever been curious about how much money car insurance takes per year? You’d be surprised by the percentage of income that’s affected by car insurance premiums. Here are some detailed data regarding premiums as a percent of income in Nevada.

| States | Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|---|

| Nevada | $1,083 | $36,477 | 2.97% | $1,048 | $34,856 | 3.01% | $1,024 | $35,605 | 2.88% |

| New Mexico | $920 | $33,358 | 2.76% | $889 | $31,573 | 2.82% | $866 | $32,526 | 2.66% |

| Utah | $853 | $33,566 | 2.54% | $821 | $32,176 | 2.55% | $805 | $31,991 | 2.52% |

| Countrywide | $982 | $40,859 | 2.40% | $951 | $39,192 | 2.43% | $924 | $39,473 | 2.34% |

According to the data, Nevada’s average annual rates are $100 higher than the national average. Motorists living in Nevada pay close to 3 percent of their annual income for car insurance premiums.

Let’s see how these rates affect you. The calculator tool below can determine the percentage of income that’s affected by car insurance premiums of Nevada. Follow the prompt within your annual salary and the average annual cost of car insurance of Nevada to determine the percentage of income you’re expected to see.

CalculatorPro

Average Monthly Car Insurance Rates in NV (Liability, Collision, Comprehensive)

As you search for car insurance, you’re likely to see minimums that may look different than the average annual rate. These minimums are split into four types: liability, collision, comprehensive, and full coverage car insurance.

Liability is the minimum coverage needed, and it’s required by law for every motorist in Nevada.

Collision car insurance is added coverage that covers a motorist’s property if it’s damaged in a car accident. This particularly helpful in complex situations.

Comprehensive car insurance coverage protects a motorist again accidents related to storm damage, stolen vehicle damage, damage from fallen objects, and any other cause not contributing to a traffic accident.

Full or combined coverage is a policy that a combination of liability, collision, and comprehensive coverage.

| Core Coverage | Amount of Coverage |

|---|---|

| Liability | $647 |

| Collision | $294 |

| Comprehensive | $117 |

| Full | $1,058 |

Because liability covers the most for a motorist, it makes sense that it would cost more than collision and comprehensive coverage.

Under full coverage, you’ll get all coverages in one policy. These coverage amounts represent the lowest minimum you’ll pay in Nevada. These minimums may change based on the company you’re with and several other factors that you’ll see later in this guide.

Additional Liability

Sometimes, states require additional coverage known as additional liabilities.

Additional liabilities for car insurance are Personal Injury Protection (PIP), Medical Payment (MedPay), and Uninsured/Underinsured Motorist (UUM or UIM).

To accurately describe these perks, we’re going to summarize these items for your convenience.

PIP is car insurance coverage available in states that have enacted no-fault laws or other car reparation reform laws for the treatment of injuries to the insured and passengers of the insured.

Uninsured/Underinsured motorist coverage helps when an at-fault motorist isn’t insured or has a policy that doesn’t fully cover the cost damages or injuries.

Here’s a short video explaining more about Medical Payment (MedPay), one of the additional liabilities you’ll find for car insurance.

https://www.youtube.com/watch?v=E-tNmTsSSuA

What’ll you’ll see in additional liability data is loss ratio. The loss ratio refers to what car insurance companies pay out and what they earn.

So, a loss ratio of 65 means the company paid $65 in claims for every $100 that they earned. Loss ratios close to 100 (such as 65 to 80) shows that the company is earning money while effectively paying claims. Loss ratios too close or exceeding 100 shows a company losing money or barely earning money.

This table will show the loss ratio of additional liabilities in Nevada.

| Additional Liability | Loss Ratio 2013 | Loss Ratio 2014 | Loss Ratio 2015 |

|---|---|---|---|

| Personal Injury Protection (PIP) | - | - | - |

| Medical Payments (MedPay) | 81.58 | 78.32 | 79 |

| Uninsured/Underinsured Motorist (UUM/UIM) | 101.86 | 107.13 | 98.4 |

PIP insurance is not required in Nevada, and neither is medical payments coverage. This can be a problem for drivers or passengers that are injured in an accident, particularly with an uninsured driver.

There doesn’t seem to any loss ratio calculations for PIP, but why are there loss ratios for MedPay and UUM/UIM? Since PIP and MedPay aren’t required, the National Association of Insurance Commissioners may have omitted their results in the total business records. It doesn’t mean claims aren’t paid out.

MedPay and UUM, on the other hand, have loss ratios close to 100 and exceeding 100 as shown in the table above.

The loss of revenue for car insurance companies have caused prices to increase. This news report goes into detail on how Nevada is increasing the already higher than average car insurance rates.

Add-ons, Endorsements, and Riders

When you decide on an insurance policy that you want, ask agents about other endorsements you can add to your car insurance. This is particularly important if you have a teen driver on your policy, or if you have a modified or classic car.

- Guaranteed Auto Protection (GAP) – Car insurance that pays the difference between the value or actual cash value of a damaged or stolen vehicle and the amount owed on the car, usually under a loan or lease.

- Personal Umbrella Policy (PUP) – This car insurance option provides a stack of high limits of liability to protect an insured motorist against a catastrophic liability loss such as bodily injury, property damage, personal injury, and even libel.

- Rental Reimbursement – A car insurance coverage with additional coverage in case a motorist has paid additional costs for a car rental.

- Emergency Roadside Assistance – Most car insurance companies provide this. This is a car insurance coverage perk that sends out locksmiths and towtrucks in case a motorist is stranded on a roadway. Most insurance companies don’t require a deductible.

- Mechanical Breakdown Insurance – Often referred to as Equipment Breakdown Insurance, this car insurance endorsement is for loss due to mechanical or electrical breakdown of a motor vehicle.

- Non-Owner Car Insurance – Simply put, this is car insurance coverage for a motorist who has liability car insurance but does not own a car.

- Modified Car Insurance Coverage – High-performance parts and custom paint jobs are covered by Modified Car insurance coverage. Alert your car insurance company that your car is custom-built. (For more information, read our “Does car insurance cover paint jobs?“).

- Classic Car Insurance – Classic cars can be treasures to gear-heads. The parts are just as rare and require costly repair if damaged. Classic Car Insurance covers those high costs.

- Pay-As-You-Drive or Usage-Based Car Insurance – Car insurance coverage that’s determined by how much you drive your car.

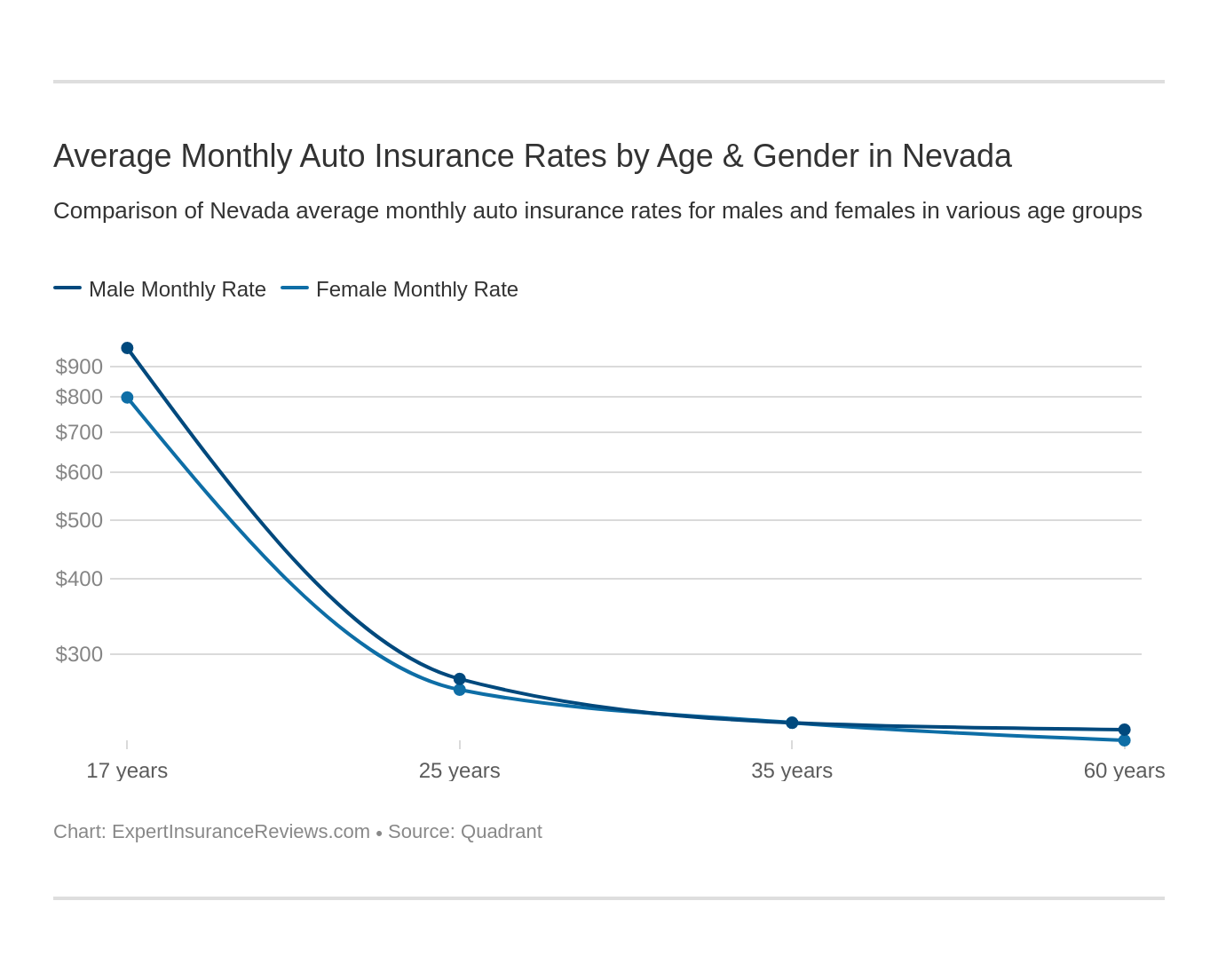

Average Monthly Car Insurance Rates by Age & Gender in NV

Age, gender, and marital status are all factors in determining annual rates. Single, young men generally pay more money for car insurance. The data described in the table below will show you how much more they pay in the state of Nevada.

| Company | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate | $10,608.38 | $12,771.99 | $3,436.69 | $3,631.01 | $3,213.12 | $3,187.35 | $2,980.43 | $3,148.67 |

| American Family Mutual | $10,708.72 | $14,014.29 | $3,166.61 | $3,653.13 | $3,166.61 | $3,166.61 | $2,821.83 | $2,821.83 |

| Mid-Century | $11,011.64 | $11,728.64 | $4,410.53 | $4,434.89 | $3,309.54 | $3,398.72 | $3,017.95 | $3,407.39 |

| GEICO | $6,851.05 | $6,237.15 | $2,737.80 | $2,324.96 | $2,764.87 | $2,674.83 | $2,816.04 | $2,873.57 |

| Safeco | $14,026.77 | $15,639.03 | $3,477.93 | $3,637.13 | $3,084.15 | $3,335.64 | $3,041.79 | $3,434.95 |

| Depositors Insurance | $5,805.75 | $6,979.24 | $2,808.27 | $2,994.55 | $2,362.11 | $2,414.50 | $2,152.73 | $2,282.29 |

| Progressive | $9,436.38 | $10,231.11 | $2,535.15 | $2,328.90 | $2,182.18 | $1,873.41 | $1,904.77 | $1,899.44 |

| State Farm | $10,846.02 | $13,863.57 | $3,917.14 | $4,378.51 | $3,496.78 | $3,496.78 | $3,171.99 | $3,171.99 |

| Travelers | $11,261.00 | $18,350.69 | $2,332.62 | $2,582.53 | $2,107.82 | $2,137.13 | $2,013.94 | $2,011.37 |

| USAA | $5,313.62 | $5,987.19 | $2,576.44 | $2,740.28 | $2,044.07 | $2,007.42 | $1,960.43 | $1,948.62 |

Licensed teen drivers have the most expensive annual rates. Even though younger drivers are less experienced, they often take more risks than older and married drivers. Therefore, the rates reflect the likelihood of risk associated with each demographic.

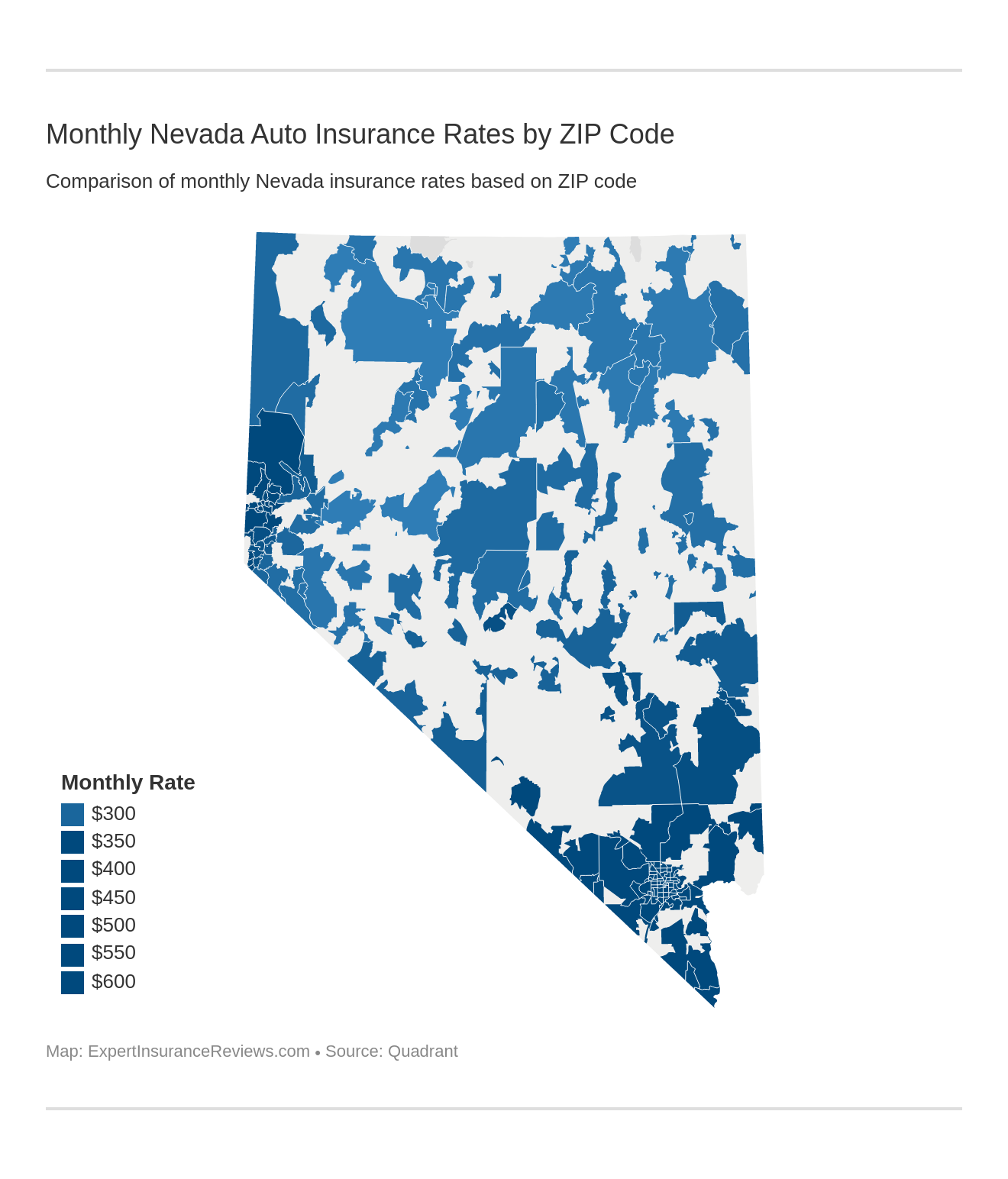

Cheapest Rates by Nevada ZIP Code

How are these reflected in each area of Nevada? We can find the rates of each area by looking at the rates based on ZIP code. Here is a list of ZIP codes that carry the cheapest and the most expensive annual rates. Let’s start with the cheapest.

We’ve included the company here as well, but to determine the cheapest and most expensive, we included the average annual rate of the area, which is on the right side of the ZIP code column.

| Zipcode | Annual Average | Allstate | American Family | Mid-Century | GEICO | Safeco | Depositors | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 89406 | $3,411.08 | $3,853.98 | $4,247.71 | $3,120.67 | $2,899.82 | $4,391.57 | $2,572.09 | $2,876.00 | $4,060.20 | $3,928.62 | $2,160.12 |

| 89832 | $3,411.87 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,505.15 | $2,535.31 | $2,522.37 | $4,254.77 | $3,577.95 | $2,573.74 |

| 89445 | $3,413.48 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,359.85 | $2,453.46 | $2,521.14 | $4,106.98 | $3,635.45 | $2,741.06 |

| 89419 | $3,428.28 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,386.51 | $2,535.31 | $2,586.28 | $4,081.33 | $3,635.45 | $2,741.06 |

| 89835 | $3,430.06 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,682.79 | $2,535.31 | $2,576.54 | $3,998.00 | $3,784.82 | $2,573.74 |

| 89831 | $3,431.30 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,505.15 | $2,535.31 | $2,685.71 | $4,285.73 | $3,577.95 | $2,573.74 |

| 89834 | $3,434.38 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,564.00 | $2,535.31 | $2,657.68 | $4,285.73 | $3,577.95 | $2,573.74 |

| 89815 | $3,434.84 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,684.24 | $2,631.58 | $2,662.57 | $4,334.73 | $3,312.12 | $2,573.74 |

| 89833 | $3,437.66 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,602.12 | $2,535.31 | $2,624.45 | $4,285.73 | $3,605.85 | $2,573.74 |

| 89801 | $3,451.43 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,684.24 | $2,631.58 | $2,667.27 | $4,230.11 | $3,577.95 | $2,573.74 |

| 89822 | $3,456.73 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,580.09 | $2,535.31 | $3,027.03 | $4,123.70 | $3,577.95 | $2,573.74 |

| 89825 | $3,463.15 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,578.64 | $2,535.31 | $2,624.45 | $4,424.85 | $3,745.13 | $2,573.74 |

| 89823 | $3,464.10 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,727.26 | $2,535.31 | $2,624.45 | $4,285.73 | $3,745.13 | $2,573.74 |

| 89447 | $3,465.95 | $3,853.98 | $3,937.56 | $3,120.67 | $2,935.94 | $4,439.50 | $2,535.31 | $2,936.92 | $4,095.71 | $4,109.98 | $2,693.93 |

| 89427 | $3,468.42 | $3,849.47 | $4,247.71 | $3,120.67 | $2,935.94 | $4,450.28 | $2,535.31 | $2,799.99 | $4,285.73 | $3,885.34 | $2,573.74 |

| 89426 | $3,468.91 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,335.52 | $2,535.31 | $2,596.03 | $4,285.73 | $3,878.60 | $2,741.06 |

| 89828 | $3,470.27 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,684.24 | $2,631.58 | $3,065.83 | $4,285.73 | $3,312.12 | $2,573.74 |

| 89425 | $3,470.37 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,379.95 | $2,535.31 | $2,596.03 | $4,222.97 | $3,911.55 | $2,741.06 |

| 89820 | $3,471.07 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,519.53 | $2,535.31 | $2,620.81 | $4,232.92 | $3,911.55 | $2,573.74 |

| 89404 | $3,474.95 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,372.72 | $2,535.31 | $2,586.28 | $4,285.73 | $3,911.55 | $2,741.06 |

| 89418 | $3,487.58 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,775.11 | $2,535.31 | $2,586.28 | $4,285.73 | $3,635.45 | $2,741.06 |

| 89415 | $3,497.60 | $3,849.47 | $4,247.71 | $3,120.67 | $2,935.94 | $4,399.49 | $2,535.31 | $3,064.82 | $4,238.98 | $4,009.91 | $2,573.74 |

| 89430 | $3,502.58 | $4,003.00 | $3,937.56 | $3,120.67 | $2,935.94 | $4,439.50 | $2,535.31 | $2,941.77 | $4,196.68 | $4,341.67 | $2,573.74 |

| 89883 | $3,504.32 | $4,032.11 | $4,060.71 | $3,120.67 | $2,935.94 | $4,682.79 | $2,535.31 | $3,065.83 | $4,251.31 | $3,784.82 | $2,573.74 |

| 89414 | $3,507.02 | $4,012.51 | $4,247.71 | $3,120.67 | $2,935.94 | $4,460.46 | $2,535.31 | $2,911.37 | $4,193.58 | $3,911.55 | $2,741.06 |

USAA is the cheapest company in ZIP code 89406. However, USAA is only available to members of the military and their immediate families. The next cheapest rate is Depositor’s Insurance with an annual rate of $2,572.

| Zipcode | Annual Average | Allstate | American Family | Mid-Century | GEICO | Safeco | Depositors Insurance | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 89101 | $7,486.53 | $8,048.30 | $8,553.10 | $9,480.30 | $4,836.05 | $9,883.38 | $5,319.48 | $5,888.23 | $9,533.35 | $9,371.11 | $3,951.95 |

| 89102 | $7,376.44 | $8,048.30 | $8,409.97 | $9,480.30 | $5,120.65 | $9,545.82 | $5,166.70 | $5,994.61 | $9,241.46 | $8,794.42 | $3,962.16 |

| 89106 | $7,374.13 | $7,769.45 | $8,409.97 | $9,480.30 | $4,962.07 | $10,172.89 | $5,533.73 | $6,020.83 | $9,274.17 | $8,165.97 | $3,951.95 |

| 89104 | $7,360.29 | $7,272.17 | $8,553.10 | $9,480.30 | $4,808.57 | $9,617.41 | $5,060.70 | $6,334.43 | $9,503.70 | $9,020.61 | $3,951.95 |

| 89030 | $7,347.44 | $8,088.48 | $8,409.97 | $9,318.62 | $4,836.05 | $9,883.38 | $5,533.73 | $6,251.86 | $8,285.37 | $8,915.00 | $3,951.95 |

| 89107 | $7,255.06 | $7,273.19 | $8,409.97 | $9,480.30 | $4,927.35 | $9,638.95 | $4,791.34 | $6,042.04 | $9,232.25 | $8,862.80 | $3,892.43 |

| 89109 | $7,199.02 | $7,710.41 | $8,553.10 | $9,480.30 | $4,846.89 | $9,183.10 | $5,060.70 | $5,686.59 | $8,294.43 | $9,297.97 | $3,876.74 |

| 89110 | $7,189.04 | $7,638.37 | $8,553.10 | $9,318.62 | $4,735.03 | $9,325.59 | $5,382.89 | $5,830.40 | $9,304.06 | $8,097.44 | $3,704.95 |

| 89169 | $7,157.11 | $7,319.33 | $8,553.10 | $9,480.30 | $4,960.96 | $9,183.10 | $5,060.70 | $5,164.44 | $8,674.52 | $9,297.97 | $3,876.74 |

| 89146 | $7,073.86 | $7,611.76 | $8,409.97 | $9,480.30 | $5,119.94 | $8,278.72 | $5,166.70 | $6,302.95 | $8,675.02 | $7,700.06 | $3,993.24 |

| 89103 | $7,029.98 | $7,954.13 | $8,409.97 | $8,690.65 | $4,977.04 | $8,275.86 | $5,166.70 | $5,732.50 | $8,928.35 | $8,202.41 | $3,962.16 |

| 89121 | $6,944.29 | $7,564.25 | $8,284.68 | $9,480.30 | $4,652.70 | $8,323.80 | $4,954.07 | $5,799.01 | $9,135.53 | $7,371.80 | $3,876.74 |

| 89119 | $6,919.52 | $7,883.30 | $8,284.68 | $8,690.65 | $4,652.70 | $9,183.10 | $5,238.74 | $5,024.44 | $8,931.76 | $7,429.11 | $3,876.74 |

| 89156 | $6,903.68 | $7,452.92 | $7,876.90 | $9,318.62 | $4,737.88 | $8,276.43 | $5,103.24 | $6,432.02 | $8,465.05 | $7,832.08 | $3,541.66 |

| 89147 | $6,898.71 | $7,915.29 | $7,953.51 | $9,160.06 | $5,280.42 | $8,177.41 | $4,959.82 | $6,140.50 | $8,392.48 | $7,111.97 | $3,895.68 |

| 89032 | $6,879.48 | $7,769.45 | $8,409.97 | $9,318.62 | $4,190.21 | $8,636.05 | $4,933.96 | $5,456.27 | $8,675.45 | $7,591.30 | $3,813.50 |

| 89142 | $6,870.53 | $7,231.45 | $7,876.90 | $9,318.62 | $4,685.71 | $8,276.43 | $4,954.07 | $5,769.08 | $9,242.92 | $7,554.76 | $3,795.37 |

| 89117 | $6,861.26 | $7,915.29 | $8,184.95 | $8,485.83 | $5,307.64 | $8,378.44 | $4,948.36 | $5,793.08 | $8,493.85 | $7,111.97 | $3,993.24 |

| 89120 | $6,856.41 | $7,489.95 | $8,284.68 | $9,480.30 | $4,635.57 | $7,922.66 | $4,738.80 | $5,423.88 | $8,609.67 | $8,101.88 | $3,876.74 |

| 89108 | $6,830.19 | $6,748.50 | $7,876.90 | $9,318.62 | $4,318.70 | $8,317.02 | $4,791.34 | $5,730.61 | $9,255.16 | $8,052.63 | $3,892.43 |

| 89122 | $6,808.18 | $7,143.22 | $7,876.90 | $9,318.62 | $4,691.99 | $8,276.43 | $4,738.80 | $5,717.62 | $9,035.87 | $7,364.02 | $3,918.32 |

| 89118 | $6,803.81 | $7,620.98 | $7,953.51 | $8,690.65 | $5,158.39 | $8,275.86 | $4,978.20 | $5,899.43 | $8,520.80 | $7,151.05 | $3,789.24 |

| 89148 | $6,782.42 | $7,748.82 | $7,818.69 | $9,160.06 | $5,070.96 | $8,079.21 | $4,809.06 | $5,965.21 | $7,852.17 | $7,424.37 | $3,895.68 |

| 89115 | $6,731.08 | $6,336.10 | $7,876.90 | $9,318.62 | $4,193.14 | $9,570.04 | $4,969.50 | $5,651.34 | $8,558.04 | $8,049.05 | $2,788.04 |

| 89139 | $6,708.63 | $7,753.29 | $6,967.21 | $8,602.85 | $5,231.49 | $7,975.48 | $4,647.53 | $6,376.44 | $8,087.23 | $7,655.58 | $3,789.24 |

ZIP code 89101 has the highest annual rates. Safeco is the most expensive in that ZIP code with over $9800 in annual rates.

Cheapest Rates by Nevada Cities

Let’s narrow the scope and take a look at annual rates by city.

| City | Annual Average |

|---|---|

| FALLON | $3,411.08 |

| OWYHEE | $3,411.87 |

| WINNEMUCCA | $3,413.48 |

| LOVELOCK | $3,428.28 |

| WELLS | $3,430.06 |

| MOUNTAIN CITY | $3,431.30 |

| TUSCARORA | $3,434.38 |

| SPRING CREEK | $3,434.84 |

| RUBY VALLEY | $3,437.66 |

| ELKO | $3,451.43 |

| CARLIN | $3,456.72 |

| JACKPOT | $3,463.15 |

| DEETH | $3,464.10 |

| YERINGTON | $3,465.95 |

| SCHURZ | $3,468.42 |

| PARADISE VALLEY | $3,468.91 |

| LAMOILLE | $3,470.27 |

| OROVADA | $3,470.37 |

| BATTLE MOUNTAIN | $3,471.07 |

| DENIO | $3,474.95 |

| IMLAY | $3,487.58 |

| HAWTHORNE | $3,497.60 |

| SMITH | $3,502.58 |

| WEST WENDOVER | $3,504.32 |

| GOLCONDA | $3,507.01 |

The city of Fallon had the cheapest annual rate.

| City | Annual Average |

|---|---|

| LAS VEGAS | $6,621.74 |

| NORTH LAS VEGAS | $6,310.63 |

| NELLIS AFB | $6,248.03 |

| HENDERSON | $5,803.78 |

| BLUE DIAMOND | $5,596.93 |

| SLOAN | $5,508.41 |

| COYOTE SPRINGS | $4,763.30 |

| JEAN | $4,706.38 |

| BOULDER CITY | $4,614.02 |

| SEARCHLIGHT | $4,576.29 |

| LAUGHLIN | $4,572.33 |

| INDIAN SPRINGS | $4,548.91 |

| LOGANDALE | $4,545.43 |

| OVERTON | $4,527.30 |

| CAL NEV ARI | $4,495.80 |

| PAHRUMP | $4,489.20 |

| MOAPA | $4,475.32 |

| MERCURY | $4,320.45 |

| CRYSTAL BAY | $4,276.80 |

| STATELINE | $4,255.26 |

| SUN VALLEY | $4,237.30 |

| ZEPHYR COVE | $4,208.43 |

| BUNKERVILLE | $4,203.71 |

| RENO | $4,194.89 |

| AMARGOSA VALLEY | $4,186.62 |

Nevada’s most expensive city is Las Vegas.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Nevada Car Insurance Companies

To properly inform you about annual rates, it’s essential to talk about some of the best car insurance companies. This section will cover financial ratings, customer satisfaction ratings, complaint rates for companies in Nevada, and various other details about company premiums.

Largest Companies Financial Rating

One of the ways we can show which companies are bigger than most is through financial ratings. These ratings are different for each financial rating agency.

Insurance rating agencies measure the financial performance of major companies in each state. One of those agencies is known as A.M. Best. They’ve provided the grade of the largest insurance companies in Nevada and across the U.S.

Top Agencies' Monthly Financial Rankings

| Insurance Company | A.M. Best | Premiums Written | Market Share | Loss Ratio |

|---|---|---|---|---|

| A+ | $83,243.00 | 0.95% | 4.64% | |

| A+ | $96,155.00 | 1.10% | 5.41% |

| A | $16,014.00 | 0.18% | 6.18% | |

| A++ | $58,908.00 | 0.67% | 6.19% | |

| A | $35,342.00 | 0.40% | 5.09% |

| A+ | $65,509.00 | 0.75% | 5.00% |

| A+ | $72,965.00 | 0.83% | 4.88% | |

| B | $148,326.00 | 1.70% | 5.31% | |

| A++ | $27,997.00 | 0.32% | 5.20% | |

| A++ | $24,957.00 | 0.29% | 6.00% |

All companies appear to be in stable and excellent condition. Most of the largest companies offer their policies nationally and are more than likely licensed to do business anywhere in the U.S.

Companies with the Best Rating

The next agency is J.D. Power. They released a study reviewing overall consumer satisfaction. They graded the results on a 1,000 point scale and circle ratings.

| Company | Score (based on a 1,000 point scale) | Circle Ratings |

|---|---|---|

| Allstate | 826 | 3 |

| American Family | 826 | 3 |

| CSAA Insurance Group | 818 | 3 |

| Farmers | 812 | 3 |

| GEICO | 818 | 3 |

| Hartford | 832 | 5 |

| Liberty Mutual | 813 | 3 |

| Nationwide | 775 | 2 |

| Progressive | 807 | 2 |

| Safeco | 821 | 3 |

| State Farm | 831 | 5 |

| Travelers | 789 | 2 |

| USAA* | 887 | 5 |

| Southwest Average** | 823 | 3 |

USAA is only available to the military and their immediate families. The Southwest Average, however, is the collective result of all companies licensed to do business in the Southwest Region of the U.S. With 823 score and three circle ratings, companies in the Southwest are moderately performing well with consumer satisfaction.

Companies with the Most Complaints in Nevada

No company or business is without complaints; they open opportunities for improvement. There are a lot of companies with complaints, but we chose the companies with the most complaints.

| Name of Insurer | Complaints | Exposure | Complaint Ratio |

|---|---|---|---|

| Accc Insurance Company | 17 | 53660 | 0.032 |

| Allstate Fire And Casualty Insurance Company | 35 | 280116 | 0.012 |

| American Access Casualty Company | 13 | 48777 | 0.027 |

| American Family Insurance Company | 13 | 122047 | 0.011 |

| Arizona Automobile Insurance Company | 16 | 143768 | 0.011 |

| Commonwealth Casualty Company | 17 | 68802 | 0.025 |

| Farmers Insurance Company Of Arizona | 35 | 404857 | 0.009 |

| Geico Casualty Company | 80 | 768375 | 0.01 |

| LM General Insurance Company | 29 | 163156 | 0.018 |

| Mendota Insurance Company | 12 | 15552 | 0.077 |

| Progressive Advanced Insurance Company | 36 | 412147 | 0.009 |

| Safeco Insurance Company Of America | 15 | 161376 | 0.009 |

| Safeway Insurance Company | 13 | 121274 | 0.011 |

| State Farm Fire And Casualty Company | 16 | 75161 | 0.021 |

| State Farm Mutual Automobile Insurance Company | 83 | 890730 | 0.009 |

Sort through complaints by clicking the up and down triangles. State Farm had the most total complaints despite having some of the cheapest rates in the U.S.

Read more: Mendota Insurance Company Review & Complaints: Auto Insurance

Cheapest Insurance Companies in Nevada

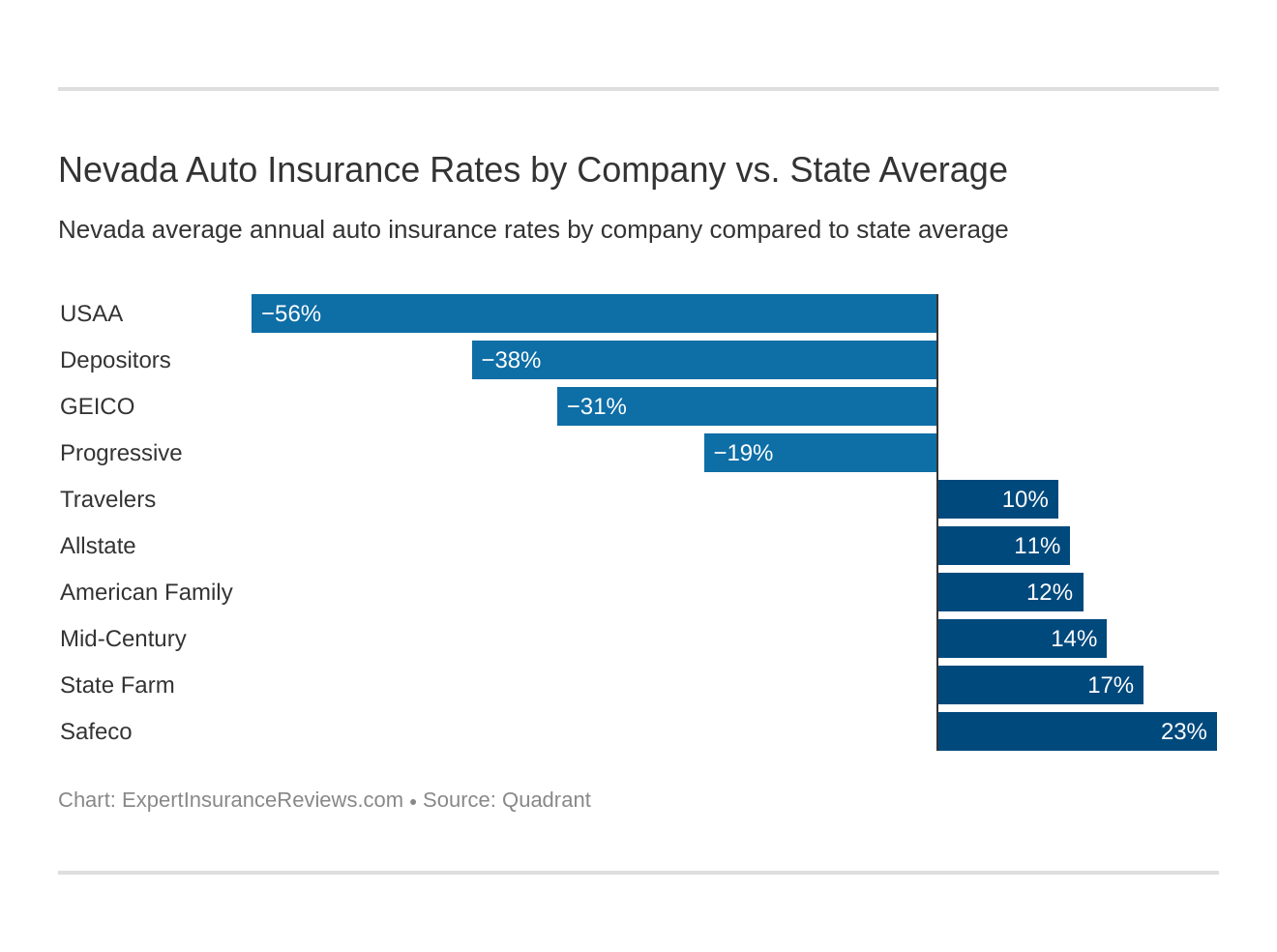

Some of the tables you’ve seen so far have been very extensive. Let’s concentrate on the average rates by each company. Additionally, let’s look at their loss ratios and market share.

| Company | Annual Average | Compared to State Average | Compared to State Average % |

|---|---|---|---|

| Allstate | $5,372.21 | $571.17 | 10.63% |

| American Family Mutual | $5,439.95 | $638.92 | 11.74% |

| Mid-Century | $5,589.91 | $788.87 | 14.11% |

| GEICO | $3,660.03 | -$1,141.00 | -31.17% |

| Safeco | $6,209.68 | $1,408.64 | 22.68% |

| Depositors | $3,474.93 | -$1,326.10 | -38.16% |

| Progressive | $4,048.92 | -$752.12 | -18.58% |

| State Farm | $5,792.85 | $991.81 | 17.12% |

| Travelers | $5,349.64 | $548.60 | 10.25% |

| USAA | $3,072.26 | -$1,728.78 | -56.27% |

The cheapest companies in Nevada, based on the table, is Depositor’s Insurance and USAA.

Commute Rates by Companies

Annual rates can be based on how much you drive your car. This table in this sub-section will show how much a motorist in Nevada could pay based on their estimated yearly commute.

| Company | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $5,372.21 | $5,372.21 |

| American Family | $5,365.30 | $5,514.60 |

| Farmers | $5,589.91 | $5,589.91 |

| GEICO | $3,595.74 | $3,724.32 |

| Liberty Mutual | $6,209.68 | $6,209.68 |

| Nationwide | $3,474.93 | $3,474.93 |

| Progressive | $4,048.92 | $4,048.92 |

| State Farm | $5,620.99 | $5,964.71 |

| Travelers | $5,349.64 | $5,349.64 |

| USAA | $3,031.47 | $3,113.04 |

Some of the companies in the table charge the same rate regardless of the number of commute miles driven during the year.

Coverage Level Rates by Companies

You may be wondering what coverage level rates are. Coverage levels are adding more to the minimum amount of liability. Additional dollars going toward bodily injury (BI), property damage (PD), and uninsured/underinsured motorist (UUM) coverage will greatly increase your annual rate.

For example, if minimum coverage (low coverage level) is $25,000 for BI, $50,000 for PD, and $20,000 for UUM, what’s the next level of coverage? Medium coverage would take it a step higher which is likely double minimum coverage.

So, medium coverage for Nevada may look something like $50,000 for BI, $100,000 for PD, and $40,000 for UUM. These coverage levels are more expensive the higher you go, but it will prepare you in case you are in a car accident where you are at-fault.

Here are the average annual rates for each coverage level in Nevada. Each company has their averages.

| Company | Annual Average with Low Coverage | Annual Average with Medium Coverage | Annual Average with High Coverage |

|---|---|---|---|

| Allstate | $4,661.25 | $5,459.03 | $5,996.34 |

| American Family | $5,164.99 | $5,761.62 | $5,393.25 |

| Farmers | $5,020.70 | $5,520.67 | $6,228.36 |

| GEICO | $3,252.50 | $3,569.08 | $4,158.52 |

| Liberty Mutual | $5,637.73 | $6,130.66 | $6,860.63 |

| Nationwide | $3,396.47 | $3,472.59 | $3,555.75 |

| Progressive | $3,507.46 | $3,891.68 | $4,747.61 |

| State Farm | $5,272.40 | $5,770.83 | $6,335.31 |

| Travelers | $4,810.46 | $5,367.41 | $5,871.04 |

| USAA | $2,723.24 | $3,040.54 | $3,452.99 |

State Farm is known for its affordable rates in the U.S., but in Nevada, the cheapest company by coverage level is Nationwide.

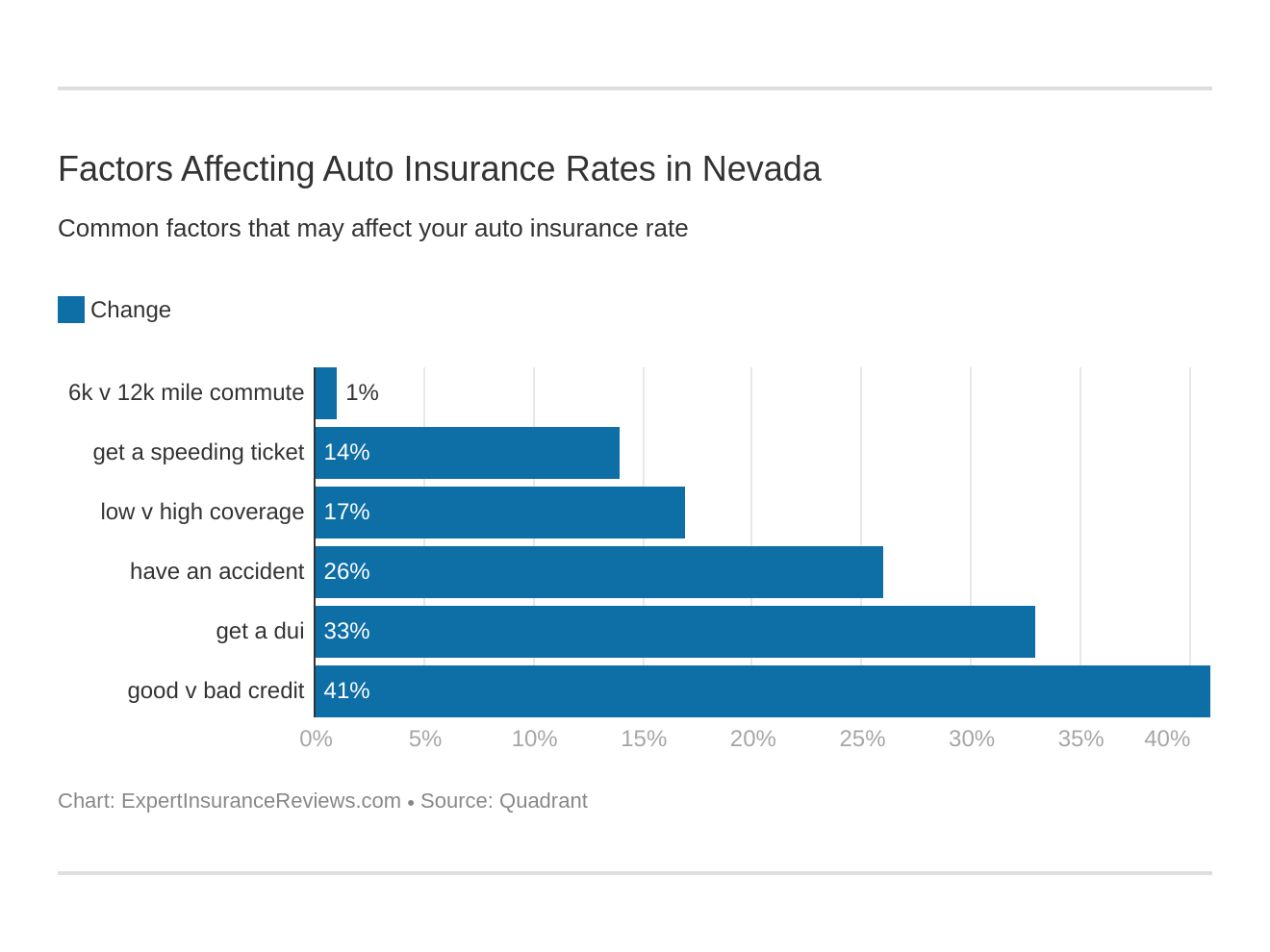

Credit History Rates by Companies

Good credit history is not only beneficial for purchasing homes, but it can also determine how much you’ll pay for car insurance premiums per year. The credit history table here shows a clear view of how credit history affects your annual premium.

| Company | Annual Average with Poor Credit | Annual Average with Fair Credit | Annual Average with Good Credit |

|---|---|---|---|

| Allstate | $6,965.19 | $5,442.36 | $4,952.60 |

| American Family | $6,723.48 | $5,259.25 | $4,947.61 |

| Farmers | $6,562.87 | $5,245.45 | $4,447.03 |

| GEICO | $4,413.75 | $5,149.36 | $4,254.31 |

| Liberty Mutual | $8,932.36 | $4,948.32 | $4,203.10 |

| Nationwide | $4,104.51 | $4,161.60 | $3,721.17 |

| Progressive | $4,443.10 | $3,982.49 | $2,935.04 |

| State Farm | $10,566.65 | $3,660.03 | $2,906.32 |

| Travelers | $5,850.87 | $3,385.24 | $2,650.28 |

| USAA | $4,397.15 | $2,650.41 | $2,169.22 |

The number of dollars is nearly polarized when you compare poor credit to good credit. If your credit status changes within the middle of your policy, consult your insurer right away to see if you can get a cheaper rate.

Driving Record Rates by Companies

There’s no question that a good driving record will get you better rates. The best insurance companies are willing to give you a discount if you have a clean record. For those who’ve had run-ins with the law, expect your car insurance rates to increase.

| Company | Clean Record | With 1 Speeding Violation | With 1 Accident | With 1 DUI |

|---|---|---|---|---|

| Allstate | $4,551.49 | $5,142.85 | $5,357.99 | $6,436.49 |

| American Family | $4,374.55 | $4,801.28 | $6,061.79 | $6,522.19 |

| Farmers | $4,654.50 | $5,599.97 | $5,942.38 | $6,162.80 |

| GEICO | $2,524.40 | $3,104.75 | $4,081.33 | $4,929.65 |

| Liberty Mutual | $4,533.69 | $5,751.46 | $7,257.65 | $7,295.91 |

| Nationwide | $2,788.60 | $3,048.57 | $3,586.11 | $4,476.45 |

| Progressive | $3,373.82 | $3,929.54 | $4,642.62 | $4,249.70 |

| State Farm | $5,262.04 | $5,792.84 | $6,323.66 | $5,792.84 |

| Travelers | $3,826.30 | $4,604.96 | $5,704.83 | $7,262.46 |

| USAA | $2,342.56 | $2,646.40 | $2,951.67 | $4,348.40 |

Based on the data, car insurance companies show some leniency to speeding violations. However, DUIs and accidents greatly increase annual rates. Liberty Mutual appears to have the highest rates if you are charged with a DUI or if a policyholder is in an accident.

Read more: Does my car insurance cover damage caused by a DUI or other criminal activity?

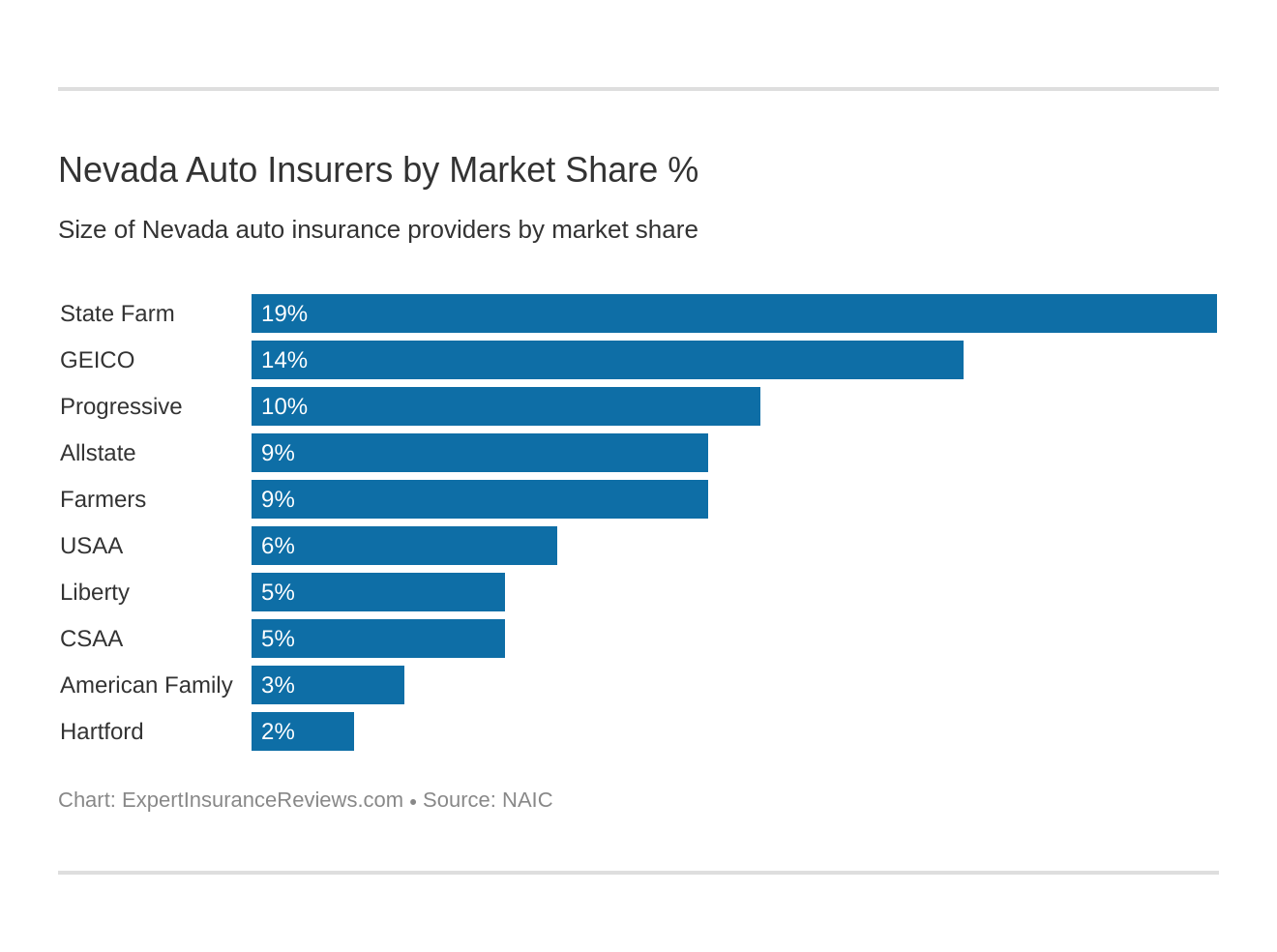

Largest Car Insurance Companies in Nevada

We mentioned market share. Market share is the market’s total sales that are earned by a car insurance company over a designated time. We’ll measure the largest companies in Nevada based on market share, direct premiums, and loss ratio.

| Rank | Company Group/group/code Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| 4 | Allstate | $214,394 | 59.62% | 9.05% |

| 9 | American Family | $69,913 | 74.88% | 2.95% |

| 8 | CSAA | $117,964 | 66.05% | 4.98% |

| 5 | Farmers | $207,969 | 63.14% | 8.78% |

| 2 | GEICO | $333,584 | 80.44% | 14.09% |

| 10 | Hartford | $53,168 | 79.29% | 2.24% |

| 7 | Liberty Mutual | $128,200 | 80.86% | 5.41% |

| 3 | Progressive | $236,952 | 64.05% | 10.01% |

| 1 | State Farm | $451,330 | 80.27% | 19.06% |

| 6 | USAA | $140,660 | 79.65% | 5.94% |

| ***** | **state Total** | $2,368,316 | 73.69% | 100.00% |

Despite fluctuating annual rates by coverage level, commute rates, and credit history, each company has maintained a stable market share. The highest market share percentage is State Farm with 19.06 percent in market share sales and an 80 percent loss ratio.

Number of Insurers in Nevada

Insurers are car insurance companies, but they are identified in two different types which are domestic and foreign.

Domestic insurers follow the rule of insurnance law of the state in which you live, while foreign insurers follow the rule of insurance law of another state.

As long as the company you’re subscribed to is licensed to do business in Nevada, you’re free to use policies from foreign insurers.

| Type of Insurer | Number of Insurers |

|---|---|

| Domestic | 9 |

| Foreign | 873 |

There are a total of 882 insurers that licensed to do business in Nevada, which gives motorists in Nevada many car insurance options to choose from.

Your one-stop online insurance guide. Get free quotes now! Secured with SHA-256 Encryption

Nevada State Laws

It’s important to know and understand the law in Nevada if you’re going to drive in the state. Very few people know all the laws of any state in which they live, but there are some laws you need to know. This section of the guide goes through some of those laws you’ll need to understand to a responsible driver on Nevada’s roadways.

Nevada Car Insurance Laws

First, let’s talk about some car insurance laws in Nevada. Every state goes about insurance law differently.

As you go through some of the information listed here, you’ll see how insurance laws are determined, how windshield coverage fits into car insurance law, high-risk insurance options, state-sponsored insurance, car insurance fraud, the statute of limitations, and vehicle laws specific to Nevada.

How Nevada Laws for Insurance are Determined

The NAIC identifies Nevada as a prior-approval, tort law state. Prior approval laws are where insurers must submit rates to the state rating authority and get approval before using them in car insurance policies. If state rating authorities have not responded in 90 days, the insurer may assume the rates have been approved.

Windshield Coverage

There’s isn’t a law in Nevada that says car insurance companies must provide a zero deductible for a windshield. Also, there’s isn’t a law against aftermarket parts. However, the windshield may be covered under comprehensive coverage. Ask your insurer whether there is a deductible if you get comprehensive coverage.

High-Risk Insurance

High-risk or SR22 insurance is the last option for a motorist who has a history of DUIs and accidents. To be eligible for high-risk car insurance, a motorist must try to find car insurance through the voluntary market for at least 60 days.

If a high-risk driver cannot find car insurance due to their high-risk status, they will eligible to enroll in the Nevada Auto Insurance Plan (NVAIP).

Under NVAIP, the motorist will be assigned to a car insurance company. Their rates will be much more expensive due to the high-risk of the driver. The motorist will be under NVAIP for at least three years.

After this period, a Nevada motorist can pursue car insurance under a voluntary market. If companies still consider the motorist a high-risk, the motorist can reapply to NVAIP after they’ve searched for and failed to find car insurance after 60 days.

Low-Cost Insurance

Nevada does not have a state-sponsored car insurance plan. Only three states have government-funded insurance—California, Hawaii, and New Jersey.

Automobile Insurance Fraud in Nevada

Any manner of fraud is punishable by law. The higher the fraud, the more fines and prison time for the scammer.

Insurance fraud in Nevada is a felony. A person convicted of insurance fraud can face four years in prison and must pay restitution to the insurance company defrauded. The criminal(s) may be ordered to pay Nevada’s fraud investigative office for the cost of the investigation and prosecution and may be ordered to pay up to $5,000 in additional fines.

To report fraud in the state of Nevada, visit the Nevada Attorney General’s Office webpage.

Statute of Limitations

The statute of limitations is the time limit in which you or any other motorist can file a claim with a car insurance company or pursue legal action against any motorist or insurance company. Nevada’s statute of limitations for personal injury is two years and three years for property damage.

The time for the statute of limitations begins when the event happens, not when it’s reported.

Nevada’s Specific Laws

Nevada lawmakers have updated road and safety laws in 2019. From mopeds to sidewalks, Nevada is limiting hazards and improving conduct in its state. Here are some laws specific to Nevada.

In October 2019, Nevada State Law required all moped riders to wear helmets. This applies to tri-mobiles with handlebars and seats. Triwheeled vehicles with an enclosed cab do not require the vehicle operator to wear a helmet.

Stunt or trick driving is considered reckless driving and carries a minimum fine of $1,000.

Recording stunt or trick driving can also lead to reckless driving charges. Hindering traffic to perform stunts and tricks is punishable by Nevada State Law

Nevada Vehicle Licensing Laws

Every motorist needs a driver’s license to operate a motor vehicle. This sub-section will go into detail on what requirements you’ll need to drive in Nevada. Also, we’ll cover REAL ID compliance, penalties for driving without insurance, laws for teen drivers, driver license renewal procedures, and negligent driver treatment systems of Nevada.

REAL ID

The Department of Homeland Security has a new compliance law where U.S. citizens will require REAL ID to board domestic flights and enter federal facilities. REAL ID has been around since 2005. They were issued in response to the 9/11 attacks.

By October 2020, U.S. citizens who want to fly domestically or who need to enter a federal facility will have to obtain a REAL ID.

Nevada is one of the states that’s compliant with the REAL ID Act and its regulations. Take a look at this short video from the Nevada DMV.

Penalties for Driving without Insurance

Driving without insurance can lead to stiff fines and misdemeanor charges. Your car can be impounded and your license can be revoked or suspended.

The Department of Motor Vehicles of Nevada lists these penalities for driving your vehicle while without car insurance.

- First Offense – A fine of $250 to $1,000. Your registration for your vehicle may be suspended until you pay a reinstatement fee and show proof of insurance. If you have SR22 status, you will have to go enroll in high-risk insurance and show proof that you’re enrolled. The reinstatement fee is $250.

- Second Offense- A fine of $500 to $1,000. Your registration for your vehicle may be suspended until you pay a reinstatement fee and show proof of insurance. If you have SR22 status, you will have to go enroll in high-risk insurance and show proof that you’re enrolled. The reinstatement fee is $500.

Don’t gamble with driving without insurance; it’s costly and could be put you at a major disadvantage when you want to be insured in the future.

Teen Driver Laws

Nevada teens have to go through several steps to become licensed drivers.

Teens who live in Nevada have to report to the DMV with a parent or legal guardian. They’ll need proof of school satisfactory school attendance. To do that, students must submit a Certification of Attendance. This form must be signed by a school official and a parent or legal guardian.

Students who are under 18 and have completed high school must provide a high school diploma or diploma equivalent in addition to having a parent or legal guardian sign it.

All drivers under 18 who want to pursue any form of driver’s license must take a driving course. Teens must be at least 15 years old to attend driving courses. The DMV of Nevada says teens are allowed to complete at-home driver training, but they must meet and log one of these requirements:

- Attend a classroom course and complete 50 hours of behind-the-wheel experience; or

- Complete an online course and 50 hours of behind-the-wheel experience; or

- Complete 100 hours of driving experience. This option applies if a classroom course is not offered within a 30-mile radius of your residence and you do not have access to the internet.

The minimum age to obtain a learner’s permit in Nevada is 15.5 years old. The teen must present proof of identity (social security card or birth certificate) and proof of residency in Nevada.

Once proven, teens must take written, initial skills and vision tests. The written and initial skills test costs $26. If the teen fails the test, they can re-test for $11. Parents or legal guardians must sign a financial responsibility form provided by Nevada DMV. The licensing fee for a learner’s permit is $23.25.

Teen learner’s permits last for one year then they will expire. To renew the learner’s permit, the teen must renew them in person.

Teens who are 16 years old can apply for a full driver’s license, however, they must meet these requirements:

- hold a valid learner’s permit for at least six months before applying

- have no “at-fault” car accidents in the six months before applying

- have no moving violation convictions in the six months before applying

- have no alcohol or drug convictions in the six months before applying

Nevada’s DMV has more details listed on their Teen Driver web page, which explains the rights of parents and out-of-state information for teens who recently moved to Nevada.

Older Driver License Renewal Procedures

Senior drivers who want to renew their driver’s licenses have the same guidelines as many other drivers. It all depends on age. For example, drivers who 65 years and older have to renew their driver’s licenses every four years. Those are the same requirements for all drivers in Nevada.

Drivers who 71 years and older who renew their licenses in person have to take the vision test. Senior drivers may renew their licenses online, but they may ask for proof of an adequate vision test. Visit an eye doctor just in case they ask for proof of clear vision.

New Residents

New residents of Nevada have to surrender their old state driver’s license, show proof of residency in Nevada, and be administered a vision test. Nevada requires motorists to obtain a driver’s license within 30 days of establishing residency in the state. The same rule applies to vehicle registration.

The fine for failing to register your vehicle is $1,000. It may be reduced upon compliance for no less than $200.

College students and active members of the military are considered temporary residents and do not have to comply with the new resident driver’s license and vehicle registration law of Nevada.

For new, permanent residents, however, they will need to present a few items to transfer their license to Nevada’s license which are:

- A valid U.S. driver’s license, social security card, and birth certificate. These items will verify your identity.

- Proof of residencies such as an address to a home or an apartment.

- Proof of insurance such as an insurance card or copy of a bill

- Current vehicle registration even if it’s out-of-state registration

- The title of the vehicle. If the lienholder has your title, this may be omitted.

- Present the vehicle identification number (VIN).

Most Nevada driver’s licenses are valid for eight years. The fee for obtaining a driver’s license is $42.25. Licenses issued to drivers 65 years and older will pay a license fee of $18.25 to obtain the new license.

If you do not have an out-of-state driver’s license and you’re a new resident of Nevada, you must take the knowledge and skills test which costs $26.

License Renewal Procedures

Nevada’s current driver’s licenses expire every four years. However, Nevada has transitioned to driver’s licenses that will be valid for eight years instead of four. Drivers who are 65 and older will receive a four-year license only.

The DMV may require an applicant for a renewal license to pass a vision test only if they plan to renew their license in person.

All persons who renew a license after it has expired may be required to complete all portions of the original license examination such as knowledge, skills, and vision tests.

Every license is renewable. It can be renewed online at any time before its expiration upon application and payment of the required fee, or it can be renewed by mail.

Mail renewals may have an additional fee. Renewal must be made no later than 30 days before the expiration date. If it’s not renewed within that time, the DMV will send you an expiration notice.

Negligent Operator Treatment System (NOTS)

Every state in the U.S. has different ways they track negligent driving operation. In Nevada, they have a Demerit Point System. This table is a summary of Nevada’s NOTS.

| Type of Violation | Demerit Points on License |

|---|---|

| Reckless Driving | 8 |

| Careless Driving | 6 |

| Failure to give information or render aid at the scene of an accident | 6 |

| Following too closely | 4 |

| Failure to yield right-of-way | 4 |

| Passing a school bus when signals are flashing | 4 |

| Hand-held cellphone use or texting | 4 |

| Disobeying a traffic signal or stop sign | 4 |

| Impeding traffic, driving too slowly | 2 |

| Failure to dim headlights | 2 |

| Speeding 1 - 10 mph over posted limit | 1 |

| Speeding 11 - 20 mph over posted limit | 2 |

| Speeding 21 - 30 mph over posted limit | 3 |

| Speeding 31 - 40 mph over posted limit | 4 |

| Speeding 41 mph or more over posted limit | 5 |

| Driving too fast for the conditions | 2 |

In addition to misdemeanor charges, most of the demerit points come with fines. Too many points on your license can get license revoked or suspended.

Rules of the Road

Now we’ve come to roadway rules for motorists in Nevada. In this sub-section we’ll talk about the type of law in Nevada, seat belt laws for adults and children, move over laws, speed limit averages, ridesharing, and automation on the road.

Fault vs. No-Fault

Nevada is a “Fault” state (often referred to as tort law).

According to Shook and Stone Injury Lawyers, Nevada is a tort state. This makes determining liability extremely important when it comes to compensation. Only those who are not more than 50 percent at fault for their injuries can collect compensation from the other driver’s insurance.

Here’s a video explaining how “fault” law works in Nevada.

https://www.youtube.com/watch?v=BHliacp2kZo

Seat Belt and Car Seat Laws

Nevada seat belt laws are straight forward. Seat belts are required for all drivers and all passengers who weigh over 60 lbs and are six years old and older. No one under 18 can ride in the cargo area of a pickup truck. There are some exceptions to farming vehicles.

Children six years old and younger and who weigh under 60 lbs must be secured in a child restraint seat. Failure to properly secure children under the age and weight conditions may result in fines, community service, or the suspension of your driver’s license.

Keep Right and Move Over Laws

Motorists approaching any car accident or emergency vehicles are required to slow down less than the posted roadway speed. Motorists should safely move to a non-adjacent lane and be prepared to stop.

Since October 2019, this law applies when approaching vehicles displaying non-flashing blue lights in the back.

Tow trucks and service vehicles under contract with Nevada Department of Transportation (NDOT) are now allowed to display non-flashing blue lights.

Speed Limits

Speed limits in Nevada are higher than average. For rural interstates, the speed limit is 80 mph. However, the speed limits for urban interstates are 65 mph. All other access roads and limited roads have a speed limit of 70 mph. Residential and commercial roads within cities and towns have speed limits much less than 70 mph.

Ridesharing

Because Nevada has so many tourist attractions, ridesharing is very popular. Most major ridesharing services are in Nevada’s largest cities as well. The car insurance companies that collaborate with ridesharing services in Nevada are Allstate, Mercury, and State Farm.

Automation on the Road

Innovation is continuously growing. Nevada is one of the first states to legalize self-driving vehicles on its roads. In 2015, Daimler’s first autonomous 18-wheeler was tested on the road under Governor Brian Sandoval’s administration.

According to the Hartford report of Nevada, a driverless shuttle bus was piloted in Downtown Las Vegas. Eight different manufacturers are testing more than a dozen autonomous vehicles in Nevada.

Safety Laws

We covered some safety laws, but we didn’t talk about DUI, marijuana-impaired, and distracted driving laws. This sub-section will cover those laws.

DUI Laws

DUI safety law is a strict law that carries hefty fines and jail time if it violated. The table above describes these punishments thoroughly.

| Offense | ALS or Revocation | Imprisonment | Fine | Other |

|---|---|---|---|---|

| 1st Offense | 90 days; eligible for restricted license after half of revocation period | 2 days - 6 months OR 96 hours community service | $400-$1000 | SR-22 for three years; pay $150 for DUI school; may be ordered to attend treatment program |

| 2nd Offense | 1 year, not eligible for restricted license | 10 days to 6 months of jail or residential confinement | $750-$1000 | possible vehicle registration suspension, may be ordered to attend treatment program or be placed under clinical supervision of treatment facility for up to one year |

| 3rd Offense | 3rd in 7 years: 3 years, restricted license may be issued | 3rd in 7 years: 1-6 years | 3rd in 7 years: $2000-$5000 | possible vehicle registration suspension; may be ordered to attend a program of treatment for 3 year minimum |

There is a zero-tolerance policy for DUIs in Nevada.

Marijuana-Impaired Driving Laws

Nevada does have a law for marijuana-impaired drivers. Here’s a short video describing that law.

Distracted Driving Laws

Using any handheld device while driving is illegal in Nevada.

If you’re caught using any device while driving, the fines are:

- First Offense – $50 for the first offense within seven years

- Second Offense – $100

- Third and Subsequent Offenses – $250.

Fines can be doubled if the offense occurs in a work zone, and courts may give you additional fees.

The first offense is not treated as a moving violation, but the second or subsequent offenses will add four demerit points to your driver’s license.

Drivers are permitted to talk using a hands-free headset or vehicular microphone to make voice-activated calls.

Exceptions to using a handheld device include reporting a medical emergency, a safety hazard or criminal activity. Also, utility workers responding to outages and emergencies are permitted to use devices provided by the company.

Law enforcement officers, firefighters and emergency medical personnel acting within the scope of their employment are allowed to use their handheld devices.

For teens, they are banned from using any device while driving on Nevada’s roadways.

Driving in Nevada

What’s it like to drive in Nevada? We can give you an idea in this section of the guide. First, we’re going to provide some critical data about vehicle thefts and fatality totals of Nevada. Also, we will talk about transportation data such as commute time, common methods of travel, and commuter transportation.

Vehicle Theft in Nevada

One of the most unexpected things that can happen to any motorist is to have their vehicle stolen. Therefore, it’s only fair that we make our readers aware of theft data in Nevada. The table provided will reflect those vehicles stolen in Nevada.

| Rank | Make/Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 1 | Honda Accord | 1996 | 1,048 |

| 2 | Honda Civic | 1998 | 1,011 |

| 3 | Chevrolet Pickup (Full Size) | 2006 | 377 |

| 4 | Ford Pickup (Full Size) | 2006 | 279 |

| 5 | Toyota Camry | 2015 | 254 |

| 6 | Nissan Maxima | 1997 | 208 |

| 7 | Nissan Altima | 1997 | 207 |

| 8 | Nissan Sentra | 2014 | 200 |

| 9 | Toyota Corolla | 2014 | 151 |

| 10 | Dodge Pickup (Full Size) | 2005 | 148 |

Honda Accords were the vehicles likely stolen by criminals, which may be due to the high number of Honda Accords on the road.

Vehicle Theft by City

Let’s narrow the scope a little more and examine the number of thefts by the city.

| City | Motor vehicle theft |

|---|---|

| Boulder City | 20 |

| Carlin | 5 |

| Elko | 59 |

| Fallon | 13 |

| Henderson | 641 |

| Las Vegas Metropolitan Police Department | 8,186 |

| Lovelock | 3 |

| Mesquite | 40 |

| North Las Vegas | 1,321 |

| Reno | 1,432 |

| Sparks | 417 |

| West Wendover | 14 |

| Winnemucca | 15 |

| Yerington | 3 |

Las Vegas, including North Las Vegas, had over 9,000 thefts. Las Vegas is one of the most popular cities in the U.S. and vehicle thieves are always on the lookout for careless moments from law-abiding motorists. It may be helpful in the long run to add comprehensive coverage to ensure that you’re covered if the event should occur.

Road Fatalities in Nevada

Car insurance premiums are often calculated because of statistics collected every year. Some of those statistics involve crash fatalities. Fatalities happen more than we want them to, and the DMV, law enforcement, and court are in constant pursuit of minimizing fatalities on the roadway.

Most Fatal Highway in Nevada

The deadliest highway in Nevada is Interstate 80 (I-80). Geotab reported that an estimated 15 fatal accidents occur on I-80 every year. So far, 153 crashes and 170 fatalities have been reported.

Fatal Crashes by Weather Conditions and Light Conditions

Sometimes, crashes aren’t caused by other individuals. Weather and light conditions can disorient a driver, causing serious injuries and sometimes, death. Here are the number of fatalities caused by weather and light conditions.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 121 | 104 | 40 | 7 | 0 | 272 |

| Rain | 1 | 6 | 1 | 0 | 0 | 8 |

| Snow/Sleet | 3 | 0 | 1 | 0 | 0 | 4 |

| Other | 4 | 0 | 1 | 0 | 0 | 5 |

| Unknown | 0 | 0 | 1 | 0 | 0 | 1 |

| TOTAL | 129 | 110 | 44 | 7 | 0 | 290 |

More people died in fatal crashes during the day than any other weather or light condition in the table.

Fatalities (All Crashes) by County

When we narrow our scope even more, we can view all the crash data by county in Nevada.

| County | 2014 Fatalites | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalies | 2014 Fatalities per 100K Population | 2015 Fatalities per 100K Population | 2016 Fatalities per 100K Population | 2017 Fatalities per 100K Population | 2018 Fatalities per 100K Population |

|---|---|---|---|---|---|---|---|---|---|---|

| Carson City | 5 | 2 | 7 | 3 | 2 | 9.24 | 3.7 | 12.93 | 5.49 | 3.61 |

| Churchill County | 4 | 5 | 8 | 6 | 4 | 16.79 | 20.89 | 33.52 | 25.01 | 16.37 |

| Clark County | 174 | 210 | 217 | 208 | 220 | 8.47 | 10.01 | 10.14 | 9.53 | 9.86 |

| Douglas County | 3 | 7 | 5 | 11 | 2 | 6.33 | 14.76 | 10.45 | 22.91 | 4.13 |

| Elko County | 13 | 12 | 8 | 9 | 10 | 24.74 | 23.19 | 15.35 | 17.19 | 19.06 |

| Esmeralda County | 3 | 5 | 3 | 4 | 4 | 363.64 | 602.41 | 363.2 | 474.5 | 484.26 |

| Eureka County | 5 | 4 | 1 | 0 | 0 | 251.51 | 197.14 | 51.65 | 0 | 0 |

| Humboldt County | 10 | 8 | 5 | 3 | 4 | 58.08 | 47 | 29.78 | 17.96 | 23.83 |

| Lander County | 3 | 5 | 3 | 3 | 2 | 50.23 | 84.98 | 52.67 | 53.53 | 35.87 |

| Lincoln County | 3 | 4 | 1 | 0 | 5 | 57.73 | 77.87 | 19.4 | 0 | 96.14 |

| Lyon County | 12 | 7 | 1 | 10 | 12 | 23.37 | 13.47 | 1.9 | 18.55 | 21.5 |

| Mineral County | 0 | 2 | 4 | 1 | 2 | 0 | 45.23 | 91.32 | 22.45 | 44.31 |

| Nye County | 12 | 11 | 6 | 9 | 14 | 28 | 25.59 | 13.86 | 20.43 | 30.87 |

| Pershing County | 4 | 1 | 1 | 2 | 3 | 59.65 | 15.1 | 15.19 | 30.9 | 45 |

| Storey County | 2 | 2 | 2 | 0 | 1 | 52.59 | 51.57 | 50.1 | 0 | 24.82 |

| Washoe County | 38 | 37 | 50 | 40 | 44 | 8.71 | 8.36 | 11.11 | 8.75 | 9.45 |

| White Pine County | 0 | 4 | 7 | 2 | 1 | 0 | 40.58 | 72.01 | 20.84 | 10.55 |

Clark County had the most fatal accidents in a five-year trend, while Mineral County had the lowest fatality crash data in Nevada.

Traffic Fatalities

What happens when we split up the coverage area from rural to urban? Are urban areas more likely to encounter fatal accidents than rural areas? Let’s examine the data.

| Traffic Fatalities | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|

| Total (C-1) | 243 | 257 | 246 | 261 | 266 | 291 | 326 | 329 | 311 | 330 |

| Rural | 106 | 104 | 108 | 77 | 82 | 91 | 108 | 104 | 81 | 89 |

| Urban | 137 | 153 | 137 | 184 | 184 | 200 | 214 | 222 | 226 | 239 |

| Unknown | 0 | 0 | 1 | 0 | 0 | 0 | 4 | 3 | 4 | 2 |

Due to the population numbers, Nevada’s urban areas are more likely to experience fatal crashes than rural areas. The table reflects this in the numbers from 2009 to 2018.

Fatalities by Person Type

The table below describes the difference between occupants and nonoccupants in the event of a fatal accident. An occupant would be someone who is in a vehicle, a motorcyclist on a motorcycle, and a nonoccupant (pedestrian).

| Person Type | Total # of Fatalities | Total % of Fatalities |

|---|---|---|

| Total Occupants | 179 | 54 |

| Total Motorcyclists | 59 | 18 |

| Total Nonoccupants | 92 | 28 |

Based on the data provided, 54 percent of people who died in a fatal crash in Nevada died while driving a motor vehicle. 28 percent of nonoccupants were involved in fatal crashes.

Fatalities by Crash Type

The crash type describes how the vehicle was involved in a fatal accident. The data table in this sub-section describes the totals of crash types, such as crashes where vehicle collision causes the vehicle to leave the roadway.

| Crash Type | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2018 Fatalities |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 291 | 326 | 329 | 311 | 330 |

| - (1) Single Vehicle | 172 | 193 | 190 | 174 | 182 |

| - (2) Involving a Large Truck | 17 | 27 | 29 | 37 | 24 |

| - (3) Involving Speeding | 100 | 112 | 126 | 95 | 92 |

| - (4) Involving a Rollover | 86 | 92 | 85 | 71 | 74 |

| - (5) Involving a Roadway Departure | 121 | 152 | 123 | 107 | 114 |

| - (6) Involving an Intersection (or Intersection Related) | 88 | 89 | 108 | 105 | 105 |

More fatal accidents occurred when a single-vehicle driver was involved, followed by fatal crashes where vehicles left the roadway.

Five-Year Trend for the Top 10 Nevada Counties

Let’s draw our focus to the counties in Nevada with the most fatal crashes in five years.

| Rank | County | 2014 Fatalities per 100K Population | 2015 Fatalities per 100K Population | 2016 Fatalities per 100K Population | 2017 Fatalities per 100K Population | 2018 Fatalities per 100K Population |

|---|---|---|---|---|---|---|

| 1 | Esmeralda County | 363.64 | 602.41 | 363.2 | 474.5 | 484.26 |

| 2 | Lincoln County | 57.73 | 77.87 | 19.4 | 0 | 96.14 |

| 3 | Pershing County | 59.65 | 15.1 | 15.19 | 30.9 | 45 |

| 4 | Mineral County | 0 | 45.23 | 91.32 | 22.45 | 44.31 |

| 5 | Lander County | 50.23 | 84.98 | 52.67 | 53.53 | 35.87 |

| 6 | Nye County | 28 | 25.59 | 13.86 | 20.43 | 30.87 |

| 7 | Storey County | 52.59 | 51.57 | 50.1 | 0 | 24.82 |

| 8 | Humboldt County | 58.08 | 47 | 29.78 | 17.96 | 23.83 |

| 9 | Lyon County | 23.37 | 13.47 | 1.9 | 18.55 | 21.5 |

| 10 | Elko County | 24.74 | 23.19 | 15.35 | 17.19 | 19.06 |

| Sub Rate 1.* | Top Ten Counties | 35.55 | 39.64 | 33.74 | 23.87 | 28.9 |

| Sub Rate 2.** | All Other Counties | 8.52 | 9.87 | 10.27 | 9.42 | 9.62 |

| Total Rate | All Counties | 10.32 | 11.36 | 11.27 | 10.46 | 10.88 |

Despite the size of Nevada, there aren’t many counties in the state. The county with the most fatalities per 100,000 people is Esmerelda County, which had the most fatalities in 2015.

Fatalities Involving Speeding by County

Fatalities caused by speeding are often considered vehicular homicide or manslaughter. Here are the numbers by county.

| County Name | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2015 Fatalities per 100K Population | 2016 Fatalities per 100K Population | 2017 Fatalities per 100K Population |

|---|---|---|---|---|---|---|

| Esmeralda County | 1 | 0 | 2 | 120.63 | 0.00 | 235.29 |

| Mineral County | 0 | 2 | 1 | 0.00 | 45.50 | 22.44 |

| White Pine County | 0 | 0 | 1 | 0.00 | 0.00 | 10.43 |

| Churchill County | 1 | 2 | 2 | 4.16 | 8.33 | 8.25 |

| Nye County | 4 | 1 | 3 | 9.29 | 2.30 | 6.79 |

| Lyon County | 1 | 0 | 3 | 1.92 | 0.00 | 5.54 |

| Douglas County | 1 | 2 | 2 | 2.11 | 4.17 | 4.14 |

| Elko County | 2 | 3 | 2 | 3.86 | 5.74 | 3.80 |

| Carson City | 0 | 2 | 2 | 0.00 | 3.68 | 3.65 |

| Clark County | 79 | 94 | 69 | 3.74 | 4.36 | 3.13 |

| Washoe County | 14 | 16 | 8 | 3.15 | 3.54 | 1.74 |

| Eureka County | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 |

| Humboldt County | 4 | 2 | 0 | 23.43 | 11.85 | 0.00 |

| Lander County | 2 | 1 | 0 | 33.85 | 17.35 | 0.00 |

| Lincoln County | 2 | 0 | 0 | 38.93 | 0.00 | 0.00 |

| Pershing County | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 |

| Storey County | 1 | 1 | 0 | 25.83 | 25.07 | 0.00 |

In a 3-year trend, five counties had low to nonexistent fatalities caused by speeding. The highest fatalities caused by speeding were in Clark County.

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

As much as Nevada law enforcement and courts try to minimize DUIs, they still occur. Here are the stats for fatal crashes caused by alcohol-impaired drivers by County.

| County Name | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities | 2015 Fatalities per 100k Population | 2016 Fatalities per 100k Population | 2017 Fatalities per 100k Population |

|---|---|---|---|---|---|---|

| Lander County | 0 | 1 | 1 | 0.00 | 17.35 | 17.57 |

| Elko County | 4 | 2 | 5 | 7.71 | 3.83 | 9.50 |

| Humboldt County | 2 | 1 | 1 | 11.72 | 5.93 | 5.94 |

| Douglas County | 1 | 1 | 2 | 2.11 | 2.09 | 4.14 |

| Washoe County | 14 | 27 | 16 | 3.15 | 5.97 | 3.47 |

| Clark County | 69 | 59 | 62 | 3.27 | 2.74 | 2.81 |

| Nye County | 2 | 4 | 1 | 4.65 | 9.22 | 2.26 |

| Lyon County | 1 | 0 | 1 | 1.92 | 0.00 | 1.85 |

| Carson City | 1 | 1 | 0 | 1.85 | 1.84 | 0.00 |

| Churchill County | 0 | 2 | 0 | 0.00 | 8.33 | 0.00 |

| Esmeralda County | 1 | 0 | 0 | 120.63 | 0.00 | 0.00 |

| Eureka County | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 |

| Lincoln County | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 |

| Mineral County | 0 | 1 | 0 | 0.00 | 22.75 | 0.00 |

| Pershing County | 1 | 0 | 0 | 15.09 | 0.00 | 0.00 |

| Storey County | 1 | 2 | 0 | 25.83 | 50.14 | 0.00 |

| White Pine County | 0 | 2 | 0 | 0.00 | 20.53 | 0.00 |

Clark County remains the county with the highest fatalities, even in fatal crashes caused by an alcohol-impaired driver.

Teen Drinking and Driving

Nevada ranks 25 in the U.S. for DUI arrests. Listed below is extensive data showing Nevada DUI stats and comparing them to the national average.

| 2017 Arrest Summary | 2017 Nevada Stats | 2017 National Average |

|---|---|---|

| Under 18: Driving under the influence | 50 | 5,135 |

| Total: Driving under the influence | 9,470 | 1,017,808 |

| Under 18: Liquor laws | 372 | 29,073 |

| Total: Liquor laws | 1,950 | 234,899 |

| Under 18: Drunkenness | 4 | 3,805 |

| Total: Drunkenness | 241 | 376,433 |

If you divide Nevada’s totals by the national average, you will be able to find the percentage that represents Nevada. For example, if we divide the Under 18: Driving Under the Influence row will see that Nevada is one percent of the national average totals.

EMS Response Time

Emergency responders try to respond to crashes as quickly as possible. Every year, the National Highway Traffic Safety Administration (NHTSA) records the average response time for each state. That data is provided in a concise table below.

| Location of EMS | Time of Crash to EMS Notification* | EMS Notification to EMS Arrival* | EMS Arrival at Scene to Hospital Arrival* | Time of Crash to Hospital Arrival* | Total Fatal Crashes Record |

|---|---|---|---|---|---|

| Urban | 2 | 6 | 23 | 30 | 212 |

| Rural | 6 | 26 | 21 | 47 | 75 |

*This is an indicator that the time spent is in minutes.

The response time for EMS varies. The averages are the sum of totals throughout the year that’s divided by the number of days in the year. Urban areas in Nevada have a stable response time. Rural areas of Nevada have a slower than average EMS Notification to EMS Arrival time.

Transportation

Finally, let’s look at some transportation data. This sub-section will feature how many cars the average Nevada resident owns, the average commute time for motorists in Nevada, the most common method of travel, and traffic congestion within one of the most popular cities in Nevada.

Car Ownership

Approximately 41 percent of motorists own two cars in Nevada. 22 percent own only one car. Only 4 percent of motorists in Nevada own five or more cars.

Commute Time

The average commute time in Nevada is 23 minutes, which is three minutes less than the 26 minute national average commute time. Only 2 percent of Nevada working residents have super commutes, which are commutes that lasts 90 minutes or more.

Commuter Transportation

The most common method of travel in Nevada is by car. Eighty percent of Nevada’s motorists drive alone to work and only 10 percent carpool to work. Roughly 4 percent of people that work from home.

Traffic Congestion in Nevada

In terms of traffic congestions, we’re going to cover one of the most prolific cities in the U.S.: Las Vegas.

Congestion levels in Las Vegas are about 16 percent for highways and 22 percent for other access roads. If we multiply 16 percent by the average commute time, we’ll how much time is affected by congestion levels.

These congestion levels increase during peak workday hours which are 8 a.m. and 5 p.m. Morning peak levels in Nevada are 25 percent and evening peak levels are 40 percent. Expect commute times peak hours to take about eight minutes more for every 30 minutes for morning commutes and 12 minutes more for evening commutes.

Again, it’s impossible to absorb all the laws of Nevada, but this guide provides the essentials you need to know to understand safety laws, road laws, and car insurance rates. Speaking of which, you can get a second look at some car insurance rates by using our car insurance rate tool provided in the free quote box below.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Frequently Asked Questions

What are the minimum car insurance coverage requirements in Nevada?

In Nevada, the minimum car insurance coverage requirements are 25/50/20, which means $25,000 for bodily injury or death of one person, $50,000 for bodily injury or death of two or more persons, and $20,000 for property damage.

is there a grace period for car insurance in Nevada?

No, there is absolutely no grace period for car insurance in Nevada. If your coverage lapses even for a day, your state registration could be suspended.

What is the average cost of car insurance in Nevada?

The average monthly cost of car insurance in Nevada is around $88.

How can I compare car insurance rates in Nevada?

To compare car insurance rates in Nevada, you can enter your ZIP code on our website to get free quotes from top companies and find the most affordable coverage.

What are the additional liability coverages in Nevada?

The additional liability coverages in Nevada include:

- Personal Injury Protection (PIP)

- Medical Payments (MedPay)

- Uninsured/Underinsured Motorist (UUM or UIM) coverage.

Are there any add-ons or endorsements available for car insurance in Nevada?

Yes, there are several add-ons and endorsements available for car insurance in Nevada, such as Guaranteed Auto Protection (GAP), Personal Umbrella Policy (PUP), Rental Reimbursement, Emergency Roadside Assistance, and more. It’s best to consult with your insurance agent to determine which endorsements suit your needs.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.