Best North Dakota Car Insurance (2025)

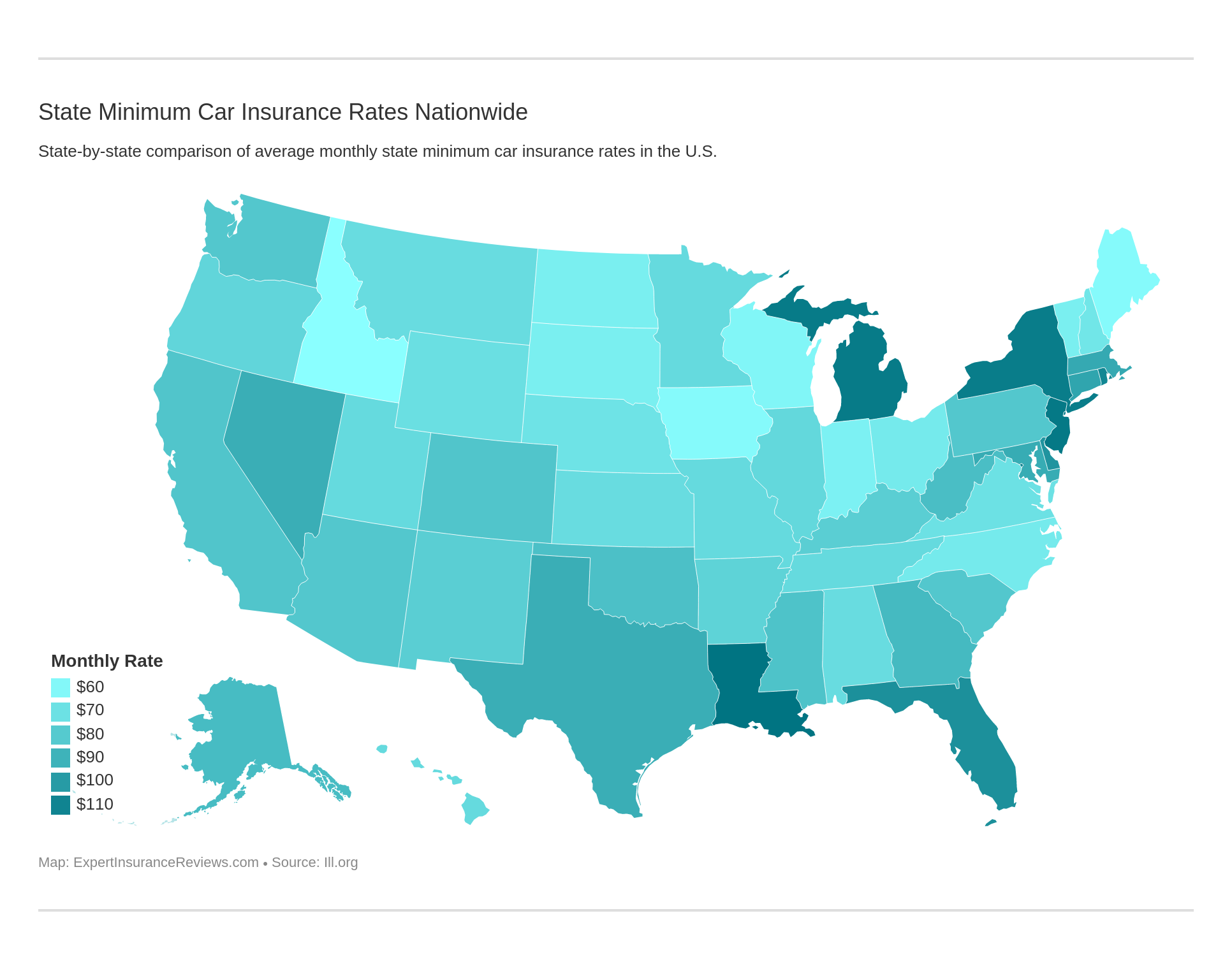

North Dakota car insurance laws require that all drivers in the state carry a minimum of 25/50/25 for bodily injury and property damage coverage and a minimum of 30/25/50 for PIP and uninsured motorist coverage. North Dakota auto insurance rates average $30 per month for minimum coverage and $64 per month for a full coverage policy.

Read moreFree Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- North Dakota minimum car insurance requirements are 25/50/10 for BIL and PDL and 30/25/50 for PIP and UM coverage

- North Dakota car insurance rates average $64 per month

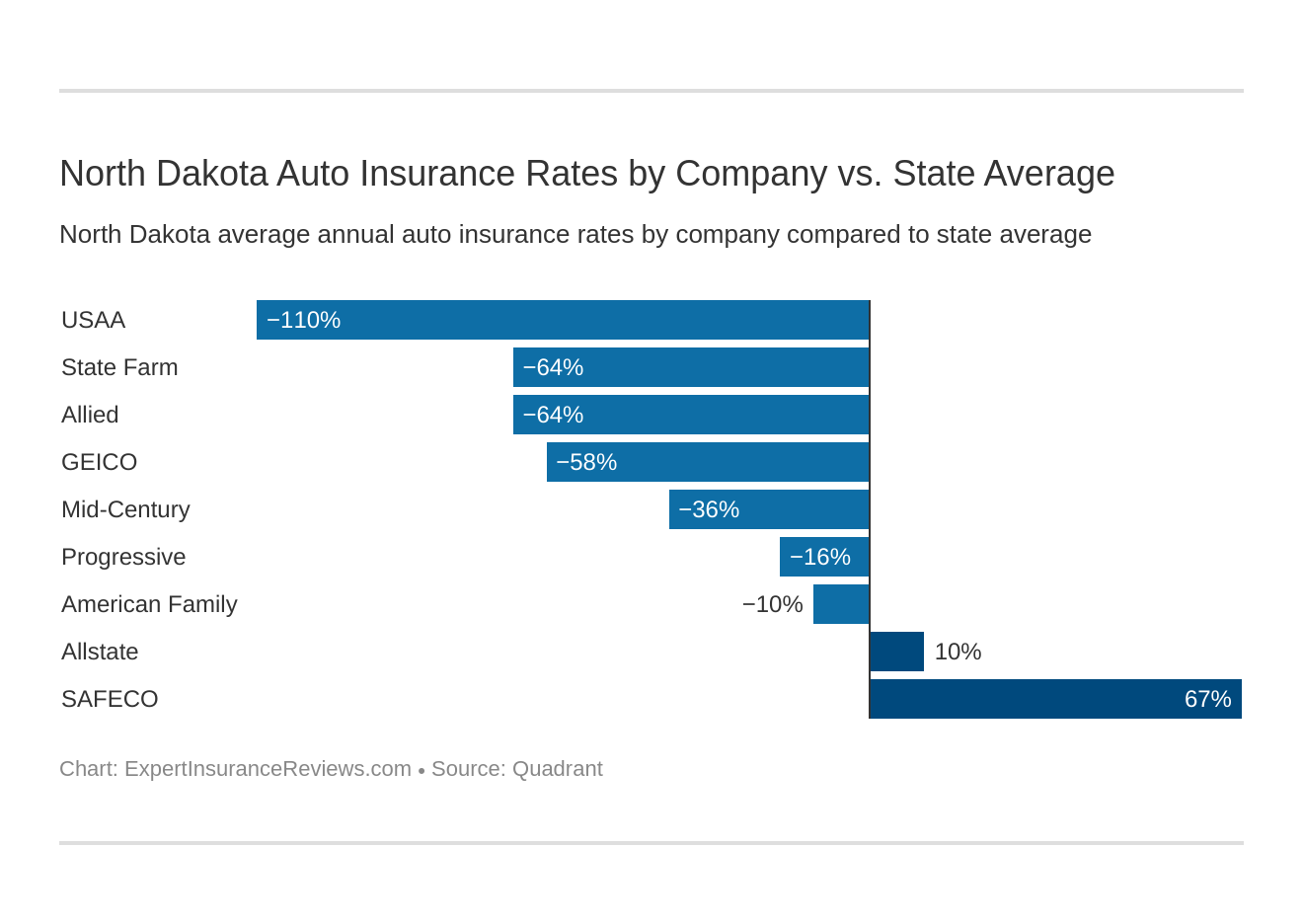

- The cheapest car insurance company in North Dakota is USAA

| North Dakota Statistics Summary | Statistics |

|---|---|

| Road Miles 2015 | Total in State: 87,128 Vehicle Miles Driven: 10,036 Million |

| Vehicles 2015 | Registered: 851,795 Total Stolen: 1,583 |

| State Population | 760,077 |

| Most Popular Vehicle | Ford F-150 |

| Percentage of Motorists Uninsured | 6.80% State Rank: 45th |

| Driving Deaths | Speeding (2008-2017) Total: 419 Drunk Driving (2008-2017) Total: 547 |

| Average Premiums 2015 (Annual) | Liability: $298.18 Collision: $244.09 Comprehensive: $231.04 Combined Premium: $773.30 |

| Cheapest Provider | USAA and Allied P&C |

Before you can drive your vehicle through North Dakota’s scenic landscapes, you’ll need to make sure your car is properly insured. If you’re new to North Dakota or are thinking of switching providers, you know that researching a car insurance provider is hard.

After all, how do you know that a provider has the best rates and coverages for your needs?

To help you through the process of picking the perfect insurer in North Dakota, we are going to cover rates and coverages. We are also going to cover North Dakota’s driving laws, traffic, and more.

So keep reading to learn about car insurance in North Dakota. If you want to search for the best online discounts by company, read our comprehensive reviews on top insurance companies.

North Dakota Car Insurance Coverage & Rates

How do you know you are getting the best coverages for the best price? Unless you’re an insurance expert, it can be hard to cut through insurers’ promises and fine print to see if you’re actually getting the best bargain.

Luckily, we’ve done the hard work for you.

In this section, we will cover what types of car insurance coverage North Dakota requires, as well as what the rates in North Dakota are. This way, you can compare rates and make sure you have the proper coverages.

Let’s dive right in.

North Dakota Minimum Coverage

To legally drive in North Dakota, you need to have North Dakota’s minimum car insurance amounts. While you can purchase more than the minimum coverages, which we highly recommend, the law requires you to have the following amounts of minimum liability coverage:

- $25,000 for the bodily injury or death of one person

- $50,000 for the bodily injury or death of two or more people

- $25,000 for property damages

In addition to these liability amounts, drivers in North Dakota must also have uninsured motorist coverage and Personal Injury Protection (PIP) in the following amounts:

- PIP Amount: $30,000 per person

- Uninsured Amounts: $25,000 per person and $50,000 per accident

Drivers must have these additional coverages because North Dakota is a no-fault state. Regardless of who caused the accident, drivers’ personal insurers will cover the accident costs.

So even if you didn’t cause the accident, you’ll have to file a claim with your insurer to receive benefits. Because of this, it pays to have more than the minimum amounts of insurance in case of an accident.

Forms of Financial Responsibility

Because car insurance is a legal requirement, you’ll have to provide proof of insurance when you register a car, when you are pulled over at a traffic stop, and when you are in an accident.

If you don’t provide proof of insurance, you could be slapped with fines and license suspension unless you can prove you have insurance within a certain time period.

Below are the acceptable forms of financial responsibility in North Dakota.

- Valid insurance ID Card

- Copy of your current insurance policy

- A certificate of self-insurance

North Dakota also allows drivers to provide electronic proof of insurance. If you have your insurer’s mobile app, you can download an electronic copy of your insurance ID card.

Of course, it’s still wise to carry a paper version, just in case your smartphone doesn’t cooperate at a traffic stop or is ruined in an accident.

Premiums as a Percentage of Income

Since incomes and rates can vary from state to state, the percentage of income you pay toward car insurance may change when you move to a new state.

We want to see what the average North Dakota resident spends on car insurance, so let’s take a look at average car insurance premiums and incomes in North Dakota.

| North Dakota Premiums as Percentage of Income | 2012 | 2013 | 2014 |

|---|---|---|---|

| Yearly Disposable Income | $50,227 | $49,309 | $51,311 |

| Yearly Full Coverage Auto Insurance | $714.75 | $743.27 | $768.09 |

| Insurance as Percentage of Income | 1.42% | 1.51% | 1.50% |

Disposable income is simply what income is left after taxes. In North Dakota, the disposable income is about $10,000 more than the countrywide average.

This is great, especially because the average cost of car insurance is also lower than the countrywide average.

In 2014, the countrywide cost of car insurance was $981, which is $208 more than North Dakota’s 2014 average.

Because North Dakota has lower rates and higher incomes, the percentage of income going to car insurance is very low. In fact, in 2014, North Dakota had the lowest percentage of income going to car insurance in the U.S.

This is fantastic and means that if you drive in North Dakota, you’ll get some of the lowest rates in the country. If you want to calculate your percentage of income going toward car insurance, you can use our free calculator below.

CalculatorPro

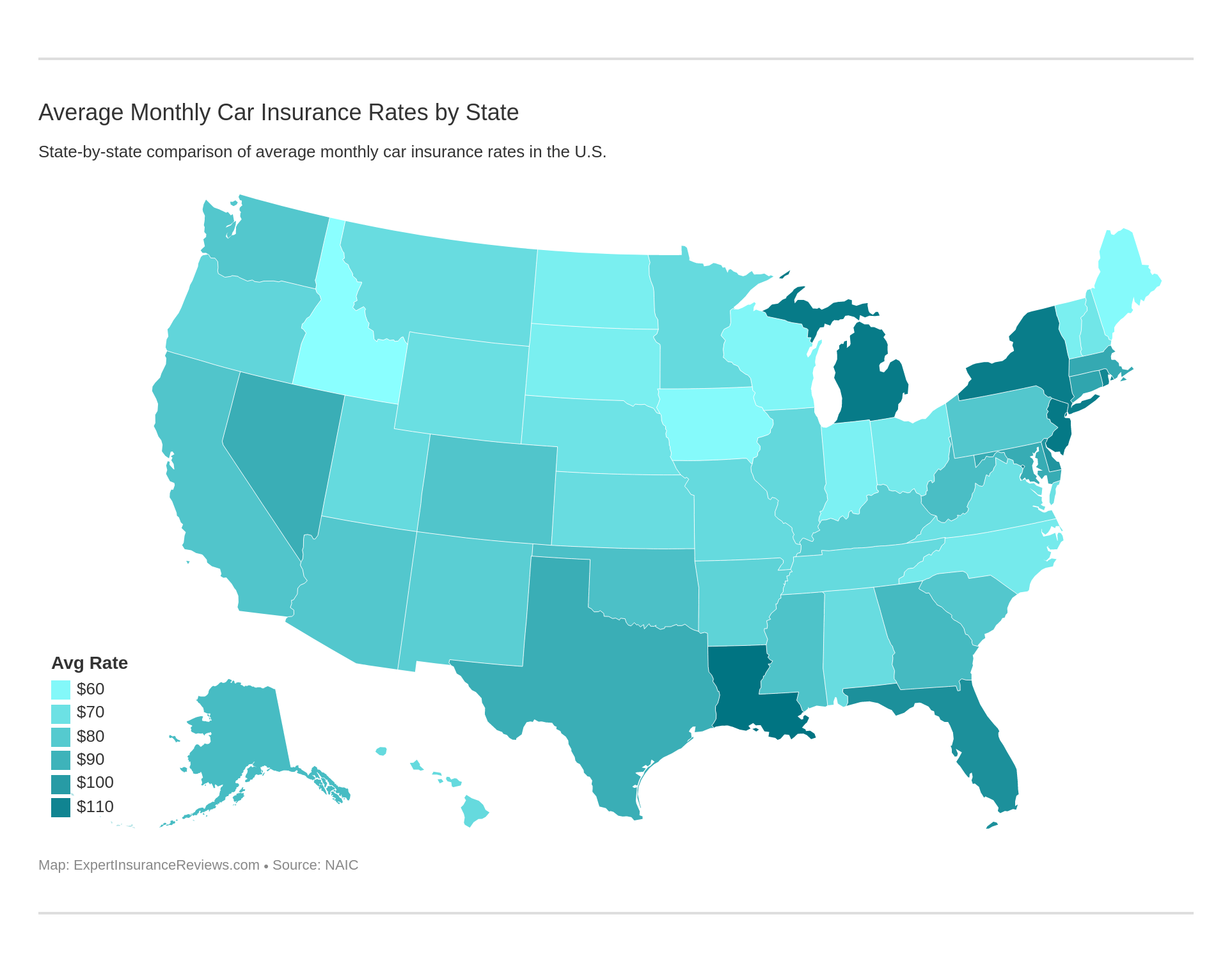

Average Monthly Car Insurance Rates in ND (Liability, Collision, Comprehensive)

Let’s dig a little deeper into North Dakota’s average rates by looking at the National Association of Insurance Commissioners’ (NAIC) information on the average rates for core coverages.

Please note that the NAIC’s data is based on the state minimum, so rates may be higher if you require more coverage or are a high-risk driver.

| Coverage Type | North Dakota Annual Costs (2015) | Countrywide Annual Costs (2015) |

|---|---|---|

| Liability | $298.18 | $538.73 |

| Collision | $244.09 | $322.61 |

| Comprehensive | $231.04 | $148.04 |

| Combined | $773.30 | $1,009.38 |

North Dakota’s average for 2015 was $236 cheaper than the countrywide average. While North Dakota’s comprehensive car insurance coverage does cost more, the rates for the other coverages were significantly cheaper.

Additional Liability

Earlier, we mentioned that North Dakota drivers must have uninsured and PIP coverage. Why do drivers need these coverages?

- Uninsured/underinsured coverage: Protects you if you’re in an accident with another driver who has little or no insurance.

- Personal Injury Protection: Covers your medical expenses after an accident.

We want to take a look at these additional coverages’ loss ratios, as well as the loss ratio for Medpay. Why do we care about loss ratios?

- High Loss Ratio: A company with a high loss ratio (over 100 percent) is paying out too many claims. Companies that do this risk going bankrupt.

- Low Loss Ratio: A company with a low loss ratio is paying out too few claims. Companies that do this risk losing customers because of multiple denied claims.

So let’s see how well North Dakota’s additional liability coverages are doing at paying out claims.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Personal Injury Protection (PIP) | 70.40% | 63.81% | 65.87% |

| Medical Payments (MedPay) | 0.0% | 0.0% | 0.0% |

| Uninsured/Underinsured Motorist Coverage | 58.03% | 50.58% | 49.57% |

All the additional coverages have loss ratios that are less than 100 percent, which is good. While PIP and uninsured coverages’ loss ratios have fallen from 2013, the loss ratios are still fairly high.

You’ve probably noticed that Medpay has had a zero loss ratio. This is because the NAIC seems to have not recorded premiums and loss ratios for North Dakota.

Since drivers must have PIP, which is similar to Medpay, it could also be that drivers simply elect to not have Medpay (hence no data recorded). Find out the best Medical Payments (MedPay) car insurance companies.

Add-Ons, Endorsements, & Riders

If you want to add more to your protection plan, the following add-ons are perfect to round out your policy.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Usage-Based Car Insurance

These add-ons are great for providing extra coverages and services, such as classic car insurance or roadside assistance.

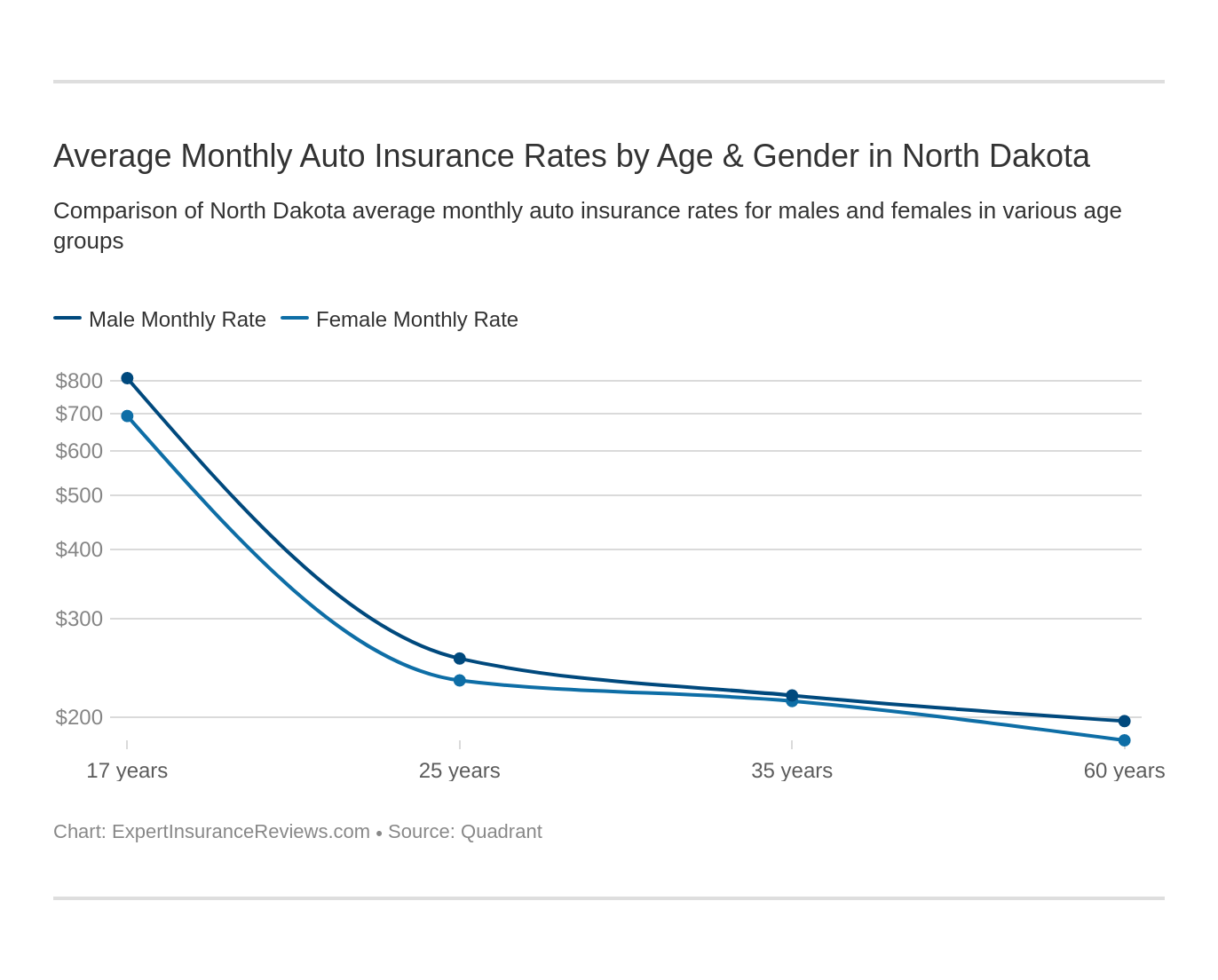

Average Monthly Car Insurance Rates by Age & Gender in ND

While some states have banned insurers from using gender as a rate determiner, North Dakota still allows insurers to base rates on drivers’ gender.

As of 2019, California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and parts of Mississippi have banned insurers from using gender to determine rates.

Because North Dakota insurance companies are allowed to use gender as a rating factor, we want to see the rate variations between genders (as well as age).

The following data (both gender data and other rate changes that we’ll cover shortly) is from our partnership with Quadrant.

Quadrant’s data is based on the coverages people actually purchase and includes rates for high-risk drivers, drivers who purchase more than the state minimum, and drivers who purchase additional coverages.

| Company | Single 17-year old female annual rates | Single 17-year old male annual rates | Single 25-year old female annual rates | Single 25-year old male annual rates | Married 35-year old female annual rates | Married 35-year old male annual rates | Married 60-year old female annual rates | Married 60-year old male annual rates |

|---|---|---|---|---|---|---|---|---|

| Allstate Insurance | $9,875.97 | $11,607.96 | $2,861.48 | $3,096.28 | $2,590.48 | $2,605.94 | $2,288.23 | $2,428.15 |

| American Family Mutual | $5,790.24 | $8,352.79 | $2,737.18 | $3,204.61 | $2,737.18 | $2,737.18 | $2,470.01 | $2,470.01 |

| Mid-Century Ins Co | $6,604.22 | $6,774.20 | $2,101.08 | $2,221.48 | $1,849.52 | $1,817.12 | $1,652.82 | $1,719.45 |

| Geico General | $4,118.08 | $5,176.02 | $1,932.65 | $2,146.59 | $2,140.76 | $2,124.33 | $1,843.20 | $1,864.30 |

| SAFECO Ins Co of America | $28,261.47 | $31,519.57 | $7,447.31 | $8,167.61 | $7,111.32 | $7,686.04 | $5,710.32 | $6,918.97 |

| Allied P&C | $4,070.66 | $5,037.47 | $2,078.84 | $2,210.12 | $1,826.79 | $1,873.86 | $1,636.45 | $1,748.60 |

| Progressive Northwestern | $7,671.25 | $8,577.02 | $2,574.11 | $2,604.38 | $2,097.81 | $2,000.91 | $1,698.60 | $1,760.43 |

| State Farm Mutual Auto | $4,560.32 | $5,771.61 | $1,846.44 | $2,086.33 | $1,653.32 | $1,653.32 | $1,456.43 | $1,456.43 |

| USAA GIC | $3,888.40 | $4,696.71 | $1,622.27 | $1,763.41 | $1,126.55 | $1,118.67 | $917.93 | $920.50 |

For the most part, males seem to pay more than females for car insurance. However, a few companies charge the same or similar rates for both genders in North Dakota.

For example, both genders in the categories of 35-year-old and 60-year-old drivers receive the same rates from American Family Mutual. Let’s take a look at the ranking of which gender and ages pay the worst and best auto insurance in North Dakota.

| Company | Demographic | Average Annual Rates |

|---|---|---|

| SAFECO Ins Co of America | Single 17-year old male | $31,519.57 |

| SAFECO Ins Co of America | Single 17-year old female | $28,261.47 |

| Allstate Insurance | Single 17-year old male | $11,607.96 |

| Allstate Insurance | Single 17-year old female | $9,875.97 |

| Progressive Northwestern | Single 17-year old male | $8,577.02 |

| American Family Mutual | Single 17-year old male | $8,352.79 |

| SAFECO Ins Co of America | Single 25-year old male | $8,167.61 |

| SAFECO Ins Co of America | Married 35-year old male | $7,686.04 |

| Progressive Northwestern | Single 17-year old female | $7,671.25 |

| SAFECO Ins Co of America | Single 25-year old female | $7,447.31 |

| SAFECO Ins Co of America | Married 35-year old female | $7,111.32 |

| SAFECO Ins Co of America | Married 60-year old male | $6,918.97 |

| Mid-Century Ins Co | Single 17-year old male | $6,774.20 |

| Mid-Century Ins Co | Single 17-year old female | $6,604.22 |

| American Family Mutual | Single 17-year old female | $5,790.24 |

| State Farm Mutual Auto | Single 17-year old male | $5,771.61 |

| SAFECO Ins Co of America | Married 60-year old female | $5,710.32 |

| Geico General | Single 17-year old male | $5,176.02 |

| Allied P&C | Single 17-year old male | $5,037.47 |

| USAA GIC | Single 17-year old male | $4,696.71 |

| State Farm Mutual Auto | Single 17-year old female | $4,560.32 |

| Geico General | Single 17-year old female | $4,118.08 |

| Allied P&C | Single 17-year old female | $4,070.66 |

| USAA GIC | Single 17-year old female | $3,888.40 |

| American Family Mutual | Single 25-year old male | $3,204.61 |

| Allstate Insurance | Single 25-year old male | $3,096.28 |

| Allstate Insurance | Single 25-year old female | $2,861.48 |

| American Family Mutual | Married 35-year old female | $2,737.18 |

| American Family Mutual | Married 35-year old male | $2,737.18 |

| American Family Mutual | Single 25-year old female | $2,737.18 |

| Allstate Insurance | Married 35-year old male | $2,605.94 |

| Progressive Northwestern | Single 25-year old male | $2,604.38 |

| Allstate Insurance | Married 35-year old female | $2,590.48 |

| Progressive Northwestern | Single 25-year old female | $2,574.11 |

| American Family Mutual | Married 60-year old female | $2,470.01 |

| American Family Mutual | Married 60-year old male | $2,470.01 |

| Allstate Insurance | Married 60-year old male | $2,428.15 |

| Allstate Insurance | Married 60-year old female | $2,288.23 |

| Mid-Century Ins Co | Single 25-year old male | $2,221.48 |

| Allied P&C | Single 25-year old male | $2,210.12 |

| Geico General | Single 25-year old male | $2,146.59 |

| Geico General | Married 35-year old female | $2,140.76 |

| Geico General | Married 35-year old male | $2,124.33 |

| Mid-Century Ins Co | Single 25-year old female | $2,101.08 |

| Progressive Northwestern | Married 35-year old female | $2,097.81 |

| State Farm Mutual Auto | Single 25-year old male | $2,086.33 |

| Allied P&C | Single 25-year old female | $2,078.84 |

| Progressive Northwestern | Married 35-year old male | $2,000.91 |

| Geico General | Single 25-year old female | $1,932.65 |

| Allied P&C | Married 35-year old male | $1,873.86 |

| Geico General | Married 60-year old male | $1,864.30 |

| Mid-Century Ins Co | Married 35-year old female | $1,849.52 |

| State Farm Mutual Auto | Single 25-year old female | $1,846.44 |

| Geico General | Married 60-year old female | $1,843.20 |

| Allied P&C | Married 35-year old female | $1,826.79 |

| Mid-Century Ins Co | Married 35-year old male | $1,817.12 |

| USAA GIC | Single 25-year old male | $1,763.41 |

| Progressive Northwestern | Married 60-year old male | $1,760.43 |

| Allied P&C | Married 60-year old male | $1,748.60 |

A teenage male will pay almost $30,000 more than a married, 60-year-old male. This enormous price increase for teenagers buying their insurance is why many parents put teenagers on the parents’ policy. Find out the best auto insurance for young adults.

The older drivers become though, the less they’ll pay for car insurance. Marriage can also lower car insurance costs because there are two people responsible for paying monthly premiums, which means they are more likely to stay on top of their car insurance.

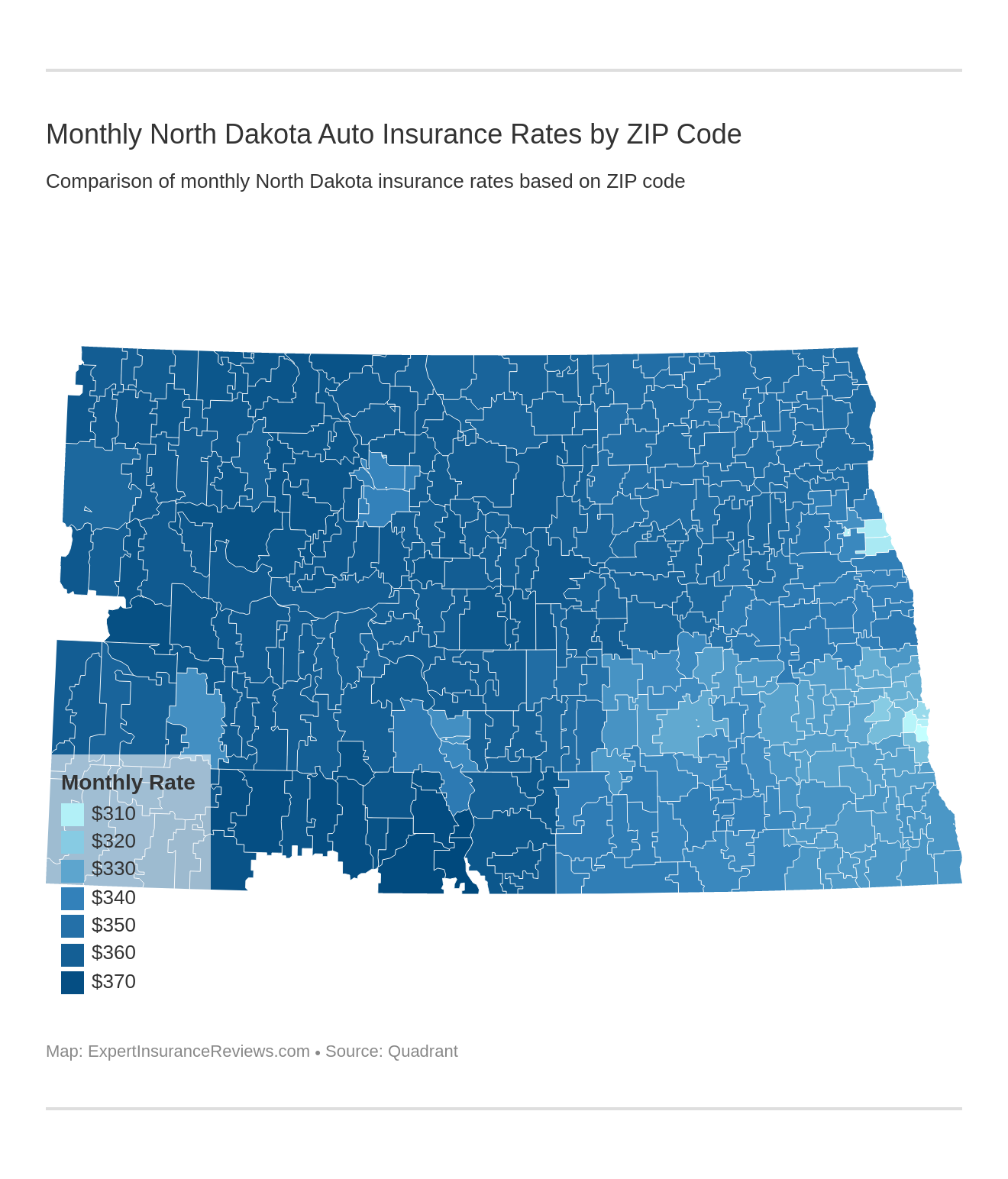

Cheapest Rates by Zip Code

Insurers look at the area customers live in to formulate rates. Areas with high crash records, high crime, or a high chance of natural disasters will have higher insurance rates.

The table below shows the average cost of car insurance by zip code, as well as providers’ rates.

| Zip Code | Annual Average | Allstate Insurance | American Family Mutual | Mid-Century Ins Co | GEICO General | SAFECO Ins Co of America | Allied P&C | Progressive Northwestern | State Farm Mutual Auto | USAA GIC |

|---|---|---|---|---|---|---|---|---|---|---|

| 58538 | $4,477.64 | $5,114.81 | $3,930.17 | $3,629.38 | $2,693.74 | $12,907.66 | $2,698.56 | $4,602.59 | $2,756.88 | $1,964.98 |

| 58528 | $4,474.33 | $5,114.81 | $3,930.17 | $3,761.79 | $2,693.74 | $12,907.66 | $2,698.56 | $4,440.38 | $2,756.88 | $1,964.98 |

| 58568 | $4,465.05 | $5,114.81 | $3,930.17 | $3,629.38 | $2,693.74 | $12,907.66 | $2,698.56 | $4,489.28 | $2,756.88 | $1,964.98 |

| 58569 | $4,462.61 | $5,114.81 | $3,930.17 | $3,629.38 | $2,693.74 | $12,907.66 | $2,698.56 | $4,467.28 | $2,756.88 | $1,964.98 |

| 58570 | $4,448.27 | $5,114.81 | $3,930.17 | $3,629.38 | $2,693.74 | $12,907.66 | $2,698.56 | $4,338.29 | $2,756.88 | $1,964.98 |

| 58529 | $4,441.63 | $5,114.81 | $3,930.17 | $3,629.38 | $2,693.74 | $12,907.66 | $2,698.56 | $4,278.47 | $2,756.88 | $1,964.98 |

| 58533 | $4,440.40 | $5,114.81 | $3,930.17 | $3,629.38 | $2,693.74 | $12,907.66 | $2,698.56 | $4,267.42 | $2,756.88 | $1,964.98 |

| 58646 | $4,435.21 | $5,114.81 | $3,930.17 | $3,351.22 | $2,693.74 | $12,907.66 | $2,772.54 | $4,424.95 | $2,756.88 | $1,964.98 |

| 58650 | $4,435.21 | $5,114.81 | $3,930.17 | $3,351.22 | $2,693.74 | $12,907.66 | $2,772.54 | $4,424.95 | $2,756.88 | $1,964.98 |

| 58634 | $4,432.73 | $5,108.65 | $3,930.17 | $3,231.84 | $2,693.74 | $13,110.33 | $2,772.54 | $4,262.07 | $2,756.88 | $2,028.39 |

| 58520 | $4,426.62 | $5,114.81 | $3,930.17 | $3,629.38 | $2,693.74 | $12,907.66 | $2,698.56 | $4,143.38 | $2,756.88 | $1,964.98 |

| 58564 | $4,421.20 | $5,114.81 | $3,930.17 | $3,629.38 | $2,693.74 | $12,907.66 | $2,698.56 | $4,094.63 | $2,756.88 | $1,964.98 |

| 58566 | $4,419.94 | $5,114.81 | $3,930.17 | $3,629.38 | $2,693.74 | $12,907.66 | $2,698.56 | $4,083.24 | $2,756.88 | $1,964.98 |

| 58763 | $4,415.86 | $4,614.80 | $4,275.38 | $3,153.74 | $2,693.74 | $13,110.33 | $2,698.56 | $4,410.94 | $2,756.88 | $2,028.39 |

| 58649 | $4,409.17 | $5,034.34 | $3,930.17 | $3,351.22 | $2,693.74 | $12,907.66 | $2,772.54 | $4,271.03 | $2,756.88 | $1,964.98 |

| 58769 | $4,407.67 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,321.89 | $2,756.88 | $2,028.39 |

| 58771 | $4,405.45 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,301.95 | $2,756.88 | $2,028.39 |

| 58639 | $4,402.71 | $5,114.81 | $3,930.17 | $3,351.22 | $2,693.74 | $12,907.66 | $2,772.54 | $4,132.40 | $2,756.88 | $1,964.98 |

| 58782 | $4,400.72 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,259.33 | $2,756.88 | $2,028.39 |

| 58756 | $4,398.33 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,237.84 | $2,756.88 | $2,028.39 |

| 58640 | $4,395.24 | $5,108.65 | $3,930.17 | $3,231.84 | $2,693.74 | $12,907.66 | $2,772.54 | $4,190.73 | $2,756.88 | $1,964.98 |

| 58746 | $4,392.89 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,188.87 | $2,756.88 | $2,028.39 |

| 58535 | $4,392.86 | $5,114.81 | $3,930.17 | $3,629.38 | $2,693.74 | $12,907.66 | $2,698.56 | $3,839.58 | $2,756.88 | $1,964.98 |

| 58721 | $4,392.34 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,183.89 | $2,756.88 | $2,028.39 |

| 58718 | $4,390.95 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,171.39 | $2,756.88 | $2,028.39 |

| 58653 | $4,390.28 | $5,034.34 | $3,930.17 | $3,351.22 | $2,693.74 | $12,907.66 | $2,772.54 | $4,100.97 | $2,756.88 | $1,964.98 |

| 58562 | $4,389.06 | $5,114.81 | $3,930.17 | $3,351.22 | $2,693.74 | $12,907.66 | $2,698.56 | $4,083.57 | $2,756.88 | $1,964.98 |

| 58835 | $4,386.72 | $4,505.04 | $3,930.17 | $3,231.84 | $2,693.74 | $13,110.33 | $2,772.54 | $4,451.60 | $2,756.88 | $2,028.39 |

| 58795 | $4,385.63 | $4,614.80 | $3,930.17 | $3,380.76 | $2,693.74 | $13,110.33 | $2,772.54 | $4,183.03 | $2,756.88 | $2,028.39 |

| 58734 | $4,385.54 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,122.73 | $2,756.88 | $2,028.39 |

| 58642 | $4,385.25 | $5,108.65 | $3,930.17 | $3,231.84 | $2,693.74 | $12,907.66 | $2,772.54 | $4,100.81 | $2,756.88 | $1,964.98 |

| 58725 | $4,383.60 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,105.29 | $2,756.88 | $2,028.39 |

| 58641 | $4,382.85 | $5,034.34 | $3,930.17 | $3,351.22 | $2,693.74 | $12,907.66 | $2,772.54 | $4,034.09 | $2,756.88 | $1,964.98 |

| 58444 | $4,380.17 | $5,108.65 | $4,029.25 | $3,170.38 | $2,693.74 | $13,110.33 | $2,642.63 | $3,881.33 | $2,756.88 | $2,028.39 |

| 58552 | $4,380.01 | $5,114.81 | $3,930.17 | $3,322.01 | $2,693.74 | $12,907.66 | $2,698.56 | $4,031.31 | $2,756.88 | $1,964.98 |

| 58573 | $4,380.01 | $5,114.81 | $3,930.17 | $3,322.01 | $2,693.74 | $12,907.66 | $2,698.56 | $4,031.31 | $2,756.88 | $1,964.98 |

| 58776 | $4,379.41 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,067.59 | $2,756.88 | $2,028.39 |

| 58524 | $4,379.34 | $5,114.81 | $3,930.17 | $3,322.01 | $2,693.74 | $12,907.66 | $2,698.56 | $4,025.29 | $2,756.88 | $1,964.98 |

| 58627 | $4,378.97 | $5,108.65 | $3,930.17 | $3,231.84 | $2,693.74 | $12,907.66 | $2,772.54 | $4,044.28 | $2,756.88 | $1,964.98 |

| 58770 | $4,378.62 | $4,614.80 | $4,029.25 | $3,153.74 | $2,693.74 | $13,110.33 | $2,698.56 | $4,321.89 | $2,756.88 | $2,028.39 |

| 58643 | $4,378.35 | $4,511.22 | $3,930.17 | $3,231.84 | $2,693.74 | $12,907.66 | $2,772.54 | $4,636.18 | $2,756.88 | $1,964.98 |

| 58792 | $4,376.39 | $4,649.46 | $4,029.25 | $3,287.58 | $2,693.74 | $13,110.33 | $2,642.63 | $4,189.24 | $2,756.88 | $2,028.39 |

| 58727 | $4,376.21 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,038.76 | $2,756.88 | $2,028.39 |

| 58737 | $4,376.21 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,038.76 | $2,756.88 | $2,028.39 |

| 58752 | $4,376.21 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,038.76 | $2,756.88 | $2,028.39 |

| 58772 | $4,376.21 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,038.76 | $2,756.88 | $2,028.39 |

| 58778 | $4,376.08 | $4,649.46 | $4,029.25 | $3,287.58 | $2,693.74 | $13,110.33 | $2,698.56 | $4,130.54 | $2,756.88 | $2,028.39 |

| 58549 | $4,375.70 | $5,114.81 | $3,930.17 | $3,322.01 | $2,693.74 | $12,907.66 | $2,698.56 | $3,992.50 | $2,756.88 | $1,964.98 |

| 58775 | $4,375.67 | $4,614.80 | $4,029.25 | $3,153.74 | $2,693.74 | $13,110.33 | $2,698.56 | $4,295.37 | $2,756.88 | $2,028.39 |

| 58787 | $4,375.63 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $4,033.59 | $2,756.88 | $2,028.39 |

| 58430 | $4,375.61 | $5,108.65 | $4,029.25 | $3,170.38 | $2,693.74 | $13,110.33 | $2,642.63 | $3,840.24 | $2,756.88 | $2,028.39 |

| 58463 | $4,375.61 | $5,108.65 | $4,029.25 | $3,170.38 | $2,693.74 | $13,110.33 | $2,642.63 | $3,840.24 | $2,756.88 | $2,028.39 |

| 58626 | $4,373.55 | $5,108.65 | $3,930.17 | $3,041.61 | $2,693.74 | $12,907.66 | $2,772.54 | $4,185.75 | $2,756.88 | $1,964.98 |

| 58830 | $4,372.77 | $4,505.04 | $3,930.17 | $3,380.76 | $2,693.74 | $13,110.33 | $2,772.54 | $4,177.05 | $2,756.88 | $2,028.39 |

| 58845 | $4,372.77 | $4,505.04 | $3,930.17 | $3,380.76 | $2,693.74 | $13,110.33 | $2,772.54 | $4,177.05 | $2,756.88 | $2,028.39 |

| 58735 | $4,370.28 | $4,614.80 | $4,029.25 | $3,153.74 | $2,693.74 | $13,110.33 | $2,698.56 | $4,246.78 | $2,756.88 | $2,028.39 |

| 58779 | $4,370.28 | $4,614.80 | $4,029.25 | $3,153.74 | $2,693.74 | $13,110.33 | $2,698.56 | $4,246.78 | $2,756.88 | $2,028.39 |

| 58759 | $4,369.62 | $4,614.80 | $4,029.25 | $3,153.74 | $2,693.74 | $13,110.33 | $2,698.56 | $4,240.90 | $2,756.88 | $2,028.39 |

| 58451 | $4,368.61 | $5,114.81 | $4,029.25 | $3,170.38 | $2,693.74 | $13,311.77 | $2,642.63 | $3,569.68 | $2,756.88 | $2,028.39 |

| 58794 | $4,366.39 | $4,614.80 | $4,029.25 | $3,380.76 | $2,693.74 | $13,110.33 | $2,698.56 | $3,984.79 | $2,756.88 | $2,028.39 |

| 58773 | $4,364.74 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $3,935.54 | $2,756.88 | $2,028.39 |

| 58838 | $4,364.51 | $4,505.04 | $3,930.17 | $3,231.84 | $2,693.74 | $13,110.33 | $2,772.54 | $4,251.66 | $2,756.88 | $2,028.39 |

| 58847 | $4,364.22 | $4,539.71 | $3,930.17 | $3,231.84 | $2,693.74 | $13,110.33 | $2,772.54 | $4,214.40 | $2,756.88 | $2,028.39 |

| 58647 | $4,363.97 | $5,034.34 | $3,930.17 | $3,231.84 | $2,693.74 | $12,907.66 | $2,772.54 | $3,983.57 | $2,756.88 | $1,964.98 |

| 58652 | $4,363.36 | $5,114.81 | $3,930.17 | $3,041.61 | $2,693.74 | $12,907.66 | $2,772.54 | $4,087.89 | $2,756.88 | $1,964.98 |

| 58733 | $4,363.23 | $4,614.80 | $4,029.25 | $3,090.35 | $2,693.74 | $13,110.33 | $2,698.56 | $4,246.78 | $2,756.88 | $2,028.39 |

| 58644 | $4,362.68 | $5,108.65 | $3,930.17 | $3,041.61 | $2,693.74 | $12,907.66 | $2,772.54 | $4,087.89 | $2,756.88 | $1,964.98 |

| 58856 | $4,361.79 | $4,505.04 | $3,930.17 | $3,281.94 | $2,693.74 | $13,110.33 | $2,772.54 | $4,177.05 | $2,756.88 | $2,028.39 |

| 58341 | $4,360.64 | $4,620.17 | $4,029.25 | $3,287.58 | $2,693.74 | $13,311.77 | $2,642.63 | $3,875.35 | $2,756.88 | $2,028.39 |

| 58760 | $4,359.44 | $4,649.46 | $4,029.25 | $3,236.05 | $2,693.74 | $13,110.33 | $2,642.63 | $4,088.22 | $2,756.88 | $2,028.39 |

| 58854 | $4,358.39 | $4,505.04 | $3,930.17 | $3,231.84 | $2,693.74 | $13,110.33 | $2,772.54 | $4,196.58 | $2,756.88 | $2,028.39 |

| 58625 | $4,357.46 | $5,108.65 | $3,930.17 | $3,041.61 | $2,693.74 | $12,907.66 | $2,772.54 | $4,040.94 | $2,756.88 | $1,964.98 |

| 58762 | $4,356.93 | $4,649.46 | $4,029.25 | $3,236.05 | $2,693.74 | $13,110.33 | $2,642.63 | $4,065.64 | $2,756.88 | $2,028.39 |

| 58849 | $4,356.90 | $4,614.80 | $3,764.24 | $3,281.94 | $2,693.74 | $13,110.33 | $2,772.54 | $4,189.20 | $2,756.88 | $2,028.39 |

| 58630 | $4,356.70 | $5,108.65 | $3,930.17 | $3,041.61 | $2,693.74 | $12,907.66 | $2,772.54 | $4,034.09 | $2,756.88 | $1,964.98 |

| 58789 | $4,356.65 | $4,649.46 | $4,029.25 | $3,236.05 | $2,693.74 | $13,110.33 | $2,642.63 | $4,063.15 | $2,756.88 | $2,028.39 |

| 58757 | $4,355.85 | $4,539.71 | $3,764.24 | $3,231.84 | $2,693.74 | $13,110.33 | $2,772.54 | $4,304.99 | $2,756.88 | $2,028.39 |

| 58761 | $4,355.73 | $4,614.80 | $4,029.25 | $3,236.05 | $2,693.74 | $13,110.33 | $2,698.56 | $4,033.59 | $2,756.88 | $2,028.39 |

| 58843 | $4,355.55 | $4,614.80 | $3,764.24 | $3,281.94 | $2,693.74 | $13,110.33 | $2,772.54 | $4,177.05 | $2,756.88 | $2,028.39 |

| 58656 | $4,354.69 | $5,108.65 | $3,930.17 | $3,041.61 | $2,693.74 | $12,907.66 | $2,772.54 | $4,016.01 | $2,756.88 | $1,964.98 |

| 58636 | $4,354.36 | $5,108.65 | $3,930.17 | $3,041.61 | $2,693.74 | $12,907.66 | $2,772.54 | $4,012.98 | $2,756.88 | $1,964.98 |

| 58313 | $4,351.04 | $4,649.46 | $4,029.25 | $3,287.58 | $2,693.74 | $13,311.77 | $2,642.63 | $3,759.65 | $2,756.88 | $2,028.39 |

| 58368 | $4,351.04 | $4,649.46 | $4,029.25 | $3,287.58 | $2,693.74 | $13,311.77 | $2,642.63 | $3,759.65 | $2,756.88 | $2,028.39 |

| 58711 | $4,351.02 | $4,614.80 | $4,029.25 | $3,236.05 | $2,693.74 | $13,110.33 | $2,642.63 | $4,047.13 | $2,756.88 | $2,028.39 |

| 58730 | $4,349.17 | $4,614.80 | $3,930.17 | $3,380.76 | $2,693.74 | $13,110.33 | $2,772.54 | $3,854.94 | $2,756.88 | $2,028.39 |

| 58755 | $4,349.17 | $4,614.80 | $3,930.17 | $3,380.76 | $2,693.74 | $13,110.33 | $2,772.54 | $3,854.94 | $2,756.88 | $2,028.39 |

| 58765 | $4,349.17 | $4,614.80 | $3,930.17 | $3,380.76 | $2,693.74 | $13,110.33 | $2,772.54 | $3,854.94 | $2,756.88 | $2,028.39 |

| 58651 | $4,348.27 | $4,511.22 | $3,930.17 | $3,351.22 | $2,693.74 | $12,907.66 | $2,772.54 | $4,246.06 | $2,756.88 | $1,964.98 |

| 58620 | $4,347.25 | $5,034.34 | $3,930.17 | $3,231.84 | $2,693.74 | $12,907.66 | $2,772.54 | $3,833.13 | $2,756.88 | $1,964.98 |

| 58740 | $4,346.05 | $4,614.80 | $3,916.59 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $3,879.95 | $2,756.88 | $2,028.39 |

| 58530 | $4,344.30 | $5,114.81 | $3,930.17 | $3,123.81 | $2,693.74 | $12,907.66 | $2,698.56 | $3,908.10 | $2,756.88 | $1,964.98 |

| 58741 | $4,342.64 | $4,649.46 | $4,029.25 | $3,236.05 | $2,693.74 | $13,110.33 | $2,642.63 | $3,937.02 | $2,756.88 | $2,028.39 |

| 58731 | $4,340.72 | $4,614.80 | $4,029.25 | $3,236.05 | $2,693.74 | $13,110.33 | $2,642.63 | $3,954.45 | $2,756.88 | $2,028.39 |

| 58716 | $4,338.28 | $4,649.46 | $4,029.25 | $2,888.70 | $2,693.74 | $13,110.33 | $2,698.56 | $4,189.24 | $2,756.88 | $2,028.39 |

| 58758 | $4,338.26 | $4,620.17 | $4,029.25 | $3,287.58 | $2,693.74 | $13,110.33 | $2,642.63 | $3,875.35 | $2,756.88 | $2,028.39 |

| 58521 | $4,337.91 | $5,114.81 | $3,930.17 | $3,170.38 | $2,693.74 | $12,907.66 | $2,698.56 | $3,804.00 | $2,756.88 | $1,964.98 |

| 58750 | $4,337.77 | $4,614.80 | $4,029.25 | $3,236.05 | $2,693.74 | $13,110.33 | $2,642.63 | $3,927.89 | $2,756.88 | $2,028.39 |

| 58486 | $4,337.52 | $4,834.94 | $4,029.25 | $3,170.38 | $2,693.74 | $13,311.77 | $2,642.63 | $3,569.68 | $2,756.88 | $2,028.39 |

| 58542 | $4,337.48 | $5,114.81 | $3,930.17 | $2,939.23 | $2,693.74 | $12,907.66 | $2,698.56 | $4,031.31 | $2,756.88 | $1,964.98 |

| 58833 | $4,336.98 | $4,505.04 | $3,930.17 | $3,380.76 | $2,693.74 | $13,110.33 | $2,772.54 | $3,854.94 | $2,756.88 | $2,028.39 |

| 58844 | $4,336.98 | $4,505.04 | $3,930.17 | $3,380.76 | $2,693.74 | $13,110.33 | $2,772.54 | $3,854.94 | $2,756.88 | $2,028.39 |

| 58852 | $4,336.83 | $4,614.80 | $3,764.24 | $3,380.76 | $2,693.74 | $13,110.33 | $2,772.54 | $3,909.76 | $2,756.88 | $2,028.39 |

| 58477 | $4,336.65 | $5,108.65 | $3,930.17 | $3,170.38 | $2,693.74 | $12,907.66 | $2,698.56 | $3,798.86 | $2,756.88 | $1,964.98 |

| 58418 | $4,336.13 | $4,834.94 | $4,029.25 | $3,170.38 | $2,693.74 | $13,311.77 | $2,642.63 | $3,557.23 | $2,756.88 | $2,028.39 |

| 58623 | $4,336.00 | $4,545.89 | $3,930.17 | $3,351.22 | $2,693.74 | $12,907.66 | $2,772.54 | $4,100.97 | $2,756.88 | $1,964.98 |

| 58540 | $4,335.37 | $4,649.46 | $3,695.26 | $3,153.74 | $2,693.74 | $13,110.33 | $2,698.56 | $4,295.37 | $2,756.88 | $1,964.98 |

| 58768 | $4,334.73 | $4,614.80 | $3,916.59 | $3,236.05 | $2,693.74 | $13,110.33 | $2,642.63 | $4,013.15 | $2,756.88 | $2,028.39 |

| 58655 | $4,333.65 | $5,034.34 | $3,657.34 | $3,231.84 | $2,693.74 | $12,907.66 | $2,772.54 | $3,983.57 | $2,756.88 | $1,964.98 |

| 58632 | $4,332.47 | $4,511.22 | $3,930.17 | $3,231.84 | $2,693.74 | $12,907.66 | $2,772.54 | $4,223.24 | $2,756.88 | $1,964.98 |

| 58654 | $4,332.47 | $4,511.22 | $3,930.17 | $3,231.84 | $2,693.74 | $12,907.66 | $2,772.54 | $4,223.24 | $2,756.88 | $1,964.98 |

| 58621 | $4,331.79 | $4,505.04 | $3,930.17 | $3,231.84 | $2,693.74 | $12,907.66 | $2,772.54 | $4,223.24 | $2,756.88 | $1,964.98 |

| 58723 | $4,331.62 | $4,620.17 | $4,029.25 | $3,287.58 | $2,693.74 | $13,110.33 | $2,698.56 | $3,759.65 | $2,756.88 | $2,028.39 |

| 58579 | $4,330.84 | $5,114.81 | $3,695.26 | $3,123.81 | $2,693.74 | $13,110.33 | $2,698.56 | $3,819.21 | $2,756.88 | $1,964.98 |

| 58577 | $4,330.48 | $5,108.65 | $3,695.26 | $3,123.81 | $2,693.74 | $13,110.33 | $2,698.56 | $3,822.06 | $2,756.88 | $1,964.98 |

| 58712 | $4,328.66 | $4,649.46 | $4,029.25 | $3,287.58 | $2,693.74 | $13,110.33 | $2,642.63 | $3,759.65 | $2,756.88 | $2,028.39 |

| 58744 | $4,328.66 | $4,649.46 | $4,029.25 | $3,287.58 | $2,693.74 | $13,110.33 | $2,642.63 | $3,759.65 | $2,756.88 | $2,028.39 |

| 58788 | $4,328.66 | $4,649.46 | $4,029.25 | $3,287.58 | $2,693.74 | $13,110.33 | $2,642.63 | $3,759.65 | $2,756.88 | $2,028.39 |

| 58541 | $4,328.65 | $5,114.81 | $3,930.17 | $3,041.61 | $2,693.74 | $12,907.66 | $2,698.56 | $3,849.40 | $2,756.88 | $1,964.98 |

| 58580 | $4,328.65 | $5,114.81 | $3,930.17 | $3,041.61 | $2,693.74 | $12,907.66 | $2,698.56 | $3,849.40 | $2,756.88 | $1,964.98 |

| 58638 | $4,327.98 | $5,114.81 | $3,930.17 | $3,041.61 | $2,693.74 | $12,907.66 | $2,698.56 | $3,843.43 | $2,756.88 | $1,964.98 |

| 58559 | $4,326.79 | $5,137.92 | $3,695.26 | $3,123.81 | $2,693.74 | $13,110.33 | $2,698.56 | $3,759.65 | $2,756.88 | $1,964.98 |

| 58575 | $4,326.79 | $5,137.92 | $3,695.26 | $3,123.81 | $2,693.74 | $13,110.33 | $2,698.56 | $3,759.65 | $2,756.88 | $1,964.98 |

| 58781 | $4,326.62 | $4,614.80 | $3,916.59 | $2,888.70 | $2,693.74 | $13,110.33 | $2,698.56 | $4,231.59 | $2,756.88 | $2,028.39 |

| 58544 | $4,325.73 | $5,114.81 | $3,930.17 | $3,322.01 | $2,693.74 | $12,907.66 | $2,698.56 | $3,542.81 | $2,756.88 | $1,964.98 |

| 58710 | $4,325.40 | $4,620.17 | $4,029.25 | $3,287.58 | $2,693.74 | $13,110.33 | $2,642.63 | $3,759.65 | $2,756.88 | $2,028.39 |

| 58736 | $4,325.40 | $4,620.17 | $4,029.25 | $3,287.58 | $2,693.74 | $13,110.33 | $2,642.63 | $3,759.65 | $2,756.88 | $2,028.39 |

| 58494 | $4,325.13 | $5,114.81 | $3,930.17 | $3,170.38 | $2,693.74 | $12,907.66 | $2,698.56 | $3,688.96 | $2,756.88 | $1,964.98 |

| 58563 | $4,324.42 | $5,114.81 | $3,930.17 | $3,013.37 | $2,693.74 | $12,907.66 | $2,698.56 | $3,839.58 | $2,756.88 | $1,964.98 |

| 58793 | $4,324.41 | $4,649.46 | $4,029.25 | $3,236.05 | $2,693.74 | $13,110.33 | $2,642.63 | $3,772.98 | $2,756.88 | $2,028.39 |

| 58713 | $4,324.25 | $4,649.46 | $4,029.25 | $3,236.05 | $2,693.74 | $13,110.33 | $2,642.63 | $3,771.56 | $2,756.88 | $2,028.39 |

| 58631 | $4,323.19 | $5,114.81 | $3,930.17 | $3,013.37 | $2,693.74 | $12,907.66 | $2,698.56 | $3,828.53 | $2,756.88 | $1,964.98 |

| 58831 | $4,322.78 | $4,505.04 | $3,764.24 | $3,231.84 | $2,693.74 | $13,110.33 | $2,772.54 | $4,042.02 | $2,756.88 | $2,028.39 |

| 58790 | $4,321.49 | $4,649.46 | $3,916.59 | $2,888.70 | $2,693.74 | $13,110.33 | $2,642.63 | $4,206.67 | $2,756.88 | $2,028.39 |

| 58531 | $4,320.73 | $5,114.81 | $3,695.26 | $3,123.81 | $2,693.74 | $13,110.33 | $2,698.56 | $3,728.16 | $2,756.88 | $1,964.98 |

| 58565 | $4,320.73 | $5,114.81 | $3,695.26 | $3,123.81 | $2,693.74 | $13,110.33 | $2,698.56 | $3,728.16 | $2,756.88 | $1,964.98 |

| 58576 | $4,320.73 | $5,114.81 | $3,695.26 | $3,123.81 | $2,693.74 | $13,110.33 | $2,698.56 | $3,728.16 | $2,756.88 | $1,964.98 |

| 58385 | $4,320.03 | $4,354.25 | $4,029.25 | $3,287.58 | $2,693.74 | $13,311.77 | $2,642.63 | $3,775.77 | $2,756.88 | $2,028.39 |

| 58545 | $4,314.51 | $5,114.81 | $3,930.17 | $3,041.61 | $2,693.74 | $12,907.66 | $2,698.56 | $3,722.18 | $2,756.88 | $1,964.98 |

| 58622 | $4,314.10 | $4,585.52 | $3,930.17 | $3,231.84 | $2,693.74 | $12,907.66 | $2,772.54 | $3,983.57 | $2,756.88 | $1,964.98 |

| 58784 | $4,311.82 | $4,614.80 | $4,029.25 | $3,415.17 | $2,693.74 | $13,110.33 | $2,698.56 | $3,984.00 | $2,232.12 | $2,028.39 |

| 58523 | $4,311.14 | $5,114.81 | $3,930.17 | $3,041.61 | $2,693.74 | $12,907.66 | $2,698.56 | $3,691.81 | $2,756.88 | $1,964.98 |

| 58532 | $4,309.28 | $5,114.81 | $3,930.17 | $3,170.38 | $2,693.74 | $12,907.66 | $2,698.56 | $3,546.31 | $2,756.88 | $1,964.98 |

| 58560 | $4,307.89 | $5,114.81 | $3,930.17 | $3,170.38 | $2,693.74 | $12,907.66 | $2,698.56 | $3,533.86 | $2,756.88 | $1,964.98 |

| 58572 | $4,307.89 | $5,114.81 | $3,930.17 | $3,170.38 | $2,693.74 | $12,907.66 | $2,698.56 | $3,533.86 | $2,756.88 | $1,964.98 |

| 58386 | $4,306.79 | $4,354.25 | $4,029.25 | $3,287.58 | $2,693.74 | $13,311.77 | $2,506.09 | $3,793.20 | $2,756.88 | $2,028.39 |

| 58332 | $4,304.77 | $4,369.58 | $4,029.25 | $3,287.58 | $2,693.74 | $13,311.77 | $2,506.09 | $3,759.65 | $2,756.88 | $2,028.39 |

| 58343 | $4,303.07 | $4,354.25 | $4,029.25 | $3,287.58 | $2,693.74 | $13,311.77 | $2,506.09 | $3,759.65 | $2,756.88 | $2,028.39 |

| 58316 | $4,303.00 | $4,369.58 | $4,029.25 | $3,170.01 | $2,693.74 | $13,311.77 | $2,642.63 | $3,724.79 | $2,756.88 | $2,028.39 |

| 58329 | $4,303.00 | $4,369.58 | $4,029.25 | $3,170.01 | $2,693.74 | $13,311.77 | $2,642.63 | $3,724.79 | $2,756.88 | $2,028.39 |

| 58558 | $4,302.50 | $5,114.81 | $3,930.17 | $3,170.38 | $2,693.74 | $12,907.66 | $2,698.56 | $3,485.34 | $2,756.88 | $1,964.98 |

| 58367 | $4,301.70 | $4,369.58 | $4,029.25 | $3,170.01 | $2,693.74 | $13,311.77 | $2,642.63 | $3,713.03 | $2,756.88 | $2,028.39 |

| 58369 | $4,301.70 | $4,369.58 | $4,029.25 | $3,170.01 | $2,693.74 | $13,311.77 | $2,642.63 | $3,713.03 | $2,756.88 | $2,028.39 |

| 58783 | $4,301.50 | $4,649.46 | $4,029.25 | $3,236.05 | $2,693.74 | $13,110.33 | $2,642.63 | $3,566.80 | $2,756.88 | $2,028.39 |

| 58748 | $4,301.23 | $4,649.46 | $4,029.25 | $3,236.05 | $2,693.74 | $13,110.33 | $2,642.63 | $3,564.31 | $2,756.88 | $2,028.39 |

| 58366 | $4,300.31 | $4,369.58 | $4,029.25 | $3,170.01 | $2,693.74 | $13,311.77 | $2,642.63 | $3,700.56 | $2,756.88 | $2,028.39 |

| 58438 | $4,294.88 | $4,346.48 | $4,029.25 | $3,287.58 | $2,693.74 | $13,311.77 | $2,642.63 | $3,557.23 | $2,756.88 | $2,028.39 |

| 58379 | $4,292.91 | $4,396.25 | $4,029.25 | $3,402.78 | $2,693.74 | $13,311.77 | $2,506.09 | $3,511.05 | $2,756.88 | $2,028.39 |

| 58645 | $4,289.13 | $4,511.22 | $3,930.17 | $3,231.84 | $2,693.74 | $12,907.66 | $2,772.54 | $3,833.13 | $2,756.88 | $1,964.98 |

| 58318 | $4,288.00 | $4,649.46 | $4,029.25 | $3,170.01 | $2,693.74 | $13,110.33 | $2,642.63 | $3,511.29 | $2,756.88 | $2,028.39 |

| 58384 | $4,288.00 | $4,649.46 | $4,029.25 | $3,170.01 | $2,693.74 | $13,110.33 | $2,642.63 | $3,511.29 | $2,756.88 | $2,028.39 |

| 58571 | $4,286.75 | $5,114.81 | $3,695.26 | $3,041.61 | $2,693.74 | $12,907.66 | $2,698.56 | $3,707.29 | $2,756.88 | $1,964.98 |

| 58422 | $4,284.91 | $4,346.48 | $4,029.25 | $3,170.38 | $2,693.74 | $13,311.77 | $2,642.63 | $3,584.64 | $2,756.88 | $2,028.39 |

| 58423 | $4,284.23 | $4,346.48 | $4,029.25 | $3,170.38 | $2,693.74 | $13,311.77 | $2,642.63 | $3,578.56 | $2,756.88 | $2,028.39 |

| 58353 | $4,283.07 | $4,369.58 | $4,029.25 | $3,170.01 | $2,693.74 | $13,311.77 | $2,642.63 | $3,545.39 | $2,756.88 | $2,028.39 |

| 58344 | $4,282.35 | $4,402.42 | $4,029.25 | $3,250.04 | $2,693.74 | $13,311.77 | $2,506.09 | $3,562.61 | $2,756.88 | $2,028.39 |

| 58374 | $4,281.62 | $4,375.75 | $4,029.25 | $3,250.04 | $2,693.74 | $13,311.77 | $2,506.09 | $3,582.64 | $2,756.88 | $2,028.39 |

| 58348 | $4,280.93 | $4,369.58 | $4,029.25 | $3,250.04 | $2,693.74 | $13,311.77 | $2,506.09 | $3,582.64 | $2,756.88 | $2,028.39 |

| 58445 | $4,279.46 | $4,375.75 | $4,029.25 | $3,250.04 | $2,693.74 | $13,311.77 | $2,486.70 | $3,582.64 | $2,756.88 | $2,028.39 |

| 58310 | $4,279.10 | $4,369.58 | $4,029.25 | $3,170.01 | $2,693.74 | $13,311.77 | $2,642.63 | $3,509.65 | $2,756.88 | $2,028.39 |

| 58356 | $4,278.15 | $4,375.75 | $4,029.25 | $3,250.04 | $2,693.74 | $13,311.77 | $2,486.70 | $3,570.79 | $2,756.88 | $2,028.39 |

| 58380 | $4,277.66 | $4,402.42 | $4,029.25 | $3,250.04 | $2,693.74 | $13,311.77 | $2,506.09 | $3,520.36 | $2,756.88 | $2,028.39 |

| 58421 | $4,276.21 | $4,346.48 | $4,029.25 | $3,250.04 | $2,693.74 | $13,311.77 | $2,486.70 | $3,582.64 | $2,756.88 | $2,028.39 |

| 58335 | $4,275.94 | $4,396.25 | $4,029.25 | $3,250.04 | $2,693.74 | $13,311.77 | $2,506.09 | $3,511.05 | $2,756.88 | $2,028.39 |

| 58370 | $4,275.94 | $4,396.25 | $4,029.25 | $3,250.04 | $2,693.74 | $13,311.77 | $2,506.09 | $3,511.05 | $2,756.88 | $2,028.39 |

| 58853 | $4,273.21 | $4,505.04 | $3,764.24 | $3,281.94 | $2,693.74 | $13,110.33 | $2,772.54 | $4,126.18 | $2,176.51 | $2,028.39 |

| 58381 | $4,272.39 | $4,375.75 | $4,029.25 | $3,250.04 | $2,693.74 | $13,311.77 | $2,486.70 | $3,519.01 | $2,756.88 | $2,028.39 |

| 58363 | $4,269.20 | $4,354.25 | $4,029.25 | $3,170.01 | $2,693.74 | $13,311.77 | $2,526.74 | $3,551.79 | $2,756.88 | $2,028.39 |

| 58357 | $4,259.04 | $4,396.25 | $4,029.25 | $3,250.04 | $2,693.74 | $13,311.77 | $2,506.09 | $3,358.94 | $2,756.88 | $2,028.39 |

| 58801 | $4,256.31 | $4,505.04 | $3,764.24 | $3,281.94 | $2,255.34 | $12,880.78 | $2,772.54 | $4,061.69 | $2,756.88 | $2,028.39 |

| 58482 | $4,255.44 | $5,114.81 | $4,029.25 | $3,170.38 | $2,693.74 | $12,316.57 | $2,642.63 | $3,546.31 | $2,756.88 | $2,028.39 |

| 58254 | $4,255.37 | $4,396.25 | $4,029.25 | $3,055.63 | $2,693.74 | $13,311.77 | $2,506.09 | $3,520.36 | $2,756.88 | $2,028.39 |

| 58272 | $4,255.37 | $4,396.25 | $4,029.25 | $3,055.63 | $2,693.74 | $13,311.77 | $2,506.09 | $3,520.36 | $2,756.88 | $2,028.39 |

| 58464 | $4,254.29 | $4,417.76 | $4,029.25 | $3,055.63 | $2,693.74 | $13,311.77 | $2,486.70 | $3,508.52 | $2,756.88 | $2,028.39 |

| 58259 | $4,254.06 | $4,396.25 | $4,029.25 | $3,055.63 | $2,693.74 | $13,311.77 | $2,506.09 | $3,508.52 | $2,756.88 | $2,028.39 |

| 58443 | $4,250.29 | $4,375.75 | $4,029.25 | $3,055.63 | $2,693.74 | $13,311.77 | $2,486.70 | $3,514.49 | $2,756.88 | $2,028.39 |

| 58339 | $4,245.24 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,551.79 | $2,756.88 | $2,028.39 |

| 58237 | $4,238.38 | $4,461.05 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,403.89 | $2,756.88 | $2,028.39 |

| 58331 | $4,237.97 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,486.37 | $2,756.88 | $2,028.39 |

| 58365 | $4,237.97 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,486.37 | $2,756.88 | $2,028.39 |

| 58225 | $4,236.08 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,427.35 | $2,756.88 | $2,028.39 |

| 58271 | $4,236.08 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,427.35 | $2,756.88 | $2,028.39 |

| 58377 | $4,234.82 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,478.65 | $2,756.88 | $2,028.39 |

| 58282 | $4,231.80 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,430.85 | $2,756.88 | $2,028.39 |

| 58273 | $4,230.93 | $4,461.05 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,336.78 | $2,756.88 | $2,028.39 |

| 58265 | $4,229.30 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,366.34 | $2,756.88 | $2,028.39 |

| 58321 | $4,228.39 | $4,402.42 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,372.61 | $2,756.88 | $2,028.39 |

| 58327 | $4,228.01 | $4,402.42 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,369.21 | $2,756.88 | $2,028.39 |

| 58478 | $4,227.93 | $4,834.94 | $4,029.25 | $3,170.38 | $2,693.74 | $12,316.57 | $2,642.63 | $3,578.56 | $2,756.88 | $2,028.39 |

| 58488 | $4,227.93 | $4,834.94 | $4,029.25 | $3,170.38 | $2,693.74 | $12,316.57 | $2,642.63 | $3,578.56 | $2,756.88 | $2,028.39 |

| 58243 | $4,227.80 | $4,461.05 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,308.63 | $2,756.88 | $2,028.39 |

| 58210 | $4,226.37 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,360.61 | $2,756.88 | $2,028.39 |

| 58345 | $4,226.05 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,357.67 | $2,756.88 | $2,028.39 |

| 58352 | $4,225.73 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,376.18 | $2,756.88 | $2,028.39 |

| 58250 | $4,225.10 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,349.13 | $2,756.88 | $2,028.39 |

| 58330 | $4,223.59 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,335.60 | $2,756.88 | $2,028.39 |

| 58229 | $4,222.78 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,328.24 | $2,756.88 | $2,028.39 |

| 58236 | $4,222.56 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,305.65 | $2,756.88 | $2,028.39 |

| 58276 | $4,222.56 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,305.65 | $2,756.88 | $2,028.39 |

| 58338 | $4,220.72 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,351.72 | $2,756.88 | $2,028.39 |

| 58231 | $4,220.67 | $4,461.05 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,244.48 | $2,756.88 | $2,028.39 |

| 58233 | $4,220.67 | $4,461.05 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,244.48 | $2,756.88 | $2,028.39 |

| 58261 | $4,220.67 | $4,461.05 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,244.48 | $2,756.88 | $2,028.39 |

| 58428 | $4,220.16 | $5,114.81 | $4,029.25 | $2,939.23 | $2,693.74 | $12,316.57 | $2,642.63 | $3,459.96 | $2,756.88 | $2,028.39 |

| 58351 | $4,220.14 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,346.47 | $2,756.88 | $2,028.39 |

| 58301 | $4,220.00 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,303.25 | $2,756.88 | $2,028.39 |

| 58362 | $4,219.99 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,345.13 | $2,756.88 | $2,028.39 |

| 58324 | $4,219.20 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,317.39 | $2,756.88 | $2,028.39 |

| 58487 | $4,216.57 | $5,114.81 | $4,029.25 | $2,939.23 | $2,693.74 | $12,316.57 | $2,642.63 | $3,427.59 | $2,756.88 | $2,028.39 |

| 58325 | $4,216.40 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,312.88 | $2,756.88 | $2,028.39 |

| 58382 | $4,216.40 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,312.88 | $2,756.88 | $2,028.39 |

| 58346 | $4,213.64 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,288.05 | $2,756.88 | $2,028.39 |

| 58270 | $4,213.64 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,246.00 | $2,756.88 | $2,028.39 |

| 58224 | $4,213.47 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,244.48 | $2,756.88 | $2,028.39 |

| 58241 | $4,213.21 | $4,461.05 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,156.73 | $2,756.88 | $2,028.39 |

| 58317 | $4,211.65 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,249.48 | $2,756.88 | $2,028.39 |

| 58216 | $4,210.58 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,197.80 | $2,756.88 | $2,028.39 |

| 58238 | $4,210.58 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,197.80 | $2,756.88 | $2,028.39 |

| 58249 | $4,209.93 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,233.94 | $2,756.88 | $2,028.39 |

| 58260 | $4,209.61 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,231.05 | $2,756.88 | $2,028.39 |

| 58269 | $4,209.61 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,231.05 | $2,756.88 | $2,028.39 |

| 58311 | $4,209.61 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,231.05 | $2,756.88 | $2,028.39 |

| 58355 | $4,209.61 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,231.05 | $2,756.88 | $2,028.39 |

| 58222 | $4,209.35 | $4,461.05 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,121.99 | $2,756.88 | $2,028.39 |

| 58239 | $4,208.62 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,222.19 | $2,756.88 | $2,028.39 |

| 58255 | $4,208.62 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,222.19 | $2,756.88 | $2,028.39 |

| 58281 | $4,208.62 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,222.19 | $2,756.88 | $2,028.39 |

| 58323 | $4,208.62 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,222.19 | $2,756.88 | $2,028.39 |

| 58372 | $4,208.62 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,222.19 | $2,756.88 | $2,028.39 |

| 58227 | $4,201.60 | $4,396.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,117.00 | $2,756.88 | $2,028.39 |

| 58262 | $4,201.35 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,156.73 | $2,756.88 | $2,028.39 |

| 58266 | $4,199.72 | $4,461.05 | $4,029.25 | $3,055.63 | $2,693.74 | $13,311.77 | $2,506.09 | $3,508.52 | $2,203.03 | $2,028.39 |

| 58361 | $4,197.95 | $4,402.42 | $3,506.23 | $3,055.63 | $2,693.74 | $13,311.77 | $2,506.09 | $3,520.36 | $2,756.88 | $2,028.39 |

| 58220 | $4,195.27 | $4,354.25 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,526.74 | $3,102.06 | $2,756.88 | $2,028.39 |

| 58212 | $4,190.99 | $4,461.05 | $3,506.23 | $3,055.63 | $2,693.74 | $13,311.77 | $2,506.09 | $3,399.16 | $2,756.88 | $2,028.39 |

| 58484 | $4,189.40 | $4,375.75 | $4,029.25 | $3,055.63 | $2,693.74 | $13,311.77 | $2,486.70 | $3,520.36 | $2,203.03 | $2,028.39 |

| 58452 | $4,188.41 | $4,402.42 | $4,029.25 | $3,055.63 | $2,693.74 | $13,311.77 | $2,486.70 | $3,484.74 | $2,203.03 | $2,028.39 |

| 58475 | $4,188.40 | $4,834.94 | $4,029.25 | $2,939.23 | $2,693.74 | $12,316.57 | $2,642.63 | $3,453.99 | $2,756.88 | $2,028.39 |

| 58251 | $4,160.48 | $4,467.22 | $4,029.25 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,250.43 | $2,203.03 | $2,028.39 |

| 58267 | $4,145.67 | $4,467.22 | $3,506.23 | $3,061.45 | $2,693.74 | $13,311.77 | $2,506.09 | $3,533.14 | $2,203.03 | $2,028.39 |

| 58448 | $4,141.42 | $4,402.42 | $3,506.23 | $3,055.63 | $2,693.74 | $13,311.77 | $2,486.70 | $3,584.88 | $2,203.03 | $2,028.39 |

| 58230 | $4,136.68 | $4,402.42 | $3,506.23 | $3,061.45 | $2,693.74 | $13,311.77 | $2,486.70 | $3,536.37 | $2,203.03 | $2,028.39 |

| 58416 | $4,134.25 | $4,402.42 | $3,506.23 | $3,055.63 | $2,693.74 | $13,311.77 | $2,486.70 | $3,520.36 | $2,203.03 | $2,028.39 |

| 58277 | $4,131.34 | $4,467.22 | $3,506.23 | $3,061.45 | $2,693.74 | $13,311.77 | $2,486.70 | $3,423.48 | $2,203.03 | $2,028.39 |

| 58554 | $4,131.14 | $5,114.81 | $3,695.26 | $2,983.98 | $2,693.74 | $12,000.32 | $2,505.21 | $3,575.80 | $2,756.88 | $1,854.27 |

| 58425 | $4,130.29 | $4,402.42 | $3,506.23 | $3,055.63 | $2,693.74 | $13,311.77 | $2,486.70 | $3,484.74 | $2,203.03 | $2,028.39 |

| 58046 | $4,124.99 | $4,402.42 | $3,506.23 | $3,061.45 | $2,693.74 | $13,311.77 | $2,486.70 | $3,431.16 | $2,203.03 | $2,028.39 |

| 58274 | $4,123.81 | $4,402.42 | $3,506.23 | $3,061.45 | $2,693.74 | $13,311.77 | $2,486.70 | $3,420.53 | $2,203.03 | $2,028.39 |

| 58045 | $4,122.50 | $4,482.57 | $3,506.23 | $2,854.99 | $2,693.74 | $13,311.77 | $2,486.70 | $3,535.05 | $2,203.03 | $2,028.39 |

| 58415 | $4,122.06 | $5,186.08 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,421.39 | $3,529.63 | $2,203.03 | $2,028.39 |

| 58056 | $4,121.86 | $4,402.42 | $3,506.23 | $3,061.45 | $2,693.74 | $13,311.77 | $2,486.70 | $3,403.02 | $2,203.03 | $2,028.39 |

| 58495 | $4,115.81 | $5,114.81 | $3,930.17 | $2,939.23 | $2,693.74 | $12,316.57 | $2,421.39 | $3,458.36 | $2,203.03 | $1,964.98 |

| 58561 | $4,112.39 | $5,114.81 | $3,930.17 | $2,939.23 | $2,693.74 | $12,316.57 | $2,421.39 | $3,427.59 | $2,203.03 | $1,964.98 |

| 58722 | $4,109.61 | $4,614.80 | $3,916.59 | $3,220.37 | $2,479.62 | $11,458.58 | $2,698.56 | $3,901.80 | $2,667.73 | $2,028.39 |

| 58219 | $4,108.65 | $4,482.57 | $3,506.23 | $2,854.99 | $2,693.74 | $13,311.77 | $2,486.70 | $3,410.37 | $2,203.03 | $2,028.39 |

| 58433 | $4,107.12 | $5,156.81 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,421.39 | $3,424.39 | $2,203.03 | $2,028.39 |

| 58785 | $4,106.35 | $4,614.80 | $3,916.59 | $3,220.37 | $2,479.62 | $11,458.58 | $2,698.56 | $3,872.47 | $2,667.73 | $2,028.39 |

| 58413 | $4,106.22 | $5,114.81 | $3,930.17 | $2,939.23 | $2,693.74 | $12,316.57 | $2,421.39 | $3,372.11 | $2,203.03 | $1,964.98 |

| 58440 | $4,106.22 | $5,114.81 | $3,930.17 | $2,939.23 | $2,693.74 | $12,316.57 | $2,421.39 | $3,372.11 | $2,203.03 | $1,964.98 |

| 58223 | $4,105.83 | $4,467.22 | $3,506.23 | $2,854.99 | $2,693.74 | $13,311.77 | $2,486.70 | $3,400.40 | $2,203.03 | $2,028.39 |

| 58442 | $4,102.85 | $5,114.81 | $3,930.17 | $2,939.23 | $2,693.74 | $12,316.57 | $2,421.39 | $3,341.72 | $2,203.03 | $1,964.98 |

| 58214 | $4,102.36 | $4,467.22 | $3,506.23 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,250.43 | $2,203.03 | $2,028.39 |

| 58460 | $4,102.31 | $5,114.81 | $3,930.17 | $2,939.23 | $2,693.74 | $12,316.57 | $2,421.39 | $3,336.90 | $2,203.03 | $1,964.98 |

| 58581 | $4,102.31 | $5,114.81 | $3,930.17 | $2,939.23 | $2,693.74 | $12,316.57 | $2,421.39 | $3,336.90 | $2,203.03 | $1,964.98 |

| 58240 | $4,101.20 | $4,402.42 | $3,506.23 | $2,854.99 | $2,693.74 | $13,311.77 | $2,486.70 | $3,423.48 | $2,203.03 | $2,028.39 |

| 58235 | $4,101.02 | $4,461.05 | $3,506.23 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,244.48 | $2,203.03 | $2,028.39 |

| 58244 | $4,101.02 | $4,461.05 | $3,506.23 | $2,954.38 | $2,693.74 | $13,311.77 | $2,506.09 | $3,244.48 | $2,203.03 | $2,028.39 |

| 58278 | $4,100.56 | $4,461.05 | $3,506.23 | $2,854.99 | $2,693.74 | $13,311.77 | $2,506.09 | $3,413.93 | $2,128.86 | $2,028.39 |

| 58016 | $4,099.98 | $4,402.42 | $3,506.23 | $3,061.45 | $2,693.74 | $13,311.77 | $2,486.70 | $3,206.11 | $2,203.03 | $2,028.39 |

| 58218 | $4,097.06 | $4,467.22 | $3,506.23 | $2,854.99 | $2,693.74 | $13,311.77 | $2,486.70 | $3,321.47 | $2,203.03 | $2,028.39 |

| 58256 | $4,087.41 | $4,461.05 | $3,506.23 | $2,781.01 | $2,693.74 | $13,311.77 | $2,506.09 | $3,369.58 | $2,128.86 | $2,028.39 |

| 58009 | $4,086.79 | $4,402.42 | $3,506.23 | $2,854.99 | $2,693.74 | $13,311.77 | $2,486.70 | $3,293.79 | $2,203.03 | $2,028.39 |

| 58257 | $4,086.50 | $4,402.42 | $3,506.23 | $2,854.99 | $2,693.74 | $13,311.77 | $2,486.70 | $3,291.19 | $2,203.03 | $2,028.39 |

| 58275 | $4,086.18 | $4,467.22 | $3,506.23 | $2,854.99 | $2,693.74 | $13,311.77 | $2,506.09 | $3,204.16 | $2,203.03 | $2,028.39 |

| 58439 | $4,084.84 | $5,186.08 | $3,506.23 | $2,939.23 | $2,693.74 | $12,316.57 | $2,421.39 | $3,468.85 | $2,203.03 | $2,028.39 |

| 58035 | $4,080.20 | $4,417.76 | $3,506.23 | $2,854.99 | $2,693.74 | $13,311.77 | $2,486.70 | $3,219.21 | $2,203.03 | $2,028.39 |

| 58458 | $4,078.26 | $4,697.64 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,421.39 | $3,623.86 | $2,203.03 | $2,028.39 |

| 58466 | $4,078.26 | $4,697.64 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,421.39 | $3,623.86 | $2,203.03 | $2,028.39 |

| 58701 | $4,077.56 | $4,614.80 | $3,676.98 | $3,220.37 | $2,693.74 | $11,458.58 | $2,751.73 | $3,901.80 | $2,667.73 | $1,712.35 |

| 58431 | $4,075.62 | $4,697.64 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,421.39 | $3,600.08 | $2,203.03 | $2,028.39 |

| 58456 | $4,065.62 | $5,156.81 | $3,506.23 | $2,939.23 | $2,693.74 | $12,316.57 | $2,421.39 | $3,325.15 | $2,203.03 | $2,028.39 |

| 58703 | $4,063.08 | $4,614.80 | $3,676.98 | $3,220.37 | $2,479.62 | $11,458.58 | $2,751.73 | $3,985.59 | $2,667.73 | $1,712.35 |

| 58490 | $4,059.67 | $4,806.45 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,421.39 | $3,347.75 | $2,203.03 | $2,028.39 |

| 58228 | $4,059.54 | $4,461.05 | $3,506.23 | $3,062.32 | $2,134.85 | $13,311.77 | $2,506.09 | $3,396.32 | $2,128.86 | $2,028.39 |

| 58455 | $4,058.45 | $4,375.75 | $4,029.25 | $3,055.63 | $2,693.74 | $12,316.57 | $2,309.20 | $3,514.49 | $2,203.03 | $2,028.39 |

| 58436 | $4,055.82 | $4,697.64 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,421.39 | $3,421.90 | $2,203.03 | $2,028.39 |

| 58707 | $4,055.48 | $4,614.80 | $3,676.98 | $3,151.91 | $2,479.62 | $11,458.58 | $2,751.73 | $3,985.59 | $2,667.73 | $1,712.35 |

| 58504 | $4,054.90 | $5,114.81 | $3,695.26 | $2,992.60 | $2,381.68 | $12,106.59 | $2,572.99 | $3,426.60 | $2,349.27 | $1,854.27 |

| 58065 | $4,052.80 | $4,402.42 | $4,029.25 | $3,061.45 | $2,693.74 | $12,316.57 | $2,309.20 | $3,431.16 | $2,203.03 | $2,028.39 |

| 58481 | $4,052.61 | $4,697.64 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,309.20 | $3,505.19 | $2,203.03 | $2,028.39 |

| 58454 | $4,051.76 | $4,668.35 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,421.39 | $3,414.69 | $2,203.03 | $2,028.39 |

| 58474 | $4,051.72 | $4,806.45 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,421.39 | $3,276.16 | $2,203.03 | $2,028.39 |

| 58461 | $4,048.15 | $4,806.45 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,309.20 | $3,356.22 | $2,203.03 | $2,028.39 |

| 58480 | $4,047.97 | $4,806.45 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,309.20 | $3,354.65 | $2,203.03 | $2,028.39 |

| 58476 | $4,047.70 | $4,375.75 | $4,029.25 | $3,055.63 | $2,693.74 | $12,316.57 | $2,309.20 | $3,417.74 | $2,203.03 | $2,028.39 |

| 58420 | $4,047.01 | $4,417.76 | $4,029.25 | $3,055.63 | $2,693.74 | $12,316.57 | $2,309.20 | $3,369.51 | $2,203.03 | $2,028.39 |

| 58497 | $4,045.44 | $4,697.64 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,309.20 | $3,440.68 | $2,203.03 | $2,028.39 |

| 58472 | $4,045.16 | $4,697.64 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,309.20 | $3,438.18 | $2,203.03 | $2,028.39 |

| 58441 | $4,039.90 | $4,697.64 | $3,506.23 | $3,213.48 | $2,693.74 | $12,316.57 | $2,421.39 | $3,278.65 | $2,203.03 | $2,028.39 |

| 58505 | $4,039.32 | $5,114.81 | $3,695.26 | $2,863.72 | $2,381.68 | $11,943.50 | $2,572.99 | $3,467.69 | $2,349.27 | $1,964.98 |

| 58503 | $4,029.26 | $5,114.81 | $3,695.26 | $2,863.72 | $2,381.68 | $11,943.50 | $2,505.21 | $3,444.89 | $2,349.27 | $1,964.98 |

| 58258 | $4,029.08 | $4,461.05 | $3,506.23 | $2,781.01 | $2,168.73 | $13,311.77 | $2,506.09 | $3,369.58 | $2,128.86 | $2,028.39 |

| 58601 | $4,028.33 | $5,034.34 | $3,657.34 | $3,091.08 | $2,255.34 | $11,886.53 | $2,772.54 | $3,416.36 | $2,176.51 | $1,964.98 |

| 58002 | $4,027.31 | $4,591.40 | $4,029.25 | $2,854.99 | $2,693.74 | $12,316.57 | $2,309.20 | $3,219.21 | $2,203.03 | $2,028.39 |

| 58496 | $4,025.55 | $4,375.75 | $4,029.25 | $2,939.23 | $2,693.74 | $12,316.57 | $2,309.20 | $3,334.81 | $2,203.03 | $2,028.39 |

| 58705 | $4,025.54 | $4,614.80 | $3,676.98 | $3,090.35 | $2,479.62 | $11,458.58 | $2,751.73 | $3,879.95 | $2,667.73 | $1,610.12 |

| 58501 | $4,020.31 | $5,114.81 | $3,695.26 | $2,803.36 | $2,381.68 | $11,943.50 | $2,572.99 | $3,467.69 | $2,349.27 | $1,854.27 |

| 58008 | $4,018.79 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,388.57 | $2,203.03 | $2,028.39 |

| 58033 | $4,015.64 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,360.22 | $2,203.03 | $2,028.39 |

| 58467 | $4,015.29 | $4,655.63 | $3,506.23 | $2,939.23 | $2,693.74 | $12,316.57 | $2,309.20 | $3,485.60 | $2,203.03 | $2,028.39 |

| 58054 | $4,014.58 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,350.72 | $2,203.03 | $2,028.39 |

| 58069 | $4,013.29 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,339.02 | $2,203.03 | $2,028.39 |

| 58429 | $4,013.08 | $4,402.42 | $3,506.23 | $3,055.63 | $2,693.74 | $12,316.57 | $2,309.20 | $3,602.51 | $2,203.03 | $2,028.39 |

| 58057 | $4,012.92 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,335.77 | $2,203.03 | $2,028.39 |

| 58076 | $4,010.71 | $4,806.45 | $3,506.23 | $2,895.53 | $2,693.74 | $12,316.57 | $2,421.39 | $3,225.04 | $2,203.03 | $2,028.39 |

| 58038 | $4,007.65 | $4,591.40 | $3,506.23 | $2,854.99 | $2,693.74 | $12,316.57 | $2,309.20 | $3,565.30 | $2,203.03 | $2,028.39 |

| 58018 | $4,007.57 | $4,806.45 | $3,506.23 | $2,836.44 | $2,693.74 | $12,316.57 | $2,421.39 | $3,255.90 | $2,203.03 | $2,028.39 |

| 58061 | $4,007.57 | $4,806.45 | $3,506.23 | $2,836.44 | $2,693.74 | $12,316.57 | $2,421.39 | $3,255.90 | $2,203.03 | $2,028.39 |

| 58032 | $4,007.50 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,286.95 | $2,203.03 | $2,028.39 |

| 58030 | $4,006.25 | $4,806.45 | $3,506.23 | $2,836.44 | $2,693.74 | $12,316.57 | $2,421.39 | $3,244.03 | $2,203.03 | $2,028.39 |

| 58483 | $4,005.59 | $4,626.35 | $3,506.23 | $2,939.23 | $2,693.74 | $12,316.57 | $2,309.20 | $3,427.59 | $2,203.03 | $2,028.39 |

| 58001 | $4,004.14 | $4,806.45 | $3,506.23 | $2,836.44 | $2,693.74 | $12,316.57 | $2,421.39 | $3,225.04 | $2,203.03 | $2,028.39 |

| 58075 | $4,004.14 | $4,806.45 | $3,506.23 | $2,836.44 | $2,693.74 | $12,316.57 | $2,421.39 | $3,225.04 | $2,203.03 | $2,028.39 |

| 58041 | $4,004.05 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,255.90 | $2,203.03 | $2,028.39 |

| 58058 | $4,004.05 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,255.90 | $2,203.03 | $2,028.39 |

| 58017 | $4,004.02 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,255.65 | $2,203.03 | $2,028.39 |

| 58049 | $4,002.73 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,309.20 | $3,356.22 | $2,203.03 | $2,028.39 |

| 58053 | $4,002.20 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,239.22 | $2,203.03 | $2,028.39 |

| 58424 | $4,001.33 | $4,697.64 | $3,506.23 | $2,939.23 | $2,693.74 | $12,316.57 | $2,309.20 | $3,317.94 | $2,203.03 | $2,028.39 |

| 58060 | $3,997.45 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,196.54 | $2,203.03 | $2,028.39 |

| 58013 | $3,996.80 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,190.61 | $2,203.03 | $2,028.39 |

| 58043 | $3,996.80 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,190.61 | $2,203.03 | $2,028.39 |

| 58067 | $3,996.80 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,190.61 | $2,203.03 | $2,028.39 |

| 58081 | $3,996.80 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,190.61 | $2,203.03 | $2,028.39 |

| 58040 | $3,994.30 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,168.14 | $2,203.03 | $2,028.39 |

| 58492 | $3,991.20 | $4,417.76 | $3,506.23 | $3,055.63 | $2,693.74 | $12,316.57 | $2,309.20 | $3,390.27 | $2,203.03 | $2,028.39 |

| 58479 | $3,987.24 | $4,417.76 | $3,506.23 | $3,055.63 | $2,693.74 | $12,316.57 | $2,309.20 | $3,354.65 | $2,203.03 | $2,028.39 |

| 58426 | $3,987.19 | $4,402.42 | $3,506.23 | $3,055.63 | $2,693.74 | $12,316.57 | $2,309.20 | $3,369.51 | $2,203.03 | $2,028.39 |

| 58704 | $3,986.79 | $4,614.80 | $3,676.98 | $3,025.07 | $2,196.11 | $11,458.58 | $2,751.73 | $3,879.95 | $2,667.73 | $1,610.12 |

| 58077 | $3,985.76 | $4,806.45 | $3,506.23 | $2,836.44 | $2,693.74 | $12,316.57 | $2,421.39 | $3,059.56 | $2,203.03 | $2,028.39 |

| 58068 | $3,984.87 | $4,526.59 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,421.39 | $3,363.19 | $2,203.03 | $2,028.39 |

| 58015 | $3,984.37 | $4,806.45 | $3,506.23 | $2,836.44 | $2,693.74 | $12,316.57 | $2,421.39 | $3,047.10 | $2,203.03 | $2,028.39 |

| 58031 | $3,983.92 | $4,526.59 | $3,506.23 | $2,947.60 | $2,693.74 | $12,316.57 | $2,309.20 | $3,323.97 | $2,203.03 | $2,028.39 |

| 58052 | $3,981.57 | $4,806.45 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,309.20 | $3,165.77 | $2,203.03 | $2,028.39 |

| 58064 | $3,980.01 | $4,417.76 | $3,506.23 | $3,061.45 | $2,693.74 | $12,316.57 | $2,309.20 | $3,283.74 | $2,203.03 | $2,028.39 |

| 58021 | $3,979.31 | $4,806.45 | $3,506.23 | $2,836.44 | $2,693.74 | $12,316.57 | $2,309.20 | $3,113.78 | $2,203.03 | $2,028.39 |

| 58071 | $3,978.43 | $4,526.59 | $3,506.23 | $2,947.60 | $2,693.74 | $12,316.57 | $2,309.20 | $3,274.48 | $2,203.03 | $2,028.39 |

| 58051 | $3,976.06 | $4,806.45 | $3,506.23 | $2,836.44 | $2,693.74 | $12,316.57 | $2,309.20 | $3,084.45 | $2,203.03 | $2,028.39 |

| 58011 | $3,974.84 | $4,526.59 | $3,506.23 | $2,947.60 | $2,693.74 | $12,316.57 | $2,309.20 | $3,242.23 | $2,203.03 | $2,028.39 |

| 58072 | $3,973.41 | $4,526.59 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,309.20 | $3,372.25 | $2,203.03 | $2,028.39 |

| 58027 | $3,972.41 | $4,526.59 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,309.20 | $3,363.19 | $2,203.03 | $2,028.39 |

| 58062 | $3,970.69 | $4,526.59 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,309.20 | $3,347.75 | $2,203.03 | $2,028.39 |

| 58063 | $3,969.97 | $4,526.59 | $3,506.23 | $2,804.73 | $2,693.74 | $12,316.57 | $2,309.20 | $3,341.27 | $2,203.03 | $2,028.39 |

| 58029 | $3,969.20 | $4,591.40 | $3,506.23 | $2,854.99 | $2,693.74 | $12,316.57 | $2,309.20 | $3,219.21 | $2,203.03 | $2,028.39 |

| 58007 | $3,961.99 | $4,526.59 | $3,506.23 | $2,854.99 | $2,693.74 | $12,316.57 | $2,309.20 | $3,219.21 | $2,203.03 | $2,028.39 |

| 58079 | $3,960.20 | $4,526.59 | $3,506.23 | $2,947.60 | $2,693.74 | $12,316.57 | $2,309.20 | $3,110.43 | $2,203.03 | $2,028.39 |

| 58036 | $3,949.60 | $4,591.40 | $3,506.23 | $2,854.99 | $2,693.74 | $12,316.57 | $2,309.20 | $3,042.88 | $2,203.03 | $2,028.39 |

| 58004 | $3,948.28 | $4,591.40 | $3,506.23 | $2,854.99 | $2,693.74 | $12,316.57 | $2,309.20 | $3,030.95 | $2,203.03 | $2,028.39 |

| 58006 | $3,948.28 | $4,591.40 | $3,506.23 | $2,854.99 | $2,693.74 | $12,316.57 | $2,309.20 | $3,030.95 | $2,203.03 | $2,028.39 |

| 58401 | $3,947.84 | $4,697.64 | $3,506.23 | $2,603.49 | $2,693.74 | $12,394.30 | $2,309.20 | $3,094.53 | $2,203.03 | $2,028.39 |

| 58405 | $3,941.49 | $4,697.64 | $3,506.23 | $2,546.35 | $2,693.74 | $12,394.30 | $2,309.20 | $3,094.53 | $2,203.03 | $2,028.39 |

| 58048 | $3,940.10 | $4,482.57 | $3,506.23 | $2,854.99 | $2,693.74 | $12,316.57 | $2,309.20 | $3,066.14 | $2,203.03 | $2,028.39 |

| 58005 | $3,926.08 | $4,591.40 | $3,506.23 | $2,854.99 | $2,693.74 | $12,316.57 | $2,309.20 | $2,802.11 | $2,232.12 | $2,028.39 |

| 58042 | $3,905.99 | $4,806.45 | $2,951.44 | $2,849.52 | $2,693.74 | $12,316.57 | $2,309.20 | $2,966.46 | $2,232.12 | $2,028.39 |

| 58059 | $3,882.71 | $4,806.45 | $2,694.34 | $2,769.40 | $2,693.74 | $12,316.57 | $2,309.20 | $3,094.21 | $2,232.12 | $2,028.39 |

| 58047 | $3,871.57 | $4,806.45 | $2,694.34 | $2,836.44 | $2,693.74 | $12,316.57 | $2,309.20 | $2,926.85 | $2,232.12 | $2,028.39 |

| 58012 | $3,838.00 | $4,526.59 | $2,694.34 | $2,854.99 | $2,693.74 | $12,316.57 | $2,309.20 | $2,915.17 | $2,203.03 | $2,028.39 |

| 58105 | $3,806.23 | $4,806.45 | $2,951.44 | $3,402.78 | $2,159.55 | $11,299.81 | $2,287.73 | $3,087.78 | $2,232.12 | $2,028.39 |

| 58102 | $3,789.93 | $4,806.45 | $2,951.44 | $2,681.89 | $2,159.55 | $11,846.78 | $2,287.73 | $3,087.78 | $2,232.12 | $2,055.63 |

| 58201 | $3,748.50 | $4,461.05 | $3,369.92 | $2,849.48 | $2,134.85 | $11,230.18 | $2,335.26 | $3,358.59 | $2,128.86 | $1,868.29 |

| 58202 | $3,736.36 | $4,461.05 | $3,369.92 | $2,585.12 | $2,134.85 | $11,230.18 | $2,335.26 | $3,353.62 | $2,128.86 | $2,028.39 |

| 58203 | $3,727.21 | $4,461.05 | $3,369.92 | $2,585.12 | $2,134.85 | $11,230.18 | $2,335.26 | $3,431.36 | $2,128.86 | $1,868.29 |

| 58204 | $3,723.40 | $4,461.05 | $3,506.23 | $2,781.01 | $2,168.73 | $11,230.18 | $2,335.26 | $3,272.83 | $2,128.86 | $1,626.47 |

| 58205 | $3,723.40 | $4,461.05 | $3,506.23 | $2,781.01 | $2,168.73 | $11,230.18 | $2,335.26 | $3,272.83 | $2,128.86 | $1,626.47 |

| 58103 | $3,716.98 | $4,806.45 | $2,951.44 | $2,600.09 | $2,159.55 | $11,299.81 | $2,287.73 | $3,060.04 | $2,232.12 | $2,055.63 |

| 58078 | $3,709.87 | $4,806.45 | $2,694.34 | $2,613.03 | $2,490.53 | $11,389.61 | $2,158.17 | $2,948.94 | $2,232.12 | $2,055.63 |

| 58104 | $3,677.18 | $4,806.45 | $2,694.34 | $2,550.59 | $2,159.55 | $11,389.61 | $2,287.73 | $2,918.61 | $2,232.12 | $2,055.63 |

Between the most and the least expensive zip codes, there is an $800 difference. This isn’t terrible, — in some states, an area change can result in an increase of a few thousand dollars.

Shopping around for providers can lower rates, as well. While the average at zip code 58538 is $4,477, Geico only charges an average of $2,693 in that area. Read more about Geico in our Geico insurance review & complaints.

Make sure to check rates in your area, as switching providers could save money.

Cheapest Rates by City

Let’s look a little closer at area rates by seeing which cities have the most and least expensive rates in North Dakota.

| City | Annual Average |

|---|---|

| WEST FARGO | $3,709.87 |

| GRAND FORKS AFB | $3,723.40 |

| GRAND FORKS | $3,737.36 |

| FARGO | $3,747.58 |

| CASSELTON | $3,838.00 |

| HORACE | $3,871.57 |

| MAPLETON | $3,882.71 |

| HARWOOD | $3,905.99 |

| ARGUSVILLE | $3,926.08 |

| HUNTER | $3,940.10 |

| JAMESTOWN | $3,944.67 |

| AMENIA | $3,948.28 |

| ARTHUR | $3,948.28 |

| GARDNER | $3,949.60 |

| WHEATLAND | $3,960.20 |

| AYR | $3,961.99 |

| ERIE | $3,969.20 |

| ORISKA | $3,969.97 |

| NOME | $3,970.69 |

| ENDERLIN | $3,972.41 |

| VALLEY CITY | $3,973.41 |

| BUFFALO | $3,974.84 |

| KINDRED | $3,976.06 |

| TOWER CITY | $3,978.43 |

| DAVENPORT | $3,979.32 |

| PAGE | $3,980.01 |

| LEONARD | $3,981.57 |

| FINGAL | $3,983.92 |

| CHRISTINE | $3,984.37 |

| SHELDON | $3,984.87 |

| WALCOTT | $3,985.76 |

| COURTENAY | $3,987.19 |

| ROGERS | $3,987.25 |

| WIMBLEDON | $3,991.20 |

| GWINNER | $3,994.30 |

| CAYUGA | $3,996.80 |

| HAVANA | $3,996.80 |

| RUTLAND | $3,996.80 |

| WYNDMERE | $3,996.80 |

| MILNOR | $3,997.46 |

| CLEVELAND | $4,001.33 |

| LIDGERWOOD | $4,002.20 |

| KATHRYN | $4,002.73 |

| COGSWELL | $4,004.02 |

| HANKINSON | $4,004.05 |

| MANTADOR | $4,004.05 |

| ABERCROMBIE | $4,004.14 |

| STREETER | $4,005.59 |

| MINOT AFB | $4,006.17 |

| FAIRMOUNT | $4,006.25 |

| WAHPETON | $4,007.43 |

| FORMAN | $4,007.50 |

| COLFAX | $4,007.57 |

| MOORETON | $4,007.57 |

| GRANDIN | $4,007.65 |

| MCLEOD | $4,012.93 |

| DAZEY | $4,013.08 |

| STIRUM | $4,013.29 |

| LISBON | $4,014.59 |

| MEDINA | $4,015.29 |

| FORT RANSOM | $4,015.64 |

| BARNEY | $4,018.79 |

| WOODWORTH | $4,025.55 |

| ABSARAKA | $4,027.31 |

| DICKINSON | $4,028.34 |

| MEKINOCK | $4,029.08 |

| BISMARCK | $4,035.95 |

| FULLERTON | $4,039.90 |

| MONTPELIER | $4,045.16 |

| YPSILANTI | $4,045.44 |

| BUCHANAN | $4,047.01 |

| PINGREE | $4,047.70 |

| SANBORN | $4,047.97 |

| LITCHVILLE | $4,048.15 |

| OAKES | $4,051.72 |

| JUD | $4,051.76 |

| SPIRITWOOD | $4,052.61 |

| PILLSBURY | $4,052.80 |

| ELLENDALE | $4,055.82 |

| KENSAL | $4,058.45 |

| EMERADO | $4,059.54 |

| VERONA | $4,059.67 |

| MINOT | $4,065.38 |

| KULM | $4,065.62 |

| DICKEY | $4,075.62 |

| LAMOURE | $4,078.26 |

| MARION | $4,078.26 |

| GALESBURG | $4,080.20 |

| FORBES | $4,084.84 |

| REYNOLDS | $4,086.18 |

| MAYVILLE | $4,086.50 |

| BLANCHARD | $4,086.79 |

| MANVEL | $4,087.42 |

| BUXTON | $4,097.06 |

| CLIFFORD | $4,099.98 |

| THOMPSON | $4,100.56 |

| GILBY | $4,101.02 |

| INKSTER | $4,101.02 |

| HATTON | $4,101.20 |

| LEHR | $4,102.31 |

| ZEELAND | $4,102.31 |

| ARVILLA | $4,102.37 |

| GACKLE | $4,102.85 |

| CUMMINGS | $4,105.83 |

| ASHLEY | $4,106.22 |

| FREDONIA | $4,106.22 |

| SURREY | $4,106.35 |

| EDGELEY | $4,107.12 |

| CALEDONIA | $4,108.64 |

| BURLINGTON | $4,109.60 |

| NAPOLEON | $4,112.39 |

| WISHEK | $4,115.81 |

| LUVERNE | $4,121.86 |

| BERLIN | $4,122.06 |

| HILLSBORO | $4,122.50 |

| PORTLAND | $4,123.81 |

| HOPE | $4,124.99 |

| COOPERSTOWN | $4,130.30 |

| MANDAN | $4,131.14 |

| SHARON | $4,131.34 |

| BINFORD | $4,134.25 |

| FINLEY | $4,136.68 |

| HANNAFORD | $4,141.42 |

| NORTHWOOD | $4,145.67 |

| LARIMORE | $4,160.48 |

| PETTIBONE | $4,188.40 |

| JESSIE | $4,188.41 |

| SUTTON | $4,189.40 |

| ANETA | $4,190.99 |

| CAVALIER | $4,195.27 |

| PEKIN | $4,197.95 |

| NIAGARA | $4,199.72 |

| MOUNTAIN | $4,201.35 |

| EDINBURG | $4,201.60 |

| CALVIN | $4,208.62 |

| HANNAH | $4,208.62 |

| MAIDA | $4,208.62 |

| SARLES | $4,208.62 |

| WALES | $4,208.62 |

| CRYSTAL | $4,209.36 |

| ALSEN | $4,209.61 |

| MILTON | $4,209.61 |

| NEKOMA | $4,209.61 |

| OSNABROCK | $4,209.61 |

| LANGDON | $4,209.93 |

| BATHGATE | $4,210.58 |

| HAMILTON | $4,210.58 |

| BISBEE | $4,211.65 |

| HENSEL | $4,213.22 |

| DAHLEN | $4,213.47 |

| LEEDS | $4,213.64 |

| PARK RIVER | $4,213.64 |

| CHURCHS FERRY | $4,216.40 |

| WEBSTER | $4,216.40 |

| TAPPEN | $4,216.57 |

| CANDO | $4,219.20 |

| PENN | $4,219.99 |

| DEVILS LAKE | $4,220.00 |

| MINNEWAUKAN | $4,220.14 |

| DAWSON | $4,220.16 |

| FORDVILLE | $4,220.67 |

| FOREST RIVER | $4,220.67 |

| MINTO | $4,220.67 |

| HAMPDEN | $4,220.72 |

| GLASSTON | $4,222.56 |

| SAINT THOMAS | $4,222.56 |

| FAIRDALE | $4,222.78 |

| EDMORE | $4,223.59 |

| LANKIN | $4,225.10 |

| MUNICH | $4,225.73 |

| LAWTON | $4,226.05 |

| ADAMS | $4,226.37 |

| HOOPLE | $4,227.80 |

| ROBINSON | $4,227.93 |

| TUTTLE | $4,227.93 |

| CRARY | $4,228.01 |

| BROCKET | $4,228.39 |

| NECHE | $4,229.30 |

| PISEK | $4,230.93 |

| WALHALLA | $4,231.81 |

| STARKWEATHER | $4,234.82 |

| DRAYTON | $4,236.08 |

| PEMBINA | $4,236.08 |

| EGELAND | $4,237.97 |

| ROCKLAKE | $4,237.97 |

| GRAFTON | $4,238.38 |

| HANSBORO | $4,245.24 |

| GLENFIELD | $4,250.29 |

| MICHIGAN | $4,254.06 |

| MCHENRY | $4,254.29 |

| MCVILLE | $4,255.37 |

| PETERSBURG | $4,255.37 |

| STEELE | $4,255.44 |

| WILLISTON | $4,256.32 |

| OBERON | $4,259.04 |

| PERTH | $4,269.20 |

| WARWICK | $4,272.39 |

| TRENTON | $4,273.21 |

| FORT TOTTEN | $4,275.94 |

| SAINT MICHAEL | $4,275.94 |

| CARRINGTON | $4,276.21 |

| TOLNA | $4,277.66 |

| NEW ROCKFORD | $4,278.15 |

| AGATE | $4,279.10 |

| GRACE CITY | $4,279.46 |

| MADDOCK | $4,280.93 |

| SHEYENNE | $4,281.62 |

| LAKOTA | $4,282.35 |

| MYLO | $4,283.07 |

| CHASELEY | $4,284.23 |

| CATHAY | $4,284.91 |

| STANTON | $4,286.75 |

| BOTTINEAU | $4,288.00 |

| WILLOW CITY | $4,288.00 |

| MEDORA | $4,289.13 |

| TOKIO | $4,292.91 |

| FESSENDEN | $4,294.88 |

| ROLETTE | $4,300.31 |

| KRAMER | $4,301.23 |