Best South Dakota Car Insurance (2025)

What car insurance is required in South Dakota? The liability requirements are 25/50/25 for bodily injury and property damage liability coverage and 25/50 for uninsured motorist coverage. South Dakota car insurance rates average $64 a month. Our experts help you find the best South Dakota car insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many different insurance providers, which gives him unique insight into the insurance market...

Commercial Lines Coverage Specialist

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

South Dakota Stats Table

| Statistics Summary | Details |

|---|---|

| Road Miles | Approximately 82,000 miles |

| Vehicles | Registered: Over 1.5 million Stolen: 1,000 |

| State Population | Approximately 895,000 |

| Most Popular Vehicle | Ford F-150 |

| Uninsured Motorists | Around 7.7% of drivers |

| Total Driving Fatalities | Speeding: 41 Drunk Driving: 24 |

| Monthly Average | Collision: $38 Comprehensive: $19 Liability: $54 |

| Cheapest Providers | Geico, State Farm, Progressive, and Farmers are some popular auto insurance providers in South Dakota |

South Dakota, which became a state in November of 1889, is most famous for the imposing and dramatic Mount Rushmore National Memorial. In fact, its official nickname is “the Mount Rushmore State,” which is even inscribed on its flag.

Love the outdoors? South Dakota has much to offer, including fishing, hunting, and hiking. The state also boasts two of the longest caves on the planet, along with Badlands National Park, which is 244,000 acres of fossil beds, prairies, and more.

South Dakota is also the final resting place for some famous figures from America’s Wild West. You can see the graves of Wild Bill Hickok, Calamity Jane, and more when you visit the Mount Moriah Cemetery, located in Deadwood. While you’re there, you can also witness a Main Street Shootout performed by actors.

There are also several events across the state every year that are worth checking out, whether you’re a resident or just visiting. The world-famous Sturgis Motorcycle Rally takes place in mid-August.

Grow up reading about Laura Ingalls Wilder? There’s a pageant with theater performances in July that’s a must-see. Curious about the culture and traditions of the Native Americans of South Dakota? Numerous powwows are held across the state throughout the summer and fall.

Whether you live in or visit South Dakota, you know the best way to get around the state is on the road. To ensure you have the essentials to travel there both safely and legally, you need to have the right car insurance coverage. Learn more about the different types of car insurance coverage.

But how much is car insurance in South Dakota? Is South Dakota a no-fault insurance state? These are important questions that need to be answered.

Finding cheap South Dakota car insurance rates and coverage for your needs can be complicated. There’s so much you need to know when you compare car insurance: legal requirements, coverage types, rates, and how those rates are derived are just a few examples. We know figuring all this out can be overwhelming. But we’ve got you covered.

To find out everything you need to know about car insurance in South Dakota so you can get the best South Dakota car insurance, keep reading. As a first step, why not use your ZIP code to get a free quote on car insurance?

South Dakota Car Insurance Coverage and Rates

The first steps toward making the all-important car insurance decision include knowing what the insurance coverage requirements are in South Dakota, deciding what coverage level you need, and knowing what other options may be available, should you decide you need something beyond basic coverage.

But where do you start in finding this information? We know this can be difficult, especially if you want to be prepared before you speak with an insurance agent. It helps to know the basics, and have an idea of what you’re looking for before you start that conversation.

We’ve pulled together some of the basics that you need, so you don’t have to spend hours doing your own research.

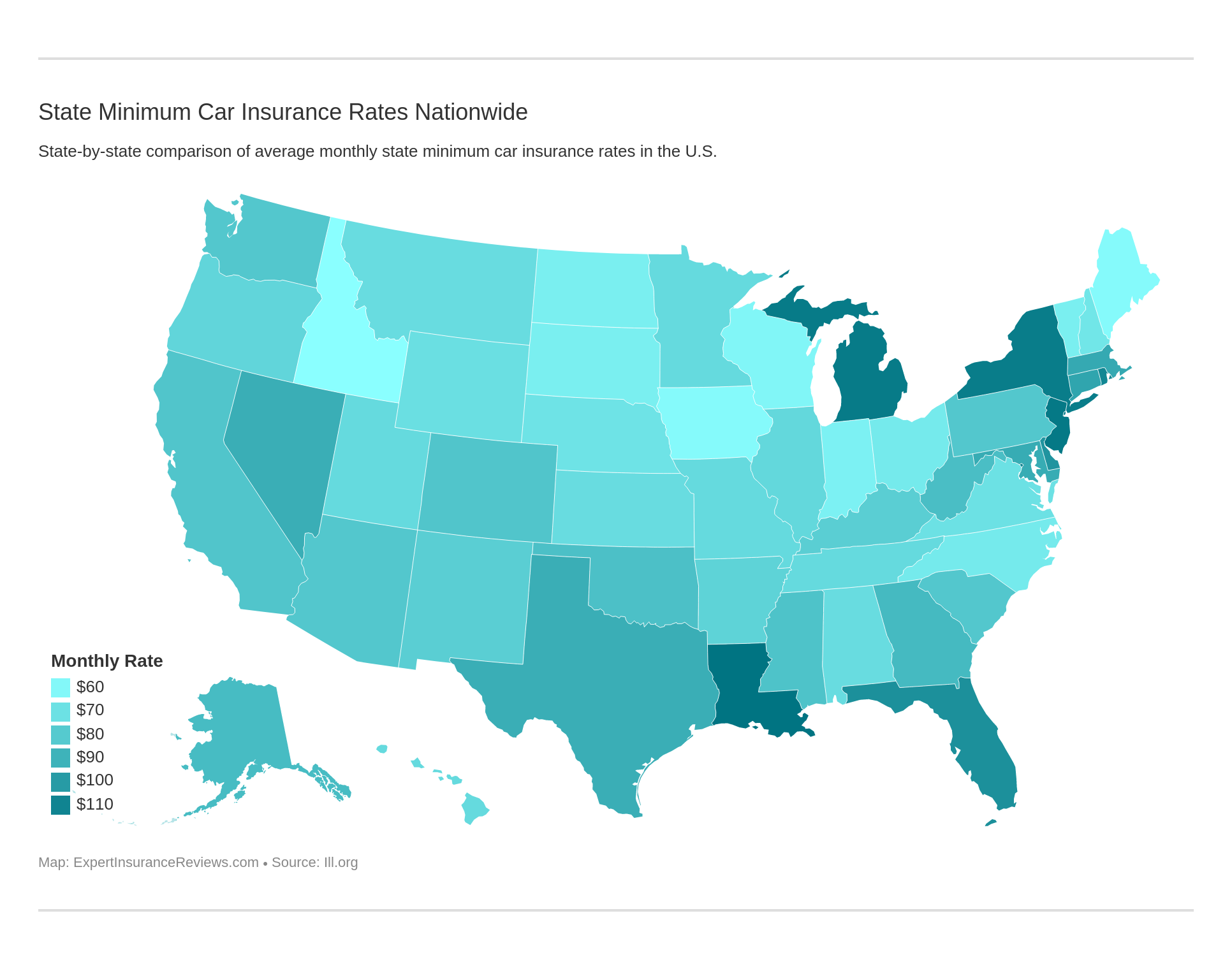

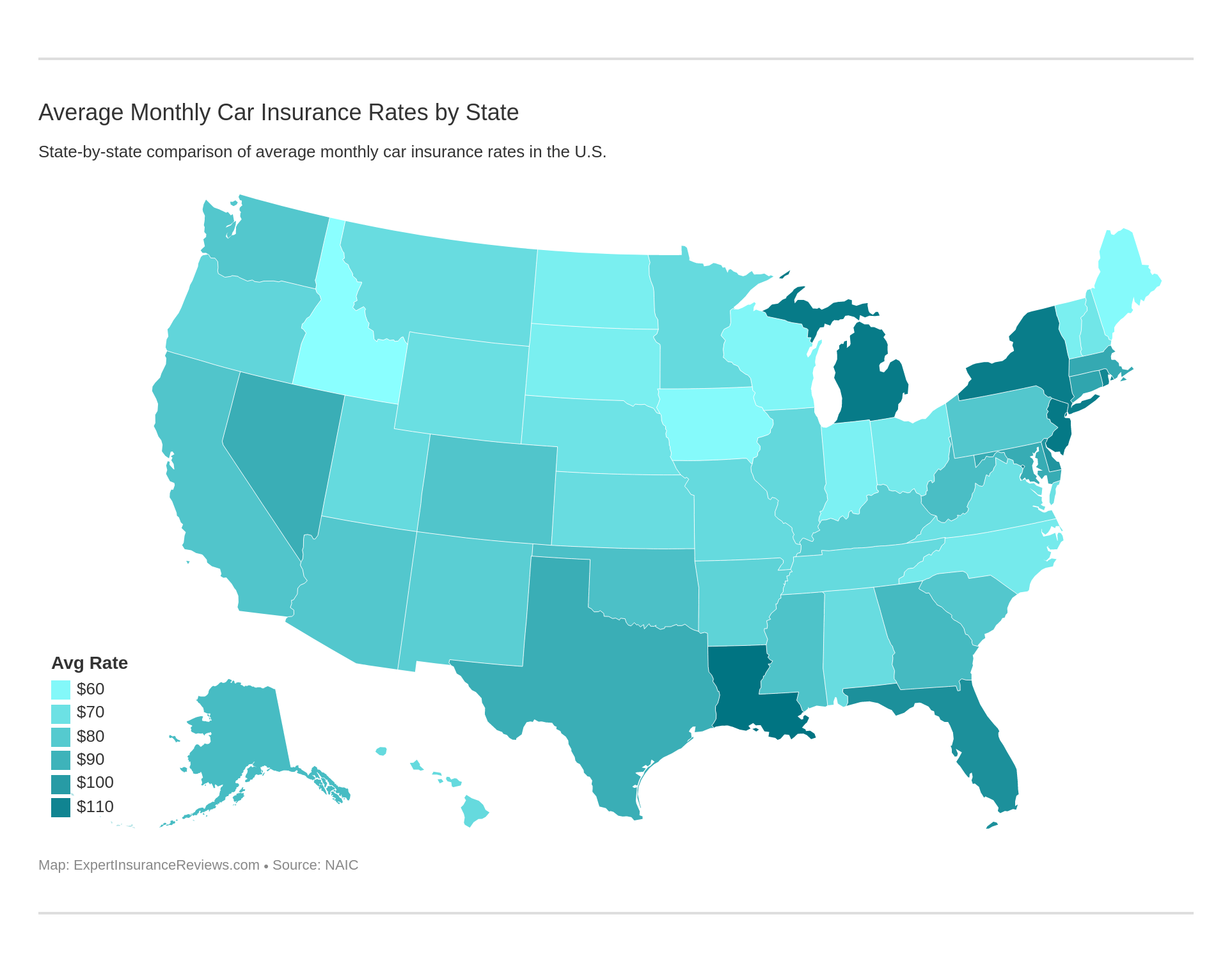

One of the first considerations you can look at is price. It is important to know what average rates are in your area, as well as how they look compared to rates throughout the United States so you can begin to determine what’s a fair price.

To get an idea of the standard price in South Dakota, take a look at the table below to see average rates for all kinds of car insurance in the Mount Rushmore State compared to the national averages.

SD Car Insurance Average

| South Dakota Average | National Average | Percent Difference |

|---|---|---|

| $110 | $123 | 11.84% |

As you can see, the national average for all car insurance types is $1,474. Compare this to the state average of $1,318. This is good news for South Dakota drivers, who pay about 12% less for car insurance than the national average.

South Dakota’s Car Culture

The most popular vehicle in South Dakota is the Ford F-150. With over 82,500 miles of road in the state, and few options for public transportation, most residents of the state own and drive their own vehicles. The F-150 is both practical and operable in a variety of terrains and weather conditions.

South Dakota has some history with the car industry. The inventor of the four-door vehicle, Thomas Fawick, lived in Sioux Falls, South Dakota. He called it the Fawick Flyer, and it was made of aluminum. He invented the Flyer in 1908, and Teddy Roosevelt rode in it during a 1910 parade.

Read more: Best Ford F-150 Car Insurance Quotes

South Dakota Car Insurance Requirements

For drivers to be safe and financially protected when driving in South Dakota, the state mandates all drivers purchase at least minimum liability insurance coverage. You must maintain this coverage to legally drive in the state.

South Dakota is considered a “fault” state. This means that if you’re in an accident, the person who caused it is financially responsible for any resulting damage. Because of this, it is even more important that you have at least the South Dakota auto insurance minimum when driving in the state. Take a look at the table below to see what you’ll need.

SD Minimum Coverage Requirements

| Required Insurance | Minimum Limits |

|---|---|

| Bodily Injury | $25,000 per person $50,000 per accident |

| Property Damage Liability | $25,000 |

| Uninsured Motorist Coverage | $25,000 per person $50,000 per accident |

While many states do not require drivers to purchase uninsured/underinsured motorist coverage as a part of the minimum liability coverage requirements, and it is often considered liability coverage, South Dakota does include this as a requirement for drivers. The cost of minimum coverage also varies from state to state.

Read more:

Keep in mind that the insurance coverage outlined in the above table is only the minimum requirement. Should you find yourself in an accident, the cost of damages could exceed the amount of coverage you have if you purchase only the bare minimum.

In such a situation, you will be responsible for paying any additional costs out of your own pocket.

If you want to make sure you have additional financial protection above the minimum liability coverage requirement, you can purchase policies that include core coverage, additional liability coverage, and other add-ons. To learn more about the car insurance options available to you in addition to the minimum liability requirements, keep reading.

Forms of Financial Responsibility

Financial responsibility is often proven through proof of insurance. In South Dakota, this proof can be in paper or digital form.

In addition to insurance, South Dakota allows residents to offer a financial non-insurance option. This is typically completed through a bond from a surety company, a certificate of money through the state treasurer, or deposited securities. All these options must equal the dollar amount of the minimum liability insurance coverage.

If you own 26 vehicles or more, you can self-insure your vehicles. Proof of this is demonstrated by a certificate of self-insurance, which must be provided to the South Dakota Department of Public Safety.

Premiums as a Percentage of Income

Now that you know what insurance you are required to carry as a driver in South Dakota, how much of your hard-earned cash can you expect to spend? How much of what you make should you be setting aside for insurance each year?

In the table below, we’ve pulled data on the average amount of disposable income South Dakota drivers typically spend on car insurance. We’ve also compared that to the national average so you can see how the state looks beside the country as a whole.

SD Premiums as a Percentage of Income

| Statistics 2019 2020 2021 | 2019 | 2020 | 2021 |

|---|---|---|---|

| South Dakota Average | 3.00% | 4.50% | 3.20% |

| National Average | 3.70% | 8.10% | 4.60% |

| Percent Difference | -19% | -44% | -30% |

South Dakota residents spend an average of 1.74& of their disposable income on car insurance coverage. By contrast, the national average for the same is 2.39%. Good news for South Dakota drivers; you spend an average of 27% less of your disposable income than the national average.

To make this more interesting, we’ve also compared South Dakota’s rate of disposable income spent on car insurance to some of the nearby states to see how the Mount Rushmore State stacks up against its neighbors. We’ve included data for Montana, North Dakota, Wyoming, Minnesota, and Nebraska.

SD Premiums of Financial Responsibility by State

| State | 2019 | 2020 | 2021 |

|---|---|---|---|

| Minnesota | 2% | 2% | 2% |

| Montana | 2% | 2% | 2% |

| Nebraska | 2% | 2% | 2% |

| North Dakota | 1% | 2% | 1% |

| South Dakota | 2% | 2% | 2% |

| Wyoming | 2% | 2% | 2% |

As you can see, only one of the five neighboring states, North Dakota, spends less than South Dakota on car insurance policies. This is good news for residents of the Mount Rushmore State.

CalculatorPro

Read more: Best North Dakota Car Insurance

Average Monthly Car Insurance Rates in SD (Liability, Collision, Comprehensive)

As the name suggests, the minimum liability coverage requirements only cover the minimum. If you end up in an accident, you may find yourself holding the bag for additional costs.

The best way to make sure you have the coverage you need to ensure you’re financially protected is to speak to your insurer about “core coverage” options you can add to your policy. These typically include collision, comprehensive, and full or combined. When you increase your policy, you can choose to purchase all or some combination of these.

Take a look at this video to find out more about the various core coverage options.

Check out this table to see how much you might pay for each of the core coverage options in South Dakota.

SD Core Coverage

| Coverage Type | 2019-2021 Average Cost in South Dakota | 2019-2021 National Average | Percent Difference |

|---|---|---|---|

| Liability | $325 | $600 | 85% |

| Collision | $225 | $350 | 56% |

| Comprehensive | $250 | $160 | -36% |

| Combined/Full | $800 | $1,110 | 39% |

When you view the above table, please keep in mind these are only average numbers based on the minimum coverage requirements in South Dakota.

As such, these National Associate of Insurance Commissioners (NAIC) rates may not be representative of exactly what you’d pay but will help you start to form a clearer picture of what fair rates are in your area.

Additional Liability

What if you feel core coverage doesn’t cover your needs? If you think you need additional financial protection, beyond what is offered through core coverage, you can consider additional liability coverage options.

Uninsured/underinsured motorist coverage, which is required as part of your minimum liability coverage in South Dakota, is typically considered an additional liability option. This liability coverage offers additional financial protection for you, should you find yourself in an accident with an uninsured/underinsured driver.

With nearly 8% of drivers in South Dakota uninsured, this could happen to you.

There are two other common forms of additional liability coverage:

- Medical Payments (MedPay) – provides additional coverage for medical costs that are not covered by your core insurance coverage (for both you and anyone listed on your policy)

- Personal Injury Protection (PIP) – provides additional coverage for medical costs that are not already covered by your core insurance coverage (for you and anyone involved in an accident, no matter who is at fault)

Ensuring you are informed of all the options at your disposal is important when shopping for insurance so you can ask the right questions and make a determination regarding which coverage types best fit your needs.

Read more:

Before you decide on any of these options, you might ask yourself if the benefit is worth the cost. Is there a good chance your insurance provider will pay out on claims for these additional liability coverage types, should you ever need to file a claim? If not, you may want to reconsider whether adding these to your policy is the right choice for you.

To find out whether or not insurance companies in South Dakota have a good track record of paying out on South Dakota car insurance claims for these additional liability options, the NAIC offers “loss ratio” data. This data is quantified as a percentage, derived by dividing the number of claims insurance companies pay out by the dollar amount of the premiums they are paid.

But what exactly does loss ratio tell you, and how do you know if the number is good or bad? Loss ratio data is an indicator of whether or not companies typically pay out on an equitable number of claims. In general, a solid range for loss ratio is between 60 and 80%.

If you find that an insurance company has a loss ratio number higher than 80%, this means they pay out on too many claims and they’re losing money. By contrast, if a company has a loss ratio lower than 60%, they are not paying out on enough claims.

The NAIC 2013-2015 loss ratio data for the South Dakota insurance market for uninsured/underinsured motorist coverage and MedPay is listed in the below table. The NAIC does not currently offer South Dakota loss ratio data for PIP.

SD Loss Ratio

| Loss Ratio | 2019 | 2020 | 2021 |

|---|---|---|---|

| Uninsured/Underinsured Motorist | 80% | 80% | 80% |

| MedPay | 70% | 70% | 70% |

As you can see, the loss ratio for MedPay is within a healthy range (70-76%) across the three-year span. However, for uninsured/underinsured motorist coverage, which you’ll recall is required as a part of South Dakota’s minimum liability coverage, the data shows a trend of underpaying out on claims.

Only 2015’s loss ratio data falls within a healthy range for this piece of liability coverage.

Add-ons, Endorsements, and Riders

Need something beyond core and additional liability coverage? There are some extra options you can consider and discuss with your insurance agent. These add-ons, endorsements, and riders are described below:

- Guaranteed Auto Protection (GAP) – covers the gap between what your car is worth and what you still owe on your loan

- Personal Umbrella Policy (PUP) – provides protection in the event you are ever faced with a lawsuit as a result of your part in a car accident

- Rental Reimbursement – provides coverage if you have to rent a car because yours was damaged in a car accident and is unavailable to drive while it’s being repaired

- Emergency Roadside Assistance – provides coverage for various roadside needs, like flat tires, towing, etc.

- Mechanical Breakdown Insurance (MBI) – provides repair coverage, often beyond what is covered by your vehicle’s warranty

- Non-Owner Car Insurance – provides insurance coverage when you don’t own a car but will be driving one

- Modified Car Insurance Coverage – provides coverage for vehicles with special modifications (wheels/tires, specialty paint jobs, spoilers, etc.)

- Classic Car Insurance – provides coverage for vehicles that are considered collector’s items

- Pay-As-You-Drive or Usage-Based Auto Insurance – insurance coverage that is specifically focused on individual driving habits

Read more:

- Does my car insurance cover rental reimbursement if my car is being repaired?

- Does my car insurance cover towing and roadside assistance?

- Can I get car insurance for a car that is modified or customized?

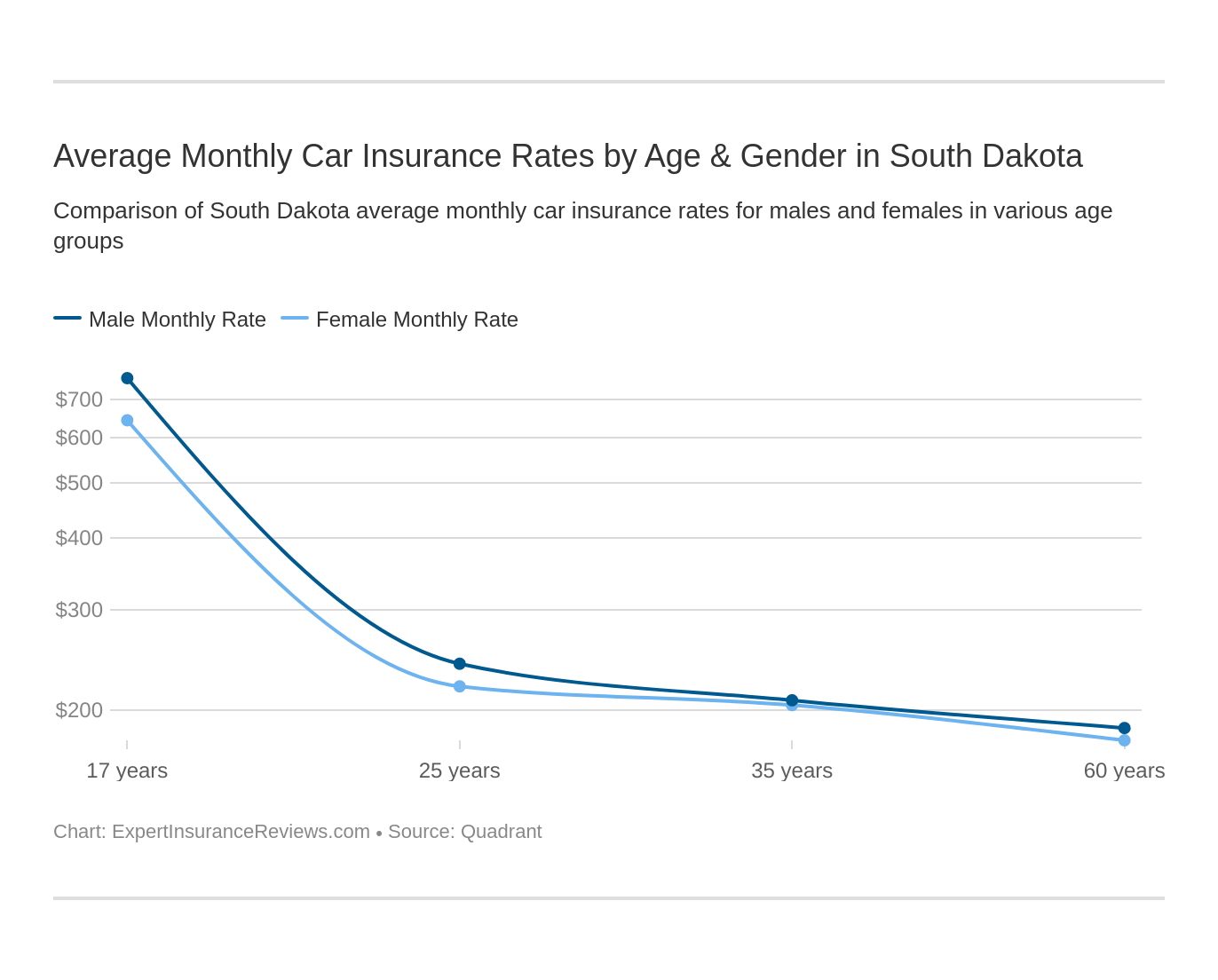

Average Car Insurance Rates by Age & Gender in SD

While the practice is becoming more of a topic of discussion across the country, and some states like California and Hawaii have made it illegal, South Dakota still allows insurance companies to consider gender as one of the factors they use when adjusting their car insurance premiums.

It is generally accepted that men (particularly young men) pay significantly more for insurance coverage than women, all else equal. But is this really true? Do gender (and associated ages) actually have an effect on insurance rates?

Take a look at the table below. Using Quadrant data, we’ve put together information on rates for various ages across both genders from some of the major insurance providers in South Dakota to answer these questions.

South Dakota Car Insurance Monthly Rates by Age and Gender

| Company | Single Female (Age 17) | Single Male (Age 17) | Single Female (Age 25) | Single Male (Age 25) | Married Female (Age 35) | Married Male (Age 35) | Married Female (Age 60) | Married Male (Age 60) |

|---|---|---|---|---|---|---|---|---|

| Allstate | $850 | $1,015 | $233 | $255 | $206 | $211 | $182 | $195 |

| AMCO | $353 | $457 | $182 | $198 | $162 | $167 | $145 | $155 |

| American Family | $502 | $738 | $243 | $299 | $243 | $243 | $215 | $215 |

| Geico | $398 | $470 | $173 | $166 | $197 | $186 | $188 | $174 |

| Mid-Century | $735 | $764 | $184 | $196 | $164 | $165 | $145 | $150 |

| Progressive | $644 | $732 | $225 | $235 | $179 | $177 | $148 | $152 |

| Safeco | $1,345 | $1,510 | $371 | $413 | $352 | $383 | $278 | $338 |

| State Farm | $321 | $412 | $146 | $164 | $131 | $131 | $113 | $113 |

As the data makes clear, both age and gender are factors in how insurance rates are determined in South Dakota. It is interesting to note, however, that each company uses these factors to adjust their rates differently. The contrasts among them are quite significant.

Let’s consider American Family Mutual, for example. Their average rates for 17-year-old males are almost 47% higher than the rates they charge females of the same age. Rates for males of the same age from Mid-Century Insurance Company, however, are only about 4% higher than their rates for 17-year-old females.

On average, across all the companies listed, 17-year-old males pay 18% more for car insurance than 17-year-old females do. However, if you examine the data more closely, it becomes clear that age is also a key factor.

At 25, males typically pay an average of 10% more than female drivers. However, at 35, the difference between rates for males and females is less than 2%. Some companies (Progressive Insurance and Geico) even charge female drivers more than male drivers for car insurance coverage.

When reviewing the above table (and associated analysis), it is important to note that the data is based on what South Dakota residents actually purchase.

To ensure this information is truly representative of the full range of drivers in the state, the data includes rates for high-risk drivers, drivers who only purchased minimum coverage, and those who purchased additional coverage.

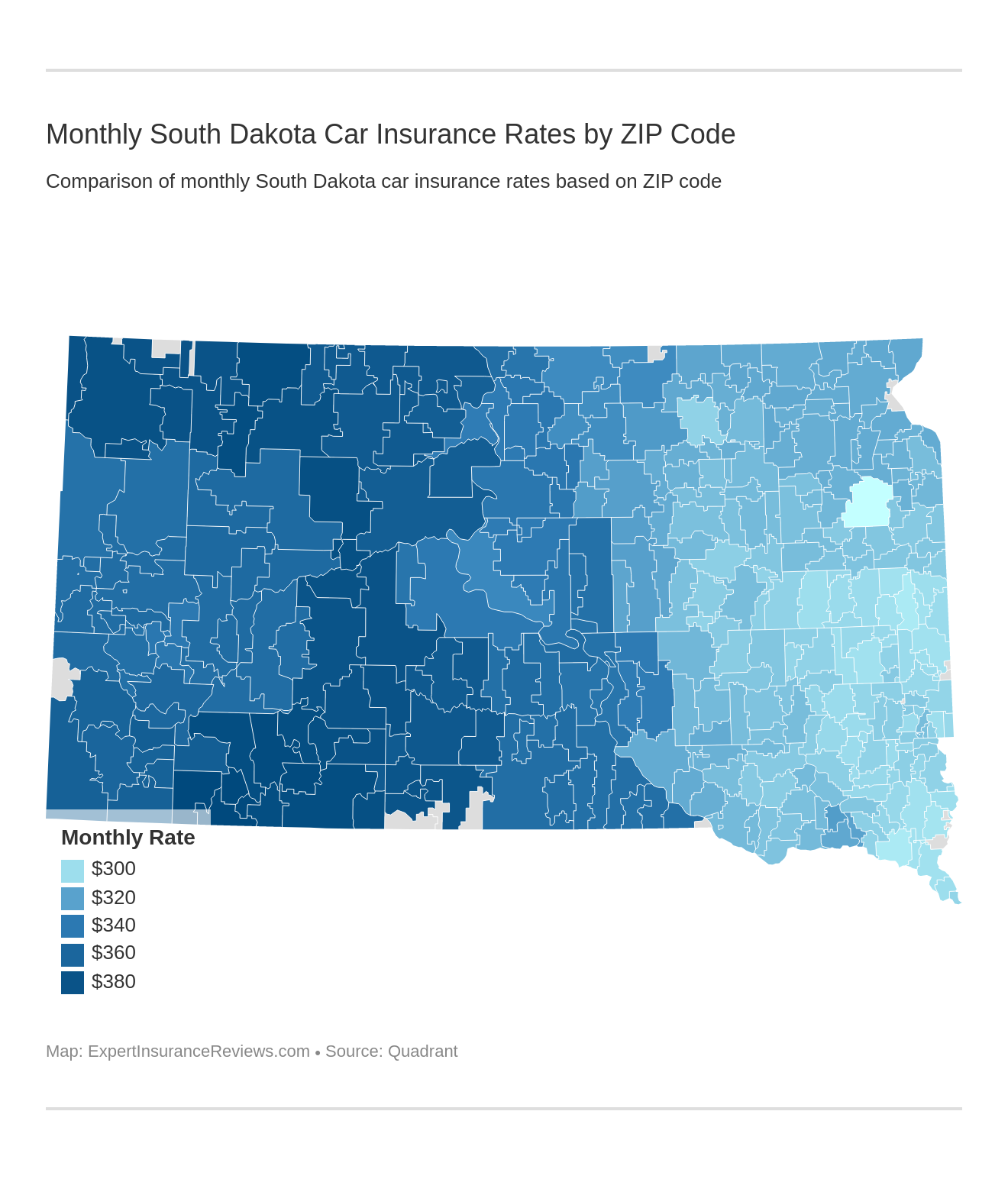

Cheapest Rates by ZIP Code in South Dakota

As we’re sure you’re aware, age and gender are only a couple of the factors companies can consider when determining rates; there are several others. Next on our list is where you live. Why does this matter?

Insurance companies want to know the risks you as a vehicle owner and driver may face based on your location. Do you live a high crime area? Do more car accidents occur close to your home? Higher risk areas can mean higher insurance rates, because those risks may mean you’re more likely to file a claim.

One way insurance companies get information is by pulling statistics based on ZIP code. The following tables break down the 25 most and least expensive ZIP codes for rates in South Dakota, so you can see the range in your state and gauge where your rates may fall.

Table of the 25 most expensive ZIP codes in South Dakota:

SD 25 Most Expensive ZIP Codes

| ZIP Code | City | Monthly Rates by ZIP Code | Most Expensive Company | Most Expensive Monthly Rates | 2nd Most Expensive Company | 2nd Most Expensive Monthly Rates | Cheapest Company | Cheapest Monthly Rates | 2nd Cheapest Company | 2nd Cheapest Monthly Rates | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 57770 | Pine Ridge | $391 | Liberty Mutual | $746 | Progressive | $407 | Nationwide | $252 | State Farm | $266 |

| 2 | 57756 | Manderson | $391 | Liberty Mutual | $746 | Progressive | $405 | Nationwide | $252 | State Farm | $268 |

| 3 | 57764 | Oglala | $391 | Liberty Mutual | $746 | Progressive | $407 | Nationwide | $252 | State Farm | $261 |

| 4 | 57794 | Wounded Knee | $390 | Liberty Mutual | $746 | Progressive | $405 | Nationwide | $252 | State Farm | $257 |

| 5 | 57714 | Allen | $389 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $255 | Nationwide | $267 |

| 6 | 57752 | Kyle | $388 | Liberty Mutual | $746 | Allstate | $401 | Nationwide | $252 | State Farm | $255 |

| 7 | 57772 | Porcupine | $386 | Liberty Mutual | $746 | Allstate | $401 | Nationwide | $252 | State Farm | $259 |

| 8 | 57716 | Batesland | $386 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $252 |

| 9 | 57638 | Lemmon | $386 | Liberty Mutual | $746 | Progressive | $403 | State Farm | $245 | Nationwide | $267 |

| 10 | 57551 | Martin | $386 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $256 | Nationwide | $267 |

| 11 | 57620 | Bison | $386 | Liberty Mutual | $746 | Allstate | $401 | Nationwide | $267 | State Farm | $275 |

| 12 | 57750 | Interior | $385 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 13 | 57623 | Dupree | $384 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $251 | Nationwide | $267 |

| 14 | 57574 | Tuthill | $384 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 15 | 57622 | Cherry Creek | $384 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 16 | 57577 | Wanblee | $384 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $250 | Nationwide | $267 |

| 17 | 57644 | Meadow | $382 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 18 | 57553 | Milesville | $382 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 19 | 57720 | Buffalo | $382 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $254 | Nationwide | $267 |

| 20 | 57547 | Long Valley | $381 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 21 | 57521 | Belvidere | $381 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 22 | 57724 | Camp Crook | $381 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 23 | 57776 | Redig | $381 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 24 | 57651 | Reva | $381 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 25 | 57552 | Midland | $380 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

Table of the 25 least expensive ZIP codes in South Dakota:

SD 25 Least Expensive ZIP Codes

| ZIP Code | City | Monthly Rates by ZIP Codes | Most Expensive Company | Most Expensive Monthly Rates | 2nd Most Expensive Company | 2nd Most Expensive Monthly Rates | Cheapest Company | Cheapest Monthly Rates | 2nd Cheapest Company | 2nd Cheapest Monthly Rates | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 57201 | Watertown | $289 | Liberty Mutual | $526 | Allstate | $378 | State Farm | $166 | Nationwide | $187 |

| 2 | 57069 | Vermillion | $296 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $158 | Nationwide | $199 |

| 3 | 57006 | Brookings | $296 | Liberty Mutual | $557 | Allstate | $384 | State Farm | $168 | Nationwide | $185 |

| 4 | 57001 | Alcester | $298 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $162 | Nationwide | $209 |

| 5 | 57220 | Bruce | $299 | Liberty Mutual | $561 | Allstate | $378 | State Farm | $169 | Nationwide | $209 |

| 6 | 57025 | Elk Point | $299 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $163 | Nationwide | $209 |

| 7 | 57004 | Beresford | $299 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $164 | Nationwide | $209 |

| 8 | 57071 | Volga | $299 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $170 | Nationwide | $209 |

| 9 | 57028 | Flandreau | $299 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $171 | Nationwide | $209 |

| 10 | 57061 | Sinai | $299 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $173 | Nationwide | $209 |

| 11 | 57042 | Madison | $299 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $175 | Nationwide | $197 |

| 12 | 57002 | Aurora | $299 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $169 | Nationwide | $209 |

| 13 | 57010 | Burbank | $299 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $173 | Nationwide | $209 |

| 14 | 57076 | Winfred | $300 | Liberty Mutual | $561 | Allstate | $378 | State Farm | $173 | Nationwide | $209 |

| 15 | 57276 | White | $300 | Liberty Mutual | $561 | Allstate | $378 | State Farm | $169 | Nationwide | $209 |

| 16 | 57007 | Brookings | $300 | Liberty Mutual | $557 | Allstate | $384 | State Farm | $173 | Nationwide | $209 |

| 17 | 57024 | Egan | $300 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $173 | Nationwide | $209 |

| 18 | 57034 | Hudson | $300 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $170 | Nationwide | $216 |

| 19 | 57231 | De Smet | $300 | Liberty Mutual | $561 | Allstate | $378 | State Farm | $174 | Nationwide | $209 |

| 20 | 57005 | Brandon | $300 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $183 | Geico | $202 |

| 21 | 57038 | Jefferson | $300 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $170 | Nationwide | $209 |

| 22 | 57027 | Fairview | $300 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $173 | Nationwide | $216 |

| 23 | 57047 | Monroe | $301 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $173 | Nationwide | $209 |

| 24 | 57249 | Lake Preston | $301 | Liberty Mutual | $561 | Allstate | $378 | State Farm | $173 | Nationwide | $209 |

| 25 | 57212 | Arlington | $301 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $171 | Nationwide | $209 |

As you can see, the average rates across South Dakota vary widely. The most expensive ZIP code is 57770 in Pine Ridge at $4,695.25, while the least expensive ZIP code is 57201 in Watertown, with an average rate of $3,467.81. This is a 35% difference.

Cheapest Rates by City in South Dakota

Another way to look at rates is by city. Similar to the ZIP codes, we provide two tables: one with the 25 most expensive cities in South Dakota and one with the 25 least expensive cities. Take a look to see if your city is listed, and if so, where it ranks.

Table of the 25 most expensive cities in South Dakota:

SD 25 Most Expensive Cities

| Rank | City | Average Monthly Rates by City | Most Expensive Company | Most Expensive Monthly Rates | 2nd Most Expensive Company | 2nd Most Expensive Monthly Rates | Cheapest Company | Cheapest Monthly Rates | 2nd Cheapest Company | 2nd Cheapest Monthly Rates |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Pine Ridge | $391 | Liberty Mutual | $746 | Progressive | $407 | Nationwide | $252 | State Farm | $266 |

| 2 | Manderson | $391 | Liberty Mutual | $746 | Progressive | $405 | Nationwide | $252 | State Farm | $268 |

| 3 | Oglala | $391 | Liberty Mutual | $746 | Progressive | $407 | Nationwide | $252 | State Farm | $261 |

| 4 | Wounded Knee | $390 | Liberty Mutual | $746 | Progressive | $405 | Nationwide | $252 | State Farm | $257 |

| 5 | Allen | $389 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $255 | Nationwide | $267 |

| 6 | Kyle | $388 | Liberty Mutual | $746 | Allstate | $401 | Nationwide | $252 | State Farm | $255 |

| 7 | Porcupine | $386 | Liberty Mutual | $746 | Allstate | $401 | Nationwide | $252 | State Farm | $259 |

| 8 | Batesland | $386 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $252 |

| 9 | Lemmon | $386 | Liberty Mutual | $746 | Progressive | $403 | State Farm | $245 | Nationwide | $267 |

| 10 | Martin | $386 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $256 | Nationwide | $267 |

| 11 | Bison | $386 | Liberty Mutual | $746 | Allstate | $401 | Nationwide | $267 | State Farm | $275 |

| 12 | Interior | $385 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 13 | Dupree | $384 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $251 | Nationwide | $267 |

| 14 | Tuthill | $384 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 15 | Cherry Creek | $384 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 16 | Wanblee | $384 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $250 | Nationwide | $267 |

| 17 | Glad Valley | $382 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 18 | Milesville | $382 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 19 | Buffalo | $382 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $254 | Nationwide | $267 |

| 20 | Long Valley | $381 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 21 | Belvidere | $381 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 22 | Camp Crook | $381 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 23 | Redig | $381 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 24 | Reva | $381 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

| 25 | Midland | $380 | Liberty Mutual | $746 | Allstate | $401 | State Farm | $249 | Nationwide | $267 |

Table of the 25 least expensive cities in South Dakota:

SD 25 Least Expensive Cities

| Rank | City | Average Monthly Rates by City | Most Expensive Company | Most Expensive Monthly Rates | 2nd Most Expensive Company | 2nd Most Expensive Monthly Rates | Cheapest Company | Cheapest Monthly Rates | 2nd Cheapest Company | 2nd Cheapest Monthly Rates |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Watertown | $289 | Liberty Mutual | $526 | Allstate | $378 | State Farm | $166 | Nationwide | $187 |

| 2 | Vermillion | $296 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $158 | Nationwide | $199 |

| 3 | Brookings | $298 | Liberty Mutual | $557 | Allstate | $384 | State Farm | $171 | Nationwide | $197 |

| 4 | Alcester | $298 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $162 | Nationwide | $209 |

| 5 | Bruce | $299 | Liberty Mutual | $561 | Allstate | $378 | State Farm | $169 | Nationwide | $209 |

| 6 | Elk Point | $299 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $163 | Nationwide | $209 |

| 7 | Beresford | $299 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $164 | Nationwide | $209 |

| 8 | Volga | $299 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $170 | Nationwide | $209 |

| 9 | Flandreau | $299 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $171 | Nationwide | $209 |

| 10 | Sinai | $299 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $173 | Nationwide | $209 |

| 11 | Madison | $299 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $175 | Nationwide | $197 |

| 12 | Aurora | $299 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $169 | Nationwide | $209 |

| 13 | Burbank | $299 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $173 | Nationwide | $209 |

| 14 | Winfred | $300 | Liberty Mutual | $561 | Allstate | $378 | State Farm | $173 | Nationwide | $209 |

| 15 | White | $300 | Liberty Mutual | $561 | Allstate | $378 | State Farm | $169 | Nationwide | $209 |

| 16 | Egan | $300 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $173 | Nationwide | $209 |

| 17 | Hudson | $300 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $170 | Nationwide | $216 |

| 18 | De Smet | $300 | Liberty Mutual | $561 | Allstate | $378 | State Farm | $174 | Nationwide | $209 |

| 19 | Brandon | $300 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $183 | Geico | $202 |

| 20 | Fairview | $300 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $173 | Nationwide | $216 |

| 21 | Monroe | $301 | Liberty Mutual | $556 | Allstate | $384 | State Farm | $173 | Nationwide | $209 |

| 22 | Lake Preston | $301 | Liberty Mutual | $561 | Allstate | $378 | State Farm | $173 | Nationwide | $209 |

| 23 | Arlington | $301 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $171 | Nationwide | $209 |

| 24 | Rutland | $301 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $171 | Nationwide | $209 |

| 25 | Trent | $301 | Liberty Mutual | $561 | Allstate | $384 | State Farm | $173 | Nationwide | $209 |

As you might expect based on the results of the ZIP code data tables, the most expensive city in South Dakota is Pine Ridge, with an average rate of $4,695.24, while the cheapest city is Watertown, with an average of $3,467.81.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best South Dakota Car Insurance Companies

After comparing car insurance rates, take one more step before you choose a provider: Look at financial and customers ratings, especially regarding the claims process. You could save yourself some frustration down the line.

Brad Larson Licensed Insurance Agent

While price is likely one of the most important factors to you when considering which insurance company and what kind of policy to choose, and we will continue discussing price later, there are other, less concrete factors to consider as well.

Two such factors to take into account are financial stability and customer service ratings for the companies you’re considering.

But how do you find this information? Is there a way to get actual data, or is anecdotal evidence your only option? The answer is yes, data is available regarding the financial stability and customer service ratings of insurance companies in your area. And to help you out, we’ve collected and provided it in the next few sections.

The Largest Companies’ Financial Ratings

Do financial ratings matter?

Yes, they do. Why? You want to know that the company you purchase insurance from will be in business for the long term and that they are financially stable enough to be able to pay out on claims, should you ever find yourself needing to file one.

But how do you find financial stability rating information for the insurance market? AM Best, a global credit firm, looks at the financials of insurance companies throughout the market and produces financial stability ratings based on the data they find.

This information can help you narrow down which company is right for you when you’re shopping for insurance. The table below compares the top insurance companies in South Dakota with their AM Best financial ratings and outlooks.

| Insurance Company | Rating | Outlook |

|---|---|---|

| State Farm Group | A++ | Stable |

| Progressive Group | A+ | Stable |

| American Family Insurance Group | A | Stable |

| Farmers Mutual Insurance Co of NE | NR | - |

| Nationwide Corp Group | A+ | Stable |

| Farmers Insurance Group | NR | - |

| USAA Group | A++ | Stable |

| Iowa Farm Bureau Group | NR | - |

| DeSmet Insurance Group | NR | - |

What does this data mean? AM Best states that any company with an A- rating or better is both financially secure and has a stable outlook.

Not all insurance companies in South Dakota have been rated by AM Best. This doesn’t mean they’re not financially stable, it just means there’s no available data. Nevertheless, South Dakota drivers can feel confident that at least half of the major insurers in the state are financially stable and capable of paying out on claims.

Companies with Best Ratings

Yet another factor to consider is customer service. Do the companies in your area have good customer service ratings? You definitely want to consider this, because once you have a policy, you need to know that you’ll get the support you need when you have questions, need to file a claim, and more.

But where do you find customer service ratings for the insurance industry? We provide information from JD Power’s review of insurance companies in regions across the United States. JD Power recently conducted a study on the customer service ratings in the insurance market, based on a “Customer Service Index Rating.”

Take a look at the table below to find out the customer service ratings for insurance companies in the central region of the country (where South Dakota falls in JD Power’s ratings by region assessment).

South Dakota Companies with the Best Ratings

| Insurance Company | Customer Satisfaction Index Rating | JD Power Circle Ratings |

|---|---|---|

| Allstate | 844 | 4 |

| American Family | 823 | 3 |

| Auto Club | 837 | 3 |

| Auto-Owners | 856 | 5 |

| Central Average | 832 | 3 |

| Farm Bureau | 822 | 3 |

| Farmers | 817 | 2 |

| Geico | 838 | 4 |

| Liberty Mutual | 811 | 2 |

| Nationwide | 807 | 2 |

| Progressive | 823 | 3 |

| Safeco | 819 | 2 |

| Shelter | 858 | 5 |

| State Farm | 828 | 3 |

| Travelers | 832 | 3 |

Shelter and Auto-Owners Insurance have the highest customer service index ratings with 858 and 856 points respectively, out of a 1,000-point scale. Both companies also have a five-circle “among the best” power circle rating. However, neither of these companies is included in the list of the top 10 largest insurers in South Dakota.

Geico is the first company on the JD Power list that is also on the top ten largest insurers in the South Dakota list (which you saw in the previous financial stability section). Geico has a customer satisfaction index rating of 838 and a JD power circle rating of “better than most” (four circles). For more information about Geico, see our Geico insurance review.

State Farm is the next highest-rated company from the top ten list. It has a customer service index rating of 832 and is in the “about average” power circle category. Learn more about State Farm in our State Farm insurance review.

The remaining South Dakota companies listed on the JD Power list are all in the “about average” category, except for Nationwide, which is in the “the rest” category, with a customer satisfaction index rating of 780.

Companies with the Most Complaints in South Dakota

In addition to customer service ratings, complaint data can be a key piece of information when determining whether or not an insurance company is a good fit for you. Just how many complaints does an insurance company you’re considering receive in a year? Does the number of complaints correlate to their customer service rating?

South Dakota’s Department of Labor & Regulation Division of Insurance does not currently provide data on complaints against car insurance companies in the state.

However, the NAIC offers complaint data on companies across the country in the form of “complaint ratios.” These ratios give an indication of how many complaints a company receives in a year.

Take a look at this table to see the 2017 complaint ratio data for the ten largest insurance companies in South Dakota, compared to their respective market share, loss ratio, and direct premiums written.

| Insurance Company | Direct Premiums Written | Complaint Ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| State Farm Group | $107,435 | 0.44 | 66.20% | 19.80% |

| Progressive Group | $75,757 | 0.75 | 59.19% | 13.96% |

| American Family Insurance Group | $52,467 | 0.79 | 59.38% | 9.67% |

| Farmers Mutual Insurance Co of NE | $27,061 | 0.59 | 63.18% | 4.99% |

| Nationwide Corp Group | $26,794 | 0.28 | 57.79% | 4.94% |

| Farmers Insurance Group | $25,241 | 0 | 52.77% | 4.65% |

| USAA Group | $23,416 | 0.74 | 78.78% | 4.32% |

| Iowa Farm Bureau Group | $20,892 | 0.77 | 62.43% | 3.85% |

| DeSmet Insurance Group | $18,654 | - | 78.16% | 3.44% |

| GEICO | $17,660 | 0.68 | 73.91% | 3.25% |

To ensure complaint comparisons are equitable regardless of a company’s size or market share, a complaint ratio is generated by dividing the total number of complaints a company receives in a year by the number of premiums they wrote in that same year.

Typically, the average number of complaints is indicated by the number one. When companies have complaint ratios above one, that means they receive greater than the average number of complaints. By contrast, when a company’s complaint ratio is less than one, it means they receive less than the average number of complaints.

In South Dakota, nine out of 10 of the largest insurance providers in the state have a complaint ratio of less than one, which is good news for South Dakota drivers. The tenth company, DeSmet Insurance Group, currently has no complaint data available.

The highest complaint ratio belongs to American Family Insurance Group at 0.79, which is still comfortably below average. However, they have a JD Power Customer Satisfaction Index rating of 823, which puts them in the “about average” category.

Farmers Insurance actually has a zero complaint ratio for 2017, the lowest in the top ten. However, surprisingly, their JD Power Customer Satisfaction Index rating is quite low, at 817 points and a power circle rating of two, which categorizes them as part of “the rest” (below average).

As a South Dakota resident, if you ever need to file a complaint against your insurance company, you can do so through the South Dakota Department of Labor & Regulations Division of Insurance complaint process. The first step is to reach out to the company in question.

Once you’ve exhausted that route, if your complaint is still not resolved, then you can file a complaint through the Division of Insurance website. If you have questions, you can email the Division of Insurance at [email protected]. If you prefer to speak to someone on the phone, you can call the Division of Insurance at 605-773-3563.

Cheapest Companies in South Dakota

Now that we’ve discussed some of the other considerations you should keep in mind when shopping for insurance, we return to price.

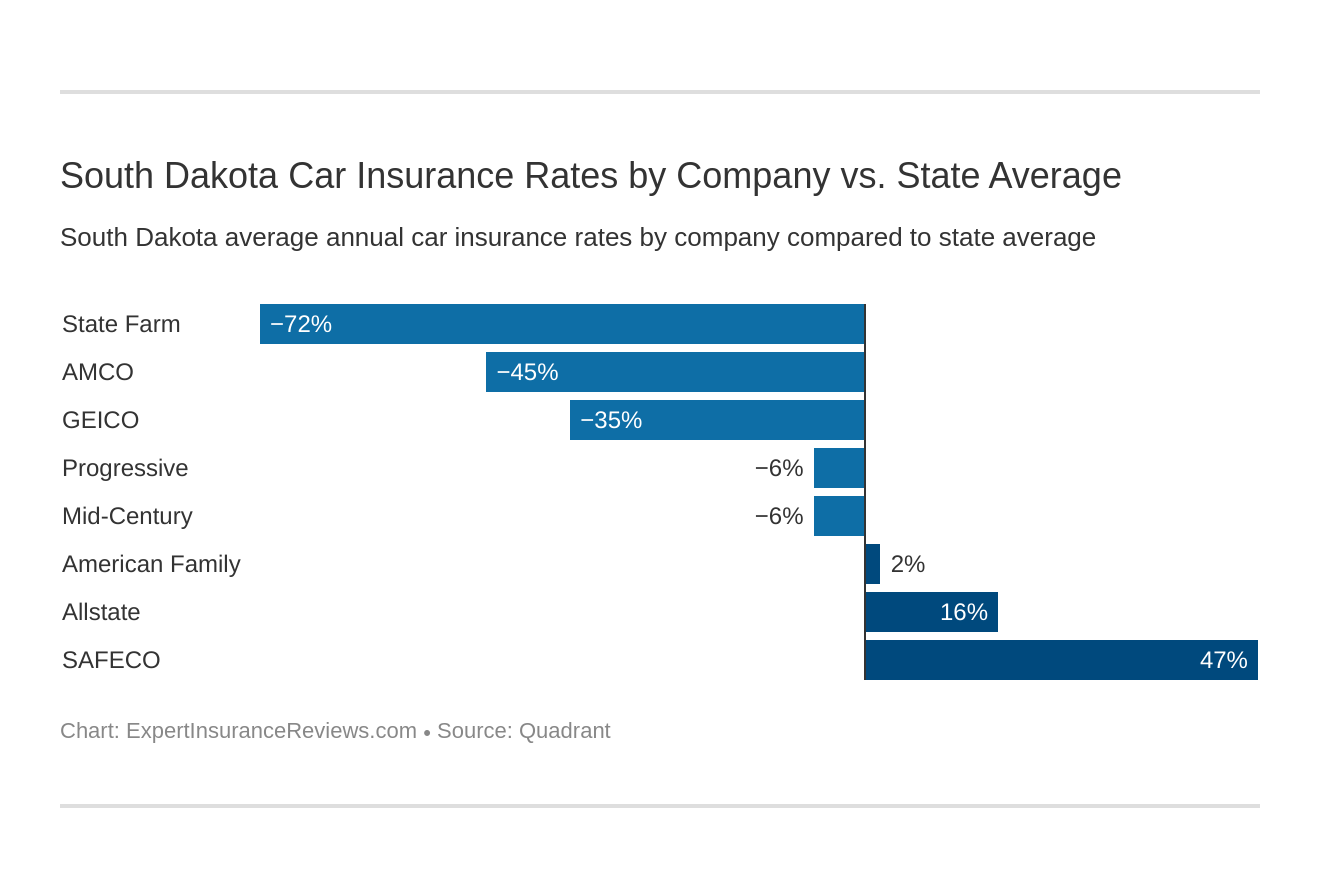

Across the state, the average rate for car insurance is $3,961.60 in South Dakota. To see how various insurance companies in the state compare, we’ve listed their average rates in the table below and calculated the difference between their rates and the state average.

SD Cheapest Companies

| Company | Monthly Average | +/- Compared to State Average | +/- Compared to State Average (%) |

|---|---|---|---|

| State Farm | $191 | -$138.70 | -72.45% |

| AMCO | $227 | -$102.89 | -45.27% |

| Geico | $244 | -$86.31 | -35.40% |

| Progressive | $311 | -$18.68 | -6.00% |

| Mid-Century | $313 | -$17.39 | -5.56% |

| American Family | $337 | $7.01 | 2.08% |

| Allstate | $393 | $63.18 | 16.06% |

| Safeco | $624 | $293.77 | 47.09% |

The rates across the listed companies vary dramatically. For example, SAFECO Insurance Company has the highest rate at $7,487 per year, which is 47% higher than the state average. By contrast, State Farm Mutual Auto has the lowest average rate at $2,297, which is 72% lower than the average.

As you can see, over half of the eight companies listed have average rates that are lower than the overall state average.

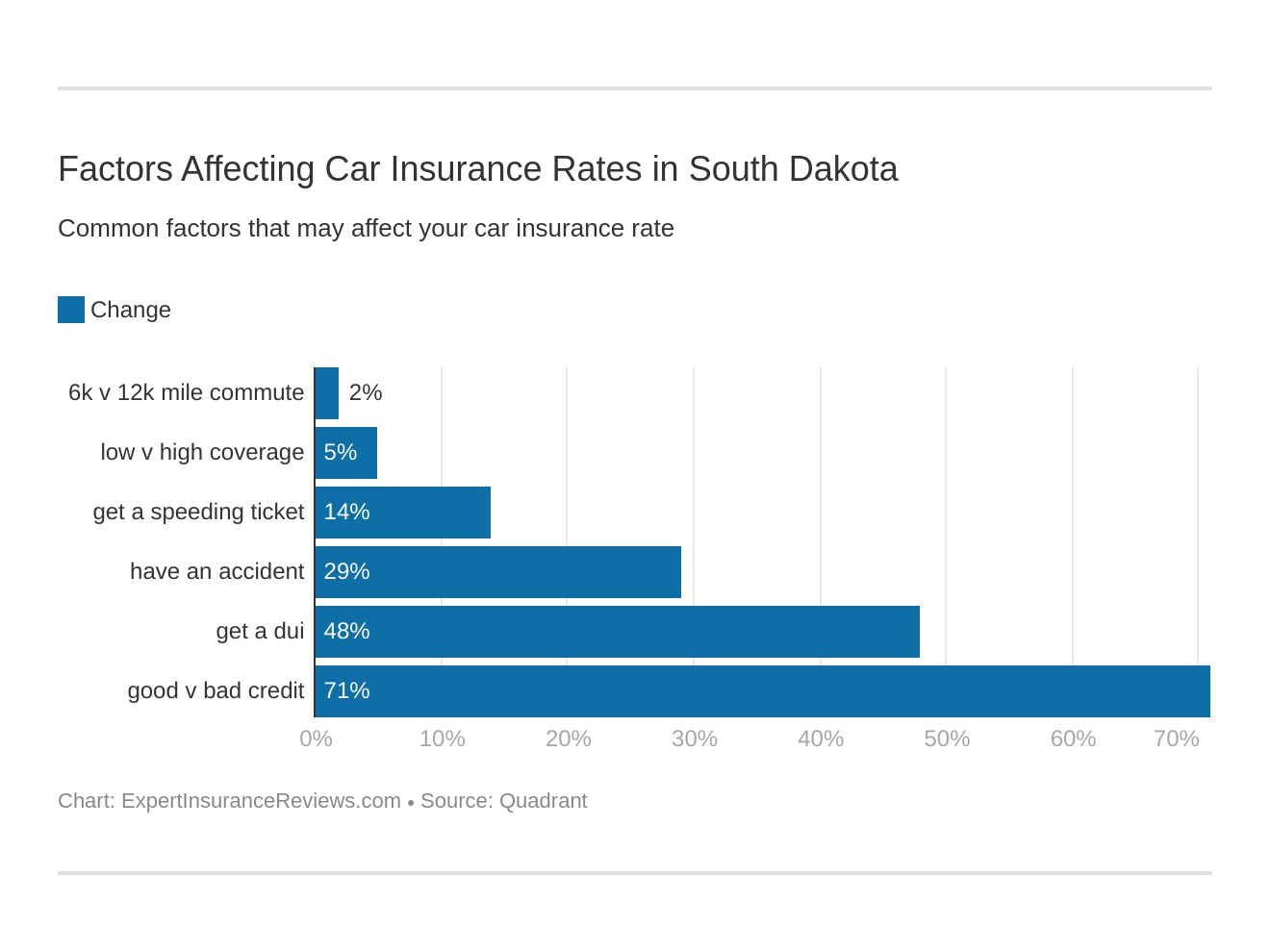

In total, between the highest and lowest average rates, there is a difference of a little over 300%. However, despite this contrast in average rates, most companies consider largely the same factors when adjusting their rates. As you know, these include age, gender, and ZIP code, which we’ve already discussed, as well as other factors.

Ultimately, your decision may come down to looking at which companies weigh which factors more or less significantly based on your specific situation.

Beyond age, gender, and ZIP code, all of which you’ve already seen can seriously affect your insurance rates, there are several other variables companies may consider when adjusting rates. These include driving record, commute distance, and credit score.

Keep reading to learn about many of the other factors companies consider when adjusting rates, and how those can affect you, depending on your lifestyle, driving record, and more.

Commute Rates by Companies

You already know the best way to get around in South Dakota is to drive (rather than taking public transit or other forms of transportation). But how does this affect your insurance rates? The more miles you drive on average, the higher your insurance rates may be.

If you think about it, this makes sense, because the more time you spend on the road, the higher your chances of getting in a car accident. To mitigate this risk, many insurance companies increase premium rates based on commute length.

To see how this can affect you in South Dakota, we’ve pulled data on major insurance companies in the state to see what average rates are for a 10-mile commute compared to a 25-mile commute. Check out the table to see what we found.

SD Commute Rates by Company

| Insurance Company | 10 Mile Commute (6000 annual mileage average) | 25 mile commute (12000 annual mileage) | percent difference |

|---|---|---|---|

| $2,241.25 | $2,353.15 | 4.99% | |

| $2,726.98 | $2,726.98 | 0.00% |

| $2,890.70 | $2,961.12 | 2.44% | |

| $3,737.41 | $3,737.41 | 0.00% | |

| $3,752.91 | $3,752.91 | 0.00% | |

| $3,995.93 | $4,095.58 | 2.49% | |

| $4,604.31 | $4,835.26 | 5.02% | |

| $7,486.83 | $7,486.83 | 0.00% |

While half of the listed companies do increase their rates for a higher commute (with the remaining half showing no change in rate based on this factor), the increase is fairly minor, with the highest rate increase being just over 5%. For South Dakota commuters, this is good news.

Commute distance is not the only factor to affect your rate.

Coverage Level Rates by Companies

What level of insurance coverage is right for you? Your budget, lifestyle, and driving choices will all factor into this decision. You’ll need to compare these against any relevant risks you face, as well as other factors that may apply, and then ask the coverage level question, both to yourself and an insurance agent.

It makes logical sense that higher levels of coverage cost more than lower levels of coverage. However, this is not always the case. What do insurance rates in South Dakota look like based on coverage level? The table below compares average rates for low, medium, and high coverage in the state.

SD Coverage Level Monthly Rates by Company

| Insurance Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| $382 | $393 | $405 | |

| $340 | $347 | $324 | |

| $300 | $309 | $329 | |

| $237 | $244 | $251 | |

| $613 | $623 | $636 |

| $215 | $226 | $241 |

| $304 | $309 | $322 | |

| $185 | $192 | $197 |

In general, the principle that higher coverage equals a higher rate is true for most of the major insurance companies in South Dakota. However, American Family’s high coverage rates are actually cheaper than their low coverage rates (though their medium coverage costs more than their low coverage).

For the remaining companies, the highest increase between low and medium coverage is Nationwide at a little under 6%, and the lowest increase is Progressive at about 2%.

In the medium to high coverage range, the highest increase is again Nationwide at 6%, and the lowest, as we already noted, is American Family, with a decrease of a little less than 6%.

Credit History Rates by Companies

What’s your credit score? Do you dread that question because you have poor credit? Or do you like to brag a little because your credit is exceptional?

Either way, this can affect more than just your ability to obtain a credit card, take out a loan, or get a better interest rate on that loan. A significant number of insurance companies actually consider your credit score when they adjust your interest rates.

Why? Because it is generally accepted that if you have good credit, you are a responsible person. If you are a responsible person, then it follows that you will drive responsibly, thereby having a lower risk of getting in a car accident than someone who drives irresponsibly or recklessly.

Experian reports that the average credit score in South Dakota is 700, which is 30 points above a “good” credit score. With this in mind, the average South Dakota driver is in good shape when it comes to car insurance rate adjustments by credit score.

Check out this table to see average rates for good, fair, and poor credit in South Dakota.

SD Credit History Monthly Rates by Company

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 |

In looking at this table, you can see that credit score seriously affects your insurance rates, particularly if you do not have a score in the “good” credit range. For example, Geico increases their rates by 48% for fair, rather than good, credit and by 97% for poor credit.

If your credit score is not at an optimum level, one insurance company to consider is Farmers, because their increases for fair and poor (rather than good) credit scores are the least significant, with increases of 4% for fair and 18% for poor credit.

Another way to look at this data is:

- Good Credit (670+) = average annual premiums: $3,049.15

- Fair Credit (580-669) = 4–47% increase: $3,616.02

- Poor Credit (300-579) = 18–97% increase: $5,219.63

Driving Record Rates by Companies

Are you a responsible driver? Or a reckless one? Do you have a few tickets on your record? Insurance companies take notice of these infractions and adjust your rates accordingly. The more you have on your record, the higher your insurance rates will be.

Take a look at this table to see the average rates in South Dakota for a clean driving record, compared to a driving record with one speeding violation, one DUI, and one accident.

SD Driving Record Monthly Rates by Company

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $326 | $379 | $504 | $365 | |

| $245 | $360 | $464 | $280 | |

| $267 | $337 | $329 | $319 | |

| $154 | $260 | $408 | $154 | |

| $526 | $652 | $679 | $638 |

| $164 | $228 | $326 | $191 |

| $269 | $363 | $290 | $324 | |

| $179 | $203 | $191 | $191 |

As the data in the table indicates, if you have any violations or accidents on your driving record, your insurance rates will likely increase fairly significantly.

However, to be able to really dig into this data and understand what it’s telling us, we need to do a little bit more work. To that end, we’ve calculated the percent increase in the average rate for each infraction type for each insurance company listed in the above table.

SD Driving Record Rates by Company - Percent Increase

| Insurance Company | percent increase - With 1 speeding violation | percent increase - with 1 DUI | percent increase - with 1 accident |

|---|---|---|---|

| 0.00% | 165.26% | 69.28% | |

| 6.68% | 6.68% | 13.37% | |

| 11.97% | 54.58% | 16.20% | |

| 14.46% | 89.59% | 47.10% | |

| 16.08% | 98.83% | 38.84% |

| 19.60% | 23.28% | 26.37% | |

| 20.51% | 7.87% | 35.26% | |

| 21.28% | 28.99% | 23.94% |

If you have a speeding ticket or two on your record, you might want to consider Geico, because they do not increase their rates at all (all else being equal) for a single speeding violation.

State Farm may be a good option if you’ve recently been in a car accident because their increase is only 13% (the lowest increase for a car accident among the companies listed).

One thing to note is how different companies handle DUIs. In general, companies charge you significantly more if you’ve had a DUI than if you’ve been in a car accident or if you’ve been convicted of speeding. Geico, for example, as we’ve already noted, doesn’t increase rates for one speeding violation. However, their rates increase by 165% for a single DUI.

However, the two companies do not follow this pattern. State Farm adjusts rates by the same 6.68% for both a speeding violation and a DUI. Surprisingly, Progressive actually has a lower rate adjustment for DUI than for speeding. For a speeding violation, they increase rates by 21%, but they only increase rates by 8% for a DUI.

Read more: Does my car insurance cover damage caused by a DUI or other criminal activity?

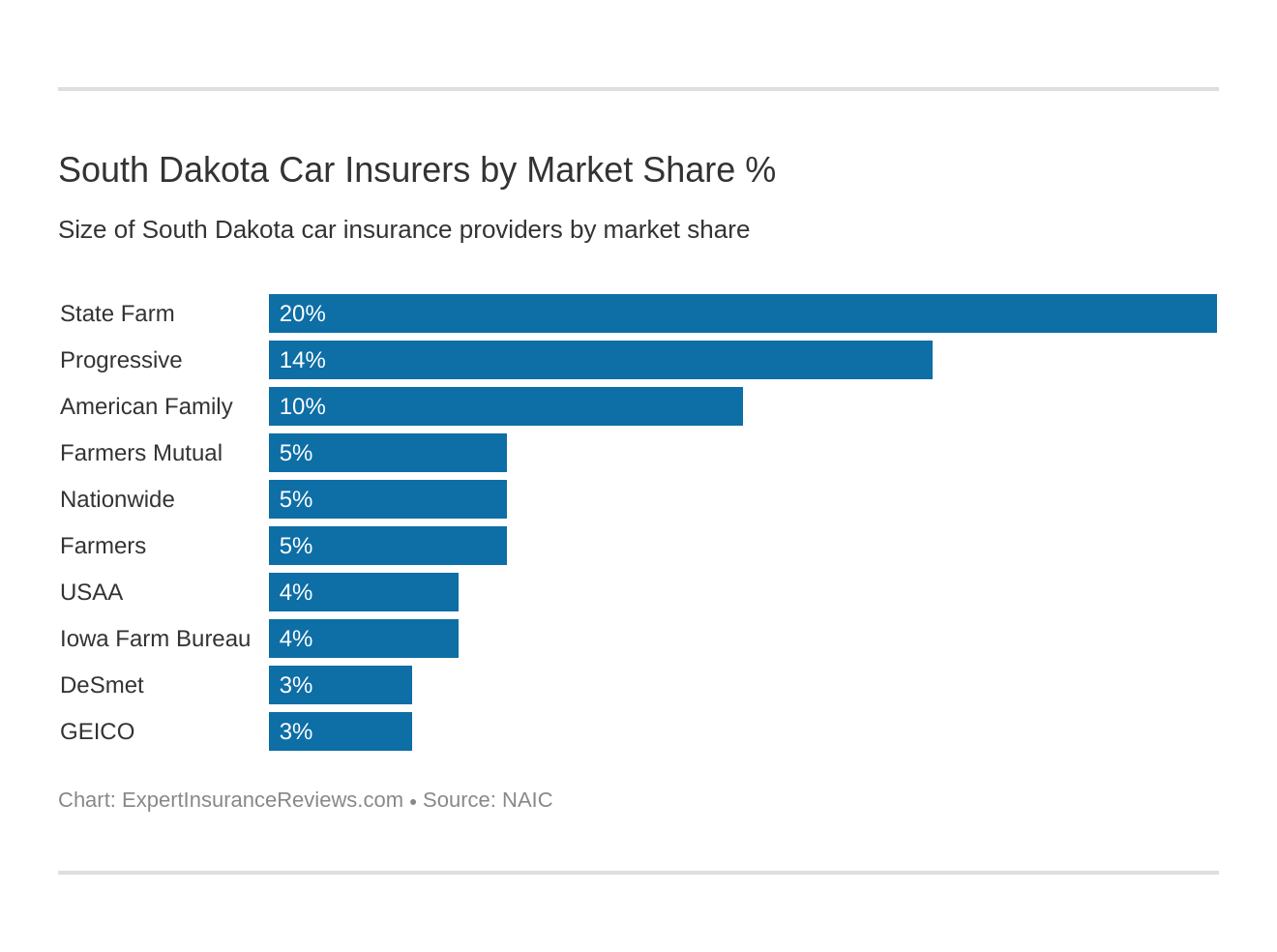

Largest Car Insurance Companies in South Dakota

Yet another factor (yes, we know there are a lot) to consider when shopping for insurance is company size. You may wonder what company size has to do with anything.

On its own, it’s simply an indicator of success from the perspective of the number of insurers a particular company serves. However, it can be combined with other information to provide some additional insight into your decision-making process.

When you look at company size (expressed as market share in this case) along with other factors we’ve already discussed like loss ratio and complaint data, you can form a better picture of which companies are most likely to be able to pay out on claims (and remain financially stable while doing so), should you ever need to file one.

The data below outlines the ten largest insurance companies in South Dakota, along with their associated direct premiums written, loss ratio, and market share.

| Insurance Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $107,435 | 66.20% | 19.80% |

| Progressive Group | $75,757 | 59.19% | 13.96% |

| American Family Insurance Group | $52,467 | 59.38% | 9.67% |

| Farmers Mutual Insurance Co of NE | $27,061 | 63.18% | 4.99% |

| Nationwide Corp Group | $26,794 | 57.79% | 4.94% |

| Farmers Insurance Group | $25,241 | 52.77% | 4.65% |

| USAA Group | $23,416 | 78.78% | 4.32% |

| Iowa Farm Bureau Group | $20,892 | 62.43% | 3.85% |

| DeSmet Insurance Group | $18,654 | 78.16% | 3.44% |

| GEICO | $17,660 | 73.91% | 3.25% |

Number of Insurers by State

As is typical for states across the country, there are two categories of insurers in South Dakota: foreign and domestic.

- Foreign insurers are those that are incorporated outside of South Dakota (i.e. in another state)

- Domestic insurers are those that are incorporated within South Dakota.

All insurance companies, both domestic and foreign, are required to follow all the state insurance laws in South Dakota, so you’ll find consistent service from the legal perspective regardless of whether the insurance company you choose is considered foreign or domestic.

When you’re looking for car insurance in South Dakota, you’ll find there are 850 insurers across the state. Of these, 834 are foreign, and 16 are domestic.

South Dakota Car Insurance Laws

Now that you know a bit more about price (and how those rates are generated), customer service, financial stability, and more, we need to shift gears and take a look at insurance laws. Why should you care about insurance laws?

You already know there are laws in place that define the minimum amount of insurance you must carry to legally drive on the road. If you’re found driving without this minimum coverage, you’ll face some serious consequences. Not only will you have to pay fines, but you’ll also likely have your driver’s license suspended and your driving privileges revoked for some period of time.

And then you’ll have to pay even more to reinstate your license, once the court allows it.

Knowing, and following, the laws that apply to you as a driver, both for insurance and on the road, can keep you out of trouble, keep you safe, and save you money.

Additionally, there are laws insurance companies must follow (recall when we mentioned domestic and foreign insurers, we alluded to the laws that all insurance companies must follow to legally operate in South Dakota).

Being knowledgeable about the laws South Dakota insurance companies must follow can help you make sure you’re working with a reputable company, and give you the information you need to ask the right questions.

We know trying to find and understand legal requirements can be painful. But fear not, like everything else we’ve discussed so far, we’ve done it for you. Keep reading to learn more about the insurance laws and rules of the road you need to follow to stay safe and keep your insurance rates low.

Car Insurance Laws

The primary insurance law that applies to you as a driver is the one we’ve already discussed regarding the minimum coverage requirement. However, there are several laws that insurers must follow that benefit you.

In general, states have laws regarding insurance fraud, how it is defined, and how they handle it. They also typically have a process in place that allows you to report suspected fraud both by insurance companies and by the insured.

There are also some laws in place that define how insurance companies must approach responding to your claims, should you need to file them, for specific kinds of damage that occur. Often this defines the minimum damages an insurance company must cover.

Over the next few sections, we’ll discuss these and other insurance laws you should be aware of, to ensure you are your own advocate both when shopping for insurance and after you’ve purchased your policy.

How State Laws for Insurance are Determined

With all these laws we plan to cover, it’s worth taking a minute or two to review how the requirements became laws in the first place.

In general, if someone or several someones determine that there needs to be legislation in place to require or prohibit something, their first step is to put together documentation that outlines the proposed legislation, the reasoning behind it, and why it should be made into law, as well as any other necessary information. This is referred to as a bill.

Once the bill is prepared, it’s presented to the state legislature for their review (and subsequent approval or rejection). The state legislature thoroughly reads, considers, and debates the bill, its pros and cons, implementation, etc. to determine whether or not the bill is both necessary and implementable.

If the legislature agrees the proposed bill is necessary and is also implementable, they will sign the bill into law. Keep reading to find out more details on the relevant South Dakota laws that are on the books.

Windshield Coverage

If you’ve spent any time on the road, particularly the highway, you’ve probably heard that unpleasant and startling “chink” as a rock or other road debris hits your windshield. Sometimes you get lucky, and no damage occurs. However, more often than not, you almost immediately see the flash of a chip and the spiderweb of cracks that follow.

What do you do when this happens to you? States across the country vary in their requirements for insurance companies when it comes to handling chipped or cracked windshields. Some have no requirements, while others have very clear requirements regarding what and how insurance companies must repair or replace windshields.

In South Dakota, insurance companies are permitted to request the use of aftermarket crash parts, as long as written notice is provided as part of the cost estimate for the repair. However, you as the insured are allowed to choose where the repair is done (insurers cannot mandate a specific company).

In South Dakota, insurance companies are not required to include coverage for windshield repair and replacement as a part of policies. However, it is often included as a part of a comprehensive policy, rather than being an add-on you have to opt into.

High-Risk Insurance

Are you a high-risk driver? What does this mean and how can it affect you?

High-risk drivers are those who have too many traffic violations on their record. When you’ve had too many violations, you’re considered too high risk for insurance companies to want to sell you an insurance policy. You may find yourself struggling to obtain insurance as a result.

Since insurance coverage is required to legally drive, what do you do?

Thankfully, South Dakota has a plan in place to assist high-risk drivers in obtaining insurance. The South Dakota Automobile Insurance Plan (SD AIP) was instituted in the 1940s to ensure high-risk drivers have the coverage they need to legally drive on the road. It is not an insurance plan itself, but instead, it matches high-risk drivers with insurance companies.

South Dakota requires insurance companies to participate in the SD AIP. Typically, each company must insure a number of applicants commensurate with their market share. For example, Progressive has about 14% of the state’s insurance market, so they must insure 14% of approved applicants from the SD AIP.

The SD AIP, like similar programs across the United States, typically considers its program to be a last resort, and you must assert that you’ve made good faith efforts to obtain insurance through traditional means before you qualify. Specifically, you must:

- Certify that you’ve been unable to obtain car insurance through traditional means in the previous 60 days

- Have a vehicle registered in the state

- Have a valid driver’s license in the state

- Provide a fully and accurately completed application

A licensed insurance agent in South Dakota can provide you with the application for the SD AIP and help you fill it out and submit it through the appropriate channels.

It’s important to note that while SD AIP enables you to purchase the necessary minimum coverage if you are considered a high-risk driver, you will have to purchase more coverage than the average driver, and your premium rates will likely be significantly higher. Find out the best car insurance companies for high-risk drivers.

Under the SD AIP you’ll also have the option to purchase additional coverage, should you so choose.

To get an idea of the difference between coverage for the average driver versus coverage for high-risk drivers through SD AIP, check out the table below.

SD AIP Minimum Insurance Requirement

| Required Insurance | SD Minimum Requirement | SD AIP Minimum Requirement |

|---|---|---|

| Bodily Injury | $25,000 per person $50,000 per accident | $100,000 per person $300,000 per accident |

| Property Damage Liability | $25,000.00 | $50,000 per accident |

| Unisured Motorist Coverage | $25,000 per person $50,000 per accident | $100,000 per person $300,000 per accident |

As you can see, the difference between what average drivers are required to carry and what’s required of high-risk drivers in South Dakota is quite significant. In fact, it ranges between 100 and 500% higher than the average driver’s requirement.

If you want to learn more about the SD AIP or have questions, you can call the South Dakota Department of Labor and Regulation Division of Insurance at 605-773-3563. You can also visit the SD AIP website for more information on the program.

Low-Cost Insurance

As we’ve noted, South Dakota offers programs to assist high-risk drivers in obtaining insurance coverage through the SD AIP. However, at this time the state does not have a commensurate program in place for low-income drivers in the Mount Rushmore state.

There are only three states (California, Hawaii, and New Jersey) that offer some form of government-funded assistance for low-income drivers to obtain and keep their insurance.

Automobile Insurance Fraud in South Dakota

Did you know that almost 10% of the losses South Dakota car insurance companies face each year are from insurance fraud? The Insurance Information Institute (III) reports this as part of a 2019 article on the problem of insurance fraud in the United States.

Insurance fraud can be committed by both insured individuals and insurers and can include everything from fudging your average commute time to faking a car accident or a company selling you a false policy.

South Dakota takes insurance fraud seriously, and like many states, classifies it as a crime. The state Attorney General’s Office handles fraud investigations through their Division of Criminal Investigation, Insurance Fraud Prevention Unit.

If you suspect insurance fraud of any kind, it is your responsibility to report it. You can do so by calling the Insurance Fraud Prevention Unit at 605-773-3331 or emailing them at [email protected].

Statute of Limitations

If you’re in a car accident and need to file a claim to obtain restitution for the damages, you’ll have a maximum of three years to do so.

If you don’t file within this three-year statute of limitations for both personal injury and property damage, you’ll lose the ability to do so. It’s also important to keep in mind that this three-year window starts on the day of the accident.

State Specific Laws

While most states are fairly consistent with certain laws, like the minimum insurance requirement (though the exact amount and specifics often vary from state to state), there are always laws unique to each state, and it pays to know these laws, to ensure you avoid road violations.

One such law in South Dakota enables law enforcement to charge individuals with a DUI even if they are not driving, but simply sitting in their vehicle, without the keys in the ignition.

We’ll discuss DUI in South Dakota in greater detail later on, but for now, it’s important to be aware of this law and ensure you have a plan to avoid ever being in this situation.

Vehicle Licensing Laws

In addition to the minimum insurance requirement, there are licensing laws that govern how your vehicle must be registered in South Dakota for you to be able to legally drive that vehicle in the state.

When you purchase a new vehicle, you have 45 days (no extensions) in which to apply for a title and registration. This law was enacted in July 2015. Before that, residents had only 30 days to title and register newly purchased vehicles. If you do not register within the 45-day window, you’ll face gradually increasing fees the longer you wait.

When you purchase a new vehicle from a dealership, they will work with you to get it registered. However, if you purchase your vehicle from a private seller, you’ll need to visit the county treasurer’s office in person, and you’ll need to bring:

- Filled out application form for vehicle title and registration

- Salvage, Recovered Theft, and Uniform Damage Disclosure form, if your vehicle is seven years old or less

- Title of the vehicle (that includes you listed as the owner)

- Registration fees

- Proof of insurance

If you need to renew your vehicle registration, which will be required annually, you can do so by:

- Visiting your country treasurer’s office,

- Sending the renewal through the mail (the specific address is dependent on which county you live in)

- Submitting it through the Online Vehicle Registration & Plates portal

- Visiting one of the DMV Now License Renewal Kiosks that can be found throughout the state.

All renewal options require the following documentation:

- Renewal notice

- Proof of ownership (if this is not already included on the renewal notice)

- Proof of valid state identification

- Applicable fees

If you’ve recently moved to South Dakota, you’ll receive reciprocity for vehicle taxes and vehicle registration fees if the state your vehicle is currently registered in requires higher than the 4% tax rate in South Dakota. However, if it’s lower than 4%, you’ll need to pay the difference to meet the South Dakota rate.

Additionally, you must register your vehicle in the Mount Rushmore State within 90 days of moving. When registering your vehicle in the state for the first time, you’ll need to visit the county treasurer’s office in person and bring the following:

- Filled out an application for motor vehicle title and registration

- Current vehicle title

- Registration fees

- Proof of insurance

- Salvage, Recovered Theft, and Uniform Damage Disclosure form, if your vehicle is seven years old or less

If you have questions regarding the vehicle licensing process, you can reach out to the South Dakota Department of Revenue Motor Vehicle Division by calling 605-773-3541, sending a fax to 605-773-2550, or emailing the division at [email protected].

Read more: Best Car Insurance Company That Accepts Salvage Titles

REAL ID

By now you’ve surely heard of the REAL ID Act instituted by the Department of Homeland Security. If you live in South Dakota, you likely already have a REAL ID-compliant driver’s license, as the state began issuing compliant licenses in 2009. In fact, South Dakota is ahead of many other states and is currently 99% compliant with the law.

The REAL ID Act was established in 2005 as a response to the tragedies of 9/11. Essentially, the goal is to ensure that everyone is who they say they are. As such, the requirements for obtaining a REAL ID-compliant license are federally defined and involve supplying sufficient documentation to prove your identity.

On October 1, 2020, REAL ID-compliant forms of identification will be required to do any of the following:

- Fly commercially within the United States (if you use a driver’s license as your form of identification)

- Access nuclear power plants (if you need to do so)

- Access some military installations (if you need to do so)

As many states have noted, it is not actually required for you to obtain a REAL ID-compliant form of identification if you do not have a need to access nuclear power plants or military installations and have no plans to fly commercially (or choose to use your passport or some other valid form of identification when you travel instead of a driver’s license).

However, many states are instituting REAL ID-compliant driver’s licenses as a strong suggestion (if not a requirement) whenever your renewal date comes up.

If you are one of the less than 1% of South Dakota drivers who do not already have a REAL ID-compliant driver’s license, you’ll need to visit a local driver exam station in person and bring the following forms of documentation:

- Two proofs of a South Dakota address

- Proof of lawful status in the United States

- Social security number (this can be your social security card, a W2, or 1099)

Like many states, South Dakota’s REAL ID-compliant driver’s licenses are indicated by a gold circle with a white star in the center on the upper right-hand corner of the license.

Penalties for Driving Without Insurance

As we’ve discussed multiple times already, you are required to maintain at least the minimum liability insurance to legally drive in South Dakota. Should you be stopped by law enforcement and found to be driving without insurance, you’ll face:

- A minimum fine of $100

- The possibility of 30 days in jail

- Suspension of your driver’s license for 30 days to one year

- A requirement that you file proof of insurance (in the form of an SR-22) each year for three years (if you do not do so, your license, vehicle registration, and plates will be suspended)

When providing proof of insurance, both the physical insurance card and an electronic form of your insurance card are considered acceptable in South Dakota.

Teen Driver Laws

If you’re a teenager in South Dakota and ready to get out on the road, you’re in luck, because the state only requires you to be 14 to start learning to drive. You’ll need to apply for a learner’s permit, which you must hold for between three and six months.

If you’re in a driver’s education program, you’ll only need to hold the permit for three months before applying for a provisional license; but if you’re not, you’ll need to hold the permit for six months before you can apply for a provisional, intermediate license.

While you have a learner’s permit, you are not required to log a certain number of hours of supervised driving. However, you cannot drive from 10:00 p.m.-6:00 a.m. without adult supervision.

After the three or six-month period of holding the learner’s permit, you can obtain a provisional license. With this license, you can have as many passengers as you’d like, but you’ll still be restricted from driving from 10:00 p.m.-6:00 a.m. without adult supervision.

You’ll be required to hold the provisional license until you are at least 16. Once you turn 16, you can obtain a full, unrestricted license.

Older Driver License Renewal Procedures

The majority of licensing renewal procedures in South Dakota are consistent no matter your age. All drivers must renew their driver’s license every five years, and all drivers can alternate between in-person driver’s license renewals and online/mailed renewals.

The only difference between the general population’s renewal process and the older population’s (in this case 65 and older) renewal process is that drivers who are 65 and older must provide proof of adequate vision at every driver’s license renewal, while the general population only needs to do so when they renew in person.

New Residents

If you’re a new resident in South Dakota, you’ll need to obtain a South Dakota driver’s license within the first 90 days of residence (if you hold a commercial driver’s license, you’ll need to do so within the first 30 days of residence).

The process for obtaining a South Dakota license will vary based on whether or not you have a REAL ID-compliant license from your previous state of residence. If you do have a REAL ID-compliant license from your previous state of residence, you’ll need to bring the following documents with you when you visit a local driver’s exam station:

- Two proofs of a South Dakota address

- Proof of lawful status in the United States

If you do not have a REAL ID-compliant driver’s license from your previous state of residence, you’ll also need to bring proof of your social security number (your social security card, W2, or 1099). All documents must be originals (no photocopies will be accepted).