Will my car insurance rates increase if I file a claim with American Family? (2025)

Generally, your car insurance rates increase by around 50% if you file a claim with American Family, depending on the specifics. For instance, you'll likely see a big American Family insurance rate increase if you're at fault. See how an American Family accident forgiveness policy prevents rate hikes below.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

A top question readers ask is, “Will my car insurance rates increase if I file a claim with American Family?” Yes, your American Family insurance rates will likely increase by around 50% after filing a claim, but it depends on its severity and cost.

Learn More: How to File a Car Insurance Claim

Still wondering, “How much does insurance increase after an accident with American Family?” We’ll overview situations where you’ll see a rate increase with American Family car insurance and how much it may increase.

Are you curious if another provider has better rates for your accident? Enter your ZIP code into our free quote comparison tool above to find the cheapest high-risk insurance provider near you.

- Insurance rates increase around 50% after an American Family claim

- The amount it goes up depends heavily on claim severity and cost

- Comprehensive claims won’t always hike rates, but it depends

What to Know About Filing a Car Insurance Claim With American Family

The nature of your claim is something that will greatly dictate what your future rate might be. Making a claim on your comprehensive coverage, for example, might not lead to a rate increase with American Family.

Check out the table below to see how much your American Family rates might go up vs. top competitors:

Full Coverage Car Insurance Monthly Rates for Clean Record vs. One Accident

| Insurance Company | Clean Record | One Accident | Percent Increase |

|---|---|---|---|

| Allstate | $160 | $225 | 41% |

| American Family | $117 | $176 | 50% |

| Erie | $58 | $82 | 41% |

| Farmers | $139 | $198 | 42% |

| Geico | $80 | $132 | 65% |

| Liberty Mutual | $174 | $234 | 34% |

| National General | $161 | $266 | 65% |

| Nationwide | $115 | $161 | 40% |

| Progressive | $105 | $186 | 77% |

| State Farm | $86 | $102 | 19% |

| The General | $232 | $327 | 41% |

| Travelers | $99 | $139 | 40% |

| USAA | $59 | $78 | 32% |

| U.S. Average | $119 | $173 | 45% |

American Family does offer fairly solid car insurance coverage, but rate increases are subject to many factors.

What Might Cause Your American Family Auto Insurance Rates to Increase

Filing claims through collision and liability coverages is more likely to lead to a rate increase. If law enforcement or the claims adjuster finds you at fault, your rate is going to increase. Unfortunately, fault has little to do with it.

You may still experience higher rates even if you’re not at fault. After a claim, insurers consider the increased risk associated with getting in a wreck and the likelihood of future incidents, regardless of fault.

Daniel Walker Licensed Insurance Agent

If it is determined that you’re not at fault, your rate still might increase. That is because insurance companies might deem you to be at risk, given recent events. Comprehensive claims are a little different in some regard, as it will depend on how much of your deductible is being used.

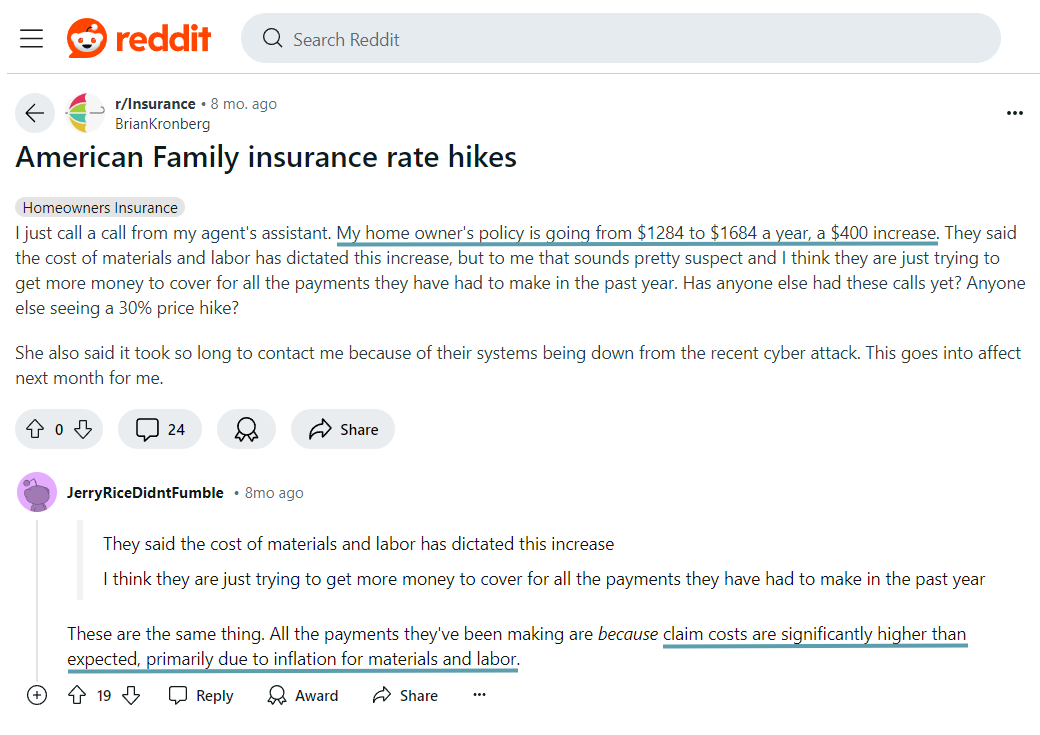

You can view some more information and customer impressions of American Family coverage in our American Family insurance review. However, if you’re still wondering, “Why is American Family insurance so expensive?” Reddit users who carry Am Fam policies are also asking the same question.

For instance, one user mentions that their homeowner’s insurance would be increasing by around $400 per year. Another Reddit user responded that many providers are raising rates due to inflation.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How to Lower Your American Family Car Insurance Rates After a Claim

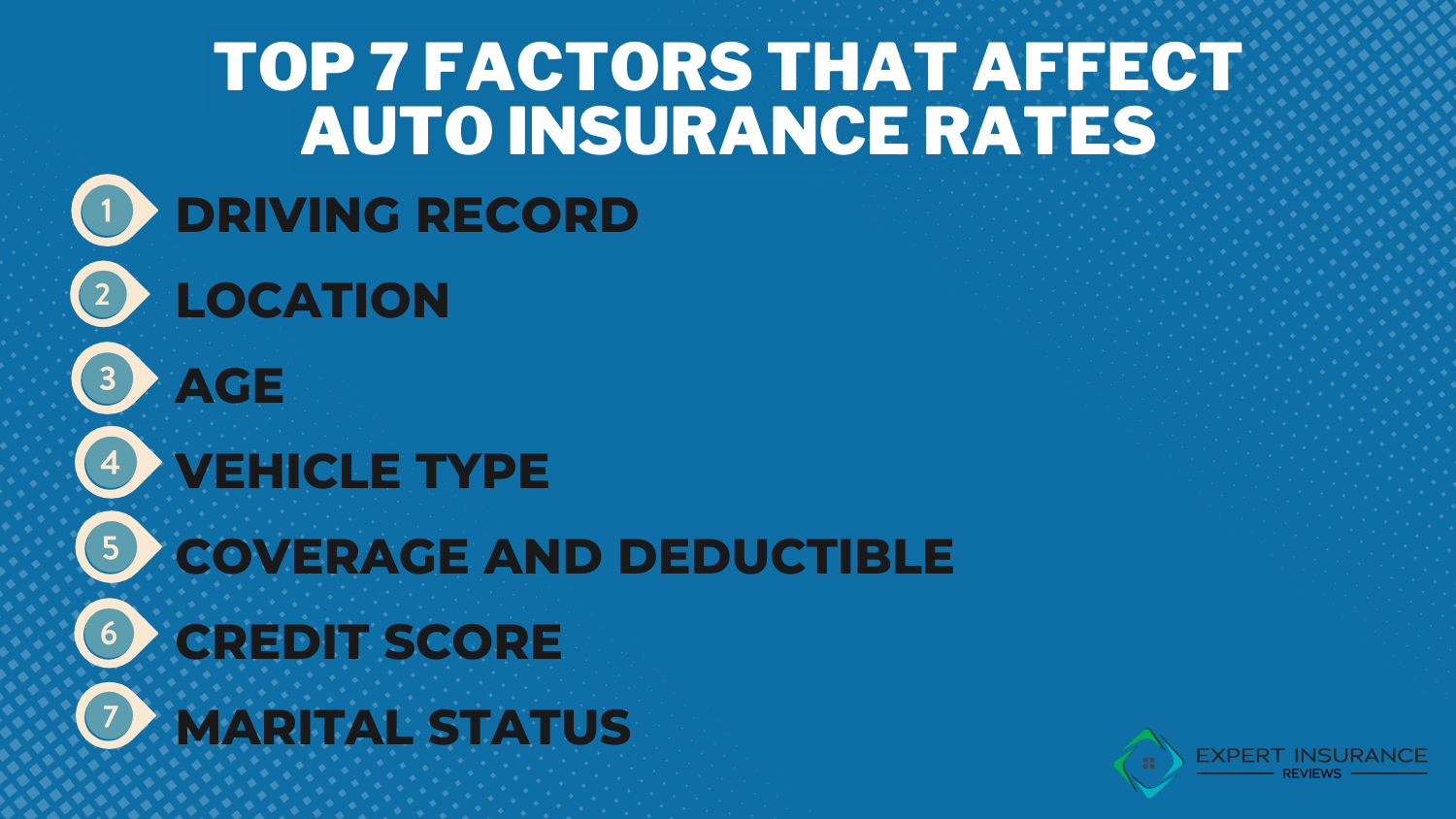

Fortunately, an American Family insurance rate increase after an accident isn’t permanent, and there are many other factors that affect car insurance rates.

For example, you’re likely to see your rate decrease thanks to a clean driving record and on-time car insurance payments. If you’re wondering, “Why is American Family insurance so expensive?” check out the list below for the top five ways to lower your rates:

- Compare Quotes: All insurance companies assess risk differently. So while you may have high accident rates with your current provider, another may offer you cheaper insurance rates, making it vital to compare quotes. You could also find one that has accident forgiveness to avoid a rate hike after your first wreck.

- Ask for Discounts: Insurers offer car insurance discounts to help lower your rates, including for maintaining a clean driving record, completing a defensive driving course, bundling policies, or having vehicle safety features.

- Consider a Higher Deductible: The higher your auto insurance deductible, the lower your rates. However, you should never raise your deductible to an amount you can’t afford to pay out of pocket.

- Improve Your Credit Score: Many insurers consider your credit score when setting your rates. So, if you increase your credit score, you could see lower premiums with some providers. Check out our expert guide titled, “How does your credit score affect car insurance rates?” for more details.

- Drop Unneeded Coverages: You could also get rid of extra car insurance coverage types you no longer need. For example, if you have an older car that’s not worth much, you could consider dropping full coverage insurance and only carry liability.

As you can see, there are many ways to find more affordable Am Fam rates after a crash. For instance, drivers could also enroll in a usage-based car insurance program, which tracks driving habits and rewards safe drivers with a discount.

Expect Insurance Rate Increases When Filing a Claim With American Family

There are many factors that can affect your insurance rates in the wake of a car insurance claim with American Family coverage. However, you won’t see a rate increase if you carry an accident forgiveness policy with American Family.

You can lower your rates by driving safe since accidents eventually fall off your record. Discounts can also be sought, which might help to offset some of the rising costs with your insurance rates.

Enter your ZIP code into our free quote tool below to instantly compare high-risk insurance quotes from the best car insurance companies in your area.

Frequently Asked Questions

Will my insurance rate increase with a claim with American Family?

You may be wondering, “Will insurance premiums increase after a claim with American Family?” Yes, but it depends on the nature of the claim. Like many insurance companies, American Family coverage rates might increase after a claim.

This isn’t always the case, but if you’re at fault, you’ll most likely see a rate increase. However, comprehensive claims might not see a price hike.

How much will my insurance go up with an at-fault accident through American Family?

So, how much does insurance increase after a claim if you’re at fault? The average increase in insurance after an accident with American Family is 50%, but the actual amount depends on factors such as fault and claim cost. However, if you were at fault, you could see an even higher hike.

Wondering if you can find better rates with another provider? Get started by entering your ZIP code into our free quote tool below to instantly compare rates from the best car insurance companies for drivers with accidents.

Does your insurance go up after a claim that is not your fault in American Family?

If someone else hit your car, you may be asking, “Will insurance go up if I’m not at fault with American Family?” Yes, even if you weren’t at fault, your American Family rates can still go up. However, it depends on the claim cost and severity.

Does American Family have accident forgiveness?

Yes, there is purchased and earned accident forgiveness. You can’t purchase the coverage outright, you will need to meet some qualifiers. Earned accident forgiveness is more lenient but needs at least five years of safe driving with zero claims.

Are American Family insurance rates competitive?

American Family offers affordable car insurance rates compared to the national average, costing around $117 monthly for full coverage insurance with a clean record.

Is American Family car insurance good?

Yes, American Family is a highly-rated and reliable car insurance company. The company carries a lower-than-average complaint index score of 0.30 from the National Association of Insurance Commissioners, indicating customer satisfaction. In addition, American Family has an A.M. Best financial strength rating of A, indicating its ability to pay out claims.

Why is my car insurance going up when I have no claims with American Family?

Your American Family rates may be increasing due to inflation, higher medical expenses, and rising repair costs. In addition, you could be experiencing higher rates if your credit score recently dropped, or if you adjusted your policy’s coverages.

How long does a chargeable accident stay on your insurance with American Family?

Generally, you can expect an accident to remain on your American Family driving record for three to five years, but it depends on your state’s insurance laws and policy specifics.

Enter your ZIP code into our free quote tool below to find the best car insurance for a bad driving record from top providers near you.

How does American Family vs. State Farm homeowners insurance compare?

While both companies offer various coverage options and discounts, State Farm generally has lower rates than American Family, but it depends on various factors. So, you should always compare home insurance quotes to see what you’ll actually pay.

What are three factors that impact the cost of car insurance premiums?

The top three factors insurers consider when setting rates are driving record, credit score, and the vehicle you drive (Learn More: Best Car Insurance Quotes by Vehicle).

How much can an insurance company raise your rates after an accident?

The amount insurers raise your rates after a wreck varies significantly. However, you can expect to see them increase by anywhere from 20% to 50%, depending on the circumstances, such as severity, driving record, and the company’s policies.

Can I get a discounted rate even with a rate increase?

You could easily qualify for a discount, and it is worth asking your insurance representative if there are any available. Rate increases might be incoming, but you could potentially at least offset some of the costs. It might not apply to your particular coverage, but it is at least worth asking to see if there are any ways to save.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.