Will my car insurance rates increase if I file a claim with USAA? (2025)

Generally, your USAA car insurance rates will increase by around 32% if you file a claim. However, it depends on the accident. For instance, while a fender bender may not affect rates much, a severe accident with injuries likely will. Also, USAA forgives your first wreck if you go accident-free for five years.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Filing a USAA claim can lead to 32% higher rates, but it depends on the claim

- Collision claims usually see a rate increase regardless of who’s at fault

- Comprehensive claims may not significantly raise your rates

Will my car insurance rates increase if I file a claim with USAA? Yes, you can usually expect your rates to go up by around 32% after a USAA claim (Learn More: How to File a Car Insurance Claim). However, the amount it increases depends on the accident severity and whether it was an at-fault accident.

We’ll overview what happens to your insurance rates with USAA after a wreck and how to correctly handle a car accident. If a car accident caused your coverage to get expensive, enter your ZIP code into our free quote tool above to compare rates from cheap car insurance companies near you.

USAA Rate Increase After Filing a Claim

Like most of the best car insurance companies, you’ll most likely see a USAA insurance increase after an accident where you file a claim. Generally, insurance rates with USAA increase by around 32% after a wreck.

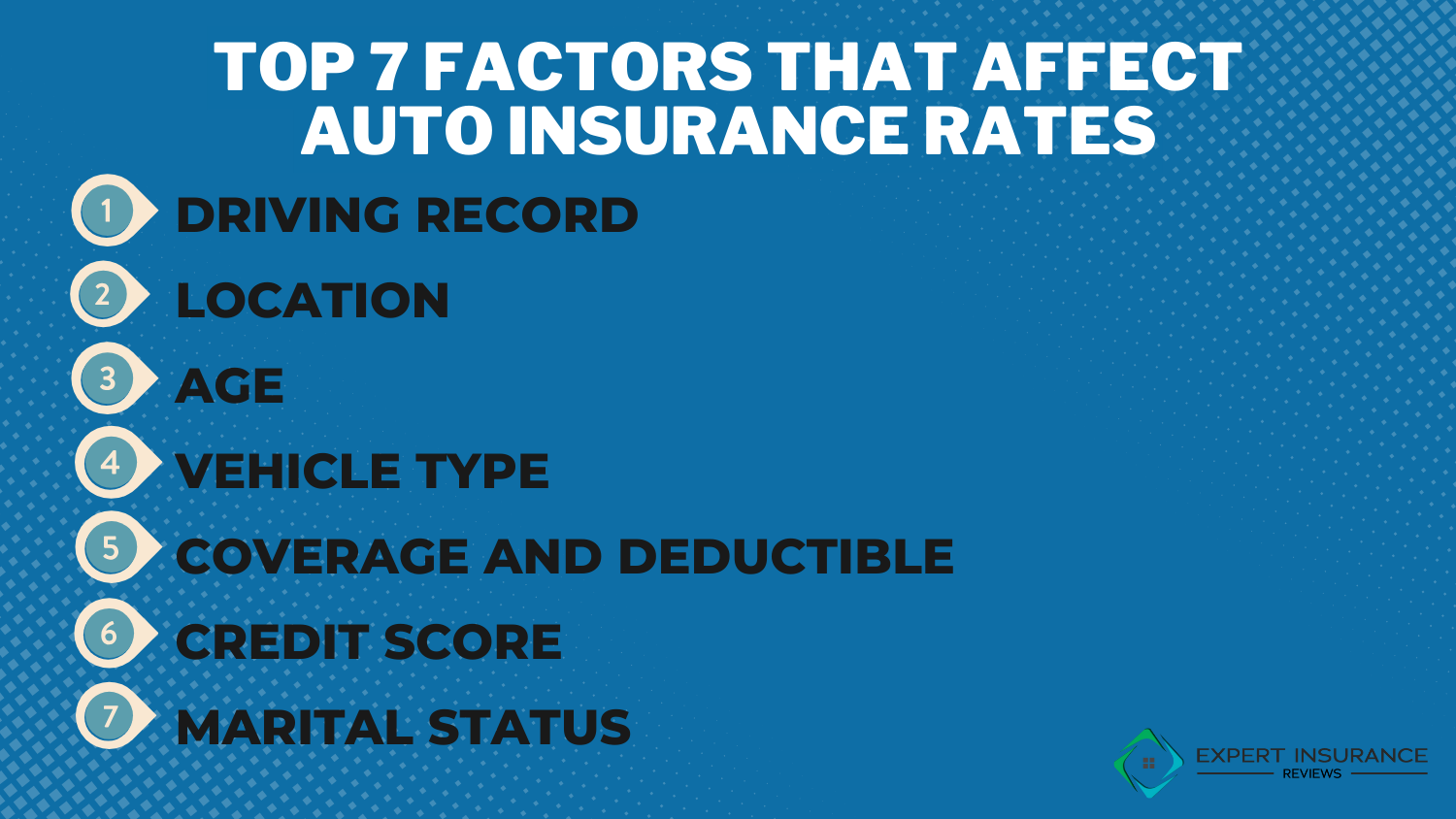

USAA rate increases after a claim depend on its severity, your driving record, and coverage. So, while minor fender benders may not affect rates much, an accident caused by a DUI will. Also, your rates stay the same after your first accident with USAA accident forgiveness.

Zach Fagiano Licensed Insurance Broker

If you need more information on the types of coverage, you can check our guide on car insurance coverage.

Wondering what you might pay after filing a claim? Check out the table below to compare USAA car insurance premiums after an accident vs. the best insurance companies:

Full Coverage Car Insurance Monthly Rates for Clean Record vs. One Accident

| Insurance Company | Clean Record | One Accident | Percent Increase |

|---|---|---|---|

| Allstate | $160 | $225 | 41% |

| American Family | $117 | $176 | 50% |

| Erie | $58 | $82 | 41% |

| Farmers | $139 | $198 | 42% |

| Geico | $80 | $132 | 65% |

| Liberty Mutual | $174 | $234 | 34% |

| National General | $161 | $266 | 65% |

| Nationwide | $115 | $161 | 40% |

| Progressive | $105 | $186 | 77% |

| State Farm | $86 | $102 | 19% |

| The General | $232 | $327 | 41% |

| Travelers | $99 | $139 | 40% |

| USAA | $59 | $78 | 32% |

| U.S. Average | $119 | $173 | 45% |

Collision coverage will usually see an increase in insurance rates, and the same can be said for liability insurance too (Read More: Best Collision Coverage Car Insurance Company).

However, comprehensive coverage is a bit different since two parties aren’t involved. Discover more about the different between collision vs. comprehensive coverage in our expert guide.

After a comprehensive auto insurance claim, you may find your rate increases, but it depends on the vehicle damages and claim severity. For example, hail or tornado damage might not cause your rates to increase with USAA. However, a falling tree that totals your car could lead to an increase.

There are multiple factors that affect car insurance rates, which can also apply after a claim.

While you may not be found at fault in the aftermath of a collision, you can still see increased rates. With many insurance companies, this is due to being seen as at-risk following an accident.

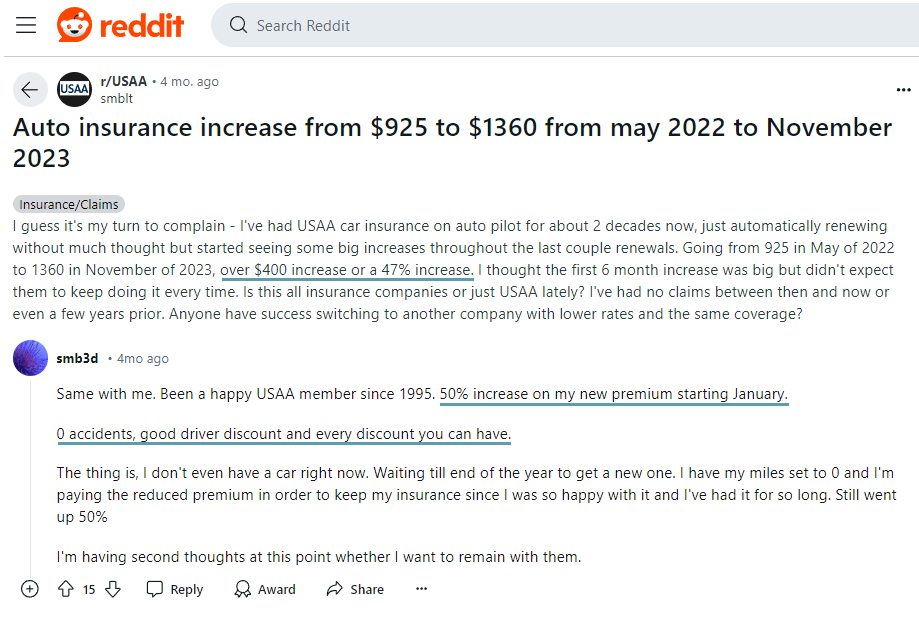

However, many policyholders are experiencing a USAA auto insurance increase, Reddit users say, without reason. One USAA driver on Reddit said their 6-month premiums increased by around $400, or 47%, after renewing their policy (Learn More: What is the process for renewing my car insurance policy?).

If you’re wondering, “Will USAA car insurance claim make rates go up?” Reddit users report that rates are rising even without filing claims. Many top providers have been steadily increasing insurance rates due to rising claim costs and medical bills associated with inflation.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

How to Lower Your Insurance Rates with USAA

Generally, USAA has affordable starting premiums, as we explain in our USAA insurance review, and offers good rates to drivers with a ticket on their record. However, if you’re looking to save more, here are five ways to lower your rates with USAA:

- Ask for Discounts: USAA has some of the best car insurance discounts, such as the safe driver discount of 30% for drivers who go without accidents or traffic violations for five years. Drivers can also save 10% by bundling their car insurance with other insurance products, such as home or renters insurance (Read More: How to Save Money by Bundling Insurance Policies).

- Maintain a Clean Record: If you continue to go accident-free for a certain period with USAA, any previous accidents will eventually fall off your record and stop impacting your rates. Check out our guide titled “Best Car Insurance Company That Only Goes Back Five Years” to understand more about your driving record’s impact and how to get cheap high-risk coverage.

- Increase Your Deductible: Opting for a higher auto insurance deductible will lower your USAA rates. However, it’s critical to ensure you can still afford the new deductible amount in the event of a claim.

- Enroll in Usage-Based Insurance: Most providers, including USAA, offer a usage-based insurance program that uses telematics to monitor driving habits and give discounts to policyholders with safe driving habits. USAA SafePilot, the company’s telematics program, can lower rates for safe drivers by 30% (Learn More: USAA SafePilot: Complete Guide & Review).

- Complete a Defensive Driving Course: Completing a defensive driving course qualifies you for a car insurance discount with many of the best insurance companies and reduces your accident risk.

USAA also offers accident forgiveness coverage, which is applicable to customers who have had no at-fault accidents over the last five years. This type of insurance coverage will prevent your first accident from raising your USAA rates.

Get an extra shot of savings with USAA SafePilot® — save up to 30% on your auto insurance for braking smooth and driving safe. Learn more at https://t.co/SMvILHCAqS. pic.twitter.com/Wk8swD17FN

— USAA (@USAA) May 17, 2022

As you can see, even if you file a claim and incur higher rates, there are many ways for USAA policyholders to achieve cheaper insurance. If you’re looking to stretch your dollar even further, check out our guide titled “Best Car Insurance Company for a Low Budget.”

Why USAA Insurance Rates Go Up After a Claim and How to Lower Them

You might have to deal with an insurance rate increase following a claim with USAA. However, it isn’t permanent, and you can find other ways to save, such as with discounts or enrolling in USAA SafePilot. You could also reduce coverage to just the minimum car insurance requirements if your car is older to lower rates.

You can easily reverse rate increases through careful driving, a clean record, and a few other deciding factors. You might also find your rate drops when entering into other situations like getting married or purchasing a newer vehicle.

If your USAA insurance rates went up after a claim, you can find the best car insurance company for drivers with accidents by entering your ZIP code into our free quote tool below to instantly compare compare car insurance rates from top-rated providers near you.

Frequently Asked Questions

Are rate increases guaranteed when filing a claim with USAA?

Not necessarily, but as mentioned it will greatly depend on the nature of the claim itself. If you find yourself in an auto accident and have been deemed at fault, you can certainly expect to see a USAA car insurance rate increase.

Learn More: What is no-fault in car insurance?

Does USAA raise rates for no-fault accidents?

After you get in an accident you didn’t cause, you might be asking, “Does USAA raise rates after a claim if it was a no-fault accident?” Yes, USAA may raise your rates after an accident, even if you weren’t at fault. However, it depends on where you live, your driving record, and policy details.

How much does USAA insurance go up after an accident?

Expect USAA car insurance rates to increase around 32% after you get in a wreck, unless you have an accident forgiveness policy.

Are your USAA rates too expensive after filing a claim? Enter your ZIP code below to instantly compare auto insurance rates from the best providers in your area.

Are rate increases assigned to a driver or the policy with USAA?

Any rate increases applied to your coverage will be applied to the policy. If you have a policy covering multiple members of your household, it will be applicable to everyone under the insurance coverage. Thankfully, this also applies to the accident forgiveness program offered by USAA.

How long does an accident stay on your record with USAA?

Like most other providers, accidents can stay on your record for anywhere from three to five years, but it depends on the situation. Check out our complete guide titled, “How long do accidents stay on your car insurance record?” for more details.

Why did my USAA auto insurance increase?

Many policyholders with USAA are asking, “Why does USAA keep raising rates?” If you haven’t filed a claim, there are many reasons USAA could have raised your rates, including inflation, policy changes, new risk assessment, and change in credit score.

Can I use any discounts following a rate increase?

It will greatly depend on your history with the company and any other pre-determined qualifiers for discounts from USAA. You may find that talking with your insurance agent can net you some savings. At any rate, it is at least worth trying to see if there is anything available to help offset the rising costs with your coverage.

Does USAA have speeding ticket forgiveness?

While you can’t get USAA speeding ticket forgiveness, the company offers great rates for drivers with a speeding ticket on their record (Learn More: Best Car Insurance Company for Bad Driving Records).

Is USAA good about paying claims?

A top question readers ask is, “How good is USAA at paying claims?” Customers generally express satisfaction with USAA customer service and how the company handles claims. In addition, USAA scored 900 out of 1,000 in J.D. Power’s 2023 claims satisfaction study, which is significantly higher than the industry average of 878.

Check out our guide on the best car insurance company for paying claims to learn more.

How does the USAA auto claims process work?

You may wonder, “How do claims work for USAA?” The claims process begins when the car insurance policyholders submits their claim in the app, online, or by calling an agent. Then, an insurance adjuster with USAA evaluates photos of the damage or evaluates in person. Once USAA settles the claim, it works with auto shops to initiate repairs.

Is accident forgiveness worth it with USAA?

USAA’s accident forgiveness is a type of insurance coverage that can be worth it for policyholders looking to avoid a rate increase after their first wreck.

How long do I have to file an insurance claim for a car with USAA?

While it’s best to file a claim as soon as possible, there isn’t a strict deadline with USAA on filing one.

Will my USAA insurance go up if my car got hit while parked?

You might be wondering, “My car was hit while parked. Will my insurance go up with USAA?” If the other drivers’ liability insurance pays for damages, you won’t have to worry about your rates going up since you didn’t file a claim on your own insurance.

However, if it was a hit-and-run, you may need to file an uninsured motorist coverage claim to pay for the repairs. Find the answer to, “How does USAA handle claims involving hit-and-run accidents?” here.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.