Best Wyoming Car Insurance (2025)

Wyoming car insurance laws require drivers to purchase bodily injury and property damage liability policies, which cost an average of $27/mo. Drivers who want the best Wyoming car insurance will want to consider full coverage, which costs more at an average of $129/mo but provides more protection.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Founder & Former Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. In addition to founding Expert Insurance Reviews, Eric is the CEO of C Street Media, a full-service marketing firm and the...

Founder & Former Insurance Agent

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Wyoming car insurance laws require all drivers to have liability car insurance to drive legally

- Wyoming minimum liability insurance costs an average of $27 per month

- Full coverage car insurance in Wyoming costs an average of $129 per month

When searching for the best Wyoming car insurance, it is important to consider what coverage you need and get multiple quotes from the best Wyoming car insurance companies to find the best deal. To help you find the most affordable Wyoming car insurance, we go over everything you need to know about Wyoming auto insurance requirements, the best car insurance companies, and much more.

Want to find the cheapest Wyoming car insurance right away? Use our free quote comparison tool to get the best Wyoming car insurance quotes today.

Wyoming Car Insurance Coverage and Rates

When you’re shopping for car insurance there are numerous elements to consider and endless companies claiming they have the coverage and prices for you. Where do you even start? What coverage are you required to have? How much can you expect to pay? What other coverage options do you have, if you feel you need more than the minimum?

Not to worry; to save you time, effort, and frustration, we’ve collected much of this information for you, so you know what to look for, what questions to ask, and can start figuring out the kind of coverage you need for your lifestyle.

To get us started, we’ll begin with something basic: price. This is probably one of the bigger concerns you have because you only want to purchase a policy you can afford. To know whether you’re getting a fair price, it helps to know what the average rates are in Wyoming.

As a first look, we have the average rates for all car insurance types in Wyoming in the below table.

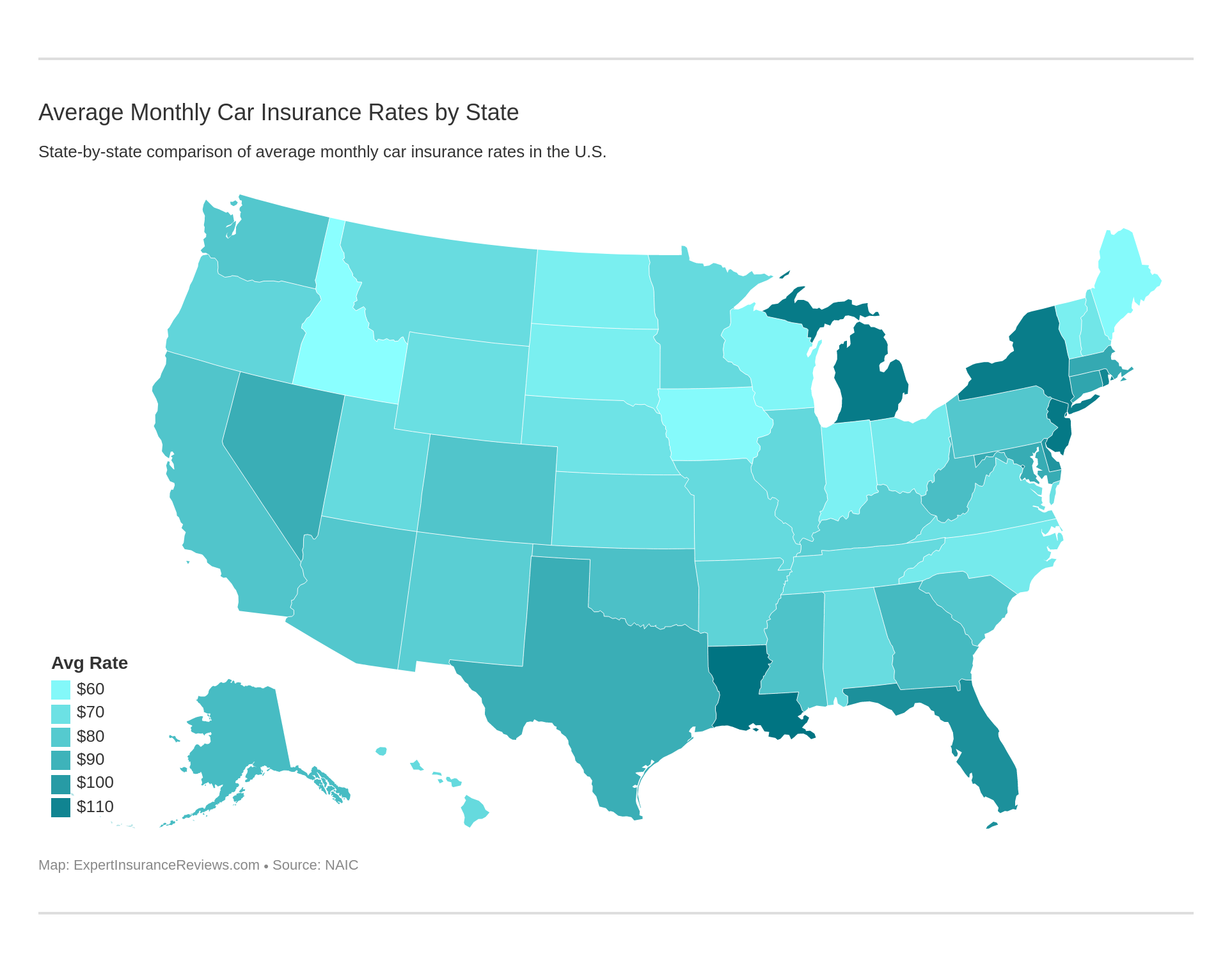

Wyoming Average Car Insurance Rates vs. U.S. Average

| Wyoming Average | National Average | Percent Difference |

|---|---|---|

| $1,541 | $1,474 | 4.55% |

Unfortunately for Wyoming drivers, the average rate for car insurance in the state is $1,541, which is 4.55 percent higher than the national average of $1,474.

Wyoming Minimum Car Insurance Coverage

Most states across the country require drivers to maintain some level of car insurance coverage to drive legally. This requirement ensures you and other drivers all have a certain amount of financial protection in the event of an accident.

To continue on your insurance shopping journey, you need to know what the insurance requirements are in Wyoming. That way, you’re legal as you traverse the state.

It also helps you understand the level of protection other drivers on the road are required to carry so you can begin deciding whether you need more than the minimum level of coverage demanded by the state.

In the below table we list the minimum coverage requirements for insurance in the Equality State.

Wyoming Minimum Liability Car Insurance Coverage Requirements

| Required Insurance | Minimum Limits |

|---|---|

| Bodily Injury | $25,000 per person $50,000 per accident |

| Property Damage Liability | $20,000 |

When you need to provide proof that you do in fact have insurance that meets at least the minimum requirement in the state, you can use electronic proof of insurance in Wyoming.

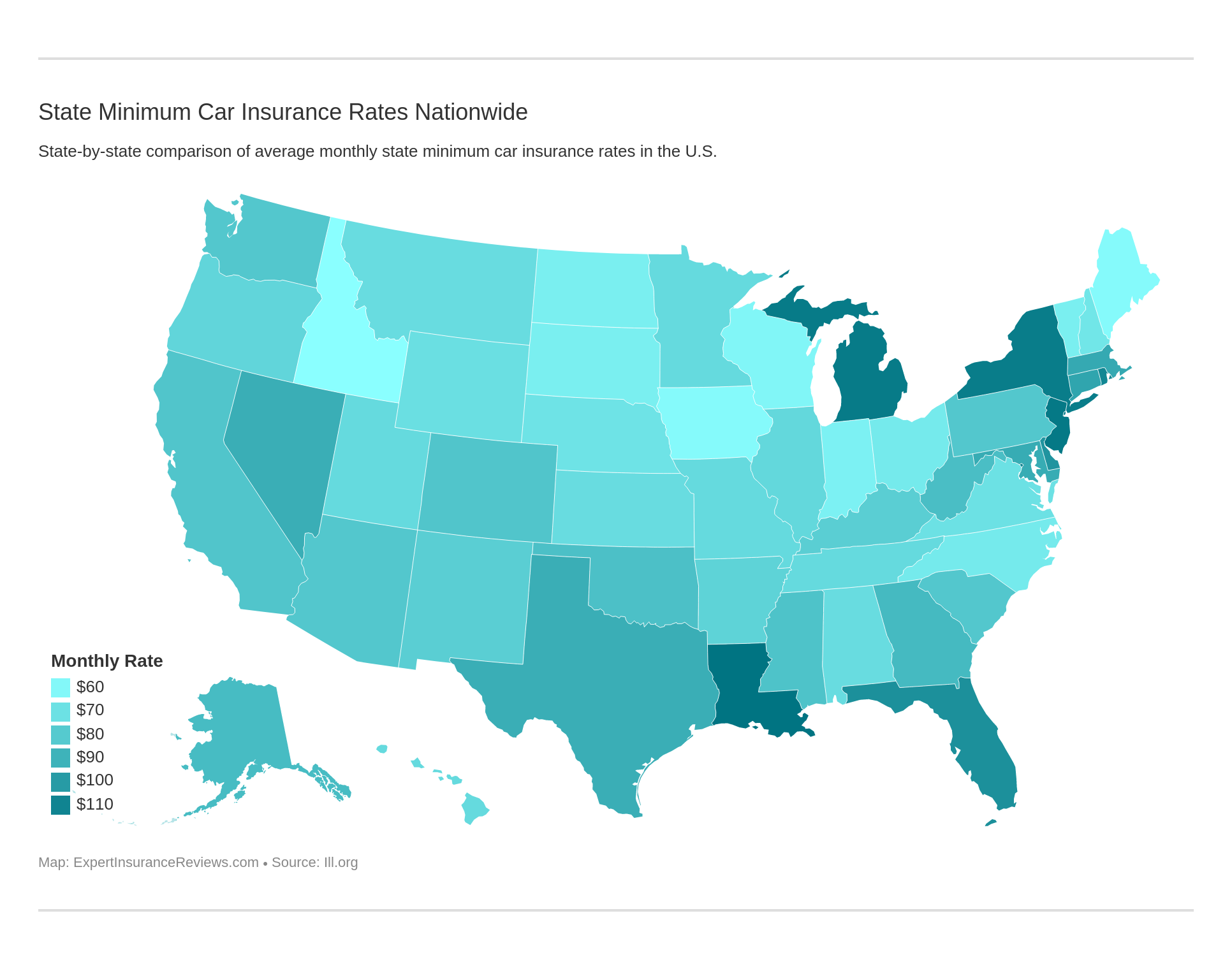

The cost of minimum coverage also varies from state to state.

What are forms of financial responsibility in Wyoming?

In Wyoming, there are three forms of financial responsibility considered acceptable:

- Proof of insurance that meets at least the minimum requirement in the state.

- A bond of surety valued at the same amount as the minimum liability coverage outlined in the previous section

- A deposit of cash or securities deposited with the state treasurer and valued at $25,000.

To ensure that you’re truly insured, the state has a Financial Responsibility Verification Program, which law enforcement can use to confirm your insurance is valid.

Failure to provide valid proof of insurance (or proof of bond, cash, or securities deposit) can result in the suspension of your license, fines, and even jail time.

What percentage of income is spent on car insurance premiums in Wyoming?

As we briefly mentioned at the beginning of this article, we know price can be a significant part of your insurance policy decision. One way to look at the cost of insurance is from the perspective of what percentage of your income will be allocated to paying your premiums.

In this table, we compare the average percentage of income allocated for insurance in Wyoming to the national average of the same.

Wyoming Percentage of Income Allocated to Car Insurance

| Year | Wyoming Average | National Average | Percent Difference |

|---|---|---|---|

| 2012 | 1.70% | 2.34% | 38% |

| 2013 | 1.72% | 2.43% | 41% |

| 2014 | 1.69% | 2.40% | 42% |

Despite the average dollar cost of insurance in Wyoming being higher than the national average, the percentage of income allocated to insurance in the state is quite a bit less than the national average.

To look at the income allocation for insurance in Wyoming with a bit more granularity, we’ll now take a minute to compare Wyoming’s average to the average allocations for insurance in several neighboring states.

Wyoming Percentage of Income Allocated to Car Insurance vs. Neighboring States

| State | 2012 | 2013 | 2014 |

|---|---|---|---|

| South Dakota | 1.67% | 1.76% | 1.78% |

| Wyoming | 1.70% | 1.72% | 1.69% |

| Idaho | 2.02% | 2.01% | 2.00% |

| Colorado | 2.13% | 2.16% | 2.15% |

| Montana | 2.29% | 2.39% | 2.10% |

| Utah | 2.52% | 2.55% | 2.54% |

Wyoming also has the lowest average percentage of income allocated for car insurance among its neighbors. This is good news for you if you’re a resident of the Equality State.

CalculatorPro

Average Monthly Car Insurance Rates in WY (Liability, Collision, Comprehensive)

While minimum liability coverage provides some financial protection, it’s typically not enough in the event of an accident. Why? There are two primary reasons:

- It only covers the cost of damages for the other person involved in an accident, not you. If you want financial protection for any damages you experience, you’ll need additional coverage

- It only provides financial protection up to the amount of coverage (recall we listed the amounts in an earlier section). If the costs exceed this amount — which is a possibility — you’ll be required to cover the remainder of the cost of damages out of your own pocket. Purchasing additional coverage for your policy will also increase your financial protection.

With this in mind, it’s important to know what other coverage options you have. We’ll start with core coverage. To better understand what core coverage includes, check out this video.

If you decide that one of these core coverage options is for you, it’s helpful to know what the average rates are to understand what this might do to your budget. In the visuals below, we list the four primary core coverage types, their average rates in Wyoming, and their average rates across the country.

Wyoming Core Coverage Car Insurance Rates

| Coverage Type | 2011-2015 Average Cost in Wyoming | 2011-2015 Average National Cost |

|---|---|---|

| Liability | $323.38 | $516.44 |

| Collision | $270.48 | $299.73 |

| Comprehensive | $222.86 | $138.87 |

| Combined/Full | $816.71 | $954.99 |

This National Association of Insurance Commissioners data is useful in helping you understand baseline rates for the different forms of core coverage. However, as you look at these numbers, it’s important to keep in mind that they may not necessarily resemble exactly what you’ll pay because they’re based on the minimum insurance requirements in Wyoming.

What additional liability is available in Wyoming?

In addition to core coverage, most insurance companies offer something called additional liability to provide even more financial protection. These additional liability options provide extra coverage for certain situations. There are three primary kinds:

- Uninsured/underinsured motorist coverage: provides additional coverage if you’re in an accident with one of the 7.8 percent of uninsured drivers in Wyoming

- MedPay: provides additional coverage for medical costs (this is only for you and anyone else listed on your policy)

- Personal injury protection (PIP): provides additional coverage for medical costs (this includes everyone involved in an accident, regardless of who is at fault)

These options may be good choices to add to your coverage if you’ve weighed the risks in your state and those risks you personally face and determine the extra cost in the short term is worth the long-term protection these provide.

However, these options are only worth adding to your policy if your insurance company is both willing and able to pay out on claims for these, should you ever need to file one. But how can you tell whether companies will pay out on insurance claims for additional liability coverage?

The NAIC generates what is called a loss ratio number, based on dividing the number of claims insurance companies payout by the total number of claims filed. A good loss ratio number is between 60 and 80 percent. Higher and companies are paying out on too many claims (which means the insurance company is losing money); lower means companies aren’t paying out on enough claims.

While the NAIC does not have loss ratio data for personal injury protection, the loss ratio data for uninsured/underinsured motorists and MedPay coverage are in the below table.

NAIC Loss Ration for Wyoming MedPay and Uninsured/Underinsured Car Insurance

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| MedPay | 65.80% | 72.23% | 75.67% |

| Uninsured/Underinsured Motorist | 49.08% | 56.18% | 49.32% |

The average MedPay loss ratio numbers in Wyoming are within a healthy range. However, the uninsured/underinsured motorist loss ratio numbers for the three years listed are all lower than 60 percent, meaning companies are likely not paying out on enough claims.

What add-ons, endorsements, and riders are available in Wyoming?

Need something beyond core and additional liability coverage? There are some extra options you can consider and discuss with your insurance agent. These add-ons, endorsements, and riders are described below:

- Guaranteed auto protection (GAP) – covers the gap between what your car is worth and what you still owe on your loan

- Personal umbrella policy (PUP) – provides protection if you’re ever faced with a lawsuit as a result of your part in a car accident

- Rental reimbursement – provides coverage if you have to rent a car because yours was damaged in a car accident and is unavailable to drive while it’s being repaired

- Emergency roadside assistance – provides coverage for various roadside needs, like flat tires, towing, etc.

- Mechanical breakdown insurance – provides repair coverage, often beyond what is covered by your vehicle’s warranty

- Non-owner car insurance – provides insurance coverage when you don’t own a car but will be driving one

- Modified car insurance coverage – provides coverage for vehicles with special modifications (wheels/tires, specialty paint jobs, spoilers, etc.)

- Classic car insurance – provides coverage for vehicles that are considered collector’s items

- Pay-as-you-drive or usage-based insurance – insurance coverage that’s specifically focused on individual driving habits

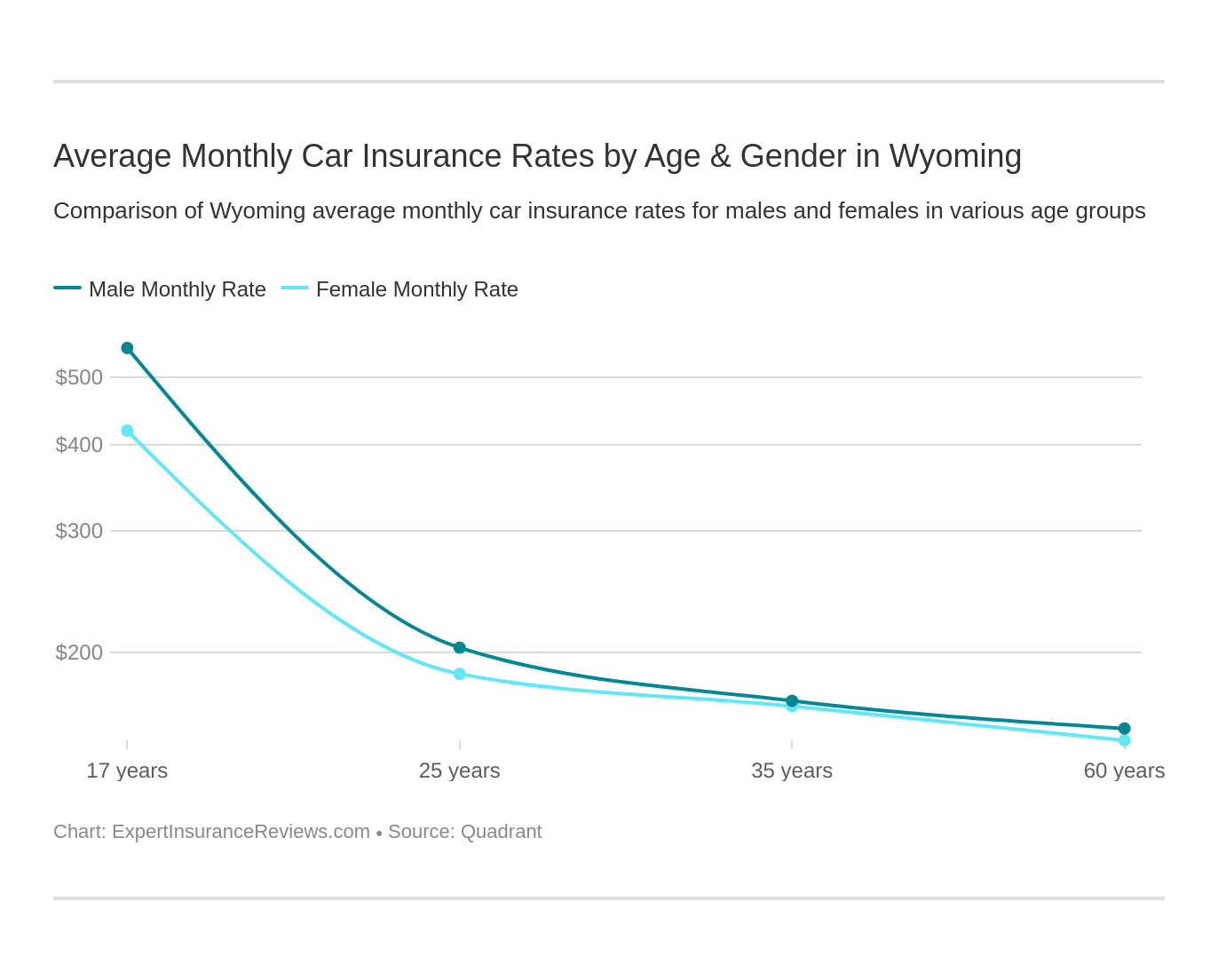

Average Car Insurance Rates by Age & Gender in WY

While insurance rates can seem arbitrary at times, in truth insurance companies use a number of factors (based on perceived risks associated with those factors) to adjust rates. If you’re considered to be a higher risk according to the factors by which insurance companies adjust rates, your rates will be higher than those perceived to be lower risk.

Two factors many insurance companies use are age and gender. While this is a somewhat controversial practice, given that it’s considered discriminatory (and some states like California have made it illegal in recent years), Wyoming still allows this policy.

To see just how much age and gender can affect you in Wyoming, take a look at this data.

Wyoming Car Insurance Rates by Age and Gender

| Insurance Company | Single 17-Year-Old Female Annual Rates | Single 17-Year-Old Male Annual Rates | Single 25-Year-Old Female Annual Rates | Single 25-Year-Old Male Annual Rates | Married 35-Year-Old Female Annual Rates | Married 35-Year-Old Male Annual Rates | Married 60-Year-Old Female Annual Rates | Married 60-Year-Old Male Annual Rates |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $8,513.43 | $10,794.53 | $2,849.40 | $3,129.16 | $2,548.54 | $2,687.45 | $2,135.78 | $2,333.15 |

| Geico General | $4,875.40 | $6,318.07 | $2,988.60 | $3,153.08 | $2,689.63 | $2,743.19 | $2,602.22 | $2,602.22 |

| Mid-Century Ins Co | $4,109.04 | $6,979.72 | $2,345.57 | $2,345.57 | $2,261.19 | $2,261.19 | $2,126.25 | $2,126.25 |

| Safeco Ins Co of IL | $3,605.13 | $4,046.51 | $1,478.54 | $1,651.78 | $1,363.71 | $1,371.22 | $1,114.24 | $1,283.71 |

| State Farm Mutual Auto | $4,032.03 | $5,368.95 | $1,568.23 | $1,861.11 | $1,504.53 | $1,504.53 | $1,294.51 | $1,294.51 |

| USAA | $5,059.24 | $6,245.07 | $2,191.51 | $2,482.95 | $1,655.42 | $1,661.22 | $1,435.20 | $1,505.63 |

As you review the data in this table, it immediately becomes obvious that both age and gender are factors in insurance rates in Wyoming. The younger you are, the more you’ll pay in car insurance. Additionally, in general (especially at younger ages), men in Wyoming pay more for insurance than women, because insurance companies perceive younger males to be higher-risk drivers than females of the same age.

For example, if you’re insured by Mid-Century Insurance Company as a 17-year-old male, you’ll pay almost 70 percent more for insurance than if you’re a 17-year-old female. While still higher, Safeco Insurance Company’s rate disparity is significantly lower. For the same age, males pay 12.2 percent more for insurance than females.

Across the board, the average difference is such that 17-year-old males pay 31.7 percent more than 17-year-old females. However, as you age, the gender rate disparity shrinks. At 25, the average difference between rates for males and females is almost 9 percent, and in one case (Mid-Century Insurance Company), males and females pay the same for insurance.

Once you reach the age of 35 (and are married), the difference between male and female insurance rates is almost non-existent. The overall average difference is 1.7 percent, while both Mid-Century Insurance Company and State Farm offering the same rates for males and females.

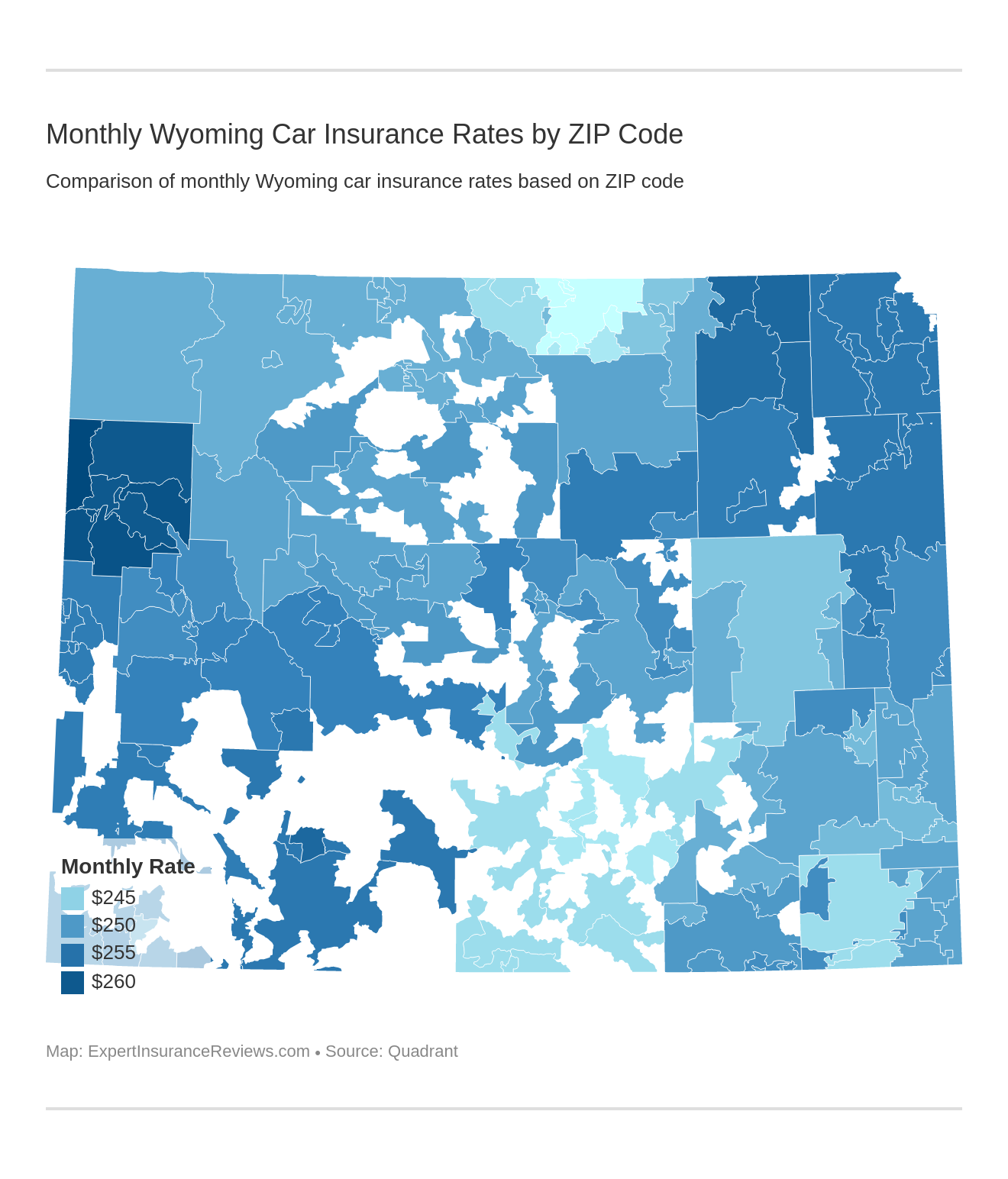

What are the cheapest rates by ZIP code in Wyoming?

Another factor many companies look at, again from the risk perspective, is where you live (and therefore drive). They want to know just how likely it is that you’ll file a claim due to an accident or crime. How do they determine this?

Insurance companies pull crime and accident data by ZIP code and adjust rates accordingly.

To see what this can mean in your area, take a look at this table. Below we’ve listed the 25 ZIP codes in the state with the lowest car insurance rates.

Wyoming 25 Cheapest Car Insurance Rates by ZIP Code

| ZIP Code | City | Average Annual Rates | Allstate F&C Annual Rates | Mid-Century Ins Co Annual Rates | Geico General Annual Rates | Safeco Ins Co of IL Annual Rates | State Farm Mutual Auto Annual Rates | USAA Annual Rates |

|---|---|---|---|---|---|---|---|---|

| 82801 | Sheridan | $2,896.66 | $4,012.21 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82833 | Big Horn | $2,896.66 | $4,012.21 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82839 | Ranchester | $2,896.66 | $4,012.21 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82845 | Wyarno | $2,896.66 | $4,012.21 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82324 | Elk Mountain | $2,920.50 | $4,381.19 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82327 | Hanna | $2,920.50 | $4,381.19 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82334 | Sinclair | $2,920.50 | $4,381.19 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82335 | Walcott | $2,920.50 | $4,381.19 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82615 | Shirley Basin | $2,920.50 | $4,381.19 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82832 | Banner | $2,921.32 | $4,160.17 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82842 | Story | $2,921.32 | $4,160.17 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82007 | Cheyenne | $2,922.78 | $4,398.39 | $3,215.76 | $3,286.65 | $2,042.51 | $2,310.05 | $2,283.32 |

| 82301 | Rawlins | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82321 | Baggs | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82323 | Dixon | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82325 | Encampment | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82329 | Medicine Bow | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82331 | Saratoga | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82332 | Savery | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82001 | Cheyenne | $2,931.29 | $4,449.45 | $3,215.76 | $3,286.65 | $2,042.51 | $2,310.05 | $2,283.32 |

| 82009 | Cheyenne | $2,931.29 | $4,449.45 | $3,215.76 | $3,286.65 | $2,042.51 | $2,310.05 | $2,283.32 |

| 82836 | Dayton | $2,931.40 | $4,220.65 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82838 | Parkman | $2,931.40 | $4,220.65 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82633 | Douglas | $2,953.92 | $4,417.02 | $2,798.83 | $3,387.40 | $2,016.76 | $2,295.47 | $2,808.05 |

| 82835 | Clearmont | $2,955.90 | $4,367.66 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

We’ve also collected the 25 ZIP codes with the most expensive rates.

Wyoming 25 Most Expensive Car Insurance Rates by ZIP Code

| ZIP Code | City | Average Annual Rates | Allstate F&C Annual Rates | Mid-Century Ins Co Annual Rates | Geico General Annual Rates | Safeco Ins Co of IL Annual Rates | State Farm Mutual Auto Annual Rates | USAA Annual Rates |

|---|---|---|---|---|---|---|---|---|

| 82845 | Wyarno | $2,896.66 | $4,012.21 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82335 | Walcott | $2,920.50 | $4,381.19 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82842 | Story | $2,921.32 | $4,160.17 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82844 | Wolf | $2,964.13 | $4,417.02 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82244 | Yoder | $2,966.79 | $4,333.82 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82243 | Veteran | $2,966.79 | $4,333.82 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82190 | Yellowstone National Park | $2,978.89 | $4,220.65 | $3,017.90 | $3,591.27 | $1,952.50 | $2,296.14 | $2,794.87 |

| 82450 | Wapiti | $2,978.89 | $4,220.65 | $3,017.90 | $3,591.27 | $1,952.50 | $2,296.14 | $2,794.87 |

| 82201 | Wheatland | $2,989.17 | $4,468.10 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82240 | Torrington | $2,989.17 | $4,468.10 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82443 | Thermopolis | $2,993.45 | $4,293.14 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82401 | Worland | $3,001.52 | $4,341.55 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82442 | Ten Sleep | $3,001.52 | $4,341.55 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82084 | Tie Siding | $3,006.61 | $4,398.39 | $3,020.36 | $3,591.27 | $2,021.74 | $2,296.14 | $2,711.75 |

| 82242 | Van Tassell | $3,017.98 | $4,471.59 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 83127 | Thayne | $3,031.04 | $4,335.30 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83126 | Smoot | $3,031.04 | $4,335.30 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 82732 | Wright | $3,041.69 | $4,417.02 | $3,355.80 | $3,387.40 | $1,986.42 | $2,295.47 | $2,808.05 |

| 82730 | Upton | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82729 | Sundance | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82336 | Wamsutter | $3,053.13 | $4,425.07 | $3,355.80 | $3,387.40 | $2,066.89 | $2,295.47 | $2,788.13 |

| 82731 | Weston | $3,081.33 | $4,624.49 | $3,355.80 | $3,387.40 | $2,016.76 | $2,295.47 | $2,808.05 |

| 82945 | Superior | $3,087.10 | $4,425.07 | $3,355.80 | $3,591.27 | $2,066.89 | $2,295.47 | $2,788.13 |

| 83014 | Wilson | $3,136.29 | $4,330.91 | $3,306.61 | $3,576.30 | $1,952.50 | $2,688.77 | $2,962.67 |

| 83025 | Teton Village | $3,136.29 | $4,330.91 | $3,306.61 | $3,576.30 | $1,952.50 | $2,688.77 | $2,962.67 |

This data shows that in Wyoming the difference in rates by ZIP code is fairly minor. For example, the highest rate in the state is in ZIP code 83414, with an average rate of $3,156.84. By contrast, the lowest rate in the state (ZIP code 82801) is almost 9 percent lower than ZIP Code 83414, with a rate of $2,896.66.

Compared to many other states, this rate difference is negligible and could be the result of several factors. One of these could be that insurance companies may not weigh crime and accident statistics very heavily in Wyoming. Another reason could be that there isn’t a significant variation in crime and accident statistics from ZIP code to ZIP code in the state (as compared to other states).

What are the cheapest rates by city in Wyoming?

We can look at these rates by separating by city as well. The average rate of insurance for the state is $3,047.46. In the below table, we list the 25 cities with the lowest rates.

Wyoming 25 Cheapest Car Insurance Rates by City

| City | Average Annual Rates | Compared to Average | ZIP Code |

|---|---|---|---|

| Sheridan | $2,896.66 | -$105.38 | 82801 |

| Big Horn | $2,896.66 | -$105.38 | 82833 |

| Ranchester | $2,896.66 | -$105.38 | 82839 |

| Wyarno | $2,896.66 | -$105.38 | 82845 |

| Elk Mountain | $2,920.50 | -$81.54 | 82324 |

| Hanna | $2,920.50 | -$81.54 | 82327 |

| Sinclair | $2,920.50 | -$81.54 | 82334 |

| Walcott | $2,920.50 | -$81.54 | 82335 |

| Shirley Basin | $2,920.50 | -$81.54 | 82615 |

| Banner | $2,921.32 | -$80.72 | 82832 |

| Story | $2,921.32 | -$80.72 | 82842 |

| Cheyenne | $2,922.78 | -$79.26 | 82007 |

| Rawlins | $2,924.73 | -$77.31 | 82301 |

| Baggs | $2,924.73 | -$77.31 | 82321 |

| Dixon | $2,924.73 | -$77.31 | 82323 |

| Encampment | $2,924.73 | -$77.31 | 82325 |

| Medicine Bow | $2,924.73 | -$77.31 | 82329 |

| Saratoga | $2,924.73 | -$77.31 | 82331 |

| Savery | $2,924.73 | -$77.31 | 82332 |

| Cheyenne | $2,931.29 | -$70.75 | 82001 |

| Cheyenne | $2,931.29 | -$70.75 | 82009 |

| Dayton | $2,931.40 | -$70.64 | 82836 |

| Parkman | $2,931.40 | -$70.64 | 82838 |

| Douglas | $2,953.92 | -$48.12 | 82633 |

| Clearmont | $2,955.90 | -$46.14 | 82835 |

In comparison, these are the rates in the 25 most expensive cities in Wyoming.

Wyoming 25 Most Expensive Car Insurance Rates by City

| City | Average Annual Rates | Compared to Average | ZIP Code |

|---|---|---|---|

| Lance Creek | $3,043.46 | $41.42 | 82222 |

| Newcastle | $3,043.46 | $41.42 | 82701 |

| Aladdin | $3,043.46 | $41.42 | 82710 |

| Alva | $3,043.46 | $41.42 | 82711 |

| Beulah | $3,043.46 | $41.42 | 82712 |

| Devils Tower | $3,043.46 | $41.42 | 82714 |

| Bairoil | $3,045.81 | $43.77 | 82322 |

| Farson | $3,052.11 | $50.07 | 82932 |

| Mc Kinnon | $3,052.11 | $50.07 | 82938 |

| Wamsutter | $3,053.12 | $51.08 | 82336 |

| Rock Springs | $3,053.12 | $51.08 | 82901 |

| Point Of Rocks | $3,053.12 | $51.08 | 82942 |

| Reliance | $3,053.12 | $51.08 | 82943 |

| Gillette | $3,076.27 | $74.23 | 82716 |

| Rozet | $3,076.27 | $74.23 | 82727 |

| Recluse | $3,081.33 | $79.29 | 82725 |

| Weston | $3,081.33 | $79.29 | 82731 |

| Superior | $3,087.10 | $85.06 | 82945 |

| Moran | $3,117.91 | $115.87 | 83013 |

| Kelly | $3,121.12 | $119.08 | 83011 |

| Moose | $3,124.21 | $122.17 | 83012 |

| Jackson | $3,136.29 | $134.25 | 83001 |

| Wilson | $3,136.29 | $134.25 | 83014 |

| Teton Village | $3,136.29 | $134.25 | 83025 |

| Alta | $3,156.84 | $154.80 | 83414 |

As we saw in the previous section (which focused on rates by ZIP code), the difference between most and least expensive average rates is fairly minor. There’s only about $260 between the highest and lowest rates by city listed. The city with the most expensive average rates in the state is Alta, while the city with the least expensive rates in the state is Wyarno.

Are you looking for free insurance quotes?

Your one-stop online insurance guide. Get free quotes now!

Secured with SHA-256 Encryption

Best Wyoming Car Insurance Companies

There are other factors to consider when shopping for insurance beyond price (though we aren’t finished with that discussion). Some of these other factors include financial stability and customer service ratings for companies.

Why should you care? Because knowing the financial stability and customer service ratings of a company you’re considering can help you determine if it’s a good choice for you. You want to know the companies you’re considering are wise with their money (and your money) and that they’ll be available for you when you need help.

For example, larger companies became that way because of their financial stability! Take a look at some of the largest companies in Wyoming.

In the next few sections, we’ll give you some financial and customer service rating information for the primary companies in Wyoming, so you can be informed as you shop for insurance.

What are the financial ratings of the largest car insurance companies in Wyoming?

Financial ratings matter because they help you understand both the current status of a company’s finances (which can help you understand whether a company has the ability to pay out on claims, should you need to file one) and their outlook for the future.

But we know finding this information is easier said than done. To help you out, we’ve pulled data from A.M. Best, a global credit firm focused on the insurance sector, to find out what the financial status of the companies in Wyoming is.

A.M. Best Ratings for Wyoming Car Insurance Companies

| Insurance Company | Rating | Outlook |

|---|---|---|

| Allstate Insurance Group | A++ | Stable |

| Farmers Insurance Group | NR | Stable |

| Geico | A++ | Stable |

| Hartford Fire & Casualty Group | A+ | Stable |

| Liberty Mutual Group | A | Stable |

| Mountain West Farm Group | A- | Negative |

| Nationwide Corp Group | A+ | Stable |

| Progressive Group | A+ | Stable |

| State Farm Group | A++ | Stable |

| USAA Group | A++ | Stable |

According to A.M. Best’s rating system, in general (and unless otherwise specified), any company with a rating of A- or better is financially secure and has a stable outlook.

As you can see, eight out of the 10 largest insurance companies in the Equality State have strong financial ratings and stable future outlooks. The two exceptions are Farmers Insurance Group and the Mountain West Farm Group.

Farmers isn’t rated by A.M. Best, which does not mean they aren’t financially stable. It just means that A.M. Best doesn’t have data to indicate their financial stability one way or the other. To learn more about Farmers insurance, read Farmers Insurance review & complaints.

However, Mountain West Farm Group is rated as an A-. This on its own isn’t a concern, given the general structure of AM Best’s ratings. However, they also note that their outlook is negative.

A negative opinion outlook “indicates that the entity/issuer or security is experiencing unfavorable financial and market trends, relative to its current Best’s Credit Rating (BCR).”

Which car insurance companies have the best ratings in Wyoming?

When you’re considering different insurance companies, you want to know whether the companies have good customer service. Are they going to answer the phone when you call? Will they be both willing and able to answer your questions? Can they help you when you need to file a claim or when one is filed against you?

One way to find out what customer service ratings look like for the companies in your area is to take a look at their J.D. Power customer satisfaction ratings. In a recent press release, they stated customer service satisfaction in the insurance industry is particularly high.

They’ve rated companies by region based on customer satisfaction and the J.D. Power Circle Rating™. For Wyoming, the ratings can be found in the Northwest region. We’ve listed those ratings in the below table.

J.D. Power Ratings for Wyoming Car Insurance Companies

| Insurance Company | Customer Satisfaction Index Rating | J.D. Power Circle Rating |

|---|---|---|

| Allstate | 816 | 3 |

| American Family | 825 | 3 |

| Farmers | 818 | 3 |

| Geico | 813 | 3 |

| Liberty Mutual | 792 | 2 |

| Nationwide | 765 | 2 |

| Northwest Average | 816 | 3 |

| PEMCO Insurance | 850 | 4 |

| Progressive | 797 | 2 |

| Safeco | 801 | 3 |

| State Farm | 820 | 3 |

| The Hartford | 833 | 4 |

| USAA | 894 | 5 |

The highest customer satisfaction index rating in the table is for USAA, with a score of 894 (out of 1,000 points) and a J.D. Power Circle Rating™ of five (meaning “among the best”). However, USAA is only available to military members and their families.

With that in mind, the highest customer service index rating for a company in Wyoming is Hartford, who has a customer satisfaction rating of 833 and a J.D. Power Circle Rating™ of four, which means “better than most.”

Read our Hartford Insurance review and complaints to learn more.

Which car insurance companies have the most complaints in Wyoming?

It’s also important to compare customer service ratings with complaint data for the companies in your area. This is another way to determine whether you’ll receive the kind of service you’re looking for in a company.

The complaint data, known as a complaint ratio, for companies in Wyoming is listed in the below table (and is pulled from the Wyoming Insurance Department Complaint Ratio Report)

Complaint Ratios for Wyoming Car Insurance Companies

| Company | Number of Complaints | Premiums ($) | Direct Premiums Written ($1.0 Million) | 2018 Complaint Ratio |

|---|---|---|---|---|

| Allstate Fire & Casualty Insurance Company | 5 | 16,003,594 | 16.004 | 0.31 |

| Allstate Property & Casualty Insurance Company | 4 | 8,420,287 | 8.42 | 0.48 |

| Farmers Insurance Exchange | 6 | 26,163,166 | 26.1632 | 0.23 |

| Geico | 5 | 14,667,553 | 14.668 | 0.34 |

| Mountain West Farm Bureau Mutual Insurance Company | 12 | 106,616,202 | 106.616 | 0.11 |

| Progressive Northern Ins Co | 4 | 30,837,684 | 30.838 | 0.13 |

| Progressive Universal Ins Co | 7 | 29,068,669 | 29.069 | 0.24 |

| Safeco Insurance Co of America | 3 | 21,043,821 | 21.044 | 0.14 |

| State Farm Fire & Casualty | 11 | 64,777,467 | 64.778 | 0.17 |

| State Farm Mutual Auto | 8 | 95,825,878 | 95.826 | 0.08 |

| USAA | 4 | 11,196,457 | 11.197 | 0.36 |

Complaint ratio data indicates whether companies receive more or less than the average number of complaints. This information is generated by the NAIC by dividing the number of complaints a company receives by the direct premiums written by that company.

An average number of complaints is represented by the number one, so companies with anything below one receive less than the average number of complaints, and companies with anything above one receive more than the average number of complaints.

Fortunately for Wyoming drivers, all of the companies listed have complaint ratios well below one, meaning they all receive less than the average number of complaints. Both Progressive branches listed have complaint ratios of below even 0.25 (one is 0.24 and one is 0.11), but they have one of the lower J.D. Power customer index ratings (797 out of 1,000, and a Power Circle Rating™ of two, meaning “the rest”).

To file a complaint against an insurance company in Wyoming, you can submit your concerns through the online Wyoming Insurance Department Consumer Request for Assistance tool.

The Wyoming Insurance Department does note that they don’t have the authority to respond to certain types of complaints. These include the cost of your rates, determining who is at fault in an accident, and when insurance companies refuse to sell you insurance.

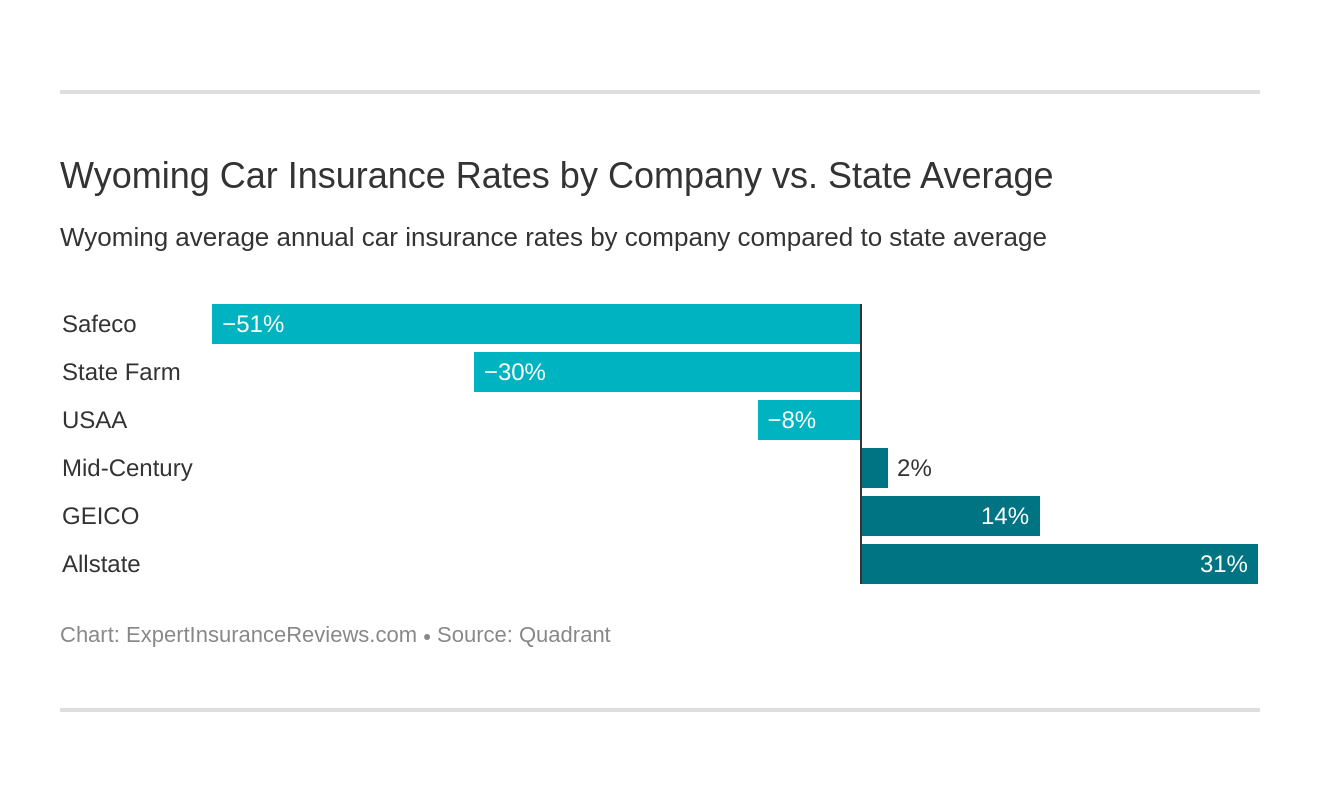

What are the cheapest car insurance companies in Wyoming?

Now that we’ve spent some time discussing complaint ratio, customer satisfaction, and financial stability information for the primary insurance companies in Wyoming, we’ll spend some more time looking at price (but you should keep this information in the back of your mind as we look at rates for the companies in the state, based on various factors they consider when adjusting those rates).

Below, we’ll compare the overall average rates for some of the main insurers in the Equality State.

Cheapest Car Insurance Companies in Wyoming

| Company | Average Annual Rates | Compared to State Average | Percentage |

|---|---|---|---|

| Safeco Ins Co of IL | $1,989.36 | -$1,012.69 | -50.91% |

| State Farm Mutual Auto | $2,303.55 | -$698.49 | -30.32% |

| USAA | $2,779.53 | -$222.51 | -8.01% |

| Mid-Century Ins Co | $3,069.35 | $67.30 | 2.19% |

| Geico General | $3,496.55 | $494.51 | 14.14% |

| Allstate F&C | $4,373.93 | $1,371.89 | 31.37% |

The companies are fairly evenly split between above and below the overall state average of $3,002.04.

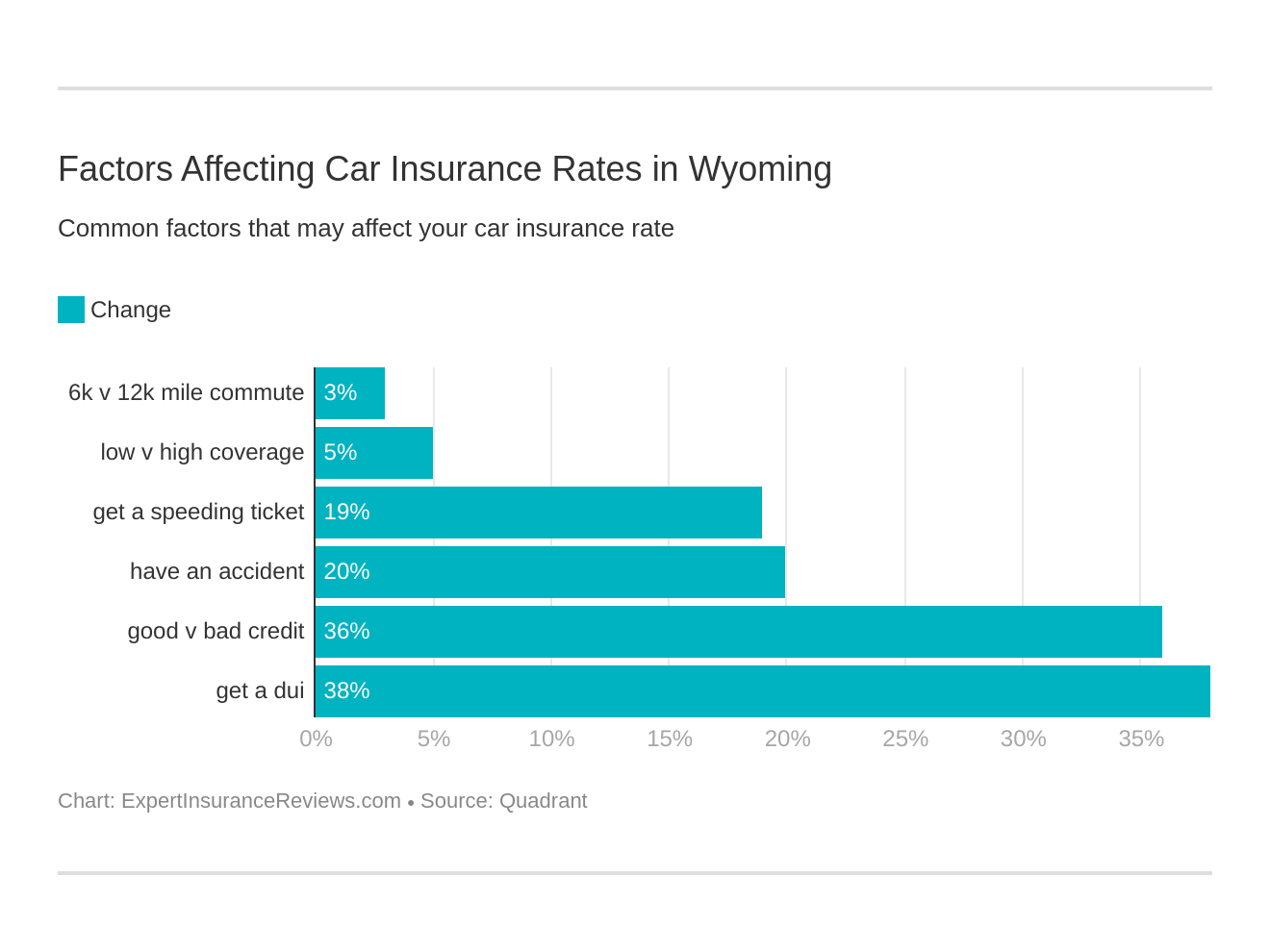

As we’ve already discussed, insurance companies adjust rates based on various risk factors. Knowing more about these factors (beyond the age, gender, and location-based adjustments we’ve already discussed) can help us better understand these rates.

To continue this discussion, we’ll spend the next few sections going over other factors insurance companies use to adjust your rates, including commute distance, credit score, and driving history.

Does my commute affect my car insurance rate in Wyoming?

Commuting to work every day can have an effect on your insurance rates. This may not initially make sense, but when you think about it, you realize it’s a logical choice. The longer your commute, the higher your insurance rates may be, simply because the more time you spend on the road, the higher your chances are of being involved in an incident that results in a claim being filed.

In this table, we compare the average rates across the major insurers in Wyoming to see if a longer commute does have an appreciable effect on your rates.

Wyoming Car Insurance Rates by Commute Time and Distance

| Insurance Company | 10 Miles Commute 6000 Annual Mileage | 25 Miles Commute 12000 Annual Mileage |

|---|---|---|

| Liberty Mutual | $1,989.35 | $1,989.35 |

| State Farm | $2,222.40 | $2,384.70 |

| USAA | $2,747.30 | $2,811.77 |

| Farmers | $3,069.35 | $3,069.35 |

| Geico | $3,440.58 | $3,552.52 |

| Allstate | $4,270.81 | $4,477.05 |

Overall the change in rates for a 6,000-mile annual commute versus a 12,000-mile annual commute is fairly minor for all the companies listed. Two of the companies (Farmers and Liberty Mutual) show no rate change at all, while the other companies’ rate changes vary between 2.35 percent and 7.3 percent.

Commute times are not the only thing that affect your rates! Take a look at some of the other factors.

Can coverage level change my car insurance rate with companies in Wyoming?

We’ve talked about the minimum level of coverage required in Wyoming, as well as a few additional insurance options you can purchase for your policy to achieve the level of protection you’re looking for from your insurer. To understand what this can do to your costs, we can broadly categorize coverage into three levels: low, medium, and high.

As you might expect, these coverage levels have varying rates, based on the amount and the insurance company. But in general, the more coverage you have, the higher your rates will be. Take a look at this table to see what low, medium, and high levels of coverage look like in terms of average cost in Wyoming.

Wyoming Car Insurance Rates by Coverage Level

| Insurance Company | Annual Rates with Low Coverage | Annual Rates with Medium Coverage | Annual Rates with High Coverage |

|---|---|---|---|

| Liberty Mutual | $1,899.46 | $1,982.49 | $2,086.12 |

| State Farm | $2,229.01 | $2,304.26 | $2,377.38 |

| USAA | $2,715.01 | $2,777.42 | $2,846.16 |

| Farmers | $2,991.48 | $3,064.88 | $3,151.68 |

| Geico | $3,445.96 | $3,499.83 | $3,543.86 |

| Allstate | $4,264.74 | $4,365.39 | $4,491.67 |

Increases in rates do occur with increasing levels of coverage. However, the differences are fairly minor, overall. For example, if you’re insured by Geico, the average increase between low and medium coverage is only 1.56 percent, and from medium to high coverage it’s an additional 1.26 percent.

The highest rate increase in the list is by Liberty Mutual, who increases rates by 4.37 percent between low and medium coverage and by another 5.23 percent for high coverage (for a total of a 9.83 percent increase from low to high coverage).

How does my credit history affect my car insurance rates with companies in Wyoming?

We mentioned briefly that many insurance companies consider credit score when adjusting your rates. As odd as this may sound, it makes a certain amount of sense, if you remember that insurance companies continually consider risk as they sell policies and adjust rates.

They can use data about you to help gauge how much risk you may be to insure. While driving record is the most obvious way to estimate the risk you represent to an insurance company (and we’ll discuss this in detail in the next section), credit score can provide more of an overall lifestyle risk judgment.

Essentially, if you have a track record of paying your bills on time and don’t have more debt than you can afford (thereby having a good credit score), this can be considered an indicator of your responsibility in general, which should translate to your driving patterns and behavior.

According to Experian, residents of Wyoming have an average credit score of 678, which pushes into the good credit score range (typically considered 670 and above) and is a good sign for your rates (all else being equal).

Wyoming Car Insurance Rates based on Credit Score

| Insurance Company | Annual Rates with Good Credit | Annual Rates with Fair Credit | Annual Rates with Poor Credit |

|---|---|---|---|

| USAA | $1,496.84 | $2,124.46 | $4,717.29 |

| Liberty Mutual | $1,752.67 | $1,956.81 | $2,258.58 |

| State Farm | $1,789.00 | $2,123.67 | $2,997.98 |

| Farmers | $2,809.91 | $3,106.41 | $3,291.73 |

| Geico | $3,166.77 | $3,364.95 | $3,957.93 |

| Allstate | $3,524.08 | $4,138.37 | $5,459.34 |

Another way we can look at this is:

- Good credit (670+) = average annual premiums: $2,423.21

- Fair credit (580-669) = 6 – 122 percent increase: $2,802.45

- Poor credit (300-579) = 25 – 215 percent increase: $3,780.48

How does my driving record affect my rates with car insurance companies in Wyoming?

Now we turn to driving record, which is one of the primary factors companies consider when adjusting rates. You should already be aware of this, given that from the risk perspective, the most accurate predictor of future risk as an insured is based on your past driving record.

The more violations there are on your record, the higher your insurance rates will be. If you have too many violations, you may be considered so high-risk that insurance companies won’t insure you (we’ll discuss this later).

As an example of what road violations can do to your rates, we’ve compared average rates in Wyoming for a clean driving record to average rates for individuals with one accident, one speeding ticket, and one DUI.

Wyoming Car Insurance Rates Based on Driving Record

| Insurance Company | Clean Record | With 1 Speeding Violation | With 1 DUI | With 1 Accident |

|---|---|---|---|---|

| Liberty Mutual | $1,427.24 | $1,980.39 | $2,365.60 | $2,184.19 |

| State Farm | $2,129.24 | $2,303.46 | $2,303.46 | $2,478.05 |

| USAA | $2,184.09 | $2,380.48 | $3,904.12 | $2,649.43 |

| Geico | $2,294.34 | $3,845.09 | $4,784.93 | $3,061.85 |

| Farmers | $2,324.65 | $2,466.47 | $4,736.07 | $2,750.20 |

| Allstate | $3,787.57 | $4,387.13 | $4,813.14 | $4,507.89 |

You can easily see that each of the different violation types results in some kind of rate increase, though the amounts vary based on the violation type and the insurance company. To help us better understand how significant these rate increases can be, we’ve calculated the percent increase for each violation and insurance company in the below table.

Effect of Driving Violations on Wyoming Car Insurance Rates

| Insurance Company | Percent Increase - 1 Speeding Violation | Percent Increase - 1 DUI | Percent Increase - 1 Accident |

|---|---|---|---|

| Allstate | 15.83% | 27.08% | 19.02% |

| Farmers | 6.10% | 103.73% | 18.31% |

| Geico | 67.59% | 108.55% | 33.45% |

| Liberty Mutual | 38.76% | 65.75% | 53.04% |

| State Farm | 8.18% | 8.18% | 16.38% |

| USAA | 8.99% | 78.75% | 21.31% |

For someone with a speeding ticket, Farmers may be worth considering, because they have the lowest increase, at 6.1 percent (compared to Geico, who has the highest at 67.6 percent). For an accident, State Farm may be an option, as theirs is the lowest increase at 16.4 percent (the highest is from Liberty Mutual at 53 percent).

Another point to note is how different companies increase rates for DUIs. In general, DUIs result in the highest rate increases. For example, Geico’s average rate for one DUI increases by 108.55 percent over a clean driving record. However, some companies treat DUIs similarly to speeding tickets from the rate increase perspective.

One example of this is State Farm. Their rate increases for speeding and DUI are the same, at 8.2 percent each. By contrast, their rate increase for one accident is about 16.4 percent.

Learn more about other factors that affect car insurance rates.

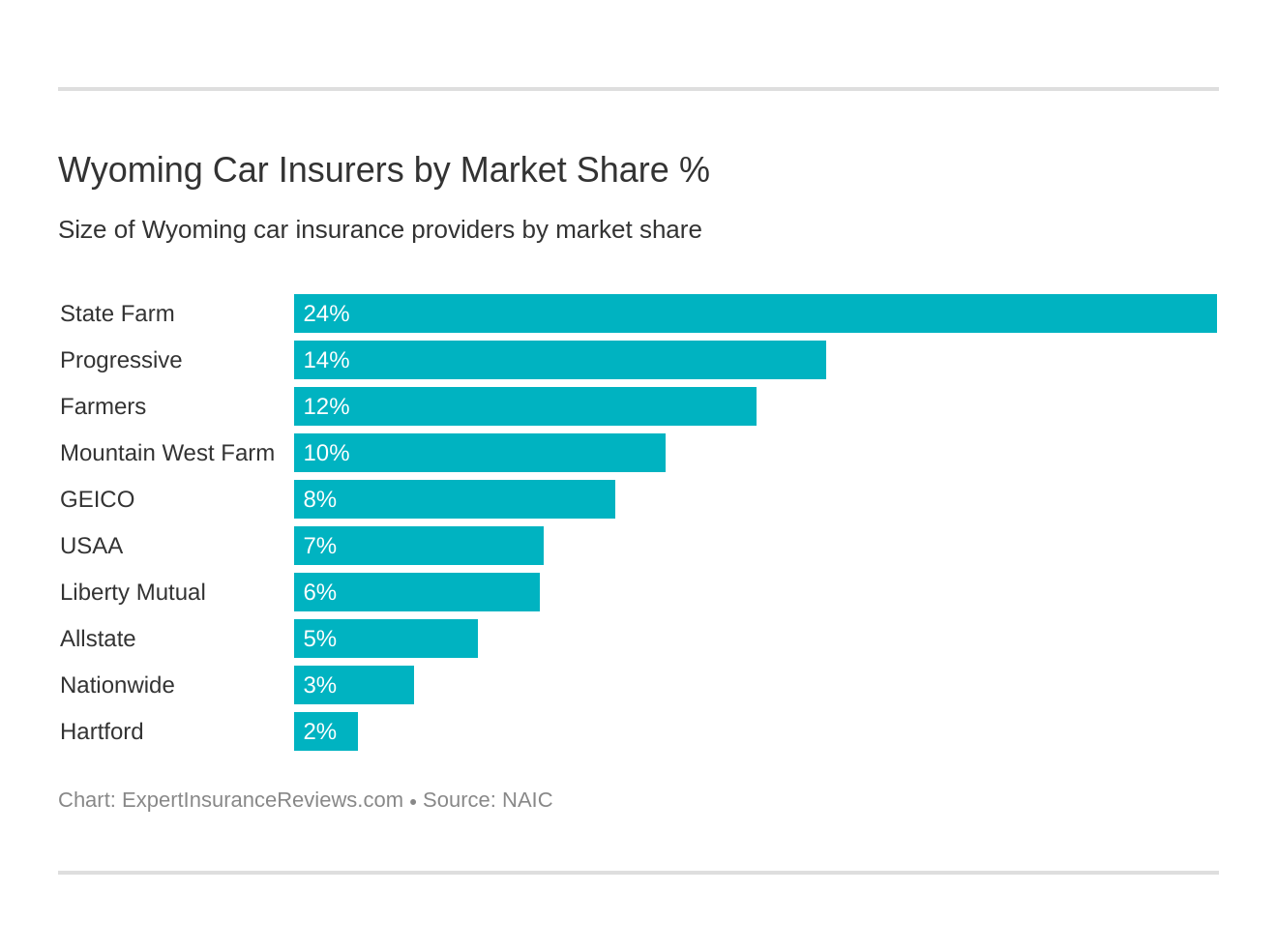

Which car insurance companies are the largest in Wyoming?

While much of the information we’ve covered so far is what car insurance companies want to know about you, we’ll briefly return to what you should know about insurance companies as you shop around.

Knowing the size of a company (typically defined as market share), along with some of the other information we’ve discussed like loss ratio and complaint ratio, can help you decide about various companies’ ability and track record for paying out on claims, in the event you ever need to file one.

Take a look at this table to see the market share and direct premiums written for the largest insurers in Wyoming.

Wyomings 10 Largest Car Insurance Companies

| Rank | Insurance Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm Group | $94,390 | 24.09% |

| 2 | Progressive Group | $54,498 | 13.91% |

| 3 | Farmers Insurance Group | $47,277 | 12.07% |

| 4 | Mountain West Farm Group | $38,093 | 9.72% |

| 5 | Geico | $32,878 | 8.39% |

| 6 | USAA Group | $25,560 | 6.52% |

| 7 | Liberty Mutual Group | $25,238 | 6.44% |

| 8 | Allstate Insurance Group | $18,926 | 4.83% |

| 9 | Nationwide Corp Group | $12,398 | 3.16% |

| 10 | Hartford Fire & Casualty Group | $6,638 | 1.69% |

How many car insurance companies are available in Wyoming?

When you’re shopping for insurance in Wyoming, you’ll find you have numerous options. In fact, you have a total of 695 from which to choose. These insurers can be broken into two categories: domestic and foreign.

- Domestic insurers are those that are incorporated in the state of Wyoming. Two of the 695 insurers are considered domestic.

- Foreign insurers are incorporated outside the state of Wyoming. The remaining 693 insurers are all considered foreign.

All insurance companies, both domestic and foreign, are required to follow all the insurance laws of the state to operate legally and sell policies.

Wyoming Laws

We’ve already talked about one law that pertains to you as a driver in Wyoming: the minimum insurance requirement necessary to legally drive in the Equality State. However, there are several other laws of which you as a driver should be aware.

Some of these include how to ensure that your vehicle is appropriately licensed per Wyoming state requirements, rules of the road, and some state-specific laws only found in Wyoming.

There are also several insurance laws (like those we mentioned in the previous section about what the state requires of insurance companies so they can legally operate in Wyoming) of which you should be aware so you can be your own advocate, ask the right questions, and understand what the law states insurers must provide to you as the insured.

Finally, we’ll cover a number of safety-related topics, fraud concerns in the state, and more. All of this information is necessary to keep you safe, ensure you’re prepared to speak to insurance agents, and aid you in keeping your own rates low. Keep reading to learn about all this and more.

What are the car insurance laws in Wyoming?

The first step is to discuss car insurance laws to which all companies in Wyoming are subject. This will prepare you to have conversations with potential insurers about how they approach meeting these requirements, as well as ensure once you’re insured, you know what your insurance company must provide.

In the next few sections, we’ll discuss windshield coverage in the Equality State, what the state expects of insurance companies with regard to how to handle high-risk insureds, low-cost insurance programs, and more.

How Wyoming Laws for Insurance are Determined

We know politics and how laws are enacted and enforced can be confusing. Even finding information on laws and how they’re generated can be complex, so before we get started, we’re going to provide a quick review.

If a person, group of people, organization, etc. concludes that something should be legislated (for example, how a state will handle autonomous vehicle testing and deployment), they’ll need to put together a document referred to as a bill. This bill will explain and define the proposed legislation. It should also include any relevant information to support the bill (additional explanation, reasoning, supporting documentation, etc.).

Once the group concludes that the bill is ready, it’s presented to the state legislature. The legislature then examines, debates, and votes on the bill. If the majority votes for the proposed legislation, it will be signed into law.

Windshield Coverage

Ever had a chip or crack on your windshield? Talk about a hassle. If you don’t get it repaired, it only gets worse; if it impairs your ability to see through the windshield, that’s unsafe for you as a driver and other drivers on the road. You can also get ticketed if law enforcement determines the crack or chip limits your vision too much.

Insurance requirements for how and when windshield coverage must be included, whether a deductible is required, and how and what kind of parts and repair shops should be used vary from state-to-state. Some states such as Arizona have fairly specific stipulations for these.

However, Wyoming leaves this up to insurance companies. There is nothing specifically outlined in the law for deductible or the repair and replacement of windshields.

High-Risk Insurance

As promised, we’ll now delve more deeply into high-risk drivers and how this can affect your insurance coverage. We stated earlier that if you’re too high-risk, insurance companies may refuse to sell you insurance policies.

This is true, but as you know, insurance is a requirement to drive legally in Wyoming. So how does the state handle this problem?

Wyoming (along with many other states in the country) has a program referred to as the Wyoming Automobile Insurance Plan (WY AIP) that enables high-risk drivers to obtain insurance, particularly when insurance companies refuse to sell those high-risk drivers policies through typical means.

The WY AIP isn’t an insurance company. Instead, it’s an organization managed by the state that all insurance companies in the state are required to participate in to be permitted to operate in the Equality State. Companies are required to insure a percentage of high-risk drivers through the WY AIP that’s in line with their respective market shares.

For example, State Farm Group has 24.09 percent of the market share in Wyoming. Under the Wyoming WY AIP participation requirements, State Farm Group is therefore required to insure 24.09 percent of the drivers approved for insurance through the WY AIP.

Applying for the WY AIP must be a last resort, after you’ve already made concerted efforts to obtain insurance through normal means. To apply, you’ll need to provide the following:

- A declaration that you’ve tried and failed to obtain car insurance through typical means in the previous two months

- Proof of valid driver’s license

- Accurately completed AIP application

Once you’ve been approved for insurance through the WY AIP, you’ll be able to purchase a policy from whichever company the organization paired you with (you won’t be able to pick a particular insurance company because the WY AIP assigns all approved applicants to specific insurance companies).

You’ll be guaranteed insurance coverage through the WY AIP for three years. After that, you can either get insurance through normal means (because you used the three years wisely to improve your driving record) or reapply to the WY AIP if you’re still unable to purchase an insurance policy on your own.

Because you’re considered high-risk if you’re purchasing insurance through the WY AIP, your minimum coverage requirements (and therefore the cost of your insurance) will be significantly higher than that of the average driver. Take a look at this table to see the difference between the state requirement for insurance and the WY AIP minimum insurance requirement.

Wyoming High Risk Insurance Requirements

| Required Insurance | State Minimum Limits | WY AIP Minimum Limits |

|---|---|---|

| Bodily Injury | $25,000 per person $50,000 per accident | $100,000 per person $300,000 per accident |

| Property Damage Liability | $20,000 | $50,000 per accident |

The minimum liability requirements for high-risk drivers are between 150 and 500 percent higher than the minimum liability requirements for the average driver. You can purchase more than the minimum liability if you so choose, but that coverage will also be higher than the average driver (with the associated higher costs). Find out the best car insurance companies for high risk drivers.

An SR-22 is required if you’re found to be driving uninsured when involved in an accident. Your license will be suspended as a result, and to reinstate your license, you’ll be required to provide an SR-22 form to the state as proof that you’ll obtain and maintain insurance for a minimum of three years.

To find out more about the WY AIP and whether you can apply, you can speak to any licensed insurance agent. They can also help you fill out and submit the application form. You can also visit the WY AIP website or call the Wyoming Department of Insurance at (307) 777-7401.

Low-Cost Insurance

As we just described, Wyoming has the WY AIP in place to help support high-risk drivers in obtaining and maintaining insurance coverage when they cannot obtain insurance through traditional means.

However, the Equality State does not have a similar, government-funded program to assist low-income drivers in obtaining and maintaining insurance coverage.

Only three states in the country (California, Hawaii, and New Jersey) offer programs like this.

Automobile Insurance Fraud in Wyoming

No matter what the context, fraud is wrong. It doesn’t matter if it seems like “no big deal” or it appears that it’s a victimless crime. Contrary to what you may believe, fraud is always a big deal, and no crime, including fraud, is victimless.

According to a report by the Insurance Information Institute (III), insurance fraud results in about $30 billion in losses each year, which works out to nearly 10 percent of the losses insurance companies must absorb. In an attempt to decrease their rates, one in 10 Americans has reported false information as a part of their application for purchasing car insurance.

What both of these statistics should demonstrate to you is that insurance fraud is a serious problem. Those profit losses ultimately mean higher costs for both goods and services for you and others, which means not only is fraud NOT a victimless crime, you are actually the victim.

Wyoming, like most states, considers insurance fraud a crime. For car insurance, this means some of the actions that constitute fraud include exaggerating injuries and damage to your vehicle or faking an accident or damage to your vehicle to get additional money.

Consequences of being convicted of car insurance fraud include fines and even up to a year in jail.

The Wyoming Department of Insurance handles fraud complaints submitted through the NAIC online report form available on the NAIC website. If you have questions or prefer to speak with someone rather than using the online tool, you can call the Wyoming Department of Insurance at (307) 777-7401.

Statute of Limitations

If you’ve been the victim of an accident, there is a statute of limitations in Wyoming that defines the amount of time post-accident that you have to file a claim before you’re no longer able to do so.

For both personal injury and property damage, you’ll have a maximum of four years from the date of the accident to file a claim. If you don’t do so within that time frame, you won’t be able to.

State-Specific Laws

Several laws are similar no matter where you are in the country (though these laws are defined by each state, they tend to be fairly consistent). Examples of this include the statute of limitations for filing claims, high-risk insurance programs, and the minimum insurance requirements necessary to drive legally.

While these laws may have slight variations (i.e. exact amounts, etc.), overall they are fairly standard across the country. However, there are some laws that are unique to individual states, and Wyoming has some of these laws.

One example is that if you don’t properly close a fence behind you when you leave, you’ll be charged a $750 fine because not closing a gate might mean livestock escapes and ends up on the road.

A somewhat bizarre law is that if you’re driving and find some roadkill, you’ll only be able to take it with you if you have permission. This permission is expected to be in the form of a letter of authorization, a permit to collect for science and education purposes, or a certificate for donation.

What are the vehicle licensing laws in Wyoming?

Ensuring your vehicle is properly registered in Wyoming and that your driver’s license is valid and up-to-date is key in making sure you’re both legal on the road and can avoid fines and the possible suspension of your license and driving privileges.

Unlike many states, the state of Wyoming does not manage vehicle registrations. Instead, drivers are required to register their vehicles and obtain vehicle license plates through the County Treasurer’s office in their respective counties.

In keeping with this approach, the county clerk’s office for each county handles vehicle titles and liens for the residents of that county.

Finally, to find out the specific county clerk and county treasurer’s offices in your county, you can use the list of cities and counties provided by the Wyoming Department of Transportation.

REAL ID

REAL ID is a federal government requirement that was initially put into law under the REAL ID Act of 2005. The purpose of this law is to ensure anyone who flies commercially is in fact who their identification says they are. This act was put in place in the wake of 9/11 as a means of decreasing the chances of such a tragedy ever again occurring.

This means the required identification documents necessary to obtain a REAL ID-compliant form of identification are set at the federal level. When you go in to obtain your REAL ID (which you’ll be required to do in person), you’ll need to bring:

- A passport or birth certificate

- Social Security number

- Two proofs of state residency

- Name change (if applicable)

By October of 2020, anyone who wishes to fly commercially will be required to have a REAL ID driver’s license (or an equivalent such as a passport). People who also have a need to access nuclear power plants and some military installations won’t be able to do so without a REAL ID.

According to the Department of Homeland Security, Wyoming is one of the 47 states in the country that are compliant with the REAL ID Act.

While Wyoming has been in compliance with the REAL ID Act for several years, there were fraud concerns associated with the previous version of their REAL ID driver’s license, so new credentials were developed, and the state began issuing them in summer 2019.

Official REAL ID credentials include a star on the upper right-hand corner of the license.

Penalties for Driving Without Insurance

Driving without insurance can result in you facing serious consequences. The severity and specifics of these consequences vary from state to state and in the number of offenses.

In Wyoming, if you’re found to be driving without insurance, you’ll be fined at least $750 and may even face up to six months in prison.

Teen Driver Laws

When you turn 15 in Wyoming, you’re eligible to apply for a learner’s permit. As a part of this, you’ll need to provide the appropriate identification documentation as well as your completion from the required driver education course you took (which you can do through your local school district).

While you hold your learner’s permit (which is required for at least 10 days), you’ll need to complete 50 hours of required driving practice. Ten of these 50 hours of driving practice must be at night. Once you’ve completed these learner’s permit requirements, you can apply for an intermediate license.

When you hold your intermediate license, you’ll have some restrictions, including that you’re prohibited from driving unsupervised between the hours of 11 p.m. and 5 a.m. You’ll also only be able to drive one under-18 passenger when you’re behind the wheel with this intermediate license.

You’re required to hold this intermediate license for at least six months before you can apply for a full, unrestricted license. The exception to this is if you turn 17 before your six-month time frame is up, you’re eligible to apply for the full, unrestricted license.

Older Driver License Renewal Procedures

Both older drivers and those that are considered part of the general population have the same driver’s license renewal requirements in Wyoming. All drivers are required to renew their driver’s license every five years, provide proof of adequate vision every 10 years, and are permitted to renew their license through the mail (rather than in person) at every other renewal.

New Residents

New residents of Wyoming are required to obtain a driver’s license with the state within the first year of having established residency in the state.

When you visit the driver exam office (which you’ll be required to do since it will be a new license with a new state), you’ll need to apply for a Wyoming driver’s and submit your out-of-state license to the office. You’ll also need to bring the following with you:

- Proof of identity

- Two proofs of current state residence

- Social Security number

License renewal procedures

Keeping your license valid and up-to-date is required by law, and in Wyoming you’re required to renew every five years. To help you keep track, the state of Wyoming will mail you a renewal application for your driver’s license about four months before your license is set to expire.

The form requires you to assert that your vision is adequate. You must get this portion of the form signed by a vision specialist or driver services examiner. Additionally, as we noted earlier, you must update your legal vision screening at least once per year (minimum every 12 months).

All drivers have the option to renew through the mail at every other renewal (no more than once every eight years), rather than handling it in-person.

All active-duty military are exempt from the requirement to get their license renewed every five years, but are required to visit the appropriate driver exam office the next time they are in Wyoming (after the license is expired). This will enable the replacement of the physical copy of your driver’s license.

Negligent Operator Treatment System (NOTS)

Several states across the country use a points-based system to discourage reckless driving. Typically these systems are structured so that being convicted of various moving violations like speeding, drunk driving, etc. results in a certain number of points being added to the person’s driver’s license.

If a driver accrues too many points within a given time period, their license is suspended. In California this system is called the negligent operator treatment system (NOTS).

Wyoming is unusual in that it does not have a points-based system in place. However, being convicted of moving violations still counts against you because it will be attached to your driving record.

If you receive two moving violations within one year, the state may require you to attend an approved driver improvement course. If the number of moving violations you’re convicted of reaches four within the same year, your driver’s license will be suspended for at least 90 days.

What are the rules of the road in Wyoming?

Rules of the road are enacted to keep you and other drivers safe when driving across Wyoming. Most of the rules of the road are things you covered when you first learned to drive, such as seat belt requirements, speed limits, and keeping right and moving over laws.

Some of these rules of the road you’re probably very familiar with because you follow them every time you get behind the wheel.

However, because not following the rules of the road can result in moving violations that can increase your insurance rates, put you at risk of license suspension, and in some cases even put yourself and others at risk, we’ve provided a quick review of some of the major rules in the next few sections.

Keep reading to learn (or review) the rules of the road you must follow in Wyoming.

Fault vs. No-Fault

Two primary legal structures define how insurance companies handle claims in the event of an incident.

In fault states, the law indicates that the driver who is at fault in an accident is responsible for the cost of any property damage or injury that occurs as a result of the accident. Ultimately this means the insurance company that insures the at-fault driver will pay the cost of those damages and injuries (and likely increase the at-fault driver’s insurance premiums as a result).

By contrast, in no-fault states, each party involved in an accident (or realistically, their insurers) is responsible for the cost of their own damages and injuries.

Wyoming is a fault state, so if you’re in an accident (and you’re not at fault), you have a few options for how to move forward with filing for damages:

- You can file a claim with your own insurance company. They’ll then reach out to the at-fault driver’s insurance company for the cost of the damages.

- You can file a claim directly with the at-fault driver’s insurance company.

- You can file a personal injury lawsuit against the at-fault driver. This will require a lawyer, unlike the previous two options, in which a lawyer is optional.

Seat belt and car seat laws

Seat belts are one of the rules of the road states have put in place to keep you safe. While the use of seat belts is mentioned at the federal level, specific implementation is left up to the state, so details can vary from state-to-state (especially in relation to car seats and riding in the back of a truck).

Once you turn 9, you’re required to be secured with a standard seat belt any time a vehicle is in motion. Any child under the age of 9 must be secured in an appropriate child restraint and in the back seat of a vehicle (if there is a back seat).

Improper use of a seat belt or child restraint is a secondary offense in Wyoming, meaning you can be ticketed for it, but only if law enforcement pulled you over for a different reason (such as speeding).

Wyoming does not define how and when it’s legal for individuals to ride in the back of a pickup truck.

Keep Right and Move Over Laws

Driving in the left lane is permitted in Wyoming, but if you’re driving slower than the speed limit (and the surrounding traffic), you’re expected to move to the right and out of the way, so you don’t slow down the flow of traffic.

Additionally, if you see emergency vehicles with flashing lights parked on the same side of the road on which you’re driving, you’re expected to merge to the farthest lane from the vehicle (this includes tow trucks and road maintenance vehicles) when the road permits.

If you cannot change lanes, you must decrease your speed by at least 20 mph below the posted speed limit.

Speed Limits

The posted speed limits in a state are set based on studies that indicate the most efficient and safest speed in a particular area, given the road structure and other risks found to be in that area.

The maximum speed limits for various kinds of roads are listed below:

- Interstate highways: 75-80 mph

- Secondary highways: 70 mph

- Residential areas: 30 mph

- Business areas: 30 mph

- School zones: 20 mph

These are the maximum limits. The posted speed limits may be slower than this in certain areas, depending on the various risk factors associated with that area.

Regardless of the posted speed limit, you’re expected to drive carefully and reduce your speed limit accordingly when weather, road conditions, and lighting change.

Ridesharing

While states across the country have welcomed transportation network companies (TNCs) and their ridesharing services, Wyoming has been a bit slower to accept these services. One reason could be that there simply isn’t the demand present in such an independent, “drive yourself” culture.

As a result, the state does not have much legislation in place regarding requirements TNCs must follow to operate legally in the state. This means that the Equality State does not have specific requirements (yet) for insurance coverage, business licenses, or licenses to operate.

Uber and Lyft, which were the first TNCs to start operating in Wyoming, were not legally allowed to do so until 2017, when the governor signed legislation that legalized their operation in the state.

To date, only USAA specifically offers insurance policies for drivers providing rides through a TNC in Wyoming.

Automation on the Road

Like many states across the country, Wyoming is cautiously considering autonomous vehicles on the roads. However, they have not enacted any legislation for or against the testing, deployment, and use of self-driving cars, nor have they enacted any legislation that defines when, where, and how this can be done.

However, the state isn’t simply ignoring the possibility of driverless cars. Discussions at the state government level, including how they could be deployed, potential benefits, and the need for infrastructure to support driverless cars, are ongoing.

A step in the direction of supporting autonomous vehicles includes the testing of connected vehicles. Essentially, connected vehicles are programmed to communicate with other connected vehicles. The goal is to allow vehicles to communicate traffic, weather and road conditions, accidents, etc. to other vehicles on the road.

Wyoming is one of three states in the country that have received federal grants to support a trial of connected vehicles on the roads.

What are the safety laws in Wyoming?

We’ve already discussed the fact that Wyoming’s rules of the road are in place to keep you safe, and following those rules of the road also helps keep your insurance rates down. Other safety-related laws include how the state handles DUI and distracted driving.

They also have laws in place related to your ability to see clearly when you’re behind the wheel. Proper visibility through your windshield and windows is key in your ability to maintain situational awareness and drive defensively. To that end, there are specific requirements for what is allowed when it comes to tinting your windshield and other windows on your vehicle.

If you drive a sedan:

- Windshield: Non-reflective tint can be placed on only the top five inches.

- Front and back-side windows: A minimum of 28 percent of outside lighting must filter into the vehicle and tint reflection cannot be more than 20 percent reflective.

- Rear window: A minimum of 28 percent of outside lighting must filter into the vehicle.

If you drive an SUV or van:

- Windshield: Non-reflective tint can be placed on only the top five inches.

- Front side windows: A minimum of 28 percent of outside lighting must filter into the vehicle and tint reflection cannot be more than 20 percent reflective.

- Back-side windows: Any darkness is permitted, and tint reflection cannot be more than 20 percent reflective

- Rear window: Any darkness is permitted, and tint reflection cannot be more than 20 percent reflective

Additionally, if any back or rear windows are tinted, dual side mirrors are required. Red, yellow, and amber tinting are prohibited on the windshield, but all colors of tinting are acceptable for the other windows on your vehicle.

In the next few sections, we’ll specifically outline the state’s laws regarding DUI and distracted driving.

DUI Laws

Driving while under the influence is foolish at best and dangerous at worst. You’re running the risk of endangering yourself and others, losing your driver’s license, and facing fines and even jail time. And as we discussed earlier, your insurance rates will likely go up (they may even double after a first offense).

Like most places in the country, Wyoming’s blood alcohol (BAC) limit is 0.08. Their high BAC (HBAC) limit is 0.15. If you’re found guilty of DUI in the state, it will remain on your record for a minimum of 10 years.

In Wyoming, there were 44 alcohol-impaired driving fatalities in 2017, according to a report by Responsibility.org. That’s 7.6 alcohol-related driving fatalities per 100,000 population, which is more than double the national average of 3.4 alcohol-related driving fatalities per 100,000 population.

Clearly, driving while under the influence in Wyoming is a serious problem. To see the consequences you’ll face in Wyoming if you’re convicted of DUI, take a look at this table.

Wyoming DUI Penalties

| Penalty | 1st DUI | 2nd DUI | 3rd DUI | 4th DUI |

|---|---|---|---|---|

| Fine | No minimum, but up to $750 | $250-$750 | $250-$3000 | Up to $10000 |

| Jail | no minimum, but up to 6 months | 7 days - 6 months | 30 days - 6 months | Up to 2 years |

| License Revoked | 90 days | 1 year | 3 years | 3 years |

| Other | Substance Abuse Assessment required; IID required for 6 months if HBAC | IID 1 year, substance abuse assessment required | IID 2 years, substance abuse assessment required | IID for life but may apply for removal after 5 years |

If you choose to drive under the influence, you’re choosing the possibility of injuring or even killing yourself and others. There is no excuse.

If you’re going to a party, planning to get some drinks with friends, or any other situation that involves alcohol, it’s your responsibility to plan ahead. Select a designated driver, make use of a taxi or ridesharing service, or choose to stay put.

Marijuana-Impaired Driving Laws

Wyoming has not chosen to follow the example set by states like California and Colorado and decriminalize marijuana. In fact, it’s still fully illegal in the state, including for medicinal use.

With the substance being completely illegal in the state, there are no laws specifically focused on driving while under the influence of marijuana. However, if law enforcement can prove a driver was impaired while operating their vehicle, a case can be made for prosecution.

Distracted Driving Laws

At this time, Wyoming has prohibited texting while driving, which is considered a primary offense. However, they still allow handheld use, and no restrictions on handheld use have been enacted so far.

There are also no young driver-specific laws regarding cell phone usage, other than the texting-while-driving ban.

Driving Safely in Wyoming

Knowing the rules of the road Wyoming has enacted to keep you safe is one piece of the equation. The remaining piece is the road safety statistics. Knowing this information can increase your preparedness as you drive throughout the state.

Unfortunately, while governments can put laws in place like Wyoming’s rules of the road, they cannot actually legislate safety. Your safety and the safety of other drivers depend on everyone following the rules of the road, as well as things outside anyone’s control such as the weather, lighting, and resulting road conditions.

To better enable you to be prepared as you drive throughout the state, we’ve collected vehicle theft data, road fatality statistics, and demographic information regarding vehicle ownership, traffic congestion, commute times, and more.

What does vehicle theft look like in Wyoming?

Knowing what vehicle theft looks like in your area can help you prepare for the possibility of it happening to you. To give you the information you need, we’ve collected two different kinds of vehicle theft data in Wyoming.